Industrial Wireless Control Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431715 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Wireless Control Switches Market Size

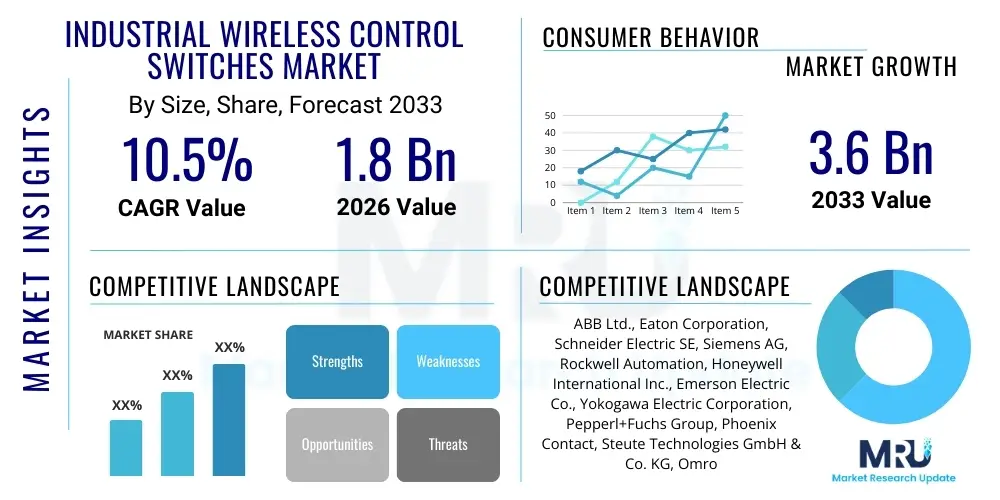

The Industrial Wireless Control Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033. The accelerated adoption of Industry 4.0 principles, combined with the necessity for enhanced operational flexibility across manufacturing and process industries, is the primary force driving this substantial expansion. The increasing sophistication of wireless communication protocols, ensuring both reliability and low latency, is overcoming historical barriers to adoption in critical control applications, thereby cementing the market's trajectory towards significant valuation growth over the coming years.

Industrial Wireless Control Switches Market introduction

The Industrial Wireless Control Switches Market encompasses devices designed for executing control functions—such as starting, stopping, sequencing, and interlocking industrial machinery—without requiring physical wiring between the control station and the receiving device. These switches leverage advanced industrial communication standards, including WirelessHART, ISA100.11a, and secure proprietary Wi-Fi variants, to ensure reliable, robust, and low-latency data transmission crucial for safety and operational continuity. The product portfolio includes pushbuttons, selector switches, emergency stops, and pendant stations, all operating wirelessly, typically powered by long-life batteries or energy harvesting techniques, which significantly enhances deployment flexibility and reduces installation complexity and associated costs.

Major applications for industrial wireless control switches span a diverse array of sectors, prominently including discrete manufacturing (automotive, aerospace), process industries (Oil & Gas, chemicals, mining), and infrastructure management (water treatment, utility monitoring). In these demanding environments, the switches provide essential functional benefits, such as enabling mobile control capabilities for operators, facilitating faster machine commissioning, and allowing control in hazardous or inaccessible areas where running cables is impractical or prohibitively expensive. This shift towards wireless control is a foundational element in the digitalization strategies of industrial enterprises worldwide.

Key driving factors propelling the market expansion include the global mandate for industrial IoT (IIoT) implementation, which necessitates seamless connectivity and real-time data exchange across the production floor. Furthermore, the inherent benefits of wireless installation—namely, the reduction in maintenance costs associated with damaged wiring, enhanced operator safety through remote control options, and the unmatched flexibility for reconfiguring production lines—make these devices highly attractive. Technological advancements in battery life, spectrum management, and cyber-security embedded within these control devices further solidify their viability as reliable replacements for traditional hardwired interfaces, ensuring high reliability even in electrically noisy environments.

Industrial Wireless Control Switches Market Executive Summary

The Industrial Wireless Control Switches Market is experiencing robust growth driven by accelerating industrial digitalization and the strategic push toward modular manufacturing processes globally. Key business trends indicate a strong move toward integrating switches with advanced diagnostics and condition monitoring capabilities, allowing them to function not merely as binary input devices but as connected sensors providing actionable operational intelligence. Geographically, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by massive investments in new manufacturing capacity, particularly in China and India, coupled with widespread governmental support for smart factory initiatives. Segment trends highlight the increasing demand for switches utilizing standardized protocols like WirelessHART due to their established interoperability, although proprietary systems offering ultra-low latency continue to dominate highly critical, safety-related applications. Furthermore, the end-user landscape is diversifying, with significant penetration now observed not only in heavy industry but also in logistics, warehousing automation, and specialized utility management, emphasizing flexibility and ease of integration as critical competitive factors.

AI Impact Analysis on Industrial Wireless Control Switches Market

User queries regarding AI's influence primarily focus on how Artificial Intelligence can elevate the operational performance, predictive maintenance capabilities, and security posture of industrial wireless control networks. Users are keen to understand if AI can optimize wireless spectrum allocation dynamically, ensuring ultra-reliable low-latency communications (URLLC) critical for control loops, and if machine learning algorithms can detect and preemptively flag anomalies indicative of impending switch or network failure. Furthermore, significant interest lies in AI’s role in enhancing cybersecurity by recognizing unusual traffic patterns associated with malicious activity in these distributed control systems. The prevailing expectation is that AI integration will transform these devices from simple command instruments into intelligent endpoints capable of contributing to system-wide self-optimization and significantly extending operational lifecycles through precise failure prediction and self-diagnosis.

- AI enables predictive maintenance by analyzing usage patterns and environmental factors influencing switch reliability.

- Machine learning optimizes wireless network performance, dynamically managing bandwidth and reducing latency for critical commands.

- AI algorithms enhance security by detecting zero-day exploits and abnormal control sequences in real-time.

- Integration allows for self-configuring and self-healing networks, minimizing manual intervention during faults.

- AI supports advanced human-machine interfaces (HMI) by processing complex input from wireless switches and translating them into optimized operational commands.

- Data aggregation from wireless switches feeds into large-scale factory optimization models, improving overall equipment effectiveness (OEE).

DRO & Impact Forces Of Industrial Wireless Control Switches Market

The market dynamics are defined by powerful driving forces, notably the global surge in Industrial Internet of Things (IIoT) deployment and the mandatory requirement for flexible, scalable manufacturing environments characteristic of modern production systems. This is significantly restrained, however, by persistent concerns regarding robust cyber-security implementation across wireless industrial networks, coupled with challenges related to effective spectrum management and interference in congested industrial environments. Substantial opportunities lie in the commercialization and widespread adoption of 5G technologies tailored for industrial use cases (Industrial 5G), promising ultra-reliable low latency communication that will open up highly critical control applications previously reserved for wired systems. The combined impact forces suggest that while initial adoption hurdles, particularly cybersecurity anxieties, require continuous mitigation efforts, the long-term systemic advantages in cost savings, deployment speed, and operational agility provided by wireless solutions will ensure continued market momentum and substantial growth over the forecast period, pushing the industry toward pervasive wireless control solutions.

Segmentation Analysis

The Industrial Wireless Control Switches Market is comprehensively segmented based on three primary dimensions: Product Type, Communication Technology, and End-User Industry. Product Type differentiation focuses on functional specialization, separating standard control switches like pushbuttons and selector switches from more complex systems such as pendant controls used for overhead cranes and mobile machinery. Segmentation by Communication Technology is crucial as it dictates reliability, range, and data rate, encompassing established standards like WirelessHART and proprietary mesh networks, alongside emerging high-speed protocols such as Industrial Wi-Fi 6/6E and 5G. The End-User Industry segmentation reflects the varying deployment requirements and standards across sectors, with process industries demanding intrinsically safe (hazardous location certified) devices, while discrete manufacturing prioritizes high-speed response and configurability. This multi-faceted segmentation allows vendors to tailor solutions precisely to the specific operational demands, regulatory compliance needs, and environmental conditions of diverse industrial landscapes, facilitating targeted marketing and product development strategies aimed at maximizing penetration across critical sectors.

- By Product Type:

- Wireless Pushbuttons

- Wireless Selector Switches

- Wireless Emergency Stop Switches

- Wireless Pendant Control Stations

- Others (e.g., foot switches)

- By Communication Technology:

- WirelessHART

- ISA100.11a

- Proprietary Protocols (e.g., Trusted Wireless)

- Industrial Wi-Fi (802.11)

- Bluetooth Low Energy (BLE)

- 5G/Cellular IoT

- By End-User Industry:

- Oil and Gas

- Chemicals and Petrochemicals

- Food and Beverage

- Automotive and Manufacturing

- Mining and Metals

- Power Generation and Utilities

- Pharmaceuticals

Value Chain Analysis For Industrial Wireless Control Switches Market

The value chain for industrial wireless control switches commences with the upstream segment, dominated by highly specialized component suppliers responsible for delivering critical electronic elements. This phase involves the manufacturing of high-performance radio frequency (RF) modules, secure microcontroller units (MCUs) optimized for low power consumption, advanced battery technologies (often lithium-ion or robust proprietary power cells), and high-reliability industrial sensor components necessary for feedback mechanisms. Key suppliers in this area include specialized semiconductor firms and wireless module providers who must adhere to stringent industrial quality standards regarding operating temperature range, vibration resistance, and long-term reliability. The competitive advantage at this stage is heavily contingent upon securing cost-effective, high-quality, and robust components that meet industrial safety integrity levels (SIL) and performance benchmarks.

The midstream phase involves the core manufacturing and assembly of the industrial wireless control switches. Major market players acquire the necessary components and integrate them into ruggedized enclosures designed to withstand harsh environments (high dust, moisture, and chemical exposure, often IP67 or NEMA rated). This stage involves rigorous quality control, adherence to industrial communication protocol certifications (e.g., TÜV for functional safety), and the development of proprietary communication stacks and application software that differentiates their products. Manufacturers also focus heavily on ergonomic design, ensuring the switches are easy for operators to use while maintaining functional safety compliance. Distribution channels in the downstream segment are multifaceted, involving a mixture of direct sales to large, integrated customers and indirect distribution through established networks of industrial distributors, system integrators, and value-added resellers (VARs).

Indirect channels, facilitated by regional distributors, are crucial for reaching small and medium-sized enterprises (SMEs) and providing localized technical support and installation services, which often require specific industrial domain knowledge. Direct sales channels are typically employed for major global accounts or large-scale Greenfield projects where bespoke solutions and long-term strategic partnership agreements are required, particularly in sectors like Oil & Gas or large automotive facilities. System integrators play an indispensable role by integrating these wireless switches seamlessly into existing or new plant control architectures (PLCs, DCS systems). The increasing reliance on system integrators underscores the complexity of modern industrial IT/OT convergence, where the effective implementation of wireless control systems requires expertise in both network architecture and industrial control logic, thus positioning integrators as critical facilitators of market growth and specialized service providers.

Industrial Wireless Control Switches Market Potential Customers

The primary end-users and buyers of industrial wireless control switches are organizations within sectors characterized by large, complex machinery, highly dynamic production lines, or challenging environments where cabling is cumbersome or hazardous. Discrete manufacturing, particularly the automotive industry, represents a significant customer base, utilizing wireless controls for flexible tooling, mobile operator stations, and managing conveyor systems that require frequent layout changes. In this context, the demand is driven by the necessity for fast changeovers and modular production capabilities. Similarly, the aerospace and heavy machinery manufacturing sectors rely on wireless pendant controls for maneuvering heavy loads and complex assembly tasks across vast industrial floors, prioritizing safety and robust signal integrity over long distances.

Process industries, including Oil & Gas, Chemicals, and Mining, constitute another vital customer segment. In these environments, wireless switches often serve mission-critical safety functions, such as emergency stops deployed in hazardous or explosion-prone zones (requiring ATEX or IECEx certifications) where minimizing wiring routes is essential for safety compliance and maintenance simplicity. The ability to deploy control points rapidly in remote locations or temporary testing setups without heavy infrastructure investment makes wireless technology highly appealing. Furthermore, the Food and Beverage sector, driven by stringent hygiene requirements and frequent cleaning protocols, benefits from the sealed, cable-free design of wireless switches, which simplifies sanitation procedures and reduces the risk of contamination associated with cable trays and conduits.

Beyond traditional industrial settings, infrastructure management and logistics are emerging as rapidly growing consumer segments. Utilities, water treatment plants, and power generation facilities use these switches for remote operation and maintenance, improving response times and reducing personnel exposure to dangerous areas. Within warehousing and large-scale logistics centers, wireless hand-held controls are integral to maximizing throughput and improving operator mobility for functions like sorting, tagging, and inventory management. These diverse applications confirm that the market’s potential is exceptionally broad, targeting any operation prioritizing enhanced operational safety, reduced installation costs, and maximum flexibility in machine control and monitoring capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Eaton Corporation, Schneider Electric SE, Siemens AG, Rockwell Automation, Honeywell International Inc., Emerson Electric Co., Yokogawa Electric Corporation, Pepperl+Fuchs Group, Phoenix Contact, Steute Technologies GmbH & Co. KG, Omron Corporation, Keyence Corporation, Pilz GmbH & Co. KG, Schmersal GmbH & Co. KG, Banner Engineering Corp., Micropac Industries, Euchner GmbH + Co. KG, B&R Industrial Automation (ABB Subsidiary), Delta Controls Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Wireless Control Switches Market Key Technology Landscape

The technological landscape of the industrial wireless control switches market is characterized by a demanding requirement for coexistence between various robust, industry-specific wireless protocols, each tailored for different operational needs regarding data rate, battery life, and functional safety. WirelessHART (Highway Addressable Remote Transducer Protocol) and ISA100.11a remain dominant for non-critical monitoring and slower control loops, primarily due to their mesh networking capabilities, which enhance reliability by providing multiple communication pathways, and their inherent ability to operate effectively in harsh environments. These protocols offer robust security layers and excellent battery longevity, making them suitable for widespread deployment across large process plants where sensor and actuator control points are numerous and geographically dispersed, significantly reducing the maintenance burden associated with battery replacement schedules.

For more high-speed and safety-critical applications, the market increasingly relies on highly secure proprietary protocols, often utilizing frequency hopping spread spectrum (FHSS) techniques to resist electromagnetic interference (EMI) prevalent on factory floors, ensuring commands are delivered reliably and with ultra-low latency. Furthermore, the integration of Industrial Wi-Fi standards (particularly Wi-Fi 6/6E) is gaining traction, especially in discrete manufacturing and warehousing, where higher data throughput is necessary for applications involving video feedback or augmented reality (AR) guidance integrated with control functions. These advanced Wi-Fi standards promise increased capacity and reduced congestion compared to older Wi-Fi generations, yet their power consumption profile often mandates external powering or frequent battery management, creating a trade-off between speed and operational longevity.

The most significant emerging technology reshaping the landscape is Industrial 5G and other Cellular IoT technologies, which offer unprecedented capabilities for URLLC (Ultra-Reliable Low-Latency Communication), targeting latency below 10 milliseconds, a threshold critical for closed-loop control applications previously exclusive to wired Ethernet systems. The development of private 5G networks allows manufacturers to own their spectrum and guarantee quality of service, overcoming the dependency on congested public spectrum. This technological convergence promises to accelerate the substitution of wired systems, particularly for large, mobile assets like automated guided vehicles (AGVs) and mobile control stations, providing seamless coverage across sprawling industrial complexes while adhering to stringent industrial performance and safety standards defined by bodies like the International Electrotechnical Commission (IEC) for functional safety.

Regional Highlights

The global Industrial Wireless Control Switches Market exhibits distinct regional dynamics driven by varying levels of industrial maturity, regulatory frameworks, and technological investment priorities. North America maintains a strong position, characterized by high early adoption rates, especially in sectors with large footprints such as Oil & Gas, aerospace, and advanced manufacturing. The region benefits from significant investments in digital transformation and a strong presence of key technology vendors and system integrators focused on deploying high-security, high-reliability wireless solutions. Regulatory standards regarding wireless communication reliability and cybersecurity mandates in critical infrastructure further push the demand for sophisticated control switches, often leading the market in adopting certified, functionally safe wireless technology.

Europe demonstrates stable and mature growth, primarily propelled by rigorous adherence to safety standards and established initiatives like Industrie 4.0, particularly in Germany and the Nordic countries. European manufacturers prioritize efficiency improvements and sustainable operational practices, driving the adoption of wireless controls to optimize existing infrastructure and reduce energy consumption. The emphasis here is often on high-quality, long-lifecycle products that comply with stringent European directives such as the Machinery Directive and ATEX regulations for hazardous areas, favoring proprietary and standardized protocols that offer proven reliability and long-term support guarantees within regulated industrial environments.

Asia Pacific (APAC) is projected to be the fastest-growing market globally, underpinned by rapid industrial expansion, significant foreign direct investment (FDI) into new factory construction, and increasing labor costs prompting automation efforts across countries like China, India, and Southeast Asia. The mass transition of manufacturing bases towards smart factory models creates an enormous addressable market for wireless controls, valuing quick installation and scalability. While price sensitivity remains a factor, the increasing awareness of the total cost of ownership (TCO) benefits derived from reduced cabling costs and enhanced flexibility is accelerating adoption across diverse sectors, including electronics, textiles, and automotive assembly, positioning APAC as the primary engine for future market volume growth.

- North America: High penetration in Oil & Gas and Aerospace; focus on cybersecurity integration and proprietary high-reliability systems.

- Europe: Strong regulatory compliance (ATEX, Machinery Directive); steady adoption driven by Industrie 4.0 and optimization projects in established industries.

- Asia Pacific (APAC): Highest CAGR fueled by rapid industrialization, governmental smart factory initiatives, and large-scale manufacturing capacity expansion.

- Latin America (LATAM): Growing adoption in mining and commodities sectors, focusing on ruggedized solutions for remote and challenging environments.

- Middle East and Africa (MEA): Demand concentrated in high-value energy infrastructure and utility projects; emphasis on hazardous location certified (Ex-rated) switches.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Wireless Control Switches Market.- ABB Ltd.

- Eaton Corporation

- Schneider Electric SE

- Siemens AG

- Rockwell Automation

- Honeywell International Inc.

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Pepperl+Fuchs Group

- Phoenix Contact

- Steute Technologies GmbH & Co. KG

- Omron Corporation

- Keyence Corporation

- Pilz GmbH & Co. KG

- Schmersal GmbH & Co. KG

- Banner Engineering Corp.

- Micropac Industries

- Euchner GmbH + Co. KG

- B&R Industrial Automation (ABB Subsidiary)

- Delta Controls Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Wireless Control Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using industrial wireless control switches over traditional wired switches?

The primary benefit is significantly reduced installation time and cost by eliminating complex cabling infrastructure, offering unparalleled flexibility for machine reconfiguration, and enabling mobile operation for enhanced operator safety and efficiency in dynamic industrial environments. Wireless deployment also minimizes ongoing maintenance expenses associated with cable damage and routing.

Which wireless protocols are most reliable for critical industrial control applications?

Protocols designed specifically for industrial environments, such as WirelessHART and ISA100.11a, offer high reliability and mesh network redundancy. However, for ultra-critical safety functions requiring guaranteed low latency, proprietary systems or emerging Industrial 5G solutions are becoming the preferred choices due to their enhanced security and guaranteed quality of service (QoS).

How do industrial wireless control switches address security concerns in factory automation?

Industrial wireless control switches address security through multiple layers, including robust encryption (often utilizing AES-128 or higher), frequency hopping techniques to prevent jamming and interception, and mandatory authentication protocols. Many modern devices also incorporate integrated security monitoring capabilities that alert control systems to unauthorized access attempts or suspicious network activity.

In which industrial sectors is the adoption of wireless control switches growing the fastest?

Adoption is growing fastest in the automotive and general discrete manufacturing sectors due to the continuous demand for flexible, modular production lines. Additionally, the Oil & Gas and Chemical sectors are rapidly adopting certified wireless switches for intrinsically safe operation in hazardous (Ex-rated) environments to improve safety and remote monitoring capabilities.

What role does battery life play in the total cost of ownership (TCO) of wireless control switches?

Battery life is a critical factor in TCO; longer battery life minimizes maintenance costs associated with frequent replacements and reduces the risk of unplanned operational shutdowns due to power failure. Manufacturers utilize advanced energy harvesting and low-power microcontroller units (MCUs) to extend operational lifecycles, ensuring reliable performance typically spanning several years without intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager