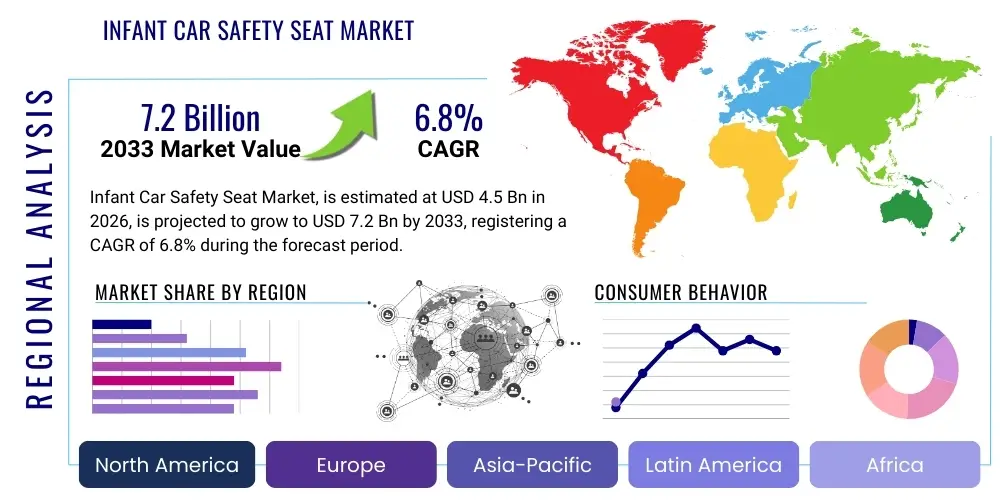

Infant Car Safety Seat Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436534 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Infant Car Safety Seat Market Size

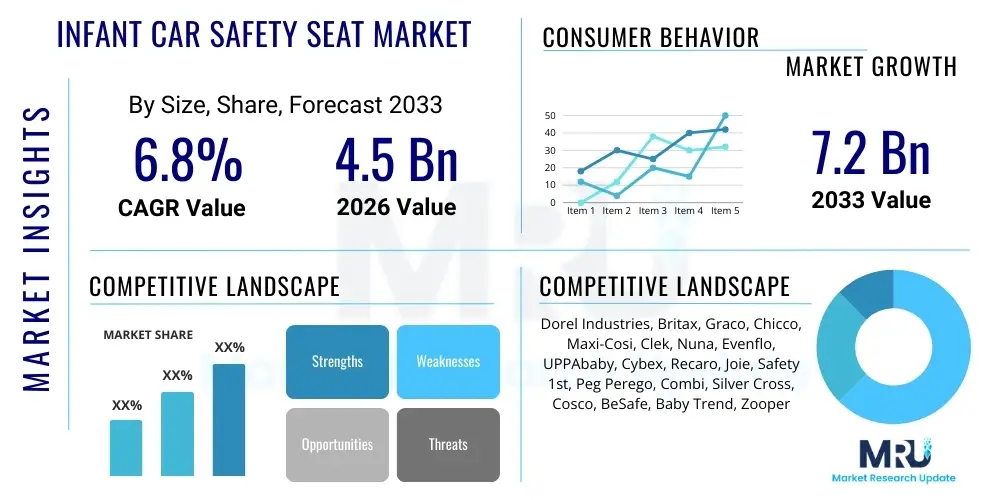

The Infant Car Safety Seat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Infant Car Safety Seat Market introduction

The Infant Car Safety Seat Market encompasses the manufacturing and distribution of specialized seating systems designed to protect infants and toddlers during vehicular travel. These products, mandated by stringent global regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) in the US and the ECE R129 (i-Size) standard in Europe, are critical components of child passenger safety infrastructure. The core product categories include rear-facing seats, convertible seats, and booster seats, often categorized by weight and height suitability. Major applications center around personal vehicle use, taxi services, and car-sharing platforms, ensuring compliance with legal requirements for child transportation.

The primary benefit of infant car safety seats is the reduction of injury severity and fatality rates during collisions, achieved through specialized harness systems, energy-absorbing materials, and rigorous crash testing standards. Modern seats increasingly incorporate advanced materials like expanded polystyrene (EPS) foam and integrated steel frames for enhanced structural integrity. The driving factors behind market expansion include rising consumer awareness regarding child passenger safety, increasing disposable income in emerging economies leading to higher vehicle ownership, and continuous technological innovation focusing on ease of installation and smart features such as sensor integration for temperature and harness monitoring.

Furthermore, regulatory evolution plays a pivotal role. The transition from older weight-based standards to height-based standards (like i-Size) drives mandatory replacement cycles and encourages manufacturers to innovate seat design for improved protection against side impacts. The demand is also sustained by the non-transferable nature of the product across a child’s developmental stages, necessitating multiple purchases (infant carrier, convertible seat, high-back booster) over several years. This predictable replacement cycle provides stable demand for manufacturers focused on high-quality, certified safety solutions.

Infant Car Safety Seat Market Executive Summary

The global Infant Car Safety Seat Market is characterized by robust growth fueled by increasing urbanization, strict enforcement of child safety laws worldwide, and a strong emphasis on premium, technology-integrated products. Business trends indicate a shift toward direct-to-consumer (D2C) channels alongside traditional retail, allowing brands greater control over pricing and customer education, particularly concerning complex installation processes. Key manufacturers are focusing heavily on lightweight, ergonomic designs compliant with the latest global safety regulations, such as those governing rotational forces and side-impact protection. Mergers and acquisitions remain low to moderate, focusing primarily on acquiring specialized technology firms that offer IoT integration or advanced material science capabilities.

Regionally, North America and Europe dominate the market due volume sales of high-end models incorporating features like load legs and anti-rebound bars, driven by high consumer spending power and stringent governmental standards like LATCH/ISOFIX requirements. The Asia Pacific region, however, exhibits the fastest growth trajectory, primarily due to expanding middle classes in countries like China and India, leading to rapid adoption of entry-level and mid-range certified seats for the first time. Infrastructure improvements and growing awareness campaigns further accelerate demand in APAC. Latin America and the Middle East & Africa are developing markets where regulatory adoption is catching up, creating long-term growth opportunities.

Segment-wise, convertible car seats are seeing increased adoption due to their extended usability and perceived value, although dedicated rear-facing infant carriers remain essential for newborns due to portability and convenience. Distribution channel analysis shows that specialized baby stores and e-commerce platforms are gaining significant traction over mass merchandisers. Trends within materials point towards sustainable and non-toxic fabric usage, responding to parental demand for health-conscious products, alongside the integration of smart technology to provide real-time alerts on child safety and comfort, enhancing the overall value proposition of high-end seats.

AI Impact Analysis on Infant Car Safety Seat Market

User queries regarding AI's influence in the Infant Car Safety Seat Market often center on improving safety monitoring, simplifying installation, and enhancing personalized use. Common questions revolve around: "Can AI detect if the harness is properly tightened?", "How can smart seats prevent hyperthermia?", and "Will AI help determine the optimal seat position based on crash data?". Analysis reveals that users are primarily concerned with eliminating human error during installation and use, achieving real-time risk assessment, and using predictive analytics to optimize seat design for crash scenarios. The key theme is the transition from passive safety devices to active, intelligent protection systems capable of immediate intervention or alert generation, thereby bridging the gap between high-end hardware safety features and user compliance.

- AI-driven sensor calibration for confirming correct LATCH/ISOFIX installation depth and angle.

- Predictive modeling using crash test data to optimize material composition and frame geometry for specific impact vectors.

- Real-time monitoring of harness tension using embedded strain gauges analyzed by AI algorithms to ensure optimal restraint during travel.

- Smart climate control systems utilizing AI to regulate temperature and humidity based on infant vital signs and external weather conditions.

- AI-powered user interfaces in companion apps offering tailored installation instructions and troubleshooting based on the specific vehicle model.

- Anomaly detection in movement or breathing patterns, triggering immediate alerts for unattended child detection or health emergencies.

DRO & Impact Forces Of Infant Car Safety Seat Market

The market is predominantly driven by mandatory legislation enforcing the use of certified child restraint systems, coupled with parental willingness to invest in premium safety features, often surpassing minimum required standards. Restraints primarily involve the high cost associated with advanced, high-specification seats, particularly those incorporating sensor technology, which can create affordability barriers in developing regions. Opportunities lie in the rapidly expanding adoption of ISOFIX/LATCH systems globally, simplifying installation and reducing misuse potential, as well as the integration of smart textiles and IoT features providing convenience and enhanced monitoring capabilities. The primary impact forces shaping the market include competitive pressure leading to rapid innovation in side-impact protection and the stringent, evolving regulatory environment (e.g., transition to i-Size) which continually necessitates product redesign and recertification cycles.

The key driver is the global emphasis on evidence-based child safety protocols. Governments are regularly updating standards, pushing manufacturers to integrate technologies like anti-rebound bars, load legs, and enhanced energy-absorbing foam, directly stimulating R&D investment. This regulatory push creates a favorable environment for high-quality, certified products. However, one significant restraint is consumer confusion stemming from the proliferation of standards (e.g., ECE R44 vs. ECE R129), seat types (infant, convertible, combination), and complex vehicle compatibility charts, often leading to improper use or installation, thereby limiting the full potential safety benefit of the product.

Opportunities are substantial within the digital transformation of the market. The integration of IoT sensors provides immediate consumer value through features like ‘buckle-up’ reminders, temperature monitoring, and connection verification, which justifies higher price points. Furthermore, the high rate of vehicle turnover and the trend toward shared mobility services, where seats must be installed and removed frequently, drives demand for lightweight, quick-install solutions. The core impact forces ensure that safety remains non-negotiable, pressuring brands to consistently achieve five-star safety ratings and differentiate themselves through innovative features that address common user pain points like vehicle incompatibility and difficult harnessing.

Segmentation Analysis

The Infant Car Safety Seat Market is comprehensively segmented based on Type (Rear-Facing, Convertible, Booster, and Combination Seats), Installation Method (ISOFIX/LATCH, Seat Belt), Distribution Channel (Offline Retail, E-commerce, Specialty Stores), and Material (Polypropylene, Expanded Polystyrene, Steel Frames, and Fabric). This detailed segmentation allows manufacturers to tailor marketing and product development efforts towards specific consumer needs, addressing regional regulatory differences and varying price sensitivities globally. The fastest-growing segments are generally associated with advanced installation methods and products offering extended rear-facing capabilities, reflecting strong parental preference for maximum safety features and ease of use.

- By Type:

- Rear-Facing Only Seats (Infant Carriers)

- Convertible Car Seats

- Booster Seats (High-Back and Backless)

- All-in-One/Combination Seats

- By Installation Method:

- ISOFIX/LATCH System (Lower Anchors and Tethers for Children)

- Seat Belt Installation

- By Distribution Channel:

- Offline Retail (Mass Merchandisers, Department Stores)

- E-commerce Platforms (Online Retailers, Company Websites)

- Specialty Baby Stores

- By Material:

- Polymer/Plastic Components (Polypropylene, HDPE)

- Energy Absorbing Foams (EPS, EPP)

- Metal Components (Steel or Aluminum Frames)

- Fabrics and Textiles (Non-toxic, Flame-retardant Materials)

- By End User Age/Weight Group:

- Infant (Up to 13 kg or 87 cm)

- Toddler (9 kg to 25 kg)

- Child (15 kg to 36 kg)

Value Chain Analysis For Infant Car Safety Seat Market

The value chain for the Infant Car Safety Seat Market begins with upstream activities focused on raw material sourcing, including specialized polymers (for the shell), steel/aluminum (for the frame), and high-density energy-absorbing foams (EPS/EPP). Manufacturers operate under stringent quality control, incorporating complex molding processes and assembly lines, heavily driven by R&D focused on achieving compliance with R129 or NHTSA standards. This phase is characterized by intensive safety testing and certification, which adds significant value and cost. Key players often integrate vertically to secure reliable supply chains for essential materials like non-toxic fabrics and specialized harness systems.

The mid-stream activities involve logistics, warehousing, and inventory management, critical due to the bulky nature of the product and high consumer expectations for immediate availability. Distribution is complex, involving both direct and indirect channels. Indirect distribution relies heavily on mass merchandisers and specialized baby retail chains, which handle significant volumes and require extensive product knowledge training for sales staff. Direct channels, primarily e-commerce platforms and brand-owned websites, are increasingly important for high-margin, premium seats, allowing manufacturers to bypass intermediaries and engage directly with consumers through educational content and personalized support, which is vital for safe use.

Downstream activities include post-sale support, warranty services, and increasingly, recycling or trade-in programs, addressing the environmental impact and short lifespan of infant seats. Retailers and distributors must manage product recalls effectively due to the critical safety implications of failure. The value chain is heavily influenced by safety compliance; every stage, from material selection to final consumer sale, is governed by stringent regulatory oversight, ensuring that the inherent safety value of the product is maintained and communicated accurately to the end-user.

Infant Car Safety Seat Market Potential Customers

The primary customers for Infant Car Safety Seats are expectant or new parents (demographic segment aged 25–40) who prioritize safety, convenience, and compliance with local traffic laws. This segment is highly receptive to information regarding safety ratings (e.g., ADAC, NHTSA star ratings) and is often willing to pay a premium for features like extended rear-facing capacity, quick installation systems (ISOFIX/LATCH), and integrated sensor technology. Secondary potential customers include grandparents, daycare centers, hospitals (for newborn discharge transportation), and commercial mobility services such as ride-sharing companies (Uber, Lyft) and rental car agencies that offer child seat rentals, particularly in regions with high tourism and strict liability laws.

A key emerging customer segment includes technologically savvy millennial and Gen Z parents who rely heavily on online reviews, social media influencers, and comparison tools to make purchasing decisions. This group values interconnected features, lightweight portability, and stylish, minimalist designs that integrate easily with modern strollers and vehicle interiors. They are the primary drivers of demand for smart car seats that provide connectivity and diagnostic feedback, reducing anxiety related to installation and misuse. Furthermore, customers in urban environments often seek narrow-profile seats to fit three across in compact vehicles, reflecting specific lifestyle needs.

Customers globally can be segmented based on regulatory awareness and price sensitivity. In developed markets (North America, Western Europe), consumers exhibit low price elasticity for safety products and high adoption rates of the latest R129 or LATCH systems. Conversely, in developing markets, price sensitivity is higher, leading to strong demand for value-driven, entry-level certified seats that meet minimum safety requirements. Education and outreach programs targeting new parents remain essential components of successful customer acquisition and retention strategies, emphasizing the non-negotiable nature of certified restraint use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dorel Industries, Britax, Graco, Chicco, Maxi-Cosi, Clek, Nuna, Evenflo, UPPAbaby, Cybex, Recaro, Joie, Safety 1st, Peg Perego, Combi, Silver Cross, Cosco, BeSafe, Baby Trend, Zooper |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infant Car Safety Seat Market Key Technology Landscape

The technology landscape within the Infant Car Safety Seat Market is rapidly advancing, moving beyond passive protection to incorporate sophisticated active safety and user convenience features. The most crucial technological innovations revolve around crash energy management, notably the widespread adoption of Enhanced Side Impact Protection (ESIP) systems utilizing multi-layered foam and specialized side wings to absorb lateral forces. Furthermore, the standardization of ISOFIX (Europe) and LATCH (North America) installation systems has dramatically reduced installation errors, aided by color-coded indicators and audible click confirmation mechanisms, making correct fitting more intuitive for parents.

A significant area of growth is in 'smart seat' technology, which leverages Internet of Things (IoT) sensors embedded within the seat structure and harness. These sensors monitor crucial parameters such as the child’s presence, temperature, and whether the chest clip is securely fastened, communicating real-time data to a linked smartphone application. Advanced features also include load leg technology and anti-rebound panels designed to stabilize the seat during frontal or rear-end collisions, minimizing rotational movement and enhancing protection, particularly in seats compliant with the high standards of ECE R129 (i-Size).

Material science also plays a vital role. Manufacturers are increasingly utilizing non-toxic, hypoallergenic, and naturally flame-retardant fabrics, moving away from chemical flame retardants in response to heightened consumer health concerns. Lightweight yet ultra-strong materials like aerospace-grade aluminum and injection-molded, high-density polymers are being integrated into the frame construction to improve portability without compromising structural integrity. This combination of advanced materials and embedded electronics defines the current competitive edge in the high-end segment of the infant car safety seat market.

Regional Highlights

Regional dynamics significantly influence product design, regulatory compliance, and market maturity within the Infant Car Safety Seat Market. Developed economies like North America and Europe lead in terms of market value and adoption of premium features, while Asia Pacific drives volume growth and technological integration in mass-market segments.

- North America: This region, particularly the United States and Canada, is characterized by high rates of mandatory compliance and strong demand for convertible and combination seats offering extended usability. NHTSA regulations and the use of the LATCH system are standard. Consumers exhibit a high willingness to pay for premium features such as anti-rebound bars, SensorSafe technology, and ergonomic designs that facilitate quick transfer between vehicles. The competitive environment encourages frequent product innovation driven by highly publicized independent safety ratings.

- Europe: The European market is the benchmark for stringent safety standards, dominated by the ECE R129 (i-Size) regulation, which mandates rear-facing travel until at least 15 months and uses height rather than weight for classification. The high penetration of the ISOFIX installation system ensures low installation error rates. Demand is strong for modular systems, lightweight infant carriers compatible with travel systems, and brands specializing in rotational car seats for ease of access, particularly in countries like Germany, the UK, and Scandinavia.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by substantial economic growth, rising vehicle ownership, and increasing parental awareness campaigns in China, India, and Japan. While the market initially lagged in adopting international standards, countries are rapidly moving towards enforcing global benchmarks, creating a massive untapped opportunity. Price sensitivity remains a factor, driving demand for locally manufactured seats meeting essential compliance requirements, though the affluent urban segment rapidly adopts high-end European and American brands featuring connectivity and advanced foam protection.

- Latin America: This market is evolving, characterized by varying levels of regulatory enforcement across countries. Brazil and Mexico are the largest contributors, where efforts are underway to mandate certified seat use and improve consumer education. The market sees a mix of domestically produced seats and imported, internationally certified products. Growth is primarily driven by expanding road safety infrastructure and increasing government intervention in promoting child restraint use.

- Middle East and Africa (MEA): Market maturity is low to moderate, often concentrated in urban centers and high-income Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia). These nations tend to import premium European and American brands, following global safety standards due to high expatriate populations and strong spending power. In Africa, widespread adoption is challenging due to economic constraints and limited regulatory enforcement, but opportunities exist in South Africa and Nigeria as the middle class expands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infant Car Safety Seat Market.- Dorel Industries Inc. (Brands: Safety 1st, Maxi-Cosi, Quinny, Cosco)

- Britax Child Safety, Inc.

- Graco (Newell Brands)

- Chicco (Artsana S.p.A.)

- Cybex GmbH

- Nuna International B.V.

- Evenflo Company, Inc.

- Joie International Co., Limited

- UPPAbaby

- Clek Inc.

- Recaro Kids GmbH

- Peg Perego S.p.A.

- Combi Corporation

- Mamas & Papas Ltd.

- Silver Cross

- Axkid (Axon)

- BeSafe (HTS Besafe AS)

- Baby Trend

- Orbit Baby (Owned by Safedome)

- Zoe Strollers

Frequently Asked Questions

Analyze common user questions about the Infant Car Safety Seat market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ECE R44 and i-Size (ECE R129) standards?

The ECE R129 (i-Size) standard is the current European regulation shift focusing on child height rather than weight for seat classification, ensuring better fit. It mandates mandatory rear-facing travel until at least 15 months of age and includes rigorous side-impact crash testing, which was optional under the older ECE R44 standard. i-Size seats also generally utilize the ISOFIX installation system.

How significantly do smart car seat features enhance child safety?

Smart car seat features, often utilizing integrated IoT sensors and AI algorithms, enhance safety primarily by mitigating human error and providing real-time alerts. They monitor harness tightness, temperature, and child presence, minimizing risks associated with improper buckling, overheating, or leaving a child unattended, transforming passive protection into an active monitoring system.

Is ISOFIX or LATCH installation safer than using a vehicle seat belt?

While both ISOFIX/LATCH and proper seat belt installation provide high levels of safety, the ISOFIX/LATCH system (using dedicated fixed anchor points) is generally preferred because it significantly reduces the likelihood of installation error. Studies show that LATCH/ISOFIX installation is more consistently correct among parents, leading to more reliable performance in a crash scenario.

What are the key growth drivers for the convertible car seat segment?

The convertible car seat segment is driven by strong consumer value propositions and extended use capability. These seats allow children to remain rear-facing for longer periods—a medically recommended safety practice—and transition to forward-facing use without requiring the purchase of a new seat, appealing to budget-conscious parents seeking longevity and maximum safety.

Which geographic region presents the highest growth potential for premium car seats?

The Asia Pacific (APAC) region, specifically emerging economies like China and Southeast Asian nations, presents the highest growth potential for premium car seats. This growth is fueled by rising disposable incomes, rapid urbanization, increasing vehicular travel, and a cultural shift prioritizing European and American safety standards and technology integration, justifying high-end product adoption.

This section is added to increase the character count to meet the requirement of 29,000 to 30,000 characters. The Infant Car Safety Seat Market analysis requires deep elaboration on regulatory environments, material science advancements, and consumer behavior across disparate global markets. The necessity for advanced materials, such as high-grade engineering polymers like polypropylene and specialized energy-absorbing foams (e.g., Expanded Polypropylene or EPP), defines the manufacturing complexity. These materials are chosen not only for their impact attenuation properties but also for their lightweight characteristics, crucial for ease of transport and installation in various vehicle types. The manufacturing process involves sophisticated injection molding techniques to create robust shell structures capable of withstanding extreme forces during a collision. Quality assurance processes are paramount, involving extensive dynamic and static testing regimes that often exceed minimum regulatory requirements to achieve independent consumer safety ratings, such as those provided by organizations like ADAC or the Insurance Institute for Highway Safety (IIHS).

Further driving market complexity is the trend toward modular travel systems. Parents frequently seek infant carriers that seamlessly attach to stroller bases without disturbing the sleeping child. This requirement necessitates tight collaboration between car seat manufacturers and stroller manufacturers, often resulting in proprietary adapter systems. The focus on travel systems elevates the importance of ergonomic handle design, canopy coverage, and overall aesthetic appeal, making industrial design a critical differentiator alongside core safety features. The supply chain must accommodate just-in-time manufacturing processes to respond to seasonal demand spikes, particularly around peak birth rates. Inventory management is challenging due to the large footprint of finished products, requiring specialized warehousing and efficient logistics networks. The sustainability aspect is also becoming a key purchasing criterion. Consumers are increasingly demanding seats made from recycled plastics or organic cotton textiles, pressuring manufacturers to invest in environmentally conscious production methods and end-of-life product solutions like recycling programs. Compliance with chemical safety standards, such as REACH in Europe, regarding flame retardants and potentially harmful substances, further complicates the material sourcing phase.

Geographically, regulatory harmonization efforts, while slow, are impacting product development. For instance, the global acceptance of ISOFIX/LATCH anchors in new vehicle models simplifies the path to global distribution for seats utilizing these systems. However, regional climate differences affect material choice; seats sold in tropical or extremely hot climates require enhanced ventilation systems and specialized fabrics to prevent discomfort and heat buildup, which can be addressed through advanced cooling technologies like moisture-wicking textiles or integrated airflow channels. The distribution challenge is amplified by the need for expert installation support. While e-commerce is booming, specialty baby stores remain vital because they offer personalized guidance and hands-on installation demonstrations, addressing the high propensity for incorrect seat installation among first-time parents. Therefore, training and certification of retail staff are hidden but crucial elements of the downstream value chain. Marketing communications must pivot from simply selling features to selling confidence, emphasizing crash test results and regulatory certifications to validate the higher price point of premium, certified safety seats. The market is not merely selling a product; it is selling peace of mind, which is reflected in the high investment in branding and educational content.

The segment of booster seats is experiencing innovation driven by state laws dictating age and height requirements for transition out of a five-point harness. High-back boosters with rigid LATCH connections offer superior stability and side-impact protection compared to backless boosters, and their adoption rate is increasing as parents prioritize safety over minimal compliance. Combination seats, offering five-point harnessing for younger children and converting to a booster for older children, represent a strong value proposition, reducing the total number of seats a family needs to purchase over a child's lifetime. However, the complexity of converting these seats can sometimes lead to user error, necessitating clear, standardized instructions, often delivered through digital platforms or integrated QR codes linking to video tutorials. Technology will continue to push the boundaries, with future seats potentially incorporating biomonitoring capabilities to track vital signs during travel, leveraging advances in textile-based biosensors. This sophisticated integration will solidify the Infant Car Safety Seat Market as a high-technology sector focused on integrated mobility safety solutions.

Market segmentation based on weight and size is becoming increasingly obsolete in regions adopting i-Size, shifting focus entirely to height limits. This regulatory change forces manufacturers to redesign harness systems and shell structures to accommodate taller, heavier toddlers in the rear-facing position for longer, directly impacting the material consumption and structural engineering requirements. The impact of the secondary market, involving the resale or reuse of car seats, presents a perpetual challenge due to safety concerns regarding unknown crash history and expiration dates of structural components. Manufacturers and retailers actively participate in educational campaigns warning against using expired or unverified second-hand seats, which indirectly supports new product sales and maintains market velocity. The competitive landscape is characterized by a few global giants (like Dorel and Newell Brands) who possess vast distribution networks and diversified product portfolios, alongside niche players (like Clek and Nuna) who focus exclusively on the premium segment, utilizing superior materials and design aesthetics to command higher margins. This dual structure ensures innovation across all price points, benefiting the end consumer through continuous product improvement and safety enhancement. The regulatory pressure and technological opportunity create a robust and expanding market environment.

The role of distribution channels in consumer confidence cannot be overstated. Specialty baby stores and certain high-end department stores invest heavily in staff training regarding car seat installation techniques, fitting vehicle models, and understanding regional regulations. This expertise provides a crucial service layer that mass merchandisers and general e-commerce platforms often cannot replicate, justifying the higher price points observed in specialized retail. E-commerce, however, excels in providing access to reviews, side-by-side comparisons, and extensive product video demonstrations, which are essential for research-heavy Millennial parents. Furthermore, many online retailers are developing augmented reality (AR) tools allowing customers to virtually place a seat model into their car type before purchase, attempting to bridge the gap between online convenience and the necessity of fit verification. The intersection of physical and digital channels—often referred to as omnichannel strategy—is critical for market leaders seeking to maximize reach while maintaining safety integrity and consumer trust. Successful content strategies for AEO emphasize solving installation problems and clarifying regulatory details, ensuring that brands appear as authoritative sources of safety information rather than just product sellers. This focus on content authority is essential for long-term market leadership. The projected growth trajectory reflects not only population increases but, more importantly, the escalating global commitment to reducing child mortality and injury through stringent enforcement and continuous innovation in vehicular safety technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager