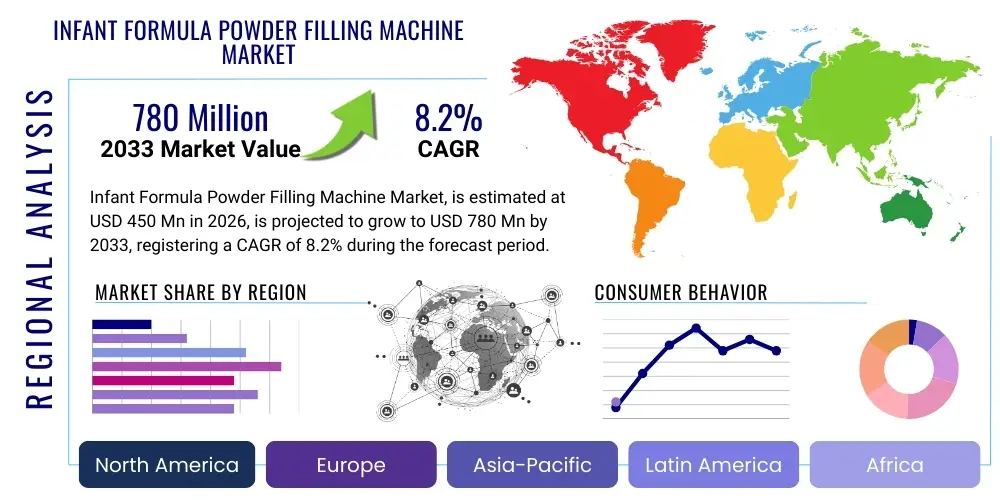

Infant Formula Powder Filling Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439053 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Infant Formula Powder Filling Machine Market Size

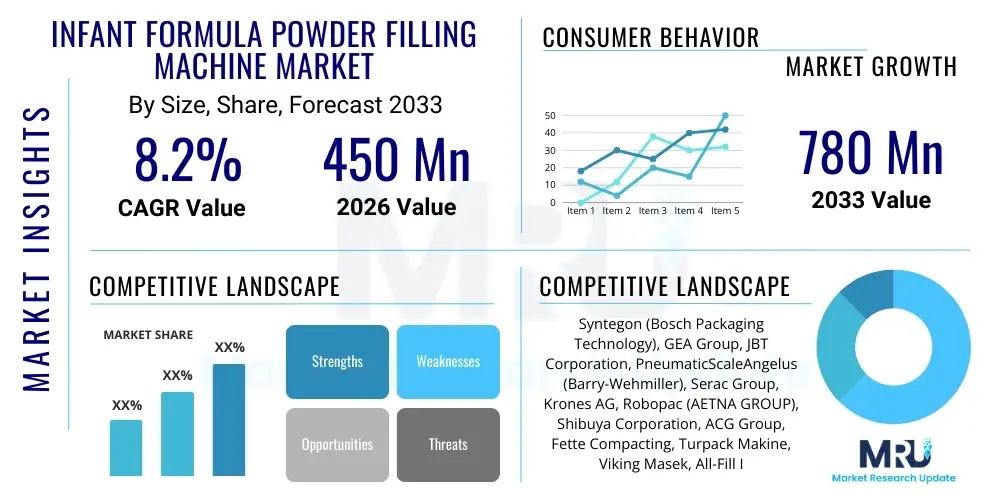

The Infant Formula Powder Filling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 780 Million by the end of the forecast period in 2033.

Infant Formula Powder Filling Machine Market introduction

The Infant Formula Powder Filling Machine Market encompasses specialized automated equipment designed for precisely measuring, dispensing, and sealing powdered milk formula into various packaging formats, including cans, jars, pouches, and rigid containers. These machines are crucial components in the dairy and infant nutrition processing chain, ensuring high standards of hygiene, accuracy, and speed required for sensitive food products intended for infants. The technology employed ranges from semi-automatic single-head fillers, suitable for small-scale operations or specialized batches, to fully integrated, high-speed rotary and linear systems capable of handling thousands of containers per hour. The primary product differentiation lies in the filling mechanism, which typically utilizes auger fillers, vacuum fillers, or volumetric cup fillers, chosen based on the powder density, flow characteristics, and required fill accuracy, which is paramount given the stringent regulatory environment governing infant nutrition.

Major applications of these sophisticated filling systems are predominantly found within large-scale infant formula manufacturing facilities operated by global food and beverage conglomerates and specialized pediatric nutrition companies. These machines are not only utilized for standard milk-based formula but also for specialized nutritional powders, such as hydrolyzed protein formulas or hypoallergenic variants, demanding even higher levels of process control and sanitation. The inherent benefits of employing these automated systems include minimizing product wastage through precision filling, maintaining product integrity by operating within controlled environments (often involving nitrogen flushing for oxygen removal), and achieving unparalleled production throughput necessary to meet global demand surges driven by population growth and changing dietary habits, particularly in emerging economies. Furthermore, the integration of advanced cleaning-in-place (CIP) and sterilization-in-place (SIP) capabilities significantly reduces cross-contamination risks, adhering to strict Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) mandates.

The market is significantly driven by several macroeconomic and industry-specific factors. The escalating global birth rates, coupled with the increasing participation of women in the workforce, have amplified the demand for convenient and safely packaged infant formula alternatives. Regulatory mandates compelling manufacturers to adopt verifiable precision filling technologies to guarantee nutrient delivery per serving also act as a strong impetus for machine upgrades and new investments. Additionally, the shift towards sustainable packaging materials, such as lighter cans or flexible pouches, necessitates continuous innovation in machine tooling and handling systems. The overall focus on enhancing food safety through automation, reducing reliance on manual labor, and improving supply chain resilience are core driving factors shaping the technological evolution and market expansion of infant formula powder filling equipment globally, ensuring operational efficiency alongside product safety.

Infant Formula Powder Filling Machine Market Executive Summary

The business landscape of the Infant Formula Powder Filling Machine Market is characterized by intense competition among established global packaging machinery manufacturers, coupled with specialized regional players focusing on cost-effective solutions. Key business trends involve a definitive move towards fully automatic, integrated production lines that offer comprehensive services including depalletizing, sterilization, filling, capping, and end-of-line packaging. Manufacturers are increasingly prioritizing modular machine designs that allow for quick changeovers between different container sizes and product types, addressing the growing consumer preference for diverse formula offerings. Strategic mergers, acquisitions, and collaborations are frequently observed, particularly where established engineering firms seek to acquire expertise in high-precision dosing technology or expand their geographical footprint into high-growth regions like Asia Pacific. Furthermore, the proliferation of smart manufacturing concepts, integrating IoT and predictive maintenance into filling systems, is becoming a standard feature, driving capital expenditure in digitalization across the industry.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, largely fueled by massive consumer bases in China and India, rising disposable incomes, and urbanization that has increased the acceptance and usage of packaged infant formula. Government initiatives supporting improved healthcare and nutritional standards further accelerate market adoption in this region. North America and Europe, while representing mature markets, maintain high demand for premium, high-accuracy filling machines due to stringent quality control regulations and high labor costs, necessitating advanced automation. These regions are primarily focused on replacement cycles, machinery upgrades compliant with Industry 4.0 standards, and adopting sustainable packaging handling equipment. Conversely, Latin America, the Middle East, and Africa (MEA) present emerging opportunities, often characterized by demand for robust, moderately automated systems that offer durability and ease of maintenance in challenging operational environments, often supplied through robust export activities from European and North American manufacturers.

Segment trends highlight the dominance of the high-speed, fully automatic filling machines, which are essential for large-volume manufacturers aiming for economies of scale. Auger filling technology remains the core segment due to its proven reliability and adaptability for various powder types, although vacuum and gravimetric systems are gaining traction for ultra-high accuracy requirements. In terms of packaging type, filling machines catering to metal cans hold the largest share due to their superior barrier properties and established recycling infrastructure, but the pouch filling segment is experiencing the highest growth rate, reflecting consumer demand for lighter, more portable, and lower-cost packaging formats. Manufacturers are thus heavily investing in developing advanced servo-driven, dust-free pouch filling and sealing systems. This comprehensive market movement towards higher automation, precision, and geographical diversification underscores the dynamic nature of the infant formula supply chain and the critical role of filling machinery innovation.

AI Impact Analysis on Infant Formula Powder Filling Machine Market

Common user questions regarding AI's influence on the Infant Formula Powder Filling Machine Market typically revolve around operational efficiency, predictive quality control, and maintenance protocols. Users frequently inquire: "How can AI reduce the giveaway (overfilling) of expensive formula powder?", "Can AI systems detect minute deviations in powder consistency or weight in real-time better than traditional sensors?", and "What is the return on investment (ROI) for implementing machine learning models for predictive maintenance on filling line components like augers or bearings?" There are also significant concerns about data security, integration complexity with legacy systems, and the need for specialized personnel to manage these advanced algorithms. Overall, the expectation is that AI will transform filling accuracy, minimize downtime, and elevate food safety standards beyond current regulatory compliance, pushing the industry towards autonomous and optimized production environments.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) models is poised to fundamentally revolutionize the operation and maintenance of infant formula powder filling machinery. AI algorithms are exceptionally capable of processing vast amounts of real-time data collected from weight sensors, vision systems, and flow meters, optimizing the servo motor movements of the auger or dosing mechanism. This allows for dynamic adjustment of fill volumes based on instant feedback about powder density variation and machine vibration, thereby reducing the standard deviation in fill weights dramatically. By minimizing overfilling, AI directly contributes to significant material cost savings, which is critical given the high cost of infant formula ingredients. Furthermore, ML models are being trained to predict subtle shifts in product quality or potential contamination risk by analyzing sensor data patterns indicative of anomalies in the filling process, ensuring proactive intervention before batch loss occurs.

Beyond process optimization, AI systems are transforming the maintenance landscape. Traditional preventive maintenance schedules are being replaced by predictive maintenance powered by ML models that analyze vibration, temperature, and energy consumption data from critical machine components. These systems can accurately forecast the remaining useful life of parts, signaling maintenance requirements precisely when needed, rather than following rigid, time-based schedules. This predictive capability dramatically reduces unscheduled downtime—a major bottleneck in high-throughput production environments—and extends the operational lifespan of the expensive machinery. While the initial investment in AI integration and sensor infrastructure is substantial, the long-term benefits in terms of enhanced efficiency, reduced operational costs, and superior quality assurance solidify AI's position as a transformative force in the high-precision powder filling sector.

- Enhanced Fill Accuracy: AI algorithms dynamically adjust dosing parameters in milliseconds, minimizing product giveaway and optimizing material use.

- Predictive Maintenance: Machine learning analyzes sensor data to forecast component failure, reducing unscheduled downtime by up to 30-40%.

- Real-time Quality Control: Vision systems linked to AI detect foreign objects, container defects, or slight inconsistencies in powder settlement with high precision.

- Process Optimization: AI models identify and suggest optimal machine settings (speed, vibration compensation, nitrogen flushing rate) based on historical batch performance.

- Autonomous Calibration: Future systems will utilize AI for self-calibration and self-diagnosis, significantly reducing the need for manual operator intervention during changeovers.

DRO & Impact Forces Of Infant Formula Powder Filling Machine Market

The Infant Formula Powder Filling Machine Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping the direction of technological investment and regional growth. Key drivers include the persistently increasing global demand for infant nutrition products, particularly in fast-developing markets where middle-class populations are expanding and purchasing power is rising. Furthermore, strict global regulations from bodies such as the WHO, FDA, and EFSA mandate ultra-high levels of hygiene and fill accuracy, forcing manufacturers to upgrade to advanced, automated filling systems that meet validation standards for precision and sterility. The necessity for high-speed production lines to achieve economies of scale and respond efficiently to global supply chain pressures further compels investment in state-of-the-art machinery capable of high throughput and minimal operational disruption.

Conversely, significant restraints hinder uniform market expansion. The high capital expenditure associated with purchasing and implementing sophisticated, fully automatic powder filling lines—especially those incorporating advanced AI, servo technology, and inert gas flushing capabilities—presents a major barrier, particularly for small and medium-sized enterprises (SMEs) or manufacturers in developing economies. Technical complexities related to handling diverse powder characteristics (density, flowability, static charge) necessitate customized engineering solutions, increasing lead times and installation costs. Moreover, the stringent regulatory environment, while a driver for quality, also acts as a restraint due to the time and cost involved in rigorous validation processes and machine certification, which can delay the deployment of new technologies and increase operational complexity for end-users trying to maintain compliance across multiple jurisdictions.

The primary opportunities for market growth lie in technological innovation and geographical expansion. The growing demand for specialized formulas (e.g., organic, non-GMO, specific therapeutic diets) requires flexible filling systems capable of rapid product changeovers without contamination risk, driving demand for modular and sterile machine designs. Market players can capitalize on the burgeoning markets in Southeast Asia and Africa by offering localized service support and financing options. Furthermore, the burgeoning trend toward sustainable and flexible packaging (pouches and biodegradable materials) provides a substantial opportunity for machine manufacturers to develop novel handling and sealing technologies optimized for these formats, moving beyond the traditional reliance on rigid metal cans. The overarching impact forces—regulatory stringency, technological necessity, and cost optimization pressures—continue to drive the market towards higher automation, greater precision, and enhanced food safety standards, defining the competitive landscape.

Segmentation Analysis

The Infant Formula Powder Filling Machine Market is systematically segmented based on Technology Type, Level of Automation, Packaging Type, and Geographic Region, providing a granular view of market dynamics and investment pockets. Analyzing these segments helps stakeholders understand which machine capabilities are experiencing the highest demand and where technological focus is concentrated. The segmentation by technology type, which primarily includes auger fillers, gravimetric fillers, and volumetric cup fillers, reflects the trade-off between speed, accuracy, and cost, with auger fillers maintaining a significant share due to their versatility and robustness in handling fine powders, although gravimetric systems are gaining ground due to superior accuracy, particularly for high-value ingredients.

Segmentation based on the level of automation—covering semi-automatic, automatic, and fully automatic lines—is highly indicative of market maturity and production scale. Fully automatic lines dominate in mature and high-volume markets like North America and China, demanding seamless integration with upstream sterilization and downstream capping and labeling systems. Conversely, semi-automatic machines remain relevant for smaller manufacturers, specialized product runs, or in regions where initial capital investment constraints are significant. The Packaging Type segment is critical, detailing machine demand for metal cans (historically dominant), plastic jars, glass bottles, and flexible pouches. The rapid shift towards flexible packaging due to logistical advantages and reduced environmental footprint is driving innovation in pouch-specific filling and sealing equipment.

Overall market segmentation highlights a clear industry trajectory toward integrated, high-speed, and high-precision machinery. The need for reduced cross-contamination risk is pushing the adoption of advanced cleaning features (CIP/SIP) across all segments, ensuring that filling machines are not just fast, but also highly sanitary and compliant with the latest global hygiene standards. This detailed segmentation allows manufacturers to tailor their product offerings, focusing on high-growth areas such as high-accuracy gravimetric systems and equipment dedicated to sustainable, flexible packaging solutions, thereby maximizing competitive advantage and aligning with evolving consumer and regulatory demands worldwide.

- Technology Type:

- Auger Fillers

- Gravimetric Fillers

- Volumetric Cup Fillers

- Vacuum Fillers

- Level of Automation:

- Semi-Automatic

- Automatic

- Fully Automatic

- Packaging Type:

- Metal Cans

- Plastic Jars

- Flexible Pouches

- Others (Glass, Bulk Containers)

- Capacity:

- Low Capacity (Up to 60 containers/min)

- Medium Capacity (60 - 150 containers/min)

- High Capacity (Above 150 containers/min)

Value Chain Analysis For Infant Formula Powder Filling Machine Market

The Value Chain for the Infant Formula Powder Filling Machine Market begins with the upstream suppliers of raw materials and sophisticated components. This includes specialized stainless steel alloys required for sterile contact parts, advanced servo motors and control systems (PLCs, HMI interfaces), precision sensors (load cells, weight checkers), and high-quality mechanical components such as gears, conveyors, and sealing elements. Key upstream activities involve the engineering and design phase, where manufacturers invest heavily in R&D to develop dust-free, high-accuracy dosing mechanisms and sanitation protocols. The quality and sourcing reliability of these components are paramount, as the final machine’s performance, particularly its operational speed and fill accuracy, directly depends on the quality of these integrated components, often sourced from global specialized technology providers in automation and robotics.

The core of the value chain is the manufacturing and assembly phase (midstream), where the machinery is designed, fabricated, and rigorously tested. This stage involves sophisticated metalworking, welding, and system integration, ensuring that the complex mechanical and electronic systems function seamlessly under high-speed, sterile conditions. Value addition here is primarily driven by intellectual property, particularly the patented designs of the filling heads and the integrated software that manages dosing adjustments and quality verification. Downstream activities involve the distribution channel, which is typically bifurcated into direct sales and indirect channels. Large, multinational machinery producers often employ a direct sales model for major infant formula manufacturers, offering comprehensive project management, customized engineering, installation, and long-term service contracts. This direct approach ensures technical complexity is managed effectively.

The indirect channel involves leveraging specialized distributors, agents, and local system integrators, particularly in emerging or smaller regional markets. These partners provide local market expertise, manage customs, and offer localized installation and maintenance support, which is crucial for maximizing machine uptime for the end-users. The final stage involves after-sales service, including spare parts supply, technical support, regular preventative maintenance, and machine upgrades. Given the continuous evolution of regulatory standards and the critical nature of infant formula production, the revenue generated from long-term service agreements constitutes a vital and high-margin component of the overall value chain for machinery manufacturers, ensuring sustained engagement with potential customers.

Infant Formula Powder Filling Machine Market Potential Customers

Potential customers for Infant Formula Powder Filling Machines are predominantly large multinational food and beverage corporations specializing in pediatric nutrition and dairy processing. These companies operate extensive, high-volume production facilities globally and require state-of-the-art, fully automated lines capable of 24/7 operation with minimal human intervention. Examples include major global dairy players and pharmaceutical companies with specialized nutrition divisions. Their purchasing decisions are driven by factors such as throughput capacity, adherence to global cGMP standards, validation services offered by the machine supplier, and the total cost of ownership (TCO), focusing on energy efficiency and long-term maintenance costs. They often prefer suppliers who can provide complete turnkey solutions, from upstream ingredient handling to final case packing.

A secondary, yet significant, customer base includes medium-sized regional dairy and infant food processors, particularly those serving specific national markets or focusing on niche product segments like organic, specialized hypoallergenic, or locally sourced formula. These customers often opt for flexible, modular, or semi-automatic filling machines that offer scalability and lower initial capital investment compared to the giant fully automatic lines. Their purchasing criteria often prioritize ease of use, robustness, and quick access to local maintenance support and spare parts, rather than maximum throughput. These regional players are crucial for market penetration in developing economies where local production is incentivized by government policies.

Furthermore, contract manufacturers (co-packers) specializing in powder handling and packaging represent a rapidly growing customer segment. These co-packers offer outsourced manufacturing services to brand owners who prefer not to invest in their own extensive production facilities. Since co-packers handle multiple clients and various product specifications, their demand leans heavily towards highly flexible filling machines with extremely fast and verifiable changeover capabilities, minimal cleaning cycles, and certified contaminant-free operations. Their need for versatility and efficiency positions them as early adopters of advanced automation and AI-driven systems designed to manage high product variety while maintaining stringent quality control, making them a premium target for machinery suppliers focused on innovation and customization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 780 Million |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syntegon (Bosch Packaging Technology), GEA Group, JBT Corporation, PneumaticScaleAngelus (Barry-Wehmiller), Serac Group, Krones AG, Robopac (AETNA GROUP), Shibuya Corporation, ACG Group, Fette Compacting, Turpack Makine, Viking Masek, All-Fill Inc., Oden Corporation, Tenco, Spee-Dee Packaging Machinery, Webster Griffin, Powder Pack Systems, ProSys |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infant Formula Powder Filling Machine Market Key Technology Landscape

The technological landscape of the Infant Formula Powder Filling Machine Market is dominated by the pursuit of ultra-high precision, maximum hygiene, and operational flexibility. The foundational technology remains the servo-driven auger filler, which utilizes highly accurate, electronically controlled rotational movements to dispense powder volumetrically. Recent advancements in this area focus on integrating dynamic compensation algorithms that automatically adjust the auger speed and duration based on real-time feedback from check weighers, correcting for variations in powder bulk density that typically occur during production. This integration of sophisticated servo technology with proprietary software ensures that filling deviations are minimized, often targeting accuracies within +/- 0.5 grams, which is critical for expensive nutritional ingredients. Furthermore, dust control technology, including sophisticated vacuum systems and closed containment chambers, is now standard to prevent cross-contamination and ensure a clean operating environment.

Gravimetric filling is emerging as a critical complementary technology, especially for premium or high-value specialized formula. Unlike volumetric auger filling, gravimetric systems measure the final product weight directly using high-speed, high-resolution load cells mounted beneath the containers. This provides superior accuracy and verifiable documentation of fill weight, which is essential for pharmaceutical-grade nutrition products. The complexity lies in designing systems that can dose powder quickly while maintaining measurement accuracy, often requiring multi-stage filling (bulk and dribble feed) combined with advanced vibration dampening. Moreover, the increased adoption of inert gas flushing (nitrogen or argon) technology is a crucial technological necessity. Before and during the filling process, containers are flushed to displace oxygen, significantly extending the shelf life and preserving the nutritional efficacy of the sensitive fat and vitamin content in infant formula.

Beyond the core filling mechanisms, the market is rapidly adopting technologies related to connectivity and data management. Industry 4.0 principles necessitate the integration of IoT sensors and Supervisory Control and Data Acquisition (SCADA) systems to enable remote monitoring, performance benchmarking (OEE tracking), and seamless integration with Enterprise Resource Planning (ERP) systems. The adoption of Clean-in-Place (CIP) and Sterilization-in-Place (SIP) systems, which use automated hot water, steam, or chemical cycles, eliminates the need for manual cleaning and significantly reduces machine downtime while guaranteeing sterility. The ongoing research focuses heavily on developing aseptic dry filling technology, which, while complex, promises the highest level of sterility assurance for highly sensitive infant nutrition products, representing the next frontier in filling machine innovation and technological supremacy within the sector.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest market share and exhibits the highest growth rate globally, driven by demographic expansion, rising urbanization, and improving economic conditions, particularly in China, India, and Southeast Asia. The region is characterized by immense investment in new manufacturing capacity to meet burgeoning domestic demand, leading to high procurement rates for fully automatic, high-capacity filling lines. Stringent governmental oversight concerning infant safety, especially following historical quality scandals, compels manufacturers to purchase advanced, verifiable machinery. Local manufacturers are emerging, challenging global players on price, though international brands maintain dominance in high-end, aseptic technology.

- North America: This region is a mature, highly regulated market focused on technological upgrades, replacement cycles, and adopting Industry 4.0 compliant machinery. The demand is concentrated on ultra-precise gravimetric and servo-controlled systems due to high labor costs and the need for zero product giveaway, adhering strictly to FDA regulations. Innovation is centered around flexible manufacturing capabilities to handle the increasing variety of specialized, premium, and organic formula products, demanding quick changeovers and robust data traceability features. The presence of major global infant nutrition headquarters drives consistent, albeit stable, demand for cutting-edge technology.

- Europe: Europe is characterized by extremely stringent quality standards (EFSA) and a strong emphasis on sustainability. Demand here focuses on energy-efficient machines and those capable of handling eco-friendly packaging materials, such as specific types of lightweight cans or recyclable pouches. The market is primarily driven by machine upgrades and maintenance of established production bases in countries like Germany, France, and Italy. Suppliers must provide extensive validation and documentation packages, making compliance support a key competitive factor alongside technical performance.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, presenting opportunities for both semi-automatic and automatic filling machines. The market is sensitive to capital costs, leading to demand for robust, reliable machinery that is easier to maintain and operate in varying infrastructure conditions. Brazil and Mexico are key hubs, attracting international manufacturers establishing local production or expanding distribution networks. Price sensitivity and the need for localized service support are major considerations for successful market penetration.

- Middle East and Africa (MEA): This region offers long-term growth potential, particularly in the Gulf Cooperation Council (GCC) countries and South Africa, driven by increased disposable income and government efforts to improve nutritional standards. While smaller in market size currently, MEA requires machines optimized for extreme climate conditions and often relies on machinery imports from Europe and Asia. The establishment of local packaging and filling operations is a strategic focus for reducing reliance on imported finished goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infant Formula Powder Filling Machine Market.- Syntegon (Bosch Packaging Technology)

- GEA Group

- JBT Corporation

- PneumaticScaleAngelus (Barry-Wehmiller)

- Serac Group

- Krones AG

- Robopac (AETNA GROUP)

- Shibuya Corporation

- ACG Group

- Fette Compacting

- Turpack Makine

- Viking Masek

- All-Fill Inc.

- Oden Corporation

- Tenco

- Spee-Dee Packaging Machinery

- Webster Griffin

- Powder Pack Systems

- ProSys

- Paxiom Group

Frequently Asked Questions

Analyze common user questions about the Infant Formula Powder Filling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-precision infant formula filling machines?

The primary driver is stringent global regulatory compliance, mandated by bodies such as the FDA and EFSA, which requires ultra-high fill accuracy to ensure precise nutrient dosage per container, coupled with escalating consumer demand for superior product safety and integrity.

How does the choice between volumetric and gravimetric filling affect operational efficiency?

Volumetric fillers (like auger systems) are faster and more economical for standard powders, optimizing throughput. Gravimetric fillers, using load cells, offer superior accuracy, reducing product giveaway and minimizing legal risk, making them essential for high-value or specialized formulas, though they may operate slightly slower than pure volumetric systems.

What role does automation play in ensuring hygiene and preventing contamination in infant formula production?

Full automation, including Clean-in-Place (CIP) and Sterilization-in-Place (SIP) systems, minimizes human contact and standardizes cleaning protocols, drastically reducing the risk of microbial and particulate contamination. Automated systems also facilitate inert gas flushing (nitrogen) to preserve product freshness and shelf life.

Which geographical region exhibits the highest growth potential for Infant Formula Powder Filling Machine sales?

The Asia Pacific (APAC) region, driven by rapid urbanization, rising middle-class disposable income, and increasing birth rates in major economies like China and India, consistently demonstrates the highest market growth rate and investment in new capacity expansion.

What technological innovations are being adopted to improve packaging flexibility?

Manufacturers are developing advanced servo-driven, modular filling lines capable of rapid and automated changeovers between different packaging formats (cans, jars, pouches). The focus is increasingly on specialized handling systems for flexible pouches, which are gaining popularity due to sustainability and logistical benefits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager