Infant Hats Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438919 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Infant Hats Market Size

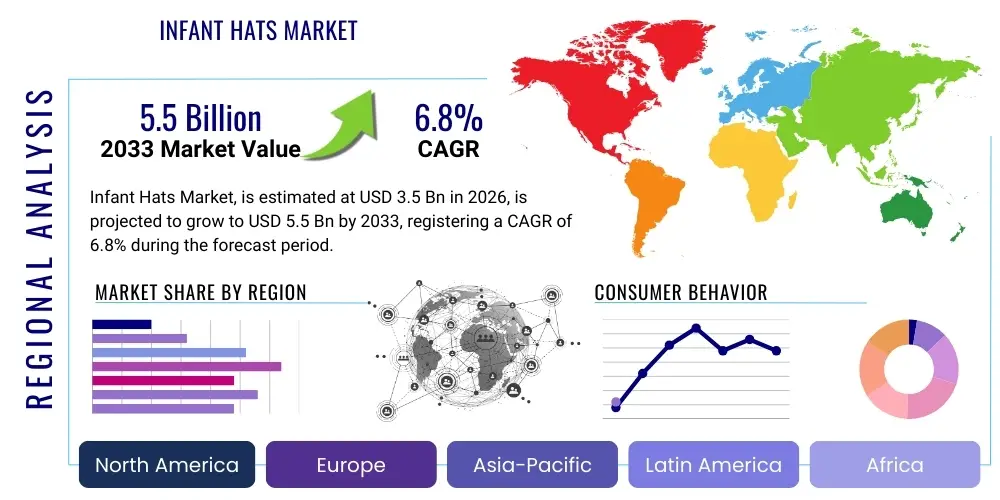

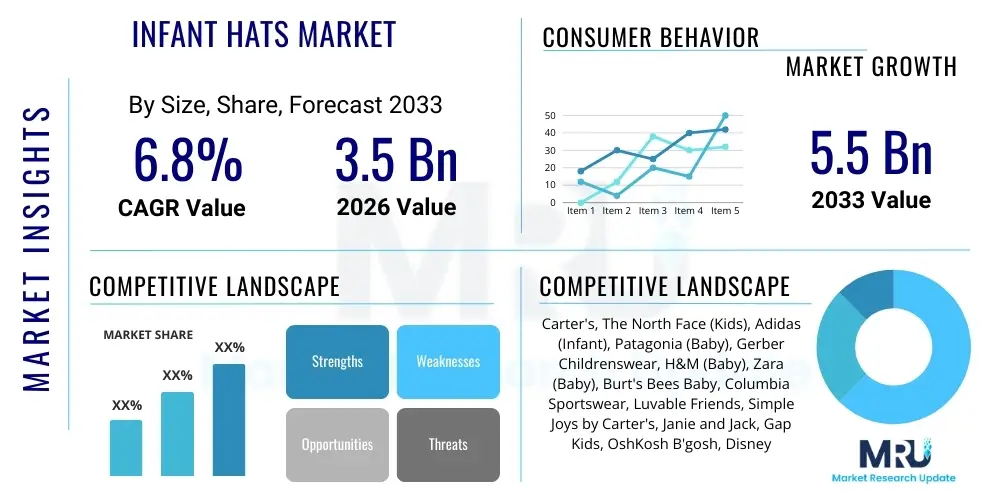

The Infant Hats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033.

Infant Hats Market introduction

The Infant Hats Market encompasses the manufacturing, distribution, and sale of headwear specifically designed for children from birth up to 24 months of age. These products serve essential functional purposes, including thermal regulation, protection from environmental elements such as harsh sunlight (UVA/UVB rays) and cold weather, and increasingly, aesthetic and fashion purposes. The market is highly influenced by seasonal changes, parental spending power, and stringent safety standards governing materials and design to prevent hazards like choking or strangulation. Key product types range from functional items like beanies and winter caps, crucial for maintaining an infant’s body temperature in early months, to fashion accessories such as sun hats, bucket hats, and specialized novelty hats for events.

Major applications of infant hats revolve around essential infant care, particularly thermal management and sun protection. Newborns require head coverings immediately after birth to prevent rapid heat loss, driving consistent demand for soft, breathable cotton beanies. As infants grow, the application shifts toward outdoor use, necessitating hats with wide brims and UV protection factors, especially in regions with high solar intensity. Furthermore, the market benefits significantly from cultural and social applications, where hats are utilized for milestones, photography sessions, or as a component of coordinated outfits. The materials used are critical, with organic cotton, bamboo fibers, and hypoallergenic blends dominating production to ensure comfort and minimize skin irritation for sensitive infant skin, necessitating high standards in sourcing and manufacturing processes.

The primary benefits driving market expansion include heightened parental awareness regarding neonatal temperature control and dermatological health, particularly concerning ultraviolet radiation exposure. Driving factors include sustained high birth rates in emerging economies, increased disposable income among millennial and Gen Z parents who prioritize branded and stylish infant accessories, and continuous innovation in material science leading to safer, more comfortable, and highly functional fabrics. Additionally, the proliferation of specialized online retail channels and social media marketing has significantly boosted visibility and accessibility for niche, designer, and ethically sourced infant hat brands, accelerating consumer adoption rates globally and increasing the perceived necessity of owning multiple types of hats for various occasions and weather conditions.

Infant Hats Market Executive Summary

The Infant Hats Market demonstrates resilient growth, underpinned by consistent demand for essential infant wear and a simultaneous surge in demand for fashionable, specialty accessories. Business trends highlight a strong shift toward digitalization, with e-commerce platforms becoming the predominant sales channel, enabling Direct-to-Consumer (DTC) brands specializing in sustainable and organic materials to gain substantial market share against established conventional retailers. Manufacturers are increasingly focusing on vertical integration, ensuring traceability of materials like certified organic cotton and recycled polyester, driven by parental preference for eco-friendly and non-toxic products. Furthermore, strategic partnerships between apparel companies and pediatric organizations or influencers are becoming crucial for building trust and brand authority in a segment where safety is the paramount concern, influencing product development cycles heavily toward compliance with international safety standards like CPSIA and EN 71.

Regional trends indicate that North America and Europe currently hold the largest market shares due to high parental spending power and established safety regulations mandating high-quality infant products. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial increases in birth rates, rapid urbanization, and rising middle-class disposable incomes, particularly in countries like China and India, where awareness of infant sun protection is escalating. Manufacturers are adapting their distribution strategies to penetrate these highly fragmented APAC markets, often utilizing local partnerships and optimizing supply chains to manage the complexities of regional regulatory differences and consumer preferences concerning color, style, and fabric weight suitable for diverse climates.

Segment trends reveal that the Material segment is witnessing the most dynamic change, with organic cotton and bamboo emerging as key growth drivers, significantly outpacing traditional materials like conventional polyester, despite the latter's cost efficiency. Within the Product Type segment, sun hats and specialized UV-protective hats are exhibiting faster growth compared to basic beanies, reflecting the increasing outdoor activities encouraged by modern parenting lifestyles and greater health consciousness. Distribution Channel analysis confirms that the Online Retail segment is the definitive leader in growth, offering consumers unparalleled access to comparative product information, customer reviews regarding fit and safety, and convenience, thereby influencing purchasing decisions significantly more than traditional brick-and-mortar stores, which nevertheless remain vital for impulse purchases and tactile quality checks.

AI Impact Analysis on Infant Hats Market

Analysis of common user questions regarding AI's influence on the Infant Hats Market reveals key themes centered around supply chain efficiency, personalized product recommendations, and advanced manufacturing optimization. Users frequently inquire about how AI can predict fashion trends and material preferences specific to regional climates and cultural events, aiming to reduce inventory risk and overproduction. Another significant area of concern involves utilizing machine learning algorithms to enhance quality control during manufacturing, particularly identifying micro-defects in stitching or material integrity that could compromise infant safety. Furthermore, parents are interested in AI-driven personalization tools, such as generative models that design unique hat styles based on parent input (e.g., color preferences, outfit matching, demographic data) or tools that recommend the precise size and fit based on aggregated infant growth data, thereby minimizing returns and enhancing customer satisfaction in the highly fragmented sizing segment of infant apparel.

- AI-Powered Demand Forecasting: Utilizing machine learning to predict regional demand shifts, preferred material types (e.g., organic vs. synthetic), and seasonal style trends, leading to optimized inventory levels and reduced textile waste in line with sustainable goals.

- Customized Product Development: Employing generative AI models to design personalized hat styles and patterns based on specific consumer requests or analysis of trending social media aesthetics, significantly speeding up the design-to-market cycle.

- Manufacturing Quality Control: Implementing computer vision systems powered by AI for automated defect detection during production (e.g., examining seam integrity, fabric uniformity, secure placement of embellishments) to maintain stringent infant safety standards.

- Supply Chain Optimization: Using predictive analytics to model and manage global supply chain risks, optimize logistics routes for raw material sourcing (like certified cotton), and minimize lead times for fulfilling e-commerce orders.

- Enhanced E-commerce Personalization: Deploying AI recommendation engines on retail platforms that use browsing history and demographic data to suggest hats based on climate, age-appropriate style, and existing outfit purchases, improving conversion rates.

DRO & Impact Forces Of Infant Hats Market

The Infant Hats Market is strategically influenced by a combination of key drivers promoting growth, intrinsic restraints posing challenges, and emerging opportunities that can redefine the market trajectory, all interacting within a complex ecosystem of impact forces. A primary driver is the increased global emphasis on preventative healthcare, specifically sun safety and thermal regulation for newborns, often supported by pediatric recommendations that mandate high-quality head coverings. This driver is powerfully reinforced by rising disposable incomes in developing regions, enabling parents to choose premium, branded products over generic alternatives. Conversely, the market faces significant restraints, including highly volatile seasonal demand, which complicates inventory management, and the ever-present regulatory scrutiny concerning small parts, drawstrings, and material toxicity, requiring continuous and costly compliance updates. Opportunities, such as the integration of wearable technology (smart hats for temperature monitoring) and the rapid expansion of sustainable sourcing networks, offer pathways for differentiation and premium pricing, mitigating some restraint effects and leveraging the consumer trend toward ethical consumption.

Impact forces within the market operate across several dimensions, notably competitive intensity and buyer power. Competitive intensity is high, characterized by numerous global and local players vying for visibility, often through aggressive digital marketing campaigns and quick adaptation to micro-trends. Established apparel giants leverage economies of scale, while niche DTC brands rely on specialized, high-margin products like organic and personalized hats. Buyer power is substantial; parents are highly informed consumers, frequently comparing quality, safety certifications, and ethical sourcing practices before purchase. This strong buyer power necessitates transparency in the supply chain and competitive pricing strategies. Supplier power, particularly for certified organic cotton and specialized UV-protective fabrics, is moderate, as brands must secure reliable, certified inputs to meet premium segment demands. This interplay necessitates robust product development focused simultaneously on safety compliance, aesthetic appeal, and cost-effective manufacturing.

The convergence of increasing social media influence on parenting trends and the stringent regulatory environment creates a dynamic market landscape. Trends popularized by celebrity culture or parent influencers can rapidly shift demand towards specific styles (e.g., gender-neutral designs or specific animal motifs), demanding rapid supply chain responsiveness. Furthermore, the mandatory requirements for clear labeling, non-toxic dyes, and secure attachments act as significant barriers to entry for new, non-compliant players. This continuous pressure from both regulatory bodies and consumer expectations for transparency and safety ensures that innovation often focuses more on material science, such as hypoallergenic coatings and enhanced breathability, rather than purely aesthetic features. Successfully navigating these driving and restraining forces requires manufacturers to prioritize verifiable safety credentials and ethical marketing practices to build lasting consumer trust in a highly sensitive product category.

Segmentation Analysis

The Infant Hats Market is segmented primarily based on Product Type, Material, Distribution Channel, and Age Group. This segmentation provides a granular view of consumer preferences and market dynamics across various categories. The product type segmentation captures the diversity of hat styles, ranging from essential protective wear like beanies and sun hats to novelty and fashion-driven accessories. Material segmentation highlights the critical consumer shift towards natural, sustainable, and hypoallergenic fabrics, which significantly influences pricing and brand positioning. Analyzing distribution channels reveals the growing dominance of e-commerce platforms, although traditional retail remains important for immediate purchases and tactile evaluation. Finally, age group analysis helps manufacturers tailor specific features, sizing accuracy, and safety considerations appropriate for developmental stages, from the delicate needs of newborns to the active lifestyle of toddlers.

- By Product Type

- Beanies/Knitted Hats

- Sun Hats (Bucket Hats, Wide Brim Hats)

- Specialty Hats (Novelty, Formal Wear, Photo Props)

- Caps and Other Headwear

- By Material

- Cotton (Organic Cotton, Conventional Cotton)

- Wool/Knit

- Polyester/Blended Fabrics

- Bamboo/Other Natural Fibers

- By Distribution Channel

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Stores (Infant Apparel Boutiques, Department Stores)

- Supermarkets and Hypermarkets

- Pharmacies/Drug Stores

- By Age Group

- Newborn (0-3 Months)

- Infant (3-12 Months)

- Toddler (12-24 Months)

Value Chain Analysis For Infant Hats Market

The value chain for the Infant Hats Market begins with upstream activities focused heavily on raw material sourcing and preparation. Given the segment's stringent safety requirements, upstream analysis centers on securing certified, high-quality, non-toxic materials, predominantly organic cotton, bamboo fibers, and specialized UV-protective textiles. Key suppliers in this phase are textile mills and certified organic cotton farms, whose adherence to certifications (like GOTS or Oeko-Tex) dictates the quality and ethical positioning of the final product. Strong relationships with suppliers who guarantee material traceability and ethical labor practices are crucial for brands targeting the premium market segment, often involving long-term contracts to ensure stable supply and price negotiation power against volatile commodity markets for raw cotton. Manufacturers prioritize bulk purchasing and efficient yarn preparation, maintaining rigorous inbound quality checks to ensure material suitability for delicate infant skin, minimizing potential for recalls or allergic reactions.

Midstream activities involve the design, manufacturing, and assembly of the hats. Design teams focus on practical elements like secure chin straps, seam placement to prevent chafing, and age-appropriate sizing accuracy, constantly iterating based on consumer feedback and pediatrician guidelines. Manufacturing encompasses cutting, stitching, and embellishment application (e.g., embroidery, patches), requiring specialized machinery that handles delicate fabrics while ensuring durability. Quality assurance and control (QA/QC) are intensive at this stage, focusing on stress testing small parts (snaps, buttons) and verifying material compliance before packaging. Efficient production processes are vital, often involving automation for standard beanie production but requiring higher levels of manual skilled labor for complex, decorative, or highly customized specialty hats, impacting unit cost and production volume flexibility.

Downstream activities center on distribution, sales, and marketing. The distribution channel is heavily bifurcated between direct and indirect sales. Indirect channels involve bulk sales to major retailers, department stores, and hypermarkets, leveraging their established supply chains and physical store presence for broad market reach. Direct channels, primarily driven by e-commerce and brand-specific websites, offer higher margins and direct consumer data access, crucial for personalization and targeted marketing efforts. The rise of social media marketing and influencer collaborations has significantly streamlined consumer engagement in the downstream segment. Effective inventory management and rapid fulfillment capabilities are essential for e-commerce success, where consumers expect quick delivery of frequently purchased, lower-cost items, necessitating sophisticated warehouse management systems and strategic partnerships with third-party logistics (3PL) providers specialized in small-package delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carter's, The North Face (Kids), Adidas (Infant), Patagonia (Baby), Gerber Childrenswear, H&M (Baby), Zara (Baby), Burt's Bees Baby, Columbia Sportswear, Luvable Friends, Simple Joys by Carter's, Janie and Jack, Gap Kids, OshKosh B'gosh, Disney Baby, Kickee Pants, Zutano, Rylee & Cru, Copper Pearl, Tiny Alpaca. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infant Hats Market Potential Customers

The primary potential customers in the Infant Hats Market are parents and immediate family members (grandparents, aunts, uncles) purchasing essential and specialty wear for infants aged 0 to 24 months. Within this group, customers are highly segmented based on purchasing criteria: the first group comprises safety-conscious parents who prioritize functionality, material quality (organic/hypoallergenic), and pediatric endorsements, often seeking out specialty infant stores or premium online brands focused on health and environmental safety. This segment is less price-sensitive and drives demand for certified, high-end products like UV-rated sun hats and GOTS-certified beanies, often researching products extensively before making a purchase, viewing the hat as a necessary item of protective equipment.

A second major customer group consists of value-seeking customers who prioritize affordability and convenience, typically purchasing basic, multi-pack hats from mass-market retailers, supermarkets, or large e-commerce platforms like Amazon. While still requiring adherence to fundamental safety standards, their decision is often driven by competitive pricing and ease of procurement, reflecting the rapid growth phase of infants which necessitates frequent replacements. This segment is highly responsive to promotions and bulk offers, favoring large, established brands known for reliable quality at accessible price points, requiring streamlined logistics and high-volume production capabilities from manufacturers.

Finally, there is a substantial segment driven by aesthetic and gifting purposes, targeting specialized, novelty, or fashion-forward hats. These customers often purchase hats for specific events, photo shoots, or as part of a curated wardrobe, heavily influenced by social media trends and designer collaborations. Retailers catering to this segment must focus on unique designs, customization options, and rapid trend responsiveness, selling primarily through specialty boutiques and dedicated online channels. Marketing to this group often involves visual content and influencer endorsements, highlighting the hat as a statement accessory rather than merely a functional necessity, thereby broadening the market beyond purely essential items and contributing significantly to the demand for higher-margin specialty products.

Infant Hats Market Key Technology Landscape

The Infant Hats Market utilizes a technological landscape primarily focused on advanced textile manufacturing, digital design, and emerging smart fabric integration. Core manufacturing technologies involve precision knitting and weaving machinery capable of handling delicate organic and fine-gauge yarns while maintaining high durability and elasticity required for comfortable infant wear. Specifically, seamless knitting technology is increasingly adopted to eliminate irritating internal seams, a major factor in infant comfort and parental preference, demanding specialized high-speed machinery. Furthermore, UV protection technologies are paramount, involving the integration of specialized ceramic particles or chemical treatments (non-toxic and certified safe) directly into the textile fibers to achieve high UPF ratings without compromising the fabric’s breathability or softness, ensuring hats meet necessary sun protection efficacy standards globally.

Digital technologies significantly influence the design and customization aspects of the market. Computer-Aided Design (CAD) software allows designers to quickly prototype various sizes and styles, optimizing fit consistency across different age groups, which is critical for reducing product returns and ensuring safety. Furthermore, Direct-to-Garment (DTG) printing and sophisticated embroidery techniques allow for customization and personalized graphics, catering to the growing demand for unique, personalized items used for gifts and milestones. The deployment of robotics and automation in the cut-and-sew stage, particularly in high-volume production facilities, aims to enhance manufacturing speed and maintain stringent quality control over repetitive tasks, thereby lowering operational costs while simultaneously improving the precision required for securing chin straps and other safety components.

The emerging technological frontier involves the integration of smart textiles and IoT components. While still nascent, manufacturers are exploring infant hats embedded with micro-sensors designed to monitor vital signs such as infant body temperature and UV exposure levels, transmitting data wirelessly to parental smart devices. This technology addresses key parental anxieties regarding overheating or inadequate sun protection, transforming the hat from a passive garment into an active protective device. The challenge lies in ensuring these electronic components are fully encapsulated, washable, non-allergenic, and do not pose any ingestion or choking hazard, demanding rigorous testing and miniaturization of battery and sensor technology. This technological leap promises to create a premium, high-value sub-segment focused on safety and real-time monitoring, drastically shifting product functionality and premium pricing potential.

Regional Highlights

- North America: This region dominates the Infant Hats Market in terms of market value, driven by high consumer awareness regarding sun protection and thermal regulation, high disposable incomes, and the strong presence of major international and specialized baby apparel brands. The U.S. market specifically sees high demand for regulated, certified products, propelling the adoption of organic cotton and technologically advanced UV-protective fabrics. E-commerce saturation is high, making digital marketing and logistics crucial competitive differentiators. Furthermore, the region’s diverse climate necessitates robust inventory management across all seasons, with high demand for both thick winter hats and extensive sun protection gear.

- Europe: Characterized by stringent regulatory standards (e.g., REACH regulations for chemicals) and a strong consumer preference for sustainable and ethically sourced products, Europe represents a mature but highly quality-driven market. Western European countries, particularly Germany and the UK, exhibit strong demand for brands with clear ethical supply chains and GOTS certification. The market dynamics are highly influenced by fashion trends from major design houses and a cultural emphasis on outdoor activities, which sustains demand for durable, weather-appropriate headwear. Retail channels are diverse, balancing strong online sales with influential specialty boutiques that curate premium, high-quality, long-lasting infant items.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapidly increasing birth rates, expanding urbanization, and rising middle-class consumer segments, especially in China, India, and Southeast Asian nations. Market growth is dual-pronged: a massive demand for affordable, basic headwear in mass markets, coupled with an accelerating demand for premium, imported, or high-quality branded products among the affluent urban populations who are becoming increasingly aware of global health and safety standards. Local manufacturing capabilities are high, leading to intense competition based on price and speed-to-market, requiring international players to adapt product sizing and material compositions to suit diverse regional climates, particularly humid conditions.

- Latin America (LATAM): The LATAM market shows promising growth, driven by positive demographic trends and increasing access to international retail channels, particularly through cross-border e-commerce. Consumer purchasing behavior is often influenced by economic fluctuations, making pricing sensitivity a critical factor. However, there is a growing segment of consumers prioritizing brand loyalty and quality, particularly in high-growth economies like Brazil and Mexico, leading to increased adoption of branded sun protection hats for year-round warm climates. Distribution challenges, including fragmented retail landscapes and logistical complexities, often require localized partnership strategies.

- Middle East and Africa (MEA): This region presents varied market dynamics. The Middle East, particularly the GCC countries, demonstrates high demand for luxury and branded infant wear due to high purchasing power, favoring imported, high-quality, and often heavily embellished products. The African market is primarily driven by functional necessity and affordability, with strong demand for basic, protective headwear designed for harsh, hot climates. Market penetration is often focused on urban centers, where international retail presence and awareness of global health standards are highest, necessitating robust supply chain solutions that can handle extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infant Hats Market.- Carter's

- The North Face (Kids)

- Adidas (Infant)

- Patagonia (Baby)

- Gerber Childrenswear

- H&M (Baby)

- Zara (Baby)

- Burt's Bees Baby

- Columbia Sportswear

- Luvable Friends

- Simple Joys by Carter's

- Janie and Jack

- Gap Kids

- OshKosh B'gosh

- Disney Baby

- Kickee Pants

- Zutano

- Rylee & Cru

- Copper Pearl

- Tiny Alpaca

Frequently Asked Questions

Analyze common user questions about the Infant Hats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety concerns associated with infant hats?

The primary safety concerns relate to choking hazards from small parts (buttons, decorative elements, or drawstrings) and the risk of strangulation from long, unsecured ties. Manufacturers must adhere strictly to international standards like CPSIA (in the U.S.) and EN 71 (in Europe) by using secure attachments, minimizing small embellishments, and ensuring chin straps break away safely under pressure to mitigate risks. Parents frequently inquire about material toxicity, favoring non-toxic, hypoallergenic dyes and fabrics.

Why is organic cotton increasingly preferred over conventional materials in infant hat production?

Organic cotton is highly preferred due to its hypoallergenic properties, reduced exposure to harmful chemical pesticides and fertilizers used in conventional farming, and its superior softness, which is essential for sensitive infant skin. This consumer preference aligns with broader trends toward sustainability and health consciousness, prompting manufacturers to secure GOTS (Global Organic Textile Standard) certification to validate ethical sourcing and non-toxic processing, positioning their products at a premium price point.

Which distribution channel exhibits the fastest growth rate for infant hats?

Online retail (e-commerce platforms and brand websites) exhibits the fastest growth rate. This is due to the convenience of purchasing, the ability to compare multiple safety certifications and user reviews easily, and the accessibility to specialized, niche organic brands that may not have a widespread physical retail presence. The channel allows brands to bypass traditional intermediaries, offering competitive pricing and greater transparency regarding product origins and material safety.

What role does UV protection technology play in the Infant Hats Market?

UV protection technology is a critical functional requirement, particularly in sun hats and bucket hats. Pediatric guidelines emphasize limiting infant sun exposure, driving demand for hats with high Ultraviolet Protection Factor (UPF) ratings (typically UPF 50+). Manufacturers achieve this by utilizing densely woven or treated fabrics that block UVA and UVB rays effectively, transforming the sun hat from a simple accessory into essential protective equipment, especially in warm and sunny geographic regions.

How do seasonal changes affect demand and inventory management in this market?

Seasonal changes create significant volatility in demand. Cold seasons drive high demand for fleece and knitted beanies for thermal insulation, while warm seasons necessitate high-UPF sun hats and light cotton caps. Manufacturers must employ sophisticated demand forecasting and flexible production schedules to avoid overstocking out-of-season items and ensure sufficient inventory of weather-appropriate headwear, impacting logistics and warehousing needs across the entire value chain to maintain responsiveness to rapid weather shifts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager