Infant Nutrition Hydrolysate Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436362 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Infant Nutrition Hydrolysate Ingredients Market Size

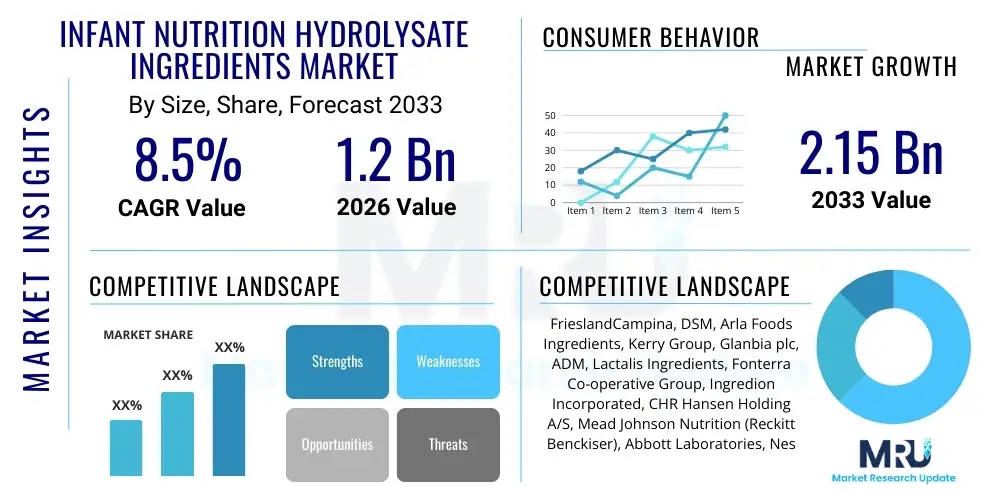

The Infant Nutrition Hydrolysate Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating prevalence of cow's milk protein allergy (CMPA) and other gastrointestinal sensitivities in infants worldwide. As pediatric guidelines increasingly recommend specialized formulas for these sensitive populations, the demand for highly refined, hypoallergenic hydrolysate ingredients has surged, establishing them as essential components in modern infant nutritional products.

The market expansion is further fueled by continuous technological advancements in enzymatic hydrolysis and purification processes, allowing manufacturers to produce high-quality, cost-effective ingredients with precisely controlled molecular weights and reduced allergenicity. Regulatory scrutiny, particularly in developed regions like North America and Europe, also plays a critical role, ensuring that only ingredients meeting stringent safety and efficacy standards are utilized in formulas targeting medically fragile or sensitive infants. These ingredients not only address immediate allergy concerns but also support better absorption and overall digestive health, cementing their crucial role in the specialized nutrition segment.

Infant Nutrition Hydrolysate Ingredients Market introduction

The Infant Nutrition Hydrolysate Ingredients Market encompasses highly processed protein components derived primarily from milk (whey and casein) or plant sources (soy, rice), where proteins have been broken down into smaller peptides and amino acids through enzymatic hydrolysis. This process significantly reduces the allergenic potential of the parent protein, making these ingredients indispensable for manufacturing specialized infant formulas, particularly those designed for infants prone to or diagnosed with allergies, malabsorption issues, or severe reflux. The market is characterized by stringent quality control and heavy regulatory oversight due to the vulnerability of the target consumer base.

Major applications of these ingredients include producing partially hydrolyzed formulas (PHF) for allergy prevention, extensively hydrolyzed formulas (EHF) for treating diagnosed CMPA, and amino acid-based formulas (AAF) for severe cases or multiple food allergies. The primary benefits associated with using hydrolysates are improved digestibility, enhanced nutrient absorption, and reduced immunogenicity, which collectively support healthy infant development when breastfeeding is not feasible or sufficient. Key driving factors include the global rise in infant allergies, increased parental awareness regarding digestive health, and robust investment in research and development aimed at optimizing peptide profiles for maximum therapeutic efficacy.

The complexity of hydrolysate ingredient manufacturing requires specialized knowledge in enzyme kinetics and separation technologies. The industry is currently witnessing a trend towards novel, non-dairy protein sources, such as rice and potato, which offer alternatives for infants with milk and soy intolerances. Furthermore, the incorporation of functional oligosaccharides and probiotics alongside hydrolysates is becoming common practice, aiming to mimic the complete nutritional and functional profile of human milk more closely, thus bolstering the premium positioning of these specialized nutritional solutions.

Infant Nutrition Hydrolysate Ingredients Market Executive Summary

The Infant Nutrition Hydrolysate Ingredients market is experiencing robust momentum, driven by structural shifts in healthcare recommendations and evolving consumer demands for specialized nutrition. Business trends indicate a strong focus on strategic mergers, acquisitions, and partnerships between ingredient suppliers and major infant formula manufacturers to secure high-quality raw materials and intellectual property related to proprietary hydrolysis techniques. Ingredient suppliers are heavily investing in vertical integration to ensure supply chain transparency and traceability, critical factors given the sensitivity of the final products.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely due to high birth rates, increasing urbanization, rising disposable incomes, and the corresponding shift toward commercial formula feeding. North America and Europe remain mature markets, characterized by high adoption rates of hypoallergenic formulas and strict regulatory frameworks that mandate ingredient specifications. In these developed regions, the emphasis is shifting from standard hydrolysates to highly specialized and premium offerings, including organic and non-GMO certified varieties.

Segment trends reveal that the Extensive Hydrolysates segment is gaining significant traction globally, primarily due to the established medical requirement for treating CMPA, a condition necessitating the lowest possible residual allergenicity. Source-wise, whey protein remains dominant due to its high nutritional value and composition similarity to human milk protein, though plant-based hydrolysates, especially rice, are rapidly expanding their market share as a preferred alternative for vegan or multi-allergic infants. The future trajectory of the market is intrinsically linked to advancements in nutritional science enabling the formulation of hydrolysates that also support the infant microbiome and cognitive development.

AI Impact Analysis on Infant Nutrition Hydrolysate Ingredients Market

User queries regarding AI's influence in the Infant Nutrition Hydrolysate Ingredients Market center on improving product safety, customizing nutritional profiles, and optimizing complex manufacturing processes. Users frequently ask how AI can accelerate the discovery of novel non-allergenic peptides, enhance the efficiency of enzymatic hydrolysis (a process highly sensitive to variables like pH and temperature), and ensure the batch-to-batch consistency of the final ingredient, which is paramount for infant safety. The key themes revolve around achieving 'precision nutrition'—using AI to match specific peptide profiles to individual infant health requirements, particularly for complex gut issues or rare metabolic disorders.

AI is poised to revolutionize the R&D landscape by analyzing vast biological datasets (proteomics, clinical trial results) to predict the allergenicity and functional properties of new hydrolysate components before extensive laboratory testing is initiated. Furthermore, in the manufacturing phase, machine learning algorithms can monitor real-time process parameters, such as the degree of hydrolysis, managing membrane fouling in ultrafiltration units, and optimizing enzyme consumption, leading to reduced operational costs and improved yield. This predictive capability significantly enhances quality assurance and minimizes the risk of producing ingredients that do not meet strict hypoallergenic standards.

The application of AI extends into personalized nutrition strategies where algorithms analyze an infant's genetic predisposition, clinical symptoms, and microbiome data to recommend the optimal type and concentration of hydrolysate ingredient, moving beyond standard 'one-size-fits-all' formula composition. This level of customization promises higher therapeutic success rates and drives the demand for specialized, highly traceable hydrolysate lots. AI systems also play a role in supply chain resilience by forecasting demand fluctuations and identifying potential contamination risks swiftly.

- AI-driven optimization of enzymatic reaction kinetics for maximizing peptide yield and minimizing processing time.

- Machine learning models used for predictive analysis of allergenicity and immunogenicity of novel protein sources.

- Enhanced supply chain traceability and risk assessment using AI to monitor ingredient origin and transportation conditions.

- AI tools accelerate R&D for identifying bioactive peptides that offer benefits beyond basic nutrition, such as immune support.

- Implementation of Computer Vision systems for real-time quality control and inspection during purification and drying processes.

DRO & Impact Forces Of Infant Nutrition Hydrolysate Ingredients Market

The Infant Nutrition Hydrolysate Ingredients Market operates under a powerful interplay of drivers, restraints, and opportunities. Primary drivers include the global increase in pediatric allergies and sensitivities, which mandate the use of hypoallergenic formulas, coupled with growing consumer and pediatrician preference for specialized nutritional solutions that are easier to digest. Significant restraints encompass the high operational costs associated with advanced enzymatic processing and purification technologies, leading to high end-product pricing, and complex, often fragmented, international regulatory landscapes that demand time-consuming and expensive clinical validation processes for new ingredients. These constraints limit accessibility in low-income regions and pose barriers to market entry for smaller players.

Opportunities for growth are predominantly centered around the emerging markets in APAC and Latin America, where rapid economic growth is increasing spending on premium infant products. Furthermore, the development of hydrolysates from non-traditional and sustainable protein sources, such as algae or microbial proteins, presents a significant avenue for diversification and reducing dependency on dairy supply chains. Impact forces are critical; the substitution force is low, as few viable alternatives exist for medically necessary hypoallergenic nutrition, but the bargaining power of major formula manufacturers is high due to consolidation in the downstream market. Regulatory changes and clinical research breakthroughs act as transformative impact forces, capable of rapidly shifting ingredient preference or market accessibility.

The increasing consumer awareness regarding the long-term impact of early nutrition on health, including the developing microbiome, acts as a continuous driver. This trend encourages formula manufacturers to seek hydrolysates that are optimized not only for allergenicity but also for fermentation properties in the infant gut. However, the requirement for sustained, large-scale supply of high-purity raw materials (like whey protein concentrate) remains a challenge, particularly when global dairy prices fluctuate, impacting the profitability margins of ingredient producers.

Segmentation Analysis

The Infant Nutrition Hydrolysate Ingredients Market is broadly segmented based on Source, Type, and Application. Analyzing these segments provides deep insight into current market dynamics and future growth vectors. The Source segment is critical as it dictates both nutritional profile and allergen potential, ranging predominantly across Dairy (Whey and Casein) and Plant (Soy, Rice, Potato) based proteins. Dairy hydrolysates currently hold the largest market share due to their established use, high biological value, and strong resemblance to human milk protein structure, particularly whey-derived peptides.

The Type segmentation—Partial Hydrolysate (PH) versus Extensive Hydrolysate (EH)—is defined by the degree of hydrolysis and directly relates to the target application, whether preventative or therapeutic. Extensive hydrolysates are the high-growth segment, driven by the increasing diagnosis of severe CMPA, necessitating minimal residual antigenicity. Application segmentation differentiates between Standard Formulas (often including small amounts of PHFs for general digestive ease) and Specialized/Therapeutic Formulas (where EHFs or AAFs are mandatory for managing allergies and metabolic disorders).

This segmented analysis confirms that market resilience is maintained by the mandatory nature of specialized nutrition for sensitive infants, guaranteeing stable demand regardless of broader economic volatility. Strategic efforts by market players are concentrated on developing highly efficient processing techniques to lower the cost differential between standard and extensively hydrolyzed ingredients, thereby improving their commercial viability and global reach, particularly in developing economies.

- By Source

- Dairy Based (Whey Protein Hydrolysate, Casein Hydrolysate)

- Plant Based (Soy Protein Hydrolysate, Rice Protein Hydrolysate, Potato Protein Hydrolysate)

- Other Novel Sources (Algae, Microbial)

- By Type

- Extensive Hydrolysates (EHs)

- Partial Hydrolysates (PHs)

- Amino Acid Formulas (AAFs)

- By Application

- Standard Infant Formulas

- Specialized and Therapeutic Formulas (Hypoallergenic Formulas, Anti-Regurgitation Formulas)

- By Form

- Powder

- Liquid Concentrates

Value Chain Analysis For Infant Nutrition Hydrolysate Ingredients Market

The value chain for Infant Nutrition Hydrolysate Ingredients begins with the stringent sourcing of raw materials, primarily high-quality, non-denatured protein concentrates (like Whey Protein Concentrate, WPC 80) from certified dairy farms or specialized crop cultivation (for plant-based sources). Upstream analysis reveals that raw material quality is non-negotiable, requiring robust supplier qualification and traceability programs to prevent contamination and ensure protein integrity. The subsequent processing stage—enzymatic hydrolysis—is the most complex and value-adding step, where specialized food-grade enzymes are used under controlled conditions, followed by sophisticated purification techniques like ultrafiltration and chromatography to achieve the required low molecular weight profile and remove residual allergens.

After processing and drying (usually spray drying to powder form), the hydrolysate ingredients enter the distribution channel. This involves specialized B2B logistics, often requiring controlled temperature and humidity storage, as the ingredients are high-value and sensitive. Distribution is primarily indirect, moving from ingredient manufacturers/suppliers to large-scale infant formula producers (the downstream market). Direct distribution to smaller, specialized nutrition firms also occurs but is less voluminous. Given the need for high technical support and strict contractual specifications, relationships in this supply chain are often long-term and integrated.

The downstream analysis focuses on the incorporation of these ingredients by infant formula manufacturers who blend them with fats, carbohydrates, vitamins, and minerals. Regulatory compliance, including achieving necessary approvals from bodies like the FDA or EFSA for formula composition, dictates the final adoption and market volume of specific hydrolysate ingredients. The final end product is then distributed via pharmaceutical channels, retail stores, or directly through healthcare professional recommendations. Traceability throughout the entire chain—from farm to infant—is a paramount concern for all stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FrieslandCampina, DSM, Arla Foods Ingredients, Kerry Group, Glanbia plc, ADM, Lactalis Ingredients, Fonterra Co-operative Group, Ingredion Incorporated, CHR Hansen Holding A/S, Mead Johnson Nutrition (Reckitt Benckiser), Abbott Laboratories, Nestlé S.A., BASF SE, Danone S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infant Nutrition Hydrolysate Ingredients Market Potential Customers

The primary potential customers and end-users of Infant Nutrition Hydrolysate Ingredients are global manufacturers of infant formula and pediatric nutritional supplements. These large multinational corporations, such as Nestlé, Danone, Abbott Laboratories, and Reckitt Benckiser (Mead Johnson Nutrition), are the bulk purchasers, requiring consistent, high-volume supplies of certified hydrolysates to produce their lines of hypoallergenic and specialized formulas. Their purchasing decisions are critically influenced by regulatory compliance, ingredient traceability, and the clinical efficacy of the hydrolysates provided by suppliers.

Secondary customer segments include smaller, specialized nutritional companies that focus exclusively on niche markets, such as formulas for infants with metabolic disorders or those requiring organic, novel protein-based diets. These smaller entities often rely on specialized contract manufacturers who source the hydrolysate ingredients. Furthermore, pharmaceutical companies involved in hospital-grade enteral feeding solutions for neonates and premature infants also represent a crucial, high-value customer base, demanding the highest level of purity, often utilizing amino acid-based formulas (AAFs).

The purchasing cycle for these ingredients is highly formalized, involving extensive technical evaluation and quality audits before a supplier is onboarded. Long-term contracts are common, emphasizing the stability and consistency of the supply chain. These customers prioritize suppliers who demonstrate innovation in peptide science and can provide robust clinical data supporting the low antigenicity and superior bioavailability of their ingredients, reinforcing the technical specialization required in this B2B market.

Infant Nutrition Hydrolysate Ingredients Market Key Technology Landscape

The manufacturing of infant nutrition hydrolysates is fundamentally dependent on advanced biotechnology and separation engineering. The core technology employed is controlled enzymatic hydrolysis, where specific food-grade proteases (like trypsin or pancreatin) are used to cleave peptide bonds. The precise selection and management of these enzymes determine the final peptide chain length, which is crucial for reducing allergenicity. Manufacturers are increasingly utilizing immobilized enzymes to improve process efficiency, reduce enzyme cost, and allow for easier separation from the final product, ensuring ingredient purity suitable for infants.

Following hydrolysis, purification and fractionation technologies are essential. Membrane separation techniques, particularly Ultrafiltration (UF) and Nanofiltration (NF), are standard for separating peptides based on molecular weight, ensuring that only small, non-allergenic peptides are retained. Chromatography, although higher cost, is sometimes employed for analytical precision or for separating specific bioactive peptides. Technological innovation is currently focused on optimizing these separation processes to minimize protein loss and energy consumption, while achieving narrower molecular weight distributions for enhanced efficacy and consistency.

A burgeoning technological area involves Precision Fermentation, which holds promise for producing highly customized, pure, and sustainable protein peptides without relying on traditional dairy or agricultural inputs. While still in early adoption for infant hydrolysates, this technology could offer novel, non-allergenic protein sources tailored for extreme sensitivities. Additionally, advanced drying techniques, such as low-temperature spray drying, are critical to maintain the nutritional integrity and solubility of the final powdered hydrolysate ingredient, preventing thermal denaturation of sensitive components.

Regional Highlights

The market for Infant Nutrition Hydrolysate Ingredients exhibits distinct regional dynamics driven by varying birth rates, economic development stages, and differing healthcare and regulatory policies. North America holds a significant market share, characterized by high consumer spending on premium, specialized formulas and robust clinical guidelines mandating the use of hydrolysates for allergy management. The region benefits from early adoption of advanced ingredients and a strong presence of key ingredient innovators and formula manufacturers, leading to continuous product diversification and formulation improvements.

Europe represents a mature and highly regulated market, where stringent European Food Safety Authority (EFSA) standards dictate the composition and clinical substantiation required for hydrolyzed formulas. Demand here is stable, driven by high awareness among pediatricians and parents regarding CMPA prevalence and preventative nutrition. Countries like Germany, France, and the UK are key consumers, often leading the market in adopting sustainable sourcing and novel plant-based hydrolysates due to strong consumer environmental consciousness.

Asia Pacific (APAC) is projected to be the fastest-growing region globally. This expansion is fueled by rising middle-class populations in China and India, increasing healthcare expenditure, and higher rates of formula adoption driven by urbanization and female workforce participation. Although regulatory structures can be heterogeneous across APAC countries, the sheer volume of the infant population, combined with increasing diagnoses of allergies, makes this region crucial for future market expansion. Ingredient suppliers are focusing on establishing local production and distribution networks to navigate trade complexities and meet rapidly escalating local demand. Latin America and the Middle East & Africa (MEA) are emerging markets, driven by improving access to specialized healthcare and economic growth, gradually increasing the affordability and penetration of advanced hydrolyzed formulas.

- North America: Dominant market share, driven by high purchasing power and stringent medical protocols for allergy management; emphasis on premium and organic hydrolysates.

- Europe: High adoption rates, underpinned by strict EFSA regulations; trend toward sustainable and traceable ingredient sourcing.

- Asia Pacific (APAC): Fastest growth region due to large infant population, rising disposable incomes, and increasing awareness of specialized infant nutrition; China and India are key growth engines.

- Latin America: Growing awareness and improving healthcare infrastructure leading to increasing demand for accessible hypoallergenic formulas.

- Middle East and Africa (MEA): Emerging market potential, focused on basic nutritional needs supplemented by humanitarian and specialized medical distribution channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infant Nutrition Hydrolysate Ingredients Market.- FrieslandCampina

- DSM

- Arla Foods Ingredients

- Kerry Group

- Glanbia plc

- ADM

- Lactalis Ingredients

- Fonterra Co-operative Group

- Ingredion Incorporated

- CHR Hansen Holding A/S

- Mead Johnson Nutrition (Reckitt Benckiser)

- Abbott Laboratories

- Nestlé S.A.

- BASF SE

- Danone S.A.

- Cargill, Incorporated

- Tate & Lyle PLC

- Protein Sciences Corporation

- AMCO Proteins

- NZMP (Fonterra)

Frequently Asked Questions

Analyze common user questions about the Infant Nutrition Hydrolysate Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between partially and extensively hydrolyzed ingredients?

Partially hydrolyzed ingredients (PHs) have proteins broken down into larger peptides, reducing allergenicity slightly, and are often used for preventative measures or general digestive ease. Extensively hydrolyzed ingredients (EHs) have proteins broken down into very small peptides or free amino acids, minimizing allergenicity almost completely, and are medically required for treating diagnosed cow's milk protein allergy (CMPA).

Why are hydrolysate ingredients more expensive than standard milk proteins?

The higher cost is attributed to the complex manufacturing process, which includes precise enzymatic hydrolysis requiring specialized, expensive food-grade enzymes, followed by intensive purification steps like ultrafiltration and chromatography to ensure the required low molecular weight and non-allergenic profile, all conducted under extremely strict quality control protocols.

Which region is expected to lead the market growth in the coming years?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant population size, rapid economic development increasing access to specialized formulas, and a growing trend toward using commercial infant formulas, especially in highly populated markets like China and India.

What role do regulatory bodies play in the hydrolysate ingredients market?

Regulatory bodies such as the FDA and EFSA play a critical role by setting stringent standards for the degree of hydrolysis, purity, safety, and clinical evidence required for hydrolysate ingredients used in infant formulas. Compliance with these regulations dictates market access and ensures the ingredients are safe and effective for vulnerable infant populations.

Are plant-based hydrolysates a viable long-term alternative to dairy-based products?

Yes, plant-based hydrolysates, particularly rice and potato proteins, are increasingly viable. They offer excellent hypoallergenic alternatives for infants with both cow's milk and soy allergies, or for families preferring vegan options. Technological advancements are continually improving their nutritional profile and amino acid balance to meet the high standards required for infant nutrition, driving their growing market share.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager