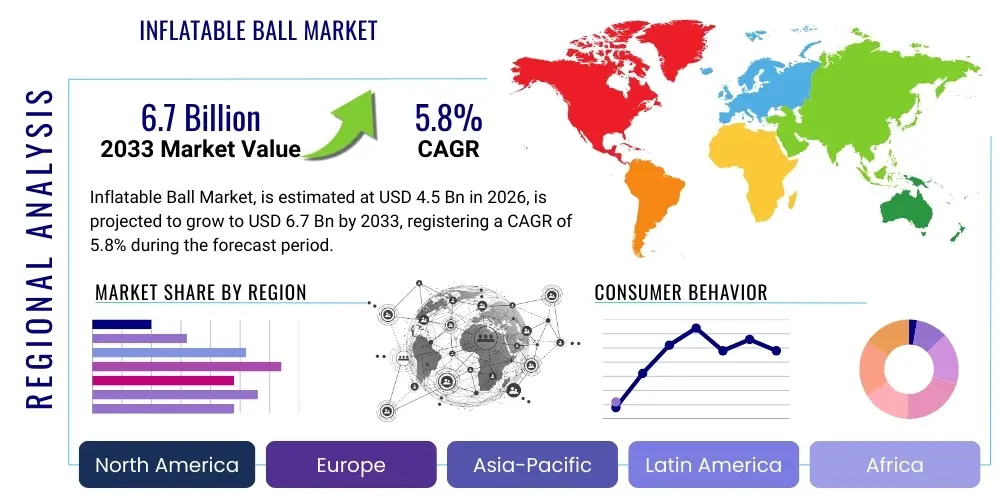

Inflatable Ball Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439061 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Inflatable Ball Market Size

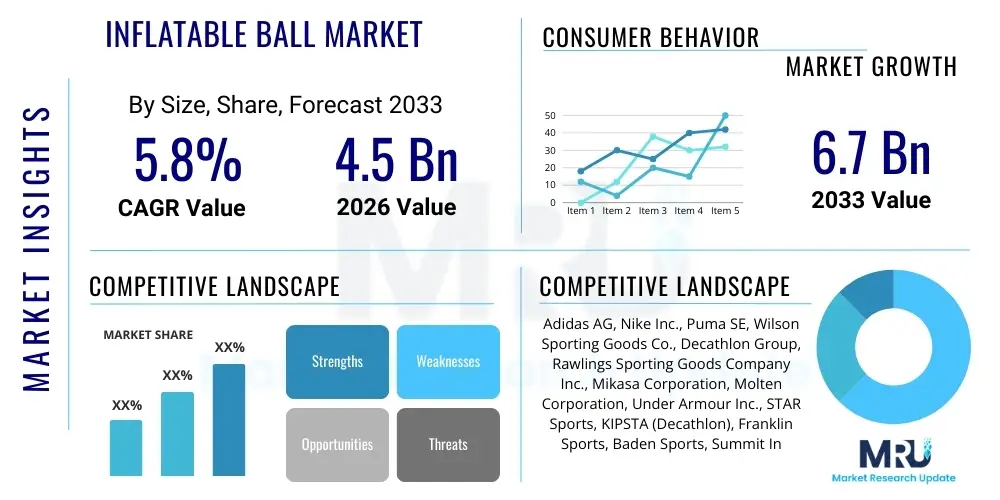

The Inflatable Ball Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Inflatable Ball Market introduction

The Inflatable Ball Market encompasses a diverse range of products characterized by their ability to be inflated with air or gas, primarily utilized for sports, recreation, fitness, promotional activities, and therapeutic applications. These products, ranging from standardized sporting goods like soccer balls, basketballs, and volleyballs to novelty items and large fitness balls (e.g., exercise balls), are fundamentally driven by material science advancements that enhance durability, grip, and air retention capabilities. The product definition extends beyond traditional leather or synthetic casings to include modern PVC, rubber, and TPU constructions, catering to varied user needs and environments, from professional courts to casual outdoor settings and aquatic environments.

Major applications of inflatable balls span competitive sports leagues, organized amateur athletics, general leisure and play (especially in the toys and games segment), physical education, and specialized fields such as physiotherapy and strength training. The inherent portability, ease of deflation for storage, and relatively low cost compared to permanent equipment make them highly attractive across global consumer segments. Furthermore, the market benefits significantly from promotional and branding opportunities, where customizable inflatable balls serve as effective marketing tools during large-scale events and campaigns.

Key driving factors fueling market expansion include the increasing global emphasis on health and wellness, leading to higher participation rates in sports and fitness activities. Additionally, rising disposable incomes in emerging economies enable greater expenditure on recreational goods. Continuous innovation in manufacturing techniques, focusing on environmental sustainability (e.g., use of eco-friendly and recycled materials) and performance enhancement (e.g., improved aerodynamics and moisture resistance), ensures sustained demand. The ubiquitous nature of inflatable balls in childhood development and recreational settings further solidifies their position as essential items globally.

Inflatable Ball Market Executive Summary

The Inflatable Ball Market is experiencing robust growth, primarily propelled by favorable demographic shifts, including a younger population base globally and increased awareness regarding active lifestyles. Business trends highlight a strong focus on automation in the manufacturing processes, particularly utilizing precision robotics for panel cutting and stitching, ensuring high quality and consistency across professional-grade products. Furthermore, strategic partnerships between manufacturers and major sports organizations are crucial for market visibility and maintaining brand loyalty. The trend towards sustainable sourcing and biodegradable polymers is reshaping the competitive landscape, forcing established players to invest heavily in R&D to meet modern consumer ethical demands.

Regional trends indicate that Asia Pacific (APAC) is poised to be the fastest-growing market, attributed to massive consumer bases, rapidly growing sports infrastructure investment (especially in China and India), and governmental initiatives promoting sports participation. North America and Europe remain mature markets, characterized by high adoption rates of premium, technologically advanced balls (e.g., smart balls embedded with sensors) and a stable demand driven by established league structures. The Latin America and Middle East & Africa (MEA) regions present substantial untapped potential, contingent upon improving economic stability and increasing investment in local sports facilities.

Segment trends reveal that the Sports Balls category maintains the largest market share, driven specifically by football (soccer) and basketball segments. However, the Fitness & Exercise Balls segment is exhibiting an accelerated growth trajectory, stimulated by the popularity of home workouts and specialized fitness regimes requiring stability balls and resistance tools. In terms of material segmentation, synthetic leather and high-performance polyurethane (PU) are dominating the premium segment, while rubber and PVC maintain stronghold in the mass market and recreational categories due to cost efficiency and durability for general use.

AI Impact Analysis on Inflatable Ball Market

Common user inquiries regarding the impact of Artificial Intelligence on the Inflatable Ball Market often center on how manufacturing costs can be reduced, how product quality control can be automated, and whether AI can enhance the user experience through product design or performance feedback. Users frequently ask about the potential for AI-driven material science discovery—specifically, identifying novel lightweight, durable, and sustainable polymers. The key themes revolve around supply chain optimization, predictive maintenance of production machinery, and the use of AI in customizing ball characteristics (e.g., rebound consistency, pressure stability) based on specific sport requirements or individual player profiles. There is also significant consumer interest in "smart balls" that integrate sensors for real-time performance tracking, analyzing metrics like speed, spin, trajectory, and power, which requires sophisticated AI processing.

The primary concern users express is the cost implication of integrating AI into manufacturing—whether the enhanced quality justifies the likely increase in retail prices. They are also curious about the longevity and practicality of smart ball technology, particularly battery life and data accuracy in rugged use environments. Manufacturers, conversely, are focused on leveraging machine learning algorithms to forecast demand with greater precision, minimizing inventory risks, and optimizing logistics. This predictive analysis helps in streamlining global distribution networks, reacting swiftly to regional sports trends, and allocating production capacity efficiently across different ball types (e.g., optimizing seasonal production of beach vs. indoor sports balls).

Ultimately, AI’s influence is moving the market towards highly personalized and performance-optimized products. Beyond manufacturing efficiencies, AI-driven data analytics derived from smart balls offer valuable insights to coaches, athletes, and product developers, creating a feedback loop that accelerates product refinement. This evolution ensures that future inflatable balls are not just simple recreational items but integrated components of athletic training ecosystems, meeting the increasingly demanding specifications of professional sports leagues and sophisticated consumers seeking quantifiable performance improvement.

- AI-driven automation enhances precision manufacturing, reducing defects in stitching and panel alignment.

- Machine learning optimizes supply chain logistics, improving demand forecasting and inventory management.

- Smart balls utilize embedded sensors and AI to track real-time performance metrics (speed, spin, trajectory).

- AI aids in material science R&D for developing sustainable, high-performance polymers tailored for specific aerodynamic requirements.

- Automated vision systems provide high-speed quality control checks, ensuring uniform pressure and weight standards.

- Generative design tools assist in rapid prototyping and testing of novel ball designs for improved aerodynamics and grip.

- Predictive maintenance schedules for factory machinery are generated by AI, minimizing downtime and increasing production efficiency.

DRO & Impact Forces Of Inflatable Ball Market

The Inflatable Ball Market is shaped by a confluence of influential forces, encapsulated by Drivers, Restraints, and Opportunities. The market is primarily driven by the surging global interest in health, fitness, and organized sports, supported by infrastructure development and government funding for athletic programs worldwide. Secondary drivers include continuous product innovation focusing on performance characteristics (e.g., enhanced grip, water resistance) and material sustainability, appealing to environmentally conscious consumers. The extensive reach of professional sports broadcasting also acts as a significant driver, inspiring consumer purchases of official and replica equipment.

Key restraints impacting growth include the market's high sensitivity to raw material price volatility, particularly fluctuations in synthetic rubber, PVC, and polyurethane costs. Furthermore, the prevalence of counterfeit and low-quality imitation products, especially in emerging markets, erodes brand value and undermines consumer trust in genuine products. Durability remains a challenge for low-cost recreational balls, leading to frequent replacement cycles which, while benefiting short-term sales, contribute to consumer perception of non-sustainable products. Regulatory hurdles concerning chemical safety in materials (like phthalates in PVC) also pose operational challenges.

Significant opportunities exist in the expansion into niche markets, such as specialized therapeutic and rehabilitation balls tailored for aging populations and physical therapy centers. The digitalization of sports equipment through smart ball technology represents a high-value opportunity, moving the market beyond traditional manufacturing into data services. Moreover, establishing strong licensing agreements with major global sporting events (e.g., FIFA World Cup, Olympic Games) provides unparalleled exposure and boosts sales significantly. The transition to fully biodegradable and recycled material manufacturing offers long-term competitive advantage and access to premium green consumer segments.

Segmentation Analysis

The Inflatable Ball Market is broadly segmented based on product type, material, application, and distribution channel, providing a granular view of market dynamics and consumer preferences across different tiers. Product type differentiation is critical, separating highly standardized professional sports balls from novelty items and specialized fitness equipment, each commanding distinct price points and quality expectations. Material segmentation reflects both cost efficiency (rubber, PVC) and high-performance requirements (PU, synthetic leather), directly influencing product performance attributes like weight, rebound, and feel. Application segmentation clearly delineates between high-volume recreational use, demanding professional sports, and burgeoning fitness/therapeutic uses. Analyzing these segments is essential for identifying high-growth pockets and optimizing supply chain strategies to meet varied market demands efficiently.

- By Product Type:

- Sports Balls (Football/Soccer, Basketball, Volleyball, Handball, Rugby, etc.)

- Fitness & Exercise Balls (Stability Balls, Medicine Balls, Yoga Balls)

- Recreational & Novelty Balls (Beach Balls, Toy Balls, Promotional Balls)

- By Material:

- Rubber

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Synthetic Leather

- Natural Leather

- By Application:

- Professional Sports

- Recreational Use

- Fitness & Health Centers

- Therapeutic & Rehabilitation Use

- Promotional Activities

- By Distribution Channel:

- Online Retail (E-commerce platforms, Company websites)

- Offline Retail (Sporting Goods Stores, Department Stores, Supermarkets/Hypermarkets)

Value Chain Analysis For Inflatable Ball Market

The value chain for the Inflatable Ball Market commences with upstream analysis, focusing on the sourcing and processing of core raw materials such as latex, various synthetic rubbers, PVC granules, polyurethane chemicals, and specialized fabrics for inner bladders and outer casings. Key suppliers in this phase are chemical companies and rubber plantations. Efficiency at this stage relies heavily on managing commodity price volatility and ensuring a steady supply of high-grade materials. Technological advancements in material compounds aimed at improving longevity and environmental profile are critical upstream activities, driving product differentiation and setting cost benchmarks for the entire chain. Quality control of raw materials directly impacts the ultimate performance and safety standards of the finished product, especially for professional-grade equipment.

The manufacturing and assembly phase represents the core of the value chain, where material inputs are transformed into finished goods through processes like cutting, vulcanization (for rubber), stitching, thermal bonding, and final inflation and inspection. This phase is increasingly automated, utilizing robotics for precision panel joining, which is essential for uniform spherical shape and consistent rebound. Downstream analysis involves rigorous testing, quality assurance, branding, and packaging before products enter the distribution channels. Efficient manufacturing management, particularly minimizing waste and optimizing energy usage, is vital for maintaining competitive pricing and adhering to corporate social responsibility mandates.

The distribution channel is bifurcated into direct and indirect routes. Direct distribution often involves sales to large professional sports leagues, educational institutions, and fitness chains, allowing manufacturers greater control over pricing and branding. Indirect channels, which form the bulk of consumer sales, rely heavily on sporting goods specialized retailers, major department stores, and increasingly, robust e-commerce platforms. The shift toward online retail demands sophisticated logistics capabilities and strong digital marketing strategies. Effective channel management, including managing inventory and providing robust after-sales support, is crucial for market penetration and customer retention, ensuring that the diverse array of inflatable balls reaches end-users across global geographical locations efficiently.

Inflatable Ball Market Potential Customers

The primary customer base for the Inflatable Ball Market is highly heterogeneous, spanning across professional, institutional, commercial, and individual consumer categories. Institutional buyers, such as schools, universities, and municipal recreation departments, represent large volume purchasers focused on durability and cost-effectiveness for heavy-duty daily use in physical education and local leagues. These buyers prioritize standardized specifications and bulk discounts. Similarly, organized professional sports leagues (e.g., FIFA, NBA, NFL) are premium customers, demanding highly specialized, technologically advanced balls that adhere to strict regulatory standards, often secured through exclusive, long-term supply contracts, and requiring minimal tolerance for performance deviation.

Commercial customers include a rapidly expanding segment of fitness centers, rehabilitation clinics, and physiotherapy practices that require specialized inflatable products like stability balls and medicine balls for client training and therapeutic exercises. Marketing and promotional companies also form a distinct customer group, utilizing customizable, low-cost inflatable balls for large-scale giveaways and brand visibility campaigns. These commercial segments prioritize product safety certifications and aesthetic branding capabilities. This diversification minimizes reliance on any single application sector, providing market resilience against cyclical downturns in specific sports or recreational activities.

The largest volume segment comprises individual consumers and households, ranging from parents purchasing toy balls for children to avid amateur athletes seeking high-quality replicas or specialized equipment for personal training. This segment is highly responsive to branding, material innovation (e.g., eco-friendly materials), and pricing strategies delivered through direct-to-consumer (D2C) and online retail channels. Success in serving this diverse consumer group requires localized marketing efforts, tailored product lines ranging from budget-friendly options to premium performance gear, and maintaining visibility across various digital and traditional retail touchpoints globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adidas AG, Nike Inc., Puma SE, Wilson Sporting Goods Co., Decathlon Group, Rawlings Sporting Goods Company Inc., Mikasa Corporation, Molten Corporation, Under Armour Inc., STAR Sports, KIPSTA (Decathlon), Franklin Sports, Baden Sports, Summit International, Tarmak (Decathlon), Spalding Sports, Reebok International, Select Sport A/S, Champion Sports, New Balance Athletics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inflatable Ball Market Key Technology Landscape

The manufacturing technology of inflatable balls has evolved significantly from traditional hand-stitched leather products to highly engineered synthetic spheres utilizing thermal bonding and vulcanization processes. A critical technology is thermal fusion bonding, which uses heat to join synthetic panels without stitching, resulting in a perfectly smooth, watertight, and highly durable surface. This method is crucial for high-performance soccer and volleyballs, offering superior shape retention and consistent flight dynamics compared to hand-stitched versions. Advances in bladder technology, utilizing butyl rubber or specialized latex composites, are focused on achieving prolonged air retention, minimizing the need for frequent reinflation and thereby enhancing user convenience and performance stability over the product lifecycle. Manufacturers are continuously refining these core processes to increase production speed while maintaining stringent quality metrics.

Material innovation is another pivotal technological area, moving towards high-performance polyurethanes (PU) that mimic the feel and responsiveness of natural leather but offer enhanced resistance to abrasion, moisture, and temperature fluctuations. This involves developing sophisticated micro-fiber composites and surface textures designed through CAD modeling to optimize aerodynamics and grip, particularly for balls used in various weather conditions. For fitness and therapeutic balls, the focus is on anti-burst technology, where the material composition and wall thickness are engineered to deflate slowly if punctured, significantly enhancing user safety during exercise and rehabilitation sessions, which is a major technological requirement for institutional buyers.

The most transformative technology is the integration of embedded electronic components, leading to the emergence of 'smart balls.' These products incorporate micro-electromechanical systems (MEMS) sensors, accelerometers, and gyroscopes to track detailed movement data, transmitting performance statistics wirelessly via Bluetooth or Wi-Fi to a connected app. The challenge lies in miniaturizing these components, ensuring they do not interfere with the ball's weight or balance, and designing robust, inductive charging systems that can withstand repeated impact. This technological leap merges traditional manufacturing with high-tech electronics and data analytics, creating new revenue streams based on the provision of performance data services and transforming the market from purely hardware sales into a sports technology ecosystem.

Regional Highlights

- North America: North America represents a mature yet high-value market segment for inflatable balls, characterized by strong consumer spending power, well-established professional sports leagues (e.g., NBA, MLB, NFL, MLS), and significant recreational participation. The demand here is highly diversified, with high volumes in basketball and baseball/softball accessories, alongside sustained growth in fitness balls driven by the booming wellness industry. Consumers are willing to pay a premium for branded, high-performance equipment and are early adopters of smart ball technology. The market is heavily influenced by major sporting goods retailers and high licensing revenues tied to professional teams, dictating strong regional brand loyalty and marketing spend by key players.

- Europe: Europe is the epicenter of the global football (soccer) market, driving immense demand for premium soccer balls related to continental leagues (e.g., Premier League, Bundesliga, La Liga) and international tournaments. The region shows strong penetration of specialized materials, with consumers demanding high quality, performance-optimized, and ethically sourced products. Germany, the UK, France, and Spain are key contributors. Beyond soccer, volleyball and handball are substantial segments, particularly in Central and Eastern Europe. Regulatory standards regarding material safety (REACH compliance) are stringent, influencing manufacturing practices and material choices across the region, favoring sustainable and non-toxic compositions.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth over the forecast period, driven by massive population density, rising urbanization, and government investments in sports infrastructure, especially in China, India, Japan, and Australia. While the market sees high demand for lower-cost, recreational PVC and rubber balls in emerging economies, there is also a significant premium segment demand, especially in Japan and South Korea, fueled by high engagement in volleyball and basketball. Increased international exposure to Western sports and rising disposable incomes are shifting consumer preferences towards branded, higher-quality inflatable products. Manufacturing hubs located in this region also contribute to rapid domestic supply and lower logistical costs.

- Latin America: Latin America, dominated by the immense popularity of football (soccer), presents a large volume market, though price sensitivity remains a significant factor for mass-market adoption. Economic stability variations across countries like Brazil, Argentina, and Mexico influence purchase patterns. Demand is primarily centered around durable, high-wear rubber and synthetic leather balls suitable for varying playing surfaces, from grass fields to concrete courts. The market growth is reliant on grassroots sports development and increased access to organized athletic programs in rural and urban areas, offering substantial potential for mid-range product expansion.

- Middle East and Africa (MEA): The MEA region is characterized by substantial infrastructure investment, particularly in the Gulf Cooperation Council (GCC) countries, supporting large-scale sporting events and leisure facilities. This has boosted demand for specialized and premium inflatable balls. Soccer dominates the market, but regional diversification is occurring with increased interest in basketball and other fitness activities. Africa presents high-volume potential, often served by cost-effective and highly durable products. Key growth factors include youth population expansion and governmental initiatives aimed at improving public health through sports, driving institutional procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inflatable Ball Market.- Adidas AG

- Nike Inc.

- Puma SE

- Wilson Sporting Goods Co.

- Decathlon Group

- Rawlings Sporting Goods Company Inc.

- Mikasa Corporation

- Molten Corporation

- Under Armour Inc.

- STAR Sports

- KIPSTA (Decathlon)

- Franklin Sports

- Baden Sports

- Summit International

- Tarmak (Decathlon)

- Spalding Sports

- Reebok International

- Select Sport A/S

- Champion Sports

- New Balance Athletics

Frequently Asked Questions

Analyze common user questions about the Inflatable Ball market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Inflatable Ball Market?

The market growth is primarily driven by increasing global health and fitness consciousness, higher rates of participation in organized sports, continuous innovation in performance materials (like high-durability PU and thermal bonding), and expanding sports infrastructure investment, particularly in emerging Asian economies. The rising demand for specialized fitness equipment, such as yoga and stability balls, also contributes significantly to overall market expansion.

How does the material used affect the performance and cost of inflatable balls?

Material significantly dictates both performance and cost. Premium balls often use synthetic leather or high-grade polyurethane (PU) with sophisticated thermal bonding for consistent flight, water resistance, and superior feel, resulting in a higher cost. Conversely, recreational and mass-market balls frequently utilize durable rubber or PVC, which are cost-effective and resilient but offer less precise aerodynamic performance, making them suitable for casual and institutional use.

What is the role of smart ball technology in the future of the market?

Smart ball technology, incorporating embedded MEMS sensors and wireless connectivity, is pivotal for the market's future. It enables real-time tracking of critical performance metrics (speed, spin, trajectory), offering valuable data for athletes, coaches, and training programs. This shift transforms the product from a static item into a data-generating device, opening new avenues for subscription-based services and performance analytics.

Which segment holds the largest share in the Inflatable Ball Market?

The Sports Balls product type segment holds the largest market share, with Football (Soccer) and Basketball being the dominant sub-segments globally, driven by global league popularity, substantial licensing agreements, and high volumes of amateur participation. However, the Fitness and Exercise Balls segment is projected to show the highest CAGR due to increased home fitness trends and therapeutic demand.

What are the main challenges facing manufacturers in the Inflatable Ball Market?

Key challenges include managing the high volatility of raw material costs (e.g., rubber and chemical polymers), combating the widespread proliferation of counterfeit goods that damage brand equity, and navigating complex global regulatory requirements concerning material sustainability and safety standards. Furthermore, maintaining product quality consistency across high-volume production requires continuous technological investment in automated manufacturing processes.

How does the retail distribution channel influence consumer access to inflatable balls?

Retail distribution is crucial, dominated by offline specialty sporting goods stores for professional buyers seeking expert advice, and online retail which provides wide geographic reach, competitive pricing, and convenience for mass-market consumers. The effectiveness of a manufacturer's distribution strategy relies on balancing partnerships with large department stores for high visibility and optimizing e-commerce logistics for rapid fulfillment and inventory precision.

What specific material innovations are manufacturers focusing on for sustainability?

Manufacturers are heavily investing in sustainable material innovations, primarily focusing on developing biodegradable polymers, increasing the use of recycled rubbers and plastics in casings and bladders, and substituting traditional synthetic components with plant-based alternatives. The goal is to reduce the environmental footprint while maintaining or improving critical performance characteristics such as durability and air retention required for competition.

How is the pricing of professional inflatable balls determined in the market?

Pricing for professional inflatable balls is determined by several factors: the premium cost of certified high-performance materials (e.g., FIFA Quality Pro stamp), the technological complexity of construction (e.g., thermal bonding versus stitching), the integration of advanced features (e.g., smart technology), and significant associated costs for official league licensing, branding, and marketing. These factors contribute to substantially higher retail prices compared to recreational balls.

Which region offers the greatest future growth potential for the inflatable ball market?

The Asia Pacific (APAC) region is projected to offer the greatest future growth potential. This is driven by massive untapped consumer bases, rapid economic development leading to increased disposable incomes, substantial government investments in expanding sports participation, and the continued construction of dedicated sports facilities and academies across major countries like China and India.

What types of inflatable balls are used in therapeutic and rehabilitation settings?

Therapeutic and rehabilitation settings primarily utilize stability balls (often large diameter), sometimes known as Swiss balls or exercise balls, and weighted medicine balls. These products are crucial for core strength training, improving balance, physical therapy following injuries, and geriatric fitness programs. Key features for this segment include anti-burst safety technology and specialized surface materials for enhanced grip.

What are the primary differences between hand-stitched and thermally bonded balls?

Hand-stitched balls, often utilizing genuine or high-grade synthetic leather, have deep seams that can absorb water, affecting weight and performance, but they offer greater elasticity. Thermally bonded balls use heat to fuse synthetic panels, creating a seamless, perfectly spherical surface that is highly water-resistant, maintains consistent shape and pressure better, and is the standard for modern professional matches requiring precise aerodynamics.

How does the market address the demand for balls used in extreme weather conditions?

To address extreme weather conditions, manufacturers employ specialized coatings and materials, such as highly abrasion-resistant PU and advanced thermal bonding techniques, which prevent water absorption and maintain consistent performance in both wet and freezing conditions. Furthermore, rigorous testing protocols are utilized to ensure that material integrity and air pressure stability remain optimal across a broad temperature spectrum.

How important are licensing agreements for manufacturers in this industry?

Licensing agreements are fundamentally important, providing manufacturers with exclusive rights to produce official balls for major professional leagues (e.g., NBA, FIFA) or tournaments (e.g., Olympics). These agreements significantly boost brand credibility, drive premium sales volumes, and act as powerful marketing tools, guaranteeing high visibility and massive consumer demand for replica and official match balls worldwide.

What impact does automation have on the manufacturing segment of the value chain?

Automation, particularly the use of robotic cutting and bonding systems, substantially improves manufacturing segment efficiency and quality control. It ensures precise panel alignment, reduces material waste, and guarantees uniform spherical geometry across high volumes, which is necessary to meet the strict regulatory specifications required for professional sports equipment, thereby lowering variable labor costs while increasing throughput.

What considerations are vital for the bladder material in inflatable balls?

The bladder material, typically butyl rubber or specialized latex, is vital for air retention and rebound characteristics. Butyl bladders offer superior air retention, lasting weeks without significant pressure loss, making them ideal for high-performance and high-use balls. Latex bladders provide a softer feel and higher responsiveness but require more frequent inflation, generally favored in specialized sports requiring maximum sensitivity.

How are promotional inflatable balls different from standard recreational balls?

Promotional inflatable balls are primarily low-cost, high-volume products, often made from PVC or thin rubber, designed for temporary use and maximized surface area for branding. They prioritize customized aesthetics and cost efficiency over high-performance features. Standard recreational balls, while also focused on durability and affordability, are built with higher quality materials intended for repeated use and moderate performance standards.

What role does aerodynamic design play in high-performance inflatable balls?

Aerodynamic design is critical for high-performance balls, especially in soccer and golf. Manufacturers utilize complex panel configurations (e.g., 32-panel, 14-panel, or specialized patterns) and surface micro-textures (grooves, dimples) to manage the boundary layer of air flowing over the ball. This ensures optimal flight stability, minimized drag, consistent trajectory, and predictable handling, all necessary for professional-level play.

Why is the supply chain management of raw materials particularly challenging for this market?

The supply chain management is challenging due to the dependence on global commodities like petroleum derivatives (for PU and PVC) and natural rubber. These materials are subject to severe price volatility driven by geopolitical factors, climate change, and currency fluctuations. Manufacturers must maintain high inventory levels or implement sophisticated hedging strategies to mitigate these inherent risks and ensure stable production costs.

How does the demand from educational institutions affect the market?

Educational institutions represent a stable, high-volume segment requiring durable, standardized, and cost-effective inflatable balls suitable for physical education classes and intramural sports. Their procurement decisions heavily favor robustness, longevity, and bulk pricing. This institutional demand provides a solid foundation for manufacturers catering to the mid-to-low price tiers of the market.

What is the impact of environmental concerns on product development?

Environmental concerns are driving significant product development shifts, pushing manufacturers toward adopting ISO 14001 certified processes, reducing reliance on solvents and hazardous chemicals, and prioritizing the use of recycled materials. This focus on sustainability influences consumer purchasing decisions, often enabling a premium price point for eco-friendly product lines and enhancing corporate reputation.

How do varying regional preferences affect product lines?

Regional preferences heavily dictate product lines; for example, North America drives demand for football (American), baseball, and basketball equipment, while Europe and Latin America prioritize soccer. Manufacturers must maintain regionally tailored inventories and marketing campaigns, often requiring customization of ball characteristics like size, weight, and surface texture to align with local sport standards and climatic conditions.

What are the future technological trends expected in the inflation and air retention sector?

Future trends in inflation focus on self-inflation mechanisms, potentially using micro-pumps or chemical reactions, and advanced sealing technologies to entirely eliminate air loss over the product's lifespan. Research is also ongoing into smart valve systems that allow digital monitoring and automated regulation of internal pressure to maintain optimal performance without manual intervention.

How do manufacturers ensure the anti-burst safety of fitness and stability balls?

Anti-burst safety is ensured through rigorous material testing and specific manufacturing processes that enhance the elasticity and tensile strength of the PVC or rubber compounds. The primary engineering goal is to ensure that if the ball is punctured, it tears slowly rather than exploding, allowing the user to safely dismount. This capability is often validated by specific weight-bearing safety certifications.

What are the strategic benefits of manufacturers engaging in direct-to-consumer (D2C) sales?

D2C sales offer strategic benefits by enabling manufacturers to retain higher margins by bypassing intermediary retailers, gaining direct access to valuable consumer data (which informs product development and marketing), and ensuring complete control over the brand message and customer experience, facilitating rapid response to market feedback and trends.

How does the shift to home fitness impact the demand for specific types of inflatable balls?

The shift towards home fitness, accelerated by global trends, has significantly boosted the demand for stability balls, weighted medicine balls, and smaller inflatable tools used for core work and yoga. Consumers prioritize durability, non-slip surfaces, and products with online instructional support, favoring specialized fitness product lines over general recreational equipment.

Why is quality control particularly critical for professional match balls?

Quality control is critical for professional match balls because they must meet incredibly strict performance criteria mandated by governing bodies (e.g., FIFA, FIBA) regarding circumference, weight, pressure stability, rebound consistency, and water absorption. Even minor deviations can disqualify a ball from use in official matches, necessitating advanced automated inspection systems during manufacturing.

What distinguishes synthetic leather from natural leather in inflatable ball manufacturing?

Synthetic leather, typically made from high-grade PU microfiber, offers superior consistency, water resistance, and abrasion durability compared to natural leather. While natural leather is highly regarded for its soft touch and traditional feel, it is prone to degradation and weight gain when wet. Synthetic materials offer a more predictable and longer-lasting performance, making them the preferred choice for most modern outdoor professional sports.

How do manufacturers leverage customization for promotional segments?

Manufacturers leverage advanced printing technologies, such as UV printing and heat transfer, to offer extensive customization for promotional inflatable balls. This includes large-scale logo placement, specific color matching, and thematic designs tailored for corporate events, product launches, or large sporting events, ensuring maximum brand visibility at a cost-effective price point.

What is the competitive advantage of manufacturers investing heavily in material science R&D?

Investing heavily in material science R&D provides a crucial competitive advantage by enabling the development of proprietary compounds that offer superior performance metrics, such as lighter weight with higher durability, enhanced grip in wet conditions, or achieving specific, desired rebound characteristics that competitors cannot replicate. This leads to exclusive product features and premium market positioning.

How does the market handle the issue of counterfeit inflatable balls?

The market combats counterfeiting through several strategies: implementing advanced security features on packaging (like holograms and unique serial codes), leveraging digital authentication platforms (often QR codes linked to secure databases), engaging in proactive legal enforcement, and educating consumers on identifying genuine products, particularly in high-risk emerging markets where imitation products are prevalent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Inflatable Ball Market Size Report By Type (Soccer, Basketball, Football, Volleyball), By Application (Direct Sale, Distribution), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Inflatable Ball Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Soccer balls, American footballs, Volleyballs, Basketballs), By Application (Supermarket, Sports store, Online store), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager