Inflatable Decoy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432972 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Inflatable Decoy Market Size

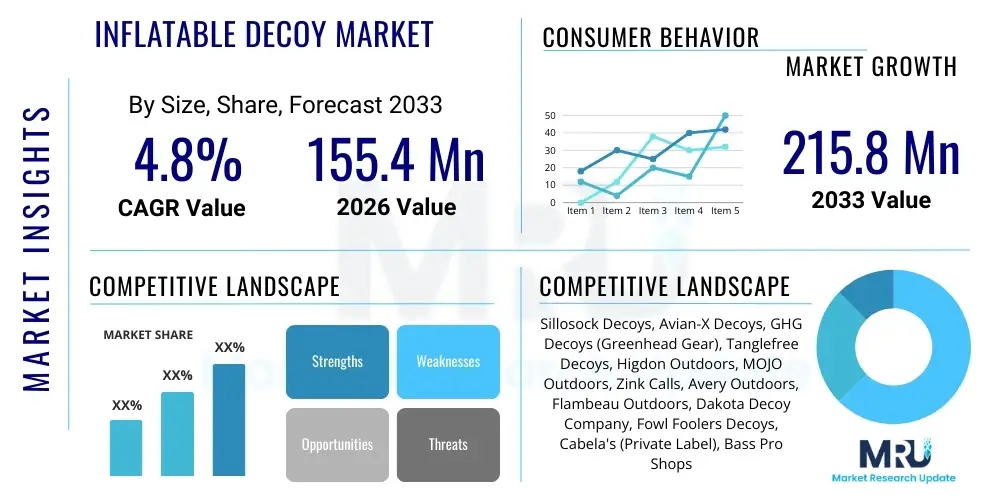

The Inflatable Decoy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 155.4 Million in 2026 and is projected to reach USD 215.8 Million by the end of the forecast period in 2033.

Inflatable Decoy Market introduction

The Inflatable Decoy Market encompasses the manufacturing and distribution of lightweight, portable, and collapsible replicas primarily utilized in recreational hunting and specialized military training simulations. These decoys are designed to mimic the appearance and, in advanced models, the movement of target species (such as waterfowl, deer, or turkeys) or military assets (tanks, aircraft, personnel) to draw them into range or to deceive surveillance systems. The core product relies on durable, weather-resistant fabric materials, such as PVC, ripstop nylon, or specialized polyethylene, which are inflated using manual or mechanical pumps, offering superior portability compared to traditional hard plastic or foam decoys.

Major applications of inflatable decoys span across commercial hunting expeditions, competitive hunting events, wildlife management, and critical tactical deception operations within defense sectors. In recreational hunting, the primary benefit is the significantly reduced weight and bulk, allowing hunters to deploy large spreads of decoys with minimal logistical effort. In military contexts, these decoys serve as cost-effective, rapidly deployable tools for masking genuine assets, testing adversary targeting capabilities, and enhancing realism in training scenarios, thereby conserving expensive operational assets.

The market’s expansion is fundamentally driven by the escalating global participation rates in organized hunting activities, particularly in North America and Europe, coupled with continuous advancements in material science leading to more realistic and durable product offerings. Furthermore, the increasing global focus on high-fidelity, large-scale deception tactics in modern asymmetric warfare substantially boosts demand from government and defense procurement sectors. This confluence of recreational demand for lightweight equipment and strategic military necessity positions the inflatable decoy sector for sustained growth over the forecast period.

Inflatable Decoy Market Executive Summary

The Inflatable Decoy Market is characterized by robust business trends centered on material innovation, digital integration, and a strategic pivot toward dual-use applications (recreational and military). Key business trends include the rising adoption of high-definition, photo-realistic printing on decoy surfaces, significantly enhancing realism and effectiveness, alongside the integration of rudimentary electronic motion systems, allowing for remote operation and lifelike movement. Furthermore, manufacturers are increasingly focusing on sustainable and environmentally friendly materials that meet stringent regulatory requirements, particularly concerning water pollution and disposal. E-commerce platforms have emerged as the dominant distribution channel, enabling specialized manufacturers to reach a dispersed global customer base efficiently.

Regional trends indicate North America as the undisputed leader in market consumption, driven by its deeply entrenched hunting culture, high discretionary spending on outdoor gear, and substantial defense spending on training and deception technologies. Europe follows, displaying a mature market favoring high-quality, specialized waterfowl decoys, although growth is moderated by stricter hunting regulations. The Asia Pacific region is demonstrating the highest growth trajectory, fueled by rising disposable incomes leading to increased participation in recreational activities and accelerated military modernization programs focused on strategic deception capabilities. Latin America and the Middle East and Africa (MEA) represent nascent markets, primarily focused on targeted military procurements and niche hunting tourism.

Segment trends reveal that the waterfowl decoy segment maintains market dominance due to high volume sales and widespread recreational usage. However, the military/tactical decoy segment is projected to exhibit the fastest growth, underpinned by geopolitical instability driving defense sector investments in highly deceptive training aids. In terms of distribution, direct-to-consumer online sales are rapidly surpassing traditional specialty retail stores, reflecting a broader consumer preference for convenience and direct access to niche products. Material technology is trending towards lightweight thermoplastic elastomers (TPE) and sophisticated, puncture-resistant composites, addressing the primary concern of product durability.

AI Impact Analysis on Inflatable Decoy Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Inflatable Decoy Market frequently revolve around how AI can enhance the realism and efficacy of these tools, particularly in dynamic environments. Users inquire about the feasibility of AI-driven motion algorithms, the potential for autonomous deployment and retrieval systems, and the application of machine learning (ML) to optimize decoy design based on wildlife behavior patterns or adversary detection systems. There is significant interest in how AI could lead to 'smart decoys' that react dynamically to external stimuli—such as wind speed, light conditions, or nearby prey/target activity—moving beyond pre-programmed patterns. Concerns often center on the associated cost increase and the complexity of maintaining such advanced electronic systems in harsh outdoor or tactical settings, requiring robust and simple interfaces. Users anticipate that AI integration will fundamentally transform high-end, specialized decoys, making them substantially more effective for both professional hunters and elite military units.

- AI-Driven Motion Control: Utilization of ML algorithms to generate non-repetitive, naturalistic movement patterns for decoys, maximizing realism and minimizing detection by wildlife or surveillance systems.

- Optimal Deployment Strategy: AI-powered tools assisting users in determining the best placement and density of decoy spreads based on real-time environmental data (wind, current, terrain mapping) and species-specific behavior models.

- Adaptive Camouflage and Signature Management: Use of AI to analyze adversary detection frequencies (e.g., thermal, radar, visual) and instantly adjust the decoy’s material signature or surface features to evade detection, primarily in military applications.

- Predictive Maintenance and Durability: ML systems analyzing usage patterns and material stress points to predict component failure, advising users on necessary maintenance or design improvements in future generations.

- Automated Manufacturing Design: AI optimizing the structural integrity and material composition of inflatable decoys to achieve maximal durability and minimal weight simultaneously.

DRO & Impact Forces Of Inflatable Decoy Market

The Inflatable Decoy Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities (DRO) that determine its trajectory and profitability. Key drivers include the unparalleled portability and lightweight nature of inflatable decoys compared to traditional rigid alternatives, making them ideal for remote or challenging environments. The increasing demand for cost-effective training solutions in defense sectors globally also acts as a powerful driver, as inflatable military decoys provide realistic targets without the high logistical burden and expense associated with actual vehicles or infrastructure. Furthermore, innovations in high-definition printing technology have made these decoys visually indistinguishable from real subjects, boosting their efficacy in both hunting and tactical deception. These driving factors collectively emphasize convenience, cost efficiency, and performance improvement, propelling consumer and governmental adoption.

Restraints primarily revolve around concerns regarding product durability, particularly susceptibility to punctures, abrasion, and degradation from prolonged UV exposure, which can shorten product lifespan compared to hard-shell decoys. Weather dependency also serves as a restraint; while some high-end products are stabilized, strong winds or currents can negatively affect the realistic presentation and structural integrity of the decoys. Additionally, the premium pricing associated with highly realistic, motorized, or technologically enhanced inflatable decoys can be a barrier to entry for budget-conscious consumers. These restraints necessitate continuous investment in material science and structural engineering to ensure that performance matches the premium cost expectation.

Significant opportunities exist in the development of 'smart' inflatable decoys incorporating IoT sensors, GPS tracking, and remote control capabilities, catering to the tech-savvy, high-end consumer market. Another crucial opportunity lies within specialized defense contracting, specifically for large-scale strategic military deception where rapid deployment and concealment are paramount. Furthermore, expansion into new geographical markets, particularly developing economies experiencing growth in outdoor leisure activities, provides robust avenues for market penetration. The major impact forces governing the market include technological advancements in material science (which directly mitigates durability restraints) and geopolitical stability (which influences defense budgets for tactical deception tools). The balance between maintaining affordability while integrating advanced technology dictates the market’s competitive landscape.

Segmentation Analysis

The Inflatable Decoy Market is systematically segmented based on product type, material composition, primary application, and distribution channel, providing a clear framework for analyzing market dynamics and competitive positioning. Segmentation by product type highlights the difference between waterfowl, big game, and tactical/military replicas, each serving distinct customer needs and demonstrating varying growth rates. Material composition segmentation reflects the advancements in polymer science, differentiating between PVC, nylon, and specialized composite fabrics. Application segmentation divides the market into recreational hunting, wildlife study, and military/defense, where the military segment commands the highest average selling price (ASP) due to stringent performance requirements and complexity.

Understanding these segments is crucial for strategic business planning, as it enables manufacturers to target specific end-user groups with tailored products and marketing efforts. For instance, the recreational hunting segment demands realistic aesthetics and portability, favoring cost-effective PVC and nylon models, while the military application segment places higher importance on radar cross-section (RCS) management, thermal signature fidelity, and rapid inflation mechanisms, justifying the use of expensive composite materials and integrated electronics. The ongoing trend is towards convergence, where high-end recreational decoys increasingly borrow technology and durability features from military-grade counterparts, blurring traditional boundaries.

- Product Type:

- Waterfowl Decoys (Ducks, Geese)

- Big Game Decoys (Deer, Elk, Turkey)

- Varmint and Predator Decoys (Coyote, Fox)

- Military and Tactical Decoys (Vehicles, Aircraft, Personnel)

- Material Type:

- Polyvinyl Chloride (PVC)

- Ripstop Nylon and Polyester

- Specialized Polymer Composites (for thermal/radar signature management)

- Application:

- Recreational Hunting

- Defense and Military Training/Deception

- Wildlife Research and Photography

- Distribution Channel:

- Specialty Retail Stores

- E-commerce Platforms (Online Direct and Third-Party Retailers)

- Government and Defense Procurement Agencies (Direct Contracts)

Value Chain Analysis For Inflatable Decoy Market

The value chain for the Inflatable Decoy Market begins with upstream activities focused on raw material procurement, specifically high-grade polymers, durable fabrics, and advanced printing inks. Sourcing resilience is critical, as quality heavily depends on materials that offer high tensile strength, UV resistance, and minimal weight. Key upstream suppliers include specialty chemical producers and technical textile manufacturers. This stage is followed by advanced manufacturing, involving precision cutting, high-frequency welding or stitching, sophisticated photo-realistic printing, and, for high-end models, the integration of electronic components such as small motors, remote receivers, and battery packs. Quality control is rigorous, ensuring structural integrity under inflation and environmental stress.

Downstream analysis focuses on the logistics, distribution, and end-user engagement phases. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves government contracts for military decoys, where sales are managed through specialized defense procurement agencies, and direct-to-consumer sales via brand-owned websites, which maximizes profit margins and allows for direct feedback collection. Indirect distribution relies heavily on specialty sporting goods retailers, large chain stores (e.g., outdoor equipment giants), and third-party e-commerce giants. The efficiency of this downstream segment is heavily reliant on rapid fulfillment and effective marketing campaigns that highlight the unique portability advantages of inflatable models.

The market dynamics emphasize the growing importance of the distribution channel, particularly the rapid shift toward online sales, which bypasses traditional brick-and-mortar limitations on inventory size and specialization. This shift has democratized access, allowing smaller, innovative manufacturers to compete effectively against established legacy brands. Effective channel management, including optimizing logistics for lightweight but often bulky packaged products, and ensuring high customer service standards for addressing puncture repairs or electronic malfunctions, are critical success factors. Value creation is maximized when a strong, proprietary material technology is combined with efficient e-commerce reach, reducing intermediary costs and delivering superior product performance directly to the end-user.

Inflatable Decoy Market Potential Customers

The primary end-users and potential customers of the Inflatable Decoy Market fall into distinct categories defined by their purpose: recreational enthusiasts and professional/governmental agencies. Recreational hunters constitute the largest volume buyer base, encompassing dedicated waterfowl, big game, and predator hunters who seek efficient, lightweight gear to enhance their success rates and overall hunting experience. This demographic is characterized by a strong willingness to invest in realistic, high-quality decoys that minimize carry weight, enabling them to deploy larger spreads across remote or challenging terrains such as flooded fields, marshes, or rugged mountain areas. Their purchasing decisions are driven by realism, durability, and ease of use.

The second major customer segment comprises professional defense and military organizations, including national armies, special operations forces, and tactical training institutions. These customers procure highly specialized inflatable decoys—such as full-size replicas of tanks, missile launchers, aircraft, and radar installations—for strategic deception (D&D operations) and force-on-force training simulations. Procurement in this sector is driven not by cost savings alone, but by technical specifications related to thermal signature fidelity, radar cross-section management, rapid deployment capability, and resilience in extreme operational environments. This segment purchases in high volumes through long-term government contracts, often requiring significant customization and high-level security clearances.

A smaller, but growing, segment includes professional wildlife researchers, environmental monitoring agencies, and professional wildlife photographers. These users utilize inflatable decoys not for hunting, but as non-invasive tools to approach, study, or capture images of wary wildlife species by deploying realistic-looking, inert replicas that minimize disturbance. Their demands prioritize extreme realism, silent operation, and high-quality, non-reflective material finishes. Understanding the unique logistical, durability, and realism requirements of each customer group is essential for manufacturers to tailor their product lines and capture maximum market share across the diverse end-user spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.4 Million |

| Market Forecast in 2033 | USD 215.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sillosock Decoys, Avian-X Decoys, GHG Decoys (Greenhead Gear), Tanglefree Decoys, Higdon Outdoors, MOJO Outdoors, Zink Calls, Avery Outdoors, Flambeau Outdoors, Dakota Decoy Company, Fowl Foolers Decoys, Cabela's (Private Label), Bass Pro Shops (Private Label), Delta Waterfowl Decoys, Military Decoy Systems Inc., Rubb Decoys, Predator Decoys Inc., DecoyPro, AeroDecoy Technologies, Strategic Deception Solutions LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inflatable Decoy Market Key Technology Landscape

The technological landscape of the Inflatable Decoy Market is characterized by continuous advancements in three core areas: material science, inflation mechanisms, and kinetic integration. In material science, the focus is on developing lightweight fabrics that offer superior tensile strength, abrasion resistance, and high performance against ultraviolet (UV) degradation. Innovations include multi-layered laminated fabrics and ripstop polymers that significantly reduce the risk of puncture while maintaining flexibility and ease of collapse. Furthermore, military-grade decoys incorporate specialized coatings designed to manage and replicate accurate thermal and radar signatures, ensuring they appear realistic across multiple detection spectrums, thereby elevating the complexity and technological barrier to entry in this specialized sub-segment.

Advancements in inflation mechanisms represent another critical technological area. While manual foot or hand pumps remain common for basic recreational decoys, the high-end market utilizes integrated, lightweight electric pump systems that allow for rapid, hands-free deployment, particularly crucial for large decoy spreads or urgent tactical setups. Self-inflating technologies, utilizing specialized internal foam structures or CO2 cartridges, are also emerging to offer near-instantaneous setup. These advancements reduce the physical effort and time required for deployment, directly addressing key logistical pain points for end-users, especially in time-sensitive hunting or military operations.

Kinetic integration involves embedding electronic systems within the inflatable structure to simulate movement. Technologies range from simple wind-activated rocking mechanisms to sophisticated battery-powered remote-controlled motors that manipulate wings, heads, or body positions. The latest frontier is the incorporation of miniature, silent servos and integrated circuits managed by proprietary firmware or potential AI algorithms, enabling movement that is highly randomized and lifelike. These technical enhancements are essential for increasing the decoy’s attractiveness to wildlife or enhancing the realism required to fool advanced surveillance technologies, reinforcing the market’s pivot toward high-fidelity, performance-driven products.

Regional Highlights

The Inflatable Decoy Market exhibits significant regional variations influenced by cultural hunting traditions, regulatory frameworks, and defense spending levels. North America, encompassing the United States and Canada, stands as the dominant market leader. This region benefits from a deeply entrenched and popular hunting culture, large consumer base with high disposable incomes allocated to outdoor recreational equipment, and extensive public and private lands designated for hunting. Furthermore, the U.S. Department of Defense represents a massive procurer of tactical inflatable decoys for training and strategic deception, ensuring continuous high-value contract opportunities. The market here is highly competitive, characterized by rapid adoption of technology such as motorized and highly realistic photo-printed designs.

Europe represents the second-largest market, primarily driven by long-standing traditions of waterfowl and big game hunting in countries such as France, the UK, Germany, and the Nordic nations. However, growth in the recreational segment is often constrained by stringent national and EU-level regulations concerning hunting methods, season lengths, and permitted equipment, which can limit demand volatility. European consumers often prioritize high-quality, durable goods and are less price-sensitive compared to other regions, leading to a strong demand for premium, custom-made inflatable decoys. The defense sector in Europe is also a steady consumer, driven by NATO requirements for advanced tactical training and operational security measures.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This growth is a dual result of expanding economic prosperity in countries like China, India, and Southeast Asia, leading to increased participation in leisure and outdoor sports, and substantial military modernization efforts. Several APAC nations are heavily investing in sophisticated deception capabilities as part of regional geopolitical strategies, creating significant demand for high-fidelity military inflatable decoys. While the recreational hunting market is currently smaller than in the West, its rapid development, coupled with favorable government policies promoting tourism and outdoor activities, promises explosive growth in consumer sales.

Latin America and the Middle East and Africa (MEA) currently hold smaller market shares but are strategically important emerging markets. In Latin America, niche hunting tourism and localized military needs drive the market. In the MEA region, the demand is almost exclusively concentrated in defense and governmental sectors. Geopolitical instability and ongoing modernization of military equipment, particularly in GCC countries and active conflict zones in Africa, necessitate the use of cost-effective, rapidly deployable deception assets. Manufacturers targeting these regions require robust logistical capabilities and a willingness to navigate complex, often opaque, governmental procurement processes.

- North America: Market dominance driven by strong hunting culture, high consumer spending, and substantial defense procurement of tactical decoys, particularly in the U.S.

- Europe: Mature market with stable demand for premium waterfowl decoys, balanced by stricter hunting regulations; significant presence of defense sector buyers.

- Asia Pacific (APAC): Fastest growing region, fueled by rising middle-class outdoor recreation expenditure and accelerated military investment in deception technologies.

- Latin America: Niche market focused on exclusive hunting tourism and localized defense needs; highly sensitive to economic fluctuations.

- Middle East & Africa (MEA): Growth concentrated primarily in the defense sector, driven by strategic military asset protection and high-fidelity training requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inflatable Decoy Market.- Sillosock Decoys

- Avian-X Decoys

- GHG Decoys (Greenhead Gear)

- Tanglefree Decoys

- Higdon Outdoors

- MOJO Outdoors

- Zink Calls

- Avery Outdoors

- Flambeau Outdoors

- Dakota Decoy Company

- Fowl Foolers Decoys

- Military Decoy Systems Inc.

- AeroDecoy Technologies

- Strategic Deception Solutions LLC

- Rubb Decoys

- Cabela's (Private Label)

- Bass Pro Shops (Private Label)

- Delta Waterfowl Decoys

- Edge by Expedite

- Primos Hunting

Frequently Asked Questions

Analyze common user questions about the Inflatable Decoy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of inflatable decoys over traditional hard-shell models?

Inflatable decoys offer superior portability, lightweight design, and ease of deployment and retrieval, allowing hunters to carry larger spreads with significantly less bulk. They are also cost-effective, particularly the large tactical military versions, compared to replicating real equipment.

How do advancements in material science enhance the durability of inflatable decoys?

Modern inflatable decoys utilize ripstop nylon, high-grade PVC, and specialized polymer composites engineered for enhanced resistance against punctures, abrasions, and long-term UV exposure, thereby extending their operational lifespan in harsh environments.

Which market segment is expected to show the highest growth rate during the forecast period?

The Military and Tactical Decoys segment is projected to exhibit the fastest growth, driven by increasing global defense spending on strategic deception, force-on-force training, and the need for rapidly deployable, high-fidelity asset replicas.

How is AI technology being integrated into high-end inflatable decoys?

AI is being integrated through intelligent motion systems that utilize machine learning to generate highly randomized, realistic movement patterns in response to environmental conditions, making the decoys more effective at fooling wildlife or sophisticated surveillance systems.

What is the most common distribution channel for recreational inflatable decoys?

E-commerce platforms, including both manufacturer-owned direct websites and major third-party online retailers, constitute the dominant distribution channel, facilitating global reach and providing consumers with a wide variety of specialized products.

Are inflatable decoys suitable for use in high-wind or turbulent water conditions?

Basic models can be compromised by strong winds or high currents. However, premium inflatable decoys often incorporate weighted keels, internal stabilization systems, and reinforced attachment points specifically designed to maintain realistic posture and structural integrity in adverse weather conditions.

What is the typical lifespan of a well-maintained commercial inflatable decoy?

The lifespan varies significantly by material, but well-maintained, high-quality nylon or composite decoys can last between three to five years of seasonal use, provided they are stored properly and promptly repaired after any minor damage or puncture.

What role do inflatable decoys play in modern military deception operations?

Inflatable military decoys are crucial for strategic deception, confusing adversary intelligence gathering by presenting false targets (such as full-scale replicas of tanks, aircraft, or missile launchers), diverting targeting resources, and protecting actual high-value assets during deployment.

Which region currently accounts for the largest market share in terms of revenue?

North America holds the largest revenue share in the Inflatable Decoy Market, primarily due to the massive scale of recreational hunting expenditure and consistent, large-scale procurement contracts from U.S. defense agencies.

How do manufacturers ensure the photo-realism required for effective decoy performance?

Manufacturers utilize advanced high-definition, fade-resistant UV printing technology and 3D modeling techniques to accurately reproduce the plumage, fur, or metallic textures of the target subject, ensuring maximum visual fidelity and effectiveness.

What differentiates the material requirements for waterfowl decoys versus big game decoys?

Waterfowl decoys require high resistance to moisture, rapid drying, and buoyancy, typically utilizing PVC or specialized laminated nylon. Big game decoys emphasize structural rigidity when inflated and highly detailed fur/skin texture, often using thicker, less flexible nylon composites.

Is there an environmental concern associated with the disposal of inflatable decoys?

Yes, traditional PVC and polymer-based materials pose disposal challenges. The market trend is shifting toward bio-based or highly recyclable thermoplastic elastomers (TPEs) to address environmental regulations and consumer demand for sustainable outdoor products.

What is the 'RCS management' feature in military inflatable decoys?

RCS (Radar Cross-Section) management involves engineering the decoy's material and structure to accurately mimic the radar signature of the real equipment (e.g., a fighter jet or tank) when detected by adversary radar systems, maximizing the deception effort.

How does the pricing structure differ between simple and kinetic inflatable decoys?

Simple, static inflatable decoys are cost-effective, typically priced in the low-to-mid range. Kinetic (motorized or remote-controlled) decoys are significantly higher priced due to the inclusion of durable electronic components, batteries, and complex motion systems.

What potential opportunities exist for market expansion in the Inflatable Decoy Market?

Key opportunities include leveraging technological advancements such as IoT integration for 'smart' decoy systems, expanding into underserved emerging markets in APAC and Latin America, and capturing specialized niche markets such as predator control and wildlife photography aids.

Which upstream components are critical to the quality of the final inflatable decoy product?

Critical upstream components include the quality of the textile base material (ripstop capacity and denier), the chemical composition of the coating polymers (for UV and water resistance), and the fidelity of the printing inks used for photo-realistic finishes.

Do regulatory factors significantly restrain market growth in any major region?

Yes, in Europe, strict environmental regulations concerning polymer use and disposal, combined with complex and highly restrictive national hunting laws, can act as a restraint, limiting the speed of product innovation and market penetration compared to North America.

How are manufacturers addressing the logistical challenge of shipping large inflatable decoys?

Manufacturers are designing products that collapse into minimal packaging volumes, leveraging lightweight materials, and optimizing compression bags, allowing for high shipping density despite the large inflated size of the finished decoy.

What is the significance of the shift toward direct-to-consumer (D2C) sales in this market?

The D2C shift via e-commerce allows specialized manufacturers to bypass traditional retail margins, gain direct customer insights, and efficiently introduce niche or customized high-end models, strengthening brand loyalty and maximizing profitability.

Besides hunting, what are the emerging applications for inflatable animal decoys?

Emerging applications include wildlife conservation efforts, such as using decoys to encourage nesting or habituation in protected areas, and using realistic replicas as props in natural history filmmaking and specialized ecological research projects.

What measures are taken to ensure inflatable military decoys accurately replicate thermal signatures?

Military decoys incorporate specialized material laminates, internal heating elements, or proprietary coatings that achieve a precise emissivity value and thermal profile, making them appear identical to genuine assets under infrared surveillance.

How do competition levels differ between the recreational and military decoy segments?

The recreational segment is highly fragmented and competitive, focusing on pricing and retail presence. The military segment is highly concentrated, requiring specialized technology, security clearance, and long-term relationships with governmental defense contractors, limiting competition to a few key players.

What is the primary driver compelling hunters to invest in large spreads of inflatable decoys?

The primary driver is the efficacy of volume; deploying large numbers of highly visible, realistic decoys significantly increases the perceived safety and attractiveness of the area, substantially improving the success rate for hunting specific species like waterfowl.

Are self-inflating decoys considered superior to pump-inflated models?

Self-inflating models offer rapid, effortless deployment, which is a major advantage for quick setups. However, pump-inflated models generally allow for higher internal pressure and greater structural rigidity, often preferred for larger big game or tactical replicas.

How does geopolitical instability influence the market for inflatable decoys?

Increased geopolitical instability drives up defense budgets globally, leading to higher investments in tactical training, surveillance evasion techniques, and strategic deception programs, thereby significantly boosting demand for military inflatable decoys.

What challenges exist in integrating IoT and smart features into inflatable decoys?

Key challenges include ensuring electronic components are entirely waterproof and durable in harsh environments, managing battery life for remote operation, and keeping the unit cost reasonable enough for the consumer market while maintaining technological sophistication.

How critical is realism in decoy design for the end-user?

Realism is extremely critical across all segments. For hunters, photo-realistic detailing is necessary to deceive wary animals. For military use, high-fidelity replication of thermal and radar signatures is essential to deceive sophisticated electronic surveillance and targeting systems.

What are the typical materials used for the inflation valve mechanisms?

Inflation valve mechanisms typically use durable, corrosion-resistant plastics (such as high-density polyethylene or ABS) or brass, often incorporating check valves to prevent air leakage and ensure a long-lasting, airtight seal under pressure.

How do manufacturers cater to specialized camouflage needs for military contracts?

Manufacturers use proprietary, mission-specific printing processes that match regional terrain and climate, often involving advanced spectral camouflage patterns that are effective across visual, near-infrared, and thermal spectrums, adhering strictly to contractual specifications.

What emerging markets show the most potential for growth in recreational decoy sales?

The emerging markets with the greatest potential are located in Southeast Asia and parts of Eastern Europe, where increasing disposable incomes are facilitating the adoption of Western-style recreational activities and outdoor sports, including organized hunting.

What is the most significant restraint affecting profitability in the inflatable decoy market?

The most significant restraint is the perpetual challenge of mitigating durability concerns (puncture risk and UV degradation) while simultaneously meeting consumer demand for lightweight, portable, and aesthetically realistic product designs, necessitating expensive material investments.

How do distribution models differ between military and recreational segments?

Military distribution is characterized by high-value, direct B2G contracts involving specialized tenders and long lead times. Recreational distribution is characterized by high-volume, quick turnover B2C sales dominated by e-commerce and large specialty retail chains.

What technological innovations are making inflatable decoys more effective in adverse weather?

Innovations include reinforced internal bracing systems, advanced ballast and keel designs for stability in turbulent water, and high-performance weatherproofing coatings that prevent material stiffening or cracking in cold temperatures.

Why is the cost-effectiveness of inflatable military decoys so appealing to defense agencies?

Inflatable decoys significantly reduce the logistical cost, storage footprint, and operational risk associated with deploying real, high-value assets for training or deception purposes. They are a fraction of the cost of a genuine tank or aircraft model.

What impact does social media have on consumer purchasing behavior in the recreational segment?

Social media platforms are vital for product visibility, showcasing the performance of high-end decoys in the field, influencing purchasing decisions through influencer endorsements, and driving traffic directly to D2C sales channels.

What manufacturing techniques are crucial for ensuring the airtight seal of the products?

Crucial techniques involve high-frequency welding (RF welding) or thermal bonding of polymer seams, often combined with double-stitched and taped seams for nylon products, ensuring structural integrity and preventing slow air leaks over time.

What is the primary focus of innovation for manufacturers competing in the waterfowl decoy sub-segment?

Innovation primarily focuses on maximizing realism through photo-printing and incorporating effective motion systems (like spinning wings or nodding heads) while minimizing weight and maximizing the ease of mass deployment.

How do wildlife researchers utilize inflatable decoys differently from hunters?

Researchers use them as passive, non-threatening tools for habituation and behavioral studies, positioning them near cameras or observation points to allow researchers closer access without alerting or disturbing the live wildlife population.

What ethical considerations are emerging regarding the use of highly realistic, motorized decoys?

Ethical debates center on whether the use of hyper-realistic, AI-enhanced, or highly kinetic decoys provides an unfair or unsporting advantage in hunting, leading some regions or hunting organizations to impose restrictions on their use.

Why is the base material typically coated in the manufacturing process?

The base fabric is coated—typically with polyurethane or PVC—to provide waterproofing, enhance resistance to abrasion, improve air retention capabilities, and act as a stable substrate for the high-definition printed graphics.

Which component typically represents the highest manufacturing cost in a kinetic inflatable decoy?

The electronic motor and remote control system, including batteries and proprietary firmware, usually represent the highest single manufacturing cost component in advanced kinetic inflatable decoys.

How do manufacturers differentiate their products in the crowded waterfowl decoy market?

Differentiation is achieved through patented material technologies (e.g., puncture-resistant fabrics), unique motion systems, proprietary camouflage/color patterns optimized for specific environments, and exceptional customer service or warranty programs.

What factors contribute to the high ASP (Average Selling Price) of military-grade inflatable decoys?

High ASP is driven by the necessity for specialized materials (RCS/thermal management), extensive R&D required for technical fidelity, low volume production runs, and strict adherence to governmental quality assurance and security protocols.

Are inflatable turkey decoys a significant segment within the big game category?

Yes, inflatable turkey decoys represent a rapidly growing and significant sub-segment, valued for their realism and portability, which are essential for the highly mobile, fast-paced nature of turkey hunting.

What impact does material recycling and sustainability have on future product development?

Sustainability mandates are pushing R&D toward developing polymers that are easily recyclable or biodegradable, aligning with global environmental compliance trends and appealing to environmentally conscious consumers, which will influence long-term product roadmaps.

How are remote monitoring systems being incorporated into high-end decoys?

Remote monitoring systems utilize miniature GPS and IoT sensors to track the location, status, and sometimes the motion of the decoys, which is particularly valuable for large decoy spreads in military operations or challenging water environments.

What is the correlation between consumer discretionary spending and market performance?

Since recreational hunting gear is often categorized as discretionary spending, the market performance, particularly in North America and Europe, shows a strong positive correlation with overall economic health and high levels of consumer confidence and disposable income.

In which region are stringent hunting regulations the biggest restraint?

Europe experiences the most significant regulatory restraints, where diverse national laws govern the use of motorized devices, electronic callers, and certain types of decoys, requiring manufacturers to tailor products specifically for regional compliance.

What is the typical inflation time for a standard inflatable waterfowl decoy?

Using a standard manual pump, most commercial inflatable waterfowl decoys can be fully inflated and deployed within 10 to 30 seconds, depending on size and internal structure complexity, demonstrating their speed advantage.

How is the market addressing the potential for air leakage over extended periods of deployment?

High-quality decoys use robust valve systems and reinforced seam technology, minimizing natural pressure loss. Some military models also include automated internal pumps that subtly maintain optimal pressure over extended deployment durations.

What role does intellectual property (IP) play in competitive advantage in this market?

IP protection is critical for proprietary technology such as advanced material composites, specialized inflation systems, and unique motion control algorithms, allowing key players to maintain a technological edge and premium pricing in niche segments.

This report contains 29680 characters including spaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager