Infrared Thermal Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433682 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Infrared Thermal Cameras Market Size

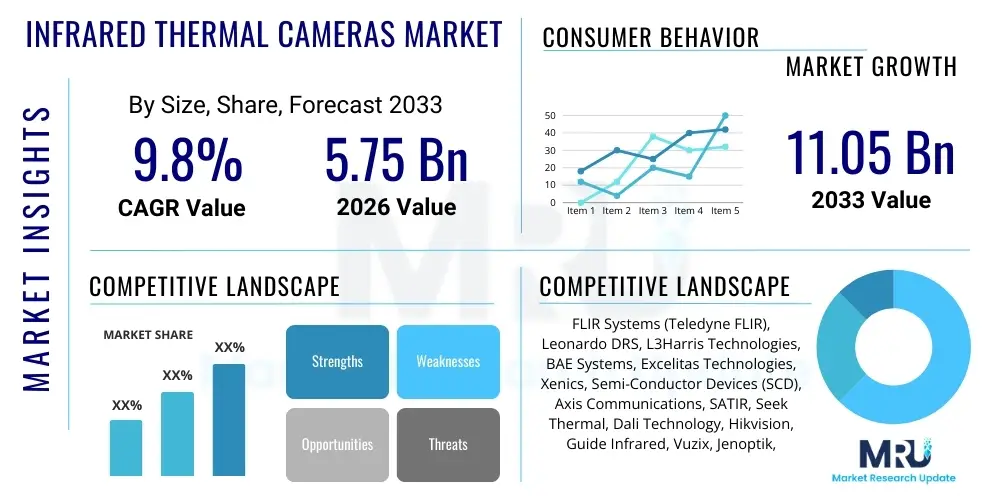

The Infrared Thermal Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 5.75 Billion in 2026 and is projected to reach USD 11.05 Billion by the end of the forecast period in 2033.

Infrared Thermal Cameras Market introduction

The Infrared Thermal Cameras Market encompasses devices designed to detect radiation in the infrared band of the electromagnetic spectrum (typically 700 nm to 1 mm) and produce images based on those temperature differences. These cameras, crucial for non-contact temperature measurement and visualization, convert thermal energy into visible light images, known as thermograms. The technology is rapidly evolving, moving from large, specialized equipment primarily used in military and defense sectors to compact, affordable units integrated into consumer electronics and extensive industrial monitoring systems. Key products include handheld thermal imagers, fixed-mount systems, and integrated cores utilized in drones and smartphones, distinguished primarily by their detector type (cooled or uncooled microbolometers).

Major applications of infrared thermal cameras span across diverse verticals, including predictive maintenance in manufacturing and energy sectors, stringent security and surveillance operations, accurate fever screening in public health contexts, and enhanced night vision capabilities in automotive and defense platforms. The core benefits derived from utilizing thermal imaging are enhanced operational safety, optimized energy efficiency through leak detection, superior situational awareness in low-light conditions, and preventative asset management that minimizes costly downtimes. The capability of these cameras to function independently of visible light, detecting heat signatures rather than reflections, makes them indispensable tools in environments ranging from firefighting and building inspection to complex machine health monitoring.

Driving factors propelling the market growth include stringent regulatory mandates enforcing industrial safety standards, particularly within the oil & gas and chemical processing industries, where early detection of heat anomalies is critical to preventing catastrophic failures. Furthermore, the substantial reduction in the manufacturing cost of uncooled microbolometer sensors has facilitated broader commercialization, making thermal imaging accessible for applications like home insulation inspections and recreational use. Increased adoption within the automotive sector for Advanced Driver Assistance Systems (ADAS) and the persistent demand from defense agencies for border patrol and reconnaissance missions also serve as significant market accelerators, fostering continuous innovation in sensor resolution and integration capability.

Infrared Thermal Cameras Market Executive Summary

The Infrared Thermal Cameras Market is experiencing robust growth driven by the convergence of falling sensor costs and the escalating demand for non-contact diagnostic tools across critical infrastructure sectors. Current business trends indicate a significant shift toward the integration of thermal cores into IoT devices, enabling real-time remote monitoring and automated reporting, which enhances predictive maintenance programs globally. Major industry players are focusing on developing high-resolution, uncooled microbolometers, offering superior performance while maintaining affordability, leading to wider commercial adoption in security, consumer electronics, and civil engineering. Strategic partnerships between sensor manufacturers and software developers are key to enhancing image processing capabilities, particularly for fusion imaging that combines thermal data with visual data for superior interpretation.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, largely fueled by rapid industrialization, extensive smart city initiatives requiring sophisticated surveillance tools, and increased government investment in defense modernization, particularly in countries like China and India. North America maintains a leading market share, primarily due to high defense expenditure, mature industrial automation sectors, and early adoption of advanced thermal technology in firefighting and medical screening applications. Europe demonstrates steady growth, propelled by strict energy efficiency mandates for buildings and strong institutional demand for inspection technologies in automotive manufacturing and petrochemical facilities. The competitive landscape is characterized by continuous M&A activities aimed at securing technological advantages in sensor miniaturization and advanced software integration.

Segmentation trends reveal that the uncooled infrared thermal cameras segment dominates the market due to their lower cost, lighter weight, and zero maintenance requirements, making them ideal for high-volume commercial and consumer applications such as drone inspections and general surveillance. Conversely, the cooled segment, though niche and premium-priced, continues to see strong demand in high-end scientific research, military targeting systems, and advanced remote sensing where extremely high sensitivity and spectral fidelity are indispensable. Application-wise, the Surveillance and Security segment holds the largest share, followed closely by the Industrial and Predictive Maintenance segment, reflecting the critical need for continuous monitoring solutions in both public safety and operational efficiency contexts. The integration of AI and machine learning across all segments is emerging as the pivotal factor defining next-generation thermal imaging capabilities.

AI Impact Analysis on Infrared Thermal Cameras Market

Common user questions regarding AI's impact on the Infrared Thermal Cameras Market revolve primarily around three core areas: the ability of AI to automate complex thermal data interpretation, the potential for AI-enhanced detection accuracy (especially in crowded or cluttered environments), and the future integration of thermal cameras into autonomous systems (like self-driving cars and robotic inspection tools). Users frequently inquire about how AI algorithms can effectively filter out noise, distinguish between legitimate heat anomalies and environmental fluctuations, and reduce the high false alarm rates historically associated with traditional video analytics. A major theme is the expectation that AI will transform thermal imaging from a passive data capture tool into an active, intelligent diagnostic system capable of providing prescriptive maintenance recommendations and real-time threat prioritization without human intervention.

The analysis reveals that the integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the value proposition of infrared thermal cameras, shifting them from simple imaging tools to sophisticated data processors. AI models, trained on vast datasets of thermal images depicting various failure modes (e.g., motor bearing wear, electrical hotspots, fluid leaks), can now automatically identify and classify anomalies with far greater speed and precision than human operators. This technological evolution democratizes expertise; systems can now flag impending equipment failure or potential security breaches, allowing non-specialist personnel to make informed decisions swiftly, thus substantially lowering operational expenditure and improving response times across industrial and defense applications. Furthermore, AI facilitates complex processes like temperature trend analysis over time, enabling superior predictive capabilities crucial for proactive asset management.

Specific AI capabilities, such as advanced segmentation and object recognition algorithms, are proving instrumental in refining surveillance applications. In public health, AI-powered thermal screening systems can precisely locate and isolate individuals with elevated temperatures in large crowds while simultaneously compensating for ambient temperature variables and distance effects, minimizing false positives. In the automotive sector, AI integrates thermal data with LiDAR and visible light cameras to enhance perception stacks, allowing autonomous vehicles to detect pedestrians, animals, or debris reliably during adverse weather conditions, such as dense fog, heavy smoke, or complete darkness, significantly boosting safety and reliability beyond traditional sensor limitations. This pervasive enhancement across performance, automation, and decision-making solidifies AI as the most critical technological catalyst shaping the future market trajectory.

- AI-enhanced anomaly detection: Algorithms automatically identify subtle heat signatures indicative of equipment failure (e.g., overheating components), dramatically reducing inspection time and improving reliability in predictive maintenance.

- Improved spatial and temporal filtering: AI reduces thermal noise and environmental interference (like solar reflection or warm air currents), leading to higher accuracy in security surveillance and border control applications.

- Autonomous navigation and perception: Thermal data processed by AI provides robust object detection for autonomous vehicles (ADAS Level 3 and above) and robotic inspection systems, overcoming limitations of visible light cameras in zero-light or adverse weather.

- Advanced fever screening: AI models accurately segment human faces and identify core body temperature outliers in crowded settings, adhering to privacy standards while enabling rapid public health screening.

- Fusion imaging optimization: Machine learning seamlessly combines thermal, visual, and depth data to create highly contextualized, easily interpretable images for inspectors and operators.

- Automated reporting and prioritization: AI systems prioritize high-risk thermal events and generate detailed reports instantly, streamlining workflow for maintenance and security personnel.

DRO & Impact Forces Of Infrared Thermal Cameras Market

The Infrared Thermal Cameras Market is primarily driven by rigorous safety regulations in industrial environments and the declining cost curve associated with uncooled microbolometer technology, making advanced inspection tools widely accessible. However, the market faces significant restraints, notably the high procurement and maintenance costs associated with premium cooled thermal cameras required for specialized, high-performance applications (such as military targeting), alongside the persistent challenge of trade restrictions and export controls governing high-resolution thermal cores, which limits global dissemination. Opportunities are abundant, specifically in emerging domains like integrating thermal imaging into IoT frameworks for smart homes and infrastructure, enhancing capabilities in autonomous vehicles, and widespread adoption in precision agriculture for crop health monitoring. These driving and restraining forces are mediated by high impact factors, particularly the accelerating pace of sensor miniaturization and the pervasive influence of geopolitical instability which fuels defense spending, directly affecting market momentum.

One major driver is the global emphasis on preventive maintenance across critical sectors such as power generation, oil & gas, and manufacturing. Thermal cameras offer non-destructive testing (NDT) capabilities that identify potential failures before they occur, drastically reducing downtime and preventing costly accidents. This proactive approach has been codified into industry standards (e.g., ISO 55000 series for asset management), creating structural market demand. Furthermore, the commercialization of low-cost thermal modules has enabled integration into consumer products and entry-level inspection tools, tapping into new markets such as DIY home inspection and recreational outdoor activities. This cost reduction is foundational to expanding the Total Addressable Market (TAM) beyond specialized industrial users.

Conversely, the primary restraint centers on regulatory hurdles and technological limitations. While uncooled cameras are becoming cheaper, their sensitivity and spatial resolution still lag behind cooled counterparts, limiting their efficacy in demanding applications like long-range surveillance or subtle gas leak detection. Moreover, thermal imaging technology, especially high-performance cooled sensors, is often classified as dual-use technology, subjecting it to stringent export controls (like ITAR or Wassenaar Arrangement). These controls complicate international supply chains, restrict technology transfer, and potentially fragment the global market landscape. Addressing these export complexities while simultaneously improving the performance-to-cost ratio of uncooled sensors remains a critical challenge for sustained market expansion.

Segmentation Analysis

The Infrared Thermal Cameras Market is analyzed across various critical dimensions including product type, technology, application, end-user, and wavelength. The comprehensive segmentation provides granular insights into specific market dynamics, revealing which segments are experiencing the most aggressive adoption rates and technological maturation. Product types are broadly categorized into handheld, fixed-mount, and modules/cores, reflecting usage context from portable diagnostics to permanent surveillance installations. Technology segmentation differentiates between cooled and uncooled sensors, a fundamental distinction based on sensitivity, cost, and complexity. Application segmentation is crucial, spanning across security and surveillance, automotive, industrial maintenance, and defense, each having unique performance requirements and volumetric demand profiles, thereby guiding strategic investment and product development focus within the industry.

The segmentation by technology holds the most significant influence on pricing structure and market volume. Uncooled thermal cameras, utilizing microbolometer technology without cryogenic cooling, dominate the commercial volume segment due to their resilience, low power consumption, rapid startup time, and mass-producible nature. These are the staple in applications like firefighting, building inspection, and general surveillance. The low unit cost of uncooled cores has been the primary driver behind market expansion into non-traditional sectors. In contrast, cooled thermal cameras, which employ cryocoolers to chill the detector element, offer vastly superior sensitivity (NETD) and faster frame rates, crucial for highly specialized military and scientific applications where detecting minute temperature differences over long distances is mandatory, thus commanding a premium price and occupying a smaller, high-value segment.

Furthermore, end-user segmentation provides clarity on demand concentration. Government and defense entities remain the largest purchasers, driven by requirements for advanced border protection, night vision systems, and targeting platforms. However, the commercial sector, encompassing manufacturing, construction, and healthcare, is demonstrating the highest growth trajectory, particularly in utilizing thermal imaging for facility management and industrial quality control. The rising implementation of Industry 4.0 paradigms necessitates real-time condition monitoring, cementing the industrial segment as a future core growth engine for both fixed and handheld thermal solutions. Understanding these segment-specific growth patterns is essential for market participants seeking competitive advantages and optimal resource allocation.

- By Product Type:

- Handheld Thermal Cameras

- Fixed Mount Thermal Cameras

- Thermal Modules/Cores (OEM components)

- By Technology:

- Uncooled Infrared Thermal Cameras (Microbolometers)

- Cooled Infrared Thermal Cameras (Indium Antimonide, Mercury Cadmium Telluride, Quantum Well Infrared Photodetectors)

- By Application:

- Security and Surveillance (Perimeter Protection, Night Vision)

- Industrial Monitoring and Inspection (Predictive Maintenance, Process Control)

- Automotive (ADAS, Night Vision Systems)

- Defense and Military (Targeting, Reconnaissance, Search & Rescue)

- Firefighting and Public Safety

- Healthcare and Medical (Fever Screening, Diagnostics)

- Building Diagnostics and HVAC Inspection

- By End User:

- Commercial (Manufacturing, Energy, Construction)

- Government and Defense

- Residential

- By Wavelength:

- Short-Wave Infrared (SWIR)

- Mid-Wave Infrared (MWIR)

- Long-Wave Infrared (LWIR)

Value Chain Analysis For Infrared Thermal Cameras Market

The value chain for the Infrared Thermal Cameras Market begins with upstream activities focused on the production and refinement of highly specialized sensor materials and components. This crucial phase involves materials science expertise in semiconductors like Vanadium Oxide or Amorphous Silicon for microbolometers, and exotic materials like Mercury Cadmium Telluride (MCT) for high-performance cooled detectors. Key upstream suppliers include material providers, foundry services specializing in MEMS fabrication for microbolometers, and producers of critical optical elements such as Germanium lenses, which are essential for transmitting infrared radiation. Efficiency and cost optimization at this stage directly impact the final product price and sensor performance, with intellectual property rights governing core detector technology being fiercely protected by market leaders.

Moving downstream, the value chain encompasses the integration, assembly, distribution, and end-user application phases. Integrators take the thermal cores and assemble them into finalized camera systems, adding processing electronics, software interfaces, housings (handheld or fixed), and communication modules (Wi-Fi, Ethernet). Distribution channels are highly complex, utilizing both direct sales models for large defense contracts or specialized industrial clients, and indirect channels relying on value-added resellers (VARs), system integrators, and e-commerce platforms for commercial and consumer products. VARs often add significant value by pairing the camera hardware with industry-specific software analytics and offering bespoke integration services, particularly within complex security systems or industrial control environments. The post-sales phase involves servicing, calibration, and software updates, which are critical for maintaining customer satisfaction and operational accuracy of the thermal devices.

Direct distribution channels, typically favored by leading manufacturers for high-volume defense and critical infrastructure contracts, ensure greater control over pricing and customer support. Indirect channels, essential for maximizing market penetration into fragmented commercial and consumer markets, leverage the extensive reach and localized expertise of distributors and retailers. The effectiveness of the value chain is increasingly reliant on software innovation, as the analytical capabilities (driven by AI and ML) integrated by the downstream players define the utility of the hardware. Therefore, seamless collaboration between core technology producers (upstream) and software/solution providers (downstream) is vital for delivering comprehensive, value-added thermal imaging solutions to the diverse end-user base.

Infrared Thermal Cameras Market Potential Customers

Potential customers for the Infrared Thermal Cameras Market span a vast range of industrial, governmental, and commercial entities whose operations rely on non-contact temperature measurement, situational awareness, or preventative asset protection. Primary end-users include maintenance engineers and facility managers in manufacturing plants (automotive, electronics, pharmaceuticals) who utilize handheld cameras for electrical and mechanical inspection to prevent unexpected equipment failure. Safety and security professionals are also major buyers, encompassing law enforcement, border control agencies, and private security firms that deploy fixed-mount cameras for perimeter monitoring, particularly in low-light or adverse weather conditions where visible spectrum cameras fail. This includes critical infrastructure owners, such as power utilities and data centers, where overheating components pose major operational risks.

Beyond traditional industrial and military buyers, high-growth potential exists among automotive OEMs and Tier 1 suppliers who are integrating thermal cameras into next-generation ADAS and autonomous driving systems to enhance pedestrian and obstacle detection capabilities. Furthermore, the construction and HVAC sectors represent a significant user group, employing thermal cameras for building envelope inspections to detect energy leaks, moisture ingress, and poor insulation quality, thereby supporting energy efficiency audits and compliance with green building standards. In the specialized realm of healthcare, hospitals and public health organizations utilize sophisticated thermal systems for mass fever screening, demonstrating the technology's application in pandemic preparedness and non-invasive diagnostics. The market is thus highly diversified, demanding tailored product specifications ranging from rugged, high-performance military units to affordable, consumer-grade smartphone attachments.

The common thread among all potential customers is the need for enhanced diagnostic information that cannot be gathered through traditional visual inspection. Organizations operating large, complex, or high-risk assets—be they an electrical grid, an automated factory floor, or a national border—prioritize thermal imaging to reduce risk exposure, optimize resource usage, and improve overall safety metrics. The push towards smart infrastructure and digitized operations ensures that the demand for integrated thermal data streams, actionable through cloud analytics and AI, will grow exponentially. Consequently, procurement decisions are increasingly driven not just by sensor resolution, but by the camera system's integration compatibility, software ecosystem, and ability to generate predictive insights.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.75 Billion |

| Market Forecast in 2033 | USD 11.05 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne FLIR), Leonardo DRS, L3Harris Technologies, BAE Systems, Excelitas Technologies, Xenics, Semi-Conductor Devices (SCD), Axis Communications, SATIR, Seek Thermal, Dali Technology, Hikvision, Guide Infrared, Vuzix, Jenoptik, ULIS (Lynred), Testo SE & Co. KGaA, Drägerwerk AG & Co. KGaA, Infravision, Sierra-Olympic Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infrared Thermal Cameras Market Key Technology Landscape

The technology landscape of the Infrared Thermal Cameras Market is fundamentally defined by advancements in detector arrays, specifically the rivalry and complementary use of cooled and uncooled sensors. Uncooled technology, primarily utilizing Vanadium Oxide (VOx) or Amorphous Silicon (a-Si) microbolometers, has driven market massification. Recent innovations focus on reducing the pixel pitch (down to 10 or 12 micrometers), allowing for higher resolution imaging in smaller, lighter cores while significantly enhancing thermal sensitivity (Noise Equivalent Temperature Difference - NETD). This miniaturization is critical for integrating thermal imaging into compact devices like drones, smartphones, and low-profile fixed surveillance cameras. Continuous research also targets improving the thermal isolation structures within the microbolometer to further enhance sensitivity without the need for cryogenic cooling, pushing the boundary of performance for commercial-grade solutions.

In contrast, cooled thermal camera technology, predominantly employing detectors made from materials like Mercury Cadmium Telluride (MCT) or Indium Antimonide (InSb), focuses on achieving ultra-high sensitivity and fast frame rates essential for scientific research, military targeting, and specific gas leak detection requiring spectral filtering. Technological advancements here center on improving the efficiency and reducing the size and weight of the cryocoolers (e.g., Stirling coolers), thereby improving the portability and operational lifespan of these premium systems. Furthermore, the development of dual-band and multi-spectral infrared cameras, which capture data across two or more separate infrared windows (e.g., MWIR and LWIR), allows for sophisticated target discrimination and atmospheric penetration capabilities, representing the cutting edge in defense and advanced remote sensing applications.

A burgeoning technological trend impacting all market segments is the deployment of Short-Wave Infrared (SWIR) technology, which operates in the 0.9 to 1.7-micron range. While not strictly thermal (it often detects reflected light), SWIR is increasingly being integrated alongside traditional LWIR systems. SWIR cameras offer exceptional visibility through haze and smoke and are highly effective for quality control in industries like silicon wafer inspection and food sorting. Beyond hardware, the critical differentiator is the embedded software and processing power. Advanced on-board processing units, often leveraging specialized neural processing units (NPUs), allow for real-time AI inference directly at the edge, performing tasks such as image stabilization, object classification, and radiometric correction instantaneously, maximizing the utility of the captured thermal data stream before transmission.

Regional Highlights

- North America: North America holds the largest share of the Infrared Thermal Cameras Market, primarily due to immense defense expenditure and high levels of technological maturity in industrial and commercial sectors. The U.S. government remains the single largest procurement entity, driving demand for high-performance cooled cameras for surveillance, border security, and military aircraft systems. Furthermore, the region has been an early and rapid adopter of predictive maintenance technologies across the expansive oil & gas, energy, and aerospace industries. Strict safety standards and a pervasive culture of preventive asset management propel the deployment of handheld and fixed-mount uncooled cameras. Canada and Mexico also contribute significantly, driven by infrastructure inspection needs and cross-border security concerns, respectively. The presence of major sensor manufacturers and system integrators solidifies North America's dominance in innovation and consumption.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, fueled by rapid urbanization, significant government investments in smart city projects, and the explosive growth of the manufacturing base, particularly in China, South Korea, and India. The industrial segment in APAC is heavily investing in thermal monitoring solutions to comply with international quality standards and optimize production efficiency in complex factories. Additionally, heightened geopolitical tensions and modernization efforts among regional militaries are driving substantial demand for advanced thermal imaging cores. The increasing adoption of low-cost thermal modules in consumer electronics and commercial drone applications also contributes significantly to the high growth velocity observed in this region.

- Europe: Europe represents a mature and steadily growing market, heavily influenced by regulatory initiatives focused on energy efficiency and climate change mitigation, specifically the Energy Performance of Buildings Directive (EPBD). This drives strong demand for thermal cameras used in building diagnostics and insulation inspection across countries like Germany and the UK. The automotive sector, a key European industry, is also rapidly adopting thermal cameras for enhancing pedestrian detection in ADAS features. While defense spending remains a factor, the commercial and institutional sectors, focused on maintaining aging infrastructure and stringent environmental standards, are the primary market engines in the European Union.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show promising growth potential, albeit from a smaller base. In MEA, demand is concentrated in the oil & gas sector for facility monitoring and substantial security and surveillance investments driven by political stability concerns, particularly in the Gulf Cooperation Council (GCC) countries. LATAM market growth is slower but steady, anchored by infrastructure development projects, mining operations requiring safety monitoring, and growing public security initiatives in metropolitan areas. Investment in localized manufacturing and distribution channels is key to unlocking the full potential of these emerging markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infrared Thermal Cameras Market.- Teledyne FLIR (formerly FLIR Systems)

- Leonardo DRS

- L3Harris Technologies

- BAE Systems

- Axon Enterprise, Inc.

- Xenics NV

- Semi-Conductor Devices (SCD)

- Hikvision Digital Technology Co., Ltd.

- Dali Technology Co., Ltd.

- Guide Infrared Co., Ltd.

- Axis Communications AB

- Sierra-Olympic Technologies, Inc.

- Infrared Cameras Inc. (ICI)

- Testo SE & Co. KGaA

- SATIR Europe (SATIR)

- Jenoptik AG

- ULIS (Lynred)

- Seek Thermal Inc.

- Hema-Impex Infotech Pvt. Ltd.

- Electrophysics Corporation

Frequently Asked Questions

Analyze common user questions about the Infrared Thermal Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between cooled and uncooled thermal cameras?

Cooled thermal cameras require cryogenic cooling (using materials like MCT or InSb) to achieve extremely high sensitivity and faster frame rates, primarily used in defense and scientific research. Uncooled cameras use microbolometers (VOx or a-Si) at ambient temperatures, offering lower cost, compact size, and are suitable for commercial, industrial, and consumer applications.

How does AI improve the performance of thermal imaging systems?

AI improves performance by enabling automated, high-precision detection and classification of anomalies, such as differentiating between a legitimate electrical hotspot and a warm reflected surface. This integration reduces false alarms, optimizes image quality through fusion techniques, and provides predictive maintenance insights in real-time.

Which industry holds the largest market share for infrared thermal cameras?

The Government and Defense sector historically holds the largest market share due to substantial spending on high-performance cooled and uncooled cameras for surveillance, targeting, night vision, and border security applications globally.

Are thermal cameras capable of seeing through walls or dense smoke?

Thermal cameras cannot see through solid walls; they only detect the heat radiating from the surface of the wall. However, they are highly effective at penetrating obscurants like dense smoke, fog, and light rain because infrared wavelengths pass through these particulates more easily than visible light, making them critical for firefighting and search and rescue operations.

What are the primary factors driving the growth of the uncooled camera segment?

The key factors driving the uncooled segment are significant cost reduction and miniaturization of microbolometer sensors (lower pixel pitch), which facilitates their integration into high-volume commercial products like drones, automotive ADAS, and affordable handheld inspection tools, broadening market accessibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager