Infrared Thermal Imager Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431348 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Infrared Thermal Imager Market Size

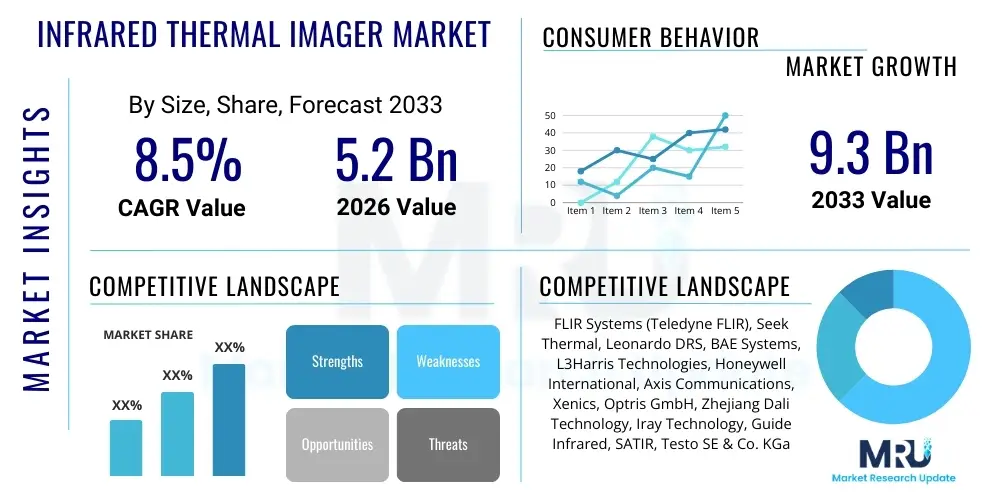

The Infrared Thermal Imager Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 9.3 Billion by the end of the forecast period in 2033.

Infrared Thermal Imager Market introduction

The Infrared Thermal Imager Market encompasses devices designed to detect infrared energy (heat) emitted by objects and convert it into a visible image, often referred to as a thermogram. These sophisticated devices operate across various infrared spectrums, primarily in the long-wave infrared (LWIR) and mid-wave infrared (MWIR) bands, enabling non-contact temperature measurement and visualization of heat signatures invisible to the naked eye. Key components include detectors (such as microbolometers or photon detectors), optics, and processing electronics. The inherent capability of thermal imagers to function effectively in total darkness, fog, or smoke, without requiring external illumination, positions them as essential tools across numerous high-stakes and routine inspection applications.

The core product offerings span from highly sensitive, high-resolution cooled thermal cameras, often used in defense and scientific research, to cost-effective, portable uncooled cameras widely utilized in commercial and industrial settings. Major applications driving market growth include predictive maintenance in manufacturing, structural inspection in construction, elevated body temperature screening in healthcare, border surveillance, and target acquisition in military operations. The utility of thermal imaging extends beyond mere visualization, providing critical diagnostic data essential for ensuring operational safety, optimizing energy efficiency, and preventing costly failures across heavy industries.

The fundamental benefits of deploying infrared thermal imagers center on improved efficiency, enhanced safety, and reduced operational downtime. For example, in industrial maintenance, these devices can quickly identify hot spots in electrical systems or machinery, signaling impending failures long before they manifest, thereby facilitating proactive intervention. Driving factors include stringent regulatory standards emphasizing worker safety, increasing global military expenditure on advanced surveillance technology, and the rapid technological advancements leading to smaller, more robust, and lower-cost uncooled microbolometer sensors, making thermal imaging accessible to a broader consumer and professional base.

Infrared Thermal Imager Market Executive Summary

The Infrared Thermal Imager Market is currently experiencing robust growth, primarily fueled by significant technological convergence, leading to the integration of thermal imaging capabilities into smartphones and advanced sensor networks. Business trends indicate a strong move toward miniaturization and enhanced computational power within the devices themselves, supporting features like radiometric analysis and augmented reality overlays. Key commercialization strategies focus on penetrating emerging markets in Asia Pacific, particularly leveraging the growing demand from the automotive sector for night vision and pedestrian detection systems, alongside massive infrastructure development projects requiring regular thermal integrity checks. Furthermore, the push for sustainable practices globally mandates efficient energy audits, significantly bolstering demand for thermal cameras used in building diagnostics and insulation inspection.

Regionally, North America and Europe currently dominate the market due to the established defense industrial complex and high adoption rates of advanced maintenance technologies in their manufacturing sectors. However, the Asia Pacific (APAC) region is projected to register the fastest CAGR over the forecast period, driven by rapid urbanization, substantial investment in public safety infrastructure, and the expansion of the electronics and automotive manufacturing base, particularly in China and India. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, spurred by oil and gas infrastructure monitoring needs and increasing governmental focus on domestic security and border control, generating specific demand for ruggedized, long-range thermal solutions.

Segmentation trends highlight the increasing dominance of the uncooled segment due to its lower cost, compactness, and zero maintenance requirements, making it ideal for high-volume commercial and consumer applications. Conversely, the cooled segment, though niche, maintains strong growth in high-performance applications such as space exploration, advanced military targeting, and specific scientific research requiring high sensitivity and high frame rates. Application-wise, the industrial sector remains the largest consumer, primarily for predictive maintenance (PdM) and non-destructive testing (NDT), while the military and defense segment continues to drive innovation in sensor resolution and spectral band customization for sophisticated surveillance and reconnaissance activities.

AI Impact Analysis on Infrared Thermal Imager Market

User inquiries regarding AI's influence on the Infrared Thermal Imager Market frequently revolve around the enhanced capability of thermal cameras to move beyond simple heat visualization toward autonomous decision-making and predictive analytics. Common questions focus on how AI algorithms can automatically detect anomalies, differentiate between human targets and background noise (especially in cluttered environments), and predict equipment failure based on subtle thermal signature shifts over time. Users are highly interested in the integration of deep learning models for improving image fusion, where thermal data is combined with visible light or LiDAR data to create richer, more context-aware outputs. The overarching expectation is that AI will transform thermal imagers from passive measurement tools into active, intelligent sensors capable of reducing false alarms, accelerating threat identification, and automating complex inspection processes that currently require manual interpretation by skilled technicians.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally redefining the utility and capabilities of infrared thermal imagers, transitioning them into smart sensing systems. AI algorithms are increasingly being embedded directly into the thermal camera hardware (edge computing) to perform real-time image processing, scene classification, and automated object recognition. This capability is critical in high-speed applications such as autonomous vehicles, where thermal data is used alongside other sensor inputs to safely navigate and detect obstacles under challenging conditions like heavy fog or complete darkness. Furthermore, AI enhances the accuracy of temperature measurements by compensating for emissivity variations and atmospheric absorption, leading to far more reliable diagnostic readings in industrial environments.

Moreover, AI-driven data analysis is essential for extracting actionable intelligence from the massive datasets generated by continuous thermal monitoring systems. In predictive maintenance, ML models are trained on historical thermal patterns associated with known equipment failures (e.g., specific winding temperature profiles in motors) to provide early warnings with high precision, moving beyond simple threshold alerts. This advanced diagnostic capability significantly enhances operational reliability and enables highly optimized maintenance scheduling. AI also plays a crucial role in enhancing image quality through advanced noise reduction and super-resolution techniques, extracting fine details even from low-cost, low-resolution sensors, thereby democratization high-fidelity thermal analysis.

- AI enables real-time, autonomous object detection and classification in surveillance applications.

- Machine Learning improves predictive maintenance accuracy by analyzing long-term thermal signature trends.

- Deep Learning algorithms enhance image fusion for multi-spectral sensor integration (thermal plus visible light).

- Edge AI processing facilitates faster, localized decision-making in autonomous navigation systems.

- AI minimizes false alarms and increases detection reliability in complex industrial and security environments.

- Algorithms optimize temperature calibration by dynamically accounting for environmental variables and emissivity.

DRO & Impact Forces Of Infrared Thermal Imager Market

The market dynamics for the Infrared Thermal Imager industry are shaped by a powerful confluence of drivers and restraining factors, balanced against significant emerging opportunities. The primary driver is the pervasive need for enhanced safety and security across global infrastructure, coupled with stringent regulatory mandates, particularly in fire safety and industrial process monitoring. Opportunities arise from the rapid miniaturization and cost reduction of microbolometer technology, enabling massive market expansion into consumer electronics and small Unmanned Aerial Systems (UAS). However, the market faces constraints related to export restrictions on high-end thermal technologies (due to military applications) and the high initial investment required for high-resolution cooled systems, which limits adoption in smaller enterprises.

The primary drivers propelling the Infrared Thermal Imager Market include the escalating adoption of Industry 4.0 principles, emphasizing smart manufacturing and condition monitoring. Companies are increasingly integrating thermal sensors into their IoT networks to prevent catastrophic equipment failures, thereby reducing unplanned downtime which can cost millions annually. Furthermore, geopolitical tensions and counter-terrorism measures globally necessitate continuous upgrading of military and civil security apparatuses, sustaining high demand for advanced surveillance, reconnaissance, and targeting systems. The rise in construction activity and infrastructure inspection needs, particularly post-pandemic, also contributes significantly, requiring tools for moisture detection, energy auditing, and structural integrity analysis.

Restraints in the market largely involve technological hurdles and regulatory complexity. High-performance, cooled thermal imagers rely on specialized, often restricted components, subjecting them to strict export controls (such as the International Traffic in Arms Regulations - ITAR), complicating global distribution and collaborative research. Another major constraint is the requirement for specialized training and interpretation skills; while AI assists, accurate thermal diagnostics often necessitate a certified thermographer, presenting a barrier to entry for widespread low-end adoption. Opportunities are primarily centered on the expanding scope of applications beyond traditional security and industrial use, including consumer electronics (e.g., professional-grade temperature screening accessories for mobile devices), advanced non-invasive medical diagnostics, and agricultural monitoring (precision farming utilizing thermal stress detection).

Segmentation Analysis

The Infrared Thermal Imager Market is meticulously segmented based on detector type, technology, application, and end-user, providing a granular view of market dynamics and adoption patterns across various industries. Analyzing these segments is crucial for strategic market positioning, as distinct end-user requirements necessitate specific thermal imaging solutions, ranging from high-sensitivity, cryogenically cooled detectors for long-range defense applications to robust, low-cost uncooled microbolometers for general industrial inspection and commercial public safety uses. The differentiation in technology directly impacts cost, resolution, and operational performance, thereby determining the optimal deployment environment for each product category.

The segmentation by detector technology is perhaps the most defining characteristic, dividing the market into cooled and uncooled categories. Uncooled thermal imagers, which rely on microbolometers that do not require cryogenic cooling, dominate the volume market due to their reduced size, weight, power consumption (SWaP), and significantly lower acquisition cost. This makes them highly attractive for handheld devices, entry-level drones, and integrated vehicle systems. Conversely, the cooled segment, utilizing technologies like Indium Antimonide (InSb) or Mercury Cadmium Telluride (MCT), offers superior sensitivity, faster frame rates, and higher resolution, making them indispensable for highly demanding military, aerospace, and scientific research applications that necessitate detecting minute temperature differences over vast distances or in high-speed scenarios.

Furthermore, application segmentation reveals the strongest areas of commercial traction. The industrial segment, encompassing electrical utility inspection, manufacturing plant monitoring, and oil and gas pipeline surveillance, accounts for the largest revenue share, driven by the critical need for uptime maximization and safety compliance. The rapid growth observed in the commercial sector is attributed to the widespread use of thermal cameras for fire prevention, security surveillance, and fever screening in public spaces. Understanding these diverse application requirements—from the ruggedness required for firefighting equipment to the spectral sensitivity needed for specialized gas leak detection—is fundamental to developing market-specific product strategies and penetrating high-growth verticals.

- By Type:

- Cooled Infrared Thermal Imagers (High sensitivity, defense, scientific)

- Uncooled Infrared Thermal Imagers (Commercial, industrial, lower cost)

- By Technology:

- Microbolometer

- Vanadium Oxide (VOx)

- Amorphous Silicon (a-Si)

- Indium Antimonide (InSb)

- Mercury Cadmium Telluride (MCT)

- Quantum Well Infrared Photodetector (QWIP)

- By Application:

- Industrial Monitoring and Inspection (Predictive maintenance, NDT)

- Military and Defense (Surveillance, targeting, reconnaissance)

- Commercial Security and Surveillance (Perimeter monitoring, access control)

- Firefighting and Public Safety (Search and rescue, hazmat response)

- Automotive (Night vision systems, pedestrian detection)

- Medical and Healthcare (Diagnostics, fever screening)

- By End-User:

- Manufacturing and Process Industries (Chemical, Power Generation)

- Oil and Gas

- Aerospace and Defense

- Construction and Infrastructure

- Healthcare and Life Sciences

- Marine and Logistics

Value Chain Analysis For Infrared Thermal Imager Market

The value chain for the Infrared Thermal Imager Market begins with specialized upstream suppliers who provide critical raw materials, including specialized optical components, semiconductor substrates, and detector materials (such as Germanium, Zinc Selenide, or specific semiconductor alloys for focal plane arrays). The complexity lies in the high-precision manufacturing of the detector technology itself, whether it is the MEMS fabrication of microbolometers or the intricate cleanroom processes required for cooled photon detectors. Key activities at this stage involve meticulous sensor design, fabrication of optics suitable for the infrared spectrum (IR lenses), and the integration of highly complex analog-to-digital conversion electronics. Companies that control the detector manufacturing process often possess significant competitive advantages in terms of cost structure and technological differentiation, serving as core suppliers to system integrators.

The midstream involves the core system assembly and integration, where the detector engine is combined with advanced signal processing hardware, sophisticated firmware for image enhancement, human-machine interface (HMI) components, and ruggedized housing tailored for specific operational environments (e.g., explosion-proof enclosures for oil rigs or lightweight housing for tactical drones). Manufacturers in this segment focus on optimization of image processing algorithms, ensuring high performance under varying thermal loads, and achieving competitive form factors and battery life for portable devices. Direct distribution channels are often leveraged for high-value defense and critical infrastructure contracts, allowing manufacturers to maintain tight control over product customization, quality assurance, and ongoing service agreements with governmental entities or large industrial conglomerates.

Downstream activities center on distribution, installation, and after-sales services, reaching the diverse end-user base. Indirect channels, such as specialized industrial distributors, electrical component suppliers, and regional security integrators, play a vital role in reaching small and medium-sized enterprises (SMEs) and localized industrial markets. These channel partners provide essential localized support, application training, and integration services, especially for complex systems that need calibration and configuration within existing supervisory control and data acquisition (SCADA) networks. The demand for ongoing software updates, predictive maintenance training, and calibration services represents a significant component of the long-term value generated in the downstream segment, emphasizing the transition from mere product sales to comprehensive solution provision.

Infrared Thermal Imager Market Potential Customers

Potential customers for Infrared Thermal Imager Market solutions span a broad spectrum of industries, primarily encompassing entities focused on critical infrastructure management, defense and surveillance, and industrial process optimization. The largest category of buyers includes utility companies (power generation, transmission, and distribution) and heavy industrial manufacturers (petrochemical, automotive, aerospace), who utilize thermal imaging primarily for proactive condition monitoring, ensuring the reliability of high-voltage equipment, rotating machinery, and process piping. These end-users demand high-reliability, radiometric cameras capable of accurate temperature logging and integration with maintenance management software systems to facilitate scheduled preventative actions.

Another high-growth segment comprises governmental agencies, including military forces, border patrol, police departments, and fire and rescue services. Military buyers seek high-end, cooled thermal systems for target acquisition, situational awareness, and night operation capabilities, prioritizing long-range detection and operational robustness in extreme environments. Civil security agencies utilize more affordable, often uncooled, handheld and drone-mounted thermal cameras for search and rescue operations, surveillance in low-light conditions, and identifying unauthorized perimeter breaches. Their purchasing decisions are often influenced by procurement cycles, standardization requirements, and compatibility with existing communications and command systems.

Emerging and commercially significant customer groups include the construction and building diagnostics sector, where thermal imagers are used by energy auditors and construction inspectors to detect moisture intrusion, locate insulation defects, and ensure HVAC efficiency. Furthermore, the automotive industry represents a rapidly expanding customer base, integrating thermal sensors into next-generation Advanced Driver Assistance Systems (ADAS) and autonomous vehicle platforms to improve safety by enhancing the vehicle's perception capabilities, especially at night or during adverse weather conditions. The continuous drive toward improved operational safety and reduced energy expenditure across all sectors guarantees a persistently high and diversified customer demand profile for thermal imaging solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 9.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne FLIR), Seek Thermal, Leonardo DRS, BAE Systems, L3Harris Technologies, Honeywell International, Axis Communications, Xenics, Optris GmbH, Zhejiang Dali Technology, Iray Technology, Guide Infrared, SATIR, Testo SE & Co. KGaA, HIKVISION, Opgal Optronic Industries Ltd., Wuhan Guide Infrared Co., Ltd., Fluke Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Infrared Thermal Imager Market Key Technology Landscape

The technology landscape of the Infrared Thermal Imager Market is rapidly evolving, driven primarily by innovations in detector materials and manufacturing processes aimed at enhancing sensitivity, reducing system size, and lowering production costs. The dominant technology in the commercial space remains the uncooled microbolometer, utilizing materials such as Vanadium Oxide (VOx) or Amorphous Silicon (a-Si). Recent technological breakthroughs focus on increasing the array size and reducing the pixel pitch (down to 10 or 12 micrometers), which allows for higher resolution imaging in smaller, lighter optics. Furthermore, advancements in wafer-level packaging (WLP) are critical, enabling high-volume, cost-effective production of these sensors, facilitating their integration into mass-market devices like drones and smartphones, thereby democratizing access to thermal imaging capabilities.

In the high-performance segment, cooled thermal imaging technology, while complex and expensive, continues to advance, particularly through the development of highly specialized materials like Type II superlattice (T2SL) detectors based on materials such as InAs/GaSb. These new materials offer performance comparable to traditional Mercury Cadmium Telluride (MCT) detectors but often provide better uniformity and stability, reducing manufacturing complexity. Furthermore, research is heavily focused on improving the lifespan and efficiency of the cryogenic coolers (Stirling coolers) required for these detectors, making cooled systems more viable for extended field operations and military deployment where superior sensitivity in the MWIR spectrum is paramount for long-range detection.

Beyond the core detector technology, significant innovation is occurring in peripheral technologies, particularly image processing and sensor fusion. Advanced algorithms leveraging AI and ML are crucial for enhancing the clarity and interpretability of thermal images, often overcoming inherent limitations of lower-cost sensors. Multispectral imaging and sensor fusion, which involve combining thermal data with visible light, LiDAR, or radar inputs, are becoming standard features in autonomous systems and advanced surveillance platforms. This fusion provides richer contextual data, enabling more accurate object recognition and temperature analysis by leveraging the strengths of different sensor modalities simultaneously. The shift toward smarter, networked thermal sensors incorporating edge processing capabilities represents the future direction of the market.

Regional Highlights

The Infrared Thermal Imager Market exhibits varied growth trajectories across different geographical regions, primarily influenced by defense spending, industrial maturity, and regulatory environments.

- North America: This region holds a significant market share, driven by the strong presence of major defense contractors, high adoption rates of predictive maintenance technologies in the industrial sector (especially oil & gas and manufacturing), and substantial governmental investment in border security and public safety. The U.S. remains the primary consumer, leading technological innovation, particularly in cooled IR systems and advanced AI integration for autonomous applications.

- Europe: Characterized by stringent energy efficiency regulations (driving demand for building diagnostics) and a robust automotive industry implementing thermal systems for ADAS. Countries like Germany and the UK are key markets, focusing heavily on industrial monitoring and R&D for advanced sensor technologies. Demand is also supported by European Union initiatives for critical infrastructure protection and standardized safety protocols.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by rapid industrialization, massive infrastructure development (e.g., smart city projects), and increasing military modernization efforts by countries like China, India, and South Korea. The expanding commercial security sector and the growing manufacturing base demanding quality control and predictive maintenance solutions are key catalysts for high-volume adoption of uncooled cameras.

- Latin America (LATAM): Growth is primarily driven by investments in surveillance systems for major cities and critical national assets, including energy infrastructure and mining operations. Adoption rates are moderate but increasing, focusing mainly on cost-effective, uncooled cameras for security and general industrial inspection, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): This region is heavily influenced by high military and defense spending, especially in Saudi Arabia and UAE, aimed at border surveillance and geopolitical security challenges, favoring high-end cooled systems. Simultaneously, the large oil and gas sector drives consistent demand for specialized thermal cameras used in flare stack monitoring and process equipment inspection under harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Infrared Thermal Imager Market.- Teledyne FLIR (formerly FLIR Systems)

- L3Harris Technologies, Inc.

- BAE Systems plc

- Leonardo DRS, Inc.

- Seek Thermal Inc.

- Honeywell International Inc.

- Axis Communications AB

- Xenics NV

- Optris GmbH

- Zhejiang Dali Technology Co., Ltd.

- Iray Technology Co., Ltd.

- Wuhan Guide Infrared Co., Ltd.

- SATIR

- Testo SE & Co. KGaA

- HIKVISION Digital Technology Co., Ltd.

- Opgal Optronic Industries Ltd.

- Infrared Cameras Inc. (ICI)

- Fluke Corporation (a Fortive Company)

- Jenoptik AG

- Vigo System S.A.

Frequently Asked Questions

Analyze common user questions about the Infrared Thermal Imager market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cooled and uncooled thermal imagers?

Cooled thermal imagers utilize cryogenic cooling mechanisms to enhance detector sensitivity, offering superior image quality and long-range performance, primarily used in military and scientific fields. Uncooled thermal imagers (using microbolometers) operate at ambient temperatures, making them smaller, cheaper, and suitable for commercial, industrial, and general surveillance applications, albeit with lower sensitivity.

How is Artificial Intelligence (AI) influencing thermal imaging technology?

AI integration is enabling thermal imagers to become intelligent sensors capable of automated decision-making. AI models enhance image processing, accurately classify objects (e.g., distinguishing humans from animals), predict equipment failure based on subtle temperature changes, and facilitate sensor fusion for comprehensive situational awareness, reducing manual interpretation errors.

Which application segment holds the largest market share for thermal imagers?

The Industrial Monitoring and Inspection segment holds the largest market share. Thermal imagers are critical tools for predictive maintenance (PdM) in manufacturing, electrical utilities, and oil and gas, helping identify overheating components and electrical faults before they lead to costly operational failures and safety incidents.

What are the key technical challenges facing the proliferation of thermal imagers?

Key challenges include the high cost associated with manufacturing high-resolution, long-wavelength infrared (LWIR) optics, stringent export controls imposed on high-performance cooled detectors, and the need for specialized calibration and thermography training required for accurate data interpretation in complex industrial settings.

Why is the Asia Pacific (APAC) region expected to show the fastest market growth?

APAC is experiencing rapid industrialization, high levels of infrastructure investment (smart cities and power grids), and increasing domestic defense and security modernization efforts, particularly in China and India. This expansive development creates massive demand for thermal cameras across industrial monitoring, public safety, and border surveillance applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager