Initial Coin Offering (ICO) Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433428 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Initial Coin Offering (ICO) Service Market Size

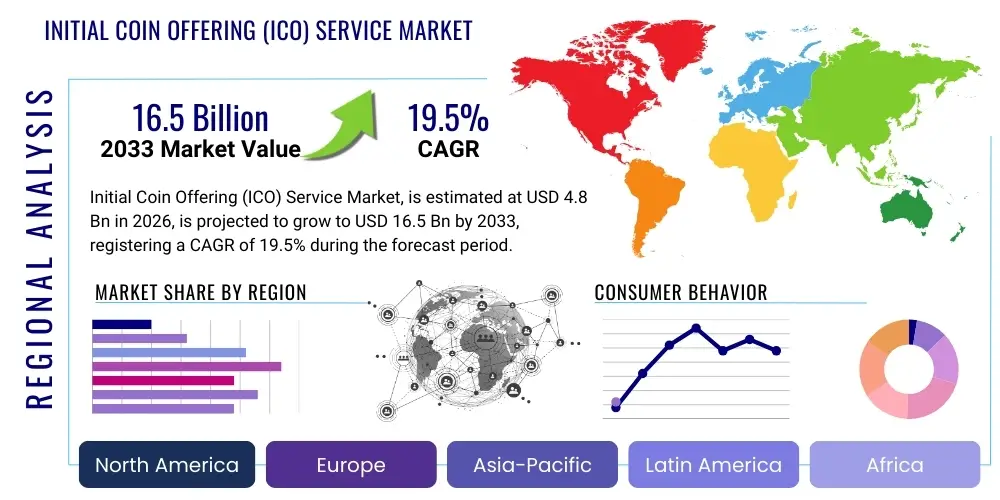

The Initial Coin Offering (ICO) Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033.

Initial Coin Offering (ICO) Service Market introduction

The Initial Coin Offering (ICO) Service Market encompasses specialized advisory, technical, and marketing support provided to blockchain projects seeking to raise capital through the issuance and sale of proprietary digital tokens. This market segment emerged as a critical facilitator for decentralized finance (DeFi) and Web3 startups, offering end-to-end solutions ranging from whitepaper generation and legal compliance to smart contract development and community management. The core product description involves comprehensive service packages that de-risk the fundraising process, ensuring regulatory adherence, technical robustness, and successful token distribution, thereby making high-growth blockchain ventures accessible to global investors.

Major applications of ICO services span across various blockchain verticals, including infrastructure development, gaming (GameFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and cross-chain interoperability solutions. The primary benefit derived by clients is the ability to bypass traditional venture capital bottlenecks, achieving rapid fundraising while leveraging decentralized mechanisms for governance and network scaling. ICO service providers facilitate the construction of compliant and auditable token sale structures, crucial for establishing investor trust in a highly volatile and scrutinized digital asset environment.

Driving factors sustaining the market growth include the global surge in blockchain adoption, the increasing sophistication of tokenomics design requiring expert consultation, and the continuous evolution of regulatory frameworks (such as those introduced by the SEC, FCA, and ESMA), which necessitates professional legal and compliance services. Furthermore, the shift towards more structured fundraising models, like Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs), often builds upon the foundational service infrastructure established by ICO providers, expanding the total addressable market for these specialized advisory firms.

Initial Coin Offering (ICO) Service Market Executive Summary

The Initial Coin Offering (ICO) Service Market is experiencing a robust resurgence driven by maturing regulatory environments and a greater focus on utility-based token ecosystems, shifting away from the speculative frenzy characterizing earlier market cycles. Current business trends indicate a strong prioritization of compliance and security, with leading service providers integrating sophisticated Know Your Customer (KYC) and Anti-Money Laundering (AML) checks directly into their fundraising platforms. Furthermore, there is a pronounced trend towards offering hybrid models, combining elements of private placement rounds with public sales, allowing projects to balance capital security with community building and broad distribution. Technological advancements, particularly in automated smart contract auditing and deployment tools, are enhancing efficiency and reducing the time-to-market for new token launches.

Regionally, the market dynamics are heavily influenced by the jurisdictional clarity concerning digital assets. North America, particularly the US and Canada, focuses intensely on regulatory compliance services, driven by stringent securities laws, making service providers specializing in STOs highly valued. Conversely, the Asia Pacific (APAC) region, led by hubs like Singapore and Hong Kong, exhibits high growth in foundational ICO services, leveraging strong developer communities and supportive governmental stances on blockchain innovation, especially in emerging economies seeking alternative financing mechanisms. Europe maintains a balanced approach, with jurisdictions like Switzerland and Malta remaining competitive centers for token domicile and legal structuring services.

Segment trends highlight the dominance of the technical services segment, encompassing smart contract development, audit, and deployment, which commands the largest revenue share due to the non-negotiable need for secure and bug-free code. The consulting and advisory segment is the fastest-growing area, propelled by the increasing complexity of tokenomics and the demand for specialized legal structuring tailored to evolving global regulations. The adoption of advanced marketing and community management services is also accelerating, as successful ICOs now rely heavily on sustained engagement and transparency, utilizing professional firms experienced in decentralized community governance models to maximize investor confidence and long-term project viability.

AI Impact Analysis on Initial Coin Offering (ICO) Service Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the inherent risks associated with ICOs, focusing on fraud detection, smart contract vulnerability analysis, and enhancing regulatory compliance speed. Key concerns revolve around whether AI algorithms can effectively replace human auditors or legal consultants, and the ethical implications of using AI to determine investor eligibility or forecast token price stability. Users express expectations that AI will significantly lower the operational costs of launching an ICO, particularly in automating due diligence processes, analyzing vast amounts of transactional data for suspicious activity, and providing real-time compliance checks against international securities laws. The consensus theme is that AI will act as a powerful augmentation tool, transforming the service market by increasing transparency, reducing manual errors, and accelerating the deployment of legally sound and technically robust decentralized applications, thereby rebuilding investor trust in the token fundraising mechanism.

The application of AI in the ICO service market is profoundly impacting how risk assessment and investor relations are managed. AI-powered algorithms are increasingly used to analyze whitepapers and project roadmaps, searching for inconsistencies or overly ambitious claims that might signal poor execution capability or potential fraud. This rigorous pre-screening capability, facilitated by natural language processing (NLP) and machine learning, allows service providers to offer a higher quality filter for projects, thereby enhancing the overall reputation and success rate of the facilitated token launches. Furthermore, AI helps in segmenting potential investors based on jurisdiction and wealth profiles, ensuring that regulatory offering limits and accreditation requirements are met automatically, which is a critical improvement over manual verification processes.

AI also plays a transformative role in the technical services segment, specifically concerning smart contract security. Machine learning models are trained on massive datasets of audited and exploited smart contracts to identify complex vulnerabilities, including reentrancy attacks, integer overflows, and timestamp manipulation, significantly faster and more accurately than traditional static analysis tools. This proactive use of AI during the development phase drastically reduces the likelihood of catastrophic financial losses post-launch, making the final product more secure and auditable. Concurrently, AI algorithms are being employed in dynamic community management, automating responses to common investor queries, detecting sentiment shifts, and flagging potential social engineering attacks, thereby maintaining robust and trustworthy communication channels throughout the token sale lifecycle.

- AI enhances fraud detection by analyzing whitepapers and team backgrounds for irregularities and historical deceit patterns.

- Automated compliance checks leveraging AI ensure real-time adherence to global KYC/AML and securities regulations.

- Machine learning models optimize smart contract auditing, identifying security vulnerabilities before deployment.

- AI-driven tokenomics simulators predict market impact and stability, improving long-term value proposition.

- NLP tools analyze community sentiment, allowing proactive crisis management and investor communication strategies.

- Operational efficiency is increased through automated investor onboarding, verification, and token allocation processes.

DRO & Impact Forces Of Initial Coin Offering (ICO) Service Market

The Initial Coin Offering (ICO) Service Market is shaped by dynamic interactions between technological innovation, regulatory pressure, and investor sentiment, summarized by key Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing global adoption of decentralized finance (DeFi) and Web3 applications, which necessitates new forms of capital raising tailored to blockchain environments. The continuous need for specialized legal and technical expertise due to the rapid evolution of blockchain technology and complex token structures also compels projects to seek professional services. Restraints largely center on regulatory uncertainty; divergent and often contradictory governmental approaches across major economies create substantial compliance hurdles and jurisdiction shopping, slowing down market standardization and increasing risk premiums. Another significant restraint is the lingering negative perception stemming from past fraudulent or unsuccessful ICOs, requiring service providers to exert extra effort in due diligence and transparency to regain widespread investor trust.

Opportunities for market expansion are substantial, primarily driven by the migration towards regulated fundraising mechanisms like Security Token Offerings (STOs) and the integration of blockchain into mainstream enterprise applications, which require professional service infrastructure to manage tokenized assets. The rising demand for decentralized governance models (DAOs) presents an opportunity for service providers to offer governance consulting and implementation services, moving beyond mere fundraising into sustainable project structuring. Furthermore, the convergence of AI with blockchain offers massive potential to automate compliance and security checks, thereby streamlining the service provision process and reducing operational costs, allowing for scalable, high-integrity service offerings that appeal to institutional investors.

The impact forces influencing this market are predominantly high on intensity and complexity. Regulatory intervention acts as a powerful external force, capable of rapidly reshaping market demand by either legitimizing or effectively banning certain types of offerings, pushing services towards regulated jurisdictions. Technological advancements, particularly in layer-2 solutions and cross-chain capabilities, necessitate continuous adaptation from service providers, driving innovation in smart contract auditing and deployment methodologies. Investor confidence, heavily influenced by macroeconomic stability and media coverage of major crypto events, remains a volatile internal force; high confidence drives demand for services, while dips require service providers to emphasize security, accountability, and project vetting to maintain pipeline momentum. These forces collectively dictate the premium clients are willing to pay for expertise that navigates this complex intersection of finance, law, and distributed ledger technology.

Segmentation Analysis

The Initial Coin Offering (ICO) Service Market is strategically segmented based on the type of service offered, allowing providers to specialize in critical areas of the token launch lifecycle, and by the end-user application, reflecting the diverse sectors leveraging blockchain financing. The primary service segments include Technical Development, Legal & Compliance, Marketing & PR, and Advisory & Consulting. Technical Development services focus on the core blockchain engineering requirements, such as smart contract coding and platform security audits. Legal & Compliance services address the complex regulatory landscape, ensuring adherence to global securities laws and facilitating proper documentation. Market segmentation by application focuses on industries like DeFi, Gaming, Supply Chain Management, and Infrastructure, highlighting where the demand for tokenized funding is most prevalent and sophisticated.

Understanding these segments is crucial for strategic market positioning. The demand for Legal & Compliance services has experienced exponential growth recently, driven by intensified regulatory scrutiny globally, establishing it as a high-value, high-margin segment. Conversely, Marketing & PR services are increasingly critical for achieving successful token distribution and community engagement, moving beyond simple digital marketing to specialized blockchain public relations and decentralized community governance facilitation. This structured approach to market segmentation enables service providers to tailor their offerings precisely, addressing the varying levels of technical and legal sophistication required by different project types, ranging from simple utility token sales to complex, regulated security token issuances, thereby optimizing resource allocation and maximizing client success rates.

- By Service Type:

- Legal and Compliance Services

- Technical Development (Smart Contract Auditing, Deployment)

- Marketing and Public Relations

- Advisory and Consulting (Tokenomics Design, Strategy)

- KYC/AML Services

- By Platform/Type of Offering:

- ICO (Initial Coin Offering)

- STO (Security Token Offering)

- IEO (Initial Exchange Offering)

- IDO (Initial DEX Offering)

- By Application/End-Use:

- Decentralized Finance (DeFi)

- Gaming and Metaverse (GameFi)

- Infrastructure and Protocol Development

- Enterprise Solutions and Supply Chain

- NFT and Digital Collectibles Platforms

Value Chain Analysis For Initial Coin Offering (ICO) Service Market

The value chain for the Initial Coin Offering (ICO) Service Market is highly specialized, starting with upstream activities involving legal counsel and strategic consulting focused on conceptualizing the token structure and defining regulatory boundaries. Upstream analysis focuses on intellectual property creation (whitepaper and tokenomics), legal structuring (jurisdiction selection and entity formation), and foundational security audits. These activities require deep expertise in decentralized systems architecture, securities law, and financial modeling. Key participants at this stage include specialized blockchain law firms, independent tokenomics consultants, and core protocol architects. The efficiency and quality of the upstream process dictate the project's legal soundness and technical feasibility, setting the stage for successful fundraising.

The midstream phase focuses on execution and deployment, encompassing smart contract development, security audits, KYC/AML platform integration, and the establishment of the token sale infrastructure (e.g., website, dashboard). This stage involves technology providers, cybersecurity firms specializing in blockchain audits, and software development houses. Downstream activities are centered on distribution, marketing, and investor relations. Distribution channels include direct sales through proprietary platforms, partnerships with crypto exchanges (IEOs), and decentralized exchange listing facilitators (IDOs). Marketing and PR agencies manage community building, media outreach, and investor transparency, which are crucial for maintaining momentum and credibility post-sale. The value generated throughout the chain is synthesized into a secure, compliant, and widely distributed digital asset.

The distribution channel dynamics are characterized by a blend of direct and indirect approaches. Direct distribution involves the project’s dedicated sale portal, managed entirely by the ICO service provider to ensure complete control over KYC/AML checks and token allocation. Indirect channels involve partnerships with centralized exchanges (for IEOs) or decentralized exchanges (for IDOs), leveraging their existing liquidity and user base for wider market reach. The complexity of the underlying technology and regulatory requirements means that indirect channels often still require substantial direct support from the ICO service firm, particularly in coordinating listing requirements, smart contract verification, and regulatory disclosures, ensuring a seamless experience for the end-user/investor, while maximizing capital injection for the client project.

Initial Coin Offering (ICO) Service Market Potential Customers

The primary customers for Initial Coin Offering (ICO) Service Providers are high-growth blockchain startups, established technology companies initiating blockchain integration projects, and decentralized autonomous organizations (DAOs) seeking seed or growth capital outside of traditional venture capital avenues. These customers are typically characterized by a strong technical foundation but often lack the comprehensive legal, regulatory, and market expertise required to execute a compliant and successful global token sale. Their needs range from foundational tokenomics design and smart contract security auditing for nascent protocols to complex multi-jurisdictional legal structuring for projects targeting institutional investment through STOs. The core value proposition for these buyers is the mitigation of risk and acceleration of time-to-market, allowing their internal teams to focus exclusively on product development.

A secondary, yet rapidly expanding, customer segment includes traditional enterprises seeking to tokenize real-world assets (RWA) or implement blockchain-based loyalty programs and supply chain tracing solutions. These legacy companies require specialized advisory services to bridge the gap between traditional corporate finance structures and decentralized ledger technology (DLT). They are often highly sensitive to regulatory compliance and require white-glove service regarding legal structuring and security audits. For these sophisticated buyers, the ICO service firm acts as a full-service blockchain integration partner, facilitating the complex technical and regulatory transition necessary to leverage distributed capital markets effectively, ensuring their tokenization efforts are both technologically sound and legally defensible.

Furthermore, early-stage incubators and venture builders focused on the Web3 space are becoming crucial indirect customers, partnering with ICO service firms to provide a standardized fundraising pipeline for their portfolio companies. These entities look for proven track records in navigating complex global compliance and successful token launch metrics. The overall buying criteria for all potential customers prioritize the service provider’s demonstrated expertise in navigating specific regulatory environments (e.g., US, EU, Singapore), the robustness of their smart contract security methodologies, and their ability to generate significant, engaged community interest, ensuring the utility and liquidity of the launched token post-sale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CoinList, Polymath, Securitize, ConsenSys, Ambisafe, OpenFinance Network, ICOBox, Elementus, TokenMarket, Kriptomat, Launchpool, Republic Crypto, Blocktrade, Stratis, Waves Platform, FinFabrik, KoreConX, Fundament Group, CrowdfundX, Gibraltar Stock Exchange (GSX) Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Initial Coin Offering (ICO) Service Market Key Technology Landscape

The technology landscape underpinning the ICO Service Market is defined by advanced cryptographic tools, distributed ledger technologies (DLT), and sophisticated compliance automation software. Central to these services is the deployment of robust and audited smart contracts, primarily utilizing Ethereum Virtual Machine (EVM)-compatible chains, though growth is accelerating on alternative high-throughput platforms like Solana, Avalanche, and Polygon. Key technological requirements include secure wallet management solutions, multi-signature capabilities for fund safeguarding, and decentralized oracle services for real-world data integration. Service providers are heavily investing in proprietary compliance technology stacks that automate KYC/AML checks, sanctions screening, and investor accreditation verification, often leveraging zero-knowledge proofs (ZKPs) to maintain privacy while ensuring regulatory adherence.

Crucially, the increasing adoption of regulated offerings (STOs) has necessitated the use of specialized tokenization platforms that support advanced features like programmable securities. These platforms implement technologies such as whitelist management (controlling who can hold the tokens), transfer restrictions based on jurisdiction or investor status, and automated corporate actions (e.g., dividend payments). The technology must be highly modular and interoperable, allowing seamless integration with various blockchain networks, custodial solutions, and legacy financial systems. The development process emphasizes formal verification methods and independent third-party audits to eliminate vulnerabilities, given the irreversible nature of blockchain transactions.

Furthermore, the technology landscape includes advanced data analytics tools and blockchain monitoring services used for ongoing market surveillance post-launch. These tools track token distribution, detect market manipulation attempts, and provide transparency reports to investors and regulators. The move towards decentralized fundraising models (IDOs) necessitates integration with decentralized exchange (DEX) infrastructure and yield farming protocols, requiring service providers to master tools for liquidity provision and automated market making (AMM). The continuous technological arms race among service providers focuses on enhancing security through cutting-edge cryptography and achieving regulatory speed through AI-driven automation, defining competitive advantage in this highly technical domain.

Regional Highlights

Regional dynamics significantly influence the ICO Service Market, primarily due to heterogeneous regulatory environments and differing levels of blockchain maturity across continents. North America, especially the United States, represents a high-value market focused heavily on compliance-driven services, particularly Security Token Offerings (STOs). The stringent enforcement of securities laws by the SEC means that US-based projects prioritize legal structuring, sophisticated accreditation verification, and advanced compliance technology, favoring service providers with established legal precedent and strong institutional ties. Canada also maintains a strong presence, focusing on regulated crypto exchanges and robust investor protection frameworks, driving demand for tailored advisory and risk management services.

Europe stands as a major hub for foundational ICO and regulated token issuance, benefiting from jurisdictions like Switzerland (Crypto Valley), Malta, and Liechtenstein, which have established clear, albeit varied, regulatory frameworks (e.g., DLT laws). European service providers excel in cross-border legal advisory, catering to projects domiciling within the continent to leverage specific regulatory clarity. The Asia Pacific (APAC) region, spearheaded by Singapore, Hong Kong, and emerging centers like South Korea and Australia, demonstrates the highest growth potential. This region is characterized by a high volume of technology-driven blockchain startups, driving demand for technical development services, high-throughput smart contract auditing, and aggressive community marketing strategies geared towards retail and high-net-worth investors.

Latin America and the Middle East & Africa (MEA) represent emerging markets with distinct drivers. In Latin America, economic volatility and high inflation drive the adoption of crypto as an alternative store of value, spurring local project development and demand for basic ICO services focused on utility tokens and decentralized infrastructure. The MEA region, particularly the UAE (Dubai, Abu Dhabi) and Bahrain, is proactively creating regulatory sandboxes and free zones dedicated to digital assets, attracting global ICO service firms to establish regional hubs. This focus on regulatory innovation in the MEA region is boosting demand for services related to large-scale infrastructure tokenization and cross-border digital asset financing, signaling a strategic shift towards legitimizing the technology for national economic diversification.

- North America: Dominance in Security Token Offerings (STOs); High demand for SEC compliance and institutional-grade security auditing services.

- Europe: Strong regulatory clarity in key nations (Switzerland, Malta); Leadership in providing specialized legal and multi-jurisdictional structuring advice.

- Asia Pacific (APAC): Highest volume growth; Focus on technical development, GameFi, and protocol infrastructure; Singapore and Hong Kong lead in fintech innovation.

- Latin America (LATAM): Growing utility token launches driven by local economic conditions; Demand for accessible, localized community management and advisory.

- Middle East & Africa (MEA): Emerging regulatory hubs (UAE, Bahrain); Strategic focus on large-scale infrastructure and real-world asset tokenization services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Initial Coin Offering (ICO) Service Market.- CoinList

- Polymath

- Securitize

- ConsenSys

- Ambisafe

- OpenFinance Network

- ICOBox

- Elementus

- TokenMarket

- Kriptomat

- Launchpool

- Republic Crypto

- Blocktrade

- Stratis

- Waves Platform

- FinFabrik

- KoreConX

- Fundament Group

- CrowdfundX

- Gibraltar Stock Exchange (GSX) Group

Frequently Asked Questions

Analyze common user questions about the Initial Coin Offering (ICO) Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between an ICO and an STO, and how does this affect service demand?

An ICO (Initial Coin Offering) typically involves utility tokens, often lacking regulatory status as a security, whereas an STO (Security Token Offering) involves tokens classified as securities, requiring stringent regulatory compliance. This distinction drastically increases demand for specialized Legal and Compliance services in the STO segment, making them higher value contracts for service providers.

Which regulatory jurisdictions are most favorable for launching an ICO or STO?

Jurisdictions offering regulatory clarity and supportive frameworks, such as Switzerland, Singapore, and specific US states with tailored fintech laws, are generally favored. These regions minimize legal uncertainty, which is a key factor potential clients consider when selecting an ICO service provider for legal structuring and token domicile.

How does the integration of AI improve security in ICO services?

AI improves security by automating the analysis of smart contracts to detect vulnerabilities (like reentrancy bugs) faster than human auditors, and by enhancing KYC/AML processes through automated identity verification and fraud pattern detection, thereby significantly reducing the operational risk associated with token launches.

What are the most critical factors for a successful ICO launch in the current market?

Success is primarily determined by stringent regulatory compliance, demonstrable utility and robust tokenomics design, transparent community engagement, and the use of audited, secure smart contract technology. Service providers must excel in all four areas to ensure investor confidence and project longevity.

Is the ICO Service Market shifting towards Initial DEX Offerings (IDOs)?

Yes, there is a clear trend towards IDOs (Initial DEX Offerings) and IEOs (Initial Exchange Offerings), driven by the desire for immediate liquidity and decentralized distribution. This shift requires service providers to specialize in liquidity pool management, decentralized exchange integration, and robust smart contract vesting mechanisms.

The continuous growth and evolution of the Initial Coin Offering (ICO) Service Market underscore its critical role in the decentralized fundraising ecosystem. As blockchain technology matures and regulatory frameworks become more defined, the reliance on specialized advisory and technical expertise continues to intensify, ensuring a trajectory of sustained expansion throughout the forecast period. Service providers who successfully integrate AI-driven compliance solutions and adapt to the rising demand for security token offerings (STOs) and decentralized exchange offerings (IDOs) are best positioned to capture the dominant market share. The need for specialized consultation in tokenomics design and global legal adherence remains the core value driver, stabilizing the market against past volatility and fostering a new era of regulated and secure digital asset financing.

Market participants are observing significant investment in infrastructure that supports multi-chain deployments, recognizing that future token launches will often involve cross-chain interoperability to maximize investor access and application utility. This technological pivot necessitates a deeper collaboration between traditional finance professionals and decentralized technology architects within the service firms. Furthermore, geopolitical stability and evolving international tax laws surrounding digital assets present both challenges and unique opportunities for service providers capable of offering sophisticated international tax planning and reporting services, adding another layer of complexity and value to their core offerings. The competitive landscape is increasingly defined not just by the volume of capital raised, but by the measurable success and long-term viability of the projects launched, cementing the service provider's reputation as a custodian of quality within the Web3 space.

In terms of human capital, the demand for personnel skilled in both traditional financial compliance and blockchain security auditing far outpaces supply. This scarcity drives up the cost of premium service provision but also solidifies the high-margin nature of the technical and legal segments. Future strategic moves in the market are anticipated to include greater consolidation, with larger technology and financial advisory groups acquiring smaller, specialized blockchain consulting firms to integrate proprietary smart contract audit technologies and regulatory expertise. This consolidation aims to create all-in-one solutions that can comprehensively manage the entire life cycle of digital asset capital formation, from initial concept to post-launch governance and liquidity management, providing institutional-grade reliability to a historically volatile sector.

Regional centers of excellence continue to solidify their positions, with jurisdictions like Singapore attracting projects focused on institutional capital due to its clarity on investment funds and digital assets, while regions offering low-cost development environments, particularly in Eastern Europe and parts of Asia, remain attractive for core technical development work. The successful navigation of these geographical nuances, integrating local expertise with global compliance standards, is fundamental to a service provider’s ability to serve a global clientele effectively. The shift from speculative fundraising to utility-driven, enterprise-focused tokenization validates the professionalization of the ICO service industry, ensuring that it remains an essential component of the global digital economy infrastructure for the foreseeable future, driving innovation across various sectors utilizing distributed ledger technology.

The impact of decentralized autonomous organizations (DAOs) on the service market is transitioning from niche advisory to a core service offering. Service providers are now developing specialized tools and governance frameworks tailored for DAOs, assisting them in legal wrapper selection, voting mechanism design, and treasury management protocols. This reflects the maturation of the decentralized governance model, which requires structured, professional support to scale effectively and maintain regulatory standing. Furthermore, the convergence of blockchain with environmental, social, and governance (ESG) criteria is generating demand for tokenization services focused on carbon credits, sustainable financing, and supply chain transparency, opening entirely new application segments requiring unique regulatory and technical expertise from service firms.

Security remains paramount, demanding constant innovation in defense mechanisms against evolving crypto threats. Service providers are increasingly offering continuous monitoring and incident response services post-ICO, moving beyond the one-time launch service model. This recurring revenue stream based on long-term security maintenance is crucial for sustaining growth and establishing enduring client relationships. The competitive advantage is increasingly being built around certifications, insurance policies covering smart contract failures, and demonstrable track records of successfully launched, high-capitalization projects that withstand significant market scrutiny and maintain long-term token liquidity and utility. These elements collectively reinforce the market's trajectory towards institutionalization and greater accountability.

In summary, the Initial Coin Offering (ICO) Service Market is poised for significant expansion, fueled by regulatory clarity, technological integration (especially AI), and the diversification of token applications across key economic sectors. While restraints related to regulatory fragmentation persist, the compelling opportunities presented by STOs, IDOs, and enterprise tokenization solutions far outweigh the challenges. Strategic players focusing on technical excellence, legal robustness, and high transparency are anticipated to lead the market, shaping the future of decentralized capital formation globally.

The market's resilience and adaptability, particularly in quickly integrating new technical standards such as multi-party computation (MPC) for enhanced key management and cross-chain messaging protocols, demonstrate its inherent innovative capacity. Service providers are effectively acting as the bridge between cutting-edge cryptographic research and practical, compliant fundraising execution. The increasing institutional involvement in the crypto asset space, including major banks and traditional financial institutions exploring tokenization of traditional assets, further validates the long-term potential of the ICO service infrastructure. This institutional validation not only brings substantial capital but also imposes rigorous operational and security standards, which benefits the entire ecosystem by elevating the overall quality and trustworthiness of service offerings globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager