Injectable Bone Graft Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431436 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Injectable Bone Graft Market Size

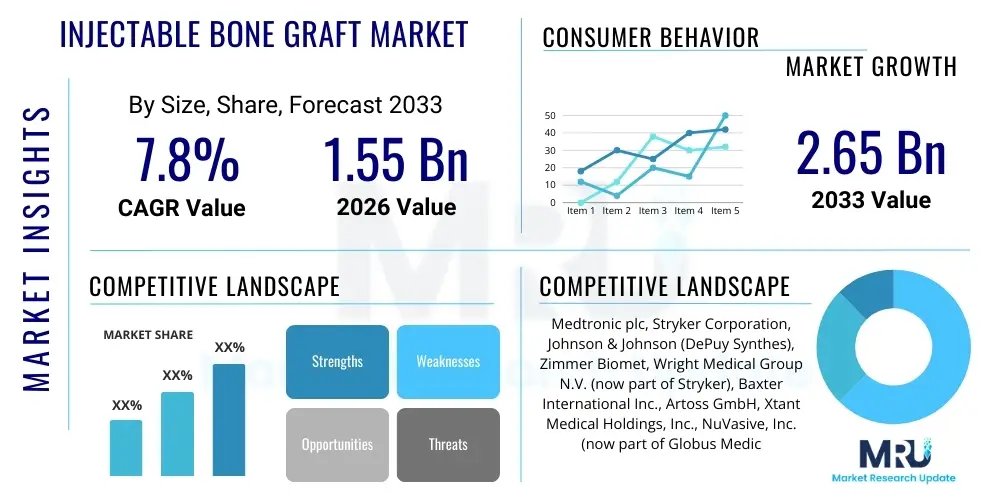

The Injectable Bone Graft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.65 Billion by the end of the forecast period in 2033.

Injectable Bone Graft Market introduction

The Injectable Bone Graft Market encompasses specialized biomaterials designed to promote bone regeneration and healing, delivered through minimally invasive techniques. These materials, often composed of ceramics, polymers, or composites, are formulated to be flowable or moldable at room temperature, allowing for precise placement into bone voids or defects without requiring large incisions. The primary application of these grafts is in orthopedic surgeries, including spinal fusion, trauma reconstruction, and dental procedures, where they act as scaffolds to support osteoconduction and sometimes possess osteoinductive or osteogenic properties to accelerate the natural healing cascade. The transition towards minimally invasive surgery (MIS) techniques is the central driver for the adoption of injectable alternatives, as they offer reduced patient morbidity, faster recovery times, and decreased surgical complexity compared to traditional block grafts or autografts.

Injectable bone grafts provide significant advantages over traditional grafting methods, particularly autografts, which require a second surgical site for harvest, leading to potential pain and complications. Allografts, while readily available, carry risks of immune response or disease transmission. Injectable synthetic grafts mitigate these issues, offering consistent quality, tailored biodegradability, and enhanced handling characteristics. These grafts often contain biologically active agents, such as growth factors or stem cells, integrated into the injectable matrix to maximize their regenerative potential. Their viscosity and setting characteristics are engineered to ensure the material fills irregular defects completely and solidifies rapidly in vivo, maintaining structural integrity during the critical initial healing phase.

The market expansion is heavily influenced by the global increase in age-related degenerative bone diseases, particularly osteoporosis and osteoarthritis, which necessitate reconstructive surgeries. Furthermore, advancements in materials science, including the development of nano-hydroxyapatite and specialized calcium phosphate cements, have improved the biocompatibility and efficacy of these injectable formulations. Key drivers include the rising incidence of road traffic accidents and sports injuries requiring trauma care, and the growing demand for complex dental implant procedures. Regulatory approval pathways, while rigorous, are evolving to accommodate novel, complex biomaterial combinations, further accelerating product innovation and market penetration across established and emerging healthcare economies.

Injectable Bone Graft Market Executive Summary

The Injectable Bone Graft Market is experiencing robust expansion driven by significant technological advancements in biomaterials and the increasing preference for minimally invasive surgical interventions across orthopedics and dentistry. Business trends highlight a clear strategic shift towards partnerships and acquisitions, particularly involving established orthopedic giants seeking to integrate specialized biomaterial companies to bolster their regenerative medicine portfolio. Manufacturers are focusing heavily on developing composite grafts that combine synthetic components with biological enhancers (like mesenchymal stem cells or platelet-rich plasma) to improve clinical outcomes, positioning efficacy as a key competitive differentiator. Pricing strategies remain premium due to the research intensity and regulatory costs associated with advanced injectable formulations, though penetration into emerging markets is being supported by localized manufacturing and tailored distribution channels.

Geographically, North America currently dominates the market due to high healthcare expenditure, established reimbursement frameworks, and the early adoption of advanced surgical techniques, particularly in complex spinal fusion procedures. However, the Asia Pacific region is projected to exhibit the fastest growth rate, fueled by improving healthcare infrastructure, a rapidly expanding elderly population, and increasing awareness regarding advanced orthopedic treatments in countries like China and India. Regional trends indicate a divergence in material preference; while Western markets show high adoption of advanced synthetic composites, developing markets are increasingly utilizing cost-effective ceramic-based cements for basic trauma applications. Regulatory variations across regions, particularly the stringent standards enforced by the FDA and EMA versus more streamlined approvals in parts of APAC, significantly influence product launch timelines and market access strategies for global players.

Segment trends confirm that Spinal Fusion remains the largest application segment, although the dental application segment is showing exceptional growth potential driven by the surging volume of restorative procedures. Material segmentation indicates that the synthetic segment, specifically calcium phosphate cements and bioresorbable polymers, holds the largest market share due to their superior safety profile and supply consistency compared to allograft-derived options. The end-user analysis shows that Hospitals remain the primary consumers, yet the shift toward Ambulatory Surgical Centers (ASCs) is prominent, particularly in North America, owing to the suitability of minimally invasive injectable procedures for outpatient settings. This segmentation highlights a market moving towards specialization, where product success is increasingly linked to efficacy in specific anatomical sites and alignment with cost-containment pressures in value-based healthcare systems.

AI Impact Analysis on Injectable Bone Graft Market

User inquiries regarding AI's impact on injectable bone grafts predominantly revolve around how artificial intelligence can optimize material design, personalize treatment protocols, and improve clinical workflow efficiency. Key themes include the use of machine learning (ML) to predict the optimal composition and degradation kinetics of novel graft formulations, identifying the most effective bioactive agents for specific patient profiles (e.g., age, bone density, and defect type), and streamlining regulatory submission processes through predictive analytics. Users also express concerns and expectations related to integrating AI-driven surgical planning systems, particularly in complex spinal or craniofacial reconstructions, where the exact volume and placement of the injectable material are critical. There is a strong interest in AI tools that can analyze vast amounts of clinical trial data to establish better efficacy benchmarks and accelerate the discovery of next-generation regenerative materials.

AI is set to revolutionize the research and development phase of injectable bone grafts by significantly shortening the time required for material discovery and optimization. Machine learning algorithms can analyze high-dimensional data generated from in vitro experiments, simulation models, and existing clinical datasets to identify synergistic combinations of polymers, ceramics, and therapeutic proteins that yield superior mechanical and biological performance. This predictive capability allows researchers to filter through millions of potential formulations virtually, optimizing parameters such as injectability, setting time, porosity, and elution profiles of incorporated drugs or growth factors, drastically reducing the cost and duration associated with traditional iterative laboratory synthesis and testing.

Furthermore, AI will play a critical role in clinical application and patient stratification. Deep learning models can analyze pre-operative patient imaging (CT, MRI) alongside clinical metadata to recommend the precise type, volume, and injection strategy for a bone graft, effectively personalizing the surgical procedure. Post-operatively, AI algorithms can analyze sequential radiographic images to predict the healing trajectory and assess the rate of graft degradation and subsequent bone integration more accurately than traditional qualitative methods. This enhanced monitoring capability not only improves patient safety but also provides invaluable real-world evidence that feeds back into material refinement, creating a continuous cycle of data-driven optimization essential for advanced regenerative products.

- AI-driven optimization of biomaterial composition and physicochemical properties (e.g., porosity, resorption rate).

- Machine learning models for personalized bone graft selection based on patient-specific bone defect characteristics.

- Enhanced predictive analytics for clinical trial outcomes and accelerated regulatory submission strategies.

- Integration of AI into robotic surgical systems for precise, automated delivery of injectable grafts in minimally invasive procedures.

- Automated analysis of post-operative imaging to quantitatively monitor graft integration and bone regeneration over time.

DRO & Impact Forces Of Injectable Bone Graft Market

The Injectable Bone Graft Market dynamics are heavily influenced by a confluence of accelerating drivers, structural restraints, and emerging opportunities, which collectively determine the market trajectory. The primary driver is the global demographic shift toward an aging population, which inherently leads to a higher prevalence of orthopedic conditions, degenerative spine disorders, and fragility fractures, necessitating bone augmentation and fusion procedures. Simultaneously, the pervasive trend toward minimally invasive surgery (MIS) across orthopedics dramatically favors injectable delivery systems, as they significantly reduce surgical trauma, minimize hospital stays, and expedite patient rehabilitation. These core drivers create a fertile environment for growth, sustained by continuous innovation in bioactive material science, ensuring high product uptake.

However, the market faces significant structural restraints that temper its growth rate. Injectable bone grafts, particularly those incorporating advanced biologics or stem cell components, are often associated with substantially higher costs compared to traditional autografts or generic allografts, posing a barrier to adoption in cost-sensitive healthcare systems and emerging economies. Furthermore, the regulatory pathway for novel composite injectable grafts is complex and lengthy; demonstrating both mechanical stability and long-term biological safety is challenging, often resulting in prolonged time-to-market. Concerns also persist regarding the potential for migration or incomplete degradation of certain synthetic injectable materials, which necessitate stringent quality control and extensive pre-clinical testing to overcome clinician skepticism and gain widespread acceptance.

Opportunities for expansion are primarily centered around the integration of 3D printing and bioprinting technologies, enabling the customization of injectable scaffold architectures to perfectly match patient anatomy and defect geometry, thereby improving graft performance and reducing failure rates. Another major avenue lies in the development of injectable, self-setting bio-inks that can deliver living cells (e.g., osteoprogenitor cells) directly to the defect site, moving the technology toward true biological regeneration rather than mere scaffolding. The untapped potential in dental applications, particularly in complex maxillofacial reconstruction and periodontal defect repair, also presents a substantial opportunity for specialized product development. The cumulative impact forces underscore a market characterized by high innovation dependency and strong clinical validation requirements, where regulatory compliance and superior clinical efficacy are the primary determinants of competitive success.

Segmentation Analysis

The Injectable Bone Graft Market is systematically segmented based on Material Type, Application, and End-User, providing granular insights into market dynamics and consumption patterns. Material segmentation distinguishes between synthetics (including calcium phosphate, calcium sulfate, and bioactive glass), allografts (demineralized bone matrix), and composite materials, reflecting the diverse origins and functional characteristics of the grafts available. This categorization is crucial as performance, cost, and regulatory burden vary significantly among these categories, with synthetics currently dominating due to their consistent supply and safety profile, while composites represent the fastest-growing segment owing to enhanced osteoinductivity.

Application segmentation highlights the key clinical areas driving demand, with Orthopedics being the core segment, specifically divided into spinal fusion, trauma, and joint reconstruction. Spinal fusion remains the largest consumer globally, given the high prevalence of spinal degeneration requiring surgical stabilization. Dental applications, encompassing socket preservation and periodontal regeneration, represent a rapidly expanding niche, favored by the convenience and effectiveness of injectable formulations in minimally invasive dental procedures. Understanding these applications is vital for manufacturers to tailor product specifications—such as mechanical load-bearing capacity and setting time—to specific procedural requirements.

The End-User segmentation categorizes consumption patterns primarily across Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics (predominantly Dental Clinics). While hospitals historically account for the largest share due to complex procedures like major trauma and spinal surgeries, the increasing adoption of injectable grafts in ASCs is accelerating. This shift is driven by the movement towards outpatient surgical models, facilitated by the short recovery times associated with minimally invasive, injectable bone grafting techniques. The performance of these segments is intrinsically linked to healthcare reimbursement policies and the evolving infrastructure designed to support complex, high-volume surgical procedures.

- By Material Type:

- Synthetic (Calcium Phosphate, Calcium Sulfate, Bioactive Glass, Polymers)

- Allograft (Demineralized Bone Matrix - DBM)

- Composite (Synthetic/Allograft combination, Synthetic/Growth Factor combination)

- By Application:

- Spinal Fusion

- Trauma and Fracture Repair

- Joint Reconstruction and Arthroplasty

- Dental (Sinus Lifts, Ridge Augmentation, Socket Preservation)

- Craniomaxillofacial

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (Orthopedic and Dental)

Value Chain Analysis For Injectable Bone Graft Market

The value chain for the Injectable Bone Graft Market begins with rigorous upstream activities involving the sourcing and processing of core raw materials, predominantly high-purity calcium compounds, bioactive polymers, and, for allografts, donor human tissue. Upstream analysis focuses heavily on standardization and quality control, ensuring that raw material inputs meet stringent medical-grade specifications, particularly for synthetic components where particle size and surface chemistry are crucial for biological performance. For allograft-based products, the quality and safety of tissue banking, processing (e.g., sterilization and viral inactivation), and demineralization techniques are paramount. The ability to secure consistent, high-quality material supply chains directly influences the final cost and regulatory compliance of the injectable graft product.

The midstream stage involves the highly specialized manufacturing and formulation processes. This includes compounding the raw materials into an injectable paste or putty, integrating bioactive additives (such as bone morphogenetic proteins or growth factors), and ensuring the final product exhibits optimal handling characteristics, including controlled viscosity and setting kinetics. Packaging and terminal sterilization are critical steps, often requiring aseptic manufacturing environments to maintain the product’s sterility and shelf stability. Research and development activities, focusing on improving mechanical properties, enhancing osteoinductivity, and optimizing minimally invasive delivery systems (e.g., specialized injection syringes), constitute a significant portion of the value added at this stage.

Downstream analysis covers distribution and sales, which are predominantly routed through established medical device distribution channels. The distribution channel is bifurcated into direct sales models, often employed by large orthopedic manufacturers who maintain specialized sales forces to interact directly with surgeons and hospital purchasing groups, and indirect models utilizing third-party medical distributors. Indirect distribution is essential for reaching smaller clinics and geographically dispersed markets. Due to the high-value, specialized nature of these grafts, sales are heavily reliant on clinical evidence and surgeon education. The final stage involves the end-user application in hospitals or clinics, followed by post-market surveillance and continuous feedback loops that inform future product improvements and regulatory updates, thereby closing the cyclical nature of the value chain and ensuring continuous quality enhancement in the marketplace.

Injectable Bone Graft Market Potential Customers

The primary consumers and end-users of injectable bone graft materials are institutions and professionals engaged in reconstructive and regenerative surgical procedures focused on the skeletal system. Hospitals, particularly those with specialized orthopedic and trauma departments, represent the largest and most frequent buyers. Within hospitals, the decision-makers include orthopedic surgeons (specializing in spine, trauma, and joint repair), neurosurgeons (for spinal procedures), and procurement managers who manage large-volume supply contracts. These buyers prioritize product efficacy, clinical safety data, ease of use in minimally invasive procedures, and comprehensive reimbursement coverage. Their purchasing decisions are often based on extensive clinical evidence and established vendor reliability.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing customer segment, driven by the increasing number of outpatient orthopedic procedures performed in the U.S. and other developed healthcare economies. ASCs seek injectable grafts that facilitate fast, successful procedures with minimal complications, aligning with their focus on efficiency and cost-effectiveness. In this setting, products that offer streamlined logistics and reduced inventory complexity are highly valued. The procedures performed in ASCs, such as simple fracture repairs and less complex spinal interventions, are increasingly suitable for injectable formulations due to their less invasive nature and reduced requirements for complex post-operative monitoring.

Specialty Clinics, notably high-volume dental and periodontic clinics, form another crucial end-user group. Dental professionals utilize these grafts extensively for bone regeneration procedures essential for dental implant placement, ridge augmentation, and socket preservation after tooth extraction. These buyers are specifically interested in materials optimized for small volume defects, offering rapid integration and excellent biomechanical stability to support subsequent dental prostheses. Their buying behavior is often influenced by professional association recommendations and direct training provided by specialized biomaterials companies, emphasizing ease of preparation and consistency in product performance for routine clinical use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Wright Medical Group N.V. (now part of Stryker), Baxter International Inc., Artoss GmbH, Xtant Medical Holdings, Inc., NuVasive, Inc. (now part of Globus Medical), Geistlich Pharma AG, Graftys, Orthofix Medical Inc., B. Braun Melsungen AG, Smith & Nephew plc, Curasan AG, RTI Surgical, SeaSpine Holdings Corporation, OsteoMed, CGBio, NovaBone Products, LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injectable Bone Graft Market Key Technology Landscape

The technological landscape of the Injectable Bone Graft Market is rapidly evolving, driven by material science breakthroughs aimed at mimicking the natural bone healing process while ensuring ease of delivery and mechanical stability. A foundational technology involves the use of self-setting calcium phosphate cements (CPCs) and calcium sulfate cements (CSCs). CPCs are highly favored because their resorption rate can be tuned to match new bone formation, and they solidify isothermally in vivo, providing immediate mechanical support. Current innovation focuses on incorporating macroporosity and microparticles into these cements to enhance surface area for cellular attachment and vascularization, moving beyond simple void filling towards active bone induction.

Another critical area of development is the rise of advanced composite materials, often utilizing bioresorbable polymers (like PLGA or PCL) blended with ceramic particles (such as hydroxyapatite or bioactive glass). These composites are engineered to offer a tailored degradation profile, releasing mechanical load gradually as the patient's natural bone regenerates. Furthermore, hydrogel technology is emerging as a preferred vehicle for delivering biological factors. Injectable hydrogels, often cross-linked in situ, provide a highly biocompatible environment for encapsulating and slowly releasing osteoinductive growth factors (e.g., BMP-2) or viable cells (Mesenchymal Stem Cells - MSCs), thereby maximizing the regenerative potential while maintaining the minimal invasiveness of the procedure.

The integration of 3D printing and precision manufacturing techniques is fundamentally changing how injectable grafts are designed and produced. While the grafts themselves are injectable, the underlying scaffold components or microspheres can be manufactured using additive processes to precisely control pore size, interconnectivity, and surface topography, which are vital for bone ingrowth. The next generation of technology involves injectable bio-inks loaded with stem cells, transitioning the field from passive scaffolding to active tissue engineering. This shift requires sophisticated delivery systems—including specialized cartridges and mixing mechanisms—that maintain cell viability and ensure sterile, rapid deployment in the operating room, underscoring the market’s reliance on complex chemical engineering and surgical device integration.

Regional Highlights

The global Injectable Bone Graft Market exhibits significant regional variations in growth and maturity, directly correlating with healthcare expenditure, regulatory frameworks, and demographic factors.

- North America (U.S. and Canada): Dominates the global market share, driven by high disposable incomes, established reimbursement policies, advanced healthcare infrastructure, and the early adoption of premium, complex synthetic and composite grafts. The high incidence of spinal and trauma-related injuries, coupled with the strong presence of key market players and a significant shift toward outpatient procedures in ASCs, sustains robust market growth and innovation.

- Europe (Germany, UK, France): Represents a mature market characterized by stringent regulatory environments (EMA) and strong government focus on cost-effectiveness. While innovation remains high, market penetration is often constrained by comparative effectiveness research requirements and national health service budgeting. Germany and the UK are leading consumers, particularly in advanced trauma and joint replacement applications, emphasizing high clinical efficacy and long-term data.

- Asia Pacific (APAC) (China, Japan, India): Projected to be the fastest-growing region, fueled by rapidly improving healthcare access, increasing medical tourism, and a massive aging population requiring orthopedic intervention. Countries like China and India offer immense untapped potential due to their high patient volumes, although they often favor more cost-effective generic synthetic options over high-priced western biologics. Regulatory harmonization and local manufacturing are key factors driving expansion here.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show steady, albeit moderate, growth. Growth in LATAM is driven primarily by private healthcare sectors in countries like Brazil and Mexico. MEA market expansion is often tied to oil wealth influencing healthcare investment (GCC nations) and addressing the burden of infectious diseases and high trauma rates. Market access remains challenging due to fragmented distribution networks and low per-capita healthcare spending in many parts of Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injectable Bone Graft Market.- Medtronic plc

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Baxter International Inc.

- Artoss GmbH

- Xtant Medical Holdings, Inc.

- NuVasive, Inc. (now part of Globus Medical)

- Geistlich Pharma AG

- Graftys

- Orthofix Medical Inc.

- B. Braun Melsungen AG

- Smith & Nephew plc

- Curasan AG

- RTI Surgical

- SeaSpine Holdings Corporation

- OsteoMed

- CGBio

- NovaBone Products, LLC

- Kuros Biosciences AG

Frequently Asked Questions

Analyze common user questions about the Injectable Bone Graft market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of injectable bone grafts over traditional block grafts?

Injectable bone grafts offer reduced invasiveness, eliminating the need for a second surgical site (common with autografts), which results in less patient morbidity, faster recovery times, and precise filling of irregular bone defects due essential for successful bone regeneration.

Which application segment holds the largest share in the Injectable Bone Graft Market?

The Spinal Fusion application segment currently accounts for the largest share of the market, driven by the high volume of surgical interventions required to treat degenerative disc diseases and complex spinal instabilities in aging populations globally.

How are advancements in biomaterials driving market growth?

Advancements focus on developing composite materials that combine synthetic components with biological factors (like growth factors or stem cells) to enhance osteoinductivity, tune resorption rates, and provide improved mechanical strength, thereby significantly improving clinical outcomes.

What is the role of Ambulatory Surgical Centers (ASCs) in the injectable bone graft market expansion?

ASCs are increasingly adopting injectable grafts due to the growing preference for minimally invasive, outpatient procedures. Injectable grafts facilitate shorter operating times and recovery periods, aligning perfectly with the cost-effective and efficient operational model of ASCs.

What key restraints impact the widespread adoption of injectable bone grafts globally?

The primary restraints include the high cost associated with advanced synthetic and composite injectable grafts, particularly those containing specialized biologics, and the complex, prolonged regulatory approval processes required to demonstrate long-term safety and efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager