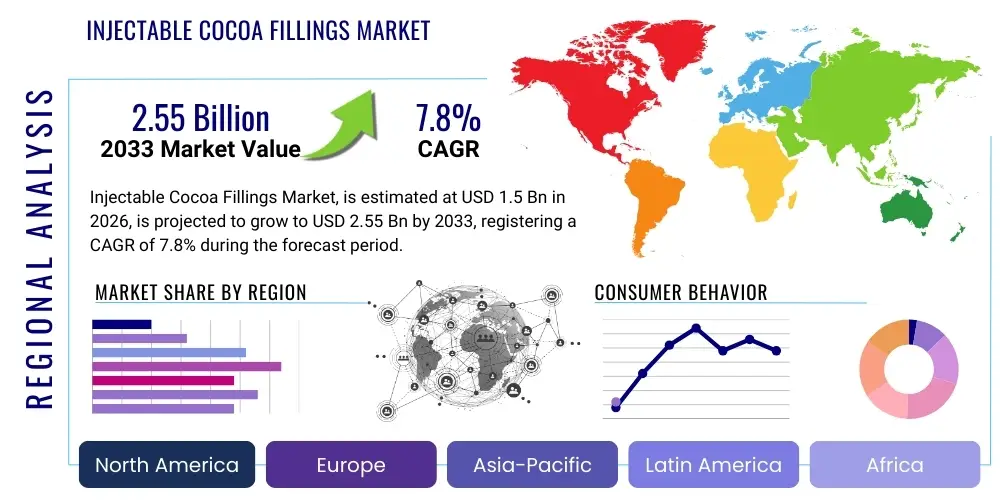

Injectable Cocoa Fillings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434877 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Injectable Cocoa Fillings Market Size

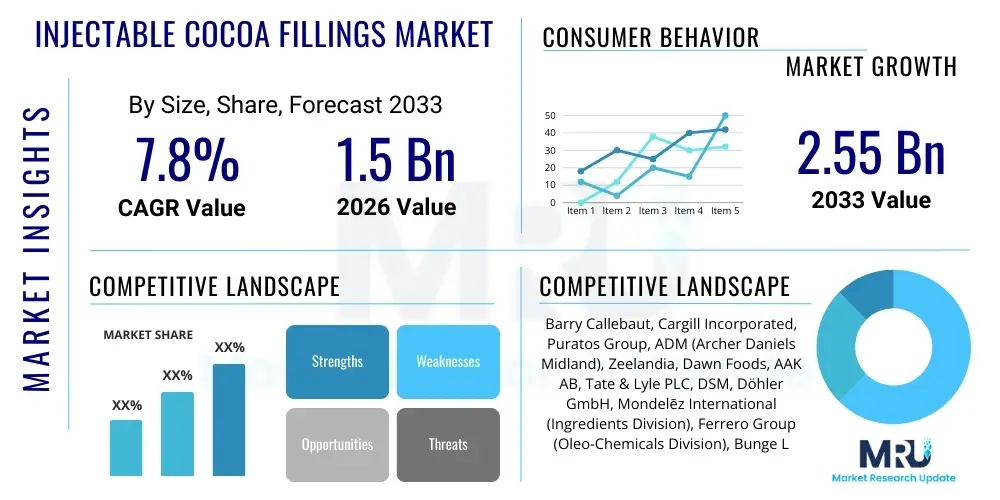

The Injectable Cocoa Fillings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Injectable Cocoa Fillings Market introduction

The Injectable Cocoa Fillings Market encompasses specialized, flowable chocolate or cocoa-based pastes designed for precise deposition into food products, such as donuts, pastries, cakes, biscuits, and confectionery bars, utilizing high-speed industrial equipment. These fillings are engineered to maintain specific textural and rheological properties, crucial for high-throughput manufacturing processes, ensuring stability against migration, moisture, and temperature fluctuations during baking or freezing cycles. The formulation often involves specific fat compositions, emulsifiers, and stabilizing agents that prevent phase separation and retain the desired mouthfeel, which is paramount for consumer acceptance in premium food categories. Demand is fundamentally driven by the convenience food sector's requirement for efficient, consistent, and superior-tasting internal components in mass-produced baked goods and snacks.

A key characteristic of injectable cocoa fillings is their adaptability to various processing demands, ranging from cold-set applications requiring rapid solidification to high-temperature baking environments where the filling must remain viscous yet non-migratory. Product descriptions often emphasize flavor authenticity, with formulations spanning dark, milk, and white chocolate profiles, alongside specialty options incorporating natural inclusions or functional ingredients. Major applications include filling pockets in injection-molded confectionery items, depositing centers into cookies post-baking, and creating layered structures within viennoiserie products. This versatility allows manufacturers to introduce complex flavor combinations and textural contrasts, elevating standard products into premium offerings without significantly increasing production complexity.

The inherent benefits of utilizing injectable fillings—such as enhanced production efficiency, reduced material waste through precise dosing, and consistent product quality—are major driving factors for market expansion. Furthermore, the modern consumer's continuous pursuit of indulgent, texturally diverse, and convenient snacking options mandates the use of high-quality internal fillings. The market is also heavily influenced by trends in clean label ingredient sourcing and sustainable cocoa practices, prompting manufacturers to innovate formulations that align with ethical consumption standards while preserving the necessary technical performance required for large-scale injection processes. These factors collectively establish a robust foundation for sustained growth in the forecast period.

Injectable Cocoa Fillings Market Executive Summary

The Injectable Cocoa Fillings Market is experiencing dynamic growth fueled by global shifts toward highly processed, yet perceived as premium, convenience foods and a persistent demand for authentic chocolate flavor profiles combined with novel textures. Business trends indicate a strong focus on supply chain resilience, particularly concerning the volatile global cocoa bean market, pushing key players toward vertical integration or secure long-term sourcing contracts to maintain cost stability and flavor consistency. Technological innovation is centered on developing fillings with extended shelf life under ambient conditions, utilizing advanced stabilizing systems that do not compromise the clean label status sought by consumers. Furthermore, merger and acquisition activity remains prevalent as large ingredient suppliers seek to expand their application expertise and geographical reach, particularly into rapidly industrializing bakery and confectionery sectors in Asia Pacific and Latin America.

Regional trends highlight distinct growth patterns across major geographies. North America and Europe, characterized by established industrial bakery infrastructure, are mature markets where growth is predominantly driven by innovation in functional fillings, such as those incorporating high protein, low sugar, or specialized fiber content, aligning with health and wellness macro trends. Conversely, the Asia Pacific (APAC) region is projected to register the highest growth rate, propelled by the swift expansion of organized retail, increasing urbanization, and the rapid adoption of Western-style confectionery and processed baked goods, necessitating localized production facilities for specialized injectable fillings. Regulatory compliance, particularly in the European Union concerning fat content and labeling standards, continues to shape product development strategies, emphasizing transparency and ingredient quality.

Segmentation trends reveal significant momentum in the 'natural and clean label' sub-segment, as manufacturers strive to replace artificial colors, flavors, and preservatives with natural alternatives derived from vegetable extracts or natural cocoa compounds, often maintaining performance stability. By application, the industrial bakery segment, particularly for laminated pastries and injected donuts, maintains the largest market share due to high volume requirements, while the confectionery segment shows substantial potential driven by complex, multi-layered chocolate bars requiring precision filling. The segment based on cocoa content also demonstrates a bifurcated market: high-cocoa-content premium fillings dominate the artisanal and specialty sectors, while standardized, cost-effective formulations serve the high-volume, mainstream snack food market, underscoring the necessity for a diversified product portfolio among leading suppliers.

AI Impact Analysis on Injectable Cocoa Fillings Market

User queries regarding the impact of Artificial Intelligence on the Injectable Cocoa Fillings Market primarily revolve around three critical areas: enhanced predictive quality control, optimization of complex ingredient blending, and strategic supply chain management in response to climate volatility impacting cocoa yields. Users express significant interest in how AI, coupled with computer vision systems, can monitor the consistency and rheology of fillings in real-time during high-speed injection, ensuring that viscosity and particle size distribution meet strict specifications, thus minimizing waste and operational downtime. A common concern is the application of machine learning algorithms to model the sensory experience of new formulations, predicting consumer preference and flavor stability before extensive and costly physical trials, accelerating the R&D cycle for novel cocoa filling flavor profiles.

Furthermore, stakeholders are keen to understand how AI can manage the inherent volatility in cocoa sourcing. Machine learning models can analyze complex datasets including historical commodity price fluctuations, weather patterns in cocoa-producing regions, geopolitical stability, and shipping logistics to provide predictive risk assessments and optimal procurement strategies. This proactive approach allows filling manufacturers to hedge against sudden price spikes or supply shortages, ensuring a stable inventory of high-quality raw materials. The application extends to optimizing manufacturing parameters, using digital twins of mixing tanks and cooling tunnels to fine-tune processing variables (temperature, shear rate, dwell time) which are crucial for achieving the desired textural integrity and flow characteristics of the injectable filling.

The implementation of AI-driven tools is transforming operational efficiency from raw material ingress to final product packaging. Predictive maintenance, utilizing sensors and AI to anticipate equipment failures in specialized injection machinery, is significantly reducing unplanned stoppages, which are particularly costly in continuous confectionery production lines. AI also facilitates the customization of small-batch orders by rapidly adjusting recipe parameters based on specific client requirements (e.g., specific protein content or sugar reduction targets), increasing market responsiveness and catering to niche demands. Overall, the market anticipates AI will be instrumental in achieving unprecedented levels of consistency, cost optimization, and rapid innovation within the highly technical domain of flowable cocoa ingredient manufacturing.

- AI-enhanced Predictive Quality Control: Real-time monitoring of filling viscosity and particle homogeneity during high-speed production via computer vision.

- Supply Chain Risk Mitigation: Utilization of machine learning for forecasting cocoa commodity price volatility and optimizing inventory levels.

- Accelerated R&D and Flavor Modeling: AI simulation of complex ingredient interactions to predict flavor stability and consumer acceptance profiles of new fillings.

- Optimized Manufacturing Parameters: Digital twin modeling to fine-tune mixing, cooling, and shear rates for optimal rheological performance.

- Predictive Maintenance: Deployment of sensor data analyzed by AI to minimize downtime of specialized injection and deposition machinery.

DRO & Impact Forces Of Injectable Cocoa Fillings Market

The Injectable Cocoa Fillings Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively constitute the Impact Forces shaping its trajectory. A primary driver is the accelerating consumer demand for premium, multi-textured snack and bakery items where the filling provides a crucial sensory counterpoint to the external structure. The increasing automation and speed of industrial food production lines necessitate highly stable and technically precise injectable fillings that perform consistently under stress, pushing manufacturers to invest heavily in specialized ingredients and processing technology. Furthermore, the persistent global trend toward indulgence, even within health-conscious markets, drives demand for high-quality cocoa formulations, often emphasizing superior cocoa sourcing and ethical certification, which adds perceived value and drives price acceptance.

Conversely, significant restraints hinder growth and operational stability. The foremost restraint is the extreme price volatility and supply chain instability of cocoa beans, the core raw material, which is highly susceptible to climatic conditions, political instability, and pervasive sustainability challenges in West African growing regions. This volatility complicates costing, pricing strategies, and long-term procurement planning for filling manufacturers. Moreover, the technical complexity associated with rheology control—ensuring the filling is fluid enough for injection but firm enough to prevent migration during baking or storage—requires specialized and often expensive stabilization agents and processing equipment, presenting a barrier to entry for smaller manufacturers and adding cost burdens to compliance with diverse regulatory standards concerning fat and sugar content across different regions.

Opportunities for expansion lie predominantly in innovation around functional fillings and geographical penetration. The development of 'better-for-you' cocoa fillings, incorporating natural sweeteners, high fiber content, or micronutrients, addresses the growing demand for indulgence without perceived guilt, offering significant market differentiation. Emerging markets in APAC and Latin America, characterized by rapid modernization of the food processing sector, represent substantial untapped capacity for injectable filling consumption as local bakeries transition from manual to automated production. The collective impact forces—driven by innovation and global indulgence trends but constrained by volatile raw material economics and technical formulation complexity—create an environment where strategic sourcing, technological differentiation, and nimble regulatory adaptation are crucial determinants of competitive success within the market.

Segmentation Analysis

The Injectable Cocoa Fillings Market is comprehensively segmented based on several key operational and functional parameters, reflecting the diverse requirements of the industrial food manufacturing sector. Primary segmentation revolves around the physical characteristics of the filling, including the type of cocoa used (natural or alkalized), the textural properties (viscosity/flowability, ranging from highly viscous for extruded products to smooth flow for liquid injection), and the overall composition, specifically the fat content (high-fat industrial fillings versus reduced-fat options). This segmentation is crucial as performance requirements vary dramatically; for instance, fillings destined for ambient shelf-stable products require different water activity and humectant profiles than those used in deep-freeze bakery applications.

Further granularity in segmentation is achieved through application and end-user categorization. Major application segments include industrial bakery (the dominant consumer, utilizing fillings for croissants, muffins, and layer cakes), confectionery (for enrobed bars and molded chocolates), and dairy/desserts (incorporating fillings into yogurts or frozen desserts). End-user segmentation typically distinguishes between large-scale industrial food manufacturers, who demand bulk supply and highly standardized specifications, and smaller artisanal or specialty food producers requiring more flexible batch sizes and premium, niche flavor profiles. The choice of packaging—from large bulk totes (IBCs) for continuous lines to smaller pails for medium-scale operations—also serves as a minor, but relevant, segmentation axis based on operational scale.

The critical segmentation dimension driving innovation is ingredient type, specifically the shift toward clean label and sustainable formulations. Sub-segments based on ingredient types include those free from artificial colors/flavors, non-GMO verified, and certified sustainable cocoa content (e.g., Rainforest Alliance, Fair Trade). This response to consumer ethics and regulatory pressure highlights a premiumization trend within the market. Manufacturers must precisely tailor their product portfolio across these segments, offering specialized rheological solutions for each application (e.g., bake-stable fillings, freeze-thaw stable fillings), ensuring that functional performance metrics are met alongside increasingly strict demands for ingredient provenance and transparency throughout the supply chain.

- By Product Type:

- Dark Cocoa Fillings

- Milk Cocoa Fillings

- White Cocoa Fillings

- Compound Cocoa Fillings

- By Cocoa Content:

- Low Content (Below 10%)

- Medium Content (10% - 25%)

- High Content (Above 25%)

- By Application:

- Industrial Bakery (Donuts, Muffins, Pastries)

- Confectionery (Chocolate Bars, Truffles)

- Dairy and Desserts (Yogurt Inclusions, Frozen Desserts)

- Snack Food Manufacturing

- By Ingredients and Functionality:

- Bake-Stable Fillings

- Freeze-Thaw Stable Fillings

- Clean Label/Natural Fillings

- Functional/Nutraceutical Fillings (e.g., Reduced Sugar, High Protein)

Value Chain Analysis For Injectable Cocoa Fillings Market

The value chain for the Injectable Cocoa Fillings Market begins with the highly complex upstream segment involving raw material sourcing, primarily cocoa beans, sugar, fats (vegetable and cocoa butter), and stabilizing agents. Upstream activities are dominated by agricultural commodity traders and primary processors who convert raw beans into cocoa liquor, cocoa powder, and cocoa butter. Stability and ethical sourcing are paramount in this stage; price volatility of cocoa directly impacts the cost structure of the entire value chain. Key challenges include maintaining consistent quality across different crop years and ensuring adherence to sustainable farming practices, often necessitating third-party certification and rigorous testing for heavy metals and contaminants before ingredients enter the manufacturing stage.

The mid-stream segment encompasses the manufacturing and formulation of the injectable filling itself. Ingredient suppliers, specialized in emulsifiers, humectants, and texturizers, provide crucial components that dictate the filling's rheology and bake stability. Filling manufacturers utilize sophisticated processes such as high-shear mixing, homogenization, tempering, and aseptic packaging to create the final product, ensuring precise specifications for viscosity, water activity, and fat crystal structure are met. Direct distribution channels, where the filling manufacturer sells directly to large industrial food producers, are common for high-volume, standardized products, facilitating rapid technical support and streamlined logistics. Indirect distribution, leveraging specialized food ingredient distributors, is utilized for smaller clients or niche geographic markets, allowing for inventory management and specialized warehousing, particularly for temperature-sensitive fillings.

The downstream segment involves the application and final consumption. Large industrial bakeries, confectionery giants, and quick-service restaurant (QSR) suppliers are the primary end-users, integrating the injectable fillings into their automated production lines. The focus at this stage is on technical performance and integration; the filling must interact seamlessly with high-speed injection equipment, maintain its integrity through subsequent processing steps (e.g., deep freezing, proofing, baking), and deliver the desired sensory experience to the consumer. Success in the downstream market is highly dependent on the manufacturer's ability to provide technical solutions and formulation adjustments specific to the client's equipment and final product matrix, underscoring the critical role of supplier-customer partnerships in optimizing application-specific performance.

Injectable Cocoa Fillings Market Potential Customers

The primary customers for injectable cocoa fillings are large-scale industrial food manufacturers operating continuous production lines where efficiency, consistency, and stability are non-negotiable requirements. This segment includes multinational confectionery companies that produce millions of chocolate bars, molded centers, and truffles annually, requiring fillings with precise rheological characteristics for high-speed deposition equipment. Similarly, global industrial bakery corporations, responsible for mass-producing items like injected donuts, layered muffins, and specialty cookies, represent a massive customer base. Their purchasing decisions are driven by cost-in-use, performance during thermal processing (bake stability), and the filling's compatibility with their specialized injection nozzles and dosing mechanisms, prioritizing suppliers who can guarantee bulk supply and stringent quality assurance.

A second significant customer base comprises the high-volume quick-service restaurant (QSR) and food service suppliers who utilize these fillings in proprietary recipes for menu items, such as specialty desserts, breakfast pastries, and limited-time offer products. For these customers, consistency across vast geographic networks is paramount; the injectable filling must taste identical whether consumed in North America, Europe, or Asia. Furthermore, the burgeoning demand from artisanal and medium-sized specialty bakeries, particularly those focused on premium, clean label, or organic products, forms a crucial emerging customer segment. While their volume demands are lower, they typically require highly customized formulations and are willing to pay a premium for fillings that align with specific dietary claims or high-quality cocoa certifications, necessitating a tailored approach from the ingredient suppliers.

Additionally, manufacturers specializing in ready-to-eat (RTE) desserts, frozen desserts, and certain dairy applications also represent substantial potential customers. In the dairy sector, for example, injectable cocoa fillings are used as inclusions or central cores in yogurt cups or layered parfaits, requiring specific water activity levels to prevent syneresis (weeping) and maintaining structural integrity under refrigeration. For all potential customers, the purchasing cycle is highly technical, involving rigorous testing and qualification processes focused not only on flavor and texture but crucially on technical specifications like pH, moisture content, sugar crystallization points, and microbial stability, confirming the critical role of supplier technical expertise in securing long-term contracts across the industrial food landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barry Callebaut, Cargill Incorporated, Puratos Group, ADM (Archer Daniels Midland), Zeelandia, Dawn Foods, AAK AB, Tate & Lyle PLC, DSM, Döhler GmbH, Mondelēz International (Ingredients Division), Ferrero Group (Oleo-Chemicals Division), Bunge Loders Croklaan, BakeMark, IFF (International Flavors & Fragrances Inc.), BENEO, Fuji Oil Holdings Inc., Guittard Chocolate Company, Blommer Chocolate Company, Lindt & Sprüngli (Industrial Segment) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injectable Cocoa Fillings Market Key Technology Landscape

The technological landscape of the Injectable Cocoa Fillings Market is dominated by advancements in processing methods that ensure product homogeneity, extended shelf life, and precise rheological control crucial for high-speed application. High-shear mixing and homogenization technologies are fundamental, utilized to ensure fine particle dispersion, preventing graininess and stabilizing the emulsion or suspension of cocoa solids in the fat and sugar matrix. The ability to precisely control the shear rate and temperature during mixing is critical for managing fat crystallization, which directly influences the filling’s texture, stability, and flow properties during both manufacturing and subsequent end-user application, requiring specialized equipment calibrated for continuous industrial output.

Aseptic processing and ultra-high-temperature (UHT) treatment technologies are increasingly relevant, particularly for injectable fillings destined for products with long ambient shelf life or those sensitive to microbial spoilage. These technologies allow manufacturers to eliminate pathogens and significantly extend the best-before date without relying heavily on chemical preservatives, aligning with the clean label trend. Furthermore, advancements in ingredient technology, particularly modified starches, hydrocolloids, and specialized emulsifiers (often derived from natural sources), play a crucial role in stabilization. These ingredients are technologically engineered to manage water activity (Aw) and moisture migration between the filling and the surrounding food matrix, preventing the filling from drying out or causing the surrounding pastry to become soggy, which is a major technical challenge in composite food products.

Integration technology, specifically related to the industrial application, also defines the technological landscape. This includes specialized, low-pressure, high-volume injection nozzles and pump systems designed to handle highly viscous, often thixotropic, cocoa fillings without inducing separation or heat degradation. Many manufacturers are adopting advanced sensor technologies and process analytical technology (PAT) to monitor key quality attributes like viscosity and temperature in real-time, allowing for immediate feedback loops and automated adjustment of the manufacturing line. This focus on real-time quality assurance and seamless integration into automated bakery and confectionery lines emphasizes the shift towards fully digitized, consistent, and highly responsive production systems.

Regional Highlights

- North America (NA): The North American market is characterized by high levels of automation in industrial bakeries and confectionery sectors, driving demand for technically advanced, bake-stable, and freeze-thaw stable cocoa fillings. The region is a hotbed for innovation in functional fillings, emphasizing low-sugar, high-fiber, and plant-based formulations to cater to proactive health and wellness trends. The US and Canada are large volume consumers, constantly pushing for new seasonal and specialty flavor profiles, ensuring the market remains premium and driven by rapid product innovation cycles.

- Europe: Europe represents a mature but highly influential market, largely dictated by stringent regulatory standards concerning labeling, fat content, and sustainable sourcing. Western European countries, particularly Germany, the UK, and France, exhibit robust demand for premium, high-cocoa-content fillings, reflecting a preference for high-quality, authentic chocolate taste. Sustainability certifications (Fair Trade, UTZ) are critical purchasing criteria, significantly impacting supplier selection and requiring filling manufacturers to maintain transparent and traceable cocoa supply chains.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, driven by rising disposable incomes, rapid urbanization, and the westernization of dietary habits, particularly the surging popularity of packaged bakery items and chocolate confectionery. Countries like China, India, and Southeast Asian nations are experiencing massive infrastructure development in their food processing sectors, leading to a high demand for standardized, cost-effective, and performance-driven injectable cocoa fillings to support newly established high-speed production lines. Localized flavor adaptation, such as incorporating regional ingredients, also drives specific market development.

- Latin America (LATAM): The LATAM market shows promising growth, particularly in countries like Brazil and Mexico, due to a burgeoning middle class and expanding organized retail. While local production of confectionery is strong, the reliance on advanced injectable filling technology is increasing as producers seek to improve efficiency and consistency. Economic instability and high import tariffs can, however, constrain market expansion, leading to a strong preference for localized manufacturing of ingredients to mitigate currency risks.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale industrial projects in the Gulf Cooperation Council (GCC) countries, focusing on premium imported goods and high-end confectionery manufacturing targeting expatriate and affluent consumer bases. Africa, despite being the primary source of cocoa beans, relies heavily on imports of finished or semi-finished fillings, presenting long-term opportunities for localized ingredient processing aimed at improving regional value capture and reducing logistics costs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injectable Cocoa Fillings Market.- Barry Callebaut

- Cargill Incorporated

- Puratos Group

- ADM (Archer Daniels Midland)

- Zeelandia

- Dawn Foods

- AAK AB

- Tate & Lyle PLC

- DSM

- Döhler GmbH

- Mondelēz International (Ingredients Division)

- Ferrero Group (Oleo-Chemicals Division)

- Bunge Loders Croklaan

- BakeMark

- IFF (International Flavors & Fragrances Inc.)

- BENEO

- Fuji Oil Holdings Inc.

- Guittard Chocolate Company

- Blommer Chocolate Company

- Lindt & Sprüngli (Industrial Segment)

Frequently Asked Questions

Analyze common user questions about the Injectable Cocoa Fillings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical requirement for high-speed injectable cocoa fillings?

The primary technical requirement is precise rheological control, meaning the filling must maintain optimal viscosity (flowability) under shear stress for accurate injection while remaining stable (preventing migration or separation) during subsequent thermal processing or extended shelf life.

How does the clean label trend influence the formulation of injectable cocoa fillings?

The clean label trend mandates the replacement of artificial colors, flavors, and preservatives with natural alternatives and sustainable ingredients, often requiring advanced stabilization techniques (like natural hydrocolloids or UHT processing) to achieve necessary shelf life without chemical additives.

Which geographical region is projected to exhibit the highest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate due to rapid industrialization of its food processing sector, increasing consumer demand for packaged baked goods, and rising penetration of automated confectionery production lines across key economies like China and India.

What are the main challenges related to raw material procurement in the cocoa filling market?

The main challenges involve the extreme price volatility of cocoa beans driven by climate change and geopolitical factors, coupled with increasing regulatory pressure and consumer demand for certified ethical and sustainable sourcing, complicating long-term cost and supply chain management.

What is a 'bake-stable' injectable filling and why is it essential for industrial bakery?

A bake-stable filling is formulated to resist structural collapse, boiling, or migration when exposed to high temperatures during baking (up to 200°C). This stability is essential for industrial bakery to ensure the filling remains centered and texturally intact within products like croissants or muffins, guaranteeing product quality and minimizing waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager