Injectable Dermal Filler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433942 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Injectable Dermal Filler Market Size

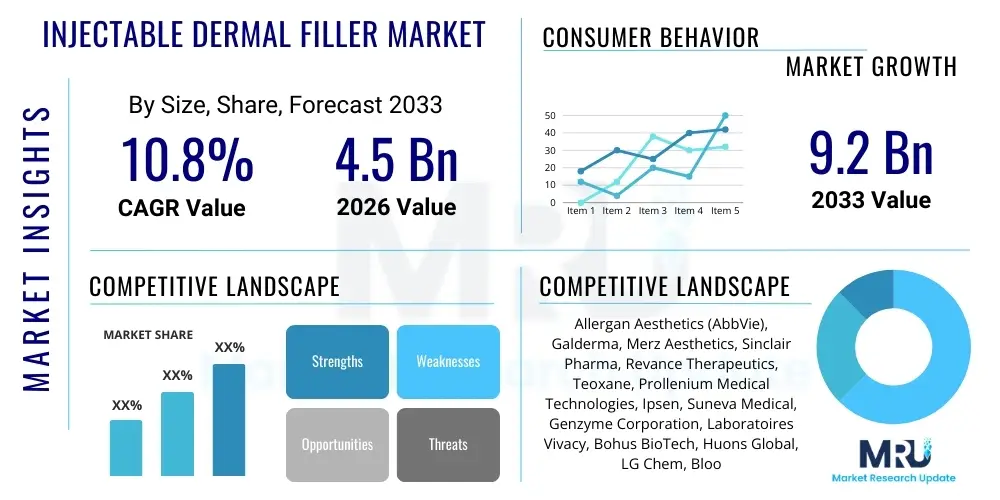

The Injectable Dermal Filler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033.

Injectable Dermal Filler Market introduction

The Injectable Dermal Filler Market encompasses medical aesthetic treatments designed to restore facial volume, minimize wrinkles, and enhance contours. These products, typically composed of biocompatible materials such as hyaluronic acid (HA), calcium hydroxylapatite (CaHA), poly-L-lactic acid (PLLA), and polymethyl methacrylate (PMMA) microspheres, are minimally invasive alternatives to traditional surgical procedures. The primary applications involve addressing signs of aging, including nasolabial folds, volume loss in cheeks and temples, lip augmentation, and correction of facial asymmetry or scarring. The increasing consumer preference for non-surgical aesthetic solutions due to minimal downtime and lower associated risks is fundamentally driving market expansion.

The market’s strong trajectory is underpinned by several benefits these procedures offer, notably immediate results, high safety profiles when administered correctly, and reversibility (in the case of HA fillers). Furthermore, product innovation focusing on longevity, specialized formulations for different facial planes (e.g., deep structural support versus superficial skin texture improvement), and integration with complementary technologies like specialized cannulas and imaging systems are enhancing treatment efficacy and patient satisfaction. Regulatory approvals in key markets, particularly in North America and Europe, for novel filler substances and indications further validate the safety and utility of these aesthetic tools, cementing their position as foundational elements of cosmetic medicine.

Key driving factors accelerating the adoption of injectable dermal fillers include the global rise in disposable incomes, expanding demographic of individuals seeking aesthetic enhancements (including younger patients seeking preventative treatments and males entering the aesthetic segment), and the pervasive influence of social media leading to increased aesthetic awareness. The availability of highly skilled practitioners, continuous aesthetic education, and robust marketing strategies by leading manufacturers are instrumental in converting consumer interest into treatment demand. Moreover, advancements in manufacturing techniques are producing purer, more cross-linked, and specialized filler materials, addressing patient needs for durability and natural-looking results.

Injectable Dermal Filler Market Executive Summary

The Injectable Dermal Filler Market is poised for substantial growth, driven by shifting societal norms favoring aesthetic optimization and rapid technological advancements in bio-compatible materials. Current business trends indicate a strong move toward portfolio diversification by major players, focusing on developing multimodal filler options that can be used synergistically for full-face rejuvenation, often termed 'liquid facelifts.' Strategic mergers, acquisitions, and licensing agreements are prevalent, allowing companies to quickly access niche technologies, particularly those related to polymer chemistry or specialized injection techniques. Furthermore, there is an increasing emphasis on developing products with built-in lidocaine or other anesthetics to enhance patient comfort during the procedure, serving as a critical differentiator in a highly competitive landscape.

Regionally, North America maintains its dominance due to high adoption rates, significant per capita expenditure on aesthetics, and a well-established regulatory framework supporting innovation. However, the Asia Pacific (APAC) region, spearheaded by countries such as China, South Korea, and India, is projected to exhibit the highest growth rate. This rapid expansion is fueled by rising medical tourism, burgeoning middle-class populations, and the strong cultural emphasis on physical appearance and youthfulness. European markets show stable growth, increasingly favoring premium, long-lasting fillers, while Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets where regulatory infrastructure is still evolving but consumer demand is accelerating.

Segmentation trends highlight the dominance of Hyaluronic Acid (HA) fillers, largely due to their proven safety record and reversibility, making them the gold standard for immediate aesthetic corrections. However, non-HA fillers, such as CaHA and PLLA, are gaining traction, especially in applications requiring long-term structural support and neocollagenesis stimulation, appealing to patients seeking more durable outcomes. The application segment sees facial rejuvenation (including wrinkle correction and volume restoration) as the primary revenue generator, while specialized applications like hand and neck rejuvenation are emerging rapidly. The end-user segment remains concentrated in dermatology clinics and aesthetic centers, which benefit from specialized infrastructure and trained medical personnel, ensuring safe and effective administration.

AI Impact Analysis on Injectable Dermal Filler Market

User queries regarding the impact of Artificial Intelligence (AI) on the Injectable Dermal Filler Market frequently revolve around precision, personalization, safety, and operational efficiency. Common themes include how AI can assist practitioners in optimizing injection sites and volumes for personalized results, the potential role of machine vision in preventing vascular occlusion or other complications, and the use of algorithms to predict patient aging patterns and long-term filler efficacy. Users are also concerned with how AI-driven diagnostics might standardize consultation processes, ensuring ethical deployment and maintaining the critical human element of aesthetic judgment, while also seeking assurances that AI integration will lead to reduced costs and improved outcomes rather than unnecessary complexity.

The integration of AI technologies is fundamentally transforming the planning and execution phases of injectable procedures. AI-powered image analysis tools utilize advanced algorithms to map facial topography, assess volume deficits precisely, and simulate post-treatment outcomes based on specific filler types and dosages. This personalized approach minimizes subjective variability inherent in manual aesthetic assessment, leading to more predictable and aesthetically harmonious results. Furthermore, AI contributes significantly to risk mitigation; algorithms trained on vast datasets of facial vascular anatomy and injection techniques can provide real-time guidance during procedures, alerting practitioners to high-risk areas and improving overall patient safety protocols, a major concern in the aesthetic field.

Beyond clinical applications, AI is also enhancing market operations, particularly in patient management and supply chain logistics. Predictive analytics are being employed by manufacturers and large aesthetic chains to forecast demand for specific filler types, optimize inventory levels, and manage expiration dates efficiently. In terms of consumer engagement, AI chatbots and virtual consultation platforms are automating initial screening, educating patients on filler options, and scheduling appointments, streamlining the patient journey from inquiry to procedure. This pervasive influence across R&D, clinical practice, and commercial operations positions AI as a core enabler of future market growth and standardization.

- AI facilitates high-precision facial mapping and volume assessment, enabling personalized treatment plans.

- Machine learning algorithms assist in real-time risk assessment, specifically preventing vascular events during injection.

- Virtual reality and augmented reality (AR) powered by AI are used for pre-procedure patient outcome simulation and training.

- AI-driven image recognition standardizes the assessment of pre- and post-treatment results and filler longevity.

- Predictive analytics optimize supply chain management, inventory forecasting, and demand planning for manufacturers.

- AI enhances practitioner training through simulation platforms offering objective performance feedback.

DRO & Impact Forces Of Injectable Dermal Filler Market

The Injectable Dermal Filler Market is powerfully shaped by an interplay of driving factors (D), regulatory and resource limitations (R), and expansion opportunities (O), creating significant impact forces. The primary drivers revolve around demographic shifts, including the aging global population and the sustained consumer demand for minimally invasive cosmetic procedures offering rapid recovery and natural results. This sustained demand is coupled with relentless innovation in material science, yielding longer-lasting, safer, and highly specialized filler formulations. However, restraining forces include the high cost of premium products and procedures, the potential for serious adverse events (though rare), and stringent regulatory pathways that can delay the commercialization of novel materials. Opportunities are vast, primarily through expanding into emerging geographical markets, developing specialized fillers for new anatomical sites (e.g., body contouring), and leveraging digital platforms for personalized consultation and education.

Drivers: The dominant force propelling the market is the cultural acceptance and mainstream adoption of aesthetic treatments, significantly amplified by digital media and celebrity endorsement, normalizing these procedures across wider demographic segments. Furthermore, the aesthetic industry is benefiting from the development of highly specialized injection techniques, suchately blunt-tip cannulas and advanced cross-hatching methods, which improve safety and efficacy, bolstering consumer confidence. The availability of reversal agents (like hyaluronidase for HA fillers) serves as a crucial safety net, mitigating risk perception and encouraging broader patient participation. The disposable income growth in developing nations further accelerates the access and utilization of these aesthetic services, creating a vast and untapped consumer base eager for preventative and corrective aging solutions.

Restraints: Despite strong market performance, several factors limit unfettered growth. The presence of counterfeit or unregulated filler products, especially in less regulated markets, poses a severe threat to patient safety and trust in the genuine product market. Another significant restraint is the necessity for highly trained, certified practitioners; improper technique can lead to suboptimal results or, in severe cases, complications like necrosis or vision loss, highlighting the dependency on specialized expertise. Economic downturns or inflation can classify aesthetic treatments as discretionary spending, leading to temporary market contraction. Moreover, the cyclical nature of product preference and the high research and development costs associated with generating clinical data for regulatory approvals also act as financial restraints on smaller innovators.

Opportunities: Future growth is heavily dependent on capitalizing on emerging opportunities. The expansion of indications beyond the face to areas such as hands, décolletage, and even non-surgical buttock and breast augmentation represents a substantial market opportunity. Developing bio-stimulatory fillers that offer both immediate volume correction and long-term collagen production presents a dual-benefit proposition highly attractive to consumers seeking sustained results. Furthermore, the integration of regenerative medicine principles, such as utilizing platelet-rich plasma (PRP) alongside fillers, offers combined treatment modalities. Strategic partnerships between manufacturers and large aesthetic clinic chains focusing on advanced training and standardized protocols will ensure sustained quality control, opening new pathways for market penetration and consumer loyalty.

- Drivers: Increasing geriatric population and aesthetic consciousness; high demand for minimally invasive procedures; continuous material innovation improving safety and longevity; positive influence of social media and celebrity endorsements.

- Restraints: Risk of side effects and complications (e.g., vascular occlusion); high procedure costs limiting access for lower-income groups; prevalence of unlicensed and counterfeit products; regulatory hurdles for novel formulations.

- Opportunities: Geographic expansion into high-growth APAC and LATAM markets; development of niche fillers for specific anatomical targets (e.g., specialized lip or tear trough fillers); technological integration (AI/3D imaging) for enhanced precision; rising male aesthetic segment.

- Impact Forces: Strong product differentiation based on longevity and rheological properties; significant investment in professional training and education required to mitigate safety risks; price sensitivity in competitive regional markets; rapid technological obsolescence necessitating continuous R&D expenditure.

Segmentation Analysis

The Injectable Dermal Filler Market segmentation provides a granular view of product preference, application usage, and end-user uptake, which are critical for strategic market positioning. The market is primarily segmented based on the type of material, differentiating between temporary, semi-permanent, and permanent fillers, with temporary Hyaluronic Acid (HA) fillers dominating the landscape due to their established safety profile and reversibility. Segmentation by application highlights facial volume restoration, wrinkle reduction, and lip augmentation as the largest revenue streams, reflecting the highest consumer needs related to age correction and aesthetic enhancement. Analyzing these segments helps stakeholders understand prevailing consumer choices, identify high-growth niches, and allocate resources effectively toward product development and targeted marketing initiatives.

Further segmentation by end-user illustrates the primary distribution and administration channels. Dermatology clinics and aesthetic centers remain the foundational end-users, given their specialized equipment, sterile environments, and access to highly trained personnel necessary for safe procedures. However, the rise of medi-spas and specialized beauty clinics, especially in urban areas, indicates a slight shift in distribution channels, requiring manufacturers to tailor product sizes and packaging accordingly. Geographical segmentation underscores disparities in adoption rates and regulatory environments, with developed regions setting trends in terms of material innovation and emerging regions driving volume growth based on affordability and increasing access to aesthetic services.

Understanding the interplay between these segments is vital for predicting future market direction. For instance, the growing preference for bio-stimulatory non-HA fillers indicates a market shift toward long-term collagen remodeling, demanding strategic investment in PLLA and CaHA research. Simultaneously, the sustained dominance of HA fillers ensures continuous demand for high-quality, specialized cross-linking technologies. Companies must therefore maintain a balanced portfolio, catering to the mass-market demand for reversible HA options while concurrently expanding their offerings in the niche, high-value, long-term correction segment to capture maximum market share across diverse consumer preferences.

- By Type:

- Hyaluronic Acid (HA) Fillers

- Calcium Hydroxylapatite (CaHA) Fillers

- Poly-L-Lactic Acid (PLLA) Fillers

- Polymethyl Methacrylate (PMMA) Fillers

- Fat Fillers (Autologous)

- By Application:

- Wrinkle Correction

- Facial Volume Restoration (Cheeks, Temples)

- Lip Augmentation

- Rhinoplasty (Non-surgical Nose Job)

- Scar Treatment

- Hand Rejuvenation

- By End-User:

- Dermatology Clinics

- Aesthetic Centers and Medical Spas

- Hospitals

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia Pacific (China, Japan, South Korea, India, Australia)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC Countries, South Africa)

Value Chain Analysis For Injectable Dermal Filler Market

The value chain for the Injectable Dermal Filler Market begins with intensive upstream activities focused on raw material procurement and highly specialized manufacturing. Upstream analysis involves sourcing pharmaceutical-grade components, primarily hyaluronic acid derived through fermentation or synthesis, and specialized polymers for non-HA fillers. This phase demands strict quality control, compliance with Good Manufacturing Practices (GMP), and significant investment in R&D to optimize cross-linking technology and ensure product purity, biocompatibility, and optimal rheological properties (viscosity and elasticity). Key suppliers often specialize in high-purity chemical components, forming a critical, capital-intensive segment of the value chain, where product safety is paramount and differentiation is achieved through patented material modifications.

The core of the value chain is the manufacturing and branding stage, where major pharmaceutical and aesthetic companies convert raw materials into final, pre-filled syringes. Distribution channels are highly regulated and typically rely on specialized logistics to ensure product integrity, particularly for temperature-sensitive products. Direct distribution models are often employed for key accounts (large clinic chains) to maintain control over pricing, training, and brand message integrity. Indirect channels utilize authorized distributors and wholesalers, particularly in smaller or geographically distant markets, requiring robust contracts to prevent diversion or the infiltration of counterfeit products, which poses a substantial threat to the brand equity and patient safety.

Downstream analysis centers on the point of consumption, primarily aesthetic clinics and certified medical professionals. This stage is characterized by high service intensity, as successful outcomes depend heavily on practitioner skill, consultation quality, and customized treatment planning. The value addition at this stage includes professional expertise, patient education, and post-procedure care. Marketing and sales efforts are strategically channeled toward educating practitioners and generating consumer pull through digital platforms and social media, creating a direct link between manufacturer R&D superiority and consumer choice, thereby maximizing brand influence within the clinical environment and ensuring the integrity of product administration.

Injectable Dermal Filler Market Potential Customers

Potential customers and end-users of injectable dermal fillers are predominantly individuals seeking aesthetic enhancements, anti-aging solutions, or facial structure improvements, categorized primarily by demographic and psychographic factors. The core buyer demographic includes women aged 35 to 65 who possess higher disposable incomes and are proactively addressing signs of aging, such as volume loss, deep wrinkles, and sagging skin. This segment prioritizes minimally invasive procedures offering high efficacy, quick recovery, and results that appear natural. They are typically well-informed consumers, relying on recommendations from certified dermatologists or plastic surgeons, and actively research product specifications, particularly concerning safety and longevity.

The emerging high-growth segment includes younger adults (20s and 30s) who seek "prejuvenation" (preventative aging treatments) and feature enhancements, particularly lip augmentation and non-surgical contouring (e.g., jawline and chin definition). This younger demographic is heavily influenced by social media aesthetics and trends, exhibiting less tolerance for invasive procedures and favoring quick, affordable, and reversible options, making HA fillers highly appealing. Furthermore, the male aesthetic segment is rapidly growing, focusing mainly on jawline sculpting, temple hollowing correction, and facial balancing, demanding specialized marketing and product approaches that address male facial anatomy and aesthetic goals.

From an institutional perspective, the immediate buyers are the medical professionals and facilities administering the products. This includes board-certified plastic surgeons, dermatologists, and licensed aesthetic physicians who act as gatekeepers for the end-user. Manufacturers must therefore view these practitioners as crucial customers, focusing resources on providing superior product training, clinical support, and ensuring reliable supply chains. Institutional customers prioritize product predictability, low complication rates, breadth of product line (rheological properties for various injection depths), and strong brand reputation to maintain clinical excellence and attract a loyal patient base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allergan Aesthetics (AbbVie), Galderma, Merz Aesthetics, Sinclair Pharma, Revance Therapeutics, Teoxane, Prollenium Medical Technologies, Ipsen, Suneva Medical, Genzyme Corporation, Laboratoires Vivacy, Bohus BioTech, Huons Global, LG Chem, Bloomage BioTechnology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Injectable Dermal Filler Market Key Technology Landscape

The Injectable Dermal Filler Market is technologically sophisticated, driven by continuous innovation in material science and delivery systems. The cornerstone technology remains the cross-linking of Hyaluronic Acid (HA) molecules, where proprietary methods—such as Vycross (AbbVie/Allergan), NASHA (Galderma), and patented CPM (Merz)—are employed to enhance viscoelastic properties, longevity, and resistance to enzymatic degradation. These technologies dictate how soft or rigid a filler is, determining its suitability for specific anatomical depths and aesthetic goals, ranging from superficial fine lines to deep bone-like contouring. Furthermore, microparticle technology is crucial for non-HA fillers like CaHA and PMMA, ensuring uniform suspension and optimal biological integration for sustained neocollagenesis.

Beyond the composition, advancements in injection techniques and delivery hardware significantly impact the procedural landscape. The transition from sharp needles to blunt-tip micro-cannulas is a major technological shift, widely adopted to minimize vascular trauma, bruising, and patient discomfort. Complementary technologies, such as advanced 3D imaging and mapping systems (e.g., Vectra 3D), are increasingly utilized to perform objective facial analysis, plan treatment volumes with millimeter accuracy, and provide realistic simulations to the patient. These digital tools enhance the consistency and predictability of aesthetic outcomes, significantly boosting consumer confidence and professional liability management.

The emerging technological frontier focuses on bio-stimulatory mechanisms and the development of intelligent, next-generation materials. Research is heavily invested in creating fillers that actively interact with host tissue, encouraging natural collagen and elastin production long after the initial volume has dissipated. This includes sophisticated PLLA formulations and peptide-infused gels designed not just to fill, but to fundamentally improve skin quality and structure. Additionally, the development of specialized fillers for diverse ethnic skin types and for challenging anatomical areas (such as the tear trough or thin skin regions) demands precise rheology and low water absorption capacity, fueling intense R&D efforts aimed at highly refined, customizable product characteristics.

Regional Highlights

The global Injectable Dermal Filler Market exhibits distinct regional dynamics shaped by cultural perceptions, regulatory maturity, and economic development. North America, particularly the United States, represents the largest market share, characterized by high consumer awareness, widespread acceptance of aesthetic procedures, and a highly evolved commercial and regulatory environment. The region benefits from a high concentration of key market players, advanced aesthetic training infrastructure, and significant consumer willingness to spend on premium, technologically advanced filler products. The U.S. remains the global leader in innovation adoption and procedural volume, setting pricing benchmarks and treatment standards for the rest of the world.

Europe constitutes a mature market with stable growth, driven by countries like Germany, France, and the UK. European consumers often favor products with proven clinical safety and a strong emphasis on natural results. The regulatory landscape, influenced by the Medical Device Regulation (MDR) which sets high standards for device safety and performance, impacts market entry and product timelines but ensures consumer protection. The APAC region, however, is the engine of future growth, propelled by the aesthetic boom in South Korea and China. South Korea, often considered a global trendsetter in aesthetic medicine, drives demand for highly specialized, affordable, and rapidly evolving filler technologies, while China’s vast, growing middle class represents the largest untapped consumer base for volume expansion. Latin America (LATAM), led by Brazil and Mexico, also shows vigorous growth, reflecting a strong cultural appreciation for aesthetic maintenance, despite economic volatility and less stringent regulatory oversight in some jurisdictions.

- North America (Dominant Market): High disposable income, established aesthetic culture, stringent FDA approval fostering consumer trust, and significant expenditure on R&D for next-generation fillers.

- Asia Pacific (Fastest Growing Market): Driven by high aesthetic consciousness in South Korea and China, growing medical tourism, increasing accessibility of treatments, and rising influence of K-Beauty trends.

- Europe (Mature Market): Strong focus on safety and established clinical evidence due to stringent MDR requirements; high demand for long-lasting, quality-certified products; stable adoption across Western European countries.

- Latin America: High penetration rates in Brazil and Mexico reflecting a cultural preference for cosmetic enhancements; significant demand for affordable and general-purpose HA fillers.

- Middle East & Africa (MEA): Emerging market characterized by increasing wealth accumulation, particularly in GCC countries, leading to a rise in aesthetic procedure expenditure, often catering to high-end clientele seeking international standards of care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Injectable Dermal Filler Market.- Allergan Aesthetics (An AbbVie Company)

- Galderma SA

- Merz Aesthetics

- Sinclair Pharma (A Huadong Medicine Company)

- Revance Therapeutics Inc.

- Teoxane Laboratories

- Prollenium Medical Technologies Inc.

- Ipsen S.A.

- Suneva Medical Inc.

- Genzyme Corporation (A Sanofi Company)

- Laboratoires Vivacy

- Bohus BioTech AB

- Huons Global

- LG Chem

- Bloomage BioTechnology

- Lumenis Ltd.

- Aesthetics Biomedical Inc.

- Dr. Korman Laboratories

- Zimmer Biomet Holdings Inc.

- Medicis Pharmaceutical Corporation (Bausch Health)

Frequently Asked Questions

Analyze common user questions about the Injectable Dermal Filler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Injectable Dermal Filler Market?

The Injectable Dermal Filler Market is projected to grow at a robust CAGR of 10.8% during the forecast period from 2026 to 2033, driven by increasing consumer demand for minimally invasive aesthetic procedures globally.

Which type of injectable dermal filler currently holds the largest market share?

Hyaluronic Acid (HA) fillers currently dominate the market share. Their leading position is attributed to their excellent safety profile, high biocompatibility, versatility across various facial applications, and the critical advantage of reversibility.

What are the primary factors restraining growth in the dermal filler industry?

Key restraints include the potential for rare but serious complications (such as vascular occlusion), the high initial cost of premium filler products, and the pervasive challenge posed by the circulation of counterfeit and unlicensed products in unregulated markets.

How does the integration of AI impact the administration of dermal fillers?

AI significantly impacts filler administration by providing high-precision facial mapping, personalized volume assessment for injection planning, and real-time risk mitigation warnings, thereby enhancing procedure safety and optimizing aesthetic outcomes for patients.

Which geographical region is anticipated to demonstrate the fastest growth rate in the market?

The Asia Pacific (APAC) region, particularly South Korea and China, is projected to exhibit the fastest growth rate, fueled by rising aesthetic consciousness, expanding middle-class demographics, and increasing access to affordable aesthetic treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager