Inlaying Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434842 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Inlaying Machine Market Size

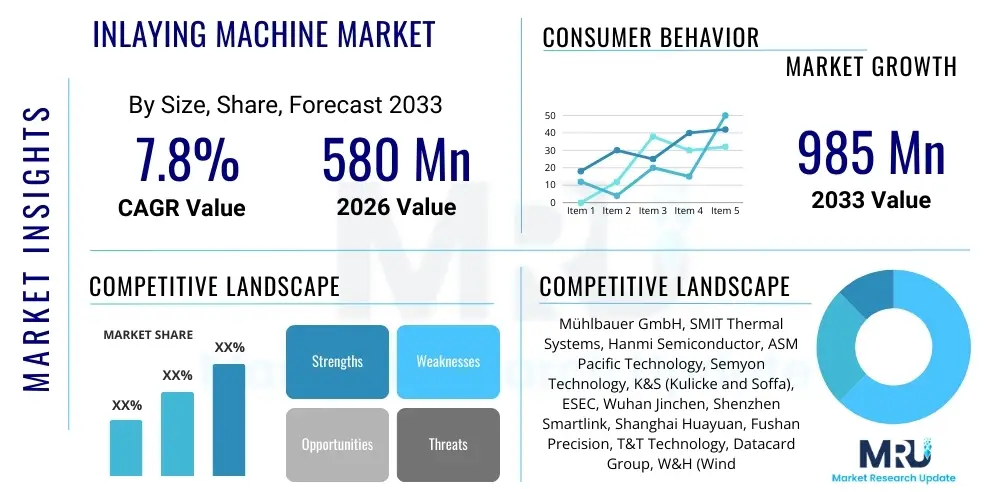

The Inlaying Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $985 Million by the end of the forecast period in 2033.

Inlaying Machine Market introduction

The Inlaying Machine Market encompasses specialized industrial equipment designed for accurately embedding materials, typically microchips, antennas, or decorative elements, into a substrate material such as plastic sheets, paper, wood, or textiles. These machines are crucial in the manufacturing of smart cards, RFID tags, electronic passports, and various decorative products where precision and high throughput are essential. The core functionality involves complex handling, alignment, bonding, and testing processes to ensure the embedded components function correctly and are structurally secure within the host material.

The increasing global demand for contactless technology, driven by growth in payment systems, logistics, inventory management, and secure identification documents, directly fuels the need for advanced inlaying machines. These modern systems offer high-speed, non-contact methods for embedding fragile electronic components, significantly improving production efficiency and yield rates compared to manual or older semi-automatic processes. Furthermore, the push towards miniaturization and flexible electronics necessitates the development of next-generation inlaying equipment capable of handling extremely thin and delicate materials with micron-level accuracy, ensuring market relevance across diverse high-tech sectors.

Key applications span across the electronics industry, particularly for smart banking cards (EMV), government identification cards (e-ID, e-passports), and the rapidly expanding Internet of Things (IoT) ecosystem, which relies heavily on high-volume production of cost-effective RFID tags for supply chain visibility. The primary benefits derived from these machines include enhanced production speed, reduced material waste, superior product quality consistency, and the ability to integrate multiple manufacturing steps (such as laminating and testing) into a single, cohesive line. These factors collectively position the inlaying machine market as a vital contributor to the global digital transformation.

Inlaying Machine Market Executive Summary

The Inlaying Machine Market is witnessing robust growth, underpinned by accelerating adoption of RFID technology in retail and logistics, coupled with continuous advancements in smart card security features. Current business trends emphasize the shift towards fully automated, modular machine designs that offer greater flexibility in handling varied substrate materials and component sizes. Key players are focusing on integrating real-time monitoring and diagnostic capabilities (Industry 4.0 readiness) to minimize downtime and optimize operational efficiency, thereby addressing the high-volume, low-margin demands of the electronic component manufacturing sector. Furthermore, sustained investments in research and development are targeting ultra-fine pitch embedding techniques required for advanced flexible electronics applications.

Regionally, the Asia Pacific (APAC) continues its dominance, driven by massive manufacturing capacities in electronics, smart devices, and high-volume production of government identification documents in countries like China, South Korea, and India. This region benefits from lower operating costs and established supply chains for electronic components, making it a pivotal hub for both consumption and production of inlaying equipment. Meanwhile, North America and Europe show steady demand, primarily focused on upgrading existing machinery to incorporate higher security standards (e.g., biometric smart cards) and integrating advanced automation features to counteract rising labor costs and ensure compliance with stringent quality regulations.

Segment trends indicate that the fully Automatic Inlaying Machine segment is experiencing the highest growth rate, largely due to its superior throughput and minimal human intervention requirements, which are crucial for maintaining profitability in high-volume production environments like RFID tag manufacturing. In terms of application, the Smart Cards and RFID Tags segments remain the primary revenue drivers. However, emerging applications, such as the embedding of specialized sensors in medical devices or luxury packaging, are showcasing significant potential, prompting manufacturers to diversify their product offerings to cater to these specialized niche markets that prioritize precision over pure speed.

AI Impact Analysis on Inlaying Machine Market

Users frequently inquire whether Artificial Intelligence (AI) can autonomously manage complex alignment and defect detection processes, how machine learning optimizes material handling, and what the long-term implications are for human operators. These concerns highlight a strong expectation that AI will transition inlaying machines from fixed-process equipment to smart, adaptive manufacturing systems. The common themes center on AI's ability to dramatically reduce error rates associated with micron-level placement of sensitive components and its potential to predict equipment failure before it impacts production yield. Users are specifically looking for evidence of AI-driven optimization in thermal bonding profiles and real-time adjustment of machine parameters based on fluctuating material properties, aiming for zero-defect manufacturing.

The integration of AI, particularly through sophisticated computer vision systems and predictive maintenance algorithms, is poised to revolutionize the operational efficiency and precision of inlaying machines. AI-enhanced vision systems can perform instantaneous quality checks on every embedded component, far surpassing the speed and consistency of traditional optical inspection methods, allowing for immediate corrective action and vastly reducing batch rejection rates. Furthermore, machine learning models analyze historical operational data—including vibration analysis, temperature fluctuations, and throughput metrics—to accurately predict potential mechanical failures, enabling proactive maintenance scheduling and extending the lifespan of critical machine components such as bonding heads and feeders.

This technological shift transforms the role of inlaying machines from simple automated tools into intelligent manufacturing assets capable of self-optimization. By applying reinforcement learning, the machines can dynamically adjust variables such as pressure, temperature, and material feed rates based on environmental conditions and material batch variations, ensuring optimal embedding quality regardless of external factors. This adaptability is critical for manufacturing complex inlays used in high-security applications, where even minor defects can render the final product unusable, thereby solidifying AI’s role as a core driver for future innovation in the market.

- AI-Powered Defect Detection: Real-time, high-speed inspection using computer vision to identify micro-defects in embedded components and substrates.

- Predictive Maintenance: Machine learning algorithms analyze sensor data to forecast equipment failure, minimizing unplanned downtime and optimizing component replacement cycles.

- Process Optimization: Dynamic adjustment of bonding parameters (temperature, pressure) based on material feedback, ensuring consistent inlay quality across different batches.

- Throughput Enhancement: AI models optimize material handling robotics and component placement sequencing, significantly increasing overall production speed (pieces per hour).

- Energy Efficiency: Optimization of machine operation cycles to reduce energy consumption without compromising speed or quality, contributing to lower operating costs.

DRO & Impact Forces Of Inlaying Machine Market

The Inlaying Machine Market is primarily driven by the massive global adoption of smart devices and secured identity documents, necessitating high-speed, high-precision embedding technologies. However, the market faces significant restraints related to the high initial capital expenditure required for purchasing fully automated systems and the constant pressure from end-users to reduce per-unit manufacturing costs. Opportunities emerge from the untapped potential in flexible electronics, IoT sensor embedding, and the growing niche market of decorative inlays using advanced materials. These forces create a dynamic environment where technological innovation in precision engineering is crucial for overcoming cost-related barriers and seizing new application areas.

Drivers: The dominant driver is the pervasive demand for RFID tags across retail, logistics, and healthcare for improved inventory management and tracking, requiring billions of inlays annually. This volume demand necessitates continuous technological scaling of inlaying machines. Furthermore, government mandates worldwide for secure e-passports and biometric identification cards require machinery that can handle complex multi-layer substrates and achieve extremely low tolerance limits for embedded chip placement, reinforcing the demand for high-end, precise automated systems. The transition from legacy magnetic stripe technology to modern chip-based solutions (EMV migration) continues to provide a foundational demand base.

Restraints: The most prominent restraint is the prohibitive cost associated with acquiring and maintaining highly sophisticated, fully automatic inlaying equipment, which often limits adoption among smaller manufacturers or those in developing economies. Additionally, the rapid pace of technological obsolescence in the semiconductor and electronics sectors means that manufacturers must frequently upgrade or replace machinery to remain competitive, leading to significant lifecycle management challenges. Another constraint is the specialized technical expertise required to operate and maintain these high-precision machines, contributing to skilled labor shortages in certain regions.

Opportunities: Significant future growth opportunities lie in the expansion of the IoT sector, particularly in embedding micro-sensors into textiles (wearables) and smart packaging materials, demanding new flexible and lightweight inlaying solutions. The ongoing development of 5G infrastructure also creates potential for specialized inlaying requirements for miniature antennas and passive components in new device form factors. Furthermore, optimization through AI integration represents a substantial opportunity to improve efficiency and reduce defects, offering competitive advantages to early adopters.

Impact Forces: The most significant impact force is technological change; constant innovation in materials science and microchip design forces inlaying machine manufacturers to adapt rapidly. Economic forces, particularly fluctuating raw material prices (like copper for antennas or specialized plastics), influence production costs and ultimately the pricing structure of the machinery. Regulatory forces, centered around data security standards (e.g., GDPR, national ID security protocols), mandate higher levels of precision and quality control, thereby raising the operational complexity of the machinery and indirectly impacting market dynamics.

Segmentation Analysis

The Inlaying Machine Market segmentation provides a granular view of equipment types, their primary functionalities, and the diverse end-user applications they serve. Analyzing these segments helps stakeholders understand the current investment patterns, emerging areas of high growth, and the differentiated needs of various industries, from high-volume standardized production to highly customized precision manufacturing. Segmentation by type typically differentiates based on automation level and throughput capacity, while application segmentation reveals the dominant drivers of revenue and future potential.

The market is predominantly segmented by the degree of automation, distinguishing between fully automatic, semi-automatic, and manual systems. Fully automatic machines, characterized by continuous operation, integrated quality control, and minimal human interaction, command the largest market share and are projected to exhibit the fastest growth due to their suitability for mass production environments like RFID tag manufacturing. Conversely, semi-automatic and manual systems cater to smaller batch production, specialized prototyping, or environments where flexibility and low volume are prioritized over pure speed.

Segmentation by end-user application is crucial, as the precision requirements and material handling techniques vary dramatically between sectors. The Electronics & Semiconductor segment, encompassing smart card and RFID production, remains the backbone of the market. However, the emerging use of inlaying technology in specialized sectors such as advanced Packaging (for track-and-trace security features) and Luxury Goods (for unique authentication and decorative embellishments) offers diversified revenue streams and demands specialized machine adaptations for handling sensitive and premium materials.

- By Type:

- Fully Automatic Inlaying Machines

- Semi-Automatic Inlaying Machines

- By Application:

- Smart Cards (Banking, ID, Access Control)

- RFID Tags and Labels (Logistics, Retail, Healthcare)

- Electronic Devices and Components (Flexible PCBs, Sensors)

- Decorative Inlays (Woodworking, Furniture, Luxury Items)

- By End-User Industry:

- Electronics and Semiconductor

- Security and Government

- Packaging and Logistics

- Luxury Goods and Crafts

- Automotive

Value Chain Analysis For Inlaying Machine Market

The value chain for the Inlaying Machine Market is characterized by highly specialized upstream component suppliers, stringent manufacturing and assembly processes, and a highly selective downstream distribution network. The upstream segment involves procuring precision components, including sophisticated motion control systems, high-accuracy vision systems, laser cutting equipment, and specialized thermal bonding units. Key suppliers often specialize in industrial automation and optics, ensuring the core functionality of the inlaying process, which relies heavily on micron-level positioning accuracy and reliable thermal cycling, demanding close collaboration and quality assurance between component vendors and the primary machine manufacturers.

In the midstream, machine manufacturers undertake complex integration, software development, and rigorous testing before machine deployment. Given the bespoke nature of many high-throughput inlaying systems—often customized for specific card or tag formats—the assembly phase requires skilled engineering teams. The downstream activities involve distribution, installation, customer training, and critical aftermarket support, including maintenance, spare parts supply, and process optimization consulting. Distribution channels typically operate through a mix of direct sales teams for large, global electronics manufacturers and specialized, regional distributors who possess the local expertise required for market penetration and post-sales technical support in developing regions.

Direct distribution, managed by the original equipment manufacturer (OEM), is preferred for major clients, high-security government contracts, and complex, high-value machinery purchases, as it allows for better control over pricing, service quality, and customized configuration. Indirect channels, utilizing independent agents or system integrators, are often employed to reach smaller enterprises or penetrate geographically dispersed markets, particularly in APAC and Latin America, where local partnerships facilitate easier logistics and cultural navigation. Effective after-sales service, including remote diagnostics and rapid spare parts supply, constitutes a significant portion of the total value offered, as machine downtime is immensely costly in high-volume production environments.

Inlaying Machine Market Potential Customers

Potential customers for inlaying machines are overwhelmingly concentrated within large-scale electronic manufacturing and high-security document production sectors, where the need for embedding components is paramount. Primary buyers include smart card manufacturers specializing in financial (EMV), telecommunication (SIM), and identification (e-ID, e-passport) applications. These entities require automated, high-speed machines capable of handling diverse chip modules and antenna layouts while meeting stringent ISO security and durability standards.

The logistics and retail sectors, through their reliance on RFID technology for supply chain visibility and anti-theft measures, constitute a rapidly expanding customer base. Companies that mass-produce RFID labels and tags, from basic sticky labels to robust industrial tags, are continuous purchasers of high-throughput automatic inlaying systems. Furthermore, global security printers and government agencies that manage the production of secure documents are essential end-users, demanding top-tier, certified machinery capable of handling sensitive materials under strict quality control protocols.

Emerging customers include manufacturers in the advanced packaging, textile, and medical device industries. For instance, textile companies embedding tiny, washable NFC chips into apparel for inventory or authentication, and medical device firms incorporating sensors into diagnostic consumables, represent niche markets demanding specialized, highly precise low-volume machines. These customers prioritize flexibility and material compatibility over sheer speed, driving demand for modular and customizable inlaying solutions that can handle non-traditional substrates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $985 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mühlbauer GmbH, SMIT Thermal Systems, Hanmi Semiconductor, ASM Pacific Technology, Semyon Technology, K&S (Kulicke and Soffa), ESEC, Wuhan Jinchen, Shenzhen Smartlink, Shanghai Huayuan, Fushan Precision, T&T Technology, Datacard Group, W&H (Windmöller & Hölscher), LPKF Laser & Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inlaying Machine Market Key Technology Landscape

The technological landscape of the Inlaying Machine Market is defined by the critical need for ultra-high precision, high throughput, and seamless integration with related manufacturing steps such as lamination and testing. Core technologies involve sophisticated motion control systems, utilizing linear motors and high-resolution encoders to achieve micron-level accuracy in component placement, essential for maintaining the integrity and function of miniature electronic inlays. Advancements in non-contact bonding methods, primarily thermal compression and ultrasonic welding, are crucial, enabling strong, durable embedding without damaging fragile chips or antennas, supporting the ongoing shift toward thinner card bodies and flexible substrates.

Optical and sensor technologies play a crucial supporting role. Advanced vision systems, often incorporating machine learning, are deployed for real-time alignment verification (compensating for minor material shifts) and 100% defect inspection post-embedding. This focus on automated quality control is paramount in the security document sector. Furthermore, the push towards Industry 4.0 readiness means that networking capabilities, modular machine architecture, and standardized interfaces (like SEMI standards in semiconductor manufacturing) are becoming standard requirements, facilitating remote diagnostics, preventative maintenance, and seamless data exchange within factory management systems.

A key differentiation factor lies in the antenna processing technology. Modern machines often integrate complex processes such as copper etching, wire bonding, or laser direct structuring (LDS) for antenna formation directly onto the substrate before chip embedding. The continuous evolution of chip module types—from standard modules to tiny, flexible micro-inlays—necessitates flexible tooling and quick-changeover capabilities, making modular design a technological imperative. The convergence of these precision mechanics, advanced optics, and smart software defines the competitive edge in the modern inlaying machine market.

Regional Highlights

The global Inlaying Machine Market exhibits significant regional disparities in demand drivers, technological maturity, and market concentration. Asia Pacific (APAC) dominates the market share and growth trajectory due to its position as the global manufacturing hub for electronics, smart cards, and consumer devices. North America and Europe, while possessing smaller market shares in terms of volume, lead in terms of technological adoption, high-security applications, and the implementation of sophisticated, AI-driven automation systems.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven by immense production volumes of low-cost RFID tags for retail and logistics, and government-led initiatives for mass issuance of national ID cards and e-passports in countries like China, India, and Southeast Asian nations. The region benefits from competitive labor costs, strong government support for electronics manufacturing, and the presence of numerous domestic inlaying machine suppliers who compete fiercely on pricing and localized service, thereby driving high adoption rates across the entire spectrum of automation levels.

The high density of semiconductor and electronics assembly operations in Taiwan, South Korea, and China ensures a consistent requirement for state-of-the-art inlaying solutions capable of handling next-generation flexible PCBs and embedded sensors for 5G devices. Furthermore, the strategic focus on high-speed rail and urban infrastructure development necessitates large quantities of automated access control and payment systems, further stimulating demand for efficient smart card inlay production. Local manufacturers often prioritize scalability and integration capabilities to match the complex, multi-stage production lines common in large Asian manufacturing facilities.

While price sensitivity remains a factor, there is increasing demand for quality and precision, particularly from international electronics firms operating within the region, pushing local suppliers to improve technical specifications and reliability. This dual focus on cost efficiency and technical performance is a defining characteristic of the APAC inlaying machine landscape. The region's robust supply chain facilitates quicker deployment and easier maintenance, solidifying its dominant position throughout the forecast period.

- North America: The North American market is characterized by high demand for quality, reliability, and advanced security features, primarily driven by the financial sector (high-security EMV cards) and high-value logistics where RFID usage ensures compliance and tracking of expensive goods. While production volumes are lower than in APAC, the region commands premium pricing for machinery that incorporates the latest technologies, such as advanced laser bonding and integrated AI inspection systems. The emphasis is heavily placed on maximizing uptime and minimizing defects due to the high cost of production interruption.

Regulatory compliance, particularly concerning secure document production (e.g., passports and military identification), is a major driver, ensuring that only certified, high-precision equipment is utilized. Key end-users include governmental facilities and specialized high-security printers. The market is moderately mature, with most investment directed towards replacing aging equipment with highly automated, energy-efficient models capable of integration with modern factory management systems. Innovation in materials handling for non-traditional substrates, particularly flexible electronics for aerospace and high-end consumer goods, is another key area of focus.

The presence of major technology innovators and strong R&D ecosystems contributes to the sustained demand for cutting-edge machinery. North American companies often invest in solutions that reduce the reliance on manual labor, opting for machines that provide comprehensive diagnostics and remote service capabilities, aligning with the region's high operational expenditure environment.

- Europe: Europe is a technologically advanced, mature market exhibiting steady growth, largely driven by the stringent regulatory environment governing data security and identification (GDPR, EU e-ID framework). Demand is sustained by the continuous renewal of national identity card programs, advanced banking card replacements, and the expanding adoption of specialized industrial RFID applications in automotive manufacturing and pharmaceuticals. European manufacturers prioritize sustainability and energy efficiency in their machine designs.

European machine builders are globally recognized for their quality engineering and specialization in customized, high-precision systems. Key regions like Germany and Switzerland house leading manufacturers who focus on developing modular, flexible machines that can rapidly adapt to changing product specifications, crucial for the diverse needs of the continental market. There is a strong emphasis on integrating sophisticated quality control mechanisms that adhere to strict European manufacturing standards, often exceeding the requirements found in other regions.

Investment trends show a preference for fully integrated production lines, combining inlaying, lamination, personalization, and testing into single, streamlined processes. The transition to Industry 4.0, integrating advanced automation and data analytics into the manufacturing workflow, is highly advanced in Europe, further solidifying the demand for smart, connected inlaying machinery capable of autonomous optimization and reporting.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions represent nascent but rapidly emerging markets. Growth in LATAM is tied to economic development, leading to increased banking penetration and the rollout of standardized national ID programs, driving sporadic but large-scale procurement of inlaying equipment. Brazil and Mexico are primary consumers in this area.

In the MEA region, market growth is primarily concentrated in the Gulf Cooperation Council (GCC) states due to significant government investment in smart city projects, sophisticated security infrastructure, and modernizing financial services, leading to major purchases of smart card and identification inlaying technology. Africa shows future potential linked to mobile payment proliferation and gradual government digitalization initiatives. Both regions typically rely heavily on imported equipment from established players in Europe and APAC, focusing on cost-effective, reliable semi-automatic and automatic systems tailored for high-volume, standardized production runs.

Challenges in these regions include infrastructure limitations, currency volatility affecting equipment procurement costs, and the need for comprehensive local technical support. As digitalization accelerates across these economies, the demand for inlaying machines to support telecommunications (SIM cards) and financial services (contactless payment) is expected to show accelerated growth, particularly in the mid-to-high throughput segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inlaying Machine Market.- Mühlbauer GmbH

- SMIT Thermal Systems

- Hanmi Semiconductor

- ASM Pacific Technology (ASMPT)

- Semyon Technology

- K&S (Kulicke and Soffa)

- ESEC

- Wuhan Jinchen Machinery Co., Ltd.

- Shenzhen Smartlink Technology Co., Ltd.

- Shanghai Huayuan Electronic Co., Ltd.

- Fushan Precision Machinery Co., Ltd.

- T&T Technology

- Datacard Group (Entrust)

- W&H (Windmöller & Hölscher)

- LPKF Laser & Electronics

- Flexcon Company, Inc.

- Tectron Machinery

- Finishing Technology (Finit)

- Kingmax Technology

- Tongda Group Holdings Limited

Frequently Asked Questions

Analyze common user questions about the Inlaying Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for fully automatic inlaying machines?

The primary applications driving demand are the mass production of secure RFID tags for global supply chain logistics, inventory management, and the high-volume manufacturing of smart cards, including EMV payment cards and government-issued biometric identification documents (e-IDs and e-passports).

How does AI technology specifically enhance the precision of modern inlaying processes?

AI technology enhances precision through advanced computer vision systems that perform real-time, micron-level quality inspection and alignment corrections. Machine learning models also dynamically optimize bonding parameters (temperature, pressure) based on material variations, significantly reducing placement error rates and improving product yield.

Which region currently holds the largest market share in the Inlaying Machine Market?

The Asia Pacific (APAC) region currently holds the largest market share, fueled by its dominant position as the global manufacturing hub for electronics and components, resulting in immense production volumes of RFID tags and smart cards in countries such as China and South Korea.

What is the most significant restraint challenging the growth of the inlaying machine market?

The most significant restraint is the high initial capital expenditure (CapEx) required for acquiring highly automated, high-precision inlaying machinery. This high cost often limits adoption, particularly among smaller or regional manufacturers, and necessitates long depreciation cycles.

Are inlaying machines primarily used for electronic components, or do they serve other industries?

While electronic components (chips, antennas) are the primary focus, inlaying machines are increasingly used in non-electronic sectors, including the decorative industry (woodworking, furniture) and specialized packaging and luxury goods, where precision embedding of non-electronic elements or security features is required.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager