Inline Printing Press Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434821 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Inline Printing Press Market Size

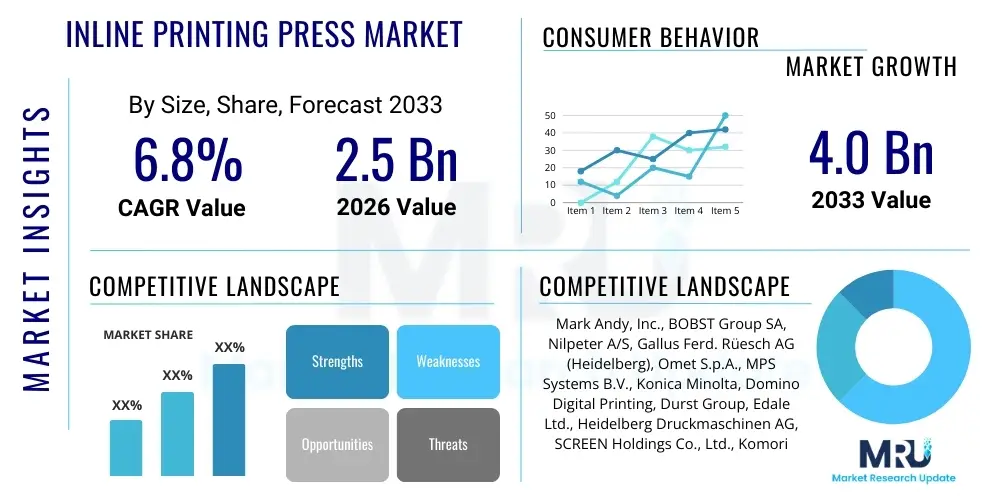

The Inline Printing Press Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Inline Printing Press Market introduction

The Inline Printing Press Market encompasses specialized machinery designed to perform multiple printing, converting, and finishing processes in a single, continuous workflow. This integration eliminates the need for transferring partially finished products between different machines, drastically improving operational efficiency, reducing waste, and shortening production cycles. Inline presses are critical in sectors demanding high precision and rapid throughput, particularly within the packaging and label manufacturing industries where complex designs and variable data printing are increasingly essential. These systems typically integrate printing stations (such as flexography, offset, or digital) with processes like die-cutting, lamination, foiling, varnishing, and inspection, all within one consolidated unit.

The core product offering in this market includes narrow-web, mid-web, and wide-web presses utilizing various printing technologies, with flexographic and digital printing driving innovation. Major applications span self-adhesive labels, flexible packaging, folding cartons, and commercial printing products. The primary benefits derived from inline systems include superior registration accuracy, reduced labor costs due to automation, and enhanced quality control enabled by integrated monitoring systems. The ability of these presses to handle diverse substrates and produce high-quality, finished products immediately makes them highly attractive to converters and brand owners seeking supply chain optimization.

Key driving factors propelling market expansion include the exponential growth of the e-commerce sector, which necessitates rapid production of personalized and complex packaging solutions, and increasing consumer demand for visually appealing, high-impact labels and flexible packaging. Furthermore, technological advancements, specifically in digital inkjet integration and faster make-ready times facilitated by servo-driven technology, are lowering operational barriers and increasing the versatility of modern inline presses. The shift toward sustainable printing practices, utilizing water-based or UV LED curable inks, also contributes positively to market growth, appealing to environmentally conscious industries.

Inline Printing Press Market Executive Summary

The Inline Printing Press Market is characterized by robust technological disruption, primarily driven by the convergence of traditional analog printing capabilities with advanced digital modules. Business trends indicate a strong move toward hybrid presses that combine the cost-efficiency of flexography for high-volume runs with the flexibility of digital inkjet for customization and short runs, offering manufacturers unprecedented adaptability. Key industry developments include the increasing adoption of automated workflow management systems and predictive maintenance tools, minimizing downtime and optimizing press utilization rates. The competitive landscape is intensely focused on offering specialized solutions for high-growth sectors like sustainable flexible packaging and sophisticated pressure-sensitive labels, pushing manufacturers to continuously enhance speed, registration accuracy, and substrate handling capabilities.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, burgeoning domestic consumer markets, and significant investments in converting infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while mature, remain crucial markets characterized by high adoption rates of advanced digital inline solutions and stringent quality and sustainability regulations, necessitating investment in state-of-the-art machinery. Latin America and the Middle East & Africa (MEA) are emerging regions showing moderate growth, propelled by the establishment of local manufacturing hubs and increasing demand for packaged goods, gradually transitioning from older, standalone systems to integrated inline technology.

In terms of segmentation, the Label and Packaging application segment dominates the market, accounting for the largest revenue share, reflecting the non-discretionary nature of these consumer goods industries. Technology-wise, Digital Inline Printing Presses, especially those utilizing high-speed inkjet, are registering the fastest CAGR due to their inherent ability to handle variable data printing, facilitate fast prototyping, and reduce waste associated with plate changes. Furthermore, narrow-web presses remain the most widely adopted format due to their extensive application in the high-volume label market, though mid-web and wide-web presses are gaining traction for flexible packaging and folding carton production, emphasizing efficiency in wider formats.

AI Impact Analysis on Inline Printing Press Market

Common user questions regarding AI’s impact on the Inline Printing Press Market frequently revolve around how AI can enhance operational efficiency, minimize human error, and improve print quality consistency. Users are particularly interested in the application of machine learning for predictive maintenance—forecasting component failure before it occurs—and for optimizing complex variables such as ink density, color matching, and web tension in real-time. Key concerns also focus on the integration complexity of AI systems with existing legacy machinery and the necessary upskilling required for press operators. The pervasive theme is the expectation that AI will automate non-value-added tasks, thereby maximizing press uptime and facilitating lights-out manufacturing environments in the printing sector.

AI is transforming quality control through advanced computer vision systems capable of detecting microscopic flaws in printed material at high press speeds, exceeding human capability and consistency. These systems use deep learning algorithms trained on vast datasets of acceptable and defective prints to make instantaneous adjustments to the press settings, ensuring zero-defect output. Furthermore, AI-powered workflow software is optimizing job scheduling and resource allocation, considering material availability, press capabilities, and delivery deadlines. This level of algorithmic planning significantly reduces changeover times and maximizes throughput across multiple orders, leading to substantial gains in overall equipment effectiveness (OEE).

The integration of AI also addresses major market restraints, such as material waste and energy consumption. AI algorithms analyze historical production data to recommend optimal press settings (speed, temperature, curing levels) for specific substrates and ink types, drastically cutting down the material wasted during setup and calibration (make-ready waste). Over time, the continuous learning capability of these systems allows presses to become self-optimizing units, adapting autonomously to environmental factors and material inconsistencies, thereby moving the industry closer to highly sustainable and automated production lines.

- Real-time defect detection and quality control using computer vision and deep learning.

- Predictive maintenance forecasting equipment failure, maximizing operational uptime.

- Automated job scheduling and workflow optimization to minimize changeover times.

- AI-driven color management and spectrophotometry for consistent color reproduction across batches.

- Optimized energy usage and reduced material waste through self-correcting press algorithms.

- Enhanced cybersecurity for connected, industrial printing systems (IoT/IIoT integration).

DRO & Impact Forces Of Inline Printing Press Market

The market trajectory is primarily dictated by powerful drivers, moderated by specific restraints, while presenting substantial opportunities that influence strategic decisions. The main drivers include the accelerated global demand for short-run, customized, and high-quality packaging and labels, primarily fueled by consumer trends and the expansion of personalized e-commerce packaging. This demand necessitates the speed, versatility, and minimal setup time offered by inline digital and hybrid presses. Furthermore, advancements in automation technology, specifically servo-driven systems, reduce labor dependency and increase precision, making inline presses more cost-effective over the long term, thereby driving adoption across global manufacturing bases.

Conversely, significant restraints hinder wider market penetration. The high initial capital investment required for state-of-the-art inline printing presses—particularly advanced digital and hybrid models—poses a substantial barrier for small and medium-sized converting operations. Additionally, the increasing complexity of these highly automated machines requires specialized technical skills for operation, maintenance, and troubleshooting, leading to a recognized shortage of highly trained professionals. Economic uncertainties and fluctuations in raw material costs (inks, substrates, components) further complicate capital expenditure planning for potential buyers, sometimes slowing down replacement cycles for older, less efficient equipment.

Opportunities for market growth lie predominantly in the continuous evolution of digital inkjet technology, which offers increased speed, resolution, and lower operational costs, making digital viable for longer runs. The rising focus on environmentally friendly and sustainable printing, utilizing water-based inks and developing recyclable substrate processes, opens new revenue streams for manufacturers innovating in green technologies. Analyzing the impact forces through a Porter’s Five Forces perspective reveals moderate to high competitive rivalry among established players offering diverse technological solutions. Buyer power is moderate, influenced by the specialized nature and high cost of the equipment. Supplier power is also moderate, dependent on highly specialized component suppliers (e.g., printhead manufacturers). The threat of substitution is low to moderate, as no current technology fully replaces the integrated finishing capability of inline presses, but the threat of new entrants is low due to high R&D and capital requirements.

Segmentation Analysis

The Inline Printing Press Market is analyzed across various dimensions including technology, application, press type, and substrate material, providing a comprehensive view of market dynamics and potential growth areas. Technology segmentation helps differentiate between established analog processes and rapidly growing digital methods, highlighting the shift toward hybrid solutions. Application segmentation identifies the dominant end-user markets driving volume and value growth, such as labels, flexible packaging, and folding cartons. Press type categorization, typically based on web width, defines the operational niche and throughput capability of the machinery, catering to specific industry requirements from narrow-web label production to wide-web flexible packaging manufacturing.

- By Printing Technology:

- Flexography

- Digital (Inkjet, Toner)

- Offset

- Hybrid (Flexo + Digital)

- By Application:

- Labels (Pressure-Sensitive, Sleeves)

- Flexible Packaging

- Folding Cartons

- Commercial Printing

- Others (Security Printing, Tubes)

- By Press Type (Web Width):

- Narrow Web (Up to 18 inches / 450 mm)

- Mid Web (18 inches to 30 inches / 450 mm to 760 mm)

- Wide Web (Above 30 inches / 760 mm)

- By Curing Technology:

- UV Curing (Conventional UV, LED UV)

- E-Beam Curing

- Aqueous/Water-based Drying

Value Chain Analysis For Inline Printing Press Market

The value chain for the Inline Printing Press Market begins with upstream activities involving the sourcing and manufacturing of highly specialized components and raw materials. Key upstream suppliers include manufacturers of precision mechanical parts (e.g., servo motors, rollers, sensors), sophisticated electronic control systems, high-definition printheads (crucial for digital systems), and specialty materials such as printing inks (UV, water-based, solvent), plates, and specialized web cleaning systems. Efficiency in the upstream segment relies heavily on maintaining high component quality and managing complex global supply chains, as component specialization dictates the performance and reliability of the final printing press machinery.

Midstream activities involve the design, engineering, and final assembly of the inline printing press systems. This stage is characterized by significant R&D investment aimed at integrating diverse printing technologies (e.g., flexo modules with digital modules), developing proprietary software for workflow automation and machine control, and ensuring compliance with global safety and quality standards. Direct distribution channels are highly favored in this capital goods market. Manufacturers typically employ highly technical sales teams to interact directly with large converting houses and brand owners. This direct interaction facilitates complex customization, contract negotiations, installation planning, and the provision of specialized post-sales services and technical training.

Downstream activities focus on the utilization and consumption of the presses by end-user industries, primarily label converters, flexible packaging producers, and folding carton manufacturers. These end-users utilize the inline presses to produce finished goods for consumer brands, leveraging the integrated finishing capabilities to maximize speed and efficiency. The relationship between the press manufacturer and the end-user extends beyond the initial sale, encompassing long-term maintenance contracts, parts supply, software upgrades, and specialized application support. Indirect channels, such as local agents or distributors, are often used in emerging markets to handle logistics and provide localized support, but the core relationship remains OEM-to-Converter due to the technical nature and high value of the asset.

Inline Printing Press Market Potential Customers

The primary customers for Inline Printing Press systems are converting companies that specialize in transforming raw materials (paper, film, foil) into finished printed products, predominantly labels and packaging. Label converters form the largest customer base, relying heavily on narrow-web inline presses (both flexo and digital/hybrid) to produce high volumes of pressure-sensitive labels, shrink sleeves, and in-mold labels with integrated finishing processes like rotary die-cutting, embossing, and slitting. These customers demand high registration accuracy, fast changeovers for short-to-medium runs, and the capability for variable data printing to meet stringent brand requirements and regulatory standards.

Flexible packaging manufacturers represent another high-growth customer segment, focusing on mid-web and wide-web inline presses capable of handling thin films and producing stand-up pouches, flow wraps, and various forms of sachets. Their requirements are centered on excellent print quality on non-porous substrates, efficient lamination capabilities, and presses optimized for longer runs, though the trend toward personalization is pushing them toward digital integration. These companies seek presses that can manage sophisticated barrier films and deliver consistent color matching across diverse packaging formats used in the food, beverage, and pharmaceutical industries.

Furthermore, folding carton producers constitute a significant customer group, particularly those specializing in integrated packaging solutions. While traditional carton production often uses sheet-fed offset, inline presses are gaining traction for niche applications requiring integrated coating, varnishing, and die-cutting for added security or complexity. Brand owners who manage captive printing operations, particularly in highly regulated sectors like pharmaceuticals or premium consumer goods, also represent potential high-value customers, investing in inline systems to gain greater control over their supply chain, ensure product authenticity, and respond quickly to market demands with new packaging designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mark Andy, Inc., BOBST Group SA, Nilpeter A/S, Gallus Ferd. Rüesch AG (Heidelberg), Omet S.p.A., MPS Systems B.V., Konica Minolta, Domino Digital Printing, Durst Group, Edale Ltd., Heidelberg Druckmaschinen AG, SCREEN Holdings Co., Ltd., Komori Corporation, Goss International, Landa Digital Printing, Fujifilm Corporation, Xeikon (Flint Group), AB Graphic International, Cartes S.p.A., Lombardi Converting Machinery S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inline Printing Press Market Key Technology Landscape

The technological landscape of the Inline Printing Press Market is dominated by the rapid maturation and integration of digital printing technologies, specifically high-speed single-pass inkjet. Digital inkjet allows presses to transition instantly between print jobs without lengthy setup processes (plate making, washing), making short and medium runs economically viable and supporting the mass customization trend. Furthermore, advancements in printhead technology are delivering resolutions and speeds previously unattainable, bridging the quality gap between digital and traditional flexographic printing. Hybrid presses, combining digital modules with conventional flexo units, represent a significant innovation, enabling complex jobs to utilize the strengths of both technologies, such as cost-effective bulk printing (flexo) and variable data insertion (digital).

Beyond the core printing units, the integration of sophisticated automation and control systems is pivotal. Servo drive technology has replaced traditional line shafts, offering independent control over each printing and finishing station. This precise control enhances registration accuracy, reduces mechanical wear, and significantly speeds up make-ready times through automated setup routines. Furthermore, UV LED curing technology is increasingly replacing traditional mercury vapor lamps. LED systems offer substantial energy savings, longer lamp life, produce minimal heat (allowing printing on delicate, thin substrates), and eliminate ozone generation, aligning with sustainability goals and enhancing operational safety.

Advanced converting and finishing technologies are also integral to the inline ecosystem. High-precision rotary die-cutting stations, often equipped with automated tool positioning, ensure perfect alignment and minimal waste. Integrated inspection systems, utilizing high-resolution cameras and pattern recognition software, monitor every unit produced for defects at maximum press speeds. The future of the technology landscape is centered around Industry 4.0 connectivity, enabling presses to communicate seamlessly within a smart factory environment, facilitating predictive diagnostics, remote maintenance, and holistic data analysis to achieve maximum operational efficiency and traceability throughout the printing process.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by extensive industrial expansion, particularly in packaging demand across fast-moving consumer goods (FMCG) sectors in China, India, and ASEAN countries. High population density, rising disposable incomes, and the corresponding boom in domestic manufacturing necessitate continuous investment in high-speed, cost-effective inline printing solutions for labels and flexible packaging. Government initiatives supporting manufacturing infrastructure further bolster market expansion.

- North America (NA): Characterized by high technological maturity, North America maintains strong demand for premium and specialized inline solutions, particularly hybrid and high-end digital presses. The market is focused on high-value applications such as pharmaceutical labels, security printing, and sophisticated e-commerce packaging. Strict regulatory requirements for traceability and quality drive the adoption of automated inspection and quality control systems integrated into inline processes.

- Europe: Europe represents a mature market known for early adoption of sustainable practices and advanced automation. Demand is strong for highly efficient, energy-saving UV LED and water-based ink systems. The region shows robust uptake of mid-web presses for high-quality flexible packaging and folding cartons, driven by the need to comply with evolving EU sustainability directives and a focus on minimizing waste and carbon footprint.

- Latin America (LATAM): The LATAM region presents moderate growth opportunities, primarily in Brazil and Mexico, fueled by increasing foreign investment and the establishment of local packaging and converting plants. The market is characterized by initial investments in established flexographic inline technology, with a gradual shift toward integrating entry-level digital capabilities as regional consumer markets stabilize and demand for packaged goods rises.

- Middle East & Africa (MEA): Growth in MEA is largely concentrated around Gulf Cooperation Council (GCC) countries and South Africa. Infrastructure development, urbanization, and a growing consumer base for packaged food and beverages are propelling demand for flexible packaging solutions. Market development often involves large-scale, often government-backed, infrastructure projects and relies on imported high-tech machinery from European and North American suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inline Printing Press Market.- Mark Andy, Inc.

- BOBST Group SA

- Nilpeter A/S

- Gallus Ferd. Rüesch AG (Heidelberg)

- Omet S.p.A.

- MPS Systems B.V.

- Konica Minolta

- Domino Digital Printing

- Durst Group

- Edale Ltd.

- Heidelberg Druckmaschinen AG

- SCREEN Holdings Co., Ltd.

- Komori Corporation

- Landa Digital Printing

- Fujifilm Corporation

- Xeikon (Flint Group)

- AB Graphic International

- Cartes S.p.A.

- Lombardi Converting Machinery S.p.A.

- Soma Engineering

Frequently Asked Questions

Analyze common user questions about the Inline Printing Press market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a hybrid inline printing press?

Hybrid inline printing presses offer the best combination of technologies, leveraging the high-speed, low-cost capability of flexography for primary colors and utilizing integrated digital inkjet modules for variable data, versioning, and fast prototyping, maximizing operational flexibility for complex jobs.

How does the shift to LED-UV curing impact inline press efficiency?

LED-UV curing technology significantly improves press efficiency by reducing energy consumption, eliminating the need for ozone extraction, and drastically lowering heat output. This allows for faster printing speeds and broader substrate compatibility, especially for heat-sensitive film materials commonly used in flexible packaging.

Which application segment drives the highest growth in the Inline Printing Press Market?

The Labels and Packaging application segment consistently drives the highest growth, specifically narrow-web labels and mid-web flexible packaging. This growth is sustained by continuous global demand from the FMCG, food and beverage, and pharmaceutical industries, coupled with the increasing complexity of packaging designs.

What major challenges restrict the adoption of new inline digital presses?

The most significant challenges include the high initial capital investment required for advanced digital or hybrid systems, the complex maintenance needs necessitating a highly skilled technical workforce, and the difficulty of integrating new digital presses seamlessly into existing, often analog, production workflows.

How is Industry 4.0 influencing the Inline Printing Press Market?

Industry 4.0 concepts are leading to the adoption of smart inline presses featuring integrated sensors, AI-driven predictive maintenance, cloud connectivity for real-time diagnostics, and automated scheduling software, resulting in higher Overall Equipment Effectiveness (OEE) and reduced manual intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager