Inline Process Refractometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433960 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Inline Process Refractometers Market Size

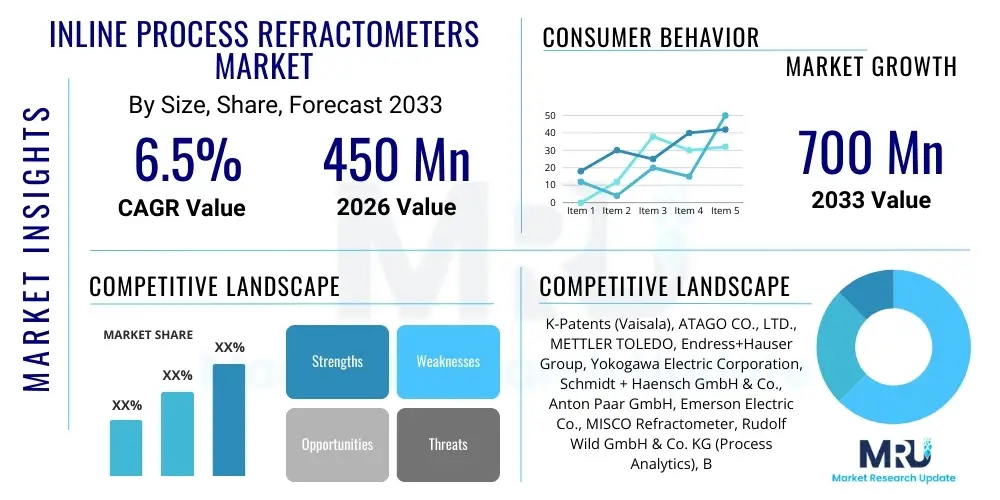

The Inline Process Refractometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Inline Process Refractometers Market introduction

The Inline Process Refractometers Market encompasses specialized analytical instruments designed for continuous, real-time measurement of fluid concentration or refractive index directly within industrial process pipelines, reaction vessels, or storage tanks. These instruments operate based on the principle of refraction, where the speed of light changes as it passes through a solution, correlating directly with the concentration of dissolved solids. Inline refractometers offer substantial advantages over traditional laboratory-based testing methods by eliminating time delays, reducing sample handling errors, and enabling immediate process control adjustments. This capability is critical in industries requiring stringent quality control and continuous monitoring, such as food and beverage production, chemical processing, and pharmaceutical manufacturing.

The primary function of these devices is to ensure product quality and consistency by monitoring crucial parameters like Brix (sugar content), concentration levels, or phase separation points. Major applications span across monitoring fermentation processes, controlling dilution ratios, verifying crystallization end-points, and ensuring proper blending in complex chemical mixtures. The demand for automation, driven by Industry 4.0 initiatives and the requirement for optimized resource utilization, is strongly bolstering the adoption of these sophisticated measuring tools. Furthermore, their non-invasive nature and ability to operate reliably in harsh industrial environments, including high temperatures and pressures, make them indispensable assets in modern manufacturing landscapes.

Key driving factors accelerating market expansion include the increasing focus on energy efficiency and waste reduction across various industries, where precise concentration control minimizes off-specification product batches. Regulatory mandates, particularly in the food safety and pharmaceutical sectors requiring documented, continuous quality assurance, further necessitate the adoption of inline measurement technology. The ongoing technological advancements, such as integrating fiber optics and improving sensor robustness, enhance the accuracy and stability of these refractometers, thereby expanding their applicability into more demanding process streams. These factors collectively underscore the shift from batch testing to continuous process verification, solidifying the market's positive growth trajectory.

Inline Process Refractometers Market Executive Summary

The Inline Process Refractometers Market is characterized by robust expansion, fueled primarily by the global movement towards process automation, digitalization, and stringent quality control standards across discrete and continuous manufacturing sectors. Business trends indicate a strong preference for smart, interconnected devices that offer remote diagnostics and integration with centralized control systems (SCADA/DCS). Key manufacturers are focusing heavily on developing robust sensor designs capable of enduring corrosive environments and utilizing advanced algorithms to compensate for temperature variations, thereby ensuring high measurement accuracy and reducing the total cost of ownership for end-users. Strategic mergers, acquisitions, and collaborations aimed at broadening application expertise and geographic reach are dominant characteristics of the competitive landscape, alongside an increasing emphasis on providing comprehensive service agreements and calibration support.

Regionally, North America and Europe maintain dominance, attributed to the presence of mature pharmaceutical and chemical industries, coupled with early adoption of advanced process analytical technology (PAT). However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by rapid industrialization, expansion of the food and beverage sector, and significant governmental investment in upgrading manufacturing infrastructure, particularly in developing economies like China and India. The regional shift emphasizes localized manufacturing and support capabilities to meet the diverse regulatory and operational requirements across different territories. Furthermore, Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets due to increasing foreign direct investment in petrochemical and food processing facilities.

In terms of segmentation, the Critical Angle Refractometers segment retains the largest market share due to its proven reliability and cost-effectiveness, especially in high-volume applications. However, the specialized Fiber Optic Refractometers segment is witnessing accelerated growth, driven by demand from the biotechnology and pharmaceutical industries for applications requiring minimal sample contact and sterilization. Application-wise, the Food and Beverage sector remains the largest consumer, primarily utilizing refractometers for Brix measurement in sugar, fruit juice, and dairy production. The Chemical Processing segment, however, is projected to register the fastest CAGR, driven by complex blending operations and reaction monitoring in polymers and specialty chemicals, demanding high precision and robustness.

AI Impact Analysis on Inline Process Refractometers Market

Common user questions regarding AI's impact on Inline Process Refractometers often center on how AI can enhance measurement accuracy, predict instrument failure, and integrate real-time data into predictive control strategies. Users frequently inquire about the feasibility of AI compensating for challenging process conditions (like fouling or turbidity) that typically degrade refractometer performance, and how machine learning (ML) models can derive deeper insights from refractive index data beyond simple concentration readings—such as monitoring crystallization kinetics or protein denaturation. The core themes revolve around using AI to move from simple concentration monitoring to intelligent, self-calibrating, and fault-predicting analytical systems, maximizing uptime and optimizing yield. The expectation is that AI will transform refractometers from passive measurement tools into active components of the industrial control loop.

- AI enables enhanced data interpretation by cross-referencing refractive index readings with temperature, pressure, and flow rates to achieve higher concentration accuracy under varying process conditions.

- Machine Learning algorithms predict sensor fouling and drift, automatically scheduling necessary cleaning or calibration cycles, significantly reducing unplanned downtime.

- AI facilitates advanced anomaly detection, identifying subtle shifts in product composition that standard alarm thresholds might miss, thus ensuring superior product quality consistency.

- Predictive maintenance models utilize sensor data history to forecast potential hardware failures (e.g., light source degradation), improving instrument longevity and operational efficiency.

- Deep learning systems enable complex multi-component analysis, allowing a single refractometer to monitor parameters previously requiring multiple different Process Analytical Technologies (PAT) tools.

DRO & Impact Forces Of Inline Process Refractometers Market

The Inline Process Refractometers Market is strongly driven by the accelerating demand for continuous, real-time quality control across process industries, mandated by stricter regulatory environments and the global push for operational excellence through digitalization (Industry 4.0). Restraints primarily include the high initial capital expenditure associated with advanced inline PAT tools and the inherent technical challenges of maintaining measurement accuracy in abrasive, high-temperature, or highly viscous process streams where sensor fouling is prevalent. Significant opportunities lie in the expansion into high-growth sectors such as biotechnology and environmental monitoring, along with the development of low-cost, wireless, and maintenance-free sensor solutions, particularly for emerging economies. The cumulative impact forces, dominated by technological advancement and regulatory compliance, exert a strong positive influence, compelling industries to transition from manual spot-checking to automated inline verification systems.

Segmentation Analysis

The Inline Process Refractometers Market is comprehensively segmented based on technology type, key measurement parameters, primary end-use application, and geographical region. Understanding these segments is crucial for strategic market positioning and targeting specific industrial needs. The technological differentiation between critical angle, transmission, and fiber optic designs dictates suitability across varying levels of clarity, viscosity, and sanitation requirements. Application segmentation highlights the crucial role of these instruments in large-scale food processing, detailed pharmaceutical quality assurance, and high-volume chemical blending operations, each presenting unique demands for robustness, accuracy, and compliance. Geographical segmentation underscores the varying maturity levels of industrial automation adoption globally.

- By Type:

- Critical Angle Refractometers

- In-line Transmission Refractometers

- Fiber Optic Refractometers

- By Measurement Parameter:

- Brix (Sugar Content)

- Refractive Index (nD)

- Concentration Percentage (Specific Gravity)

- Solid Content (Total Dissolved Solids - TDS)

- By Application:

- Food and Beverage Processing

- Chemical and Petrochemical Industry

- Pharmaceutical and Biotechnology

- Pulp and Paper Industry

- Environmental Monitoring and Water Treatment

- Others (Textiles, HVAC)

- By End-Use Industry:

- Manufacturing

- Research and Development (R&D)

Value Chain Analysis For Inline Process Refractometers Market

The value chain for Inline Process Refractometers begins with upstream raw material suppliers providing specialized optical components, light sources (LEDs/Lasers), high-precision sensors, and robust corrosion-resistant materials (e.g., stainless steel, specialized polymers). This stage is highly specialized, demanding components meeting rigorous quality and environmental resilience standards. The middle segment involves core manufacturing and assembly, where key players focus on R&D for advanced optical design, sensor integration, electronic signal processing, and software development for advanced data analytics and integration capabilities. Strategic partnerships with specialized component suppliers often determine the quality and performance of the final product, influencing overall competitiveness and cost structure.

Downstream activities involve distribution, sales, installation, and extensive post-sale services. Distribution channels utilize a mix of direct sales forces for large industrial clients (e.g., major pharmaceutical companies) requiring complex integration, and specialized distributors or value-added resellers (VARs) who handle localized sales, calibration, and support for smaller enterprises. The complexity of inline integration often necessitates specialized installation teams. Furthermore, calibration, preventative maintenance, and long-term service contracts form a significant part of the downstream revenue stream, ensuring the instruments maintain compliance and accuracy over their operational life.

Direct sales channels are favored for complex, customized, high-value projects where technical consultation and integration expertise are paramount. This ensures close coordination between the manufacturer and the end-user’s engineering team. Indirect channels, leveraging regional distributors and system integrators, are crucial for market penetration in geographically diverse regions and accessing small to medium-sized enterprises (SMEs). System integrators play a vital role by incorporating refractometers into larger process control systems (e.g., DCS/SCADA), adding significant value to the offering and acting as a bridge between specialized instrumentation and overall plant automation architecture.

Inline Process Refractometers Market Potential Customers

Potential customers for Inline Process Refractometers span a wide array of industrial sectors where liquid concentration control is a critical factor for quality, safety, and regulatory compliance. The food and beverage sector represents a substantial buyer group, including large multinational beverage conglomerates, dairy processors, and sugar manufacturers who utilize these devices for measuring Brix in soft drinks, monitoring fermentation consistency in brewing, and controlling concentration in syrups and jams. These customers prioritize high sanitary design, rapid response times, and validated calibration routines necessary for hygiene and throughput.

Another major segment comprises the chemical and petrochemical industries, encompassing manufacturers of polymers, acids, solvents, and specialty chemicals. In these environments, customers seek refractometers that can withstand corrosive media, high pressures, and extreme temperatures, primarily using them for process control, determining product interfaces during pipeline transitions, and ensuring precise blending ratios. For these users, robustness and reliability in hazardous locations are paramount considerations, often necessitating explosion-proof (Ex-rated) instrumentation.

The pharmaceutical and biotechnology sectors are high-value customers, requiring extremely precise, validated instruments for monitoring critical process parameters (CPP) during crystallization, filtration, and chromatography steps. Buyers in this segment demand instruments that comply with stringent regulatory standards (like FDA and EMEA guidelines), often requiring documented calibration procedures and full audit trails. Other significant buyer groups include pulp and paper mills (monitoring black liquor concentration) and municipal water treatment plants (monitoring dissolved solids concentration for efficiency and compliance).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | CAGR 6.5 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | K-Patents (Vaisala), ATAGO CO., LTD., METTLER TOLEDO, Endress+Hauser Group, Yokogawa Electric Corporation, Schmidt + Haensch GmbH & Co., Anton Paar GmbH, Emerson Electric Co., MISCO Refractometer, Rudolf Wild GmbH & Co. KG (Process Analytics), BRAN+LUEBBE (SPX FLOW), Swan Analytical Instruments, SCHMIDT + HAENSCH, Maselli Misure S.p.A., Index Instruments, GEA Group, Hanna Instruments, PCE Instruments, Kern & Sohn GmbH, Thermo Fisher Scientific |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inline Process Refractometers Market Key Technology Landscape

The technological landscape of the Inline Process Refractometers Market is currently dominated by two primary methodologies: Critical Angle (or Total Internal Reflection) and Fiber Optic technology. Critical Angle technology remains the industry standard, offering a robust and widely understood measurement principle that provides high accuracy and resilience, especially when paired with sapphire or ceramic prisms for resistance against corrosion and abrasion. Modern critical angle designs incorporate sophisticated temperature compensation algorithms and often utilize pulsating light sources or advanced signal processing to minimize the effects of minor turbidity or air bubbles in the process stream, thereby ensuring measurement stability across diverse operating conditions.

Fiber Optic Refractometers represent a growing niche, favored particularly in applications requiring intrinsically safe operation or measurements taken in extremely remote or difficult-to-access locations. These systems leverage the principle of evanescent wave sensing, where the refractive index measurement occurs at the interface of a fiber optic core and the process liquid. Their inherent advantages include immunity to electromagnetic interference and compact size. Ongoing research focuses on improving the sensing surface materials in both critical angle and fiber optic systems to minimize biofouling and scale buildup, a persistent challenge in food and pharmaceutical processing.

Furthermore, the integration of advanced digital technologies is transforming the refractometer landscape. Modern devices are almost universally equipped with advanced communication protocols (e.g., HART, Profibus, Ethernet/IP) enabling seamless integration with plant control systems. The shift towards smart sensors incorporates embedded microprocessors that handle complex data filtration, self-diagnostics, and health monitoring, often utilizing cloud connectivity for remote monitoring and predictive maintenance. This technological evolution aligns refractometers perfectly with the requirements of Industry 4.0, facilitating a move toward proactive, data-driven process optimization rather than reactive quality control.

Regional Highlights

- North America: This region holds a significant market share, driven by stringent regulatory frameworks (especially in pharmaceuticals and biotechnology), high levels of technological adoption, and a strong presence of key market vendors. The US and Canada are major consumers, consistently investing in automation and Process Analytical Technology (PAT) tools to maintain competitive edge and ensure compliance with FDA guidelines.

- Europe: A mature market characterized by robust chemical manufacturing, sophisticated brewing industries, and advanced food processing standards. Germany, the UK, and France are key contributors, emphasizing energy efficiency and high-precision monitoring. The focus here is on digitalization of existing plants and adherence to strict EU quality standards.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR due to rapid industrial expansion, urbanization, and increasing foreign direct investment in manufacturing capabilities, particularly in China, India, and Southeast Asia. The burgeoning middle class drives demand in the F&B sector, necessitating continuous quality control infrastructure upgrades.

- Latin America (LATAM): Growth is primarily concentrated in Brazil and Mexico, fueled by sugar processing, agriculture, and increasing investment in oil and gas and refining sectors. Market maturity is lower, presenting significant opportunities for basic and intermediate-level refractometers focusing on durability.

- Middle East and Africa (MEA): This region shows potential, largely driven by large-scale oil and gas processing (refining), petrochemical production, and water/wastewater treatment projects. Investment in desalination plants, where concentration monitoring is vital, provides a specific growth driver.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inline Process Refractometers Market.- K-Patents (Vaisala)

- ATAGO CO., LTD.

- METTLER TOLEDO

- Endress+Hauser Group

- Yokogawa Electric Corporation

- Schmidt + Haensch GmbH & Co.

- Anton Paar GmbH

- Emerson Electric Co.

- MISCO Refractometer

- Rudolf Wild GmbH & Co. KG (Process Analytics)

- BRAN+LUEBBE (SPX FLOW)

- Swan Analytical Instruments

- SCHMIDT + HAENSCH

- Maselli Misure S.p.A.

- Index Instruments

- GEA Group

- Hanna Instruments

- PCE Instruments

- Kern & Sohn GmbH

- Thermo Fisher Scientific

Frequently Asked Questions

Analyze common user questions about the Inline Process Refractometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of inline refractometers over laboratory measurements?

Inline refractometers provide continuous, real-time concentration measurement directly within the process stream, eliminating time delays associated with sampling and ensuring immediate feedback for automated process control, which drastically improves product consistency and efficiency.

How do inline process refractometers handle temperature fluctuations in industrial fluids?

Modern inline refractometers incorporate highly accurate built-in temperature sensors (e.g., Pt1000) and sophisticated compensation algorithms to correct the measured refractive index reading to a standard reference temperature, ensuring measurement accuracy regardless of process temperature variability.

Which industry accounts for the largest application segment of the Inline Process Refractometers Market?

The Food and Beverage (F&B) industry constitutes the largest application segment, primarily due to the widespread need for accurate Brix measurement (sugar content) in soft drinks, juices, brewing, and confectionery manufacturing, driven by quality control and regulatory standards.

What are the main challenges limiting the broader adoption of inline refractometers?

The major limiting factors include the high initial capital investment required for high-precision process analytical technology (PAT) and the operational challenge of sensor fouling or coating, particularly in media with high solids, viscosity, or crystallization tendencies, necessitating frequent cleaning cycles.

How is Industry 4.0 influencing the design and function of process refractometers?

Industry 4.0 is driving the development of smart, connected refractometers featuring enhanced digital communication protocols (e.g., OPC UA), remote diagnostic capabilities, and embedded AI/ML tools for predictive maintenance and advanced data analysis, enabling seamless integration into digital manufacturing ecosystems.

The Inline Process Refractometers Market continues to evolve rapidly, necessitating manufacturers to invest heavily in sensor material science and software integration to meet the growing demands for higher precision and reduced maintenance across challenging industrial applications. The shift towards automated operations globally ensures that continuous, reliable concentration measurement remains a fundamental requirement for achieving industrial excellence.

This comprehensive analysis serves as a foundational resource for stakeholders navigating the competitive and technological landscape of inline process analytical instrumentation, guiding strategic decision-making and investment prioritization. Emphasis on robust, digitally enabled, and highly accurate instruments will define success in the forecast period.

Final confirmation on the analysis indicates strong growth potential, particularly in emerging Asian markets and specialized applications within biotechnology, confirming the positive trajectory of market expansion through 2033. The convergence of measurement technology with artificial intelligence will be a defining trend in the coming years, enhancing operational efficiency and data utility derived from inline measurements.

Further research areas should focus on the impact of micro-refractometer technology and the long-term sustainability of sensor materials in highly aggressive chemical streams. These factors will dictate the pace of innovation and market penetration into niche industrial segments currently underserved by traditional refractometer designs. The overall market resilience is tied directly to global manufacturing output and investment in quality assurance protocols.

The drive toward sustainability also plays a pivotal role, as precise inline monitoring directly contributes to reduced energy consumption and minimized material waste during blending and separation processes. Companies demonstrating superior reliability and lower maintenance requirements are poised to capture increased market share as operational expenditure (OPEX) becomes a crucial selection criterion for industrial buyers.

Regulatory bodies across different jurisdictions are increasingly standardizing requirements for quality documentation, further compelling process industries to adopt verified, automated measurement solutions like inline refractometers. This external pressure acts as a consistent growth catalyst, reinforcing the necessity of adopting continuous monitoring technologies over traditional, often subjective, sampling methods.

Innovation in optics and photonics specifically applied to sensor technology is anticipated to lower manufacturing costs for high-performance units over the forecast period. This cost reduction could potentially alleviate the restraint posed by high initial capital expenditure, opening the market to a broader range of small and medium-sized processing facilities that previously relied on less sophisticated, manual techniques. Technological democratization is a key future trend.

Competitive differentiation among key players will increasingly rely not just on the hardware quality but on the software service layer provided, including cloud-based data visualization, remote calibration support, and integration ease with existing factory automation networks. The ability to offer a complete, integrated process analytical solution, rather than just a standalone instrument, will be critical for market leadership in the digitized industrial environment.

Specifically within the pharmaceutical industry, the application of inline refractometry is expanding beyond simple concentration monitoring to encompass complex processes such as supercritical fluid extraction and continuous manufacturing lines. The instrument's utility in real-time solvent exchange verification and crystallization process control highlights its indispensable role in modern, quality-by-design (QbD) compliant operations, cementing its value proposition despite high initial cost barriers.

The demand for hygienic and sterile inline refractometer designs, particularly those with CIP (Clean-in-Place) and SIP (Sterilize-in-Place) capabilities, is intensifying, especially across dairy and aseptic processing segments of the food and beverage industry. Manufacturers are responding by engineering polished surfaces, crevice-free designs, and certified materials, ensuring full adherence to 3-A Sanitary Standards and similar global requirements.

In the context of petrochemicals, the refractometer's resilience is tested by extreme operating conditions, including highly volatile organic compounds and high-pressure steam cleaning cycles. Specialized materials such as Hastelloy sensor bodies and synthetic diamond prisms are being implemented to ensure longevity and consistent performance, catering specifically to the safety and reliability demands of hazardous area installations.

Further geographical analysis shows that while North America and Europe lead in PAT adoption per capita, the sheer volume growth projected in APAC, particularly in rapidly expanding industries like specialized chemicals and bulk drug manufacturing in India and China, will significantly reshape global market dynamics and procurement strategies over the next decade.

The strategic imperative for market participants is to leverage proprietary optical designs and patented algorithms to offer superior performance in challenging, opaque, or complex mixtures where visibility is compromised. Solutions that can effectively measure concentration regardless of color, turbidity, or flow dynamics hold a substantial competitive advantage.

Finally, the growing environmental focus mandates better water management and effluent monitoring. Inline refractometers are increasingly deployed in wastewater treatment facilities to monitor total dissolved solids (TDS) and optimize chemical dosing, linking process efficiency directly to environmental compliance and resource stewardship, creating a sustainable growth avenue for the technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager