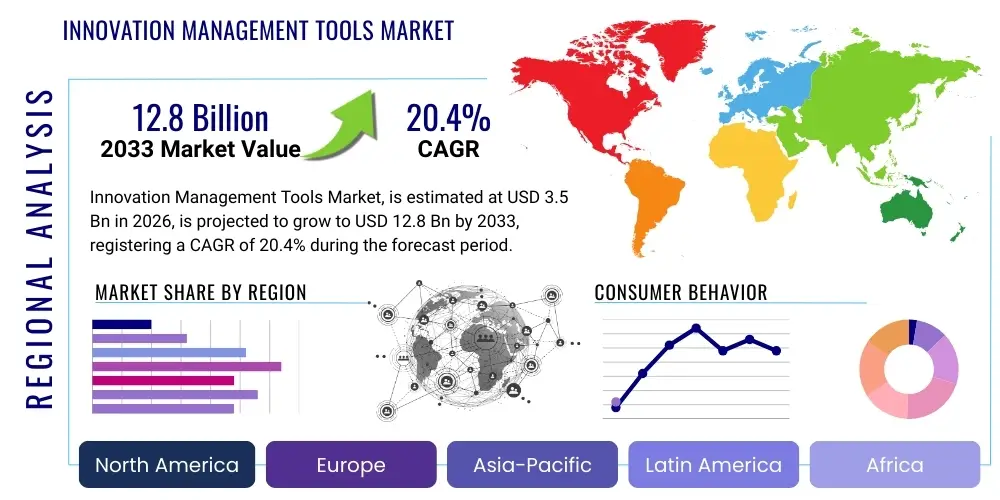

Innovation Management Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438306 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Innovation Management Tools Market Size

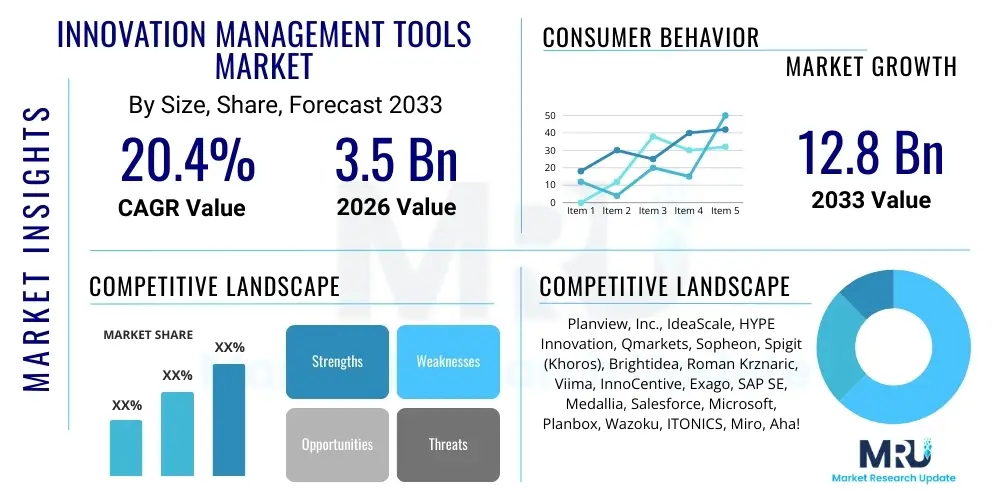

The Innovation Management Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.4% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 12.8 Billion by the end of the forecast period in 2033.

Innovation Management Tools Market introduction

The Innovation Management Tools Market encompasses software solutions and integrated platforms designed to systematize, track, and optimize the entire innovation lifecycle within an organization, ranging from initial idea generation and collection to portfolio management, implementation, and commercialization. These sophisticated tools serve as centralized hubs that facilitate collaboration across departments, geographies, and external stakeholders, ensuring that valuable insights are captured, evaluated rigorously, and converted into viable products, services, or optimized processes. The core objective of these solutions is to foster a culture of continuous innovation, provide transparency in decision-making regarding resource allocation for potential projects, and dramatically reduce the time required to bring novel concepts to market, thereby conferring a critical competitive advantage.

Product offerings in this market are highly diverse, including specific modules for idea screening, crowd-sourcing, technology scouting, and intellectual property management. Major applications span corporate strategy formulation, product lifecycle management (PLM), and continuous process improvement initiatives, serving key functional areas such as Research & Development (R&D), Marketing, and Operations. Key benefits derived from adopting innovation management tools include enhanced organizational efficiency through automated workflows, superior alignment of innovation projects with strategic business goals, improved employee engagement and collaboration, and quantifiable return on innovation investment (ROII).

The market growth is primarily driven by the imperative for digital transformation across all industry verticals, compelling enterprises to seek structured and measurable approaches to innovation to maintain relevance in rapidly evolving global markets. Furthermore, the increasing complexity of product portfolios, the need for agile and distributed team collaboration, and the proliferation of open innovation models—where organizations actively solicit ideas from customers, partners, and the broader public—are significantly fueling the adoption of robust, scalable innovation management platforms. These factors collectively establish a strong foundational demand for sophisticated tools capable of handling vast amounts of data and diverse collaborative inputs effectively.

Innovation Management Tools Market Executive Summary

The Innovation Management Tools Market is characterized by robust business trends centered on the integration of artificial intelligence and machine learning capabilities into core platform functionalities, enhancing predictive analytics for idea viability and automating the complex process of semantic grouping and idea deduplication. Corporations are increasingly moving away from siloed R&D models toward integrated, enterprise-wide innovation ecosystems, demanding platforms that offer seamless integration with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems. This shift is driving demand for comprehensive, modular software suites rather than point solutions. A pronounced trend is the heightened focus on user experience (UX) and gamification within these tools, designed to maximize internal participation and idea submission rates, directly contributing to the quantity and quality of the innovation pipeline.

Regionally, North America maintains market dominance due to the high concentration of technology innovators, early adoption rates of advanced cloud-based solutions, and significant investment in R&D across sectors like IT and BFSI. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid industrialization, increasing governmental support for digital initiatives, and the massive scale-up of manufacturing capabilities requiring constant process optimization and product innovation. European markets are driven primarily by regulatory compliance requirements and strong emphasis on sustainability-driven and circular economy innovation, leading to specialized demand for tools capable of tracking environmental and social impact metrics alongside financial returns.

Segment trends reveal a significant preference for Cloud deployment models across all organization sizes, primarily due to lower total cost of ownership (TCO), enhanced scalability, and ease of deployment for globally distributed teams. Among components, Services—specifically implementation and strategic consulting—are experiencing rapid growth as enterprises require expert guidance to tailor complex innovation processes to the capabilities of the software. Large enterprises continue to be the primary revenue generators, but Small and Medium Enterprises (SMEs) are rapidly increasing their adoption, leveraging flexible, subscription-based Software as a Service (SaaS) offerings to structure their nascent innovation programs. Application-wise, Idea Management and Collaboration Tools remain foundational, while Portfolio Management solutions are seeing increasing uptake as organizations mature their governance structures around R&D spending.

AI Impact Analysis on Innovation Management Tools Market

User inquiries regarding AI's influence on Innovation Management Tools primarily revolve around three critical areas: the potential for AI to automate the creative process, the reliability of AI in predicting innovation success, and the ethical considerations surrounding AI-driven idea screening. Users frequently ask how generative AI can augment human ideation rather than replace it, specifically seeking tools that move beyond simple keyword analysis to perform semantic clustering of diverse ideas, identify white spaces in competitive landscapes, and rapidly generate concept variations based on predefined constraints. Furthermore, there is strong interest in predictive analytics models that use machine learning to correlate historical project data, market trends, and organizational resource availability to forecast the probability of success and required investment for new ideas, offering a data-driven justification for project funding.

The integration of AI, including Machine Learning (ML) and Natural Language Processing (NLP), is fundamentally transforming the capabilities and value proposition of innovation management platforms. AI algorithms are now deployed to manage the overwhelming volume of data associated with large-scale crowd-sourced idea campaigns, automatically filtering redundant submissions, categorizing ideas based on strategic alignment, and routing them to the most appropriate experts for evaluation. This automation significantly reduces the administrative burden on innovation managers, allowing them to focus on high-value strategic decision-making and cross-functional leadership, thereby accelerating the time-to-decision metrics critical for agile organizations.

Furthermore, AI is enabling personalized innovation journeys for users by recommending relevant challenges, collaborators, and knowledge resources based on an individual's skills, past contributions, and organizational network. This capability is instrumental in breaking down internal silos and ensuring that the right expertise is matched with the most pertinent innovation problems. The long-term impact of AI is the shift of innovation management tools from simple tracking systems to proactive intelligence platforms that not only manage ideas but also actively guide the entire innovation pipeline by identifying gaps, predicting bottlenecks, and suggesting optimal pathways for resource allocation and development, drastically enhancing overall R&D efficiency and strategic alignment across the enterprise portfolio.

- AI-driven semantic analysis and clustering of user-submitted ideas, reducing redundancy and improving categorization accuracy.

- Predictive modeling using machine learning to forecast the commercial viability and technical feasibility of innovation projects.

- Generative AI capabilities used for rapid concept generation and prototyping based on user-defined constraints and market signals.

- Automation of the idea screening and evaluation process, accelerating funnel throughput and reducing managerial overhead.

- Enhanced personalization of innovation campaigns, matching employees with relevant challenges and collaborators based on expertise.

- Intelligent identification of innovation white spaces and emerging technological trends through automated external data scraping and analysis.

DRO & Impact Forces Of Innovation Management Tools Market

The Innovation Management Tools Market is dynamically shaped by powerful internal and external forces driving adoption while simultaneously facing critical challenges related to integration and data security. The primary market Driver is the ubiquitous mandate for digital transformation and continuous business model innovation across competitive industries, forcing companies to move beyond ad-hoc idea collection methods to structured, quantifiable innovation governance systems. Opportunities stem significantly from the burgeoning concept of Open Innovation and crowd-sourcing, requiring dedicated, secure platforms to manage external contributions and IP sharing agreements effectively. However, the market faces notable Restraints, including the inherent complexity and cultural resistance associated with implementing enterprise-wide innovation programs, alongside significant integration challenges when attempting to connect these sophisticated tools with legacy IT infrastructure and various other enterprise systems (e.g., PLM, ERP, CRM). The collective balance of these elements determines the pace and direction of market expansion.

Drivers: The increasing complexity of global supply chains and product development cycles necessitates robust, centrally governed platforms to manage distributed innovation efforts and collaboration across diverse geographies and time zones. Furthermore, the pressure from rapidly evolving consumer expectations and disruptive startups mandates that established corporations maintain an extremely high velocity of innovation simply to remain competitive, driving investment in tools that streamline the entire ideation-to-launch sequence. The demonstrable link between structured innovation processes and improved financial performance, particularly in terms of higher revenue derived from new products, serves as a powerful financial justification for executive-level investment in these specialized tools, accelerating procurement cycles and widespread adoption.

Restraints: Despite the recognized benefits, a major restraint is the difficulty large organizations face in achieving internal alignment and cultural adoption. Innovation management tools often require significant shifts in organizational behavior, moving from hierarchical, top-down decision-making to more democratic, transparent processes, which is frequently met with internal friction and resistance from middle management. Technical restraints include the high initial deployment costs for complex, customized, on-premise solutions and the ongoing challenge of securing sensitive intellectual property (IP) within cloud-based platforms, particularly in highly regulated sectors like aerospace, defense, and healthcare. These factors often extend the pilot phase and slow down full enterprise rollout.

Opportunities: The market offers vast opportunities through the expansion into underserved segments, particularly SMEs in emerging economies, enabled by flexible, low-cost SaaS models requiring minimal capital expenditure. A major technological opportunity lies in leveraging blockchain technology for secure, transparent tracking of idea provenance and intellectual property rights, crucial for open innovation platforms. Additionally, the growing focus on sustainability and ESG (Environmental, Social, and Governance) mandates creates specialized demand for innovation tools capable of tracking and managing ideas specifically aimed at corporate responsibility, waste reduction, and energy efficiency, opening up new specialized vertical markets and compliance-driven sales channels for vendors.

Segmentation Analysis

The Innovation Management Tools Market segmentation provides a granular view of user preferences, purchasing behavior, and solution specialization across different deployment models, organizational structures, and functional applications. The market is primarily analyzed based on Component (Software and Services), Deployment (Cloud and On-Premise), Organization Size (SMEs and Large Enterprises), Application (Idea Management, Portfolio Management, Collaboration, etc.), and Industry Vertical. Understanding these segments is critical for vendors to tailor their offerings, pricing strategies, and marketing efforts, ensuring their solutions address the specific pain points and technological readiness of diverse end-users.

The shift in segmentation trends highlights the ongoing digital transformation globally, with the Cloud segment dominating due to its inherent advantages in scalability, accessibility for remote teams, and continuous automatic updates, which are vital for agile innovation environments. Conversely, the Services component is growing faster than the Software component, reflecting the realization among enterprises that successful innovation is not just about having the tool, but about structuring and executing the underlying processes correctly. This includes demand for consulting services to map existing innovation workflows, system integration services to ensure compatibility with enterprise architecture, and ongoing support and training to maximize user engagement and platform efficacy.

Furthermore, segmentation by application demonstrates the maturation of the market, moving beyond basic idea collection (Idea Management) to more strategic and financially focused functions. Specifically, Portfolio Management tools are experiencing robust demand as executives seek enhanced visibility and control over their innovation pipeline, requiring tools that can calculate risk-adjusted return on investment (ROI) for individual projects and optimize resource allocation based on real-time performance metrics. This specialized demand reflects a broader market trend where innovation is increasingly treated as a critical, measurable business function rather than an abstract concept.

- By Component:

- Software (Subscription-based, Perpetual License)

- Services (Consulting, Implementation, Training and Support & Maintenance)

- By Deployment:

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud)

- On-Premise

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Collaboration Tools and Networking

- Idea Management and Crowd-sourcing

- Portfolio Management and Prioritization

- Product Development and Lifecycle Management

- Technology Scouting and Trend Analysis

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) & Telecom

- Healthcare and Pharmaceuticals

- Manufacturing (Automotive, Heavy Industry)

- Retail and E-commerce

- Government and Public Sector

- Energy and Utilities

Value Chain Analysis For Innovation Management Tools Market

The Value Chain for the Innovation Management Tools Market begins with the upstream activities centered on software development and platform design, which is highly knowledge-intensive. This stage involves deep research into behavioral science, organizational development theories, and cutting-edge software engineering to build robust, scalable, and secure platforms incorporating AI/ML capabilities for data processing and analysis. Key upstream functions include continuous feature development, intellectual property (IP) protection of proprietary algorithms, and ensuring compliance with global data privacy regulations (like GDPR). The quality and sophistication of the core software architecture directly influence the competitive differentiation and long-term viability of the vendor’s offering in a rapidly evolving technological landscape.

Moving through the distribution channel, vendors utilize a mix of direct sales forces focused on securing large enterprise contracts and indirect channels, primarily comprising value-added resellers (VARs), strategic system integrators (SIs), and implementation partners. System integrators play a crucial role by customizing the innovation platform to specific organizational workflows, facilitating seamless integration with existing enterprise systems (such as ERP and HRIS), and providing specialized industry consulting. The success of the distribution stage is heavily reliant on the technical expertise and vertical-specific knowledge of these indirect partners, ensuring that the software is deployed and utilized effectively to deliver measurable strategic outcomes for the end-user.

Downstream activities focus predominantly on the Services component, which includes post-implementation support, continuous training, user adoption management, and ongoing strategic consulting to refine the client's innovation processes over time. Customer retention and long-term contract value are significantly influenced by the quality of this downstream support. Furthermore, feedback loops from large enterprise clients regarding feature requests, scalability issues, and performance metrics feed directly back into the upstream development process, completing the value cycle and driving continuous product improvement and relevance. This robust service layer is essential for converting initial software sales into sustained, high-value, long-term partnerships.

Innovation Management Tools Market Potential Customers

Potential customers for Innovation Management Tools are diverse and span virtually every industry vertical that faces competitive pressure to differentiate or optimize internal operations. The primary end-users are large multinational corporations (MNCs) that possess extensive R&D budgets, complex internal structures, and geographically dispersed teams, necessitating a standardized, centralized system for idea capture and portfolio governance. Key decision-makers in these organizations typically include Chief Innovation Officers (CIOs), Chief Technology Officers (CTOs), Heads of R&D, and Vice Presidents of Corporate Strategy, who are responsible for ensuring that innovation aligns with overarching business objectives and delivers quantifiable value.

Beyond traditional R&D-heavy sectors like Pharmaceuticals, Aerospace, and Automotive Manufacturing, there is a rapidly expanding customer base within the Banking, Financial Services, and Insurance (BFSI) sector, driven by the need to combat disruption from Fintech startups and optimize internal processes for regulatory compliance and customer experience. These institutions utilize innovation management tools to crowdsource ideas for new digital products, enhance cybersecurity protocols, and streamline back-office operations. Similarly, government agencies and public sector organizations are increasingly adopting these tools to improve citizen engagement, optimize resource allocation, and foster efficiency initiatives across bureaucratic structures.

The emerging potential customer segment comprises high-growth Small and Medium Enterprises (SMEs) that recognize the critical need for structured innovation but lack the internal resources for bespoke development. These SMEs seek accessible, modular, cloud-based solutions that can be quickly implemented and scaled up as their business matures. Their buying decisions are often influenced heavily by cost-effectiveness, ease of use, and the provision of adequate training and support, making them ideal targets for SaaS vendors offering tiered subscription models tailored to smaller operational scales and limited IT infrastructure support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 12.8 Billion |

| Growth Rate | 20.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Planview, Inc., IdeaScale, HYPE Innovation, Qmarkets, Sopheon, Spigit (Khoros), Brightidea, Roman Krznaric, Viima, InnoCentive, Exago, SAP SE, Medallia, Salesforce, Microsoft, Planbox, Wazoku, ITONICS, Miro, Aha! |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Innovation Management Tools Market Key Technology Landscape

The technological landscape of the Innovation Management Tools Market is rapidly evolving, driven primarily by the maturation and integration of advanced analytical and collaborative technologies. At the core, these tools rely heavily on sophisticated cloud infrastructure (AWS, Azure, Google Cloud) to provide the requisite scalability, global accessibility, and data processing power needed for large, multinational innovation campaigns. Key enabling technologies include advanced database architectures capable of handling structured and unstructured data inputs (such as text, video, and design files), robust security frameworks utilizing encryption and multi-factor authentication to protect sensitive IP, and scalable APIs for seamless integration with the complex tapestry of enterprise systems used by clients.

The most transformative technologies currently reshaping this market are Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are crucial for migrating the platforms beyond simple data storage to intelligent decision support systems. Specific applications of AI include Natural Language Processing (NLP) for thematic categorization and sentiment analysis of thousands of submitted ideas, sophisticated predictive analytics models that use historical data to score the potential ROI and risk of new concepts, and intelligent routing systems that automatically assign ideas to the most qualified subject matter experts for rapid evaluation. The increasing sophistication of these AI modules differentiates leading vendors by significantly enhancing operational efficiency and the strategic value of the generated insights.

Furthermore, contemporary innovation platforms incorporate powerful visualization and collaboration tools utilizing technologies such as real-time interactive whiteboards, enhanced video conferencing integration, and gamification mechanics (leaderboards, badges) to maximize user engagement and ensure continuous contribution. Blockchain technology is emerging as a niche but critical technology, particularly for open innovation platforms, offering decentralized, immutable ledger capabilities to securely track the ownership, timestamp, and modification history of ideas and related IP assets. This cryptographic proof of provenance addresses critical legal and trust issues inherent in collaborative external innovation, promising to unlock greater participation in crowd-sourced projects across highly competitive verticals.

Regional Highlights

Regional dynamics play a crucial role in shaping the Innovation Management Tools Market, reflecting varying levels of digital maturity, R&D investment, and regulatory environments globally. North America, encompassing the United States and Canada, remains the largest market share holder. This dominance is attributable to the region's concentration of early technology adopters, massive investment in R&D across the pharmaceutical, IT, and aerospace sectors, and a pervasive corporate culture that prioritizes formalized, data-driven innovation processes. The demand here is characterized by a high preference for advanced, AI-enabled, subscription-based cloud solutions and robust integration services required by large technology enterprises and financial institutions.

Europe represents the second-largest market, characterized by strong governmental mandates supporting digitization and sustainable innovation. Countries like Germany, the UK, and France show significant adoption, driven by their established manufacturing bases and high regulatory standards. European demand often focuses on tools that incorporate strong multi-language capabilities and compliance features relevant to GDPR, as well as specialized applications for managing innovation related to sustainable development goals (SDGs) and the circular economy. The market in Europe is mature, with established vendors competing heavily on niche specialization and consulting support.

Asia Pacific (APAC) is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is driven by rapid industrial expansion, increasing investments by governments in digital infrastructure (particularly in China, India, and Southeast Asia), and the rapid transition of local enterprises from manual processes to structured IT solutions. The APAC market is characterized by strong demand for mobile-friendly solutions, high competition on pricing, and a growing adoption of cloud deployment models as large, diverse corporations seek to standardize processes across rapidly growing regional offices and manufacturing hubs. Latin America and the Middle East & Africa (MEA) are emerging markets, with growth concentrated in the BFSI and Energy sectors, showing potential for future expansion driven by foreign direct investment and localized digital transformation initiatives.

- North America: Market leader; high technology adoption; focus on AI/ML integration and enterprise-level portfolio governance, dominating the software segment revenue.

- Europe: Mature market; driven by manufacturing and regulatory compliance; strong demand for multi-lingual and sustainability-focused innovation tracking solutions.

- Asia Pacific (APAC): Highest growth rate; propelled by industrialization and cloud migration; focused on efficiency improvement and high-volume crowd-sourcing solutions.

- Latin America (LATAM): Emerging growth; increasing adoption in financial services and telecommunications; preference for scalable, cost-effective SaaS models.

- Middle East and Africa (MEA): Growth centered around oil & gas, government, and finance sectors; demand for secure, on-premise solutions due to data sovereignty requirements, though cloud adoption is accelerating in tech hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Innovation Management Tools Market.- Planview, Inc.

- IdeaScale

- HYPE Innovation

- Qmarkets

- Sopheon

- Spigit (Khoros)

- Brightidea

- Planbox

- Wazoku

- InnoCentive

- Exago

- SAP SE

- Medallia

- Salesforce (via acquisition/integration)

- Microsoft (via integration with collaboration suites)

- Itonics GmbH

- Aha! Labs Inc.

- Miro (RealtimeBoard)

- Accept Mission

- Viima Solutions Ltd.

Frequently Asked Questions

Analyze common user questions about the Innovation Management Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Innovation Management Tool?

The primary function is to provide a structured, centralized platform for managing the entire innovation lifecycle, encompassing idea generation, collection, evaluation, prioritization, and tracking of projects from concept through to commercialization and portfolio reporting.

How is Artificial Intelligence (AI) impacting the utility of these tools?

AI, through machine learning and NLP, enhances utility by automating idea screening, performing semantic analysis to categorize and deduplicate submissions, and providing predictive analytics to forecast the potential success and risk profile of innovation projects, thereby accelerating decision-making.

What is the key difference between Cloud and On-Premise deployment for innovation platforms?

Cloud deployment offers superior scalability, lower initial capital expenditure, rapid deployment, and easier access for globally distributed teams, while On-Premise deployment provides maximum control over data security and compliance, often preferred by highly regulated industries.

Which industry vertical is showing the fastest growth in adoption of Innovation Management Tools?

The Asia Pacific (APAC) region, particularly driven by its Manufacturing and IT & Telecom sectors, is exhibiting the fastest growth in the adoption of innovation management tools, necessitated by rapid digital transformation and efficiency mandates.

What are the greatest challenges organizations face when implementing a new innovation platform?

The greatest challenges involve overcoming internal cultural resistance to formalized innovation processes, ensuring seamless integration with existing enterprise resource planning (ERP) and legacy IT systems, and securing sustained, high levels of employee engagement post-implementation.

Are Innovation Management Tools suitable for Small and Medium Enterprises (SMEs)?

Yes, the market increasingly caters to SMEs through highly flexible, cost-effective SaaS subscription models that require minimal internal IT infrastructure, enabling smaller firms to formalize their innovation efforts without major capital investment.

What is Open Innovation and how do these tools support it?

Open Innovation involves sourcing ideas and solutions externally (from customers, partners, or the public). Innovation management tools support this by providing secure, scalable crowd-sourcing platforms and collaboration spaces, often leveraging blockchain for secure IP tracking.

What role does Portfolio Management play in innovation software?

Portfolio Management modules help executives strategically allocate financial and human resources across multiple competing innovation projects, ensuring that the overall pipeline is balanced, aligned with corporate strategy, and optimized for risk-adjusted return on investment (ROI).

How do vendors ensure data security for highly sensitive intellectual property (IP) on cloud platforms?

Vendors utilize advanced security protocols including end-to-end encryption, multi-factor authentication, stringent access controls, and compliance certifications (like ISO 27001) to protect sensitive IP and maintain data sovereignty standards globally.

Besides software, why are professional services an important segment of this market?

Professional services, including consulting and integration, are crucial because successful implementation requires tailoring the software to unique organizational workflows, overcoming cultural barriers, and integrating the platform deeply with existing enterprise architecture, ensuring strategic rather than purely technical adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager