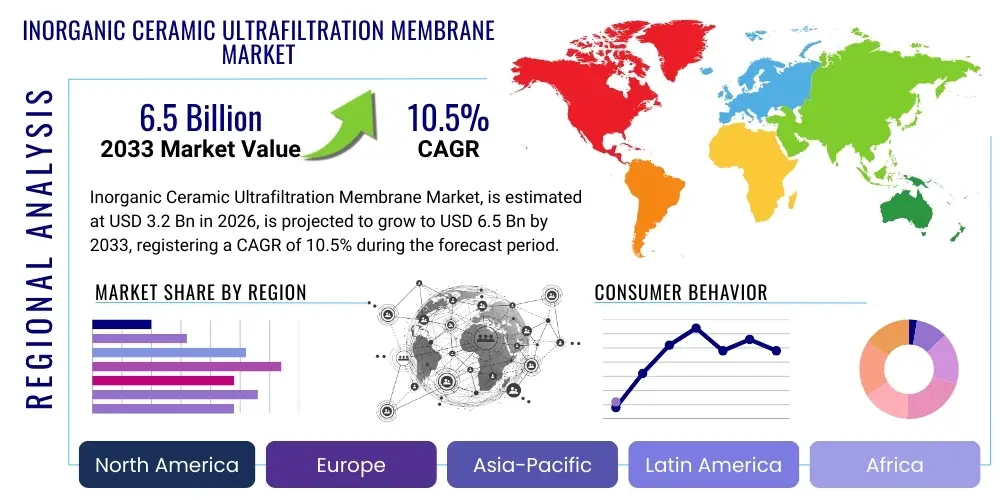

Inorganic Ceramic Ultrafiltration Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436387 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Inorganic Ceramic Ultrafiltration Membrane Market Size

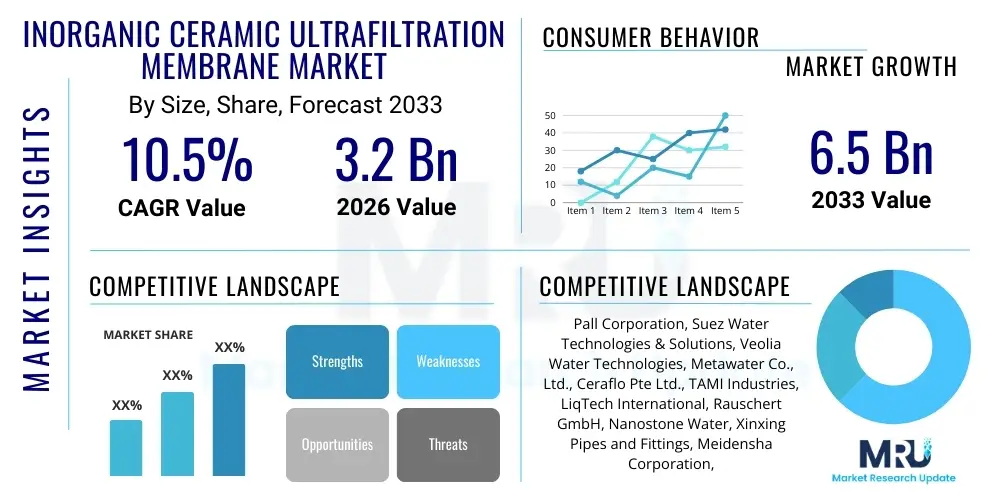

The Inorganic Ceramic Ultrafiltration Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for high-purity water, particularly in industrial sectors facing stringent discharge regulations and acute water scarcity challenges. Ceramic membranes offer superior durability and operational efficiency compared to conventional polymeric alternatives, positioning them as essential components in modern separation processes.

Inorganic Ceramic Ultrafiltration Membrane Market introduction

The Inorganic Ceramic Ultrafiltration Membrane Market encompasses advanced separation technology utilizing porous materials, primarily derived from metal oxides such as alumina, titania, and zirconia, fabricated into monolithic or tubular structures. These membranes are designed for cross-flow filtration, operating with pore sizes generally ranging from 0.01 to 0.1 micrometers, effectively separating macromolecules, colloids, viruses, and particulates from liquid streams while allowing smaller molecules and water to pass through. The intrinsic properties of ceramic materials, including exceptional thermal stability, high chemical resistance across extreme pH ranges, and mechanical robustness, distinguish them sharply from less resilient polymeric membranes, making them indispensable in challenging environments such as high-temperature processing, solvent filtration, and aggressive chemical recovery processes, thereby ensuring sustained performance and extended operational life in complex industrial setups.

The core application domains driving the market expansion include sophisticated municipal and industrial wastewater recycling, the production of purified water for electronics and pharmaceuticals, and critical separation stages within the food and beverage industry, particularly for dairy and fruit juice clarification. In wastewater treatment, ceramic UF membranes facilitate superior effluent quality necessary for reuse applications, addressing critical environmental mandates. Furthermore, the rising adoption in oil and gas for produced water treatment and in chemical processing for catalyst recovery underscores their versatility and reliability under demanding operational parameters. The ability of these membranes to withstand repeated steam sterilization and harsh chemical cleaning regimes provides a significant operational cost advantage over the long term, cementing their status as a premium separation solution for high-value streams requiring absolute integrity.

Key driving factors accelerating market adoption involve rapidly increasing global industrialization, coupled with stricter governmental mandates regarding environmental protection and water resource management, particularly in fast-growing economies in the Asia Pacific region. The ongoing technological evolution in membrane fabrication, leading to improved flux rates and reduced capital expenditure, further enhances the economic viability of ceramic UF systems. These systems provide a compelling solution for industries seeking sustainable processes, offering lower lifecycle costs through reduced fouling potential and decreased downtime. The superior longevity and energy efficiency compared to traditional filtration techniques are pivotal advantages contributing to their increasing market penetration across diverse high-ppurity and high-volume separation applications worldwide.

Inorganic Ceramic Ultrafiltration Membrane Market Executive Summary

The global Inorganic Ceramic Ultrafiltration Membrane Market is experiencing robust growth fueled by pivotal business trends centered around sustainability, advanced material science, and strategic regional expansion. A primary business trend involves the development of hybrid membrane systems that integrate ceramic UF modules with other separation technologies, such as nanofiltration or reverse osmosis, to achieve comprehensive, multi-barrier water treatment solutions. Furthermore, leading manufacturers are focusing heavily on standardizing module designs and optimizing production processes to lower the overall capital expenditure, making ceramic membranes more competitive against conventional polymeric solutions in moderately aggressive applications. Strategic partnerships between membrane suppliers and large Engineering, Procurement, and Construction (EPC) firms specializing in water infrastructure are becoming commonplace, facilitating quicker market penetration and large-scale project deployment, particularly in urban water reclamation and major industrial complexes.

Regionally, Asia Pacific (APAC) stands out as the foremost growth engine, driven by massive investments in new industrial capacity, rapid urbanization, and severe water stress across nations like China and India, necessitating advanced water and wastewater recycling infrastructure. Regulatory pressures concerning industrial effluent quality in Europe and North America continue to sustain demand, focusing on membrane bioreactors (MBRs) and advanced tertiary treatment for environmental compliance. The Middle East and Africa (MEA) region is exhibiting accelerated adoption, largely due to governmental initiatives aimed at enhancing water security and utilizing non-conventional water sources for agricultural and industrial development, where the robustness of ceramic membranes in handling challenging feedwaters is highly valued. Latin America is also showing emerging potential, particularly in the mining and chemical sectors, where process water recycling is critical for operational efficiency and meeting environmental stewardship goals.

Segmentation trends indicate a strong shift towards applications requiring high-temperature resistance and chemical resilience, specifically within the pharmaceutical and petrochemical industries, driving demand for membranes fabricated from advanced materials like Zirconia and Silicon Carbide (SiC) which exhibit unparalleled chemical inertness. By material, alumina-based membranes still command a significant market share due to their cost-effectiveness and proven performance in general water treatment and food processing. However, the fastest growth is observed in high-performance materials suitable for solvent-resistant applications. By application, industrial wastewater treatment remains the largest segment, but food and beverage processing, particularly in aseptic filtration and enzyme recovery, is exhibiting the highest Compound Annual Growth Rate, spurred by global consumer demands for natural, minimally processed, and clean-label products which necessitate highly efficient, non-thermal separation techniques like ultrafiltration.

AI Impact Analysis on Inorganic Ceramic Ultrafiltration Membrane Market

User queries frequently revolve around how Artificial Intelligence (AI) can mitigate the two most critical operational challenges associated with ceramic ultrafiltration: fouling prediction and energy optimization, alongside concerns about maintenance costs and system reliability. Key themes emerging from user concerns include expectations for predictive maintenance schedules, optimizing backwash frequency to minimize water consumption and energy use, and the potential for real-time membrane health monitoring in complex industrial environments. Users anticipate AI integrating sensor data—such as transmembrane pressure, temperature, pH, and flow rates—to accurately predict flux decline before it severely impacts operational efficiency, thereby enabling proactive intervention. The central expectation is that AI will transform ceramic UF systems from reactive, scheduled maintenance platforms into predictive, highly efficient assets, enhancing their overall economic viability and reducing the need for intensive human intervention in complex plant operations.

- AI-driven Predictive Fouling Detection: Utilizing machine learning models to analyze operational data and predict the onset of reversible and irreversible membrane fouling, optimizing chemical cleaning cycles and prolonging membrane lifespan.

- Automated Flux Optimization: Employing AI algorithms to dynamically adjust cross-flow velocity and transmembrane pressure in real-time based on feed water quality fluctuations, maximizing throughput while minimizing energy consumption.

- Enhanced Process Control: Integrating AI into Supervisory Control and Data Acquisition (SCADA) systems for automatic fault detection, system diagnostics, and autonomous response to operational anomalies, improving overall plant stability.

- Digital Twin Simulation: Creating virtual replicas of UF systems using AI to simulate various operating conditions, test new feed sources, and optimize plant design parameters before physical deployment, reducing commissioning time and risks.

- Supply Chain and Inventory Management: Using AI to forecast demand for replacement modules and optimize raw material procurement (alumina, titania) based on predictive maintenance schedules and regional project timelines, stabilizing costs.

DRO & Impact Forces Of Inorganic Ceramic Ultrafiltration Membrane Market

The market is primarily driven by the mandatory shift towards water reuse and conservation, particularly in water-stressed regions, necessitating filtration solutions capable of handling heavily contaminated feed streams (Drivers). However, high initial capital investment compared to polymeric membranes (Restraints) remains a significant barrier to entry, particularly for smaller municipal projects. The increasing research into low-cost ceramic membrane fabrication techniques and the emerging applications in biofuel production and pharmaceutical crystallization represent substantial market Opportunities. These forces collectively dictate market trajectory: high performance is required, but cost constraints must be overcome, leading manufacturers to invest heavily in mass production techniques and material innovation to achieve cost parity, thereby exerting a crucial Impact Force on pricing strategies and material science development globally.

Drivers: The escalating global focus on industrial wastewater treatment and tertiary polishing to meet stringent discharge limits is the primary driver. Ceramic membranes are uniquely suited for these applications due to their ability to tolerate harsh operating conditions, including extreme pH, high temperatures (up to 300°C), and resistance to microbial degradation, which polymeric membranes cannot sustain. Furthermore, increasing government investment in water infrastructure modernization, particularly in the Middle East and Asia Pacific, specifically mandates advanced separation technologies for public health protection and economic sustainability. The rising demand from the food and beverage industry for cold sterilization and clarification of heat-sensitive products, where ceramic membranes prevent thermal degradation while ensuring high hygiene standards, also significantly propels market expansion.

Restraints: Despite their superior performance, the relatively higher initial cost of ceramic ultrafiltration membrane modules compared to their polymeric counterparts poses a significant financial restraint, particularly for projects with tight budget constraints or in developing economies. Additionally, the inherent brittleness of ceramic materials necessitates careful handling during installation and operation, contrasting with the flexibility of polymeric systems. Another restraint involves the energy intensity required for the high cross-flow velocities often employed in ceramic ultrafiltration systems to maintain flux and reduce fouling, which can lead to higher operational expenditure (OPEX) if not optimized, forcing end-users to carefully calculate the long-term cost benefits against upfront investment and energy costs.

Opportunities: Major opportunities reside in expanding applications outside conventional water treatment, such as the separation of oil-water emulsions in the petrochemical and refining industries, which demand chemically resistant membranes. The emerging field of forward osmosis (FO) and pressure-retarded osmosis (PRO) integrated systems utilizing ceramic supports also presents a substantial opportunity for future growth. Furthermore, ongoing research focused on developing thin-film composite ceramic membranes and exploring alternative, cost-effective raw materials like natural clays and waste-derived materials offers the potential to dramatically reduce manufacturing costs, democratizing the technology and opening up new markets currently dominated by lower-cost polymeric solutions.

Impact Forces: The long-term durability and lower replacement frequency of ceramic membranes act as a strong positive impact force, influencing lifecycle cost analysis heavily in their favor, especially in CAPEX-sensitive industrial settings. Conversely, fierce competition from improved polymeric membranes (e.g., highly resistant cross-linked polyethersulfone) capable of handling moderately harsh conditions acts as a moderating force, preventing rapid price escalation for standard ceramic modules. Regulatory standardization, especially concerning membrane integrity testing (MIT) and validation protocols in highly regulated industries like pharmaceutical production, drives innovation towards uniform module dimensions and quality assurance, thereby impacting manufacturing practices and market entry requirements globally.

Segmentation Analysis

The Inorganic Ceramic Ultrafiltration Membrane Market is comprehensively segmented based on material type, filter mode, pore size, and primary application, providing a granular view of market dynamics and technology adoption patterns across different industrial verticals. Material segmentation is crucial as it dictates the chemical, thermal, and mechanical resistance profile of the membrane, with alumina, titania, and zirconia being the principal raw materials, each suited for distinct operating environments and cost considerations. The application segment is the largest determinant of market volume and revenue, reflecting the significant demand generated by environmental regulations in industrial wastewater recycling, while specialized segments like biological separation in pharmaceuticals drive high-value, low-volume consumption.

Filter modes primarily differentiate between cross-flow filtration, which is predominant due to its fouling resistance and suitability for continuous high-solids operation, and dead-end filtration, which is less common but sometimes used for batch processes or highly diluted solutions. Pore size classification separates ultrafiltration (UF) from microfiltration (MF) and nanofiltration (NF), where the UF range (0.01 to 0.1 µm) is optimized for virus and macromolecule removal. This segmentation is fundamental for manufacturers to tailor product offerings to precise separation needs, such as ensuring pathogen removal in drinking water applications or precise protein fractionation in bioprocessing, optimizing performance characteristics like flux and rejection rates for specific industrial streams.

- By Material Type:

- Alumina (Al2O3)

- Titania (TiO2)

- Zirconia (ZrO2)

- Silicon Carbide (SiC)

- Mixed Oxides

- By Filter Mode:

- Cross-Flow Filtration

- Dead-End Filtration

- By Application:

- Water and Wastewater Treatment (Municipal, Industrial Effluent, Tertiary Treatment)

- Food and Beverage Processing (Juice Clarification, Dairy Processing, Wine Filtration)

- Pharmaceutical and Biotechnology (Biologics Separation, Fermentation Broth Clarification)

- Chemical Processing (Catalyst Recovery, Solvent Filtration, Acid/Base Purification)

- Oil and Gas (Produced Water Treatment, Emulsion Separation)

- By Pore Size:

- 0.01 µm to 0.05 µm

- 0.05 µm to 0.1 µm

Value Chain Analysis For Inorganic Ceramic Ultrafiltration Membrane Market

The value chain for the Inorganic Ceramic Ultrafiltration Membrane Market begins with the upstream sourcing and preparation of highly refined metal oxide powders (alumina, zirconia, titania). This stage requires specialized mineral processing to achieve the required purity and particle size distribution critical for membrane porosity control. Key upstream suppliers include major chemical and material science companies. The manufacturing phase, involving sintering, slip casting, or extrusion, is highly capital-intensive and requires significant technical expertise to control the final membrane structure, including the support layer, intermediate layers, and the thin active separation layer. Successful value realization hinges on minimizing defects during the high-temperature sintering process and achieving maximum reproducibility in pore size distribution, which directly affects product performance and market price.

Midstream activities involve membrane module assembly, where individual ceramic elements (tubes, monoliths) are housed within robust stainless steel or composite casings, ready for integration into larger systems. This stage also includes crucial quality control processes such as bubble point testing and integrity validation. Downstream distribution primarily involves two pathways: direct sales to large, integrated industrial end-users (e.g., major petrochemical plants or pharmaceutical manufacturers) that purchase standalone modules for in-house integration, and indirect sales through Original Equipment Manufacturers (OEMs) and specialized system integrators (SIs). OEMs purchase the modules and incorporate them into complete, skid-mounted UF systems customized for specific applications, such as high-capacity wastewater treatment plants or specialized dairy fractionation systems, adding significant value through engineering, automation, and project management expertise.

The direct and indirect distribution channels are differentiated by the complexity of the project and the technical capacity of the end-user. Direct channels are typical for experienced buyers requiring standardized replacement modules or custom designs in ongoing operations. Indirect channels, utilizing system integrators and distributors, are essential for reaching smaller clients, municipal projects, and geographically dispersed markets, where the integrator provides installation, commissioning, and long-term maintenance support, thereby extending the manufacturer's reach and managing project risk. Customer proximity and responsive technical support are crucial factors in the downstream value chain, as ceramic membranes require specialized cleaning and maintenance protocols to ensure optimal long-term performance, making local service expertise a key differentiator in securing long-term contracts and recurring revenue streams.

Inorganic Ceramic Ultrafiltration Membrane Market Potential Customers

Potential customers for Inorganic Ceramic Ultrafiltration Membranes span a diverse range of high-value industrial sectors and municipal utilities that require reliable, high-integrity separation under challenging operational conditions. The primary end-users are large multinational corporations in the food and beverage industry seeking superior clarification and sterilization methods that avoid heat damage, such as dairy processors (whey protein fractionation) and fruit juice producers (clarification). Another significant customer base includes pharmaceutical and biotechnology companies requiring highly purified water (WFI) and precise separation of temperature-sensitive biologics, where the chemical inertness and sterilization capability of ceramic membranes meet stringent regulatory standards (e.g., FDA, EMA).

Furthermore, industrial facilities that generate significant volumes of complex wastewater, notably the petrochemical refining industry, textile manufacturers, and mining operations, represent major potential customers. These sectors frequently deal with high oil content, extreme pH, or high temperatures, rendering conventional polymeric membranes unsuitable. Ceramic UF membranes offer a sustainable solution for treating produced water, recovering valuable process chemicals, or complying with zero liquid discharge (ZLD) mandates. Municipal water utilities are also increasingly becoming potential customers, particularly in regions facing seasonal water scarcity or needing to upgrade existing facilities to handle challenging source water qualities or meet highly elevated effluent standards for non-potable reuse applications, favoring the robustness of ceramic solutions for long-term infrastructure investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation, Suez Water Technologies & Solutions, Veolia Water Technologies, Metawater Co., Ltd., Ceraflo Pte Ltd., TAMI Industries, LiqTech International, Rauschert GmbH, Nanostone Water, Xinxing Pipes and Fittings, Meidensha Corporation, Atech Innovations GmbH, Applied Membranes Inc., CT Ceramics, Mantec Technical Ceramics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inorganic Ceramic Ultrafiltration Membrane Market Key Technology Landscape

The technological landscape of the Inorganic Ceramic Ultrafiltration Membrane market is characterized by continuous material science innovation aimed at enhancing flux, reducing fouling, and lowering production costs. A key technological advancement is the development of asymmetric and multilayered structures, which involve depositing a thin, highly porous separation layer onto a thicker, mechanically strong support layer, typically via techniques like slip casting, extrusion, or sol-gel processing. This design maximizes throughput (flux) while maintaining high selectivity and minimizing material consumption. Recent focus has been placed on Silicon Carbide (SiC) membranes, which boast superior hydrophilicity and thermal conductivity, resulting in significantly reduced scaling and fouling rates, particularly beneficial for aggressive produced water treatment and high-solids concentration applications, commanding a premium price point in the market.

Another major area of focus involves surface modification technologies, utilizing techniques such as grafting, coating, or plasma treatment to enhance the anti-fouling characteristics of the membrane surface. By introducing highly hydrophilic or oleophobic functional groups, manufacturers can significantly mitigate the adhesion of organic foulants and oil droplets, leading to longer operational cycles and less frequent chemical cleaning. This technological evolution directly addresses one of the primary operational drawbacks of all membrane filtration—flux decline. Furthermore, advancements in module design, moving from traditional tubular modules to more compact configurations like ceramic flat sheets and multichannel monoliths, are increasing the packing density and reducing the required plant footprint, making ceramic UF systems more competitive for municipal and land-constrained industrial sites.

The manufacturing process itself is undergoing optimization, particularly through the exploration of lower-temperature sintering techniques and the utilization of novel binders and pore formers to achieve reproducible pore structure control while reducing the high energy expenditure traditionally associated with ceramic manufacturing. The integration of advanced sensor technology, often coupled with the AI analysis mentioned previously, allows for real-time monitoring of transmembrane pressure, conductivity, and turbidity, forming the foundation of smart filtration systems. These technological integrations enhance operational reliability, minimize costly unplanned shutdowns, and solidify the position of inorganic ceramic membranes as the preferred choice for mission-critical, high-assurance separation tasks across regulated industries globally.

Regional Highlights

The global market for Inorganic Ceramic Ultrafiltration Membranes displays significant regional disparities in growth rate and technology adoption, primarily dictated by varying regulatory environments, levels of industrial maturity, and regional water resource challenges. Asia Pacific (APAC) holds the dominant market share and exhibits the fastest growth trajectory globally. This is largely attributable to intensive industrialization, particularly in chemical processing, electronics manufacturing, and coal-fired power generation, all of which require massive volumes of high-purity water and face escalating governmental pressure to treat and recycle wastewater effectively. Nations like China and India are making substantial public and private investments in water treatment infrastructure, creating a massive, sustained demand for robust ceramic membrane technology capable of handling complex industrial effluents and providing reliable water reuse solutions.

North America and Europe represent mature markets characterized by stable, high-value demand, primarily driven by strict environmental protection laws and sophisticated industrial sectors such as pharmaceuticals and specialty chemicals. In North America, the focus is heavily on applying ceramic membranes in advanced municipal tertiary treatment for aquifer recharge and non-potable reuse schemes, where reliability and minimal operator intervention are paramount. European growth is primarily spurred by the food and beverage sector’s need for hygienic filtration and the energy sector’s requirement for complex separation tasks in oil and gas and biofuel production. These regions prioritize quality, operational efficiency, and low lifecycle costs, driving demand for high-end materials like SiC and advanced module designs, often incorporating stringent integrity monitoring systems.

The Middle East and Africa (MEA) region is emerging as a critical growth area, particularly in the Arabian Peninsula, where extreme water scarcity necessitates aggressive implementation of desalination and water recycling projects. The harsh environmental conditions, including high salinity and temperature fluctuations, favor the inherent robustness of inorganic ceramic membranes over conventional polymeric systems for treating produced water, municipal effluent, and seawater reverse osmosis pre-treatment. Latin America, while smaller in market size, is demonstrating steady adoption, particularly within the mining industry for tailings water recovery and metal extraction process optimization, and within the expansive Brazilian food and beverage industry, leveraging ceramic UF for high-efficiency clarification and concentration processes.

- Asia Pacific (APAC): Dominates the market share; fastest growth driven by industrial expansion, severe water scarcity, and stringent wastewater discharge regulations in China and India.

- North America: Mature market focused on municipal water reuse (tertiary treatment), oil/gas produced water, and high-purity applications in electronics and pharma.

- Europe: High adoption rates in the food and beverage industry (hygienic filtration) and compliance with strict EU environmental directives regarding chemical effluent treatment.

- Middle East & Africa (MEA): High growth potential due to water security initiatives and the demand for robust membranes capable of handling challenging feedwaters in desalination and industrial recycling.

- Latin America: Emerging demand fueled by the mining sector (process water management) and high-volume food processing industries (Brazil, Mexico).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inorganic Ceramic Ultrafiltration Membrane Market.- Pall Corporation

- Suez Water Technologies & Solutions

- Veolia Water Technologies

- Metawater Co., Ltd.

- TAMI Industries

- LiqTech International

- Rauschert GmbH

- Nanostone Water

- Xinxing Pipes and Fittings

- Ceraflo Pte Ltd.

- Meidensha Corporation

- Atech Innovations GmbH

- Applied Membranes Inc.

- CT Ceramics

- Mantec Technical Ceramics

- Inopor GmbH

- Ceramem

- Nanjing Tangent Fluid Technology Co., Ltd.

- Jiuwu Hi-Tech

- M-Filter Oy

Frequently Asked Questions

Analyze common user questions about the Inorganic Ceramic Ultrafiltration Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of ceramic UF membranes over polymeric membranes in industrial applications?

Ceramic ultrafiltration membranes offer superior resistance to high temperatures, aggressive chemicals (extreme pH), and organic solvents. Their mechanical robustness allows for effective steam sterilization, frequent backwashing, and longer operational lifecycles, translating into lower long-term maintenance costs and higher operational reliability in harsh industrial environments like petrochemical processing and food sterilization.

In which applications are Silicon Carbide (SiC) membranes gaining the most traction?

SiC membranes are experiencing rapid adoption in highly demanding applications, particularly in oil-water separation (produced water treatment), concentration of high-solids feeds, and chemical processing involving abrasive media. Their exceptional thermal conductivity and hydrophilicity significantly reduce fouling and enable high flux rates under intense operating conditions, making them ideal for high-value process streams.

How does the high initial cost of ceramic membranes affect their overall market adoption?

While the initial capital expenditure (CAPEX) for ceramic UF systems is higher than for polymeric systems, the market is adopting a lifecycle cost analysis approach. The long operational lifespan (often exceeding 10 years), reduced need for frequent replacement, minimized chemical cleaning downtime, and superior performance in recovering valuable materials often justify the initial investment, making them economically advantageous in the long term for industrial users.

Which geographical region is currently driving the largest growth in the ceramic UF market?

Asia Pacific (APAC), particularly driven by industrial expansion and severe water quality challenges in China and India, is the leading growth region. Strict governmental mandates for industrial wastewater recycling and substantial infrastructure investments are creating a massive, sustained demand for robust, high-performance ceramic ultrafiltration solutions across the region.

What is the role of AI in optimizing the performance of ceramic ultrafiltration systems?

AI is crucial for enhancing ceramic UF performance by implementing predictive maintenance, optimizing cleaning cycles, and automating flux control. Machine learning analyzes real-time sensor data (pressure, flow) to anticipate fouling before it occurs, ensuring continuous peak efficiency, reducing energy consumption, and extending the effective service life of the membrane elements through proactive adjustments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager