Insect Repellent Lights Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433351 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Insect Repellent Lights Market Size

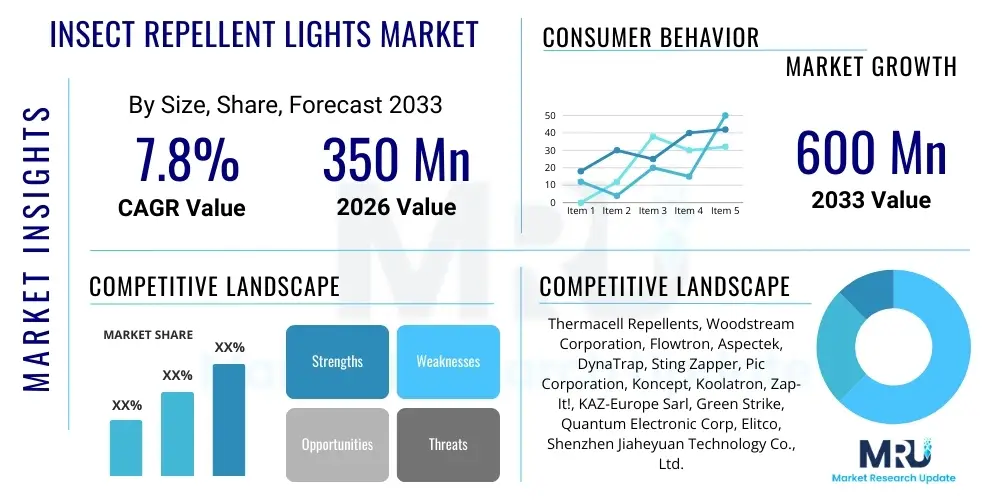

The Insect Repellent Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 600 Million by the end of the forecast period in 2033.

Insect Repellent Lights Market introduction

The Insect Repellent Lights Market encompasses specialized lighting solutions designed to mitigate or eliminate insect presence, primarily mosquitoes and flies, through mechanisms such as specific light wavelengths, ultraviolet (UV) attraction followed by electrocution (zappers), or integrated diffusion systems. These products serve a critical function in enhancing comfort and public health, especially in areas prone to insect-borne diseases. The core innovation driving this market is the integration of lighting efficiency, predominantly LED technology, with pest control effectiveness, moving away from conventional chemical sprays towards safer, localized, and continuous protection. Key product categories include indoor electric zappers, outdoor solar-powered lanterns, and dual-purpose lighting fixtures that emit yellow or amber light wavelengths known to be less attractive to biting insects.

Major applications of these lights span across residential, commercial, and industrial settings. Residential use accounts for a significant portion, driven by increasing outdoor leisure activities and a rising desire for chemical-free home environments. In the commercial sector, the hospitality industry, particularly restaurants with outdoor seating and resorts, heavily relies on these solutions to maintain customer satisfaction and hygiene standards. Furthermore, agricultural storage facilities and specialized manufacturing plants utilize robust industrial-grade systems to protect inventory and maintain operational compliance. The versatility of form factors, ranging from portable USB-charged units to fixed architectural lighting, allows for broad adoption across diverse environmental requirements and aesthetic preferences.

The principal benefits driving market expansion include enhanced public health safety by reducing exposure to vectors carrying diseases like Dengue, Zika, and Malaria. Consumers are increasingly seeking eco-friendly alternatives, viewing these lights as sustainable long-term solutions compared to consumable chemical products. Driving factors include climate change accelerating the geographic spread of insect populations, significant growth in global tourism and outdoor recreation, and stringent regulatory pressures in developed nations concerning the use of harmful pesticides. Technological advancements, particularly in optimizing UV spectrums for maximum attraction efficiency and incorporating smart home connectivity, further cement the market's positive growth trajectory, promising greater effectiveness and convenience for end-users worldwide.

Insect Repellent Lights Market Executive Summary

The Insect Repellent Lights Market is characterized by robust innovation focusing on sustainability, connectivity, and dual functionality. Current business trends heavily favor manufacturers integrating energy-efficient LED technology with advanced pest control mechanisms, particularly incorporating features such as variable light modes and automated cleaning cycles. A significant shift is observed towards the proliferation of solar-powered units, reducing operational costs and enabling deployment in areas lacking reliable grid infrastructure. Furthermore, strategic partnerships between lighting companies and smart home platform providers are accelerating the adoption of connected insect repellent devices, allowing users remote control and performance monitoring, thereby transforming these specialized lights into essential smart appliances for residential and commercial environments.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily due to high population density, tropical climates, and the endemic presence of mosquito-borne diseases, creating an urgent and sustained demand for effective repellent solutions. Rapid urbanization and subsequent infrastructure development in countries like India and China are boosting the construction sector, which incorporates these lights into new residential and public spaces. North America and Europe, while mature markets, demonstrate strong demand for premium products characterized by superior design, energy efficiency, and compliance with strict environmental standards. European consumer preference leans towards aesthetically integrated, low-noise solutions that blend seamlessly into garden and patio designs, whereas North American consumers prioritize maximum coverage and durability for extensive outdoor spaces.

Analysis of segment trends reveals that the electrical zappers segment, while mature, continues to dominate revenue due to its proven efficacy and cost-effectiveness. However, the ultrasonic and sonic repellent segment is experiencing rapid growth, driven by consumer demand for silent, non-intrusive alternatives, despite ongoing scientific debate regarding their effectiveness compared to UV zappers. The residential end-user category remains the largest consumer base, but the commercial segment, particularly hospitality and outdoor event management, is demonstrating the highest growth velocity, necessitating high-capacity, robust solutions. Distribution channels are undergoing transformation, with e-commerce platforms increasingly surpassing traditional retail stores in sales volume, attributed to broader product ranges, competitive pricing, and extensive consumer reviews facilitating informed purchasing decisions.

AI Impact Analysis on Insect Repellent Lights Market

Common user inquiries concerning AI in this sector often revolve around the practical utility of machine learning in optimizing insect control: Can AI differentiate between target pests and beneficial insects? How can smart lights predict peak insect activity to conserve energy? And, crucially, does AI integration justify the increased cost of the device? Users are seeking evidence that AI moves beyond mere connectivity to deliver tangible improvements in effectiveness and efficiency. The integration of artificial intelligence primarily addresses the limitations of static, reactive systems by enabling predictive monitoring and dynamic operational adjustments, ensuring the lights are functioning optimally only when and where required, thus addressing energy conservation concerns while maximizing pest elimination rates.

AI's influence in the Insect Repellent Lights Market is primarily channeled through algorithmic refinement of operational protocols. Machine learning models, trained on environmental data such as temperature, humidity, light intensity, and seasonal pest migration patterns, can predict high-risk periods for insect activity with significant accuracy. This predictive capability allows smart repellent lights equipped with integrated sensors and AI chips to automatically adjust light frequency, intensity, and operational timing, thereby conserving power during low-activity periods and maximizing attraction power when needed most. For instance, AI can analyze real-time light trap data—counting and classifying trapped insects—to calibrate the optimal UV spectrum wavelength dynamically, a feature impossible with traditional fixed-frequency devices. This transition from passive defense to intelligent, predictive intervention represents a major technological leap for the industry.

Furthermore, AI facilitates enhanced integration within the broader smart home ecosystem. Through natural language processing (NLP) and contextual awareness, smart repellent lights can communicate with other smart devices, such as weather stations or smart sprinklers, to further refine their operational strategies. Maintenance and user experience are also optimized; AI algorithms can monitor the lifespan and performance degradation of UV bulbs or electrocution grids, proactively alerting users when cleaning or replacement is necessary. While the initial cost of AI-enabled devices remains a barrier for mass adoption, the long-term value proposition—reduced energy consumption, increased efficacy, and minimal manual intervention—is increasingly appealing to tech-savvy consumers and commercial entities focused on operational efficiency and preventative maintenance protocols.

- AI-driven predictive scheduling based on hyperlocal environmental data and historical pest trends.

- Real-time classification of trapped insects using integrated camera sensors to optimize light wavelength targeting.

- Enhanced energy management and battery life optimization through dynamic power scaling based on activity prediction.

- Automated fault detection, maintenance alerts, and remote diagnostics facilitated by machine learning algorithms.

- Seamless integration into smart home and building management systems (BMS) for centralized control and automation.

DRO & Impact Forces Of Insect Repellent Lights Market

The market for insect repellent lights is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces acting upon industry growth and structure. Key drivers include the escalating global prevalence of vector-borne diseases, creating a public health imperative for effective mosquito control, coupled with the increasing trend towards outdoor living and recreational activities demanding comfortable, pest-free environments. Opportunities abound in leveraging renewable energy sources, particularly solar power, and integrating IoT capabilities to enhance device intelligence and user convenience. Conversely, the market faces restraints such as skepticism regarding the efficacy of non-chemical methods like ultrasonic technology, the relatively high initial purchasing cost of advanced, durable units, and regulatory hurdles concerning UV light usage in certain public spaces, necessitating careful market navigation by manufacturers.

The primary impact force driving market expansion is the convergence of public health concerns and environmental consciousness. As climate change expands the geographic reach of disease vectors, governments and consumers are prioritizing preventative measures, pushing demand for reliable, large-area coverage solutions. This demand acts as a robust force encouraging investment in R&D for more efficient attraction mechanisms and safer electrocution grids. The secondary impact force relates to consumer purchasing behavior, specifically the shift from short-term chemical solutions to long-term, fixed lighting installations. This is supported by the rapid decline in LED component costs, making integrated repellent features more accessible, thereby amplifying market penetration across diverse socio-economic demographics and sustaining growth momentum.

Restraining factors impose a moderating force on growth. The need for periodic bulb replacement in UV zappers, and the resulting recurring maintenance cost, can deter consumers compared to purely passive methods. Furthermore, the market is highly susceptible to inexpensive, low-quality imports, which, while reducing entry costs, can erode consumer trust in the overall product category if their performance is subpar. To counteract these restraints, companies must focus on establishing premium brand differentiation through certified efficacy, extended warranties, and robust customer education regarding the benefits of proprietary light spectrum technologies, thereby leveraging the opportunity presented by consumers willing to pay a premium for certified health and safety benefits.

Segmentation Analysis

The Insect Repellent Lights Market is highly heterogeneous, requiring deep segmentation based on technology, power source, end-user application, and distribution channel to accurately assess market dynamics and strategic focus areas. Understanding these segments allows manufacturers to tailor product development efforts, marketing strategies, and geographical expansion plans to areas demonstrating the highest propensity for growth. The market structure reflects the varied needs of customers, ranging from individual residential users requiring simple, portable solutions to large commercial enterprises needing robust, permanently installed systems capable of covering vast outdoor areas. Analyzing the interplay between power source (electric vs. solar), application environment (indoor vs. outdoor), and technology type (UV zappers vs. ultrasonic repellents) is crucial for competitive positioning and targeted revenue maximization.

- Technology Type

- UV Electric Zappers

- UV Non-Zapping Traps

- Ultrasonic and Sonic Repellents

- Heat-based/Thermal Attractants

- Integrated Repellent Diffusion Systems (e.g., citronella diffusion integrated with light)

- Power Source

- Electric Powered (Plug-in)

- Battery Powered (Rechargeable/Disposable)

- Solar Powered

- Application/End-User

- Residential (Homes, Patios, Gardens)

- Commercial (Hotels, Restaurants, Cafes, Resorts)

- Industrial (Warehouses, Agricultural Storage)

- Government/Public Spaces (Parks, Campgrounds, Military Bases)

- Coverage Area

- Small Coverage (Up to 500 Sq. Ft.)

- Medium Coverage (500 – 1500 Sq. Ft.)

- Large Coverage (Above 1500 Sq. Ft.)

- Distribution Channel

- Offline (Hypermarkets, Specialty Stores, Hardware Stores)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Insect Repellent Lights Market

The value chain for the Insect Repellent Lights Market begins with raw material sourcing, primarily involving the procurement of specialized components critical for both illumination and pest control functions. Upstream activities focus on securing high-quality LED chips and UV light bulbs (typically Black Light Blue or BLB for optimal attraction), durable plastics or metal alloys for housing, high-capacity batteries (especially for solar and portable units), and sophisticated electronic components such as PCB boards, transformers, and sensors required for smart functionality. Efficient upstream management is vital to mitigate supply chain risks, particularly concerning the volatile pricing and availability of rare earth elements used in high-efficiency LEDs. Manufacturers often establish long-term contracts with specialized component suppliers to ensure quality control and maintain competitive pricing, which is crucial given the commoditized nature of some standard repellent light components.

Mid-stream activities involve the manufacturing, assembly, and quality assurance processes. This stage is characterized by high levels of automation, especially in mass production facilities in Asia Pacific economies. Manufacturing involves precise assembly of UV lights and high-voltage grids, integration of solar panels, and sealing for weatherproofing, especially for outdoor-rated products (IP-rated enclosures). Quality control (QC) is paramount, focusing on electrical safety, light spectrum accuracy, longevity testing, and adherence to international electromagnetic compatibility (EMC) standards. Proprietary technology, such as specialized reflectors or patented safety cage designs, adds value at this stage, differentiating premium brands from generic offerings. Efficient production logistics and lean manufacturing principles are necessary to manage inventory levels and respond quickly to seasonal demand fluctuations.

Downstream analysis focuses on distribution and sales channels. Direct channels include manufacturer-owned e-commerce platforms, allowing for greater margin capture and direct customer interaction for feedback and customized offerings. Indirect distribution, which accounts for the majority of sales, relies heavily on large-format retailers (Home Depot, Walmart), hardware stores, and, increasingly, major global e-commerce marketplaces (Amazon, Alibaba). Effective distribution requires robust logistics for handling bulky items and seasonal stocking. Post-sales services, including warranty fulfillment, technical support, and the supply of replacement UV bulbs, complete the value chain, playing a critical role in customer retention and brand reputation, particularly in a market where product longevity and continuous efficacy are key consumer considerations.

Insect Repellent Lights Market Potential Customers

The customer base for Insect Repellent Lights is broad and segmented into distinct categories based on usage needs, volume requirements, and purchasing motivations. The largest segment is the residential end-user, comprising homeowners and tenants who primarily seek enhanced personal comfort and protection against mosquito-borne diseases in private gardens, patios, and indoor living spaces. Residential buyers prioritize ease of use, aesthetic appeal (especially for decorative outdoor lighting), energy efficiency, and low-noise operation. Their purchasing decisions are often influenced by local insect severity, the presence of children or pets (driving demand for chemical-free options), and promotional pricing offered through mass-market retail channels.

The commercial sector represents a high-growth customer segment, characterized by high volume purchases and a demand for durable, professional-grade equipment. This segment includes the hospitality industry (hotels, resorts, outdoor dining establishments), where insect control directly impacts customer experience and business reputation. Commercial buyers require systems with large coverage areas, low maintenance needs, and robust weather resistance, often integrating them into existing landscaping and lighting infrastructure. Furthermore, organizations managing outdoor events, such as music festivals or sports venues, represent specialized commercial clients demanding temporary, high-powered, and reliable solutions to maintain attendee comfort and regulatory compliance.

Specialized institutional and industrial customers form another critical segment, demanding unique specifications often related to hygiene and inventory protection. This includes food and beverage processing plants, pharmaceutical storage facilities, and agricultural entities (e.g., mushroom farms, greenhouses) where strict hygiene standards mandate non-chemical pest control that will not contaminate produce or sensitive equipment. Governmental agencies, including military bases, public health organizations, and municipal parks departments, also constitute significant potential customers, requiring procurement of rugged, large-scale insect control systems often tailored for public safety and disease prevention campaigns in high-risk zones.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 600 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermacell Repellents, Woodstream Corporation, Flowtron, Aspectek, DynaTrap, Sting Zapper, Pic Corporation, Koncept, Koolatron, Zap-It!, KAZ-Europe Sarl, Green Strike, Quantum Electronic Corp, Elitco, Shenzhen Jiaheyuan Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insect Repellent Lights Market Key Technology Landscape

The technological landscape of the Insect Repellent Lights Market is rapidly evolving, moving beyond simple high-voltage zappers towards sophisticated, integrated pest management systems. A cornerstone of this evolution is the optimization of light sources. While traditional UV-A light (350-400 nm) remains common for attracting nocturnal insects, leading manufacturers are investing heavily in narrow-band UV-LEDs that promise higher spectral purity and efficiency, potentially offering selective attraction to specific pest types while minimizing attraction to beneficial pollinators. This focus on spectral precision is complemented by the development of amber and yellow spectrum LEDs, which are utilized as 'repellent' lights that do not attract insects in the first place, offering dual-functionality where users can switch between attraction/kill mode and deterrence mode based on their immediate needs and location.

Another dominant technological trend is the rise of smart and connected devices, driven by the proliferation of the Internet of Things (IoT). New-generation insect repellent lights feature Wi-Fi or Bluetooth connectivity, allowing them to be controlled and monitored remotely via smartphone applications. This connectivity facilitates features such as operational scheduling, performance monitoring (tracking insect kill counts), remote status checks on bulb lifespan, and integration with voice assistants. Furthermore, the efficiency of power sources is constantly improving. Advancements in high-capacity lithium-ion batteries and highly efficient monocrystalline solar panels enable durable, long-lasting, and truly portable outdoor repellent solutions that can operate autonomously without reliance on continuous grid power, significantly enhancing market reach in remote or off-grid locations.

Beyond light and connectivity, material science and design innovations contribute significantly to product efficacy and safety. Safety remains a critical technological area, leading to patented safety cage designs that protect children and pets while maximizing the area of the electrified grid exposed to insects. In the non-zapping segment, ultrasonic technology continues to be refined, with ongoing research attempting to identify and emit frequencies that demonstrably disrupt insect navigation and feeding patterns, although scientific consensus on broad-spectrum efficacy remains fragmented. Finally, integrated systems are leveraging thermal technology, mimicking the heat signatures of hosts (e.g., humans or animals) alongside CO2 emission devices to enhance attraction rates for specific mosquito species, effectively creating advanced, localized trapping stations that offer superior performance in epidemiological critical areas.

Regional Highlights

Regional variations in climate, population density, regulatory environments, and economic factors dictate distinct market performance characteristics for insect repellent lights globally. North America, including the United States and Canada, represents a highly mature market characterized by strong consumer spending power and a preference for high-tech, aesthetically pleasing outdoor solutions. The demand here is largely driven by leisure and residential outdoor activities (deck and patio use), coupled with stringent safety standards requiring durable, certified products. North American growth is focused on premium segments, emphasizing solar integration, smart home compatibility, and superior design quality rather than sheer volume expansion.

The Asia Pacific (APAC) region is the engine of volumetric growth for the Insect Repellent Lights Market. High temperatures, humidity, and the widespread presence of diseases like Malaria and Dengue fever create a persistent, massive demand for effective and affordable insect control. Countries like India, China, Indonesia, and Thailand are major consumers. Rapid urbanization, increasing household disposable income, and government initiatives focused on public health prevention are key drivers. The APAC market shows a high penetration of basic electric zappers but is rapidly adopting dual-purpose LED lights and solar-powered lanterns for cost-effective, decentralized use in suburban and rural areas.

Europe presents a balanced market scenario, defined by a strong emphasis on ecological considerations and product aesthetics. European regulations, particularly REACH standards, influence material composition and disposal, encouraging manufacturers to focus on long-lasting, repairable, and environmentally benign products. Western European consumers, particularly in Germany, the UK, and France, seek integrated garden solutions that blend seamlessly with landscaping. Demand in Southern Europe (Mediterranean countries) is high due to favorable climates for outdoor dining and tourism, fueling the commercial segment, with a growing interest in non-UV-based deterrent systems to comply with evolving light pollution guidelines.

- North America: Focus on premium, smart, and solar-integrated outdoor lifestyle products; high regulatory compliance standards.

- Asia Pacific (APAC): Highest growth rate driven by public health crisis prevention and rapid urbanization; strong demand for affordable and effective zapper technology.

- Europe: Emphasis on aesthetic integration, energy efficiency, and compliance with stringent environmental and light pollution regulations.

- Latin America: Growing market fueled by tropical climates and significant public health necessity; affordability is a major purchasing factor.

- Middle East and Africa (MEA): Emerging market potential linked to tourism development and efforts to control insect populations in arid and semi-arid regions; solar power is critical due to energy infrastructure limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insect Repellent Lights Market.- Thermacell Repellents

- Woodstream Corporation

- Flowtron

- Aspectek

- DynaTrap

- Sting Zapper

- Pic Corporation

- Koncept

- Koolatron

- Zap-It!

- KAZ-Europe Sarl

- Green Strike

- Quantum Electronic Corp

- Elitco

- Shenzhen Jiaheyuan Technology Co., Ltd.

- Inadays

- Viatek Consumer Products Group

- Skeet-R-Gone

- The Coleman Company Inc.

- Ecolab Inc. (Professional Solutions)

Frequently Asked Questions

Analyze common user questions about the Insect Repellent Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most effective technology for long-term outdoor insect control?

For consistent, large-area coverage outdoors, UV Electric Zappers remain highly effective due to their proven ability to attract and eliminate a wide range of flying insects. However, solar-powered UV traps with enhanced spectral attractants (often using proprietary wavelengths or CO2 simulation) are gaining prominence for durability and low operating cost, offering optimal long-term efficacy without chemical reliance.

Are ultrasonic insect repellent lights truly effective against mosquitoes and flies?

Scientific consensus on the effectiveness of standalone ultrasonic devices for repelling biting insects like mosquitoes is generally inconclusive. While some users report success, many regulatory bodies and entomological studies suggest that sound frequencies alone may not reliably deter pests. For assured protection, combining ultrasonic technology with physical barriers or proven UV attraction methods is typically recommended.

How does the integration of IoT and smart features benefit residential users?

IoT integration allows residential users to schedule operation times, monitor bulb lifespan, and receive performance reports remotely via smartphone applications. This ensures the device operates only during peak insect activity periods (e.g., dusk to dawn), maximizing battery life and energy efficiency, and providing peace of mind through proactive maintenance alerts.

What is the typical lifespan and maintenance requirement for UV insect zapper bulbs?

UV-A fluorescent bulbs used in insect zappers typically maintain optimal insect-attracting power for 2,000 to 3,000 hours of continuous use, or roughly 3 to 4 months of heavy seasonal operation. While the bulb may still illuminate after this period, the critical UV spectrum that attracts insects degrades, necessitating replacement for effective pest control. Maintenance usually involves periodic cleaning of the high-voltage grid and emptying the catch tray.

What are the primary differences between commercial-grade and residential insect repellent lights?

Commercial-grade lights offer significantly larger coverage areas, often exceeding 1,500 square feet, and are constructed with industrial-grade, weather-resistant materials (e.g., heavy-duty metal housing). They feature higher voltage grids, enhanced capacity catch trays, and require less frequent maintenance. Residential units prioritize aesthetics, portability, and ease of use over sheer killing capacity and ruggedness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager