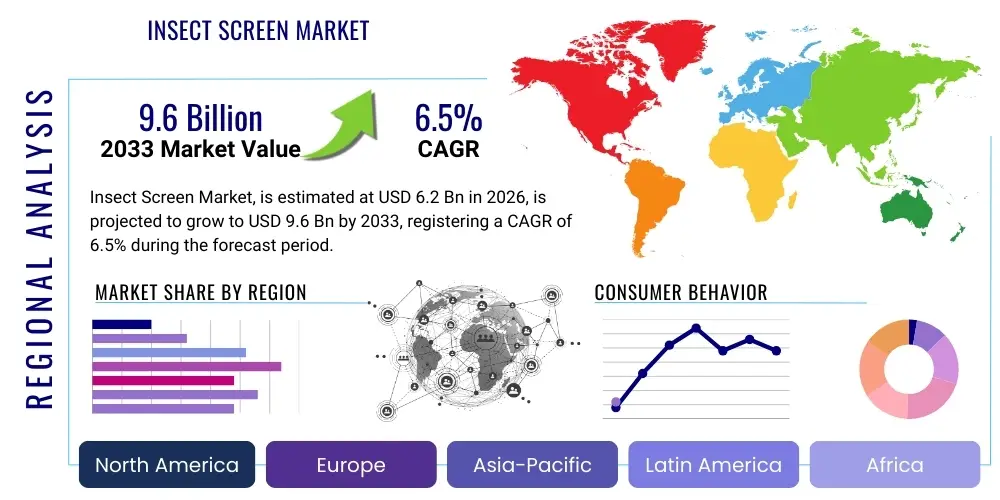

Insect Screen Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435934 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Insect Screen Market Size

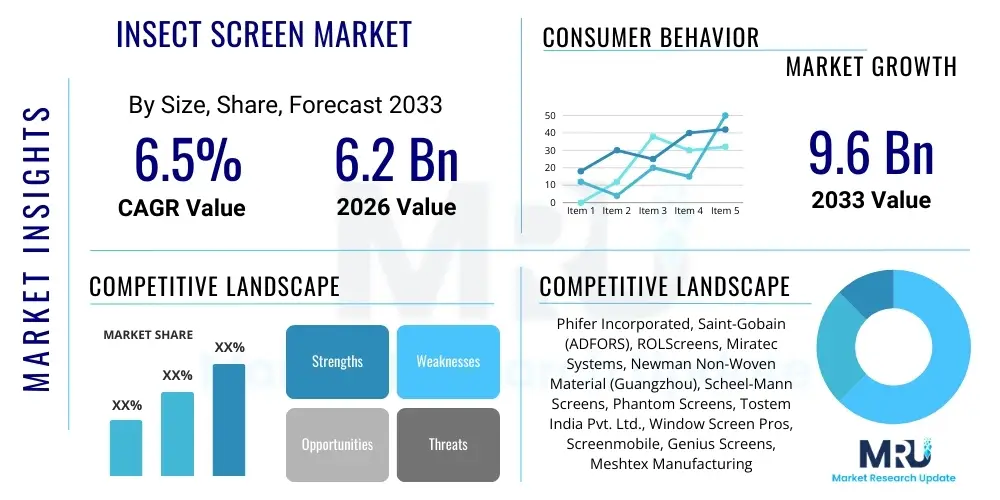

The Insect Screen Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Insect Screen Market introduction

The Insect Screen Market encompasses the manufacturing, distribution, and installation of physical barriers designed to prevent insects and pests from entering residential, commercial, and industrial structures while allowing natural ventilation. These screens are essential components of modern architecture, driven primarily by increasing health consciousness regarding insect-borne diseases like malaria, dengue fever, and Zika virus. The market scope includes various materials such as fiberglass, aluminum, stainless steel, and specialized synthetic polymers, integrated into fixed, retractable, sliding, or hinged frame systems that are customized to fit windows, doors, and other openings.

The core product functions extend beyond simple pest exclusion, offering enhanced privacy, slight shade, and protection against dust and debris, contributing significantly to improved indoor air quality and overall dwelling comfort. Product innovation, particularly in terms of aesthetic appeal and seamless integration with smart home systems, continues to expand the adoption rate in developed economies. Major applications span new construction projects, renovation activities in existing buildings, healthcare facilities, and specialized agricultural environments where pest control without chemical intervention is highly valued. The continuous evolution of mesh technology, including micro-mesh screens and allergen-blocking materials, further solidifies the product's role as a necessary utility rather than a luxury item.

Market growth is predominantly propelled by rapid urbanization and subsequent infrastructural development in emerging economies, coupled with stricter governmental regulations globally aimed at controlling disease vectors. The benefits of using high-quality insect screens—including durability, ease of maintenance, and their role as a cost-effective, non-chemical pest control method—are major driving factors. Furthermore, shifting consumer preferences towards sustainable and environmentally friendly building materials are boosting demand for eco-friendly screen options, positioning the insect screen sector for robust and stable expansion throughout the forecast period.

Insect Screen Market Executive Summary

The Insect Screen Market is experiencing sustained expansion characterized by evolving consumer demands for higher aesthetic integration and functionality. Current business trends indicate a strong move toward retractable and motorized screen systems, particularly in high-end residential and commercial construction sectors, as these products offer superior convenience and minimal visual intrusion. Manufacturers are strategically focusing on vertical integration and geographical expansion, leveraging automated production techniques to enhance output efficiency and maintain competitive pricing. A significant operational trend involves the utilization of specialized coatings, such as anti-microbial or easy-clean treatments, to differentiate standard screen offerings and capture market share in health-sensitive environments like hospitals and educational institutions.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure investments, rapid population growth, and the pervasive threat of mosquito-borne illnesses in countries like India and Southeast Asia. North America and Europe, while more mature, demonstrate stable demand driven by renovation cycles, stringent building codes mandating energy efficiency and protection against pests, and a preference for durable, high-specification materials. The Middle East and Africa (MEA) region is exhibiting accelerating growth, largely due to ongoing large-scale urban development projects and the necessity of managing desert insects and sand fly populations, necessitating robust screening solutions.

Segment trends highlight the dominance of the fiberglass segment owing to its cost-effectiveness, durability, and resistance to corrosion, making it the material of choice for mass-market applications. However, the aluminum and stainless steel segments are witnessing increased value-based growth due to their use in demanding commercial applications and hurricane-prone areas requiring superior strength. Furthermore, the application segment shows that doors and large openings are gaining disproportionately high revenue share, driven by the popularity of patio doors and bi-folding door systems which require large, custom-fitted, and often automated screening solutions, underscoring the market's shift toward customized large-scale protection solutions.

AI Impact Analysis on Insect Screen Market

Analysis of common user questions related to AI's impact on the Insect Screen Market reveals key themes centering on manufacturing optimization, supply chain efficiency, and the potential for "smart" screening solutions. Users frequently inquire about how AI can predict demand fluctuations, minimize material waste during cutting and assembly, and optimize inventory management across highly fragmented product lines (varying sizes, materials, and colors). A significant area of interest is the integration of AI-powered sensors into screens to detect and potentially repel insects based on environmental parameters or insect type, moving beyond passive protection to active monitoring. Consumers also express expectations regarding AI-driven personalization, where systems suggest the optimal screen type and material based on geographical location, local pest risks, architectural style, and budget constraints, streamlining the complex purchasing process for end-users and contractors.

While the core function of the insect screen remains physical barrier protection, Artificial Intelligence (AI) integration is poised to revolutionize the entire operational and customer-facing lifecycle. In the manufacturing domain, AI algorithms can analyze performance data from cutting machines and weaving equipment to identify micro-defects in real-time, drastically reducing scrap rates and ensuring superior product consistency. Predictive maintenance schedules, managed by AI, minimize costly unplanned downtime for complex machinery involved in coating and assembly processes. This operational enhancement directly contributes to higher throughput and reduced manufacturing costs, ultimately benefiting competitive pricing strategies across the market.

Beyond internal operations, AI’s greatest impact will materialize through enhanced customer experience and smart product development. AI-driven simulation tools can assist architects and developers in designing complex screening solutions for unique architectural openings, ensuring perfect fit and aesthetic alignment before production commences, minimizing installation failures. In the future, specialized smart screens could leverage machine learning to analyze local air quality and humidity levels, automatically triggering ventilation adjustments or even utilizing micro-vibrations derived from AI models to deter specific types of pests without human intervention, transforming the screen from a static barrier into a dynamically responsive building element.

- AI-Optimized Manufacturing: Real-time defect detection and quality control in mesh weaving and coating processes, leading to reduced material wastage.

- Predictive Demand Forecasting: Utilization of machine learning models to analyze seasonal pest trends and construction cycles, optimizing inventory levels for custom and standard products.

- Supply Chain Robotics: AI-managed automated warehousing and sorting systems for complex stock keeping units (SKUs) related to varying frame sizes and material types.

- Smart Screen Development: Integration of AI with environmental sensors to monitor local insect activity and automatically adjust screen integrity or incorporate non-chemical repellent strategies.

- Customization Engines: AI platforms assisting contractors and end-users in selecting the optimal screen material, color, and mounting system based on specific geographical and architectural requirements.

- Efficiency in Installation: AI tools providing augmented reality assistance to installers, ensuring precise measurements and reducing installation time and errors for complex retractable systems.

DRO & Impact Forces Of Insect Screen Market

The Insect Screen Market is governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the market’s trajectory and define the Impact Forces currently at play. The primary driver is the undeniable necessity of controlling disease vectors; increasing global health awareness and the recurring threat of pandemics linked to insect transmission necessitate robust protective measures in both developed and developing regions. This core driver is synergized by global demographic shifts, specifically the rapid expansion of urban areas where population density increases the risk of concentrated pest activity. However, market growth is often restrained by the high initial cost associated with premium, custom-fitted, and motorized screen systems, making them prohibitively expensive for low-income segments. Additionally, the fragmented nature of the local installation and distribution network in many emerging markets poses logistical challenges, hindering seamless product delivery and quality assurance.

Significant opportunities are present in the commercial and industrial sectors, particularly in the food processing, pharmaceutical manufacturing, and hospitality industries, where regulatory compliance regarding pest control is exceptionally strict and non-negotiable. The shift toward sustainable building materials represents another substantial opportunity, allowing manufacturers who invest in eco-friendly polymer meshes or recycled frame materials to capture environmentally conscious consumer segments. Furthermore, the development and patenting of highly specialized screens, such as those that block fine particulate matter (PM2.5) while maintaining ventilation or screens designed for extreme weather conditions, promise high-margin growth in niche markets. The ongoing consumer demand for aesthetic integration—screens that are virtually invisible when retracted or designed to blend seamlessly with modern window frames—pushes the boundaries of product design and manufacturing capabilities, generating innovation opportunities.

The cumulative impact forces dictate that market participants must prioritize product innovation and vertical integration to remain competitive. The increasing enforcement of global quality standards acts as a filtering force, favoring manufacturers capable of consistent, certified production. The market is currently experiencing moderate to high competitive rivalry, driven by differentiation in frame quality, mesh technology, and installation expertise. Price sensitivity remains a critical force, especially in high-volume residential markets where low-cost fiberglass alternatives dominate. Ultimately, success hinges on balancing cost-effectiveness with performance, ensuring that products offer effective pest control while maximizing durability and aesthetic value, thereby satisfying the dual demand for utility and architectural integration.

Segmentation Analysis

The Insect Screen Market is systematically segmented across critical dimensions including material type, product type, application, and end-user, providing a granular view of demand patterns and growth pockets. This segmentation allows stakeholders to accurately target investment and product development efforts toward the most lucrative areas. Material segmentation, which includes fiberglass, metal (aluminum/stainless steel), and polymer meshes, reflects differing priorities related to cost, durability, and specific environmental exposures. Product type segmentation, covering fixed screens, sliding screens, retractable (roll-up) screens, and hinged screens, defines the level of convenience and architectural complexity addressed by the solution. The fundamental driver behind these segments remains the necessity for ventilation without insect intrusion, tailored specifically to the functional requirements of the aperture being covered, whether it is a small kitchen window or a large balcony door.

Application analysis focuses on the specific structural openings where screens are installed, primarily windows and doors, but also extending to specialized applications like patios, verandas, and specialized ventilation systems. The door segment is growing rapidly due to the trend toward larger, floor-to-ceiling glass systems requiring robust, large-format screening mechanisms, often motorized for ease of use. End-user segmentation distinguishes between residential, commercial, and industrial usage. The residential sector forms the backbone of the market due to sheer volume and renovation cycles, while the commercial sector, encompassing hospitality, healthcare, and education, provides stable, high-value contracts demanding superior quality and compliance with stringent public health standards.

The comprehensive analysis of these segments reveals that while fixed screens remain the volume leader due to simplicity and low cost, the retractable screen segment exhibits the highest value growth rate, driven by consumer preference for seamless design and premium features in developed markets. Companies specializing in custom architectural solutions and high-performance materials are best positioned to capitalize on the increasing average selling price (ASP) witnessed across commercial and luxury residential projects. Understanding these segment dynamics is crucial for formulating effective pricing strategies and R&D pipelines focused on next-generation screening technologies that balance aesthetic appeal with high protective efficiency against micro-insects and environmental pollutants.

- By Material:

- Fiberglass

- Aluminum

- Stainless Steel

- Polyester/Synthetic Polymers

- Bronze/Copper Alloy Mesh (Niche)

- By Product Type:

- Fixed/Standard Screens

- Retractable (Roll-up) Screens

- Sliding Screens

- Hinged Screens

- Pleated Screens (Plissé)

- By Application:

- Windows

- Doors (Standard, Patio, Bi-folding)

- Patios and Porches/Verandas

- Other Apertures (Vents, Skylights)

- By End User:

- Residential

- Commercial (Hotels, Offices, Retail)

- Industrial (Warehouses, Food Processing)

- Healthcare and Hospitality

Value Chain Analysis For Insect Screen Market

The value chain of the Insect Screen Market begins with the upstream activities centered on raw material procurement and preparation, which is a critical determinant of final product quality and cost. This stage involves sourcing primary materials such as glass fibers, aluminum ingots, stainless steel wire, and specialized polymer resins used for coating and extrusion. Manufacturers rely heavily on specialized textile mills and metal fabricators to produce the highly precise mesh material and the extruded aluminum profiles for the frames. Efficiency in this upstream segment is vital, as fluctuations in global commodity prices for aluminum and polymers directly influence manufacturing costs. Strategic partnerships with raw material suppliers that guarantee consistent quality and timely delivery are essential for maintaining stable production schedules and product uniformity across diverse product lines, from basic fixed screens to sophisticated motorized systems.

The midstream phase involves core manufacturing processes, including mesh weaving, frame cutting, coating (for UV resistance and anti-microbial properties), and final assembly. This segment is characterized by increasing automation and precision engineering, particularly for retractable and pleated screens which require highly calibrated mechanisms. Distribution channels constitute the crucial downstream element. The market utilizes a mixed model: direct sales to large construction projects and OEM manufacturers (original equipment manufacturers of windows and doors), and indirect sales through a vast network of specialized screen installers, independent retailers, and large-scale home improvement stores (DIY chains). The indirect channel, relying on skilled local installation services, is particularly important due to the customized nature of most screen installations, which necessitates accurate measurement and professional fitting.

The complexity of the installation process itself often dictates the choice of distribution channel; high-end, bespoke installations are typically handled directly by certified dealers, ensuring quality control and warranty adherence. In contrast, standard, off-the-shelf screens are effectively distributed through large retail outlets. The value chain culminates with end-user acquisition and after-sales service, which is critical for retaining market trust, especially concerning mechanical components like tensioning springs and retraction systems. A robust service network guarantees longevity and customer satisfaction, cementing the competitive advantage of providers who offer comprehensive service packages alongside their product offerings, ultimately sustaining the product lifecycle and encouraging replacement demand.

Insect Screen Market Potential Customers

The Insect Screen Market targets a broad spectrum of potential customers, segmented predominantly by their volume requirements, regulatory environment, and technical specifications. The largest customer base resides within the residential sector, comprising homeowners undertaking new construction, home renovations, or essential maintenance. These customers are highly sensitive to aesthetics, ease of use (favoring retractable and sliding systems), and total cost of ownership, prioritizing solutions that offer effective pest control without compromising the dwelling’s visual appeal. The demand in this segment is strongly correlated with regional economic health and disposable income levels, driving steady, dispersed consumption across various product tiers, from economical fiberglass mesh to premium aluminum framed systems.

The second major customer group consists of commercial establishments, including hospitality venues such as hotels and resorts, educational institutions, and large office complexes. For these customers, the purchasing decision is heavily influenced by regulatory compliance related to hygiene, public health, and architectural standards. They typically require large volumes of durable, often fire-retardant, and aesthetically uniform screens. Food processing facilities and pharmaceutical plants represent a highly specialized subset of commercial users, demanding screens with fine mesh to exclude even minute insects and rigorous materials like stainless steel that are resistant to frequent industrial cleaning and chemical exposure, prioritizing compliance over initial cost.

Furthermore, Original Equipment Manufacturers (OEMs) within the window and door manufacturing industry form a crucial customer segment, integrating pre-assembled screen systems directly into their finished products. These manufacturers seek high-volume supply, rigorous quality control, and seamless dimensional compatibility. Governmental agencies and public health organizations also represent key potential customers, particularly in regions prone to endemic insect-borne diseases, often procuring large quantities of durable, standardized screens for deployment in public housing, military bases, and field hospitals, where effectiveness and longevity in harsh environments are the primary procurement criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Phifer Incorporated, Saint-Gobain (ADFORS), ROLScreens, Miratec Systems, Newman Non-Woven Material (Guangzhou), Scheel-Mann Screens, Phantom Screens, Tostem India Pvt. Ltd., Window Screen Pros, Screenmobile, Genius Screens, Meshtex Manufacturing, Alu-Pro, Smartex Screen, Titan Screen Solutions, Fenestra Building Products, Screen Tight, Quality Screen Co., V-Screen Systems, KCM Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insect Screen Market Key Technology Landscape

The Insect Screen Market is undergoing continuous technological refinement focused on enhancing durability, aesthetic integration, and multi-functionality. A core technological advancement involves the chemical composition and weaving structure of the mesh material itself. High-definition (HD) mesh technology, for instance, utilizes ultra-fine yarns to create a tighter weave that maintains significantly higher visibility and improved airflow compared to traditional mesh, addressing the aesthetic concerns of many modern homeowners. Furthermore, the development of specialized coatings, including anti-microbial treatments based on silver ions and UV-resistant polymers, significantly extends the product lifespan and relevance, particularly in humid or high-UV environments where material degradation and mold growth are common issues.

In terms of framing and operating mechanisms, the shift toward advanced retractable and motorized systems represents a major technological leap. These systems incorporate precision-engineered tensioning mechanisms, often concealed within the frame, ensuring smooth and reliable retraction without sagging or jamming, which were historically weak points in roll-up designs. Motorized screens, increasingly integrated with smart home automation protocols (like Z-Wave or ZigBee), allow for remote operation and scheduling, offering superior convenience and integration into energy management systems. The engineering challenges revolve around creating large-format systems (e.g., for panoramic patio doors) that can withstand high winds while maintaining structural integrity and ease of use.

A burgeoning technological area is the integration of advanced functionality beyond basic insect exclusion. This includes meshes designed explicitly to filter out pollutants such as pollen, smog, and fine dust particles (PM2.5), transforming the screen into an air quality filter, a necessity in heavily industrialized urban areas. Furthermore, materials science is enabling the production of highly durable, pet-resistant meshes that maintain optimal airflow. Successful market players are those that invest heavily in patented mechanisms and material compositions, positioning themselves not merely as providers of basic screening, but as suppliers of advanced architectural solutions that contribute to overall building performance and resident well-being through passive environmental control.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, primarily driven by explosive urbanization rates, extensive new residential and commercial construction activities (especially in China, India, and Southeast Asia), and the critical need for defense against endemic diseases like dengue and malaria. Government initiatives focused on public health and sanitation often include mandated or subsidized pest control measures, boosting market penetration significantly. The region's preference for cost-effective fiberglass and standard sliding screens drives high volume, though demand for premium pleated and retractable systems is accelerating in urban centers like Singapore, Hong Kong, and metropolitan areas in China.

- North America: This is a mature market characterized by a high preference for durable, high-quality, and aesthetically pleasing screening solutions, dominated by retractable and custom-fitted products. Demand is strongly correlated with renovation cycles and new high-end construction. Consumers in the US and Canada prioritize superior materials like aluminum and high-visibility meshes. Stringent building codes, particularly in hurricane-prone coastal regions, drive demand for specialized, high-impact resistant screening solutions, contributing to a high average selling price (ASP) relative to other regions.

- Europe: The European market demonstrates steady growth, highly influenced by regional architectural aesthetics and energy efficiency standards. Central and Northern European countries show strong demand for integrated, nearly invisible screening systems (retractable and pleated screens) that complement high-performance window frames (often PVC or composite). The emphasis is on quality certification, durability, and features like pollen and dust filtration (driven by high allergy awareness), particularly in Germany, the UK, and France. Mediterranean countries also show robust demand driven by warm climates and heavy insect populations.

- Latin America (LATAM): Growth in LATAM is robust, spurred by recovering economies, significant residential building booms, and the high endemic presence of insect-borne pathogens, making basic screening an essential public health necessity. Brazil and Mexico are key markets. The market here is highly price-sensitive, leading to strong sales of basic fixed and hinged fiberglass screens, although economic modernization is gradually increasing the accessibility and appeal of mid-range sliding and retractable options in large metropolitan areas.

- Middle East and Africa (MEA): This region is experiencing high market acceleration, particularly within the Gulf Cooperation Council (GCC) states due to mega-infrastructure projects (e.g., Saudi Vision 2030 and UAE real estate development). The unique climate challenges—intense heat, sandstorms, and specialized desert pests—mandate highly robust, durable materials (often specialized aluminum frames and durable mesh). South Africa also contributes significantly, driven by residential and hospitality sector demand where aesthetic quality is paramount alongside insect protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insect Screen Market.- Phifer Incorporated

- Saint-Gobain (ADFORS)

- ROLScreens

- Miratec Systems

- Newman Non-Woven Material (Guangzhou)

- Scheel-Mann Screens

- Phantom Screens

- Tostem India Pvt. Ltd.

- Window Screen Pros

- Screenmobile

- Genius Screens

- Meshtex Manufacturing

- Alu-Pro

- Smartex Screen

- Titan Screen Solutions

- Fenestra Building Products

- Screen Tight

- Quality Screen Co.

- V-Screen Systems

- KCM Systems

- Sankalp Screens

- EZE Breeze

- Custom Screen Doors Inc.

- FlexScreen

- Sunair Awnings & Retractable Screens

- Liri Architecture Technology

- Screen USA

- Sentry Screens

- SecureScreen Systems

- UltraVue Screening

Frequently Asked Questions

Analyze common user questions about the Insect Screen market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased adoption of retractable insect screens globally?

The growing consumer preference for aesthetics, seamless integration into architectural designs, and convenience drives the demand for retractable screens. These systems offer protection when needed and are virtually invisible when stored, appealing strongly to luxury residential and modern commercial markets that value clean lines and unobstructed views.

Which material segment holds the largest market share and why is fiberglass popular?

Fiberglass holds the largest market share by volume due to its superior cost-effectiveness, inherent resistance to corrosion, and relative ease of installation. It offers a balance of durability and affordability, making it the preferred material for mass-market residential applications and standard window installations worldwide.

How do insect screens contribute to public health in emerging economies?

In emerging economies, insect screens are vital public health tools, serving as a primary, non-chemical barrier against disease vectors like mosquitoes carrying malaria, dengue, and Zika viruses. Their widespread use reduces reliance on insecticides, offering a sustainable and immediate layer of protection in densely populated urban and rural areas.

What key technological innovations are shaping the future of insect screen manufacturing?

Future innovations include the development of highly transparent, high-definition meshes (HD Mesh) for better visibility, specialized coatings for filtering fine particulate matter (PM2.5), and advanced motorized mechanisms integrated with smart home automation systems for seamless operation and climate control compatibility.

Is the commercial sector a significant growth area for the insect screen market?

Yes, the commercial sector, particularly food processing, healthcare, and hospitality, represents a high-value growth area. These segments require screens that meet stringent regulatory compliance and hygiene standards, driving demand for premium, industrial-grade materials like stainless steel and specialized, robust framing systems, often procured in high volumes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager