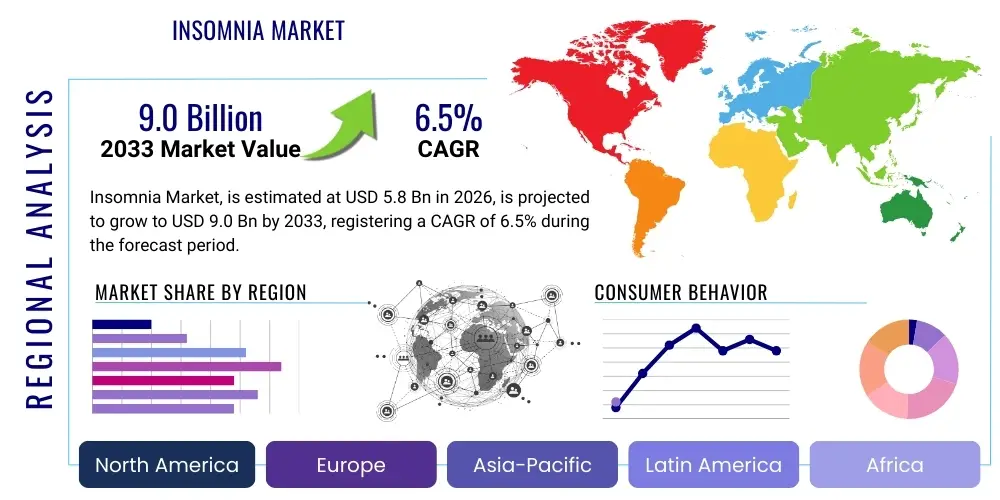

Insomnia Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433546 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Insomnia Market Size

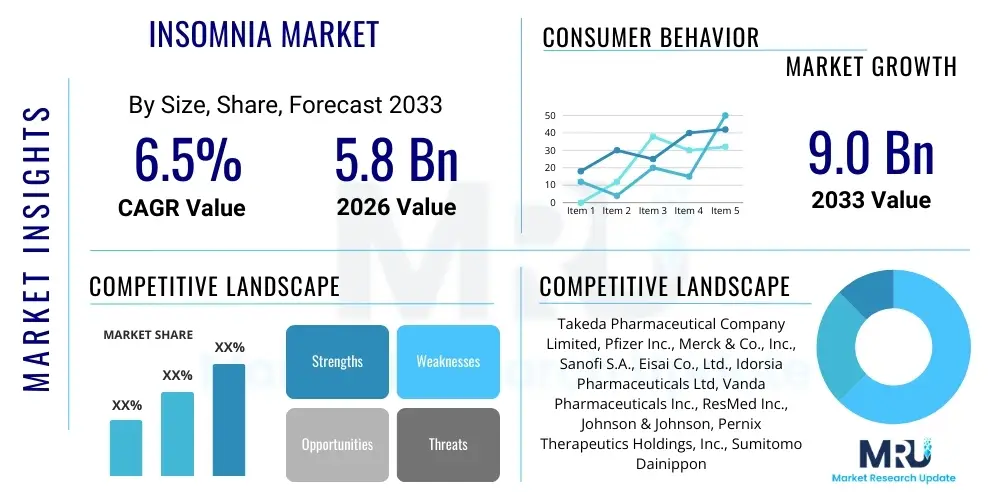

The Insomnia Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.0 Billion by the end of the forecast period in 2033.

Insomnia Market introduction

The Insomnia Market encompasses the global commercial landscape for pharmacological and non-pharmacological therapies aimed at treating chronic and acute sleep disorders characterized by difficulty falling asleep, staying asleep, or obtaining restorative sleep. Key products within this market include prescription pharmaceuticals such as hypnotics (e.g., benzodiazepine receptor agonists, dual orexin receptor antagonists), over-the-counter sleep aids, and advanced digital therapeutics. The market also includes devices, notably continuous positive airway pressure (CPAP) machines for comorbid sleep apnea, and neurofeedback devices for improving sleep architecture.

Major applications of these therapeutic solutions span primary insomnia treatment, addressing sleep disturbances secondary to psychiatric or medical conditions, and managing sleep patterns in aging populations. Driving factors for market expansion include the escalating global prevalence of chronic insomnia, driven by increased stress levels, widespread adoption of digital devices impacting sleep hygiene, and a growing awareness regarding the adverse health outcomes associated with untreated sleep deprivation, such as cardiovascular disease and metabolic dysfunction. Furthermore, the introduction of novel, safer drug classes with improved side effect profiles is fueling adoption rates across key demographics.

The primary benefit derived from effective market solutions is the restoration of normal sleep patterns, which consequently improves daytime functioning, cognitive performance, and overall quality of life. The increasing research into personalized medicine approaches, coupled with regulatory approvals for non-addictive sleep treatments, underscores the industry's shift toward patient-centric care models. Continued investment in understanding the neurological basis of sleep disorders ensures a robust pipeline of innovative treatments, maintaining the market's dynamic trajectory.

Insomnia Market Executive Summary

The Insomnia Market is experiencing significant upward momentum, underpinned by favorable demographic shifts and robust technological advancements. Business trends highlight a pronounced pivot toward non-benzodiazepine receptor agonists and novel dual orexin receptor antagonists (DORAs), which offer reduced risk profiles compared to legacy treatments. Pharmaceutical companies are aggressively pursuing merger and acquisition strategies to integrate digital therapeutic platforms, recognizing the necessity of combining medication with behavioral interventions, such as Cognitive Behavioral Therapy for Insomnia (CBT-I). Furthermore, investment in real-world evidence (RWE) studies is intensifying to demonstrate the long-term efficacy and cost-effectiveness of established and emerging insomnia management protocols, thereby strengthening reimbursement policies globally.

Regional trends indicate North America currently holds the dominant market share, primarily driven by high healthcare expenditure, sophisticated diagnostic infrastructure, and high consumer awareness regarding sleep health. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by rapid urbanization, increasing disposable incomes, and the rising prevalence of lifestyle-related sleep disturbances in densely populated economies like China and India. European growth remains steady, supported by centralized healthcare systems that are increasingly incorporating standardized screening and treatment guidelines for sleep disorders.

Segmentation trends reveal that the pharmacological treatment segment, particularly prescription drugs, retains the largest revenue share, though digital therapeutics and device segments are growing at an accelerated pace. Within the prescription drugs category, DORAs are gaining substantial traction over traditional GABAergic agents due to their targeted mechanism of action, addressing patient demand for treatments that maintain natural sleep architecture. The chronic insomnia indication dominates the application landscape, reflecting the persistent and pervasive nature of long-term sleep issues globally. This trend emphasizes the need for durable, non-addictive, and multimodal treatment strategies across all age groups.

AI Impact Analysis on Insomnia Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Insomnia Market frequently center on three core themes: the potential of AI in personalized diagnostics, the use of generative models to enhance therapeutic interventions like CBT-I, and concerns about data privacy and regulatory oversight of AI-driven sleep tracking tools. Users are keen to understand how AI can move beyond simple activity tracking to predict sleep onset and quality with high fidelity, tailoring treatment schedules to individual patient chronotypes. There is significant expectation for AI to facilitate the scalability of sophisticated behavioral therapies, such as delivering customized CBT-I modules via conversational agents or automating sleep hygiene recommendations based on continuous biometric data analysis. Conversely, concerns revolve around algorithmic bias in diagnosing specific demographics and ensuring the reliability of AI tools in clinical settings where regulatory approval is stringent.

AI's primary transformative impact is anticipated in enhancing precision medicine for insomnia. Machine learning algorithms, trained on vast datasets encompassing polysomnography readings, wearable device data, genetics, and patient-reported outcomes, can identify highly granular insomnia subtypes that are currently difficult to diagnose through traditional methods. This capability allows pharmaceutical companies to develop more targeted drug candidates and clinicians to prescribe existing therapies more effectively. For instance, AI can distinguish between sleep maintenance insomnia driven by physiological arousal versus environmental factors, leading to highly personalized treatment protocols that optimize efficacy and minimize adverse effects.

Furthermore, AI is instrumental in streamlining the delivery and accessibility of Cognitive Behavioral Therapy for Insomnia (CBT-I), which is often constrained by the availability of trained therapists. AI-powered chatbots and adaptive digital platforms can monitor patient progress, adjust stimulus control instructions, and provide real-time behavioral nudges, essentially democratizing access to the gold standard non-pharmacological treatment. The integration of Natural Language Processing (NLP) allows these platforms to interpret free-text patient entries about sleep logs and mood, extracting meaningful insights that inform dynamic therapeutic adjustments, thereby maximizing patient adherence and long-term treatment success.

- AI-driven diagnostics enable highly accurate, personalized subtyping of insomnia disorders based on physiological and behavioral data.

- Machine learning algorithms optimize drug development by predicting responder phenotypes for novel therapeutic agents.

- Natural Language Processing (NLP) facilitates the scalable deployment of personalized Cognitive Behavioral Therapy for Insomnia (CBT-I) through digital platforms.

- Predictive analytics allow for timely intervention, mitigating the transition from acute to chronic insomnia.

- AI enhances wearable device accuracy by filtering out noise and providing clinically meaningful sleep stage analysis (e.g., deep sleep duration, REM latency).

- Algorithmic monitoring improves adherence to treatment plans, especially in combination therapy regimes.

DRO & Impact Forces Of Insomnia Market

The Insomnia Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the impact forces shaping its trajectory. The primary driver is the pervasive increase in the global prevalence of sleep disorders, intrinsically linked to modern stressors, shift work, and the digital lifestyle, which contribute to chronic sleep deprivation across all demographics. Concurrently, heightened public and clinical awareness regarding the serious long-term consequences of untreated insomnia—ranging from impaired cognitive function to increased risk of cardiovascular and metabolic disorders—is stimulating demand for both diagnostic and therapeutic solutions. Regulatory reforms supporting the approval of novel drug classes, such as DORAs, that offer superior safety profiles compared to older sedative hypnotics, further propel market growth by addressing clinical unmet needs and improving physician comfort with prescribing pharmacological interventions.

Conversely, significant restraints hinder optimal market penetration. Chief among these is the widespread preference for over-the-counter (OTC) supplements and non-regulated sleep aids, which often delays patients from seeking professional diagnosis and effective prescription treatment. Furthermore, the high cost associated with proprietary prescription medications and advanced digital therapeutics, coupled with variable reimbursement policies, particularly in emerging markets, limits accessibility for large patient populations. A persistent challenge is the stigma associated with psychiatric medications and the fear of dependency, leading to patient non-adherence or early discontinuation of prescribed hypnotics, regardless of the drug's safety profile.

Opportunities for market stakeholders primarily reside in the untapped potential of digital health and behavioral medicine integration. The growing acceptance of telehealth provides an avenue to deliver scalable and cost-effective CBT-I programs, which are recognized as the first-line treatment but often lack accessibility. Investment in novel non-pharmacological interventions, including neuromodulation devices and tailored biofeedback systems, represents a robust growth avenue. Moreover, addressing the vast global population suffering from comorbid insomnia—where sleep disturbance is secondary to depression, anxiety, or chronic pain—opens up extensive opportunities for combination therapies and integrated care pathways. These factors dictate strategic prioritization for key players focusing on synergistic product development.

Segmentation Analysis

The Insomnia Market segmentation provides a critical view of therapeutic landscape adoption, categorizing the market primarily based on treatment type, drug class, distribution channel, and application (severity). This granular analysis helps stakeholders understand where clinical demand is most acute and where competitive pressures are most intense. The market is increasingly defined by the shift from traditional, broad-spectrum sedative agents to highly specific mechanism-of-action drugs, reflecting a movement towards precision therapeutics and lower side-effect burden. This structural evolution drives investment towards R&D targeting novel neurobiological pathways implicated in sleep regulation, ensuring continuous innovation across treatment modalities.

By treatment type, the market is bifurcated into pharmacological and non-pharmacological segments. While pharmacological treatments, driven by physician prescriptions, constitute the largest revenue generator, the non-pharmacological segment—encompassing CBT-I, light therapy devices, and specialized relaxation techniques—exhibits the faster growth rate. This accelerated growth is primarily attributed to rising patient demand for non-drug alternatives and enhanced clinical guideline recommendations that prioritize behavioral interventions. Furthermore, the distribution channel analysis highlights the dominance of hospital pharmacies and retail drugstores, though online pharmaceutical sales are rapidly capturing market share, especially for over-the-counter sleep aids and digital therapeutic subscriptions.

The application segment distinguishes between acute and chronic insomnia. Chronic insomnia, defined by symptoms lasting longer than three months, remains the largest and most challenging segment, necessitating long-term management strategies, often involving sustained release formulations and integrated care. Conversely, the market for acute, short-term insomnia is largely managed through short-acting hypnotics and OTC products. Understanding these distinct needs guides the strategic development of dosage forms and treatment durations for market penetration, ensuring products are optimally positioned for both short-term relief and chronic disease management.

- Treatment Type:

- Pharmacological Treatment (Prescription Drugs, OTC Sleep Aids)

- Non-Pharmacological Treatment (CBT-I, Digital Therapeutics, Devices)

- Drug Class:

- Benzodiazepine Receptor Agonists (BZRAs)

- Dual Orexin Receptor Antagonists (DORAs)

- Melatonin Receptor Agonists

- Antidepressants and Antipsychotics (Off-label use)

- Barbiturates

- Others (Herbal supplements, Antihistamines)

- Application:

- Chronic Insomnia

- Acute Insomnia

- Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies/E-commerce

- Therapy Type (Non-Pharmacological):

- Cognitive Behavioral Therapy for Insomnia (CBT-I)

- Light Therapy

- Relaxation Techniques/Biofeedback

- Neuromodulation Devices (Cranial Electrotherapy Stimulation - CES)

Value Chain Analysis For Insomnia Market

The value chain for the Insomnia Market initiates with upstream activities centered on pharmaceutical R&D and raw material sourcing. This segment is highly concentrated, involving specialized biopharmaceutical firms and academic institutions focused on identifying novel sleep regulatory targets, synthesizing active pharmaceutical ingredients (APIs), and conducting complex clinical trials. Due to the high regulatory hurdles and intellectual property requirements, this stage dictates the future innovation landscape, heavily relying on advanced genomics, proteomics, and neuroscience research to discover safer and more effective therapeutic compounds, particularly in the DORA class and non-addictive sedative-hypnotics. Quality control and stringent adherence to Good Manufacturing Practices (GMP) are paramount at this stage to ensure product safety and efficacy.

Midstream activities involve large-scale manufacturing, formulation, and packaging of prescription drugs, devices, and digital therapeutics. This segment includes contract manufacturing organizations (CMOs) that handle production volume and specialized device manufacturers creating wearable sensors or light therapy systems. Optimization of manufacturing processes, including cost-efficient synthesis and developing stable, bioavailable dosage forms (e.g., orally disintegrating tablets, extended-release formulations), is crucial for maintaining competitive pricing and supply chain resilience. Rigorous adherence to global regulatory standards, such as FDA and EMA approvals, transitions the product to the downstream segment.

Downstream analysis focuses on distribution, marketing, and sales, encompassing both direct and indirect channels. Direct distribution involves large pharmaceutical companies utilizing specialized sales forces to target neurologists, psychiatrists, and primary care physicians, often coupled with patient support programs. Indirect distribution, which accounts for the vast majority of transactions, flows through wholesalers, national distributors, and ultimately, retail and hospital pharmacies, acting as crucial intermediaries. The rapid growth of digital therapeutics requires robust, secure online platforms and integration with electronic health records (EHRs), effectively creating a parallel distribution channel for software-as-a-medical-device (SaMD) solutions that require ongoing subscription management and technical support.

Insomnia Market Potential Customers

The primary end-users and potential buyers in the Insomnia Market are clinically segmented populations requiring intervention for sustained sleep disturbances. This includes individuals diagnosed with chronic primary insomnia, where sleep difficulty is not attributable to another disorder, representing a large, high-value customer base seeking long-term solutions. A rapidly expanding cohort comprises patients with secondary or comorbid insomnia, often associated with underlying mental health conditions (e.g., major depressive disorder, generalized anxiety disorder) or chronic physical ailments (e.g., pain, restless legs syndrome), requiring integrated treatment plans that address both the root cause and the sleep symptom.

Institutional customers constitute another critical buying group. Hospitals, sleep clinics, psychiatric institutions, and long-term care facilities purchase pharmaceutical bulk supplies and specialized diagnostic and therapeutic devices (e.g., polysomnography equipment, CPAP machines, and hospital-grade light therapy systems). These institutional buyers prioritize products with established clinical evidence, favorable formulary status, and cost-effectiveness over large patient populations. Furthermore, corporate wellness programs and military organizations are emerging niche customers, increasingly investing in diagnostic screening tools and digital therapeutics to mitigate the productivity and safety risks associated with sleep deprivation among their employees or personnel.

Finally, a significant segment consists of self-medicating consumers purchasing over-the-counter (OTC) sleep aids, including melatonin, diphenhydramine, and herbal extracts, often through retail pharmacies and e-commerce platforms. While these consumers might eventually transition to prescription therapies if OTC solutions prove ineffective, they represent the front-line market for early intervention products. Marketing efforts targeting this segment must focus on education regarding sleep hygiene and the differentiation between regulated sleep aids and unregulated supplements, aiming to steer individuals toward clinical consultation when symptoms persist beyond an acute period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Takeda Pharmaceutical Company Limited, Pfizer Inc., Merck & Co., Inc., Sanofi S.A., Eisai Co., Ltd., Idorsia Pharmaceuticals Ltd, Vanda Pharmaceuticals Inc., ResMed Inc., Johnson & Johnson, Pernix Therapeutics Holdings, Inc., Sumitomo Dainippon Pharma Co., Ltd., Philips Respironics, Ebb Therapeutics, Sleep Number Corporation, Harmony Biosciences, LLC, Jazz Pharmaceuticals plc, Neurim Pharmaceuticals, Ltd., Meda AB (Mylan N.V.), Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insomnia Market Key Technology Landscape

The technological landscape of the Insomnia Market is characterized by innovation across both pharmacological and digital domains, aiming to improve efficacy, minimize side effects, and enhance patient compliance. In pharmacology, the primary technological shift involves the transition from legacy GABA-A receptor agonists to highly selective Dual Orexin Receptor Antagonists (DORAs). DORAs operate by blocking the wakefulness-promoting neuropeptides orexins, leading to a more natural induction of sleep with less disruption to the normal sleep architecture (REM and NREM cycles) and reduced risk of dependence or residual sedation (hangover effect), representing a significant chemical engineering and neuroscience achievement.

On the non-pharmacological front, digital therapeutics leveraging mobile applications and Software-as-a-Medical-Device (SaMD) technology are revolutionizing access to Cognitive Behavioral Therapy for Insomnia (CBT-I). These platforms utilize proprietary algorithms, often incorporating Artificial Intelligence (AI), to deliver customized, protocolized therapy based on user input, sleep diary logs, and integrated data from wearable devices. Key features include automated stimulus control coaching, sleep restriction guidance, and biofeedback modules, ensuring high fidelity delivery of complex behavioral interventions without the constant presence of a human therapist, thereby addressing scalability challenges.

Furthermore, sensor technology and neuromodulation devices are gaining prominence. Advanced wearable devices and under-mattress sensors utilize photoplethysmography (PPG) and actigraphy to monitor heart rate variability (HRV), respiratory rate, and movement, providing longitudinal, objective data on sleep quality superior to traditional subjective self-reporting. Cranial Electrotherapy Stimulation (CES) devices, which deliver microcurrents to the brain, are also used for non-invasive treatment, focusing on anxiety and associated insomnia. These technological advancements collectively drive the market towards objective diagnosis, data-driven treatment adjustment, and integrated care models.

Regional Highlights

Regional dynamics within the Insomnia Market are highly varied, reflecting differences in healthcare infrastructure, regulatory environments, consumer awareness, and lifestyle-related prevalence rates. North America, encompassing the United States and Canada, currently dominates the global market in terms of revenue share. This dominance is attributed to high disease burden (driven by stressful professional environments and high rates of psychiatric comorbidities), early adoption of advanced therapeutic technologies, robust research funding, and favorable reimbursement policies for both innovative prescription drugs and regulated digital therapeutics. The presence of major pharmaceutical innovators and a highly developed network of specialized sleep clinics further consolidates the region's leading position, focusing particularly on high-value DORAs and approved CBT-I digital platforms.

Europe represents a mature market with steady, substantial growth, driven by increasing awareness and standardized clinical guidelines established by national health services and the European Medicines Agency (EMA). Western European countries (Germany, France, UK) show high adoption rates of prescription sleep aids, although there is a strong cultural preference for non-pharmacological interventions, positioning Europe as a key growth hub for neuromodulation devices and behavioral therapies. Regulatory harmonization across the EU facilitates easier market entry for new medical devices and SaMD solutions, provided they meet rigorous safety and efficacy standards, fostering competitive landscape focused on quality and long-term patient outcomes.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is spurred by rapid demographic changes, including an expanding middle class, increased urbanization leading to higher stress levels, and greater access to Western medical standards. Countries such as Japan, South Korea, and Australia possess advanced healthcare systems that readily adopt novel treatments. Simultaneously, vast population bases in China and India, characterized by increasing prevalence of lifestyle diseases and improved healthcare spending, offer immense untapped potential. Challenges remain regarding regulatory fragmentation and lower affordability compared to Western markets, leading to higher consumption of generic drugs and traditional Chinese medicine (TCM) for sleep management.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer long-term opportunities. Growth in these regions is fundamentally driven by improvements in healthcare infrastructure, expansion of diagnostic facilities, and increasing patient education initiatives. LATAM growth is sensitive to economic fluctuations and relies heavily on imported branded and generic pharmaceuticals. In the MEA, high-income Gulf Cooperation Council (GCC) countries are rapidly adopting cutting-edge therapies, including advanced digital solutions, while market penetration in sub-Saharan Africa remains constrained by limited healthcare access and lower per capita spending on chronic disease management.

- North America: Market leader; driven by high prevalence, advanced diagnostic infrastructure, significant R&D investment, and strong reimbursement for high-cost novel therapies (DORAs, SaMD).

- Europe: Stable growth; characterized by rigorous regulatory oversight, strong patient demand for non-pharmacological options, and standardized clinical guidelines across centralized healthcare systems.

- Asia Pacific (APAC): Fastest projected growth; fueled by urbanization, rising chronic disease burden, improving healthcare access, and large, untapped populations in China and India.

- Latin America (LATAM): Moderate growth; expansion dependent on economic stability and improving infrastructure; significant reliance on generic drug adoption.

- Middle East & Africa (MEA): Emerging market; growth concentrated in GCC nations adopting specialized technology, facing challenges related to accessibility and economic variability elsewhere.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insomnia Market.- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Merck & Co., Inc.

- Sanofi S.A.

- Eisai Co., Ltd.

- Idorsia Pharmaceuticals Ltd

- Vanda Pharmaceuticals Inc.

- ResMed Inc.

- Johnson & Johnson

- Pernix Therapeutics Holdings, Inc.

- Sumitomo Dainippon Pharma Co., Ltd.

- Philips Respironics

- Ebb Therapeutics

- Sleep Number Corporation

- Harmony Biosciences, LLC

- Jazz Pharmaceuticals plc

- Neurim Pharmaceuticals, Ltd.

- Meda AB (Mylan N.V.)

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Biogen Inc.

- Cognito Therapeutics

Frequently Asked Questions

Analyze common user questions about the Insomnia market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the current growth of the Insomnia Market?

The primary driver is the accelerating global prevalence of chronic insomnia, largely fueled by modern lifestyle factors such as increased psychological stress, shift work, and excessive screen time, coupled with higher public awareness regarding the severe long-term health risks associated with untreated sleep disorders.

How are Dual Orexin Receptor Antagonists (DORAs) changing insomnia treatment?

DORAs represent a significant therapeutic advancement by selectively blocking wakefulness-promoting neurotransmitters (orexins), offering a more physiologically natural mechanism of action compared to older sedative-hypnotics, leading to lower risks of dependence, abuse potential, and residual next-day sedation.

What role do digital therapeutics play in the Insomnia Market?

Digital therapeutics, often delivered via mobile apps, are crucial for scaling Cognitive Behavioral Therapy for Insomnia (CBT-I), the first-line treatment. They use AI and proprietary algorithms to deliver personalized, accessible, and cost-effective behavioral interventions, addressing the critical shortage of trained sleep therapists globally.

Which geographical region is projected to exhibit the highest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by rapid urbanization, significant improvements in healthcare spending, and increasing recognition and diagnosis of sleep disorders in densely populated emerging economies like China and India.

What are the key restraints impacting the widespread adoption of prescription insomnia medication?

Key restraints include the societal stigma associated with long-term use of psychiatric drugs, the patient fear of developing dependency, the high cost of patented novel medications, and the widespread self-medication using unregulated over-the-counter supplements, delaying professional intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Insomnia Therapeutics Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Drugs, Medical Devices), By Application (Prescription, Over-the-Counter (OTC)), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Insomnia Treatment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Non-pharmacological Therapy, Pharmacological Therapy), By Application (Hospital Pharmacies, Retail Pharmacies and Drug Stores, Online Pharmacies), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Insomnia Medication Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Over the Counter (OTC) Sleep Aids, Prescription Sleep Aids), By Application (Pharmacy, Hospital, Clinic, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Insomnia Drugs Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pills Product, Capsules Product, Others), By Application (Adults, Kids), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager