Instant Coffee Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432936 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Instant Coffee Powder Market Size

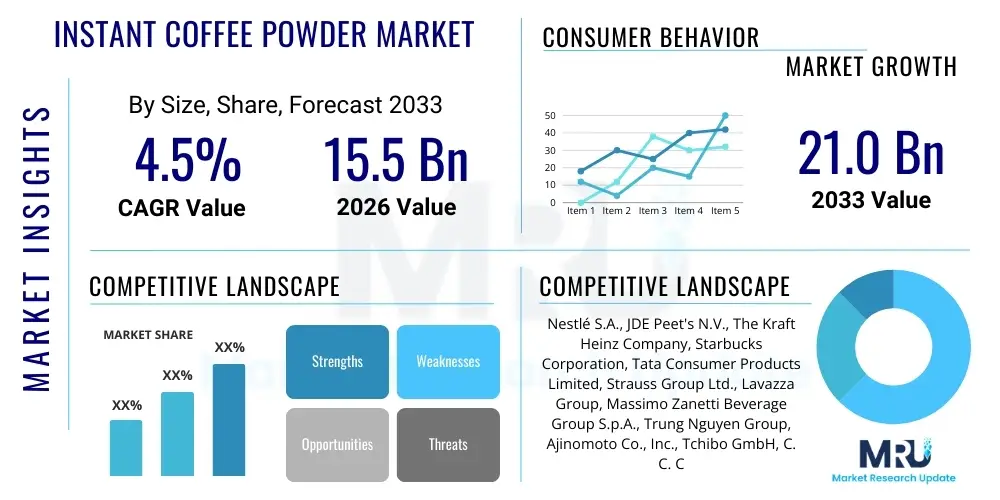

The Instant Coffee Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. This robust growth trajectory is underpinned by continuous product innovation, particularly in the premium and functional instant coffee segments, alongside sustained demand for convenience across global demographics. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033. This expansion reflects the industry's successful adaptation to modern consumer lifestyles, offering rapid, high-quality, and increasingly diverse options that challenge traditional perceptions of soluble coffee products. The market size calculation incorporates revenues from pure soluble coffee, instant coffee mixes, and micro-ground coffee variants sold through both retail and institutional channels worldwide.

Instant Coffee Powder Market introduction

The Instant Coffee Powder Market encompasses the global trade and consumption of concentrated coffee products derived from brewing coffee beans, which are then processed via specialized industrial techniques such as spray drying or freeze-drying into soluble granules or fine powder. This foundational market segment is universally characterized by its unparalleled convenience, exceptional shelf stability, and significant ease of preparation, requiring only hot water to produce a caffeine-rich beverage instantly. It holds immense appeal for a broad spectrum of consumers, including busy urban dwellers, professionals constrained by time, and households prioritizing speed without sacrificing access to their daily coffee fix. Over the past decade, instant coffee has successfully shed its reputation as a lower-quality alternative, largely due to technological advancements that allow manufacturers to better preserve the nuanced aromas and flavor complexities inherent in high-quality roasted coffee beans, thereby driving market value upwards through premiumization efforts.

Product diversity remains a core characteristic and key competitive battleground within this industry. Manufacturers actively differentiate their offerings through various types, including pure black instant coffee, instant coffee mixes often fortified with non-dairy creamers or specialized sweeteners, and highly customized instant coffee drinks tailored for specific global palates, such as the popular Vietnamese or Malaysian 3-in-1 formulations. Major applications extend significantly beyond simple residential consumption; the powder is a foundational input extensively utilized in the food service sector (HORECA), automated vending machine systems, and increasingly, as a critical ingredient in the large-scale production of confectionery items, dessert flavors, and the rapidly growing market for ready-to-drink (RTD) coffee formulations. The market's consistent resilience and growth are significantly bolstered by technologically advanced, robust global supply chains capable of efficiently handling high-volume production and ensuring prompt, ubiquitous product distribution, thereby guaranteeing widespread consumer access across diverse socioeconomic regions and geographies.

A set of interconnected macro-environmental factors is fundamentally driving the sustained market expansion. These include the unrelenting pace of global urbanization, which creates a substantial consumer base seeking time-saving food and beverage solutions, particularly prominent in rapidly developing economies across the Asia Pacific region. Furthermore, consistently rising global disposable incomes empower consumers to gradually trade up from basic, traditional beverages to branded, convenience-focused, and increasingly higher-quality instant coffee products. The intrinsic functional benefits of instant coffee, such as extreme portability, precise portion control, and guaranteed flavor consistency across millions of units, contribute substantially to its sustained mass-market appeal. Modern marketing initiatives now heavily emphasize health and wellness attributes, featuring low-calorie options, decaffeinated varieties, and instant coffees enriched with functional additives (e.g., adaptogens or B vitamins), strongly influencing contemporary purchasing decisions and solidifying the ongoing trend towards premiumization and specialty instant offerings within the Fast-Moving Consumer Goods (FMCG) landscape.

Instant Coffee Powder Market Executive Summary

The Instant Coffee Powder Market is currently undergoing a profound phase of strategic transformation, largely initiated by evolving consumer expectations demanding both convenience and enhanced product quality diversification. Contemporary business trends clearly indicate a decisive industry shift towards deep commitment to Environmental, Social, and Governance (ESG) principles, with leading global manufacturers channeling substantial financial resources into ethical sourcing programs, promoting sustainable cultivation practices across coffee farms, and developing highly recyclable or biodegradable packaging solutions, directly addressing heightened consumer environmental and social consciousness. The sector is simultaneously observing a notable increase in strategic merger and acquisition activities, primarily focused on assimilating niche, high-growth, or specialized premium instant coffee brands, a calculated effort to rapidly capture high-value, quality-focused market segments. Furthermore, the pervasive adoption of digitalization is fundamentally reshaping the established distribution paradigm, positioning advanced e-commerce platforms and Direct-to-Consumer (DTC) models as increasingly indispensable and high-performing sales channels for brand visibility and transaction execution, especially within digitally mature Western markets.

From a regional perspective, Asia Pacific (APAC) firmly establishes itself as the primary catalyst and most dynamic engine for volumetric market growth. This rapid expansion is intensively fueled by expansive population bases, the continuous economic ascent of the middle classes, and a gradual, yet significant, cultural shift away from traditional tea consumption towards coffee adoption. The instant format is exceptionally well-suited for this transition, owing to its superior cost-effectiveness and inherent preparation simplicity. In contrast, North America and Europe, recognized as geographically mature markets, are distinctively characterized by an unwavering focus on premiumization. Consumers in these regions are increasingly demonstrating a willingness to pay significantly more for specialty instant coffees, specifically demanding single-origin traceability, dark roast intensity, and micro-ground inclusion, thereby fueling value expansion even as volume growth rates stabilize. Emerging economic zones in Latin America and the Middle East and Africa (MEA) present substantial, largely untapped commercial potential, supported by continuous enhancements in local retail infrastructure and highly focused, tailored marketing strategies executed by established global industry leaders determined to secure first-mover advantages.

Detailed segmentation analysis provides essential insights into prevailing consumer behavior. The Freeze-Dried instant coffee sub-segment continues to exhibit a stronger growth momentum and superior revenue performance compared to traditional Spray-Dried coffee. This divergence is fundamentally due to the fact that the freeze-drying process is scientifically proven to better retain the complex flavor compounds, original color vibrancy, and distinct aroma profile of the initial coffee brew, successfully justifying the attached higher average selling prices and supporting premium brand positioning. In terms of end-use, while residential consumption consistently maintains the largest market share, the commercial or institutional segment, encompassing the Hotels, Restaurants, and Catering (HORECA) industry, is experiencing a robust and significant recovery following global disruptions, substantially contributing to the surging wholesale volume demand. The persistent preference for customized instant coffee mixes and highly convenient 3-in-1 products (combining coffee, sugar, and creamer) remains exceptionally strong across diverse Southeast Asian and Latin American geographies, effectively catering to regional consumer preferences for sweeter, creamier, and highly caloric beverage profiles, while the demand for unadulterated pure instant coffee granules continues its unwavering dominance in Western European and North American consumption markets.

AI Impact Analysis on Instant Coffee Powder Market

User queries regarding AI's influence on the Instant Coffee Powder Market frequently center on achieving supreme operational efficiency, facilitating highly personalized consumer experiences, and establishing verifiable supply chain transparency. Common questions actively explore how sophisticated AI algorithms can be deployed to optimally calibrate and monitor critical parameters in bean roasting and subsequent processing stages, ensuring absolute flavor consistency across astronomically large production batches—a non-negotiable quality metric within the competitive instant coffee sector. Users are equally interested in the demonstrable benefits of AI-driven demand forecasting models, optimized inventory management systems, and proactive predictive maintenance protocols crucial for minimizing costly downtime in extensive, high-speed manufacturing facilities. Furthermore, a significant segment of user curiosity revolves around how generative AI tools and machine learning analytics can effectively process and analyze vast datasets encompassing consumer purchasing behavior, emerging social media trends, and hyper-local regional sales statistics to inform the rapid development of new products, such as accurately predicting the market viability of novel flavor combinations or precisely identifying currently underserved demographic niches for specialty instant coffee formats.

The practical application of Artificial Intelligence technology is currently revolutionizing the entire spectrum of instant coffee manufacturing by enabling previously unattainable levels of quality assurance and maximizing production yields with surgical precision. Advanced AI-powered sensor arrays and complex machine learning algorithms are now seamlessly integrated and actively deployed across every critical stage of the production lifecycle, starting from the rigorous selection of raw green coffee beans and extending through to the final automated packaging processes. These integrated systems are designed to continuously monitor and adjust dynamic variables such as precise temperature gradients, fluctuating pressure levels, critical moisture content percentages, and resulting particle size distributions throughout the energy-intensive drying phases (both spray drying and freeze-drying). This ability to enforce hyper-precision dramatically mitigates batch-to-batch variability, substantially minimizes raw material waste, conserves significant amounts of operational energy, and guarantees that the resulting flavor and aromatic profiles strictly adhere to stringent international quality standards, thereby strongly supporting the brand consistency that is absolutely essential for global mass-market instant coffee brands.

Moving beyond the intrinsic factory floor operations, AI technology plays a pivotal and strategic role in dramatically enhancing market responsiveness and deepening consumer engagement. Sophisticated predictive analytics models are continuously refining complex supply chain logistics, allowing for the remarkably accurate forecasting of sudden spikes or unexpected drops in market demand based on detailed analysis of seasonal consumption patterns, effectiveness of promotional activities, and critical macroeconomic indicators. This capability permits the optimization of stock levels globally, effectively preventing damaging stockouts or costly overstocking situations. Moreover, AI-driven marketing platforms are empowering instant coffee brands to execute highly personalized product recommendations and extremely targeted advertising campaigns. By diligently analyzing individual consumer purchasing histories, behavioral data, and declared preferences, companies can specifically promote unique blends (e.g., specialized decaf options, intense dark roast variants, or specific flavored mixes) to the most statistically receptive audiences, drastically improving the Return on Investment (ROI) of marketing efforts and fostering a robust sense of brand loyalty within the fiercely competitive Fast-Moving Consumer Goods (FMCG) environment.

- AI-driven Predictive Maintenance: Minimizing operational downtime and reducing repair costs in high-speed spray and freeze drying equipment through preemptive scheduling.

- Quality Control Automation: Implementing real-time monitoring of instantaneous particle uniformity, color metrics, and critical moisture content during volatile processing stages.

- Advanced Demand Forecasting: Generating highly accurate, granular prediction of regional and seasonal instant coffee consumption trends to effectively optimize global inventory allocation.

- Flavor Profiling Optimization: Utilizing sophisticated machine learning models to identify and fine-tune optimal roasting, extraction, and concentration parameters for achieving specific, repeatable flavor consistency goals.

- Personalized Digital Marketing: Executing targeted campaigns and dynamic product recommendations to consumers based on their historical purchase patterns and detailed lifestyle segmentation data.

- Sustainable Sourcing Oversight: Employing integrated AI platforms for tracking the environmental impact, ethical labor compliance, and transparent traceability across the extensive green coffee bean supply chain.

DRO & Impact Forces Of Instant Coffee Powder Market

The structural dynamics of the Instant Coffee Powder Market are meticulously governed by a complex and ever-shifting tripartite interplay of Drivers, Restraints, and latent Opportunities (DRO). The foundational Drivers firmly center on the ubiquitous global consumer demand for unparalleled convenience, significantly amplified by rapidly accelerating urban migration and increasingly time-poor lifestyles, particularly evident across the burgeoning Asian economies where instant coffee serves as the most accessible and cost-efficient gateway into the global coffee culture. Strategic Opportunities are concentrated substantially in continuous product innovation, actively pursuing premiumization strategies through the introduction of advanced, high-quality instant formats (such as micro-ground infusions and specialized single-serve pods), and embedding functional attributes, including instant coffee products fortified with essential vitamins, added protein, or cognitive-enhancing nootropics. Conversely, primary Restraints originate from the intense competitive pressure exerted by high-street coffee shop chains, the growing appeal of sophisticated ready-to-drink (RTD) coffee beverages, and the deeply ingrained historical consumer perception that instant coffee is inherently inferior in taste and quality when benchmarked against traditionally freshly brewed alternatives. These powerful impact forces collectively dictate pricing elasticity, market penetration success rates, and the required complexity of competitive brand positioning.

The momentum-generating drivers for sustained market growth are intricate and deeply embedded in current demographic shifts and infrastructural improvements. The continuous global expansion of modern organized retail chains, coupled with the exponential proliferation of e-commerce platforms, ensures maximum product accessibility, effectively cementing instant coffee's status as a readily available, ubiquitous household staple across diverse geographies. Furthermore, sophisticated and aggressive marketing campaigns, often leveraging innovative packaging solutions—particularly single-serve formats and highly portable travel packs—significantly augment the product's appeal, resonating strongly with younger, highly mobile consumer demographics. The intrinsically low unit cost of preparing instant coffee at home, especially when benchmarked against the premium pricing of retail coffee shop purchases, strategically positions the product as an economically attractive, defensive consumer staple during periods marked by heightened economic uncertainty or rapid inflationary spikes, ensuring robust sales volume stability. The relentless consumer quest for faster, more efficient, and simpler methods to consume highly caffeinated beverages decisively reinforces the market's consistent upward sales trajectory across all geopolitical regions, irrespective of their relative economic development stages.

Despite the undeniable strength of these growth drivers, the instant coffee industry must vigilantly navigate several persistent restraints and operational challenges. Rising public health scrutiny regarding high sugar content, excessive sodium levels, and non-nutritive additives commonly found in widely popular instant coffee mixes (3-in-1 products) represents a significant long-term existential threat, often compelling health-conscious consumers to seek out healthier, zero-sugar, or pure coffee alternatives. More immediate is the critical issue of volatility in the global green coffee bean commodity prices, frequently exacerbated by unpredictable climate change patterns severely impacting key coffee-producing regions. This price instability creates significant cost management hurdles for manufacturers, who must absorb input cost increases without substantially raising retail prices, which inevitably compresses crucial operating profit margins. Successfully capitalizing on market opportunities necessitates sustained, high-level investment in technological differentiation, building inherent supply chain resilience, and crafting compelling brand narratives centered on the quality assurance, premium provenance, and unimpeachable ethical sourcing of the coffee, thereby systematically dismantling the ingrained consumer bias favoring traditionally fresh-ground alternatives.

Segmentation Analysis

The Instant Coffee Powder Market is subjected to a granular and multi-dimensional segmentation based on essential variables including fundamental product type, advanced processing technology utilized, consumer packaging format, primary distribution channel employed, and final application scenario. Comprehending the deep nuances within these segments is entirely critical for global manufacturers who seek to meticulously tailor their product development pipelines and optimize market penetration strategies. The fundamental segmentation bifurcates the market into Pure Instant Coffee Powder and Instant Coffee Mixes (including customized flavored blends and 3-in-1 formats). This division directly mirrors the geographically diverse consumer demands—pure powder maintains absolute dominance in sophisticated Western markets where flavor purity is paramount, while highly convenient mixes are the undisputed champions in regions prioritizing speed and high sugar/creamer content, such as Southeast Asia and parts of Latin America. Processing technology serves as a critical differentiator, profoundly influencing both the final unit cost and the perceived quality benchmark, with the demanding Freeze-Drying technique consistently commanding a significant premium average selling price due to its scientifically superior flavor retention capacity compared to the more prevalent and economical Spray-Drying method.

Detailed analysis of distribution reveals the persistent, although slightly declining, market dominance of conventional Supermarkets and Hypermarkets, which remain essential for mass-market visibility. However, the analysis emphatically highlights the accelerating strategic importance of the Online Retail segment, particularly for the promotion, distribution, and subscription sales of niche, ultra-premium, and ethically-sourced instant coffee brands that thrive on direct consumer engagement. Application segmentation meticulously classifies consumption into Residential use (in-home preparation) versus Commercial and Institutional use (spanning HORECA, corporate offices, and various institutions). This segment currently shows vigorous recovery and strong growth in the institutional sector as global business travel and office attendance patterns normalize post-pandemic. These detailed segmentation breakdowns unequivocally illustrate the highly complex and heterogeneous nature of the instant coffee ecosystem, underscoring the necessity for adaptable, nuanced, and regionally sensitive marketing strategies designed to efficiently maximize market share across widely varying consumer personas, ranging from the highly cost-conscious buyer of generic mass-market spray-dried product to the quality-focused affluent purchaser of traceable, specialty freeze-dried granules.

Further segment granularity is achieved by examining packaging innovation, recognizing its powerful impact on consumer appeal and perceived convenience. Single-serve formats, such as small sachets and slim sticks, are witnessing the most dynamic growth, perfectly aligning with the on-the-go consumption habits of younger generations and urban workers. Conversely, larger jars and bulk refill pouches remain staple segments for high-volume residential and institutional use, offering superior cost-efficiency and environmental benefits through reduced material usage. Manufacturers are consistently leveraging packaging material science to extend shelf life through enhanced moisture and oxygen barriers, directly supporting the global export potential of the product. The ability to innovate and optimize across these segmentation axes—from flavor profile (product type) to structural integrity (packaging)—is the defining factor determining long-term brand success and sustainable revenue generation in this rapidly evolving consumer goods category.

- By Product Type:

- Instant Coffee Mixes (3-in-1, 2-in-1, Specialty Flavored Mixes)

- Pure Instant Coffee Powder (Regular and Decaffeinated Variants)

- By Processing Technology:

- Freeze-Dried Instant Coffee (Superior Flavor Retention)

- Spray-Dried Instant Coffee (High Volume, Cost-Effective)

- Agglomerated Coffee (Intermediate Quality, Enhanced Dissolvability)

- By Packaging:

- Glass Jars and Metal Tins (Premium Presentation, Longer Shelf Life)

- Pouches and Refills (Environmentally Friendly, Cost-Efficient)

- Sachets and Sticks (Single Serve, Highest Convenience)

- By Distribution Channel:

- Supermarkets and Hypermarkets (Mass Retail, High Volume)

- Convenience Stores (Impulse Purchase, Immediate Access)

- Online Retail (DTC, Subscription Models, Niche Brands)

- Specialty Stores (Premium and Imported Products)

- By Application:

- Residential Consumption (In-Home Use)

- Commercial Use (HORECA, Vending Machines, Food Processing)

Value Chain Analysis For Instant Coffee Powder Market

The comprehensive value chain for the Instant Coffee Powder Market is an intricately linked and highly industrialized mechanism, commencing with the critical sourcing and procurement of raw green coffee beans, which constitutes the rigorous upstream analysis phase, and culminating with the final point-of-sale transaction at the consumer level, defined as the downstream analysis. The upstream phase is arguably the most critical and complex, necessitating the ethical procurement of high-quality coffee bean varieties, predominantly Arabica (valued for flavor) and Robusta (valued for body and yield), sourced from vast agricultural networks spanning key producing nations like Brazil, Vietnam, Colombia, Indonesia, and Ethiopia. This phase is acutely sensitive to global commodity market fluctuations and requires rigorous quality assurance checks, adherence to established fair trade certifications, and transparent sustainability verification processes. Key agricultural and pre-processing activities include selective harvesting, initial wet or dry processing, precise bean grading, sophisticated logistics handling, and large-scale international commodity trading, where operational efficiency and demonstrable ethical sourcing directly dictate the brand’s public image and significantly influence variable input costs for the subsequent manufacturing stages.

The midstream component of the value chain represents the core manufacturing and transformation process: converting the stable green beans into soluble coffee powder. This is a highly capital-intensive operation involving sophisticated industrial equipment for roasting, grinding, precision brewing to create a concentrated liquid extract, and finally, the specialized drying stage (spray-drying or freeze-drying). Global manufacturers, typified by industry giants such as Nestlé and JDE Peet's, maintain a strategic focus on operating immense, technologically advanced production facilities to aggressively leverage economies of scale and optimize unit production costs. The distribution network within this midstream phase is frequently optimized for efficiency. Direct distribution channels are strategically utilized for selling high volumes of product directly to large institutional buyers, encompassing major food service companies and massive national or international retailers. This direct approach facilitates bespoke product formulations and streamlined bulk transactions, bypassing intermediate distribution layers for specific client segments. The management of complex logistics, ensuring product freshness, and minimizing transportation costs are the paramount focus areas within this intermediary transformation phase.

The downstream segment is primarily focused on efficiently reaching the final consumer and managing the diverse retail landscape. The distribution architecture is fundamentally segregated into highly efficient direct and indirect routes. The indirect distribution system is responsible for the vast majority of instant coffee sales volume, relying heavily on a network of third-party wholesalers, specialized distributors, and large-format retail infrastructure, specifically Supermarkets and Hypermarkets. This expansive, indirect network ensures maximal geographical penetration and ubiquitous market presence for mass-market brands. Conversely, direct channels are increasingly being leveraged, particularly by newer, premium, and boutique instant coffee brands utilizing dedicated brand e-commerce websites or highly focused proprietary retail outlets. This direct approach provides significantly greater control over the end-to-end customer experience, facilitates effective brand storytelling around quality and origin, and allows for enhanced margin capture. The overarching trend involves adopting a synchronized omnichannel distribution strategy, seamlessly integrating physical retail logistics with advanced e-commerce fulfillment capabilities, recognized as indispensable for optimizing inventory flow and maximizing global market share in the contemporary instant coffee market.

Instant Coffee Powder Market Potential Customers

The prospective customer base for the Instant Coffee Powder Market is exceptionally broad and geographically dispersed, encompassing a wide spectrum of income brackets, diverse age demographics, and distinct cultural preferences, all bound by the fundamental, non-negotiable requirement for extreme convenience and rapid access to caffeine. The most substantial primary segment comprises the time-constrained urban residents: including busy corporate executives, university students, and daily commuters who decisively prioritize preparation speed and efficiency over the lengthy rituals associated with traditional coffee brewing. These consumers exhibit a high degree of sensitivity to innovative product formats, actively favoring compact single-serve sachets, pre-portioned sticks, or readily storable refill pouches that integrate flawlessly into their increasingly mobile and high-demand daily schedules. Moreover, economically sensitive customer segments in lower and middle-income tiers, particularly prevalent in fast-growing emerging markets across Asia and Africa, strategically view instant coffee as an affordable, accessible, and often branded daily luxury, offering a cost-effective alternative to prohibitively expensive high-street coffee shop purchases, thereby driving significant volume demand.

A structurally important and rapidly expanding secondary customer segment includes institutional procurement managers and the entire global Food Service sector. This category encompasses Hotels, Restaurants, and Catering (HORECA) operations, large corporate offices, various educational institutions, and centralized canteens, all of which rely critically on instant coffee to provide a consistently standardized, rapid, and inherently low-cost beverage solution for serving large, fluctuating numbers of individuals efficiently. For these substantial bulk buyers, the primary purchasing criteria revolve strictly around product consistency, the availability of robust institutional-sized bulk packaging, simplified storage requirements, and the ease of preparation by non-specialized staff. Furthermore, governmental and specialized institutional buyers, such as military logistical departments and disaster relief agencies, constitute critical potential large-scale buyers due to the undisputed advantages offered by instant coffee’s extended shelf life, minimal logistical footprint, and reliability, ensuring a stable, accessible supply of hot beverages even under the most logistically challenging or environmentally compromised operational conditions.

The ongoing market trend of premiumization is concurrently cultivating and defining a third, distinct customer profile: the discerning, quality-focused consumer demanding specialty coffee attributes in an instantly soluble format. These consumers, often categorized within the Millennial and Gen Z demographics, possess both the awareness and the financial willingness to pay a considerable premium for high-quality, ethically sourced, freeze-dried, or single-origin instant coffee varieties. They function as end-users who actively seek verifiable sustainability commitments, complete supply chain traceability, and a noticeably superior, highly nuanced flavor experience, effectively bridging the cultural divide between specialty coffee enthusiasm and the absolute necessity of convenience. Their demand profile is critical as it validates and supports manufacturers' investments in advanced drying technologies and ethical sourcing programs, expanding the traditional customer base into highly profitable, higher-margin segments and securing the long-term premiumization path for the industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., JDE Peet's N.V., The Kraft Heinz Company, Starbucks Corporation, Tata Consumer Products Limited, Strauss Group Ltd., Lavazza Group, Massimo Zanetti Beverage Group S.p.A., Trung Nguyen Group, Ajinomoto Co., Inc., Tchibo GmbH, C. C. C. (Compañía Colombiana de Café S.A.), DEK, OZON Coffee, Key Coffee Inc., Mount Hagen, Suntory Holdings Limited, The Coca-Cola Company, Smucker’s (Folgers), Super Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Instant Coffee Powder Market Key Technology Landscape

The technological infrastructure supporting the Instant Coffee Powder Market is exceptionally advanced, defined by high-precision industrial engineering processes explicitly designed to maximize the critical retention of volatile flavor compounds and ensure high energy efficiency during the complex transformation of liquid coffee concentrate into stable, dry soluble powder. The industry fundamentally relies on two cornerstone drying methodologies: spray drying and freeze drying. Spray drying involves finely atomizing highly concentrated coffee extract into a large chamber filled with extremely hot, circulating air, which facilitates the near-instantaneous evaporation of water, yielding fine, spherical powder particles. While this technique offers significant advantages in terms of cost-efficiency and high throughput volume, it inherently involves high temperatures that can regrettably volatilize and compromise delicate aromatic components. Conversely, the more sophisticated freeze drying method necessitates freezing the coffee extract to cryogenic temperatures, followed by subjecting it to a sublimation process under a deep vacuum, which preserves a markedly superior flavor, color, and aroma profile, making it the non-negotiable standard for all premium instant coffee offerings. This dichotomy drives relentless investment in research and development to refine equipment design and optimize the thermodynamic efficiency of both processes.

Contemporary technological advancements are centrally focused on enhancing both the qualitative outcome and the overall operational sustainability across the entire coffee processing sequence. A significant developmental stream involves the integration of advanced, non-traditional extraction technologies, such as utilizing extremely high pressures (supercritical fluid extraction) or deploying specific enzymatic processes. These novel methods aim to significantly increase the desirable yield of complex flavor molecules and functional compounds derived from the initial roasted coffee grounds before the drying stage. Furthermore, the pioneering technology of micro-ground inclusion, where extremely finely milled roasted coffee bean particles are purposefully integrated and blended into the standard soluble powder base, has rapidly emerged as a critical innovation pathway. This hybrid technology enables manufacturers to deliver a sensory profile dramatically closer to that of traditionally fresh-filtered coffee, successfully overcoming a long-standing consumer reluctance regarding instant coffee quality. This blending of true soluble particles with finely ground insoluble coffee represents a crucial technological leap forward, actively facilitating the continued successful premiumization of the instant coffee category.

The strategic incorporation of robust Industry 4.0 principles, including the pervasive deployment of sophisticated sensor networks, centralized IoT connectivity, and powerful, real-time data analytics platforms, is systematically transforming the instant coffee manufacturing process into a truly highly precise and autonomous operation. Automation and comprehensive digitalization are strategically utilized to meticulously manage and minimize the energy consumption inherent in the highly energy-intensive drying phases, and simultaneously ensure absolute adherence to rigorous global food safety and traceability standards. Furthermore, adjacent packaging technology is continually evolving, with breakthroughs in multi-layer barrier films, specialized oxygen-scavenging liners, and precision nitrogen-flushing techniques dramatically extending product shelf life and preventing the oxidative degradation of critical volatile flavors. Globally, responsible manufacturers are now proactively pursuing sustainable processing technologies, specifically concentrating efforts on substantial wastewater reduction and developing novel methods for high-value repurposing of spent coffee grounds (e.g., bio-fuel, cosmetic ingredients), firmly establishing environmental stewardship as a core technical requirement alongside traditional flavor and quality metrics.

Regional Highlights

The regional analysis of the Instant Coffee Powder Market showcases significant variances in local consumption behaviors, preferred product formats, and overall growth momentum across key global zones, necessitating distinctly tailored and localized market entry strategies. Asia Pacific (APAC) stands out unambiguously as the preeminent global market driver, responsible for the highest volume consumption and strongest growth projections, primarily energized by the massive consumer bases in developing economies such as China, India, Indonesia, and Vietnam. Within these nations, the key drivers are the unmatched convenience and competitive affordability of 3-in-1 instant coffee mixes. The region is witnessing intense investment in new, advanced manufacturing capacity, specifically designed to satisfy this rapidly escalating and robust demand. The combination of sustained urbanization and the continuous expansion of the middle class is steadily facilitating the successful introduction of premium, higher-priced instant coffee segments, signaling a strategic shift away from reliance solely on basic, commodity-grade instant products.

Conversely, North America and Europe function as geographically mature, yet highly valuable, markets where sustained revenue growth is predominantly achieved through strategic innovation, diversification, and aggressive premiumization initiatives, rather than through simple mass-volume expansion. Consumers across Western Europe, particularly those in the Nordic countries, the UK, and Germany, are increasingly demonstrating strong brand loyalty toward freeze-dried, ethically certified, and specific single-origin instant coffees, valuing quality over low price. In the North American context, the market is characterized by high penetration rates for highly specialized instant formats, notably including instant espresso powders used for beverages and baking, and advanced instant cold brew concentrates, successfully catering to the region’s sophisticated, health-conscious consumer tastes. The competitive dynamics in these regions are heavily influenced by the aggressive market entry and expansion of specialized offerings originating from major global coffee house chains, which leverage their strong brand equity in the instant sector.

Latin America and the Middle East and Africa (MEA) are emerging as strategically vital zones poised for significant future expansion. Latin America, which is intrinsically a major global coffee producer, exhibits consistently high domestic instant coffee consumption, especially in large markets like Brazil, Mexico, and Chile, driven by deep-seated local preferences for quick preparation and established regional brand presence. In the Middle East and Africa (MEA), especially within the economically vibrant Gulf Cooperation Council (GCC) states and high-growth consumer hubs such as South Africa and Nigeria, rapid infrastructural development, evolving consumer dietary patterns, and a youthful population structure are collectively fueling a sharp increase in instant coffee demand. Successful market entry strategies in the MEA region demand a focus on robust, localized branding, cultural sensitivity in product formulation, and ensuring extremely reliable and resilient logistics chains capable of supporting related chilled ready-to-drink variants that often utilize instant coffee as their base ingredient.

- Asia Pacific (APAC): Leading volume market; dominated by 3-in-1 mixes; high urbanization rates driving convenience demand (China, India).

- Europe: High-value market; emphasis on specialty, traceable, and freeze-dried segments; strong growth in organic instant coffee consumption.

- North America: Focus on highly specialized instant formats (espresso, cold brew concentrates); high adoption of single-serve pod technology; competitive influence from major brand extensions.

- Latin America: High domestic consumption due to affordability and tradition (Brazil, Mexico); market penetration driven by local manufacturing and robust supply chains.

- Middle East and Africa (MEA): Rapid consumption growth potential; driven by young demographics and economic diversification; strategic focus on expanding modern retail channels (GCC countries).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Instant Coffee Powder Market.- Nestlé S.A. (Market leader with Nescafé, key innovator in micro-ground and premium blends)

- JDE Peet's N.V. (Global presence with Jacobs, Tassimo, and other strong regional instant brands)

- The Kraft Heinz Company (Owner of various traditional and flavored instant coffee brands in North America)

- Starbucks Corporation (Leveraging brand equity with Starbucks VIA Ready Brew and other instant products)

- Tata Consumer Products Limited (Strong market position in the Indian subcontinent with brands like Tata Coffee)

- Strauss Group Ltd. (Major player in Eastern Europe and Israel through its coffee subsidiaries)

- Lavazza Group (Expanding its premium instant coffee offerings globally)

- Massimo Zanetti Beverage Group S.p.A. (Holding multiple regional and international coffee brands including Segafredo)

- Trung Nguyen Group (Dominant player in Southeast Asia, famous for its G7 instant coffee brand)

- Ajinomoto Co., Inc. (Significant presence in the Asian instant coffee and coffee mix markets)

- Tchibo GmbH (European retailer focusing on quality and sustainability in its instant product lines)

- C. C. C. (Compañía Colombiana de Café S.A.) (Key supplier leveraging Colombian coffee origin)

- DEK (D. E Master Blenders 1753) (Historically significant portfolio of coffee products)

- OZON Coffee (Emerging player utilizing advanced sourcing and processing technologies)

- Key Coffee Inc. (Strong regional presence and product diversification in the Japanese market)

- Mount Hagen (Leader in organic and certified fair-trade instant coffee)

- Suntory Holdings Limited (Active in the instant coffee and RTD sector, particularly in Asia)

- The Coca-Cola Company (Through strategic brand partnerships expanding into the instant segment)

- Smucker’s (Folgers) (Maintaining a strong consumer base in the mass-market instant coffee segment in North America)

- Super Group Ltd. (Dominant supplier of 3-in-1 instant coffee mixes in Southeast Asia)

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Instant Coffee Powder Market between 2026 and 2033?

The Instant Coffee Powder Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of approximately 4.5% throughout the forecast period from 2026 to 2033. This growth is predominantly fueled by heightened consumer demand for convenience and accelerated market penetration into rapidly urbanizing regions, particularly across Asia Pacific and parts of Latin America.

How do freeze-drying and spray-drying technologies fundamentally influence the quality of instant coffee?

Freeze-drying utilizes sublimation under cryogenic temperatures and vacuum pressure to extract water, resulting in superior preservation of the coffee’s natural flavor, color, and volatile aromatic compounds, commanding a premium price point. Conversely, spray-drying employs high heat, which is cost-effective for mass production but often leads to some flavor degradation.

Which geographical region represents the most significant growth opportunity for instant coffee powder?

Asia Pacific (APAC) currently offers the most significant growth opportunity, dominating the market in terms of volume expansion. This rapid adoption is driven by large-scale consumer acceptance of affordable instant coffee mixes (3-in-1 formats) and consistently improving retail infrastructure in developing economies like China, India, and Indonesia.

What role does Artificial Intelligence (AI) play in the modern instant coffee manufacturing process?

AI is increasingly crucial for optimizing operational efficiency and quality control. It is utilized for predictive maintenance of specialized drying equipment, real-time monitoring of particle quality, and highly accurate demand forecasting, which minimizes waste and ensures consistent product flavor profiles across vast production runs globally.

What emerging product segments are driving the premiumization trend in the instant coffee market?

The premiumization trend is driven by the rise of high-quality product segments, including freeze-dried single-origin instant coffees, specialty instant cold brew concentrates, and hybrid products incorporating micro-ground roasted coffee particles to achieve a flavor profile closer to traditionally brewed coffee.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager