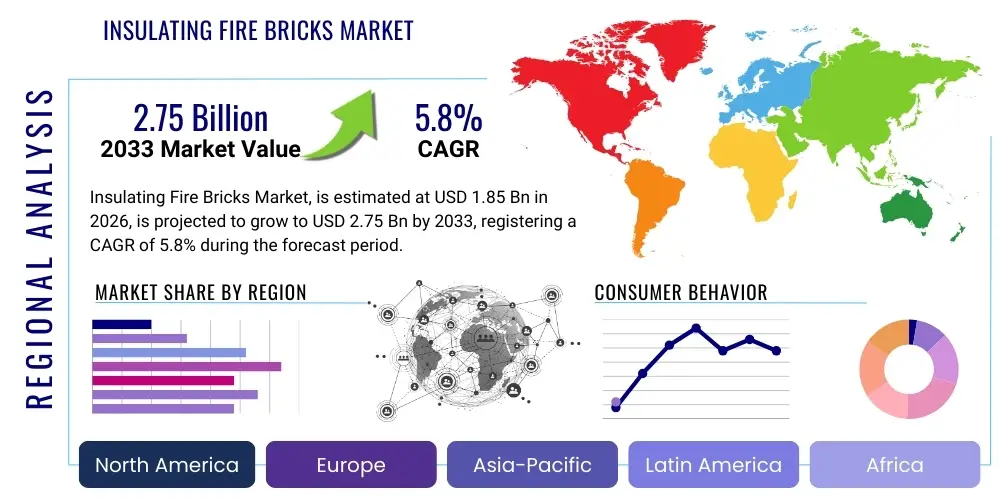

Insulating Fire Bricks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435040 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Insulating Fire Bricks Market Size

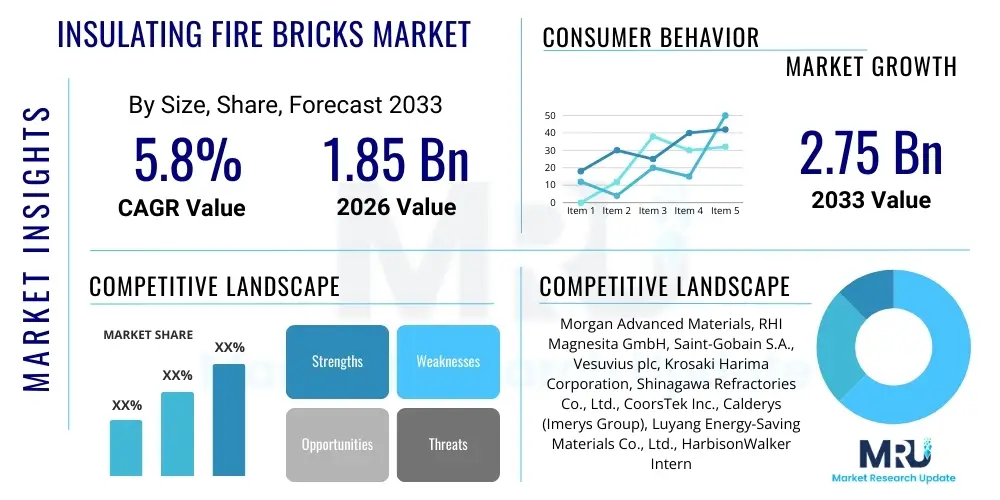

The Insulating Fire Bricks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.75 billion by the end of the forecast period in 2033.

Insulating Fire Bricks Market introduction

Insulating Fire Bricks (IFBs) constitute a critical component within the high-temperature industrial landscape, primarily serving as refractory materials designed not only to withstand extreme heat but, crucially, to minimize thermal conductivity and heat storage. These lightweight, porous ceramics are engineered from high-purity refractory clays, alumina, and silica, and are manufactured through processes that create specific pore structures, resulting in exceptional insulation properties. IFBs are fundamentally distinct from dense refractories as their primary function is energy conservation, rather than mechanical load bearing in the hottest zones, making them indispensable in cyclical operations where rapid heating and cooling cycles occur.

Major applications of IFBs span a vast array of thermal processing equipment, including kilns, furnaces, boilers, incinerators, and hot gas ducts across industries such as iron and steel, petrochemicals, glass manufacturing, and ceramics production. The core benefit derived from utilizing IFBs is the substantial reduction in energy consumption achieved by lowering the external surface temperature of the equipment, thereby decreasing heat loss to the environment. Furthermore, their low thermal mass allows for faster cycling times and lower operational costs, translating directly into enhanced production efficiency and greater profitability for end-users, especially those facing stringent environmental and energy efficiency regulations.

The market is currently being driven by several macro-economic and industry-specific factors, including the global push for decarbonization and energy efficiency mandates across developed and developing economies. The increasing demand for high-performance thermal insulation materials that can operate reliably under oxidizing or reducing atmospheres is bolstering market expansion. Moreover, significant infrastructure investments in emerging economies, particularly in the cement and metals industries, necessitate the continuous installation and maintenance of high-efficiency thermal units, further cementing the role of IFBs as essential thermal management solutions.

Insulating Fire Bricks Market Executive Summary

The Insulating Fire Bricks market is experiencing robust business trends characterized by a dual focus on performance enhancement and sustainability. Manufacturers are actively investing in R&D to develop advanced IFBs, such as high-alumina and mullite-based compositions, capable of enduring temperatures exceeding 1700°C while maintaining superior insulation characteristics. Key business strategies observed include strategic mergers and acquisitions aimed at consolidating supply chains and expanding geographical reach, particularly into high-growth regions like Asia Pacific. The competitive environment is leaning towards specialization, where companies differentiate themselves based on custom product geometry, quick delivery times, and comprehensive technical support services for complex refractory linings.

Regionally, the market dynamics are highly heterogeneous. Asia Pacific (APAC) dominates the market share due to burgeoning industrialization, massive infrastructure projects, and the rapid expansion of the steel, cement, and glass industries in China and India, leading to high consumption volumes. North America and Europe, while mature markets, emphasize technological innovation, driving demand for premium, energy-efficient IFBs as industries strive to meet strict greenhouse gas emission targets imposed by regional regulatory bodies. The Middle East and Africa (MEA) are emerging as significant consumption hubs, propelled by investments in petrochemical refining and primary metals production, though political instability and reliance on imports remain minor operational challenges.

Segment-wise, the market shows distinct trends based on temperature rating and material type. IFBs classified for lower temperature applications (up to 1200°C) maintain a stable demand in general insulation uses, whereas the demand for high-temperature IFBs (above 1500°C) is surging, driven primarily by specialized applications in advanced ceramics and metallurgical furnaces requiring extreme thermal stability. Furthermore, the segmentation by end-user highlights the steel and iron industry as the primary revenue generator, although the glass and ceramics sectors are exhibiting the fastest growth rates due to their high dependency on precise, energy-efficient temperature control in their continuous processing operations.

AI Impact Analysis on Insulating Fire Bricks Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Insulating Fire Bricks market predominantly center on optimizing manufacturing processes, predicting product failure, and enhancing quality control. Users are keen to understand how AI can reduce energy expenditure during the firing process of bricks, a highly energy-intensive stage, and how predictive maintenance models can extend the life cycle of refractory linings in end-user furnaces. The core theme revolves around leveraging machine learning for improved thermal profile modeling within kilns and automated inspection systems to identify microscopic defects, thereby ensuring higher batch consistency and reducing material waste, signaling a shift towards AI-driven material science and smart manufacturing in the refractory sector.

- AI-driven process optimization minimizes energy consumption during IFB production (e.g., precise control of kiln temperature gradients).

- Predictive maintenance algorithms analyze thermal imaging data from furnaces to forecast refractory wear and scheduled replacement, reducing unplanned shutdowns.

- Machine learning improves quality control by automating defect detection in finished bricks using high-resolution vision systems.

- AI simulations enable faster development of novel IFB compositions by predicting material performance under various thermal stress conditions.

- Smart inventory management systems optimize stocking levels of IFB types based on historical consumption patterns and industrial activity forecasts.

- Integration of Industrial Internet of Things (IIoT) sensors with AI analytics provides real-time monitoring of thermal flux across refractory linings.

DRO & Impact Forces Of Insulating Fire Bricks Market

The market for Insulating Fire Bricks is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities. The primary driver is the pervasive global emphasis on industrial energy efficiency, compelling industries to replace conventional, less efficient refractory linings with high-performance IFBs that offer superior thermal barriers. Simultaneously, the sustained growth in major end-user sectors, particularly the steel, cement, and glass industries in Asia, dictates the bulk demand for these materials. However, the market faces constraints related to the inherent fragility of IFBs compared to dense refractories, limiting their use in high-abrasion or high-load zones, and the volatility of raw material prices (e.g., specialized clays and alumina), which affects production costs and final product pricing. These factors collectively shape the market landscape, determining investment priorities and supply chain strategies.

A significant opportunity arises from the accelerating transition towards green manufacturing and the utilization of hydrogen and bio-fuels in industrial heating applications. New furnace designs required for these emerging energy sources often necessitate highly specialized, low-thermal-mass refractory linings, perfectly aligning with the core competencies of IFBs. Furthermore, the opportunity to retrofit older industrial furnaces globally with modern IFB technology presents a massive, untapped market potential focused on energy savings. The impact forces acting on the market are high due to regulatory pressures demanding reduced carbon emissions; for instance, European Union directives on industrial emissions directly increase the necessity for energy-saving materials like IFBs.

The market's structural evolution is heavily impacted by technological advancements leading to the development of higher-grade IFBs (e.g., those using advanced ceramics like zirconia or yttria stabilization) which address some of the existing limitations regarding maximum service temperature and chemical corrosion resistance. This focus on performance mitigates the restraint imposed by material fragility in certain applications. Overall, the powerful driving forces related to energy conservation and industrial expansion outweigh the structural restraints, creating a strong positive impact trajectory for the market, particularly for manufacturers who can consistently deliver customized, high-specification products that meet precise industrial thermal requirements.

Segmentation Analysis

The Insulating Fire Bricks market is systematically segmented based on material composition, maximum service temperature, and end-use application. Understanding these segments is crucial for strategic market positioning, as each category addresses specific thermal management challenges across various industrial processes. Segmentation by material often dictates the brick’s physical properties, while segmentation by temperature rating determines its suitability for different furnace zones, ensuring optimal energy performance and structural integrity in extreme heat environments. The end-use application segment confirms the market's reliance on core industrial sectors such as metallurgy, glass, and chemicals, providing clear insight into consumption patterns and growth pockets globally.

- By Material Type:

- High Alumina Bricks (High strength, high temperature)

- Silica Bricks (Good thermal shock resistance)

- Mullite Bricks (Excellent thermal stability)

- Corundum Bricks (Highest temperature applications)

- Clay Bricks (Standard insulation, lower cost)

- By Maximum Service Temperature:

- Below 1200°C (For lower heat insulation, general applications)

- 1200°C - 1500°C (Intermediate temperature furnaces and kilns)

- Above 1500°C (High-temperature metallurgical and ceramic firing applications)

- By End-Use Industry:

- Iron and Steel Industry (Furnace linings, ladle covers)

- Glass Industry (Regenerator checkerwork, melter crowns)

- Cement Industry (Rotary kiln linings, preheaters)

- Ceramics and Tiles Industry (Intermittent and tunnel kilns)

- Petrochemical and Chemical Industry (Process heaters, reactors)

- Others (Power generation, Incineration)

Value Chain Analysis For Insulating Fire Bricks Market

The value chain for the Insulating Fire Bricks market commences with upstream activities focused on the sourcing and processing of specialized raw materials. Key inputs include high-purity refractory clays (kaolin), bauxite, alumina powder, silica, and proprietary additives used for porosity control. Upstream suppliers are vital, as the quality and consistency of these raw materials directly determine the insulating performance and maximum service temperature of the final brick product. Ensuring stable supply chains and managing the costs associated with energy-intensive mineral processing are critical functions at this initial stage. Efficiency in raw material beneficiation and calcination greatly influences the overall production cost structure.

Midstream processing involves manufacturing, which is highly specialized, encompassing complex molding, drying, and high-temperature firing processes in tunnel or shuttle kilns. Manufacturers of IFBs invest heavily in advanced mixing technologies and precise atmospheric controls during firing to achieve the desired lightweight, porous structure and exact dimensional tolerance. This stage is where value addition through technological know-how is maximized. Downstream activities focus on distribution, installation, and after-sales support. Due to the high degree of customization often required, effective technical consultation and precise engineering of refractory linings are essential services provided at the distribution level.

Distribution channels in this market are predominantly direct for large-volume industrial end-users (e.g., major steel mills) where technical specifications and supply security are paramount. However, indirect channels, involving specialized refractory distributors and agents, handle smaller orders, maintenance requirements, and serve regional markets lacking direct manufacturer presence. These indirect partners often provide crucial local inventory, cutting, and installation services. The success of the distribution phase hinges on providing robust logistical support, minimizing breakage during transit (due to the material's inherent fragility), and ensuring timely delivery to meet critical industrial shutdown schedules for relining operations.

Insulating Fire Bricks Market Potential Customers

The primary customers for Insulating Fire Bricks are large industrial enterprises operating high-temperature processing equipment that requires stringent thermal management and energy efficiency. These end-users are characterized by continuous operational cycles and significant reliance on thermal energy, making energy loss a substantial operational cost. Key segments include integrated steel manufacturers, who utilize IFBs extensively in blast furnaces, hot blast stoves, and reheating furnaces, and cement producers, where these bricks are critical for lining preheaters and specific zones within rotary kilns to maintain thermal gradients and reduce shell temperatures.

Another crucial customer segment is the glass manufacturing industry, which demands high-purity IFBs for lining regenerators, float baths, and furnace crowns, primarily to minimize heat storage and facilitate consistent melting temperatures. The chemical and petrochemical industries represent growing customers, using IFBs in cracking furnaces, process heaters, and reactors where controlling exothermic reactions and maintaining thermal uniformity is non-negotiable for safety and efficiency. These customers prioritize IFB performance attributes such as maximum operational temperature, resistance to chemical attack (e.g., from sulfur or alkali vapors), and structural stability over long operating periods.

Purchasing decisions among these end-users are driven not merely by initial cost but overwhelmingly by Total Cost of Ownership (TCO), focusing on energy savings realized over the refractory lining lifecycle, expected lifespan, and the potential reduction in downtime. Therefore, market penetration strategies must emphasize the long-term economic benefits and technical superiority of the bricks. Smaller but specialized customers include foundries, heat treatment facilities, and producers of advanced technical ceramics, who require highly customized IFB solutions for intermittent, specialized heating processes requiring extremely low thermal mass for fast cycle times.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 2.75 billion |

| Growth Rate | CAGR 5.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Morgan Advanced Materials, RHI Magnesita GmbH, Saint-Gobain S.A., Vesuvius plc, Krosaki Harima Corporation, Shinagawa Refractories Co., Ltd., CoorsTek Inc., Calderys (Imerys Group), Luyang Energy-Saving Materials Co., Ltd., HarbisonWalker International (HWI), Resco Products Inc., Unifrax LLC, Refractories West Inc., Isolite Insulating Products Co., Ltd., JFE Refractories Corporation, Christy Refractories, Shandong Lude Thermal Technology Co., Ltd., Puyang Refractories Group Co., Ltd., Sichuan ZTC Refractory Co., Ltd., Fosbel Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulating Fire Bricks Market Key Technology Landscape

The technological landscape of the Insulating Fire Bricks market is constantly evolving, driven primarily by the need to achieve higher insulation performance and greater mechanical strength without compromising low thermal mass. A significant area of focus is the development of ultra-low thermal mass (ULTM) bricks, often achieved through enhanced porous structures created via proprietary organic burn-out materials or foaming techniques during the manufacturing process. These technologies aim to reduce the density of the final product while increasing the volume of entrapped air pockets, thereby substantially lowering thermal conductivity and facilitating extremely fast heating and cooling cycles critical for intermittent kilns in the ceramics industry.

Another major technological trend involves enhancing the chemical resistance and service temperature of IFBs. This is achieved by incorporating advanced ceramic materials such as high-purity mullite, fused silica, and specialized zirconia compositions, particularly for bricks designed for applications above 1600°C. These high-end materials resist corrosion from volatile industrial byproducts, such as alkali vapors in cement kilns or fluxing agents in glass furnaces, extending the refractory lining life. Furthermore, innovations in production techniques, including hot pressing and specialized vacuum forming, are improving the structural uniformity of the bricks, minimizing micro-cracks and ensuring predictable performance under thermomechanical stress.

Digitalization and automation are also playing an increasing role in the technological landscape. Advanced computational fluid dynamics (CFD) modeling is now routinely used by manufacturers to simulate the thermal performance of new IFB designs and optimize lining thickness for specific furnace geometries before physical prototyping. Additionally, the application of precision robotics in brick stacking and handling during manufacturing minimizes human error and reduces breakage. The integration of spectroscopic analysis and non-destructive testing (NDT) techniques ensures that quality control measures are maintained at the highest level, guaranteeing that manufactured bricks meet the rigorous standards required for critical industrial applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily fueled by the robust industrial expansion in China, India, and Southeast Asian nations. The region's dominance is attributed to massive ongoing infrastructure development, substantial crude steel production, and the exponential growth of the cement and ceramics sectors. Government policies supporting 'Make in India' and China's industrial modernization drive high demand for energy-efficient refractory solutions to meet rapidly expanding capacity requirements.

- North America: This region is characterized by mature industrial sectors focusing intensely on efficiency upgrades and sustainability. Demand is driven by the replacement of older, inefficient refractory materials with premium, specialized IFBs. The petrochemical and specialized manufacturing sectors are key consumers, prioritizing compliance with stringent environmental regulations and optimizing operational costs through superior thermal management.

- Europe: Europe represents a technologically advanced market heavily influenced by strict EU directives aimed at reducing industrial carbon emissions. This regulatory environment mandates the adoption of best available techniques (BAT), favoring high-grade IFBs with certified low thermal conductivity. The market growth here is predominantly concentrated in specialized areas, such as advanced ceramics production and high-efficiency glass melting furnaces, where material purity and energy savings are critical competitive differentiators.

- Latin America (LATAM): Growth in LATAM is moderately steady, tied closely to the performance of regional mining and primary metals industries, particularly in Brazil and Mexico. The market often faces economic volatility, but stable long-term investments in cement and steel facilities sustain continuous, albeit fluctuating, demand for basic and intermediate temperature IFBs for maintenance and relining projects.

- Middle East and Africa (MEA): MEA is an emerging high-potential region, driven by significant investments in large-scale oil and gas refining, petrochemical facilities, and primary aluminum smelting projects. These energy-intensive industries require large volumes of IFBs for lining process heaters and reaction vessels, making this a strategic area for market penetration, although logistical complexities remain a consideration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulating Fire Bricks Market.- Morgan Advanced Materials

- RHI Magnesita GmbH

- Saint-Gobain S.A.

- Vesuvius plc

- Krosaki Harima Corporation

- Shinagawa Refractories Co., Ltd.

- Calderys (Imerys Group)

- CoorsTek Inc.

- Luyang Energy-Saving Materials Co., Ltd.

- HarbisonWalker International (HWI)

- Resco Products Inc.

- Unifrax LLC

- Isolite Insulating Products Co., Ltd.

- JFE Refractories Corporation

- Christy Refractories

- Shandong Lude Thermal Technology Co., Ltd.

- Puyang Refractories Group Co., Ltd.

- Sichuan ZTC Refractory Co., Ltd.

- Tesco Refractories

- CeramTec GmbH

Frequently Asked Questions

Analyze common user questions about the Insulating Fire Bricks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Insulating Fire Bricks (IFBs) and Dense Refractories?

IFBs are engineered for superior thermal insulation and low heat storage, achieved through a highly porous, lightweight structure. Dense refractories, conversely, are designed for high mechanical strength and abrasion resistance in direct contact with molten materials, offering comparatively lower insulation performance.

Which industry accounts for the largest demand for Insulating Fire Bricks?

The Iron and Steel Industry is currently the largest consumer of IFBs, utilizing them extensively in applications such as blast furnace linings, hot blast stoves, and reheating furnaces to significantly reduce heat loss and improve overall thermal efficiency in steel manufacturing processes.

How do Insulating Fire Bricks contribute to sustainability goals in industrial operations?

IFBs contribute substantially to sustainability by minimizing energy consumption in high-temperature processes. Their low thermal conductivity means less heat escapes the furnace system, directly reducing the required fuel input and consequently lowering carbon dioxide and other greenhouse gas emissions.

What are the key material types used in the manufacturing of high-performance IFBs?

Key materials include high-purity alumina, mullite, and silica. High-alumina and mullite compositions are critical for IFBs operating above 1500°C, offering enhanced refractoriness and chemical stability essential for advanced ceramic and specialized metallurgical applications.

What factors restrain the wider adoption of Insulating Fire Bricks in certain high-wear industrial zones?

The primary restraint is the inherent fragility and lower mechanical strength of IFBs due to their high porosity. They are generally unsuitable for furnace zones experiencing extreme mechanical stress, heavy abrasion, or direct impingement by high-velocity gases or molten material flow, requiring the use of dense refractories or castables instead.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager