Insulation Blowing Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438162 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Insulation Blowing Machine Market Size

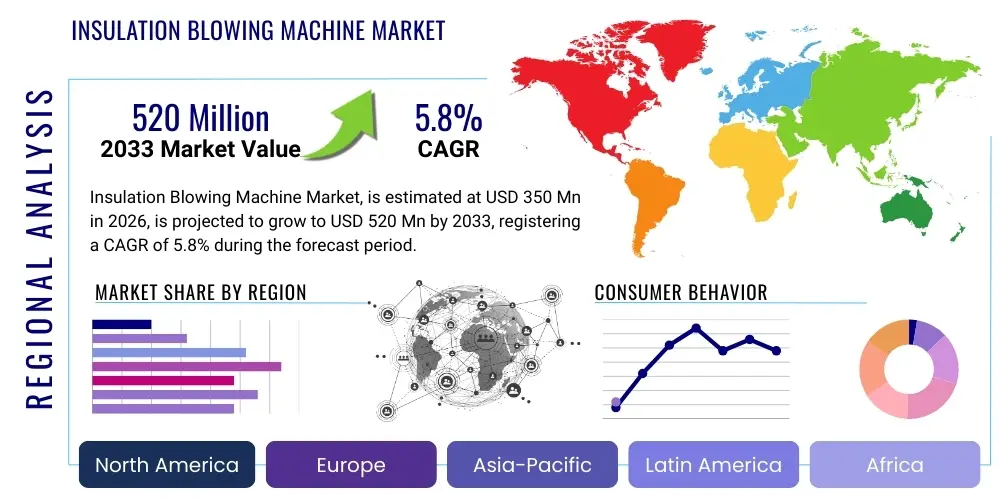

The Insulation Blowing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 520 Million by the end of the forecast period in 2033.

Insulation Blowing Machine Market introduction

The Insulation Blowing Machine Market encompasses the manufacturing, distribution, and utilization of specialized equipment designed to install loose-fill insulation materials such as cellulose, fiberglass, and rock wool into residential, commercial, and industrial structures. These machines function by breaking up the compacted insulation material, mixing it with air, and propelling it through a hose into wall cavities, attics, or hard-to-reach spaces, ensuring a uniform and dense application critical for achieving optimal thermal performance and energy efficiency. The primary function of this machinery is to expedite the insulation process while minimizing material waste and labor intensity, positioning them as essential tools in the modern construction and retrofitting sectors.

Major applications of insulation blowing machines span new construction projects seeking high R-values and deep energy retrofits aiming to upgrade older building envelopes to meet stringent modern energy codes. Key benefits derived from the use of these systems include superior insulation density, elimination of thermal bridging gaps commonly associated with batts, enhanced acoustic dampening capabilities, and significant long-term energy cost savings for building occupants. The versatility of these machines allows for handling various types of materials, adapting easily to different job site requirements and insulation thickness specifications mandated by regional building standards.

The market growth is primarily driven by escalating global focus on sustainability and energy conservation, coupled with supportive governmental regulations promoting green building initiatives and deep insulation penetration across mature economies. Furthermore, the persistent rise in energy prices globally necessitates cost-effective solutions for thermal regulation, making the installation of high-performance insulation, facilitated by efficient blowing machines, a core component of building envelope strategies. The increasing demand for retrofit projects in aging infrastructure, particularly in North America and Europe, further accelerates the adoption rate of portable and high-capacity insulation blowing equipment.

Insulation Blowing Machine Market Executive Summary

The global Insulation Blowing Machine Market is characterized by robust business trends centered on technological advancements aimed at improving material handling efficiency, portability, and automation features. Manufacturers are focusing on developing high-output, low-maintenance machines equipped with digital controls for precise material flow regulation, addressing the growing contractor demand for reliability and speed on large-scale projects. Sustainable material compatibility is another critical trend, with machines optimized to handle eco-friendly and recycled insulation products like recycled cellulose, aligning with global green construction mandates. The integration of telematics and diagnostic capabilities is emerging, allowing for remote monitoring and predictive maintenance, thereby reducing downtime and increasing overall operational profitability for insulation contractors.

Regional trends indicate North America maintaining market leadership due to stringent energy efficiency codes, high disposable income facilitating investments in energy retrofits, and a large existing building stock requiring frequent insulation upgrades. Europe follows closely, driven by the ambitious "Renovation Wave" strategy, which mandates significant improvements in building energy performance across the European Union. Asia Pacific is poised for the highest growth rate, fueled by rapid urbanization, massive infrastructure development, and increasing awareness of thermal comfort in emerging economies like China and India, where demand for basic and mid-range blowing machines is expanding exponentially. Government incentives in key regions, particularly tax credits for energy-efficient home improvements, continue to shape purchasing patterns.

Segment trends reveal that the medium-capacity machine segment dominates the market, catering effectively to both residential new construction and large-scale retrofit applications, offering an optimal balance between cost and performance. However, the high-capacity, trailer-mounted industrial machines are witnessing specialized growth driven by large commercial and industrial construction projects requiring extremely high throughput for materials like loose-fill fiberglass. In terms of insulation type, cellulose-compatible machines remain highly demanded due to the material's cost-effectiveness and favorable environmental profile, while fiberglass machines benefit from the material's superior fire resistance and durability, contributing significantly to market volume and revenue streams across all geographical areas.

AI Impact Analysis on Insulation Blowing Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Insulation Blowing Machine Market predominantly revolve around optimizing job site efficiency, predicting machine failure, and automating material logistics. Common user concerns include whether AI can manage material density dynamically, how machine learning algorithms could optimize application patterns to minimize waste in complex geometries, and the timeline for integrating AI into standard blowing equipment controls. Users are also keen to understand if AI-powered diagnostics could drastically reduce service call times and improve the precision of insulation installation, ultimately driving down overall project costs and improving the quality assurance processes in building performance assessment.

AI's primary influence will center on enhancing the precision and predictive maintenance capabilities of insulation equipment. Machine learning algorithms can analyze real-time operational data, including air pressure, material feed rate, and motor load, to dynamically adjust settings based on external environmental factors or internal system stress, ensuring consistent material density and coverage uniformity throughout the installation process. This dynamic control minimizes human error and guarantees that the insulation achieves the specified R-value, a crucial quality metric that currently requires extensive manual verification.

Furthermore, predictive maintenance powered by AI is set to revolutionize the servicing landscape. By analyzing historical performance data and identifying minute anomalies in vibration or temperature signatures, AI systems can accurately forecast component failure well before it occurs. This transition from reactive repairs to proactive maintenance significantly reduces equipment downtime, enhances contractor profitability, and improves the lifecycle cost-effectiveness of high-investment blowing machines, transforming machine ownership models from traditional service contracts to subscription-based performance assurance systems.

- AI-driven optimization of material density and flow rate for superior thermal performance consistency.

- Predictive maintenance analytics reducing equipment downtime by forecasting mechanical failures based on real-time sensor data.

- Automated material logistics planning, utilizing AI to calculate optimal material quantities and delivery schedules for large projects, minimizing waste.

- Integration of computer vision and AI for real-time quality control checks on insulation coverage within wall cavities or attic spaces.

- Enhanced operator training simulations utilizing AI feedback loops for faster skill acquisition and safety compliance.

DRO & Impact Forces Of Insulation Blowing Machine Market

The market dynamics of Insulation Blowing Machines are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's trajectory and the strategic decisions of key industry players. The principal driving forces stem from global legislative movements mandating higher energy efficiency in both new and existing buildings, particularly the adoption of advanced building codes that necessitate superior insulation levels to achieve net-zero energy targets. These regulatory tailwinds create a foundational, non-discretionary demand for insulation application equipment. Concurrently, technological advancements leading to more portable, powerful, and user-friendly machines are reducing the barriers to entry for smaller contractors and increasing overall market penetration across diverse geographical regions.

Despite the strong demand drivers, the market faces significant restraints that dampen growth potential in specific regions. A key restraint is the high initial capital investment required for professional-grade, high-capacity insulation blowing machines, which can be prohibitive for small and medium-sized contracting firms, especially in developing economies. Furthermore, the reliance on skilled labor for efficient operation and maintenance of these specialized machines poses a challenge; shortages of trained insulation installers can limit the scale and speed of adoption. Finally, cyclical downturns in the construction sector, particularly in residential new construction, occasionally introduce volatility into equipment demand, requiring manufacturers to adapt to fluctuating order books and production schedules.

Significant opportunities exist in the market, primarily revolving around the massive global potential in the energy retrofit sector, particularly insulating previously uninsulated or poorly insulated existing structures, which represents a continuous, multi-decade market opportunity. Product innovation focusing on automation, such as robotic blowing systems for inaccessible areas like crawl spaces, presents a high-value niche. Expanding market penetration in emerging economies through the offering of cost-effective, durable, and easily maintainable entry-level equipment is also a major growth avenue. The cumulative impact of these forces suggests a sustained growth trend, where drivers significantly outweigh restraints, positioning the market favorably for expansion over the forecast period, contingent upon continuous product refinement and strategic regional expansion initiatives.

Segmentation Analysis

The Insulation Blowing Machine Market is comprehensively segmented based on machine type, capacity, material type handled, end-user application, and geographical region, providing a granular view of market dynamics and targeted strategic investment areas. This segmentation helps stakeholders understand specific demand characteristics across different operational environments and budget constraints. The classification by capacity, ranging from portable residential units to trailer-mounted industrial systems, is particularly critical as it dictates the throughput rates and suitability for various project scales, directly impacting procurement decisions by insulation contractors worldwide.

Analyzing the market by machine type—hydraulic, electric, or pneumatic—reveals underlying technological preferences, often linked to job site infrastructure availability and required material handling power. Electric and hydraulic systems are favored for high-capacity professional applications due to their consistent power output and ability to handle dense materials, while pneumatic systems often cater to lighter, more flexible residential tasks. Furthermore, the segmentation by material, encompassing cellulose, fiberglass, and rock wool compatibility, highlights the specialized requirements that manufacturers must meet to ensure optimal material integrity and application performance, with many machines offering multi-material compatibility to maximize utility.

From an end-user perspective, the segmentation into Residential, Commercial, and Industrial sectors dictates machine ruggedness, size, and operational hours required. The Residential sector drives demand for highly portable and easy-to-use machines, whereas the Commercial and Industrial segments demand high-volume, continuous-operation systems optimized for large building envelopes. This holistic segmentation structure is essential for targeted marketing, product development focused on specific performance attributes, and competitive analysis within specialized insulation sub-markets globally.

- By Machine Type:

- Electric Blowing Machines

- Hydraulic Blowing Machines

- Pneumatic Blowing Machines

- By Capacity:

- Low Capacity (Portable Residential Units)

- Medium Capacity (Professional Residential/Small Commercial)

- High Capacity (Trailer-Mounted Industrial Units)

- By Insulation Material:

- Fiberglass Insulation Blowing Machines

- Cellulose Insulation Blowing Machines

- Rock Wool/Stone Wool Blowing Machines

- Multi-Material Blowing Machines

- By Application:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Retrofitting and Renovation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Insulation Blowing Machine Market

The value chain for the Insulation Blowing Machine Market begins with upstream activities involving raw material procurement and component manufacturing. Key inputs include high-grade steel and aluminum for machine chassis, specialized motors (electric or hydraulic), complex electronic control units, and robust hosing systems designed to withstand abrasive insulation materials under high pressure. Manufacturers often rely on established relationships with precision engineering firms for motor and blower assemblies, which are the core mechanical components determining the machine's efficiency and longevity. Efficient sourcing and quality control at this stage are paramount to ensuring the reliability and performance of the final insulation blowing unit, directly impacting the equipment’s resale value and operational lifespan in the field.

The midstream stage involves the assembly, testing, and branding of the final machinery. Specialized manufacturers, ranging from global construction equipment giants to niche insulation technology providers, conduct rigorous internal quality assurance protocols, including field-testing machines under various load conditions using different insulation types (e.g., damp-spray cellulose versus dry fiberglass). Innovation often occurs here, focusing on proprietary agitator designs, integrated dust control systems, and intuitive digital interfaces that improve ease of use and reduce operator fatigue. This stage also involves obtaining necessary certifications (e.g., electrical safety standards, capacity verification) before machines enter the distribution channels.

Downstream activities center on distribution, sales, and aftermarket support. Distribution channels are typically a mix of direct sales to large insulation contracting firms, specialized equipment rental companies, and indirect distribution through networks of authorized dealers and construction supply houses. Indirect channels are crucial for reaching smaller regional contractors and providing localized support, training, and rapid access to spare parts. Excellent aftermarket service, including technical assistance, maintenance programs, and spare part availability, is a critical competitive differentiator, ensuring sustained customer loyalty and maximizing machine uptime for high-volume users in the construction industry.

Insulation Blowing Machine Market Potential Customers

The primary end-users and buyers of Insulation Blowing Machines are insulation contractors who specialize in applying thermal and acoustic materials to residential and commercial structures. These professionals require reliable, high-throughput machinery that can handle diverse insulation types (cellulose, fiberglass, rock wool) and adapt quickly to varying job site conditions, from dense packed walls in new construction to open blow attics during retrofits. The decision to purchase is heavily influenced by machine reliability, long-term maintenance costs, ease of portability, and the capacity to achieve specific installation densities mandated by engineering specifications and local building inspectors.

A second significant customer segment includes large home improvement retail chains and specialized equipment rental companies. Retail chains often purchase portable, lower-capacity machines to offer DIY renters, catering to homeowners undertaking smaller retrofit projects or attic insulation upgrades. Equipment rental companies, conversely, maintain a diverse fleet, ranging from professional-grade medium-capacity units to industrial trailer-mounted systems, serving contractors who prefer renting equipment on a per-project basis to avoid large capital expenditure, especially during peak construction seasons or for short-term specialized jobs.

Lastly, large-scale general contractors, particularly those focused on commercial, multi-family, and government infrastructure projects (like military housing or institutional buildings), constitute a crucial customer base. These entities often integrate insulation application capabilities internally or specify high-performance machinery for their subcontractors. Their procurement decisions emphasize durability, continuous operational capacity, adherence to stringent safety standards, and sophisticated documentation features that track material consumption and installation parameters for quality assurance and regulatory compliance purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 520 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cool Machines Inc., Krendl Machine Co., Meyer Machine & Equipment Inc., Graco Inc., Accu-1 Manufacturing, Intec Equipment Inc., Unisul, X-Floc Dammtechnik-Maschinen GmbH, Versa-Foam Systems (RHH Foam Systems), CertainTeed Corporation, Sunbelt Rentals, Arkema, Atticus Machine LLC, CMC Construction Services, Blow-In-Blanket Contractor, Foam It Insulation, Machine Systems, Inc., Therm-O-Trol, Woolsulation Machines, Hi-Flow Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulation Blowing Machine Market Key Technology Landscape

The technological landscape of the Insulation Blowing Machine Market is rapidly evolving, moving beyond simple mechanical agitation and pneumatic delivery towards sophisticated, digitally controlled systems. Modern professional-grade machines increasingly integrate Variable Frequency Drives (VFDs) and advanced electronic control units (ECUs) to achieve precise control over motor speed, material conditioning, and air pressure. This precision is vital for maintaining the specified density of insulation material, particularly cellulose, which requires careful control to prevent settling over time and ensure long-term thermal performance. Furthermore, the adoption of closed-loop hydraulic systems in high-capacity machines provides superior power delivery and control, optimizing performance when working with denser materials like stone wool or heavy cellulose blends in adverse temperature conditions.

A significant trend involves the incorporation of sensors and Internet of Things (IoT) capabilities. These sensors monitor key operational parameters such as material hopper weight, flow rate in the hose, motor temperature, and vibration levels. This data is transmitted in real-time to onboard displays and cloud platforms, enabling operators to confirm installation quality instantaneously and allowing contractors to track machine utilization remotely. IoT integration facilitates proactive diagnostics and preventative maintenance scheduling, a major technological advancement that minimizes costly and unpredictable job site breakdowns, thereby maximizing return on investment for high-cost industrial units, a critical factor in contractor purchasing decisions.

Another crucial area of innovation is focused on improving material handling efficiency and dust mitigation, responding directly to health and safety concerns and environmental regulations. Advanced shredder and agitator designs are being developed to condition insulation materials gently yet thoroughly, reducing material degradation and airborne particulate matter. Furthermore, the development of specialized "damp spray" application kits, which accurately meter and inject water or adhesive binders into the material stream, allows for the highly effective application of materials like cellulose into open wall cavities before drywall installation, expanding the functional utility and precision capabilities of contemporary insulation blowing machinery systems.

Regional Highlights

North America is anticipated to maintain its dominance in the Insulation Blowing Machine Market throughout the forecast period, driven primarily by mature residential and commercial construction markets and a deeply entrenched culture of energy efficiency improvements. Strict energy codes, such as those governed by ASHRAE and regional state-level mandates, necessitate the use of high R-value insulation, creating robust demand for high-capacity, sophisticated machinery capable of dense-packing techniques. The strong presence of key market players, coupled with significant investment in rental fleets by national chains, ensures widespread access to both purchase and rental options for contractors across the United States and Canada, supporting continuous market liquidity and technology uptake in professional insulation services.

Europe represents a highly dynamic market, fueled significantly by the European Union’s ambitious energy targets and the vast scale of necessary building retrofits. Countries such as Germany, France, and the UK have implemented substantial incentive schemes and regulations (e.g., Energy Performance Certificates) that directly encourage homeowners and property managers to upgrade insulation levels. The European market exhibits a strong preference for machines compatible with environmentally friendly materials, such as wood fiber insulation and recycled cellulose, aligning with the region’s strong focus on sustainable construction practices. Furthermore, the fragmentation of the European construction sector means that highly portable and versatile machines suited for navigating smaller urban job sites and complex older buildings are particularly valued and contribute strongly to overall regional demand.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate, driven by rapid urbanization, massive infrastructure spending, and a growing middle class demanding higher standards of comfort and energy efficiency in new residential towers and commercial spaces. While initial market penetration for specialized insulation machinery has been lower compared to the West, increasing awareness of high energy costs, particularly in hot and humid climates requiring substantial air conditioning, is spurring demand in key economies like China, India, and Australia. The market here is characterized by strong demand for entry-level and mid-range electric machines, where durability and affordability are prioritized over high-end automation features, although premium systems are gaining traction in certified green building projects.

Latin America (LATAM) and the Middle East & Africa (MEA) currently represent smaller, yet emerging, markets. In LATAM, growth is sporadic but focused on energy-intensive industrial applications and new commercial developments in major urban centers like São Paulo and Mexico City, where imported technology often dictates market trends. In MEA, particularly the GCC nations, extreme climatic conditions mandate effective insulation to minimize colossal cooling loads, driving demand for heavy-duty, robust machines capable of handling mineral wool and dense fiberglass in large, modern commercial complexes. Government investments in sustainable cities, such as those planned in Saudi Arabia and the UAE, are expected to create localized surges in demand for advanced insulation application equipment over the latter half of the forecast period.

- North America: Market leader due to strict energy codes, large retrofit sector, and strong contractor demand for high-capacity, advanced fiberglass and cellulose machines.

- Europe: High growth fueled by "Renovation Wave," governmental incentives, and strong preference for sustainable materials like wood fiber and recycled cellulose.

- Asia Pacific (APAC): Fastest-growing region driven by rapid urbanization, infrastructure development, and increasing adoption of thermal comfort standards in new buildings, particularly in China and India.

- Latin America: Emerging market growth concentrated in industrial and major commercial centers, with demand influenced by foreign construction practices and specialized industrial projects.

- Middle East and Africa (MEA): Growth driven by extreme climate conditions necessitating robust insulation and large government-led sustainable city projects, focusing on high-volume mineral wool applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulation Blowing Machine Market.- Cool Machines Inc.

- Krendl Machine Co.

- Meyer Machine & Equipment Inc.

- Graco Inc.

- Accu-1 Manufacturing

- Intec Equipment Inc.

- Unisul

- X-Floc Dammtechnik-Maschinen GmbH

- Versa-Foam Systems (RHH Foam Systems)

- CertainTeed Corporation (Equipment Division)

- Sunbelt Rentals (Equipment Rental Focus)

- Arkema (Specialized Equipment)

- Atticus Machine LLC

- CMC Construction Services

- Blow-In-Blanket Contractor

- Foam It Insulation

- Machine Systems, Inc.

- Therm-O-Trol

- Woolsulation Machines

- Hi-Flow Equipment

Frequently Asked Questions

Analyze common user questions about the Insulation Blowing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Insulation Blowing Machine Market?

The Insulation Blowing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing global mandates for building energy efficiency and widespread retrofitting projects across developed economies.

Which geographical region holds the largest market share for insulation blowing machines?

North America currently holds the largest market share, attributable to stringent local building codes demanding high insulation R-values and a mature renovation market requiring advanced, high-capacity insulation blowing equipment for both residential and commercial applications.

How is AI expected to impact the operational efficiency of insulation blowing machines?

AI is primarily expected to enhance operational efficiency through predictive maintenance analytics, reducing unexpected machine downtime, and integrating dynamic control systems to ensure consistent material density and superior thermal performance during the installation process, minimizing waste.

What are the primary restraint factors affecting market growth?

Key restraint factors include the high initial capital investment required for professional-grade, high-capacity machinery and the persistent shortage of skilled labor trained in the specialized operation and maintenance of advanced insulation blowing equipment across many regions.

What are the key end-user segments for insulation blowing equipment?

The key end-user segments are specialized insulation contractors (the largest segment), equipment rental companies serving contractors and DIY consumers, and large general contractors focused on commercial and multi-family construction projects that require high-volume installation capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager