Insulation Monitoring Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432860 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Insulation Monitoring Equipment Market Size

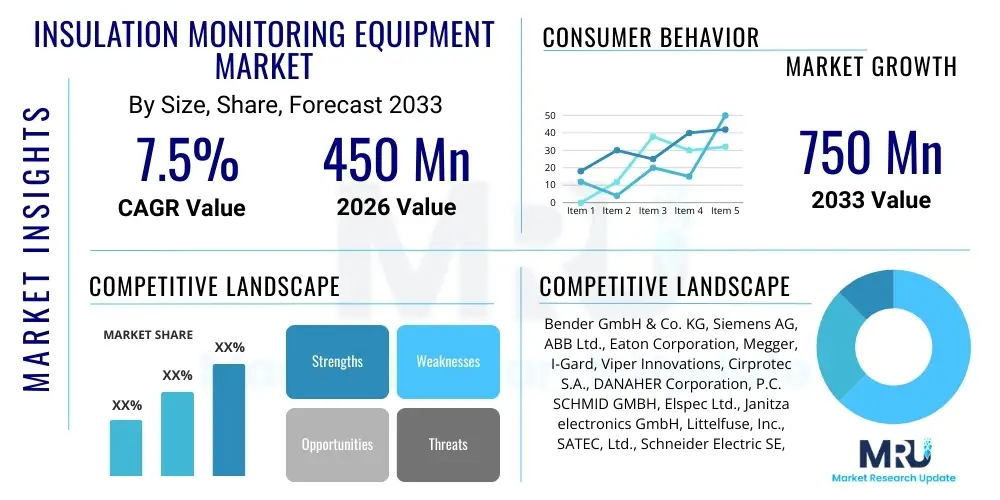

The Insulation Monitoring Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Insulation Monitoring Equipment Market introduction

Insulation Monitoring Equipment (IME) plays a crucial role in maintaining electrical safety and operational continuity, particularly in industrial settings, healthcare facilities, and electric vehicle (EV) charging infrastructure where ungrounded or high-resistance grounded systems are common. These systems continuously measure the insulation resistance between active conductors and the earth potential in live installations, ensuring that leakage currents remain within safe operational limits. The primary function is predictive—detecting insulation degradation early before a critical fault occurs, thereby preventing downtime, equipment damage, and electrical fires. This proactive approach is particularly vital in environments where high reliability is non-negotiable, such as hospitals (operating theaters) and large-scale continuous processes.

The core product offerings within the Insulation Monitoring Equipment market include sophisticated devices utilizing measuring methods like the superimposed DC voltage method, active leakage current monitoring, and specialized ground fault detection techniques tailored for alternating current (AC), direct current (DC), and mixed systems. Major applications span power generation and distribution, including substations and renewable energy installations (solar and wind farms), industrial manufacturing sectors (chemical processing, steel mills), and transportation systems (railways, electric vehicle powertrains). These devices offer benefits such as enhanced system reliability, compliance with stringent international electrical safety standards (IEC, NFPA), and significant cost savings derived from minimized unplanned outages and improved maintenance scheduling.

The market expansion is substantially driven by the increasing global emphasis on worker safety regulations and the rapid deployment of complex electrical infrastructure that mandates continuous monitoring, such as the proliferation of high-voltage DC systems used in battery storage and data centers. Furthermore, the accelerating adoption of electric vehicles and associated charging stations requires robust, integrated insulation fault detection to ensure user safety and system integrity, thus creating a fertile ground for IME innovation and deployment across new operational landscapes. This demand is further amplified by the transition toward smart grid technologies that necessitate real-time condition monitoring.

Insulation Monitoring Equipment Market Executive Summary

The global Insulation Monitoring Equipment (IME) Market demonstrates robust growth, primarily fueled by the accelerating shift towards distributed power generation, complex IT infrastructure, and stringent industrial safety mandates across mature economies. Key business trends indicate a significant push toward integrating monitoring devices with advanced communication protocols (e.g., Modbus, Ethernet/IP) to facilitate remote diagnostics and integration into supervisory control and data acquisition (SCADA) systems and Industrial Internet of Things (IIoT) platforms. Companies are investing heavily in developing multi-standard devices capable of handling diverse grounding schemes (IT, TN, TT systems) and mixed AC/DC network topologies, which are increasingly common in hybrid power systems and specialized industrial machinery.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by massive infrastructure investments in developing countries like China and India, particularly in expanding power grids, establishing new manufacturing bases, and rapidly deploying EV charging networks. North America and Europe remain foundational markets, characterized by high adoption rates stemming from rigorous regulatory compliance in critical sectors such as healthcare and oil & gas, alongside substantial investments in modernizing aging electrical infrastructure and integrating renewable energy sources. The Middle East and Africa (MEA) are also emerging as key regions, spurred by large-scale energy projects and the necessity for robust monitoring in harsh operating environments.

Segment trends reveal that the Hardware component segment holds the largest market share, though the Software and Services segments—specifically focused on cloud-based predictive maintenance and analytics—are projected to exhibit the highest Compound Annual Growth Rate (CAGR). By application, the Industrial Manufacturing and Power Generation segments traditionally dominate, while the Transportation segment, largely propelled by the booming electric vehicle and railway sectors, is anticipated to show the most dynamic growth over the forecast period. Fixed insulation monitoring devices, offering continuous and comprehensive system coverage, retain their market leadership compared to portable testing equipment, which is primarily utilized for periodic maintenance checks and troubleshooting.

AI Impact Analysis on Insulation Monitoring Equipment Market

Common user questions regarding AI's influence on the Insulation Monitoring Equipment Market often center on how machine learning algorithms can enhance the predictive capabilities of current systems, moving beyond simple threshold alerts. Users frequently inquire about the integration of AI for analyzing complex insulation resistance trends, differentiating between nuisance alarms and genuine faults, and predicting the remaining useful life (RUL) of insulation materials. There is significant interest in how AI can process historical operational data, environmental variables (temperature, humidity), and load fluctuations to create highly accurate fault signatures, thereby minimizing false positives and ensuring maintenance activities are optimally timed. Furthermore, users are keen to understand the standardization challenges and cybersecurity implications of linking critical monitoring systems to cloud-based AI platforms.

AI is set to revolutionize IME by transforming reactive monitoring into highly sophisticated predictive intelligence. Current monitoring systems provide instantaneous resistance values, but AI algorithms can analyze decades of operational data to identify subtle, non-linear degradation patterns that human operators or standard statistical methods often overlook. This capability is paramount in mitigating risks associated with slow, progressive insulation breakdown caused by thermal aging, mechanical stress, or chemical contamination. By applying deep learning models, AI enables the creation of adaptive fault models that automatically tune monitoring sensitivity based on real-time operating conditions, ensuring optimal system safety and availability.

The integration of AI also addresses the complexities associated with monitoring large, interconnected industrial networks. In a modern smart factory or renewable energy farm, the number of potential fault sources is immense. AI can rapidly correlate data points across hundreds of monitoring units, pinpointing the exact location and root cause of transient or intermittent faults that might otherwise take days to diagnose manually. This shift toward cognitive monitoring not only reduces diagnostic time but also optimizes asset management strategies, allowing organizations to maximize the lifespan of critical electrical components through precise, condition-based maintenance interventions.

- AI enhances predictive maintenance by analyzing historical trends to forecast insulation failure timing.

- Machine learning algorithms filter out ambient noise and transient spikes, reducing false alarms in complex systems.

- AI optimizes fault localization in large-scale distributed networks, significantly improving diagnostic speed.

- Deep learning models facilitate automatic adaptation of alarm thresholds based on real-time operational context and load cycles.

- Integration with AI-driven anomaly detection improves compliance and auditing by providing robust evidence of system health over time.

DRO & Impact Forces Of Insulation Monitoring Equipment Market

The Insulation Monitoring Equipment Market is driven by a powerful confluence of regulatory mandates, technological advancements, and increasing industrial complexity, counterbalanced by significant market restraints primarily related to implementation costs and system integration challenges. A major driver is the escalating global focus on preventing electrical accidents, particularly in environments governed by strict safety standards (e.g., medical IT systems and mining operations). The proactive nature of IME, which allows for scheduled maintenance before catastrophic failure, aligns perfectly with modern industrial operational efficiency goals, making it a critical investment rather than merely a compliance cost. Furthermore, the rapid growth in renewable energy installations, particularly large-scale solar farms and battery energy storage systems (BESS) utilizing high-voltage DC architectures, creates an inherent demand for specialized insulation monitoring equipment capable of handling complex DC grounding issues.

However, the market faces restraints, primarily stemming from the high initial capital expenditure associated with installing comprehensive, fixed IME systems, particularly when retrofitting older infrastructure. Small and medium-sized enterprises (SMEs) often prioritize immediate cost savings over long-term predictive safety benefits. Another significant restraint involves the complexity of integrating advanced IME devices into legacy control systems and the requirement for specialized training for maintenance personnel to accurately interpret the generated diagnostic data. Furthermore, the market must constantly combat price competition from basic, less sophisticated earth fault indicators that do not offer the same level of continuous, predictive monitoring offered by high-end IME systems.

Opportunities for market expansion are abundant, particularly through the development of highly customized solutions for emerging applications, such as high-speed rail networks, marine vessels, and microgrids, where stability and safety are paramount. The substantial global push toward electromobility, including passenger vehicles and industrial fleets, presents a massive untapped segment where insulation monitoring is intrinsically linked to battery safety and operational viability. The move towards subscription-based software services (SaaS) for predictive maintenance analytics, leveraging the IIoT connectivity of the monitoring devices, offers manufacturers a recurring revenue stream and customers a lower barrier to entry for accessing advanced diagnostic capabilities. Furthermore, focusing on solutions that simplify integration and offer enhanced user interfaces will be key to unlocking growth potential in technically less mature markets.

Segmentation Analysis

The Insulation Monitoring Equipment market is systematically segmented based on Component, Application, and System Type to address the diverse needs across critical infrastructure and industrial sectors. This segmentation highlights the distinct market dynamics influencing hardware manufacturing versus software and service delivery, recognizing the increasing value derived from advanced data analytics. Analyzing these segments provides crucial insights into where technological investment is concentrated, revealing a trend towards sophisticated, interconnected hardware complemented by predictive analytics software, moving away from standalone monitoring solutions toward integrated system health platforms.

- By Component: Hardware, Software, Services

- By Application: Healthcare, Mining, Oil & Gas, Power Generation (Utility & Renewable), Industrial Manufacturing, Transportation (Railways & EV Charging), Marine

- By System Type: Fixed Insulation Monitoring Devices, Portable Insulation Monitoring Devices

- By End-Use Industry: Utilities, Manufacturing, Data Centers, Residential/Commercial, Mining & Metals

Value Chain Analysis For Insulation Monitoring Equipment Market

The value chain for the Insulation Monitoring Equipment market begins with upstream activities focused on the procurement of high-quality electronic components, sensors, microcontrollers, and communication modules, often sourced from specialized semiconductor manufacturers. Key upstream challenges include managing the supply chain for specialized high-precision measurement components and ensuring compliance with stringent industrial quality standards (e.g., electromagnetic compatibility, operational temperature ranges). Research and Development (R&D) activities are intensely focused in the upstream phase, driving innovation in measurement accuracy, speed of response, and the integration of advanced digital signal processing techniques necessary for reliable insulation assessment in noisy electrical environments.

The midstream focuses on the manufacturing and assembly of the monitoring units. This phase includes the integration of proprietary algorithms into the device firmware, meticulous calibration, and rigorous testing protocols to ensure the devices accurately perform under various fault conditions (symmetrical and asymmetrical faults) across diverse grounding topologies (IT systems being the primary focus). Efficiency in manufacturing, leveraging lean production techniques, is critical to maintaining competitive pricing, although the emphasis remains on product reliability and robustness given the criticality of the applications (e.g., maintaining uptime in a hospital IT system). Packaging and branding follow, positioning the equipment based on its certification and suitability for specific hazardous or critical environments.

The downstream segment encompasses distribution, sales, installation, and post-sales services. Distribution channels are generally dual: direct sales to large utilities, original equipment manufacturers (OEMs) in panel building, and critical infrastructure operators, and indirect sales through specialized electrical distributors, system integrators, and value-added resellers (VARs). System integrators play a vital role in providing tailored installation services and ensuring seamless integration with existing SCADA or building management systems (BMS). Post-sales services, including technical support, calibration, maintenance contracts, and software updates (often delivered through subscription models), are becoming increasingly significant differentiators, driving long-term customer relationships and market stability.

Insulation Monitoring Equipment Market Potential Customers

Potential customers for Insulation Monitoring Equipment are predominantly organizations operating mission-critical electrical systems where unplanned downtime or safety hazards pose catastrophic financial or human risks. The largest end-users include major utilities (both public and private power generators and distributors) who must monitor substations, transmission lines, and increasingly, renewable energy assets such as solar arrays and wind turbines to prevent grid destabilization due to ground faults. In the industrial sector, key buyers are entities in continuous process industries—like chemical processing plants, refineries, steel mills, and automotive manufacturing—where uninterrupted power supply is essential for operational viability and profitability.

A rapidly growing segment of end-users is the healthcare sector, specifically hospitals and specialized medical centers, which are legally mandated in many jurisdictions to use IT (Isolated Terra) systems for their operating theaters and intensive care units to ensure patient safety from micro-shock hazards. Furthermore, the burgeoning data center industry is a critical customer base, requiring highly reliable power distribution systems to prevent outages that could translate into massive data losses and service disruptions. The emphasis in these high-reliability sectors is on premium, continuously self-testing IME solutions that offer immediate fault notification and precise localization.

Other significant buyers include transportation authorities—specifically railway operators needing to monitor traction power supply systems and rolling stock for insulation integrity—and the burgeoning Electric Vehicle (EV) infrastructure developers, who require robust monitoring for both charging stations and the high-voltage systems within the vehicles themselves. Marine and offshore industries, including oil rigs and specialized ships, also represent high-value customers due to the corrosive, confined environments that accelerate insulation degradation and the stringent safety requirements mandated by maritime classification societies. These buyers typically seek rugged, highly certified equipment capable of withstanding extreme operational conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bender GmbH & Co. KG, Siemens AG, ABB Ltd., Eaton Corporation, Megger, I-Gard, Viper Innovations, Cirprotec S.A., DANAHER Corporation, P.C. SCHMID GMBH, Elspec Ltd., Janitza electronics GmbH, Littelfuse, Inc., SATEC, Ltd., Schneider Electric SE, Zennio Avance y Tecnología S.L., Accusys Pte Ltd., DEIF A/S, Testo SE & Co. KGaA, Phoenix Contact GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insulation Monitoring Equipment Market Key Technology Landscape

The technological landscape of the Insulation Monitoring Equipment (IME) market is defined by innovation in measurement precision, communication capabilities, and diagnostic intelligence. The dominant technology for continuous insulation monitoring in unearthed systems (IT networks) remains the superimposed measuring principle, particularly the Bender measuring method (often referred to as the active measuring method). This technique injects a low-frequency, low-amplitude AC or pulsating DC signal between the system conductors and earth potential, allowing the device to calculate the insulation resistance (Riso) and system leakage capacitance (Ce) even while the system is live and fully loaded. Advanced versions of this technology have improved robustness against harmonic noise and high transient voltages commonly found in inverter-fed systems (e.g., VFDs and solar inverters), ensuring reliable measurements in highly disturbed environments.

A crucial technological development driving market adoption is the integration of high-speed fault localization and reporting features. Modern IME systems utilize specialized components, such as insulation fault locators (IFLs), which work in conjunction with the primary monitor. These locators employ pulsed current injection and measuring current transformers (MCTs) to precisely track and locate the branch circuit where the insulation fault originated, eliminating the need for manual, time-consuming fault tracing. This precise localization capability drastically reduces Mean Time To Repair (MTTR), thereby boosting system availability, a critical performance metric for industrial and utility customers. Further technological enhancement includes the use of differential current monitoring for systems that are temporarily grounded or exhibit complex fault characteristics.

Connectivity and data processing form the third pillar of the current technological evolution. Newer IME devices are standardly equipped with integrated web servers, allowing for remote parameterization, monitoring, and data logging accessible via standard browsers or mobile applications. Communication protocols such as Modbus TCP/IP, Profibus, and IEC 61850 are standard features, facilitating seamless integration into SCADA, DCS (Distributed Control Systems), and cloud-based asset management platforms. This integration supports the broader trend of Industrial Internet of Things (IIoT), enabling advanced diagnostics, predictive failure pattern identification, and the implementation of AI-driven maintenance strategies based on the rich, time-stamped data collected by the monitoring devices.

Regional Highlights

- North America: This region is characterized by high demand originating from the stringent regulatory environment governing critical facilities, particularly in the healthcare, oil and gas, and data center sectors. The U.S. market leads in adopting advanced, networked IME solutions due to a strong focus on system reliability and the modernization of aging transmission and distribution infrastructure. Furthermore, the rapid growth in large-scale battery storage projects and EV charging infrastructure mandates continuous monitoring, ensuring North America remains a significant investment hub for high-end IME manufacturers and solution providers.

- Europe: Europe holds a dominant position in the IME market, driven largely by historical reliance on IT earthing systems in critical applications and pioneering regulatory standards, such as those set by VDE (Germany) and relevant IEC standards for medical locations. Germany, Austria, and Switzerland are key manufacturing and innovation hubs, benefiting from strong industrial automation sectors and extensive railway networks. The region’s aggressive decarbonization targets, promoting large-scale integration of fluctuating renewable energy sources and the development of high-voltage DC grids, ensure sustained market expansion for technologically sophisticated monitoring equipment.

- Asia Pacific (APAC): APAC is projected to experience the fastest growth during the forecast period, primarily fueled by rapid industrialization, massive investments in utility-scale power generation (including smart grid expansion), and explosive growth in electric vehicle production and deployment, particularly in China, South Korea, and Japan. The need to establish reliable electrical infrastructure in developing economies, coupled with increasing adoption of international safety standards in manufacturing, creates a substantial volume market for both fixed installation and portable testing equipment. Localization of manufacturing and increased local competitive pressure are defining market characteristics here.

- Latin America (LATAM): The LATAM market growth is driven by increasing investment in mining, oil and gas extraction (especially offshore), and the expansion of renewable energy capacity (hydro and solar) in countries like Brazil, Mexico, and Chile. The demand is often project-specific, focusing on robust equipment suitable for harsh, remote operational environments where reliability and resistance to voltage instability are crucial. Regulatory enforcement, while varying by country, is steadily strengthening, pushing industrial operators toward greater adoption of continuous monitoring solutions over manual testing methods.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated within the energy and industrial sectors, particularly large oil and gas processing facilities, petrochemical plants, and infrastructure projects in the Gulf Cooperation Council (GCC) countries. The demand profile favors robust, highly durable IME systems capable of operating reliably in extreme temperatures and dusty conditions. Investment in new smart city projects and associated critical infrastructure (like major airports and water treatment facilities) across the UAE and Saudi Arabia further underpins the need for high-availability power systems protected by advanced insulation monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insulation Monitoring Equipment Market.- Bender GmbH & Co. KG

- Siemens AG

- ABB Ltd.

- Eaton Corporation

- Megger

- I-Gard

- Viper Innovations

- Cirprotec S.A.

- DANAHER Corporation

- P.C. SCHMID GMBH

- Elspec Ltd.

- Janitza electronics GmbH

- Littelfuse, Inc.

- SATEC, Ltd.

- Schneider Electric SE

- Zennio Avance y Tecnología S.L.

- Accusys Pte Ltd.

- DEIF A/S

- Testo SE & Co. KGaA

- Phoenix Contact GmbH & Co. KG

Frequently Asked Questions

Analyze common user questions about the Insulation Monitoring Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Insulation Monitoring Equipment (IME) in IT systems?

The primary function of IME in unearthed IT (Isolated Terra) systems is to continuously measure the insulation resistance between the system conductors and earth. This monitoring detects insulation degradation and the first fault condition immediately, issuing an alarm but allowing the system to remain operational until scheduled maintenance, thereby ensuring high availability and compliance with critical safety standards, especially in medical and industrial applications.

How is the growth of Electric Vehicles (EVs) impacting the demand for Insulation Monitoring Equipment?

EV growth significantly boosts IME demand in two critical areas: ensuring the safety of high-voltage DC battery systems within the vehicles and guaranteeing the operational integrity and user safety of public and private EV charging infrastructure. High-voltage DC systems are particularly susceptible to insulation faults, making IME crucial for both vehicle manufacturers and charging station operators to meet stringent international safety norms and prevent fire hazards.

What are the key technological trends currently dominating the IME market?

Key technological trends include enhanced connectivity through IIoT integration and standard industrial protocols (Modbus, IEC 61850) for remote monitoring; the development of high-precision superimposed measuring methods that are robust against inverter noise; and the implementation of advanced fault localization tools that precisely pinpoint the fault location within complex electrical networks, thereby reducing diagnostic time dramatically.

Which industry application contributes most substantially to IME market revenue?

The Industrial Manufacturing and Power Generation (including Utility and Renewables) sectors contribute most substantially to IME market revenue. These industries rely on continuous operations and complex, high-power electrical systems, where the financial and safety consequences of an unscheduled power outage necessitate the investment in high-reliability, fixed insulation monitoring solutions for predictive maintenance and safety compliance.

What is the main difference between fixed and portable insulation monitoring devices?

Fixed Insulation Monitoring Devices are permanently installed in the electrical panel or distribution system, providing continuous, real-time monitoring of insulation resistance while the system is live. Portable Insulation Monitoring Devices (or testers) are used by maintenance personnel for periodic testing, troubleshooting, or commissioning, requiring the system to often be de-energized or temporarily isolated for the measurement to be performed accurately, offering flexibility but not continuous protection.

The Insulation Monitoring Equipment Market is undergoing a rapid technological transformation, moving beyond basic fault detection towards integrated system health management platforms. This transition is being driven by the confluence of regulatory pressure, particularly in sectors such as healthcare and mining, and the increasing reliance on complex electrical systems in industries that demand zero downtime. The adoption of continuous monitoring is becoming a global standard, supplanting traditional periodic testing methods due to the inherent risks and limitations associated with manual checks. Manufacturers are responding by embedding greater intelligence into their devices, utilizing microprocessors to run sophisticated proprietary algorithms that can distinguish between system noise, transient conditions, and genuine insulation breakdown, ensuring higher reliability of alarm systems.

In terms of component trends, while the sale of physical hardware remains foundational, the long-term growth trajectory is undeniably focused on software and services. The software segment includes specialized diagnostic tools, predictive analytics suites, and centralized data management platforms that aggregate data from numerous monitoring points across an enterprise. Services encompass installation support, customized commissioning, calibration, and long-term maintenance contracts, often bundled with cloud-based data hosting and reporting. This pivot toward service-oriented models reflects a broader industry movement where customers seek outcomes (system reliability, uptime) rather than just equipment, prompting manufacturers to provide comprehensive, end-to-end monitoring solutions that leverage the collected data for actionable business insights.

Furthermore, standardization efforts, particularly around communication interfaces and measurement methodologies, are critical for accelerating market acceptance. Interoperability is a major concern for large industrial operators who utilize equipment from multiple vendors. Manufacturers that adhere strictly to international standards (e.g., IEC 61557-8 for insulation monitoring devices and relevant communication protocols) provide greater flexibility and easier integration, positioning their products favorably in competitive tenders. Future developments are anticipated to focus on enhanced remote diagnostics capabilities, including augmented reality tools for field maintenance, and further refinement of sensor technology to handle extremely high-voltage DC applications efficiently and safely. The market environment is highly competitive, characterized by continuous product life cycle management and intense intellectual property development centered on fault detection algorithms.

The geopolitical landscape also subtly influences the market, particularly concerning supply chain resilience and regional manufacturing capabilities. As demand for critical monitoring components increases globally, ensuring a stable supply of advanced microelectronics and sensors is paramount. Companies are increasingly diversifying their manufacturing footprints and engaging in strategic partnerships to mitigate risks associated with regional trade disputes or logistical disruptions. This strategic focus is particularly evident in the APAC region, where local production capabilities are rapidly maturing to serve the massive internal market demand, simultaneously increasing regional competition and driving down costs for basic to mid-range IME systems. However, high-end, specialized products requiring complex certification often still originate from established European and North American suppliers known for their heritage in electrical safety technology.

Customer education and technical support are paramount factors influencing market adoption. Given the complexity of IT systems and the critical nature of IME deployment, end-users require substantial training to properly select, install, and operate these devices. Manufacturers who offer robust technical academies, comprehensive documentation, and easily accessible support channels often secure a competitive advantage, especially when dealing with system integrators and electrical consulting engineers who act as key influencers in the procurement process. The consultative sales approach, emphasizing total cost of ownership (TCO) reduction through preventative maintenance rather than just initial purchase price, is increasingly effective in convincing risk-averse customers in highly regulated sectors.

Within the Power Generation sector, the rise of renewable energy sources introduces unique challenges that are heavily influencing IME technological requirements. Unlike conventional AC grids, solar PV arrays and utility-scale battery energy storage systems (BESS) operate predominantly on high-voltage DC, necessitating specialized insulation monitors designed to accurately assess resistance in DC environments, which inherently behave differently from AC systems during fault conditions. These monitors must also manage the often complex interplay of inverter switching frequencies and high leakage capacitances typical of large solar arrays, demanding advanced filtering and signal processing capabilities. This technological differentiation means that suppliers with proven expertise in DC monitoring are uniquely positioned to capture significant market share in the rapidly expanding renewables segment, driving innovation in both hardware design and measurement algorithms.

Furthermore, cybersecurity considerations are rapidly becoming a critical aspect of IME deployment, particularly as devices become integrated into IIoT ecosystems. Because insulation monitors are often deployed in critical national infrastructure (CNI) like power plants and substations, any vulnerability could be exploited to compromise grid stability or industrial operations. Consequently, the latest generation of IME solutions incorporates features such as secure boot, end-to-end encryption for communication protocols, and robust user authentication mechanisms to adhere to evolving cybersecurity standards (e.g., IEC 62443). Customers, especially governmental and utility organizations, are placing increasing emphasis on the security posture of the devices they procure, making security certification a significant competitive differentiator in tender processes.

The segmentation by System Type—Fixed vs. Portable—reflects the different operational philosophies of maintenance teams. Fixed IME devices represent the proactive, safety-critical layer, providing continuous protection and real-time alerts necessary for adherence to continuous operation mandates in facilities like hospitals or data centers. The revenue generated from fixed installations is higher and more stable, linked to large capital projects and infrastructural build-outs. Portable IME devices, conversely, serve the essential role of diagnostics and verification. They are indispensable for electricians during system commissioning, periodic regulatory inspections, and fault investigation tasks. While portable device sales are more cyclical, tied to maintenance schedules and fleet replacement cycles, they remain vital for specialized applications such as high-voltage cable testing and motor insulation analysis, complementing the continuous monitoring provided by their fixed counterparts.

The competitive landscape is marked by a blend of highly specialized German manufacturers, historically dominant in IT system monitoring (e.g., Bender, P.C. SCHMID), and diversified global electrical giants (e.g., Siemens, ABB, Schneider Electric) who integrate IME into broader energy management and automation portfolios. This competition drives innovation in miniaturization, cost-effectiveness, and ease of integration. Smaller, niche players often excel in highly specialized areas, such as marine or mining applications, where unique regulatory or environmental challenges require custom-engineered solutions. Strategic mergers and acquisitions are common as larger entities seek to rapidly incorporate specialized measurement technologies or expand their geographical reach, particularly into fast-growing APAC markets.

Pricing dynamics within the market are sensitive to regional labor costs and regulatory stringency. In regions with strict electrical codes and high labor costs (North America, Western Europe), the value proposition of IME—reducing manual testing time and preventing catastrophic failures—justifies premium pricing. Conversely, in developing markets, price sensitivity is higher, leading to greater demand for mid-range products that offer essential monitoring functions without the full suite of advanced IIoT connectivity and localization features. The shift towards outcome-based sales, where reliability is sold as a service, is expected to stabilize pricing models over the long term, moving away from pure hardware cost competition.

Finally, material science advancements also indirectly influence the IME market. The continuous development of new insulation materials for high-voltage cables and windings, particularly those designed for higher operating temperatures or specialized chemical resistance, necessitates that IME manufacturers continuously update their measurement algorithms. A monitor must be capable of accurately assessing the resistance characteristics and degradation signatures specific to these modern materials. This requirement ensures ongoing R&D investment to maintain the relevancy and accuracy of monitoring equipment across the evolving landscape of electrical component technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager