Insurance Claims Management Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433903 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Insurance Claims Management Solution Market Size

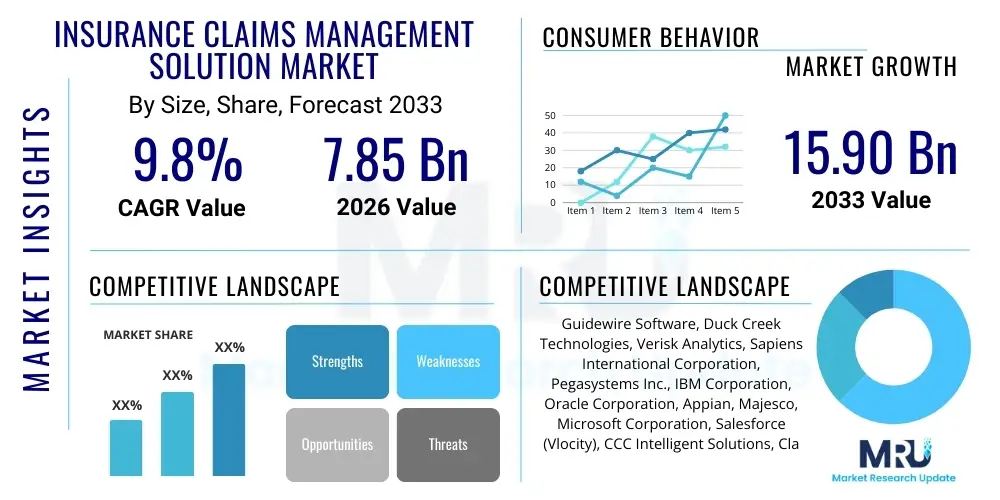

The Insurance Claims Management Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 7.85 Billion in 2026 and is projected to reach USD 15.90 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global imperative among insurance carriers to modernize legacy core systems, enhance operational efficiency through automation, and meet escalating customer demands for rapid and transparent claims processing. Digital transformation initiatives, coupled with advancements in Artificial Intelligence (AI) and Machine Learning (ML), are pivotal forces underpinning this accelerated market trajectory.

Insurance Claims Management Solution Market introduction

The Insurance Claims Management Solution Market comprises specialized software platforms and integrated service offerings designed to manage the entire claims processing lifecycle, spanning from the initial First Notice of Loss (FNOL) to final claim settlement and subrogation. These solutions are essential tools for insurance companies across Property and Casualty (P&C), Life, and Health sectors, aiming to streamline traditionally complex, manual, and time-consuming workflows. Modern claims systems move beyond mere transactional processing; they incorporate advanced functionalities such as intelligent routing, fraud detection algorithms, automated reserve setting, and regulatory compliance checks, thereby transforming claims operations from a cost center into a core competency that directly influences customer loyalty and profitability. The primary objective of adopting these solutions is to optimize straight-through processing rates, reduce leakage (inaccurate or unwarranted payments), and provide real-time transparency to policyholders.

The product portfolio within this market segment is highly diversified, ranging from comprehensive end-to-end core claims suites offered by major vendors like Guidewire and Duck Creek, to specialized point solutions focusing on specific functions such as fraud analytics, litigation management, or claims payment systems. Major applications are concentrated in automating low-complexity claims, facilitating virtual adjustments through telematics and imagery analysis, and supporting complex commercial lines claims requiring intricate data reconciliation and regulatory adherence. The inherent benefits include significant reductions in cycle times, improved adjuster productivity, enhanced data accuracy, and compliance with stringent international data governance standards, notably GDPR and CCPA. Furthermore, the integration with ecosystem partners, such as repair shops, medical providers, and regulatory bodies, is increasingly facilitated by open APIs, making these solutions central to a unified digital ecosystem.

Key driving factors accelerating the market’s growth include the pressure to reduce Loss Adjustment Expenses (LAE), the rising incidence of insurance fraud necessitating sophisticated detection tools, and competitive pressures forcing insurers to deliver superior digital customer experiences. Furthermore, the shift towards usage-based insurance (UBI) and parametric insurance models requires claims systems capable of handling event-triggered, instant payouts with minimal human intervention. Cloud deployment models are increasingly favored due to their inherent scalability, lower total cost of ownership (TCO), and faster deployment timelines, allowing even mid-sized carriers to access sophisticated claims technology previously reserved for Tier 1 insurers.

Insurance Claims Management Solution Market Executive Summary

The Insurance Claims Management Solution Market is experiencing robust expansion, characterized by a fundamental transition from monolithic, on-premise legacy systems toward highly modular, cloud-native platforms emphasizing agility and interoperability. Business trends indicate a strong focus on strategic mergers and acquisitions among established vendors to integrate specialized technologies, particularly in AI-driven automation and predictive analytics, ensuring comprehensive end-to-end service offerings. There is a discernible trend toward "low-code/no-code" configuration environments within claims platforms, enabling insurers to quickly adapt workflows and business rules without extensive custom coding, thereby accelerating time-to-market for new products and complying swiftly with evolving regulations. Furthermore, the adoption of ecosystem integration capabilities through APIs is defining the competitive landscape, allowing insurers to connect seamlessly with third-party data providers, InsurTech startups, and customer engagement tools.

Regionally, North America maintains the largest market share, driven by high technology adoption rates, the presence of major core system vendors, and a highly competitive insurance environment demanding operational excellence. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by rapid digitalization in emerging economies like India and China, coupled with increasing insurance penetration and a vast, underserved population transitioning directly to digital-first insurance models. Europe's market growth is propelled primarily by regulatory modernization (such as Solvency II requirements) and a strong commitment to customer data privacy, necessitating advanced, compliant claims handling systems. Segments trends highlight that the Software component segment dominates in terms of absolute value, but the Services segment, encompassing integration, consulting, and managed services, is experiencing higher growth due to the complexity associated with migrating legacy data and customizing modern cloud platforms. Property and Casualty (P&C) insurance remains the largest end-user vertical, given the high volume and variability of auto and home claims.

AI Impact Analysis on Insurance Claims Management Solution Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on insurance claims management predominantly revolve around three critical themes: automation efficiency, fraud prevention capabilities, and the future role of human adjusters. Users frequently question the accuracy of AI-driven claim severity prediction, the ethical implications of automated claim denial, and the tangible Return on Investment (ROI) derived from implementing sophisticated AI models for tasks such as damage assessment via computer vision or sentiment analysis of customer interactions. Key concerns center on ensuring that black-box AI models maintain transparency and fairness (AI explainability), particularly in high-stakes decisions affecting policyholders. Users also express high expectations regarding AI's potential to dramatically reduce claims cycle times, facilitate instantaneous claim validation for simple cases, and liberate human staff to focus exclusively on complex, empathetic, or high-value cases requiring nuanced judgment.

- Automated FNOL Processing: AI chatbots and Natural Language Processing (NLP) streamline initial claim intake, capturing essential data and routing complex cases appropriately, significantly reducing intake time.

- Fraud Detection and Prevention: Machine learning models analyze historical data patterns, transactional behavior, and network analysis to flag suspicious claims in real-time with higher accuracy than traditional rules-based systems.

- Damage Assessment: Computer vision analyzes photographs and videos submitted by policyholders or field adjusters to quickly estimate repair costs and assess damages, particularly in auto and property claims.

- Claim Severity Prediction: AI algorithms predict the potential total cost and duration of a claim early in the process, optimizing reserve allocation and resource planning.

- Enhanced Customer Experience: AI powers virtual assistants and personalized communication, offering 24/7 status updates and facilitating smoother, faster interactions.

- Straight-Through Processing (STP): AI enables fully automated adjudication and payment for low-severity, clean claims, dramatically improving operational efficiency.

DRO & Impact Forces Of Insurance Claims Management Solution Market

The dynamics of the Insurance Claims Management Solution Market are shaped by a powerful combination of drivers, restraints, and opportunities, collectively forming the key impact forces influencing vendor strategies and carrier adoption rates. A primary driver is the accelerating pressure on insurers to enhance operational efficiency and profitability by minimizing the Loss Adjustment Expense (LAE) ratio. This is inextricably linked to the compelling opportunity presented by advanced technologies like AI, blockchain, and IoT, which promise unprecedented levels of automation, accuracy, and ecosystem connectivity. Conversely, the market faces significant restraints, notably the immense complexity and cost associated with replacing or integrating legacy core systems, often hampered by outdated data structures and internal resistance to major process change. This technological inertia, combined with the stringent need for regulatory compliance across fragmented global markets, creates a high barrier to entry for full-scale digital transformation.

The prevailing impact force driving immediate investment is the desire to elevate the customer experience. In the modern insurance landscape, claims settlement is the critical moment of truth where customer loyalty is won or lost. Therefore, claims solutions that offer seamless digital interaction, real-time tracking, and rapid payout capabilities gain significant market traction. Opportunities also emerge from the shift towards proactive risk management and parametric insurance; these models require claims systems that can automatically trigger settlements based on external, verified data (like weather conditions or flight delays) rather than traditional damage assessments. However, data privacy concerns, the difficulty in maintaining data quality across disparate sources, and the need for specialized skills to manage and interpret complex analytical models remain ongoing restraints that organizations must address strategically.

The market impact forces dictate that vendors must prioritize modular, API-first architecture, allowing insurers to adopt solutions incrementally (i.e., replacing only the FNOL module first) rather than mandating an expensive, risky, 'rip-and-replace' migration. The convergence of InsurTech startups offering specialized tools with established core system providers through partnership models further strengthens the market's dynamic. This competitive environment ensures continuous innovation, particularly focused on tools that enhance forensic analysis for complex commercial claims and optimize litigation management, which represents a significant portion of claims expenditure in certain jurisdictions.

Segmentation Analysis

The Insurance Claims Management Solution Market is segmented based on component, deployment type, enterprise size, and end-user, reflecting the diverse needs across the global insurance industry. The component segmentation differentiates between the software itself—which includes the core processing modules, data analytics tools, and fraud detection systems—and the extensive services required to support implementation, system integration, professional consulting, and ongoing maintenance. Deployment models are critically divided into cloud-based solutions, which offer scalability, remote accessibility, and subscription-based pricing, and on-premise solutions, which are often preferred by large organizations with substantial legacy infrastructure and strict data control requirements. The market serves end-users ranging from small, local carriers to multinational, diversified insurance groups, necessitating highly configurable solutions.

- Component:

- Software (Core Systems, Analytical Tools, Workflow Management)

- Services (Consulting, Integration, Managed Services, Support)

- Deployment Type:

- Cloud-Based

- On-Premise

- Enterprise Size:

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

- End-User:

- Property and Casualty (P&C) Insurance

- Life and Annuity Insurance

- Health Insurance

Value Chain Analysis For Insurance Claims Management Solution Market

The value chain for Insurance Claims Management Solutions begins with upstream activities focused on foundational technology development, primarily involving core system architecture design, data infrastructure setup (including big data repositories), and the continuous research and development of specialized analytical modules such as AI and machine learning engines for predictive modeling. Key upstream suppliers include general technology providers, cloud infrastructure vendors (AWS, Azure, Google Cloud), and niche InsurTech firms specializing in specific data services, such as telematics data aggregation or aerial imagery processing. The quality and sophistication of these upstream inputs directly determine the robustness and flexibility of the final claims management platform.

The core of the value chain involves the solution providers themselves (e.g., Guidewire, Duck Creek), who focus on product development, customization, and quality assurance. Their role is to integrate various technologies into a cohesive, functional claims suite suitable for different regulatory environments and insurance lines. Distribution channels are varied, encompassing direct sales models, particularly for large-scale enterprise implementations requiring deep engagement and customization, and indirect sales through strategic partnerships with system integrators (SIs) and consulting firms (e.g., Accenture, Deloitte). These SIs play a crucial role in bridging the gap between the software vendor and the insurance carrier, providing implementation expertise and change management services critical for successful adoption.

Downstream activities center on deployment, training, and post-implementation support for the insurance carriers, who are the ultimate end-users. The effective integration of the claims system with other core carrier systems—including policy administration and billing—is paramount. Direct distribution allows vendors greater control over the implementation process and stronger direct relationships with high-value clients, facilitating tailored upgrades and support. Indirect channels, typically involving resellers or specialized value-added partners, significantly expand market reach, especially into international markets or smaller regional carriers, providing localized expertise that the primary vendor may lack. Successful claims management relies heavily on this downstream support to ensure continuous system optimization and compliance.

Insurance Claims Management Solution Market Potential Customers

The primary potential customers and end-users of Insurance Claims Management Solutions are the global insurance carriers operating across diverse lines of business. This includes Tier 1 global insurers and reinsurers who require highly sophisticated, scalable, multi-jurisdictional platforms capable of handling billions in annual claims volume, down to small to mid-sized regional carriers and mutual associations who prioritize cost-effective, easily deployable cloud solutions. Within the P&C sector, key buyers include auto insurers, homeowners insurers, and commercial lines carriers (e.g., liability and professional indemnity). The high frequency and variability of P&C claims make them the most intensive users of advanced claims automation tools and fraud detection software.

Beyond P&C, Life and Annuity carriers represent a growing customer base, driven by the need to automate complex mortality and maturity claims, improve beneficiary communication, and manage regulatory requirements related to claims payment timing. Health insurance providers also constitute a significant end-user segment, utilizing these solutions for processing high volumes of medical claims, managing complex coordination of benefits (COB), and integrating with electronic health records (EHRs). Furthermore, non-traditional buyers are emerging, such as Third-Party Administrators (TPAs) who manage claims on behalf of self-insured corporations or smaller carriers, and large corporations that self-insure their employee health or casualty risks. These customers seek solutions that minimize processing errors and optimize cash flow management. The decision-makers typically include Chief Operating Officers (COOs), Chief Information Officers (CIOs), and senior claims executives focused on operational transformation and cost control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.85 Billion |

| Market Forecast in 2033 | USD 15.90 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Guidewire Software, Duck Creek Technologies, Verisk Analytics, Sapiens International Corporation, Pegasystems Inc., IBM Corporation, Oracle Corporation, Appian, Majesco, Microsoft Corporation, Salesforce (Vlocity), CCC Intelligent Solutions, ClaimCenter, Insurity, Applied Systems, Hyland Software, FICO, Exigen Services, LexisNexis Risk Solutions, Genpact |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insurance Claims Management Solution Market Key Technology Landscape

The technology landscape for Insurance Claims Management Solutions is rapidly evolving, moving beyond relational databases and basic workflow engines to embrace intelligent, interconnected systems. The foundation is shifting to microservices architecture, enabling modularity and faster deployment of new features, contrasting sharply with the rigidity of older, monolithic core systems. Cloud computing, specifically Software-as-a-Service (SaaS) models, is the dominant delivery mechanism, offering carriers improved scalability, automatic updates, and reduced infrastructure maintenance costs. This migration to the cloud facilitates the rapid adoption of advanced analytical tools without significant upfront hardware investment. Furthermore, Application Programming Interfaces (APIs) are crucial, serving as the connective tissue that allows claims systems to integrate seamlessly with a vast ecosystem of third-party data sources, regulatory bodies, and specialized InsurTech applications (e.g., aerial drone data providers, medical billing platforms).

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful technology layer, driving predictive and prescriptive capabilities. AI is leveraged for sophisticated pattern recognition used in fraud detection, automated claim triage and routing, and highly accurate reserve calculations. Computer vision technology, a subsegment of AI, is specifically used to analyze visual data (photos and videos of damages) for immediate assessment and estimation in auto and property claims, significantly speeding up the adjustment process. Natural Language Processing (NLP) is employed to analyze unstructured data, such as adjuster notes, policyholder emails, and medical reports, extracting key information to inform automated decision-making and ensure regulatory compliance in documentation.

Other key technologies include Robotic Process Automation (RPA), which handles repetitive, high-volume administrative tasks such as data entry and system reconciliation, freeing up human adjusters. The adoption of Blockchain technology is emerging, particularly for use in complex reinsurance claims and shared parametric insurance contracts, promising enhanced data transparency, security, and immutable record-keeping across multiple parties. Furthermore, telematics data (from connected vehicles and IoT devices) is increasingly integrated directly into claims systems, enabling real-time accident reconstruction and more granular liability assessment, which relies on the claims platform's ability to handle massive streams of diverse unstructured data efficiently.

Regional Highlights

- North America (U.S. and Canada): Represents the largest market share globally due to the presence of technologically advanced insurers, high adoption rates of core system replacements, and significant investment in AI-driven fraud detection. The competitive environment pushes carriers towards early adoption of cloud-native and microservices architecture platforms.

- Europe (UK, Germany, France): Characterized by stringent regulatory environments (e.g., GDPR, Solvency II) which mandate robust, compliant claims processing systems. The market sees strong growth in sophisticated analytical tools and outsourced services, particularly among mid-sized carriers seeking to manage modernization costs while adhering to localized consumer protection laws.

- Asia Pacific (APAC) (China, India, Japan, Australia): Projected to be the fastest-growing region. Growth is fueled by rapid insurance market expansion, increasing digital literacy, and leapfrogging legacy systems by adopting cloud-first solutions. Emerging economies in Southeast Asia are prioritizing mobile-first claims applications to serve large, geographically dispersed populations efficiently.

- Latin America (LATAM): Market growth is driven by digitalization efforts aimed at improving transparency and combating high rates of insurance fraud. Focus is on standardized, scalable platforms that can manage economic volatility and regional regulatory variations efficiently.

- Middle East and Africa (MEA): Represents an emerging market focused primarily on adopting modern, off-the-shelf core systems to establish digital infrastructure for nascent or rapidly expanding insurance sectors, with strong interest in solutions that manage catastrophe claims resulting from severe weather events.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insurance Claims Management Solution Market.- Guidewire Software

- Duck Creek Technologies

- Verisk Analytics

- Sapiens International Corporation

- Pegasystems Inc.

- IBM Corporation

- Oracle Corporation

- Majesco

- Appian

- CCC Intelligent Solutions

- Insurity

- Applied Systems

- Hyland Software

- FICO

- LexisNexis Risk Solutions

- Genpact

- TCS (Tata Consultancy Services)

- DXC Technology

- SAP SE

- Vertafore

Frequently Asked Questions

Analyze common user questions about the Insurance Claims Management Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Insurance Claims Management Solution market?

The primary driver is the necessity for insurance carriers to minimize operational costs (Loss Adjustment Expenses - LAE) and enhance customer satisfaction by utilizing automation technologies like AI and ML to expedite claims processing, improve accuracy, and reduce fraudulent payouts. The shift to cloud-native platforms facilitates this modernization.

How does Artificial Intelligence (AI) specifically benefit claims processing?

AI benefits claims processing by enabling straight-through processing (STP) for simple claims, improving fraud detection accuracy through predictive modeling, and automating damage assessment via computer vision and photo analysis, leading to faster settlements and better resource allocation.

What is the difference between Cloud-Based and On-Premise claims solutions?

Cloud-Based solutions are deployed and maintained by the vendor via the internet, offering lower upfront costs, high scalability, and automatic updates. On-Premise solutions are installed and managed internally by the insurer, offering greater control over data but requiring significant internal IT infrastructure investment and maintenance.

Which insurance sector is the largest end-user of claims management technology?

The Property and Casualty (P&C) insurance sector (including auto and home insurance) is the largest end-user segment, driven by the high volume, frequency, and variability of claims which necessitate advanced workflow automation and rapid damage assessment tools for efficiency.

What are the main restraints impacting the adoption of new claims solutions?

The main restraints include the high capital investment required for migrating data from legacy systems, the complexity of integrating new platforms with existing core carrier systems, and the ongoing challenge of maintaining compliance across diverse and evolving regulatory landscapes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager