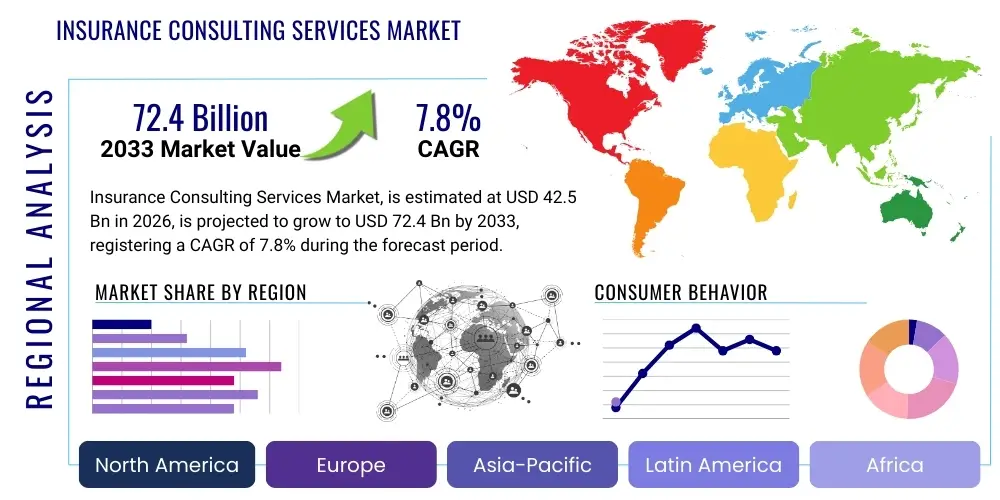

Insurance Consulting Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435662 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Insurance Consulting Services Market Size

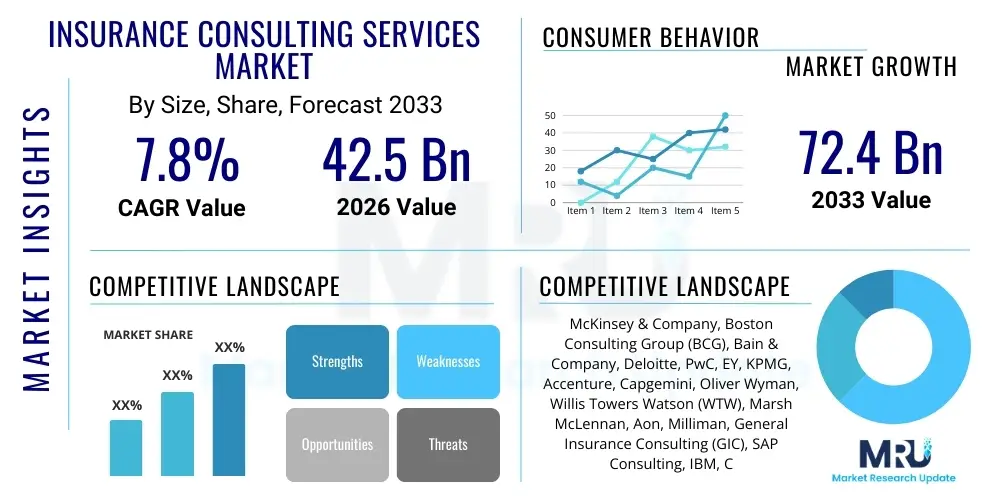

The Insurance Consulting Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $42.5 Billion in 2026 and is projected to reach $72.4 Billion by the end of the forecast period in 2033. This substantial growth is driven by the increasing complexity of regulatory frameworks, the rapid integration of digital technologies, and the persistent need for efficiency optimization among carriers globally. Insurance companies are increasingly relying on external expertise to navigate digital transformation, manage catastrophic risk exposure, and develop advanced customer engagement models, contributing significantly to the market expansion.

Insurance Consulting Services Market introduction

The Insurance Consulting Services Market encompasses advisory and professional services provided to insurance carriers, brokers, and related entities globally. These services are crucial for helping insurance organizations optimize operations, mitigate risks, comply with stringent regulations, and leverage technological advancements to enhance competitiveness. Core service offerings include strategy consulting, actuarial services, risk management, regulatory compliance, technology implementation (InsureTech), and operational efficiency improvement. The fundamental purpose is to translate complex industry challenges—such as climate change impacts, cyber threats, and shifting consumer expectations—into actionable business strategies that secure long-term profitability and resilience for the client.

Major applications of these consulting services span across Life, Property and Casualty (P&C), and Health insurance sectors. In Life insurance, consulting often focuses on mortality risk modeling, product development, and legacy system modernization. For P&C, the emphasis is frequently on claims optimization, catastrophe modeling, and underwriting transformation. Health insurance consulting is dominated by regulatory compliance (e.g., healthcare reforms), provider network optimization, and value-based care strategy development. The widespread adoption of cloud computing, predictive analytics, and process automation within the insurance value chain necessitates specialized consulting support, driving demand for technologically proficient advisors.

Key benefits derived from utilizing insurance consulting services include enhanced operational efficiency, better risk quantification, improved regulatory adherence (such as Solvency II and IFRS 17 adoption), and accelerated digital transformation timelines. Driving factors propelling this market include global economic uncertainty requiring precise capital allocation, the necessity to combat sophisticated cyber risks, and intense competitive pressures forcing carriers to innovate their product offerings and distribution channels. Furthermore, the persistent pressure to reduce the Combined Ratio and improve customer lifetime value mandates the continuous engagement of expert external consultants.

Insurance Consulting Services Market Executive Summary

The Insurance Consulting Services Market is experiencing robust growth fueled by mandatory technological modernization and global regulatory convergence. Business trends highlight a strong shift toward specialized consulting focused on data governance, cloud migration, and AI integration, moving away from generalized IT outsourcing. Carriers are prioritizing engagements that yield immediate returns on investment through efficiency gains, particularly in claims processing and underwriting. Regional trends show North America maintaining dominance due to high technology adoption and complex regulatory landscapes (e.g., state-specific regulations), while the Asia Pacific region exhibits the fastest growth driven by rising insurance penetration rates, especially in emerging economies like India and China, necessitating foreign expertise to structure sophisticated product lines and distribution networks.

Segment trends indicate that technology consulting, encompassing digital strategy and implementation services, is the fastest-growing service type segment. Within end-users, large insurance carriers represent the largest consumer base, demanding comprehensive, multi-year transformation projects. However, the Small and Medium-sized Enterprises (SMEs) segment is showing rapid adoption of tailored, modular consulting services, particularly for basic regulatory and cyber security needs. Furthermore, the rising prominence of InsureTech startups, which often require specialized consulting for scaling and regulatory navigation, is diversifying the client base and driving innovation in delivery models, such as platform-based advisory services.

Overall, the market remains highly competitive, dominated by a few large global management consulting firms and specialized actuarial houses. The focus is shifting towards intellectual property development, where consulting firms develop proprietary tools and accelerators (like AI-powered risk assessment platforms) that are integrated into their advisory offerings, thereby increasing switching costs for clients and enhancing service stickiness. This strategic shift towards value-added intellectual property and outcome-based pricing models is redefining the competitive landscape and driving the overall market valuation higher across the forecast period.

AI Impact Analysis on Insurance Consulting Services Market

User queries regarding AI's impact on Insurance Consulting Services predominantly revolve around themes of job displacement, the adoption of proprietary AI tools by consultancies, and the necessity for specialized AI ethics and governance consulting. Users often question how AI will fundamentally change actuarial modeling, claims adjudication processes, and risk aggregation, seeking guidance on selecting the right AI strategies and avoiding implementation pitfalls. A significant concern is whether consulting firms themselves will be automated out of existence, or if they will pivot to become essential guides for AI integration and compliance, particularly concerning fairness and transparency in algorithmic decision-making. The consensus expectation is that AI will necessitate a higher level of technical expertise among consultants, shifting the focus from manual process review to strategic technology implementation and ethical oversight, creating significant opportunities for specialized AI advisory segments.

- AI accelerates data analysis and pattern recognition, enhancing predictive modeling accuracy in underwriting and pricing strategies.

- Automation of routine tasks (e.g., due diligence, data extraction) reduces manual consulting hours, shifting consultant focus to high-level strategic guidance.

- Development of proprietary AI tools (accelerators) by consulting firms creates new revenue streams and enhances competitive differentiation.

- Increased demand for consulting services focused on AI ethics, regulatory compliance (bias detection), and explainable AI (XAI) implementation.

- AI transforms claims consulting by enabling real-time fraud detection and automated claims processing workflows, requiring new optimization strategies.

- Integration of Generative AI improves content generation for policy documentation and customer communications, necessitating consulting on implementation and governance frameworks.

- AI adoption drives carrier demand for consultants specializing in cloud infrastructure, data warehousing, and API integrations necessary to support large-scale machine learning operations.

DRO & Impact Forces Of Insurance Consulting Services Market

The market dynamics are governed by a complex interplay of internal and external forces. Key drivers include mandatory global regulatory shifts (e.g., IFRS 17 standardization), which necessitate immediate and specialized external assistance for complex accounting and reporting changes, alongside the ubiquitous push for digital transformation driven by competitive necessity. Restraints primarily involve the high cost associated with premium consulting services, often placing them out of reach for smaller or regional insurance players, coupled with the internal resistance within conservative insurance institutions to rapid technological and organizational change. Opportunities are abundant in emerging technologies, particularly in helping carriers navigate cyber resilience, build advanced usage-based insurance (UBI) models, and establish sustainable ESG (Environmental, Social, and Governance) strategies, creating highly specialized, premium service offerings.

The impact forces further amplify these elements. Increased competition from agile InsureTech startups forces established carriers to seek consulting advice on disruptive business models and rapid technology deployment, enhancing the driver element. Conversely, the shortage of highly skilled consultants specializing in niche areas like quantum computing or advanced climate risk modeling acts as a constraint, limiting the supply of specialized expertise. The increasing sophistication of data analytics and the move towards hyper-personalization demand continuous consulting engagement to manage complex data ecosystems and maintain competitive pricing advantage, solidifying the market's dependence on specialized external advisors.

The major impact forces—namely technological disruption and regulatory pressure—are expected to maintain upward momentum on market growth. While cyclical economic downturns might temporarily dampen discretionary spending on long-term strategy projects, the unavoidable need for risk management and regulatory adherence ensures a stable baseline demand for core consulting services. The proliferation of accessible data and advanced analytical tools, while initially posing a threat by potentially internalizing some analytical functions, ultimately increases the complexity of integration and governance, guaranteeing continued demand for high-level consulting support.

- Drivers (D): Global regulatory harmonization (e.g., IFRS 17), accelerated digital transformation mandates, complexity of catastrophic risk modeling, and persistent pressure on combined ratio improvement.

- Restraints (R): High upfront costs of premium consulting services, internal resistance to organizational change within traditional insurance firms, and shortage of specialized talent (e.g., AI actuaries) within consulting firms.

- Opportunities (O): Expansion into adjacent advisory services (e.g., cyber risk quantification, ESG strategy, data monetization), growth in emerging markets (APAC and MEA), and provision of specialized services to the rapidly growing InsureTech ecosystem.

- Impact Forces: Intense competitive landscape favoring technologically adept carriers; increasing data sophistication driving demand for data governance; and climate change necessitating advanced risk assessment consulting.

Segmentation Analysis

The Insurance Consulting Services Market is comprehensively segmented based on Service Type, Insurance Type, End-User, and Deployment Model, reflecting the diverse needs of the global insurance industry. The analysis reveals that strategic consulting and technology consulting dominate the market share, driven by major organizational overhauls and mandated IT modernization projects across large global carriers. Service Type segmentation helps consultants tailor their offerings—from high-level market entry strategy advice to detailed implementation support for regulatory mandates, ensuring relevance across the client lifecycle. Understanding the nuances within each segment allows consulting firms to deploy targeted resources and develop proprietary methodologies optimized for specific industry sub-challenges, such as optimizing claims handling in the P&C sector or managing mortality risk in the Life segment.

The segmentation by Insurance Type (Life, P&C, Health) highlights varied growth trajectories, with P&C showing strong demand fueled by sophisticated risk assessment needs and the integration of IoT data for dynamic pricing. Conversely, Health insurance consulting is heavily influenced by regional governmental healthcare policies and the shift towards value-based care models, requiring specialized payer-provider interaction advisory. Furthermore, the End-User segmentation distinguishes between large enterprises, which require multi-million dollar, multi-year transformation contracts, and smaller firms that often prefer modular, subscription-based advisory services, particularly for compliance and basic cyber security needs. This diversity in client requirements reinforces the need for flexible service delivery platforms among market players.

Analyzing these segments provides strategic insights for market participants. For instance, focusing on the Technology Consulting segment and targeting large global carriers provides access to high-value contracts related to core system modernization and cloud adoption. Conversely, targeting SMEs with specialized Risk Consulting packages offers opportunities for high volume, steady recurring revenue streams. The market structure demonstrates a robust ecosystem where specialized niche players can thrive alongside global generalists, provided they possess deep sector expertise or cutting-in-edge technological capabilities, enabling clients to efficiently navigate the complex, multi-faceted operational and strategic challenges facing the modern insurance landscape.

- Service Type: Strategy Consulting, Operations Consulting, Technology Consulting, Financial Consulting (Actuarial and Risk), Regulatory and Compliance Consulting, HR and Change Management Consulting.

- Insurance Type: Life Insurance, Property and Casualty (P&C) Insurance, Health Insurance, Reinsurance.

- End-User: Large Insurance Enterprises, Small and Medium-sized Enterprises (SMEs), InsureTech Startups, Brokers and Agents.

- Deployment Model: On-Premise Consulting, Cloud-Based Consulting/Platform as a Service (PaaS) Advisory.

Value Chain Analysis For Insurance Consulting Services Market

The value chain for insurance consulting services begins with the upstream activities centered around intellectual capital development and talent acquisition. Upstream analysis involves rigorous research and development into proprietary methodologies, predictive models, and technology accelerators (e.g., AI platforms designed for underwriting). The capability to recruit, train, and retain highly specialized consultants—such as actuaries certified in IFRS 17, cloud architects with deep insurance domain knowledge, and cyber security experts—is the primary value creation mechanism at this stage. Strong investment in knowledge management systems and continuous professional development ensures that consultancies maintain their competitive edge by offering cutting-edge, innovative solutions that are difficult for clients to replicate internally.

Midstream activities involve the actual service delivery, which includes scoping the engagement, data gathering and analysis (often leveraging proprietary platforms), developing strategic recommendations, and managing the implementation phase. The key differentiator here is the consulting firm's ability to seamlessly integrate technology solutions (digital transformation) with organizational change management (OCM), ensuring that the proposed strategies translate into measurable client outcomes. Distribution channels are primarily direct, involving partner-led sales processes and relationship management with C-suite executives, especially for large, high-value strategy and technology projects. Indirect channels, though less common, include partnerships with technology vendors (e.g., cloud providers) or specialized software houses, where consulting services are bundled with technology implementation packages.

Downstream analysis focuses on post-engagement support, monitoring, and ongoing relationship management. This stage is crucial for ensuring client satisfaction and securing future follow-on engagements, often leading to recurring revenue through managed services or continuous advisory contracts (Retainer Model). Feedback loops from completed projects are fed back into the upstream R&D process to refine methodologies and enhance the proprietary toolset, thereby continuously improving the overall value proposition. The strength of the consultant-client relationship, built on demonstrated expertise and trust, is the final critical component in maximizing value delivery and market penetration within this specialized service industry.

Insurance Consulting Services Market Potential Customers

The primary customers for Insurance Consulting Services are the core institutional players within the global insurance and reinsurance industry. These include large multinational insurance carriers specializing in Life, Property and Casualty (P&C), and Health sectors, who require complex, enterprise-wide transformation projects encompassing everything from regulatory compliance to core system replacement. Reinsurance companies also form a significant customer segment, particularly needing advanced modeling services for catastrophic risk, capital management optimization, and navigating solvency requirements globally. These large entities often represent the highest revenue contracts for consulting firms due to the scale and duration of their transformation needs, often spanning multiple years and geographies.

Beyond the major carriers, the segment of small to medium-sized insurance enterprises (SMEs) and regional niche players constitutes a rapidly growing client base. While their project budgets are smaller, their need for compliance assistance (especially regarding cyber security and data privacy regulations) is critical, often driving demand for modular, fixed-scope engagements. Furthermore, the explosive growth of the InsureTech ecosystem has created a new, dynamic customer segment. InsureTech startups, ranging from specialized claims automation providers to innovative distribution platforms, require expert consulting for regulatory licensing, scaling operations, structuring their business model, and securing subsequent rounds of funding, positioning them as high-growth, technically demanding clients.

Auxiliary customers also include institutional investors and private equity firms focused on the insurance sector, seeking M&A due diligence, actuarial valuation, and portfolio optimization advice. Regulatory bodies and governmental organizations occasionally engage consulting firms for market analysis, policy assessment, and implementation planning related to national insurance reforms. Essentially, any entity dealing with significant insurance risk, regulatory obligation, or large-scale data processing within the financial services ecosystem represents a potential customer for specialized insurance consulting expertise, driven by the persistent need for efficiency, innovation, and risk mitigation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $42.5 Billion |

| Market Forecast in 2033 | $72.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte, PwC, EY, KPMG, Accenture, Capgemini, Oliver Wyman, Willis Towers Watson (WTW), Marsh McLennan, Aon, Milliman, General Insurance Consulting (GIC), SAP Consulting, IBM, Cognizant, Wipro, TATA Consultancy Services (TCS). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insurance Consulting Services Market Key Technology Landscape

The technology landscape underpinning the Insurance Consulting Services market is rapidly evolving, driven by the need for efficiency and advanced risk modeling capabilities. Key technologies deployed include sophisticated data analytics platforms (Big Data tools like Hadoop and Spark) used for extracting insights from massive policyholder and claims datasets, crucial for actuarial and risk consulting. Cloud computing (AWS, Azure, Google Cloud) forms the foundational architecture, enabling carriers to modernize legacy core systems and allowing consultants to deploy proprietary analytical models with scalability and security. This shift to the cloud is a primary focus area for technology consulting, encompassing migration strategy, security posture assessment, and platform optimization to support advanced AI workloads.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are central to innovation, used extensively in developing predictive underwriting models, automating fraud detection, and optimizing customer interactions via Natural Language Processing (NLP) chatbots. Consultants leverage specialized InsureTech solutions—such as those focused on Robotic Process Automation (RPA) for streamlining back-office operations like claims intake and policy administration—to drive measurable operational improvements. The increasing threat landscape has also elevated cyber security consulting, relying on technologies like Zero Trust Architecture and advanced threat intelligence platforms to help carriers build resilient digital environments, which is a high-growth service area.

Another crucial technology segment involves the application of Distributed Ledger Technology (DLT) or blockchain, primarily for smart contracts and enhancing transparency in reinsurance transactions and claims processes, although adoption is still nascent compared to AI and Cloud. Geographic Information Systems (GIS) and satellite imagery analysis are becoming critical tools for P&C consultants to accurately assess catastrophe exposure (e.g., flood, wildfire risk) and validate property claims post-event. Consulting firms themselves are investing heavily in these technologies to create proprietary, sector-specific accelerators and tools, thereby enhancing the speed and accuracy of their recommendations and cementing their role as technology integrators and strategic advisors.

Regional Highlights

The global Insurance Consulting Services Market exhibits distinct regional dynamics, influenced by varying regulatory environments, technological maturity, and insurance penetration rates. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributable to the region’s mature insurance market, the mandatory need for sophisticated risk management due to exposure to various natural disasters, and a high concentration of large multinational carriers that possess substantial budgets for continuous digital transformation projects. Furthermore, complex state-level regulatory requirements in the US necessitate ongoing consulting support for compliance and market expansion, especially concerning health insurance reforms and cyber governance.

Europe represents the second-largest market, characterized by stringent regulatory oversight, notably Solvency II and IFRS 17 implementation, which continues to drive high demand for actuarial and financial consulting services. The market here is moderately fragmented, with a strong presence of both global consultancies and highly specialized regional firms. Western European countries like the UK, Germany, and France are leaders in adopting specialized services related to ESG strategy and sustainable finance, pushing carriers to redefine their investment and underwriting portfolios, thereby generating new, high-value consulting engagements focused on ethical governance and climate risk modeling.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by burgeoning middle-class populations, increasing disposable income, and subsequent rising insurance penetration, particularly in emerging economies such as China, India, and Southeast Asia. These markets require consulting services focused on developing distribution strategies, establishing regulatory frameworks, and implementing greenfield core systems to handle massive customer growth efficiently. The demand is often centered on technology implementation and operational efficiency to manage the rapid scaling process. Latin America and the Middle East & Africa (MEA) are emerging regions, where consulting demand is tied to regional economic stability, regulatory modernization efforts, and the strategic expansion of global carriers seeking to establish footholds in these untapped markets.

- North America: Market leader; driven by high technological maturity, complex federal and state-level regulatory compliance (e.g., NAIC mandates), and extensive spending on AI and cloud migration projects by major P&C and Health carriers.

- Europe: Strong demand fueled by mandatory regulatory adherence (Solvency II, IFRS 17), focus on climate risk and ESG consulting, and substantial investments in open insurance and API strategies.

- Asia Pacific (APAC): Highest growth potential; characterized by expanding insurance penetration, need for establishing modern distribution channels, and demand for system integration and operational scaling consulting in rapidly developing markets.

- Latin America (LATAM): Growth linked to economic stabilization and regulatory reforms; demand concentrated in risk management, capital optimization, and digital transformation aimed at improving customer experience.

- Middle East & Africa (MEA): Emerging market; consulting needs focus on fundamental market structure development, specialized Takaful insurance advisory, and implementation of basic core administrative systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insurance Consulting Services Market.- McKinsey & Company

- Boston Consulting Group (BCG)

- Bain & Company

- Deloitte

- PwC

- EY

- KPMG

- Accenture

- Capgemini

- Oliver Wyman

- Willis Towers Watson (WTW)

- Marsh McLennan

- Aon

- Milliman

- General Insurance Consulting (GIC)

- SAP Consulting

- IBM Global Business Services

- Cognizant

- Wipro

- TATA Consultancy Services (TCS)

Frequently Asked Questions

Analyze common user questions about the Insurance Consulting Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current demand for Insurance Consulting Services?

The primary driver is the mandatory acceleration of digital transformation coupled with complex, non-negotiable regulatory changes globally, such as the implementation of IFRS 17 and evolving data privacy laws like GDPR and CCPA. These require specialized external expertise for successful and compliant execution.

How is Artificial Intelligence (AI) reshaping the role of insurance consultants?

AI is shifting the consultant's role from process optimization to strategic technology integration and governance. Consultants are now essential for advising on AI ethics, building proprietary predictive models, and ensuring seamless integration of machine learning tools into core insurance operations like underwriting and claims processing.

Which segment of Insurance Consulting Services is projected to grow the fastest?

Technology Consulting is projected to be the fastest-growing segment, driven by the massive investment carriers are making in cloud migration, core system replacement, and the development of modern digital channels to improve customer acquisition and retention.

What are the key differences between Life Insurance and P&C Insurance consulting needs?

Life Insurance consulting focuses heavily on long-term liability modeling, mortality risk, annuity product design, and managing complex legacy IT systems. P&C consulting focuses on short-term risk assessment, catastrophe modeling, claims optimization, and integrating IoT and telematics data for dynamic pricing and risk mitigation.

What major challenges restrict the growth of the Insurance Consulting Services Market?

Key challenges include the high cost associated with premium, specialized consulting expertise, making services inaccessible for smaller regional firms, and the persistent shortage of highly specialized consultants (e.g., those proficient in cloud-native core systems or advanced actuarial AI) capable of meeting niche demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager