Insurance IT Spending Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435802 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Insurance IT Spending Market Size

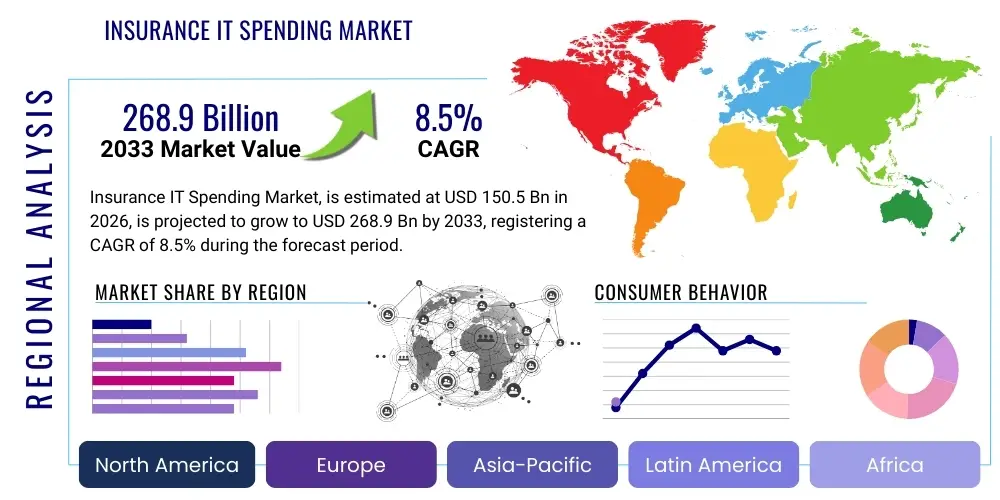

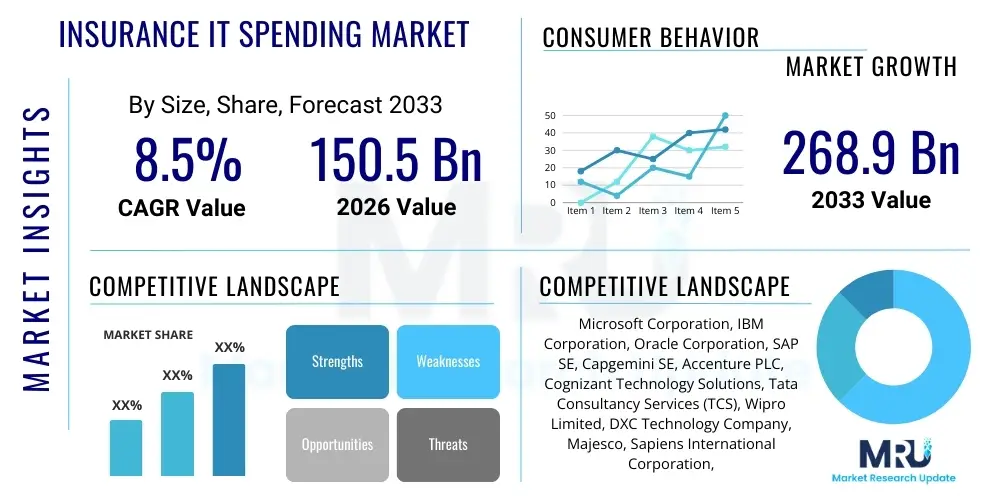

The Insurance IT Spending Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 150.5 Billion in 2026 and is projected to reach USD 268.9 Billion by the end of the forecast period in 2033.

Insurance IT Spending Market introduction

The Insurance IT Spending Market encompasses all expenditures by insurance carriers—including life, non-life, and health insurers—on information technology infrastructure, software, services, and associated personnel necessary to conduct business operations, enhance customer engagement, and meet stringent regulatory requirements. This spending is primarily focused on modernizing legacy systems, implementing digital transformation strategies, and leveraging advanced technologies such as cloud computing, artificial intelligence, and sophisticated data analytics platforms. The core objective of increased IT investment is to improve operational efficiency, accelerate product time-to-market, enhance the precision of underwriting and claims management processes, and deliver highly personalized customer experiences across multiple channels. Strategic investments are often channeled into core systems replacement, particularly for policy administration and claims platforms, which are critical for long-term competitiveness in a rapidly evolving digital marketplace.

The product description within this market spans several critical technological domains. Software spending includes investments in core systems (Policy Administration Systems, Billing Systems, Claims Management Systems), specialized tools for risk modeling and regulatory compliance (e.g., Solvency II, IFRS 17), and customer-facing applications (portals, mobile apps). Hardware expenditure, while a slower growing segment, covers necessary infrastructure upgrades, including servers, networking equipment, and data storage solutions essential for handling massive volumes of structured and unstructured insurance data. Furthermore, IT services, encompassing managed services, consulting, and system integration, form a significant portion of the spending, driven by the complexity of integrating disparate systems and the ongoing need for specialized cybersecurity expertise to protect sensitive policyholder information from increasingly sophisticated threats.

Major applications driving this market include automated underwriting, advanced fraud detection, sophisticated claims processing using image recognition and machine learning, and the creation of hyper-personalized insurance products tailored to individual risk profiles derived from telemetry and behavioral data. Key driving factors accelerating market expansion are the intense pressure from InsurTech startups compelling established carriers to innovate rapidly, the global trend towards regulatory compliance requiring significant data handling and reporting capabilities, and the overwhelming demand from contemporary consumers for seamless, digital interactions that mimic experiences found in other retail and financial sectors. These factors necessitate continuous investment in scalable, agile, and secure IT environments, making IT spending a non-negotiable strategic priority for all tiers of insurance entities seeking to maintain solvency and capture market share.

Insurance IT Spending Market Executive Summary

The Insurance IT Spending Market Executive Summary highlights a pronounced shift towards platform modernization and cloud-centric architectures as insurers seek agility and scalability in response to dynamic market conditions. Current business trends indicate a strong prioritization of expenditures related to Customer Relationship Management (CRM) tools, data warehousing, and predictive analytics, designed to transform raw data into actionable insights for risk management and targeted marketing campaigns. Furthermore, there is a notable consolidation among technology providers specializing in insurance solutions, driving innovation through mergers and acquisitions and offering comprehensive end-to-end platforms that integrate policy administration, billing, and claims functions. The imperative for operational resilience, particularly following global disruptions, has accelerated investments in robust disaster recovery and business continuity planning enabled by hybrid and multi-cloud strategies, ensuring uninterrupted service delivery regardless of external factors.

Regional trends reveal distinct investment patterns across geographies. North America and Europe maintain the largest share of IT spending, primarily focusing on advanced regulatory technology (RegTech) solutions and the integration of artificial intelligence into core business processes like underwriting and fraud detection, reflecting high levels of IT maturity and substantial capital reserves. In contrast, the Asia Pacific (APAC) region is experiencing the fastest growth, driven by rapid insurance penetration in emerging economies, high mobile adoption rates, and a 'leapfrog' effect where new carriers bypass legacy systems entirely, directly adopting cloud-native core platforms. This disparity in regional investment pace reflects varying levels of digital maturity and the divergent regulatory landscapes that necessitate region-specific technology deployment strategies tailored to local consumer behaviors and compliance requirements, such as data localization mandates.

Segment trends underscore the dominance of the IT Services category, which continues to command the largest market share due to the ongoing demand for system integration, custom application development, and expert consultation required to manage complex digital transformations. Within the software segment, spending on digital core platforms, particularly those utilizing microservices architectures, is outpacing investment in traditional, monolithic systems. Moreover, the deployment trend is unequivocally favoring the cloud, with insurers increasingly comfortable migrating mission-critical applications to public or private cloud environments to reduce capital expenditure and improve flexibility. Life and Annuity insurers are allocating significant budget toward customer self-service portals and predictive modeling for actuarial valuation, while Property and Casualty (P&C) insurers are heavily investing in telematics and Internet of Things (IoT) data processing capabilities to enable usage-based insurance (UBI) models and accelerate claims assessment.

AI Impact Analysis on Insurance IT Spending Market

Common user questions regarding the impact of AI on the Insurance IT Spending Market revolve around quantifying return on investment (ROI), understanding necessary data infrastructure upgrades, and assessing the potential for job displacement versus upskilling requirements. Users frequently inquire about which specific insurance functions (e.g., claims, underwriting, customer service) will see the most immediate AI adoption and how generative AI will reshape policy language drafting and personalized communication. The core concerns center on data governance, algorithmic bias, and ensuring compliance while leveraging sophisticated models. Based on this analysis, the key themes indicate that AI is viewed not merely as a cost-cutting measure but as a fundamental enabler of hyper-personalization, enhanced risk accuracy, and superior operational speed, demanding substantial, continuous IT investment in robust data ingestion, cleaning, security, and specialized machine learning operations (MLOps) platforms. This shift necessitates specialized AI-ready infrastructure and a strong focus on cloud integration to provide the required computational power and scalability for high-volume model deployment and retraining.

- AI drives spending on advanced data infrastructure, including data lakes and lakehouses, necessary for handling diverse, large datasets required for model training.

- Increased investment in specialized cognitive computing software and machine learning platforms for automated underwriting and dynamic pricing models.

- Significant expenditure on conversational AI and chatbots to automate frontline customer service, inquiry handling, and basic claims reporting, optimizing resource allocation.

- AI-powered fraud detection systems necessitate new security software spending, capable of real-time monitoring and anomaly identification across policy and claims transactions.

- Demand for predictive analytics tools to forecast policy lapse rates and optimize cross-selling strategies, leading to higher software licensing and implementation costs.

- Generative AI tools are driving pilot project spending for automating content creation, such as drafting personalized correspondence and summarizing complex documentation.

- Need for specialized talent and consulting services focused on data science and ethical AI implementation, categorized under IT services expenditure.

DRO & Impact Forces Of Insurance IT Spending Market

The Insurance IT Spending Market is profoundly shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate investment priorities and market growth trajectories. A primary driver is the accelerating pace of digital transformation, necessitated by fierce competition from agile InsurTech firms and the shifting expectations of digitally native consumers who demand instant, transparent, and seamless service interactions accessible via mobile devices and personalized platforms. This driver compels incumbent carriers to continuously retire outdated mainframe systems and adopt modular, API-driven architectures, significantly increasing expenditure on modernization projects, cloud migration services, and cybersecurity enhancements required to protect increasingly interconnected digital ecosystems from escalating cyber threats. Furthermore, the global imperative for enhanced data governance, regulatory compliance (e.g., GDPR, CCPA, IFRS 17), and sophisticated risk modeling places substantial, non-discretionary demands on IT budgets, ensuring a sustained baseline level of technology spending.

However, the market faces significant restraints that temper aggressive growth. The inertia associated with replacing deeply embedded legacy systems remains a primary challenge; these systems are often highly customized, complex, and pose substantial integration risks and high migration costs, leading many insurers to opt for protracted phased replacements or complex system encapsulation projects, thereby slowing immediate large-scale spending. Moreover, the persistent shortage of specialized IT talent proficient in both insurance domain knowledge and cutting-edge technologies like cloud security, machine learning operations (MLOps), and API development limits the pace at which ambitious digital initiatives can be executed, sometimes forcing reliance on expensive external consulting resources. Economic uncertainties and geopolitical instability can also cause cyclical slowdowns, leading insurers to postpone non-essential capital expenditure on innovation in favor of maintaining core operational stability and solvency margins during periods of financial stress.

Opportunities within the market largely revolve around the proliferation of specialized vertical solutions and the strategic use of disruptive technologies. The adoption of Usage-Based Insurance (UBI) across P&C segments, enabled by IoT devices and telematics data processing, presents a vast opportunity for new product lines and increased spending on Big Data analytics platforms. Similarly, the growing acceptance of low-code/no-code platforms offers insurers the chance to accelerate application development and empower business users, reducing dependence on scarce developer resources and decreasing long-term maintenance costs. The transition to hybrid and multi-cloud environments provides scalability and geographical resilience, attracting higher investment in cloud management tools and security frameworks. Capitalizing on these opportunities requires a fundamental reorientation of IT strategy, moving from being a mere support function to acting as a core business driver, fostering collaboration between business units and technology teams to leverage innovation for competitive advantage and enhanced policyholder retention.

Segmentation Analysis

The Insurance IT Spending Market segmentation provides a granular view of investment distribution across various technological components, deployment models, applications, and insurance types, offering critical insights into areas of focused growth and maturity. The segmentation highlights the tactical decisions carriers are making regarding where to allocate their resources to achieve maximum strategic advantage, whether through modernizing backend infrastructure, enhancing customer-facing channels, or improving data analytical capabilities. Understanding these segments is vital for vendors to tailor their offerings effectively and for carriers to benchmark their expenditure against industry peers. The market is broadly categorized based on the nature of the expenditure (Component), the method of delivery (Deployment Type), the business function being supported (Application), and the core business line of the insurer (Insurance Type), reflecting a comprehensive framework for analysis.

Analyzing the component segment reveals the underlying investment hierarchy. Services invariably dominate due to the continuous need for system integration, professional consulting, and managed operations required to keep complex ecosystems running securely and efficiently. Software expenditure, particularly for platform replacements and specialized analytics tools, exhibits the fastest growth as insurers strive for differentiated capabilities. Hardware investment remains stable but crucial, primarily supporting data center consolidation and high-performance computing necessary for actuarial modeling and risk assessment. Within the application segment, investments are rapidly flowing into digitalization initiatives centered on enhanced Customer Relationship Management (CRM) and sophisticated Claims Management Systems, directly impacting efficiency and customer satisfaction metrics. The segmentation by insurance type—Life & Annuity versus Property & Casualty (P&C) and Health—shows distinct expenditure focus, with P&C leading the way in adopting IoT and telematics technologies, while Life insurers focus heavily on sophisticated policy administration and automated underwriting based on mortality risk data.

- Component:

- Hardware

- Software

- IT Services (Consulting, Integration, Outsourcing)

- Deployment Type:

- On-Premise

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud)

- Application:

- Core Insurance Management (Policy Administration, Billing)

- Claims Management

- Sales and Marketing/CRM

- Risk Management and Fraud Detection

- Finance and Accounting

- Human Resources and Administration

- Insurance Type:

- Life Insurance

- Property and Casualty (P&C)/Non-Life Insurance

- Health Insurance

Value Chain Analysis For Insurance IT Spending Market

The Value Chain Analysis for the Insurance IT Spending Market begins with the upstream activities involving hardware manufacturers and infrastructure providers (servers, network equipment, storage systems) and core software developers who create foundational platforms (operating systems, database management systems). This upstream segment is characterized by high research and development investment aimed at delivering scalable, secure, and computationally efficient technologies, such as advanced microprocessors and robust data center cooling solutions. Software providers, including large enterprise resource planning (ERP) firms and specialized InsurTech vendors, continuously innovate to offer modular, API-first solutions that facilitate easier integration and customization. Key upstream challenges involve managing supply chain volatility and meeting the stringent data security requirements demanded by highly regulated financial institutions, which necessitates robust quality control and verifiable security certifications from component providers.

The midstream involves the crucial role of system integrators, IT consulting firms, and managed service providers (MSPs). These entities act as the bridge between raw technology components and the insurer's specific business needs. They are responsible for implementing, customizing, and integrating diverse software packages (policy administration, claims, CRM) onto the chosen deployment infrastructure (on-premise or cloud). Distribution channels for IT products are multifaceted, including direct sales from large enterprise vendors, partnerships through system integrators, and increasingly, platform-as-a-service (PaaS) or software-as-a-service (SaaS) subscription models delivered indirectly via cloud marketplaces. The success of the midstream segment hinges on the ability of integrators to manage the complexity of retiring legacy systems while simultaneously deploying modern, interconnected architectures that meet the performance and resilience standards required for mission-critical insurance operations.

Downstream activities center on the insurance carriers themselves (the end-users) and their policyholders. Carriers leverage the acquired IT capabilities to improve underwriting accuracy, expedite claims handling, and enhance customer experience through digital portals and mobile applications. The downstream success is measured by operational efficiency gains, reduced fraud losses, improved policyholder retention, and compliance adherence. Direct channels involve carriers purchasing standardized SaaS solutions directly from vendors, especially for non-core functions. Indirect channels, which are far more prevalent for core system replacement, involve leveraging global system integrators (GSIs) or specialized insurance technology consultants to manage complex transformation projects. The increasing prevalence of cloud distribution necessitates robust vendor management and clear service level agreements (SLAs) to ensure data portability, security, and continuous service availability for the high-volume, real-time demands of modern insurance transactions.

Insurance IT Spending Market Potential Customers

The potential customers and primary buyers in the Insurance IT Spending Market are diverse, encompassing the entire spectrum of financial entities engaged in risk pooling and policy issuance. These buyers are broadly segmented into three main categories: Life and Annuity Insurers, Property and Casualty (P&C) Insurers (also known as Non-Life insurers), and Health Insurers. Each segment approaches IT spending with unique priorities driven by their specific risk models, regulatory requirements, and customer lifecycles. Life insurers, for example, typically focus heavily on long-term policy administration systems, actuarial modeling software for calculating reserves and solvency requirements, and sophisticated CRM systems to manage multi-decade policyholder relationships. Their IT investments prioritize stability, accuracy, and compliance with long-term financial reporting standards such as IFRS 17.

P&C insurers represent a critical and highly dynamic customer segment, characterized by high-frequency, lower-value claims and a strong need for rapid response capabilities. Their IT spending is heavily skewed toward technologies that enable immediate data processing, such as telematics platforms for usage-based insurance, geospatial analytics for catastrophe modeling, and advanced claims systems utilizing AI and image recognition for automated damage assessment. They are early adopters of cloud technologies for elasticity, allowing them to scale quickly in response to major weather events or sudden increases in claim volumes. Furthermore, they invest significantly in fraud detection software that can analyze complex transaction patterns in real-time, justifying the high capital expenditure through substantial loss reduction and operational efficiency gains, making the ROI on specialized IT solutions highly attractive.

Health insurers constitute the third major customer group, characterized by complex regulatory environments, intricate provider networks, and massive transaction volumes related to claims processing, eligibility verification, and adherence to privacy regulations like HIPAA. Their IT expenditures are concentrated on modernizing payer systems, integrating patient data from various sources (EHRs, wearables), and developing robust security infrastructure to protect sensitive health information. Managed Care Organizations (MCOs) and third-party administrators (TPAs) also represent significant buyers, often purchasing outsourced IT services and specialized software for claims adjudication and provider management. As the healthcare landscape shifts towards value-based care, these buyers are increasingly prioritizing investments in population health management platforms and predictive analytics to forecast medical trends and manage overall risk exposure efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.5 Billion |

| Market Forecast in 2033 | USD 268.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Capgemini SE, Accenture PLC, Cognizant Technology Solutions, Tata Consultancy Services (TCS), Wipro Limited, DXC Technology Company, Majesco, Sapiens International Corporation, Guidewire Software, Vertafore, Duck Creek Technologies, Salesforce.com, Google LLC (Google Cloud), Amazon Web Services (AWS), Genpact, and NTT DATA Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Insurance IT Spending Market Key Technology Landscape

The technology landscape governing the Insurance IT Spending Market is defined by a rapid convergence of several advanced concepts, prioritizing agility, data processing capabilities, and secure accessibility. Cloud computing, specifically multi-cloud and hybrid deployments, sits at the foundation of modern IT strategy, offering unparalleled scalability, elasticity, and reduced total cost of ownership compared to maintaining proprietary data centers. Insurers are moving beyond merely hosting non-critical applications in the cloud; core systems—including policy administration and claims processing—are increasingly being re-platformed or replaced with Software-as-a-Service (SaaS) solutions built on microservices architectures. This shift allows for rapid iterative development, easier integration via APIs, and enhanced resilience, minimizing downtime during critical operations. Furthermore, the focus on data security in these cloud environments drives significant spending on specialized cloud security posture management (CSPM) tools and data encryption services.

Artificial Intelligence (AI) and Machine Learning (ML) represent the most transformative technologies currently attracting capital investment. Insurers are integrating AI across the entire value chain, from using neural networks for highly accurate underwriting risk assessment based on vast datasets to employing natural language processing (NLP) for efficient analysis of unstructured documents, such as complex medical records or incident reports. The increasing use of predictive modeling for optimizing pricing strategies and identifying potential fraud rings requires substantial investment in high-performance computing (HPC) infrastructure and specialized data science platforms that can handle the heavy computational load. This technological push is also fueling the growth of Robotic Process Automation (RPA) tools, which are utilized to automate repetitive, high-volume backend tasks such as data entry and policy issuance, freeing human resources to focus on complex decision-making and customer relationship management.

Other crucial technologies include the Internet of Things (IoT) and telematics, which are fundamentally reshaping the P&C and Health insurance sectors. IoT devices, ranging from connected cars and wearable fitness trackers to smart home sensors, generate massive streams of data that necessitate investment in specialized edge computing infrastructure and Big Data analytics platforms capable of real-time processing and ingestion. This data enables the transition to personalized, dynamic pricing models like Usage-Based Insurance (UBI), creating new product opportunities and reducing overall portfolio risk. Additionally, the adoption of blockchain technology is being explored, particularly for streamlining reinsurance transactions, enhancing data veracity across complex supply chains, and establishing immutable records for claims settlement, although its primary impact remains concentrated in niche pilot projects focused on efficiency and transparency improvement rather than mainstream core system replacement, thus requiring targeted, exploratory IT spending.

Regional Highlights

- North America: Market maturity, high regulatory compliance spending, and rapid adoption of AI/ML in core functions.

- Europe: Driven by complex data privacy rules (GDPR) and solvency regulations (Solvency II), strong focus on cloud adoption and legacy modernization.

- Asia Pacific (APAC): Highest growth rate, fueled by emerging economies, mobile penetration, and direct adoption of cloud-native solutions.

- Latin America (LATAM): Increasing investment in digital channels and mobile applications driven by high smartphone usage and unbanked populations entering the insurance market.

- Middle East & Africa (MEA): Growth concentrated in key financial hubs, with a strong emphasis on cybersecurity and regional digital transformation mandates.

North America, comprising the United States and Canada, remains the largest market for Insurance IT Spending, characterized by a highly competitive landscape and robust capital reserves that allow for large-scale, transformative projects. The region leads globally in adopting advanced technologies like Artificial Intelligence for complex risk selection, predictive analytics for claims severity forecasting, and utilizing blockchain for back-office efficiency, particularly within reinsurance markets. The primary drivers of spending here are the continuous need to manage vast amounts of data effectively, the necessity of real-time regulatory compliance reporting, and intense competitive pressure from aggressive InsurTech ventures that force established carriers to maintain an extremely high pace of innovation. Consequently, spending is heavily weighted toward IT Services (consulting, system integration) and specialized software licenses, aimed at driving differentiation through technological excellence and delivering hyper-personalized customer journeys facilitated by sophisticated CRM and marketing automation platforms.

The European market presents a unique blend of regulatory complexity and technological conservatism, driving strategic, measured IT investment. Stringent directives such as the General Data Protection Regulation (GDPR) mandate significant spending on data governance, data localization infrastructure, and enhanced cybersecurity measures to ensure compliance, making data protection a key budget priority. Furthermore, financial reporting standards like IFRS 17 require substantial overhauls of actuarial and accounting systems, necessitating dedicated IT spending on compliance software and implementation services. While cloud adoption is increasing steadily, particularly within non-core operations, many major European insurers still maintain significant on-premise infrastructure for core policy administration due to ingrained risk aversion and complex regulatory requirements regarding data sovereignty, leading to sustained spending on hardware maintenance and highly customized legacy system support contracts, often slowing down overall transition pace compared to North America.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, primarily driven by the burgeoning insurance penetration across populous, emerging economies such as China, India, and Indonesia, coupled with the absence of deeply entrenched legacy systems in many nascent markets. This allows carriers to adopt cloud-native core insurance platforms directly, bypassing decades of technical debt. IT spending in APAC is heavily influenced by high mobile adoption rates, leading to significant investment in mobile-first applications for policy sales, claims submission, and customer self-service portals tailored to localized consumer behavior. The rapid urbanization and increasing frequency of natural catastrophe events also spur investment in specialized risk modeling and geospatial analytics tools. Consequently, the focus in APAC is predominantly on foundational digitalization, scalable infrastructure through public cloud adoption, and leveraging technology to reach previously underserved populations through simplified, digitally-enabled insurance products, focusing expenditures on deployment and rapid market expansion capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Insurance IT Spending Market.- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Capgemini SE

- Accenture PLC

- Cognizant Technology Solutions

- Tata Consultancy Services (TCS)

- Wipro Limited

- DXC Technology Company

- Majesco

- Sapiens International Corporation

- Guidewire Software

- Vertafore

- Duck Creek Technologies

- Salesforce.com

- Google LLC (Google Cloud)

- Amazon Web Services (AWS)

- Genpact

- NTT DATA Corporation

Frequently Asked Questions

Analyze common user questions about the Insurance IT Spending market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of current IT spending in the insurance sector?

The primary driver is the necessity for comprehensive digital transformation, spurred by consumer demand for seamless digital experiences, competitive pressure from agile InsurTech firms, and the regulatory mandate to modernize core administrative systems for enhanced efficiency and reporting accuracy.

How is cloud computing influencing IT investment strategies for major insurers?

Cloud computing is fundamentally reshaping IT strategy by enabling scalability and reducing reliance on costly proprietary hardware. Insurers are increasingly migrating core policy and claims systems to hybrid or public cloud environments, shifting spending from capital expenditure (CapEx) to operational expenditure (OpEx) for greater agility and resilience.

Which technology segment is expected to grow the fastest during the forecast period?

The Software segment, particularly specialized core platform solutions (Policy Administration Systems, Claims Management Systems) and advanced analytics/AI software, is expected to exhibit the fastest growth, driven by the need for personalized products and automated business processes.

What are the biggest challenges faced by insurers when implementing new IT systems?

The biggest challenges involve the complexity and high cost of integrating or replacing highly customized legacy mainframe systems, the persistent scarcity of IT talent with dual domain knowledge (insurance and technology), and ensuring robust cybersecurity and compliance with diverse data privacy regulations across regions.

How does AI impact claims processing expenditure within the market?

AI significantly increases spending on specialized machine learning software and data infrastructure, but it leads to long-term cost savings by automating first notice of loss (FNOL), speeding up adjudication through image recognition, reducing human error, and markedly improving fraud detection accuracy, thereby transforming claims into an automated, highly efficient process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager