Integral Drill Steels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435840 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Integral Drill Steels Market Size

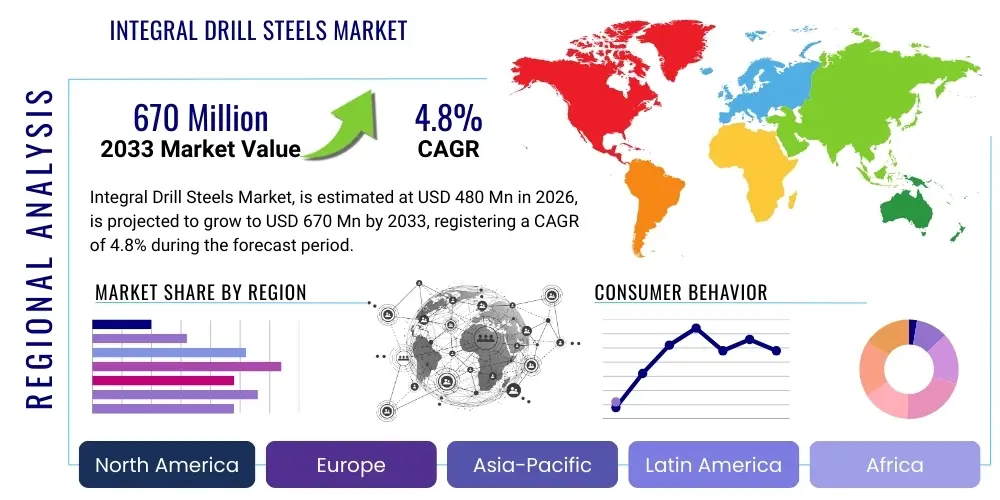

The Integral Drill Steels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $480 Million in 2026 and is projected to reach $670 Million by the end of the forecast period in 2033. This consistent upward trajectory is primarily driven by sustained global investments in infrastructure development, particularly in emerging economies where tunneling, quarrying, and small-to-medium scale mining operations rely heavily on the efficiency and cost-effectiveness offered by integral drilling equipment. Furthermore, the specialized nature of integral drill steels, particularly their ability to maximize energy transfer and maintain structural integrity in challenging environments, positions them as essential consumables in highly regulated construction and resource extraction sectors, contributing robustly to the overall market valuation growth over the coming years. The adoption of advanced manufacturing techniques, leading to superior steel quality and longer product life cycles, is simultaneously stabilizing replacement demand and promoting market expansion.

Integral Drill Steels Market introduction

Integral drill steels are essential components in the field of percussive drilling, specifically engineered as a single, unified unit that combines the drill rod, coupling, and often the bit connection, facilitating direct and highly efficient transmission of impact energy from the rock drill machine to the drilling face. These steels are typically characterized by a solid or hollow body, manufactured from high-grade alloy steel, and meticulously heat-treated to ensure exceptional resistance to bending, torsion, and high-frequency impact fatigue, making them indispensable for pneumatic and hydraulic rock drilling applications, especially in confined spaces. The intrinsic benefits of using integral steels include enhanced rigidity, reduced vulnerability to coupling failures, and minimized energy loss during the drilling process, optimizing penetration rates and overall operational throughput in sensitive applications.

The primary applications of integral drill steels span various heavy industries, including dimensional stone quarrying, where precise hole placement is critical for block extraction; civil construction, particularly for anchor drilling, foundation work, and trenching in urban environments; and small-scale underground mining and tunneling operations where shorter holes and high maneuverability are required. The product’s core advantage lies in its simplicity and durability, offering a cost-effective solution for short-hole drilling (typically up to 6 meters), which is a common requirement across numerous global infrastructure projects. The increasing global focus on sustainable and efficient resource extraction methodologies further necessitates the use of reliable drilling consumables like integral drill steels, ensuring minimal downtime and maximizing productivity across diverse geological conditions.

The market is predominantly driven by significant infrastructural expenditures, particularly the proliferation of road and railway tunnels, hydroelectric power projects, and urbanization-related quarrying activities across Asia Pacific and Latin America. Key benefits driving adoption include superior energy transmission leading to faster drilling speeds, reduced operational costs due to fewer components requiring replacement or maintenance, and enhanced safety for operators due to simplified setup procedures. These factors collectively contribute to the high demand for robust, high-performance integral drill steel solutions that can withstand the abrasive and high-stress environments characteristic of modern drilling operations, thereby underpinning the market’s steady growth trajectory and competitive landscape definition.

Integral Drill Steels Market Executive Summary

The Integral Drill Steels Market is experiencing substantial growth propelled by robust business trends centered on technological refinement, consolidation among manufacturers, and a strong pivot toward high-performance material science to enhance product longevity and efficiency. Global business strategies are increasingly focusing on vertical integration to control the quality of specialized alloy steel inputs, thereby maintaining competitive pricing and ensuring the reliability required by high-stakes mining and construction contracts. The integration of digital tracking technologies for inventory and usage monitoring is another emerging trend, though still nascent, aimed at optimizing supply chain logistics and reducing operational waste for end-users. This technological push is supporting premium product offerings and driving overall market value expansion.

Regionally, the market exhibits highly diverse dynamics, with the Asia Pacific region emerging as the unequivocal growth leader, fueled by massive, government-backed infrastructure initiatives in China, India, and Southeast Asian nations, alongside intensive urban development programs necessitating significant quarrying and foundation work. Conversely, North America and Europe, characterized by highly mature mining sectors, show stable demand driven primarily by replacement cycles and the adoption of technologically advanced, environmentally compliant drilling methods, focusing on automation and precision. Latin America continues to demonstrate strong potential, particularly in Chile and Brazil, linked to ongoing copper, iron ore, and dimensional stone extraction activities, requiring consistent supply of durable drilling tools.

Segment trends highlight the dominance of the Hexagonal Steel type due to its superior strength-to-weight ratio and suitability for demanding pneumatic drilling applications, whereas Round Steel is gaining traction in specialized, high-precision hydraulic drilling tasks requiring reduced friction. The primary end-user segment remains dimensional stone quarrying, demanding continuous, reliable drilling for block removal, followed closely by general civil construction, which utilizes integral steels for utility installation and foundational reinforcement. The shift towards automation in drilling machinery is influencing manufacturers to produce steels compatible with high-frequency, computerized rock drills, ensuring segments focused on high-efficiency operations will witness the most significant revenue increase over the forecast period, cementing integral drill steels' role as critical consumables.

AI Impact Analysis on Integral Drill Steels Market

Common user inquiries regarding AI’s influence on the Integral Drill Steels Market typically revolve around whether AI can predict tool failure, optimize drilling parameters based on geological data, or automate the steel manufacturing process. Users are keen to understand if AI-driven predictive maintenance (PDM) models can extend the lifespan of these high-wear consumables and reduce unplanned downtime in high-cost drilling operations. Concerns also focus on the potential integration of sensor technology within the steel itself or the drilling rig to collect real-time data on vibration, torque, and stress, which AI algorithms could then process to advise operators or automatically adjust machine settings. The consensus expectation is that while AI will not directly replace the physical steel product, it will fundamentally revolutionize the consumption patterns, inventory management, and application efficacy of integral drill steels by introducing unprecedented levels of operational intelligence and precision.

- AI-driven Predictive Maintenance (PDM) extends tool life by forecasting wear rates, optimizing replacement schedules, and minimizing unexpected failure.

- Enhanced inventory optimization systems use machine learning to predict consumption patterns based on project type and geological complexity, streamlining supply chains.

- Automated drilling parameter optimization utilizes AI to instantly adjust feed force and rotation speed, maximizing penetration rates while reducing undue stress on the integral steel.

- Quality control in manufacturing benefits from AI-powered visual inspection systems, ensuring superior metallurgical consistency and defect detection in heat treatment processes.

- AI-enabled geological mapping and analysis help select the optimal integral steel type (e.g., specific carbide grade or shank configuration) for challenging rock conditions.

DRO & Impact Forces Of Integral Drill Steels Market

The Integral Drill Steels Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting significant Impact Forces shaping its expansion and evolution. The primary driver is the pervasive global demand for essential commodities and infrastructure, necessitating consistent mining and construction activities, which directly translates into higher consumption of drilling consumables. Opportunities arise from technological advancements, particularly in developing ultra-high-strength steel alloys and implementing specialized carbide inserts that offer significantly increased drilling endurance and lower lifetime cost. Conversely, the market faces restraints such as volatile raw material pricing—specifically high-grade steel and tungsten carbide—which directly influences manufacturing costs and market stability, alongside the intense competition posed by alternative drilling technologies, particularly larger diameter and longer-hole drilling systems that may favor coupled rod configurations.

Impact forces currently favoring market growth include rapid urbanization across Asia and Africa, compelling governments to invest heavily in utility tunnels, metropolitan subway systems, and foundation stabilization projects, all relying on the specific short-hole capabilities of integral steels. Furthermore, stringent safety regulations in developed markets encourage the use of reliable, single-piece drilling tools to minimize on-site handling risks and potential equipment failure. This regulatory push elevates the required quality standards, rewarding manufacturers capable of delivering certified, high-performance integral solutions, thereby intensifying competitive differentiation based on quality rather than merely price point.

However, restraining impact forces related to product substitutability and longevity pose long-term challenges. As manufacturers increase the lifespan and durability of integral drill steels through advanced metallurgy and coating technologies, the required frequency of replacement purchases decreases, potentially slowing market volume growth, albeit raising market value per unit. Strategic opportunities lie in penetrating niche markets, such as precision geotechnical sampling and specialized rescue tunneling, which demand bespoke, highly durable integral steel solutions tailored to extreme operational parameters. Navigating these forces requires manufacturers to balance cost-effective production with continuous innovation in material science and application-specific customization to maintain long-term relevance in a continually evolving industrial landscape.

Segmentation Analysis

The Integral Drill Steels Market is systematically segmented based on key functional and application attributes, including the type of steel used, the diameter size, the primary application area, and the specific geographic region of consumption. This segmentation provides a crucial framework for analyzing demand patterns, identifying high-growth niches, and formulating targeted marketing strategies for manufacturers. The distinction between segments often reflects specific operational requirements; for example, smaller diameter integral steels are typically associated with precision-demanding activities like bolt hole drilling, while larger diameters cater to bulk fragmentation tasks in quarrying. Understanding the interplay between steel type (e.g., Hexagonal vs. Round) and end-user preference (e.g., Quarrying vs. Construction) is essential for predicting future revenue streams and optimizing manufacturing capacity utilization.

The segmentation by end-user industry is particularly critical, as it dictates the required steel hardness, shank configuration, and total operational hours expected from the product. Quarrying and mining demand robust steels capable of handling high stress and abrasion over extended periods, often requiring specialized carbide inserts to maintain cutting edge efficiency. In contrast, civil construction applications, while perhaps less continuously demanding, often require versatility across different rock types and adherence to strict project timelines, favoring rapid delivery and consistent quality assurance from suppliers. This diverse need matrix necessitates a highly granular approach to product development and distribution across all defined market segments.

Geographic segmentation remains paramount, reflecting the stark differences in drilling technology maturity, regulatory frameworks, and infrastructural investment cycles across global regions. High-growth areas in APAC are characterized by volume demand and competitive pricing sensitivity, whereas developed markets prioritize technological sophistication, sustainability credentials, and long-term durability, even at a higher unit cost. Consequently, manufacturers tailor their product mix and distribution channels—either direct sales to major mining conglomerates or indirect sales through specialized industrial distributors—to effectively serve the unique commercial demands of each identified segment, ensuring market penetration depth and competitive advantage sustainability.

- By Steel Type:

- Hexagonal Steel

- Round Steel

- By Diameter Size:

- Up to 25 mm

- 25 mm to 35 mm

- Above 35 mm

- By Application/End-User:

- Dimensional Stone Quarrying

- General Civil Construction (Roads, Foundations, Utilities)

- Small-Scale Underground Mining

- Tunneling and Trenching

- Geotechnical Investigation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Integral Drill Steels Market

The Integral Drill Steels market value chain commences with the upstream activities centered on the procurement and processing of specialized raw materials, primarily high-carbon alloy steel, often enriched with elements like molybdenum, chromium, and vanadium to achieve the necessary hardness, toughness, and fatigue resistance crucial for drilling applications. This stage also includes the sourcing of high-purity tungsten carbide required for the integrated bit tips. Key manufacturers often invest heavily in forging and precision machining capabilities, followed by meticulous heat treatment processes—a critical step that defines the ultimate performance and longevity of the integral steel. Controlling quality and minimizing waste at this initial stage is paramount, as defects introduced here propagate massive costs and operational risks downstream, necessitating rigorous metallurgical testing and standardization protocols throughout the production phase.

Midstream activities primarily encompass the manufacturing, grinding, and finishing of the integral steels, followed by packaging and inventory management. Distribution channels play a vital role, acting as the critical link between specialized manufacturers and globally dispersed end-users. Direct distribution is favored when dealing with large-scale mining houses or major construction conglomerates that require specialized technical support, bulk orders, and custom dimensions. In contrast, indirect distribution, leveraging regional industrial suppliers, specialized hardware dealers, and maintenance, repair, and operations (MRO) distributors, serves smaller quarrying operations, local contractors, and the high-volume replacement market, ensuring broad geographical reach and accessibility, particularly in remote mining areas where immediate availability is often a logistical challenge and a key competitive differentiator.

The downstream segment involves the ultimate application and consumption of the integral drill steels by end-users in mining, construction, and quarrying sites. Post-sale activities, including technical support, usage consultation, and, increasingly, sustainable end-of-life management (recycling or reconditioning of steel components), complete the value chain loop. The interaction between the manufacturer and the end-user is critical for continuous product improvement, as real-world performance data informs material science development and design iterations. Effective channel management, coupled with rapid inventory replenishment capabilities, ensures that operational downtime for end-users is minimized, reinforcing brand loyalty and securing long-term supply contracts, thus validating the efficiency of the entire value chain operationally and financially.

Integral Drill Steels Market Potential Customers

The primary customers for Integral Drill Steels are enterprises engaged in capital-intensive activities that necessitate reliable and high-frequency rock drilling operations, particularly those involved in extraction or foundational work across diverse geological terrains. The largest segment comprises dimensional stone quarry operators, who require consistent, shallow hole drilling for the careful extraction of granite, marble, and limestone blocks with minimal fracturing and waste, making the precision and reliability of integral steels indispensable. These customers prioritize tool durability and consistent performance to maximize block yield and minimize operational costs associated with non-productive time and frequent tool changes, often entering into long-term supply agreements with manufacturers guaranteeing specified quality and volume delivery schedules.

A significant customer base is found within the civil engineering and infrastructure development sector, including companies specializing in constructing tunnels for roads, railways, and utilities, as well as those undertaking large-scale foundation and anchor drilling projects in urban centers. These construction customers value the speed and efficiency integral steels offer in confined or complex environments where maneuverability is restricted, and precise depth control is mandatory for structural integrity. The demand here is often project-driven and cyclical, requiring suppliers to maintain flexible manufacturing capabilities to meet sudden peaks in demand related to major public works contracts, ensuring the prompt supply of correctly sized and configured drilling tools for immediate deployment across multiple high-priority sites.

Furthermore, small to medium-scale underground mining operations, particularly those utilizing pneumatic equipment for drift development, short-hole blasting, and roof bolting, represent a steady and crucial customer segment. These miners leverage the inherent simplicity and ruggedness of integral steels, particularly in environments where maintenance resources might be limited and operational continuity is critical for profitability. Geotechnical firms performing site investigations, environmental sampling, and structural testing also constitute niche but high-value customers, requiring extremely accurate, small-diameter drilling capabilities where the integral steel's ability to maintain a tight bore hole tolerance and minimize vibration damage is highly prized and non-negotiable for data validity and project adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $480 Million |

| Market Forecast in 2033 | $670 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Epiroc AB, Robit Plc, Furukawa Co., Ltd., Boart Longyear Ltd., Tungaloy Corporation, Mitsubishi Materials Corporation, Kennametal Inc., Rockmore International, Changsha Heijingang Industrial Co., Ltd., HL Rock Tools, ProDrill, Jiangsu Huiren Industrial Co., Ltd., Mincon Group Plc, Bulroc (Pty) Ltd., Digger Specialised Rock Tools, Hishimo International, Torco Inc., SMT Scharf AG, Sinosteel Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integral Drill Steels Market Key Technology Landscape

The technological landscape of the Integral Drill Steels Market is characterized by a persistent pursuit of superior material science, focusing on achieving optimal balance between hardness, wear resistance, and resistance to impact fatigue—the critical factors determining operational lifespan. Advanced metallurgical processes, including vacuum degassing and controlled forging, are employed to minimize internal defects and impurities in the alloy steel, resulting in a more homogeneous and robust structure capable of withstanding millions of stress cycles. Furthermore, sophisticated heat treatment regimes, such as complex quenching and tempering sequences, are now precisely controlled using computerized systems to tailor the microstructure of the steel, ensuring maximum core toughness coupled with surface hardness, thereby significantly boosting the steel's overall durability and drilling efficacy across varied rock conditions. These innovations in material handling are fundamental to differentiating high-quality products in the competitive global market.

Beyond the base material, significant technological advancement is concentrated on the integrated tungsten carbide inserts, which are the primary interface for rock fragmentation. Manufacturers are utilizing proprietary cemented carbide grades that incorporate rare earth elements or novel binding agents to enhance abrasive resistance and thermal stability, crucial when dealing with extremely hard or highly abrasive rock formations like quartzite or certain types of granite. The geometry and secure attachment method of these carbide inserts—often through specialized hot press fitting or vacuum brazing techniques—are continually refined to optimize energy transfer and prevent premature detachment or chipping, a common mode of failure in high-stress drilling. The objective is to maximize the time the integral steel remains effective in the hole before needing replacement, directly impacting the end-user's productivity metrics and operational profitability.

Another crucial technological development involves surface engineering and protective coatings applied to the integral drill steels. Specialized surface treatments, such as shot peening, which introduces compressive residual stresses on the surface, dramatically increases the steel’s resistance to fatigue cracking, extending the operational life in high-vibration environments. Furthermore, protective coatings, including advanced anti-corrosion and friction-reducing layers (e.g., specialized polymers or thin film depositions), are being investigated and implemented to improve drilling performance in wet environments and minimize energy loss due to frictional heat generated against the borehole wall. While these integral steels typically operate at shorter lengths, ensuring maximum energy transmission and fatigue resistance through technological refinement remains the core strategy for market leadership, pushing the boundaries of conventional steel mechanics and carbide durability.

Regional Highlights

The global demand for integral drill steels is heavily influenced by regional infrastructure spending and natural resource extraction activities, leading to distinct market maturity levels and growth trajectories across major geographical regions. Asia Pacific (APAC) currently dominates the market both in terms of consumption volume and growth rate, primarily driven by massive urbanization projects, extensive road and rail network expansion (including complex tunneling work in countries like China and India), and robust growth in the dimensional stone industry throughout Southeast Asia. The intense construction cycles in this region necessitate a constant supply of reliable, cost-effective drilling consumables, positioning APAC as the central hub for manufacturing and consumption, characterized by highly competitive pricing structures and rapid technological absorption.

North America and Europe represent mature markets characterized by sophisticated, high-efficiency drilling operations and a strong emphasis on worker safety and environmental compliance. Demand here is stable, largely driven by replacement needs, technological upgrades compatible with highly automated drilling rigs, and niche applications such as specialized civil engineering and complex refurbishment projects. European markets, in particular, show a strong preference for products adhering to strict quality standards and longevity, valuing tool life extension over initial unit cost, which encourages innovation in high-durability alloy steels and advanced surface treatments. The mining sectors in these regions, while mature, maintain consistent demand for integral steels in smaller-scale, precision blasting applications and ground support work.

Latin America and the Middle East & Africa (MEA) are emerging as significant growth contributors. Latin America, particularly countries rich in mineral resources like Chile, Brazil, and Peru, drives consistent demand through copper, iron ore, and gold mining activities, alongside ongoing infrastructure development connecting remote resource sites. MEA’s market growth is tied to developing economies investing in initial infrastructure build-out, including utilities and basic tunneling, particularly in South Africa, Morocco, and the GCC nations. However, these regions often face challenges related to logistical complexity and volatile geopolitical environments, necessitating localized distribution and support systems to maintain supply chain resilience and effectively cater to the diverse needs of both large international mining operators and smaller local contractors.

- Asia Pacific (APAC): Leads global consumption due to extensive tunneling, infrastructure projects (e.g., high-speed rail, metro systems), and large-scale dimensional stone quarrying in China, India, and Vietnam.

- North America: Stable, high-value market focused on replacement demand, adopting high-tech integral steels for highly automated mining operations and specialized foundation drilling.

- Europe: Characterized by demand for high-performance, durable tools meeting stringent environmental and safety regulations; strong reliance on integral steels for complex civil tunneling and quarrying operations.

- Latin America: High growth potential fueled by continued investment in copper and iron ore mining, requiring robust drilling consumables for resource extraction and related infrastructure development.

- Middle East and Africa (MEA): Growth driven by regional construction booms and foundational infrastructure projects, with concentrated demand around specific resource hubs in South Africa and key construction centers in the Gulf region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integral Drill Steels Market.- Sandvik AB

- Epiroc AB

- Robit Plc

- Furukawa Co., Ltd.

- Boart Longyear Ltd.

- Tungaloy Corporation

- Mitsubishi Materials Corporation

- Kennametal Inc.

- Rockmore International

- Changsha Heijingang Industrial Co., Ltd.

- HL Rock Tools

- ProDrill

- Jiangsu Huiren Industrial Co., Ltd.

- Mincon Group Plc

- Bulroc (Pty) Ltd.

- Digger Specialised Rock Tools

- Hishimo International

- Torco Inc.

- SMT Scharf AG

- Sinosteel Corporation

Frequently Asked Questions

Analyze common user questions about the Integral Drill Steels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes integral drill steels from conventional coupled drilling systems?

Integral drill steels are single-piece units combining the rod and bit connection, offering superior energy transmission, enhanced rigidity, and reduced failure points compared to coupled systems, making them ideal for high-precision, short-hole drilling applications.

Which industries are the primary consumers of Integral Drill Steels?

The primary consumers are the dimensional stone quarrying industry, utilizing them for precise block separation, and the civil construction sector, relying on them for foundation drilling, tunneling, and utility installation in urban and infrastructural projects.

How is market growth influenced by material science advancements?

Market growth is significantly influenced by material science, as innovations in high-alloy steel composition, advanced heat treatment processes, and superior tungsten carbide grades directly increase the operational lifespan and performance efficiency of the steels, driving adoption and replacement cycles.

What key factors determine the lifespan and durability of an integral drill steel?

The lifespan is primarily determined by the quality of the alloy steel (fatigue resistance), the integrity of the heat treatment (toughness and hardness balance), the abrasive resistance of the integrated carbide tip, and correct operational practices (feed pressure and rotational speed alignment).

Which geographical region exhibits the fastest growth rate for integral drill steels?

The Asia Pacific (APAC) region currently demonstrates the fastest growth rate, driven by massive public and private sector investments in infrastructure development, tunneling, and rapid urbanization across major economies like China, India, and Southeast Asia.

The Integral Drill Steels Market, though mature in application, continues to evolve technologically, particularly in material composition and manufacturing precision, ensuring its irreplaceable role in various high-demand resource extraction and civil engineering projects globally. Manufacturers are continuously focused on maximizing the fatigue strength and abrasive resistance of their products, acknowledging that operational efficiency and minimization of downtime are the key purchasing criteria for end-users across all geographic segments. The competitive environment is characterized by large, established global suppliers competing on innovation and comprehensive service packages, while regional manufacturers often leverage cost efficiencies and localized distribution networks to capture market share. Sustainable practices, including the development of steels with higher recyclability rates and the implementation of cleaner manufacturing processes, are becoming increasingly important competitive factors, especially in environmentally conscious markets in Europe and North America, setting the stage for future regulatory compliance and operational requirements. Further investment in predictive maintenance integration and digital connectivity for monitoring tool usage will solidify the value proposition of integral drill steels in the next phase of industrial digitalization.

A crucial consideration for future market development is the evolving regulatory landscape surrounding dust suppression and noise pollution in drilling operations, particularly in urban and confined tunneling environments. Integral drill steel design must continually adapt to accommodate newer drilling techniques, such as water-flushing systems and advanced pneumatic mufflers, without compromising the fundamental energy transfer efficiency. This necessitates collaborative innovation between drill steel manufacturers and original equipment manufacturers (OEMs) of rock drilling machines. The longevity offered by premium integral steels minimizes the volume of steel waste generated on site, aligning with global trends toward reducing environmental footprints in construction and mining. This trend reinforces the market’s pivot towards quality-driven consumables over purely price-sensitive offerings, ensuring that technological excellence remains the core driver of market penetration and profitability in the long term. The sustained expansion of global mining exploration into deeper and harder rock formations further mandates the continuous refinement of integral steel properties to withstand increasingly extreme operational stresses and temperatures, pushing the boundaries of metallurgical science.

Given the capital intensity of the end-user industries, procurement decisions related to integral drill steels are often centralized and highly scrutinized, focusing not only on unit cost but also on the total cost of ownership (TCO), including labor efficiency gains and reduced maintenance expenditures. Suppliers capable of providing comprehensive logistical support, including guaranteed regional stock levels and rapid technical assistance, gain a substantial competitive edge. The market is also witnessing a gradual shift towards leasing or performance-based contracts, particularly for specialized, high-cost integral tools used in critical tunneling projects, allowing end-users to manage capital expenditure while ensuring access to the latest, most efficient drilling technology. This business model innovation provides a stable revenue stream for key manufacturers and enhances market resilience against short-term economic fluctuations. The continued strong performance in developing economies, coupled with strategic innovation in mature markets, assures the Integral Drill Steels Market of stable and predictable growth throughout the projected forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager