Integral Horsepower Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432654 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Integral Horsepower Motors Market Size

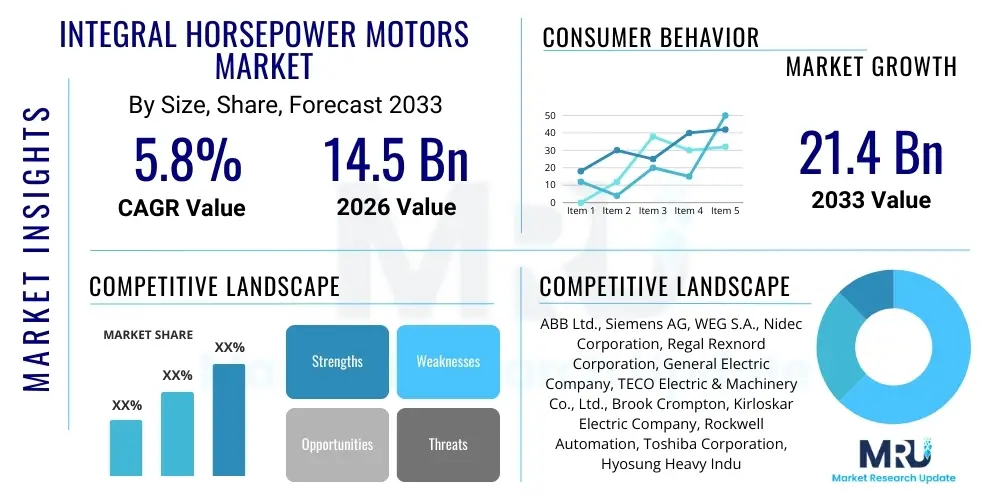

The Integral Horsepower Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 21.4 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by stringent global energy efficiency regulations, particularly the adoption of IE3 and IE4 standards, which necessitate the replacement and upgrade of older, less efficient motor installations across key industrial sectors worldwide. Furthermore, the rapid industrialization in emerging economies, coupled with increased automation in manufacturing and processing plants, drives the consistent demand for high-performance, reliable integral horsepower motors designed for continuous operation under demanding conditions. The market expansion is also fundamentally tied to capital expenditure cycles in heavy industries suchating mining, oil and gas, utilities, and chemicals, where these motors serve as the core power source for large pumps, compressors, and fans.

Integral Horsepower Motors Market introduction

The Integral Horsepower Motors Market encompasses electric motors generally rated above one horsepower (or 0.746 kW), designed primarily for continuous industrial applications requiring high power output and reliability. These motors are the workhorses of industrial infrastructure, powering critical mechanical equipment such as massive centrifugal pumps, industrial compressors, conveyor systems, and heavy-duty blowers in complex operational environments. The fundamental product line includes AC induction motors (the largest segment), permanent magnet motors, and synchronous motors, categorized based on their design, operating principles, and efficiency profiles, often adhering to international standards such as NEMA (North American) or IEC (International Electrotechnical Commission).

Major applications of integral horsepower motors span across various heavy industries, notably oil and gas exploration, chemical processing, power generation (both conventional and renewable), water and wastewater management, and metals and mining. The enduring benefits associated with modern integral horsepower motors include enhanced energy efficiency, significantly reduced operational costs over their lifespan, improved power density allowing for smaller footprints, and superior torque capabilities suitable for starting high-inertia loads. The integration of Variable Frequency Drives (VFDs) with these motors further enhances speed control and energy savings, making them indispensable components in modern automated manufacturing setups. The shift towards electrification and the pursuit of operational sustainability are key tenets defining the market's current environment.

Driving factors for this market are multi-faceted, heavily influenced by global legislative frameworks prioritizing energy conservation. Government mandates compelling industries to upgrade to high-efficiency motors (IE3, IE4, and eventually IE5) serve as a fundamental market catalyst, forcing rapid replacement cycles. Moreover, the increasing adoption of Industry 4.0 principles, integrating motors with IoT and predictive maintenance systems, is enhancing the value proposition of modern integral motors. The sustained growth of critical infrastructure projects, particularly in Asia Pacific and the Middle East, demanding large-scale pumping and ventilation systems, further bolsters the market's trajectory, ensuring consistent demand for motors rated for severe duty cycles.

Integral Horsepower Motors Market Executive Summary

The Integral Horsepower Motors market is currently defined by an overwhelming shift towards high-efficiency technologies, driven by global regulatory pressures and the tangible economic benefits derived from reduced energy consumption. Key business trends include aggressive merger and acquisition activities focused on acquiring advanced permanent magnet motor technologies and expanding digital service offerings related to motor monitoring and maintenance. Manufacturers are increasingly prioritizing supply chain resilience, mitigating risks associated with critical raw materials such as rare earth magnets and specialized copper windings, while simultaneously investing heavily in automated manufacturing processes to maintain competitive pricing and improve quality control. The competitive landscape is characterized by a balance between multinational giants offering comprehensive product portfolios and specialized regional players focusing on niche applications or extreme operating conditions.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, fueled by unprecedented expansion in manufacturing capacity, rapid urbanization, and massive infrastructure investments in countries like China, India, and Southeast Asian nations. North America and Europe, while being mature markets, exhibit strong demand for replacement motors and high-value, digitally integrated products, driven by stringent mandates like the U.S. Department of Energy’s motor efficiency standards and the EU’s Ecodesign Directive. Furthermore, emerging markets in Latin America and the Middle East are showing accelerated growth, particularly within the oil and gas sector and water utilities, demanding robust, explosion-proof, and corrosion-resistant integral horsepower solutions tailored for harsh environments and remote operations.

Segmentation trends highlight a decisive movement towards Synchronous Motors, especially Permanent Magnet Synchronous Motors (PMSMs), due to their superior efficiency (often exceeding IE4 standards) and compact design, making them ideal partners for VFD applications. While AC Induction Motors still hold the highest market share by volume, their growth is predominantly limited to standard industrial applications, whereas specialized segments are rapidly adopting advanced motor types. By end-user, the HVAC and Water & Wastewater industries are exhibiting the fastest growth rates, driven by the necessity for advanced fluid handling systems in smart buildings and expanding public utility infrastructure. The adoption of smart motor controls and condition monitoring systems is becoming a mandatory requirement across almost all high-power motor installations, pushing manufacturers to standardize integrated sensor technology.

AI Impact Analysis on Integral Horsepower Motors Market

User queries regarding the impact of Artificial Intelligence on the Integral Horsepower Motors Market primarily revolve around operational efficiency gains, the potential for zero-downtime manufacturing, and the economic justification for implementing costly monitoring systems. Common questions address how AI can accurately predict motor failures, optimize energy consumption based on real-time load conditions, and whether current motor designs are compatible with AI-driven monitoring platforms. Users are keen to understand the shift from traditional reactive or time-based maintenance to true predictive maintenance (PdM) enabled by machine learning algorithms analyzing vibration, temperature, current, and acoustic signatures. The central concern is the complexity and cost of integrating AI solutions versus the guaranteed reduction in unplanned downtime and maximizing the motor's operational lifespan, alongside the need for standardized data protocols across different manufacturers.

AI is fundamentally transforming the lifecycle management of integral horsepower motors, shifting the emphasis from hardware robustness to intelligent operational control and preemptive diagnostics. By deploying advanced sensor arrays (Internet of Things or IoT) on motors, massive amounts of operational data are collected, which AI algorithms then process to detect subtle anomalies indicative of impending component failure (e.g., bearing wear, insulation degradation, rotor bar cracks). This capability allows end-users to schedule maintenance precisely when necessary, minimizing disruption and maximizing asset utilization, which is critically important for continuous process industries like chemical production or power generation. The transition catalyzed by AI moves motors from being purely mechanical assets to critical data generation points within the industrial ecosystem.

Furthermore, AI-powered control systems are optimizing motor performance in real-time, especially when integrated with Variable Frequency Drives (VFDs). Instead of relying on static programming, AI learns the system's dynamic load characteristics and adjusts motor speed and torque requirements to maintain optimal efficiency and power factor correction under fluctuating operational demands. This dynamic optimization is crucial in mitigating energy waste that often occurs when motors run at partial loads. As data lakes grow larger and AI models become more sophisticated, the motor maintenance and control segment is expected to become a highly service-oriented business, focusing on delivering uptime and efficiency metrics rather than just selling hardware.

- Predictive Maintenance (PdM): AI algorithms analyze real-time sensor data (vibration, heat, current) to forecast component failures with high accuracy, drastically reducing unplanned downtime.

- Energy Optimization: Machine learning models dynamically adjust motor operating parameters via VFDs based on varying loads to ensure peak energy efficiency (IE5 performance level realization).

- Anomaly Detection: Rapid identification of operational deviations caused by external factors (e.g., pipe clogging, pump cavitation) or internal motor issues, ensuring timely intervention.

- Automated Fault Diagnostics: Self-diagnosis capabilities embedded in smart motors, reducing the need for specialized human analysis and accelerating repair timelines.

- Asset Performance Management (APM): AI systems aggregate motor data across entire fleets, providing comprehensive performance benchmarking and life cycle extension strategies.

DRO & Impact Forces Of Integral Horsepower Motors Market

The Integral Horsepower Motors Market is profoundly shaped by a confluence of powerful drivers related to global energy policies and industrial modernization, counterbalanced by persistent restraints concerning raw material sourcing and the high initial capital expenditure required for high-efficiency installations. Opportunities are emerging primarily through the digitalization of motor systems and expansion into rapidly growing sectors such as renewable energy infrastructure and advanced wastewater treatment plants. The cumulative impact forces, therefore, lean towards accelerated adoption of advanced motor technologies, propelled by regulatory mandates but occasionally hindered by economic volatility and the complexities inherent in standardizing global efficiency codes, creating a market environment prioritizing long-term operational savings over immediate purchase price considerations.

Key drivers include mandatory governmental regulations, notably the implementation of IE3 (Premium Efficiency) and IE4 (Super Premium Efficiency) standards across North America, Europe, and increasingly in Asia, compelling industrial users to phase out lower-efficiency motors. The rising cost of industrial electricity worldwide further acts as a powerful financial driver, making the return on investment (ROI) for higher-efficiency motors significantly shorter and more attractive. Conversely, major restraints involve the volatile pricing and supply chain fragility of key raw materials, particularly copper, electrical steel (silicon steel), and rare earth metals essential for Permanent Magnet Synchronous Motors (PMSMs). Furthermore, the high initial cost of IE4 and IE5 rated motors, coupled with the complexity of retrofitting existing industrial infrastructure, presents a significant barrier to entry, particularly for Small and Medium Enterprises (SMEs) operating under tight budget constraints.

The market is rich with opportunities centered on the proliferation of smart motors and integrated control systems, leveraging IoT and AI to provide superior performance and maintenance services. The increasing global focus on decarbonization and electrification presents substantial opportunities in sectors like electric vehicle manufacturing facilities and utility-scale solar and wind farms requiring sophisticated pumping and tracking systems. The shift towards modular and customizable motor solutions, designed specifically for harsh or hazardous environments (e.g., explosion-proof motors for chemical plants), also represents a vital avenue for market expansion and differentiation among key manufacturers. The comprehensive impact forces ensure that while short-term economic factors may slow demand, the underlying long-term structural demand for efficiency and reliability will continue to dominate market growth.

Segmentation Analysis

The Integral Horsepower Motors Market is extensively segmented across multiple dimensions to accurately reflect the diversity of products and applications required by the global industrial sector. Primary segmentation is based on Motor Type, distinguishing between the dominant AC Induction Motors, increasingly prevalent Permanent Magnet Synchronous Motors (PMSMs), and specialized DC Motors. A critical secondary segmentation focuses on Efficiency Class (IE standards: IE3, IE4, IE5), reflecting the regulatory environment and technological advancements driving motor replacement cycles. Furthermore, segmentation by End-User Industry provides crucial insights into demand concentration, ranging from heavy process industries like Oil & Gas and Metals & Mining to rapidly growing sectors such as HVAC and Water Treatment, each demanding motors tailored to specific operational requirements like duty cycle, ingress protection (IP rating), and hazardous area classification.

The segmentation by Voltage Range is also paramount, dividing the market into Low Voltage (LV), Medium Voltage (MV), and High Voltage (HV) motors, corresponding directly to the scale and power output of the industrial application. LV motors (up to 1,000V) are common in general manufacturing and auxiliary plant equipment, while MV and HV motors (1kV to 15kV) are essential for massive pumps, large compressors, and main drive systems in power plants and mining operations. This voltage-based categorization dictates the complexity of motor insulation, control systems, and cooling methods. The technological divergence within these segments is noticeable, with higher voltages often requiring custom-engineered solutions and advanced diagnostics, whereas LV motors are increasingly standardized and mass-produced for broad distribution.

Geographic segmentation remains vital, highlighting the contrasting growth dynamics between mature markets (North America, Western Europe) focused on premium efficiency and digitalization, and emerging markets (APAC, MEA) characterized by high volume installations driven by greenfield projects and rapid infrastructure build-out. Analyzing these segmentations allows stakeholders to identify specific pockets of demand, such as the increasing demand for explosion-proof (Ex) motors in the chemicals sector or the volume sales of IE3 motors driven by minimum efficiency mandates. The continuous innovation in motor materials and design, particularly the shift towards PMSMs and Synchronous Reluctance Motors (SynRMs), indicates that the Efficiency Class segment will experience the most rapid evolution and value growth over the forecast period, impacting market share distribution across all other segments.

- By Motor Type:

- AC Induction Motors (Asynchronous)

- Permanent Magnet Synchronous Motors (PMSM)

- DC Motors (Less prevalent, specific niche uses)

- Synchronous Reluctance Motors (SynRM)

- By Efficiency Class (IE Standard):

- IE3 (Premium Efficiency)

- IE4 (Super Premium Efficiency)

- IE5 (Ultra-Premium Efficiency)

- By Output Power (Approximate Range):

- 1 HP to 50 HP

- 51 HP to 200 HP

- Above 200 HP

- By End-User Industry:

- Oil and Gas

- Mining and Metals

- Power Generation (Utility and Industrial)

- Water and Wastewater Treatment

- HVAC (Heating, Ventilation, and Air Conditioning)

- Chemical, Petrochemical, and Cement

- Pulp and Paper

Value Chain Analysis For Integral Horsepower Motors Market

The Value Chain for the Integral Horsepower Motors Market is intricate, starting with the sourcing of specialized raw materials and extending through complex, high-precision manufacturing processes and multi-layered distribution networks. The upstream segment is defined by the procurement of high-grade copper wire for windings, electrical steel laminations for rotors and stators (critical for minimizing core losses), and increasingly, rare earth materials like neodymium and dysprosium for advanced permanent magnets. Volatility in the commodity markets for these materials, particularly geopolitical tensions impacting rare earth supply, directly affects manufacturing costs and lead times, necessitating robust supply chain risk management strategies among major motor manufacturers.

The core manufacturing stage involves highly automated processes including winding, varnishing, precise balancing, and assembly, which demand significant capital investment in machinery and strict quality control to meet efficiency and durability standards (e.g., NEMA Premium or IE4). Downstream activities primarily encompass distribution, installation, commissioning, and extensive aftermarket services. Distribution channels are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) who integrate the motors into their machinery (e.g., compressor manufacturers) and indirect sales through a vast network of authorized distributors, system integrators, and value-added resellers (VARs) who cater to maintenance, repair, and overhaul (MRO) markets and general industrial end-users.

The distribution landscape is characterized by the necessity for specialized technical support; distributors often require expertise in motor sizing, efficiency calculation, and compatibility with Variable Frequency Drives (VFDs). The increasing importance of digital services means that the downstream value chain now includes service providers focusing on installing and maintaining IoT sensors, data analytics platforms, and predictive maintenance software, often creating recurring revenue streams for manufacturers. The effectiveness of the value chain is measured by the speed of delivery for custom-configured motors and the availability of essential spare parts, ensuring minimal operational downtime for end-users.

Integral Horsepower Motors Market Potential Customers

Potential customers for integral horsepower motors are fundamentally large industrial enterprises and public utilities whose operations depend on continuous, high-power mechanical movement. The end-users primarily reside within energy-intensive sectors where the motor asset base is extensive and operational uptime is non-negotiable. Key buyer groups include equipment manufacturers (OEMs) who integrate these motors into finished products such as industrial gearboxes, large chiller units, and specialized machinery, and institutional end-users who purchase motors directly for plant expansion, modernization, or replacement cycles (MRO).

The Oil and Gas sector (upstream, midstream, and downstream) represents a massive consumer base, requiring robust, often explosion-proof (Class I, Division 1 or 2) motors for pump jacks, pipeline booster pumps, and large compressors used in processing plants. Similarly, the Water and Wastewater Treatment sector is a rapidly expanding customer segment driven by global urbanization and increased regulation of water quality, requiring highly reliable motors for aeration blowers, large transfer pumps, and mixers, with a strong preference for high-efficiency IE4/IE5 ratings to mitigate exorbitant energy bills associated with continuous operation.

Furthermore, the Metals and Mining industry relies heavily on integral horsepower motors to power massive conveyors, crushers, grinding mills, and ventilation systems, often operating in dusty, high-vibration, and remote conditions. In the Power Generation segment, customers include utility companies and independent power producers utilizing these motors for cooling water pumps, boiler feed pumps, and fan systems. The purchasing decisions of these institutional customers are driven less by initial cost and more by total cost of ownership (TCO), lifetime energy savings, demonstrated reliability metrics, and the availability of sophisticated service and maintenance contracts provided by the motor manufacturer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, WEG S.A., Nidec Corporation, Regal Rexnord Corporation, General Electric Company, TECO Electric & Machinery Co., Ltd., Brook Crompton, Kirloskar Electric Company, Rockwell Automation, Toshiba Corporation, Hyosung Heavy Industries, Franklin Electric Co., Inc., Marathon Electric, Maxon Motor AG, Leroy-Somer (Nidec), VEM Group, Mitsubishi Electric Corporation, Rotor S.p.A., Tatung Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integral Horsepower Motors Market Key Technology Landscape

The Integral Horsepower Motors market is currently undergoing a significant technological renaissance, moving away from conventional AC induction technology towards solutions that offer superior efficiency and power density, largely driven by regulatory compliance and the demand for smarter operations. A foundational shift involves the adoption of Permanent Magnet Synchronous Motors (PMSMs) and Synchronous Reluctance Motors (SynRMs). PMSMs leverage rare earth magnets embedded in the rotor to eliminate rotor losses, achieving efficiencies that frequently surpass IE4 standards, particularly beneficial in applications requiring high dynamic response and precise speed control. SynRMs, on the other hand, achieve high efficiency without permanent magnets, reducing dependence on volatile rare earth supplies, making them an economically attractive and sustainable high-efficiency option, particularly when paired with VFDs.

The most pervasive technological advancement impacting the market is the integration of Internet of Things (IoT) capabilities and advanced sensor technology directly into the motor housing. This shift results in "smart motors" equipped with integrated sensors monitoring key parameters such as vibration, bearing temperature, winding temperature, and voltage/current fluctuations in real-time. This continuous data stream facilitates predictive maintenance (PdM), moving maintenance scheduling away from calendar-based routines and toward condition-based monitoring, dramatically improving asset longevity and minimizing catastrophic failures. The communication protocols, such as industrial Ethernet and standardized cloud platforms, are crucial components of this connected technology landscape, ensuring seamless data flow to centralized asset management systems.

Furthermore, innovation in material science plays a critical role, focusing on developing lower-loss electrical steel laminations and advanced insulation systems capable of withstanding the high switching frequencies and voltage spikes introduced by Variable Frequency Drives (VFDs). The motors are increasingly designed with enhanced thermal management solutions, including optimized cooling fins and specialized cooling circuits, essential for maintaining peak performance and ensuring motor longevity when operating under demanding IE4 and IE5 efficiency regimes, which inherently generate higher operational heat in certain components. These technological advancements collectively contribute to a paradigm where the motor is not just a power converter but an intelligent, network-enabled asset within the industrial infrastructure.

Regional Highlights

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (APAC) (China, India, Japan, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa)

The North American market is highly mature but characterized by strong replacement demand driven by stringent energy efficiency regulations, primarily those mandated by the Department of Energy (DOE). The region is a leader in adopting high-efficiency IE4 motors and integrated smart motor solutions (IoT-enabled). Investment is heavily concentrated in the downstream segments, particularly oil and gas midstream operations, large-scale HVAC systems for commercial real estate, and modernization of aging manufacturing plants. The U.S. represents the largest market share in the region, focusing on total cost of ownership (TCO) analysis for purchasing decisions, favoring suppliers who offer robust service contracts and advanced predictive maintenance solutions. Canadian demand is similarly efficiency-driven, with significant uptake in the mining and pulp and paper industries where continuous operation is essential.

The regulatory framework, combined with high electricity costs relative to some other global regions, provides a substantial economic incentive for rapid migration to premium efficiency motors. Key manufacturers are focusing on establishing local assembly and service centers to cater to the specific NEMA standards and certification requirements of the region. Furthermore, the expansion of renewables and electric vehicle manufacturing facilities within the U.S. is creating new, highly specialized demand for specific high-power, high-dynamic motors, ensuring sustained growth in the value-added segment of the market.

Europe is defined by the rigorous implementation of the Ecodesign Directive, mandating the sale and installation of IE3 and IE4 efficiency class motors across nearly all power ranges, making it one of the most technologically advanced markets. The region demonstrates strong demand for synchronous motors (PMSM and SynRM) due to their superior efficiency profiles, crucial for achieving ambitious European decarbonization goals. Germany and Italy are pivotal manufacturing hubs, both for motor production and the machinery (OEM) sector that integrates these motors, driving significant internal demand and export volumes.

The focus in Europe extends beyond mere efficiency to include sophisticated control and digitalization, aligning with Industry 4.0 initiatives. There is high penetration of VFDs across all integral horsepower applications, maximizing energy savings and process control flexibility. The water and wastewater treatment sector and the automotive manufacturing industry (adapting to EV production lines) are key growth verticals. The market is also heavily influenced by circular economy principles, leading to increased demand for robust, repairable motors and comprehensive lifecycle management services offered by manufacturers.

APAC stands as the largest and fastest-growing regional market, primarily driven by rapid industrialization, urbanization, and massive government investment in infrastructure and manufacturing capacity expansion. China dominates the market both in terms of consumption and production, fueled by massive capital investments in power generation, metals, and industrial automation. India is experiencing explosive growth due to ambitious "Make in India" campaigns and the modernization of its utilities and infrastructure, leading to a huge volume demand for integral horsepower motors, often balancing cost against the newly implemented national efficiency standards.

While the volume market often centers on cost-competitive IE2/IE3 solutions, key countries like Japan and South Korea demonstrate demand comparable to Europe and North America, focusing on advanced IE4 technology and robotics integration. The region faces challenges related to inconsistent efficiency mandate enforcement across all territories, leading to varied technological adoption rates. However, the sustained growth in heavy industries and the increasing necessity for reliable, durable motors in demanding environments ensures that APAC remains the critical global driver for market expansion over the forecast period.

The Latin American market is exhibiting steady growth, driven largely by capital expenditure cycles in the mining sector (Chile, Peru), oil and gas production (Brazil, Mexico), and infrastructure development. Brazil, possessing a robust domestic manufacturing base and significant industrial activity, leads the region. Market adoption is increasingly influenced by regional efficiency standards, although enforcement can be sporadic compared to G7 nations. The region presents strong opportunities for retrofitting projects, replacing outdated, inefficient motors prevalent in older facilities.

MEA growth is intrinsically linked to massive investments in hydrocarbon extraction, processing, and transportation infrastructure, creating high demand for explosion-proof and high-power motors capable of handling high temperatures and severe operating conditions. Saudi Arabia and the UAE are also major investors in large-scale water desalination and utility projects, necessitating specialized integral horsepower pump motors. South Africa, driven by its expansive mining sector, remains a key consumer. The regional demand profile favors specialized, reliable, and durable motors over mass-market general purpose units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integral Horsepower Motors Market.- ABB Ltd.

- Siemens AG

- WEG S.A.

- Nidec Corporation

- Regal Rexnord Corporation

- General Electric Company

- TECO Electric & Machinery Co., Ltd.

- Brook Crompton

- Kirloskar Electric Company

- Rockwell Automation

- Toshiba Corporation

- Hyosung Heavy Industries

- Franklin Electric Co., Inc.

- Marathon Electric

- Maxon Motor AG

- Leroy-Somer (Nidec)

- VEM Group

- Mitsubishi Electric Corporation

- Rotor S.p.A.

- Tatung Company

Frequently Asked Questions

Analyze common user questions about the Integral Horsepower Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Integral Horsepower Motors Market?

The primary driver is the enforcement of global energy efficiency regulations, specifically the mandatory adoption of IE3 (Premium) and IE4 (Super Premium) efficiency standards, necessitating the replacement of older, less efficient industrial motor fleets worldwide to reduce carbon emissions and operational costs.

How is AI impacting the maintenance of integral horsepower motors?

AI facilitates the shift to true Predictive Maintenance (PdM) by analyzing real-time data from IoT sensors (vibration, temperature). This allows industrial users to forecast potential failures and schedule maintenance precisely, maximizing uptime and significantly extending the motor's operational life.

Which motor type is gaining market share due to superior efficiency?

Permanent Magnet Synchronous Motors (PMSMs) and Synchronous Reluctance Motors (SynRMs) are rapidly gaining market share, particularly in applications paired with Variable Frequency Drives (VFDs), as they offer efficiencies that often exceed regulatory mandates (IE4 and beyond) while providing high power density.

Which geographic region demonstrates the highest growth potential for this market?

The Asia Pacific (APAC) region, led by China and India, exhibits the highest growth potential, driven by rapid industrial expansion, massive investments in manufacturing automation, and the continuous build-out of critical infrastructure like power generation and water treatment facilities.

What are the main risks associated with the Integral Horsepower Motors supply chain?

The main risks include the price volatility and geopolitical supply constraints concerning critical raw materials, primarily high-grade copper wire, electrical steel laminations, and rare earth elements necessary for high-efficiency permanent magnet motor construction.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager