Integrally Geared Centrifugal Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435463 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Integrally Geared Centrifugal Compressor Market Size

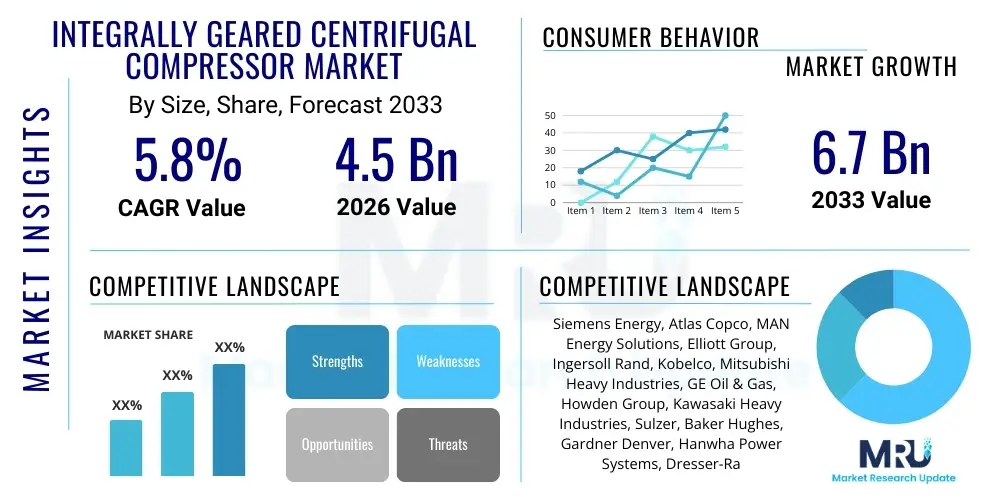

The Integrally Geared Centrifugal Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Integrally Geared Centrifugal Compressor Market introduction

The Integrally Geared Centrifugal Compressor (IGCC) market is defined by advanced turbo-machinery engineered for high-efficiency and compact compression solutions across various industrial sectors. IGCCs utilize a single gearbox to drive multiple impeller stages, allowing each stage to operate at its optimal, independent speed. This design significantly improves aerodynamic performance and mechanical efficiency compared to conventional straight-through compressors, leading to lower energy consumption and reduced operational footprints. Their architecture supports diverse configurations, ranging from multi-stage air compression to highly specialized gas handling in complex chemical processes, making them indispensable in modern industrial infrastructure.

These compressors are widely adopted across heavy industries primarily due to their superior efficiency, robust construction, and ability to handle large volumes of gas at variable flow rates and pressures. Major applications include upstream and midstream oil and gas operations, petrochemical refining, chemical processing (such as fertilizer production and ethylene synthesis), and crucial utility roles like air separation and industrial refrigeration. The inherent benefits, such as oil-free compression options and simplified maintenance procedures due to modular design, further solidify their position as the preferred choice over traditional compressor technologies in applications demanding stringent reliability and performance metrics.

Key driving factors propelling market expansion include accelerating industrialization across developing economies, stringent global regulations aimed at improving energy efficiency in manufacturing, and substantial investment in the modernization of existing industrial plants. Furthermore, the growing demand for specialized gases and the expansion of Liquefied Natural Gas (LNG) infrastructure, where highly efficient compression is mandatory, are crucial drivers. The market is also benefiting from continuous technological advancements focused on integrating predictive maintenance capabilities and utilizing advanced materials to enhance durability and operational lifespan under extreme conditions.

Integrally Geared Centrifugal Compressor Market Executive Summary

The global Integrally Geared Centrifugal Compressor (IGCC) market is currently undergoing significant transformation, driven by a convergence of sustainability mandates, industrial digital integration, and shifting energy paradigms. Business trends indicate a strong move towards customization and modularity, allowing manufacturers to rapidly deploy application-specific solutions that cater to nuanced process requirements, particularly in complex petrochemical synthesis and carbon capture utilization and storage (CCUS) projects. Furthermore, strategic collaborations and mergers among key players are intensifying competition while simultaneously facilitating the exchange of specialized technologies, particularly in magnetic bearing systems and advanced aerodynamic modeling software, which are critical for maximizing compressor uptime and performance.

Regionally, the Asia Pacific (APAC) continues to lead the market, fueled by massive infrastructure development, robust growth in the chemical and fertilizer sectors in countries like China and India, and significant investments in industrial power generation capacity. North America, characterized by its mature oil and gas sector and a burgeoning interest in sustainable energy projects, shows strong demand for high-capacity, heavy-duty compressors, especially related to natural gas processing and blue hydrogen production. Meanwhile, Europe is driven primarily by regulatory pressures enforcing energy efficiency and decarbonization targets, leading to increased adoption of IGCCs in industrial air compression and heat pump applications.

Segment trends highlight the dominance of the multi-stage segment due to its versatility and suitability for high-pressure ratio requirements common in industrial applications like syngas production and complex refining processes. Application-wise, the Oil & Gas sector remains the largest consumer, although the Chemical & Petrochemical segment is exhibiting the highest projected growth rate, driven by the construction of mega-refineries and specialty chemical production facilities globally. Capacity trends show increasing demand for large-capacity units (above 100,000 m3/hr) as industrial processes scale up to meet global consumption needs, coupled with rising adoption of smaller, localized units for specific niche applications requiring high reliability.

AI Impact Analysis on Integrally Geared Centrifugal Compressor Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Integrally Geared Centrifugal Compressor market frequently revolve around how AI can enhance operational expenditure efficiency, extend component lifespan, and optimize complex control parameters in real-time. Users are specifically concerned about the feasibility of integrating legacy systems with new AI-powered diagnostic platforms and the tangible Return on Investment (ROI) derived from AI-driven predictive maintenance programs. Furthermore, there is considerable interest in how machine learning algorithms can be utilized during the design phase to rapidly simulate and optimize compressor aerodynamics and mechanical performance, thereby reducing prototyping costs and time-to-market for specialized units.

The implementation of AI is fundamentally transforming the lifecycle management of IGCCs, shifting maintenance strategies from time-based or reactive approaches to highly granular predictive models. AI algorithms analyze vast datasets—including vibration monitoring, temperature readings, pressure fluctuations, and historical failure data—to accurately forecast potential equipment failure several weeks in advance. This capability minimizes unplanned downtime, which is exceptionally costly in continuous process industries like refining and chemicals. Additionally, AI optimizes energy consumption by continuously adjusting compressor speed, flow, and surge control limits based on real-time demand fluctuations, ensuring the compressor operates consistently within its optimal efficiency envelope, a key selling point in the increasingly energy-conscious industrial environment.

Beyond maintenance and efficiency, AI tools are revolutionizing compressor design and manufacturing quality control. Generative design techniques leverage AI to explore thousands of potential impeller geometries far more quickly than traditional simulation methods, leading to designs with improved aerodynamic stability and wider operating ranges. In the manufacturing stage, computer vision and machine learning are employed for high-precision quality checks on complex components like impellers and gearing, ensuring tighter tolerances and higher reliability standards before deployment. This holistic integration of AI, from conception to end-of-life monitoring, is crucial for maintaining the technological competitiveness of modern IGCC solutions.

- AI-driven Predictive Maintenance: Minimizes unplanned outages by analyzing multivariate data to predict component failure.

- Real-time Operational Optimization: Adjusts compressor controls dynamically to maximize energy efficiency and throughput.

- Generative Design Optimization: Accelerates the development of high-performance aerodynamic components (impellers, diffusers).

- Enhanced Surge Control Systems: Utilizes machine learning to anticipate and mitigate surge conditions more rapidly than traditional controls.

- Digital Twin Creation: Enables virtual testing, simulation of wear, and optimization of complex multi-stage configurations.

- Automated Quality Inspection: Improves manufacturing accuracy of critical rotating components using computer vision.

DRO & Impact Forces Of Integrally Geared Centrifugal Compressor Market

The Integrally Geared Centrifugal Compressor market is propelled by robust drivers centered around energy efficiency and industrial expansion, countered by significant restraints related to capital investment and technological complexity, while offering expansive opportunities in emerging energy sectors. The primary drivers include the global push for decarbonization and the necessity for industrial operators to reduce utility costs, making the IGCC’s superior polytropic efficiency highly desirable. Restraints largely involve the high upfront capital expenditure required for these precision machines and the specialized technical expertise needed for installation and complex overhauls, posing barriers, particularly for smaller operational entities. Opportunities are vast, focused on the green transition, particularly the burgeoning fields of Carbon Capture, Utilization, and Storage (CCUS) and green hydrogen compression, which require customized, high-reliability compression solutions.

The market impact forces delineate the intricate relationships between these DRO elements. High market dynamism is observed due to the rapid technological advancements in magnetic bearings and lubrication systems, which mitigate some maintenance restraints and enhance overall reliability, thereby strengthening the driver of operational uptime. The bargaining power of suppliers remains moderately high, owing to the concentration of specialized manufacturing technology among a few global industry leaders, maintaining pressure on pricing. Conversely, the threat of substitutes is relatively low in high-flow, high-pressure applications where IGCCs offer a unique balance of efficiency and footprint that simpler technologies cannot match, securing the market position.

Overall, the market trajectory is heavily influenced by geopolitical stability affecting global investment in energy infrastructure and industrial manufacturing capacity, particularly in the APAC region. Regulatory pressures demanding lower emissions and higher energy productivity act as a powerful external force, compelling industries to phase out older, less efficient compressor models in favor of advanced IGCC units. This regulatory push, combined with the technological opportunities presented by digitalization and new energy vectors, suggests a sustained period of growth, provided that supply chain resilience and skilled labor availability can keep pace with accelerating demand.

Segmentation Analysis

The Integrally Geared Centrifugal Compressor market is comprehensively segmented based on its structural components, operational characteristics, capacity requirements, and specific end-use applications, providing clarity on regional demand patterns and technological trends. The segmentation by type (Single-stage vs. Multi-stage) is crucial, as it dictates the achievable pressure ratio and flow rate, directly impacting suitability for applications ranging from simple air compression to complex multi-component gas mixture handling in petrochemical processes. Furthermore, segmentation by capacity (Small, Medium, Large) helps manufacturers tailor product lines to reflect the scale of industrial operations, where large-scale processing requires customized, high-horsepower compression trains.

Analyzing the market through the lens of applications reveals the underlying demand drivers across major industrial verticals. The Oil & Gas sector demands robust, API 617 compliant units for upstream gas lift, midstream transportation, and downstream refining processes. In contrast, the Chemical and Petrochemical sectors require compressors highly specialized in handling corrosive or toxic gases, demanding specific material construction and sealing technologies. This detailed segmentation allows stakeholders to focus R&D efforts on the most lucrative and technically demanding niches, ensuring optimal resource allocation and maximizing market penetration strategies. The varying regulatory environments across these applications also necessitate segmented product offerings tailored to specific compliance standards (e.g., ATEX, OSHA).

- Type:

- Single-stage Integrally Geared Centrifugal Compressors

- Multi-stage Integrally Geared Centrifugal Compressors

- Capacity:

- Small (Below 10,000 m3/hr)

- Medium (10,000 m3/hr – 50,000 m3/hr)

- Large (Above 50,000 m3/hr)

- Application:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical

- Power Generation

- Air Separation Unit (ASU)

- Industrial Gas Production

- Manufacturing & Others

- Sealing Technology:

- Dry Gas Seals

- Labyrinth Seals

- Oil Seals

Value Chain Analysis For Integrally Geared Centrifugal Compressor Market

The value chain for the Integrally Geared Centrifugal Compressor market begins with the highly specialized upstream analysis involving the sourcing of high-grade raw materials, primarily specialized steel alloys, titanium, and advanced composites required for impellers, gearing, and casings to ensure durability and high-speed operation. This initial stage also includes the design and manufacturing of critical components such as high-speed gearboxes, precision bearings (including magnetic and hydrodynamic types), and specialized sealing systems (dry gas seals). Upstream manufacturing is capital-intensive and requires rigorous quality control, relying heavily on CNC machining and additive manufacturing techniques to achieve the precise tolerances necessary for optimal aerodynamic performance and mechanical reliability.

The downstream analysis focuses on the final assembly, system integration, rigorous testing (including Full Load/Full Speed testing), and distribution channel logistics. Major manufacturers utilize both direct sales channels for large, complex, custom-engineered projects, particularly in Oil & Gas and large petrochemical facilities, and indirect channels (through specialized distributors and engineering procurement construction or EPC firms) for standardized units and after-market services. Direct interaction ensures technical clarity and custom fitment for client-specific requirements, while indirect channels provide broader market reach and localized support, particularly for maintenance, spares, and rapid field service response.

The distribution network is crucial, as IGCCs are heavy, high-value assets requiring specialized transportation and handling. The after-sales service and maintenance segment form a significant portion of the value chain, often representing long-term revenue streams. This segment encompasses predictive monitoring systems, scheduled maintenance contracts, spare parts management, and complex overhauls. The efficiency and quality of this downstream service, including the use of digital monitoring and remote diagnostics, heavily influence customer retention and brand reputation within the global IGCC market, demanding a highly trained global service engineering workforce.

Integrally Geared Centrifugal Compressor Market Potential Customers

Potential customers for Integrally Geared Centrifugal Compressors are primarily large-scale industrial operators requiring reliable, high-volume gas compression in continuous process environments. These customers prioritize machine efficiency, robustness, compliance with international standards (such as API), and long-term operational costs over initial procurement expense. The largest segment of end-users includes national and international oil companies (NOCs and IOCs), independent natural gas processors, and major midstream pipeline operators who rely on IGCCs for gas boosting, reinjection, and LNG liquefaction processes where energy efficiency directly impacts profitability and operational scale.

Beyond the hydrocarbon sector, key buyers include major global chemical and fertilizer manufacturers, particularly those involved in the production of ammonia, methanol, and ethylene, where these compressors are integral to the synthesis loop, demanding extremely high reliability due to the toxic and high-pressure nature of the processes. Furthermore, industrial gas producers, such as suppliers of oxygen and nitrogen for medical and industrial applications via Air Separation Units (ASUs), are critical customers, as IGCCs provide the essential high-volume, contamination-free air compression required for the cryogenic distillation process.

Emerging segments of high-potential customers are those involved in sustainability and new energy infrastructure. This includes utility companies and industrial firms investing in Carbon Capture and Storage (CCS) projects, which require specialized high-pressure compressors to inject CO2 into geological reservoirs. Additionally, manufacturers scaling up green hydrogen production utilize IGCCs for high-efficiency hydrogen compression before transportation or storage, marking a rapidly growing customer demographic seeking customized, corrosion-resistant compression technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, Atlas Copco, MAN Energy Solutions, Elliott Group, Ingersoll Rand, Kobelco, Mitsubishi Heavy Industries, GE Oil & Gas, Howden Group, Kawasaki Heavy Industries, Sulzer, Baker Hughes, Gardner Denver, Hanwha Power Systems, Dresser-Rand. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integrally Geared Centrifugal Compressor Market Key Technology Landscape

The Integrally Geared Centrifugal Compressor market is characterized by continuous technological evolution focused heavily on maximizing aerodynamic efficiency, minimizing mechanical friction, and enhancing system monitoring capabilities. A central technological pillar involves advanced impeller and diffuser design, utilizing Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) to perfect three-dimensional blade geometries. These advanced aerodynamic profiles allow the compressor stages to achieve higher pressure ratios and wider operating envelopes, reducing the need for complex, costly piping arrangements and enhancing overall machine stability, especially important when handling variable process gases.

Another pivotal technological advancement is the integration of high-speed magnetic bearings, which replace traditional oil-lubricated bearings. Magnetic bearings eliminate frictional losses associated with oil systems, leading to superior energy efficiency, reduced maintenance needs, and the complete removal of oil contamination risks, critical for applications like air separation and electronics manufacturing. While the initial cost of magnetic bearing systems is higher, the substantial operational savings and extended mean time between overhauls (MTBO) often justify the investment, positioning this technology as a key differentiator for premium IGCC manufacturers aiming for oil-free operation.

Furthermore, digitalization plays a crucial role through the adoption of sophisticated monitoring and control systems. Modern IGCCs are equipped with dense sensor arrays that measure vibration, temperature, pressure, and surge proximity. These sensors feed data into integrated Condition Monitoring Systems (CMS) and Predictive Maintenance (PdM) platforms, often leveraging AI and machine learning for diagnostics. This technology landscape ensures that the compressor operates safely and efficiently throughout its lifespan, providing operators with actionable insights for optimal asset management and compliance with increasingly demanding industrial safety standards.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market segment, driven primarily by extensive infrastructure spending and robust expansion in the chemical, petrochemical, and manufacturing sectors, especially in China, India, and Southeast Asia. The region’s growing demand for energy and subsequent investment in LNG import/regasification terminals and industrial gas production facilities (ASUs) fuels the need for high-efficiency IGCCs. Government initiatives supporting manufacturing capacity and urbanization further solidify APAC's market dominance.

- North America: This region is characterized by a mature Oil & Gas industry, particularly in shale gas extraction and processing, driving demand for heavy-duty, reliable IGCCs compliant with stringent API standards. Renewed focus on energy independence and investment in CCUS projects and hydrogen infrastructure across the United States and Canada provides significant new market avenues for high-pressure compression units. Technological adoption, especially related to digitalization and predictive maintenance, is exceptionally high in this region.

- Europe: The European market is highly regulated and innovation-driven, focusing intensely on energy efficiency, environmental compliance, and decarbonization targets. Demand here is spurred by the modernization of aging industrial infrastructure and the adoption of IGCCs in industrial air compression, waste heat recovery, and emerging sectors like green hydrogen production and centralized heat pump systems. Germany, the UK, and the Benelux countries are key contributors, emphasizing efficiency and low-noise operation.

- Middle East and Africa (MEA): Growth in MEA is strongly linked to large-scale, state-sponsored investments in petrochemical complexes, refining capabilities, and LNG export facilities, particularly in Saudi Arabia, UAE, and Qatar. These projects require massive, high-capacity compression trains, often purchased directly via EPC contracts. The region demands extreme reliability and durability due to harsh operating environments and high-capacity factors.

- Latin America (LATAM): The LATAM market growth is steady, fueled by investments in offshore oil and gas production (Brazil and Mexico) and subsequent downstream processing capabilities. Economic volatility remains a restraint; however, long-term investments in gas infrastructure and fertilizer production provide stable demand for IGCC technologies, especially those offering operational flexibility and robustness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integrally Geared Centrifugal Compressor Market.- Siemens Energy

- Atlas Copco

- MAN Energy Solutions

- Elliott Group (Ebara Corporation)

- Ingersoll Rand

- Kobelco Compressors America, Inc.

- Mitsubishi Heavy Industries, Ltd.

- GE Oil & Gas (BHGE)

- Howden Group

- Kawasaki Heavy Industries, Ltd.

- Sulzer Ltd.

- Baker Hughes

- Gardner Denver (now part of Ingersoll Rand)

- Hanwha Power Systems

- Dresser-Rand (now Siemens Energy)

- IHI Corporation

- Piller Blowers & Compressors GmbH

- Air Squared, Inc.

Frequently Asked Questions

Analyze common user questions about the Integrally Geared Centrifugal Compressor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Integrally Geared Centrifugal Compressors over conventional compressors?

The primary advantages include significantly higher efficiency due to independent speed optimization of each impeller stage, a compact footprint, superior flexibility across variable operating conditions, and the potential for oil-free operation through technologies like magnetic bearings, leading to lower energy consumption and maintenance costs.

Which industry applications drive the highest demand for IGCC technology globally?

The highest demand is driven by the Oil & Gas sector (especially LNG and gas processing), followed closely by the Chemical and Petrochemical industries, which require high-reliability compression for processes like synthesis gas production and ammonia manufacturing, along with Air Separation Units (ASUs) for industrial gas supply.

How is the adoption of digitalization impacting the IGCC maintenance landscape?

Digitalization, through AI-powered predictive maintenance and digital twins, is profoundly impacting maintenance by enabling real-time condition monitoring, accurate failure forecasting, and remote diagnostics, drastically reducing unplanned downtime and optimizing scheduled overhaul intervals based on actual component wear.

What role do Integrally Geared Centrifugal Compressors play in the emerging green hydrogen economy?

IGCCs are essential for the green hydrogen economy by providing the high-efficiency compression needed to compress hydrogen gas—which is notoriously challenging—for pipeline transport, storage, and subsequent utilization in fuel cell or power generation applications, facilitating large-scale deployment.

What are the main factors influencing the cost and complexity of an IGCC installation?

Key factors include the required capacity and pressure ratio (driving size and number of stages), specialized material requirements for handling corrosive gases, the complexity of the sealing system (e.g., dry gas seals), and the integration of advanced features such as magnetic bearings and sophisticated control systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager