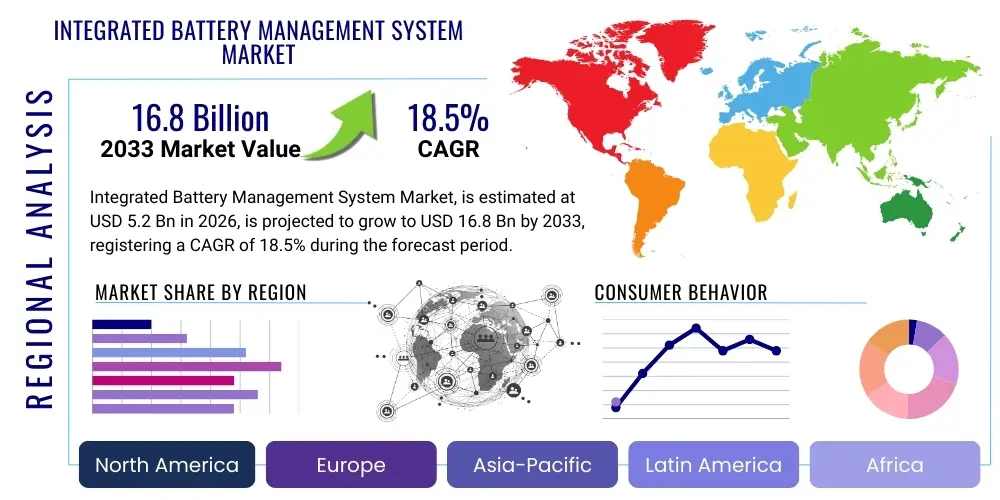

Integrated Battery Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437110 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Integrated Battery Management System Market Size

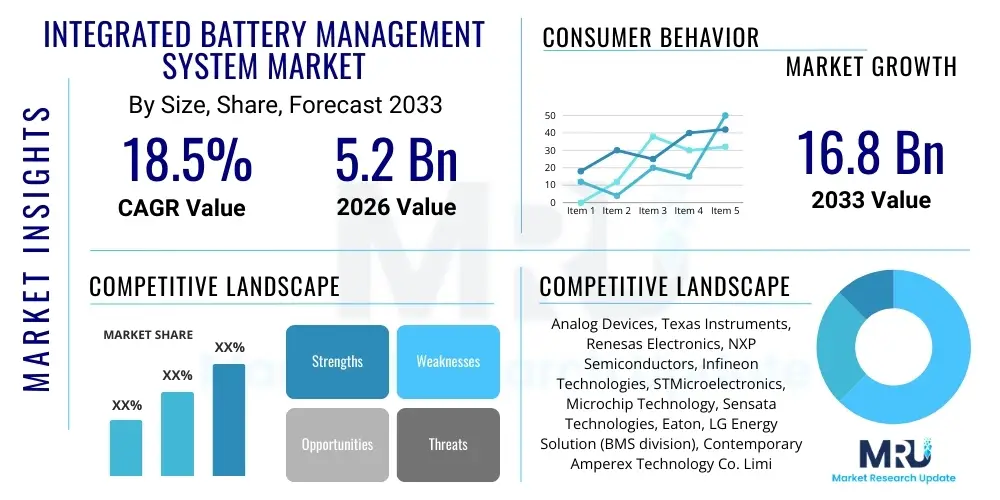

The Integrated Battery Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 16.8 Billion by the end of the forecast period in 2033. This substantial growth is primarily fueled by the rapid expansion of the electric vehicle sector, coupled with increasing global deployment of renewable energy storage systems, which necessitate highly efficient, reliable, and space-saving battery management solutions. The continuous refinement of semiconductor technology, allowing for higher integration densities and enhanced performance, further contributes to this upward trajectory.

Integrated Battery Management System Market introduction

The Integrated Battery Management System (BMS) Market encompasses advanced electronic control systems designed to monitor, regulate, and optimize the performance of rechargeable batteries, particularly lithium-ion chemistries. These systems integrate multiple functionalities—such as cell balancing, state-of-charge (SoC) estimation, state-of-health (SoH) assessment, and thermal management—into a single, compact unit, often utilizing System-on-Chip (SoC) solutions or highly dense printed circuit board assemblies. The core product provides enhanced safety, extended battery life, and superior efficiency compared to discrete component BMS architectures, making them essential components in high-voltage and high-capacity applications.

Major applications of Integrated BMS span across the electric mobility sector, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and electric two-wheelers, where weight reduction and reliability are paramount. Beyond transportation, these systems are critical in large-scale stationary energy storage systems (ESS) used for grid stabilization and renewable energy integration, as well as in consumer electronics requiring high power density and longevity. The fundamental benefit of an Integrated BMS lies in its ability to centralize complex management algorithms, thus reducing system complexity, minimizing manufacturing costs, and significantly accelerating deployment timelines for complex battery packs.

The market is predominantly driven by stringent governmental regulations across North America, Europe, and Asia Pacific promoting vehicle electrification and mandating higher safety standards for energy storage devices. Furthermore, the continuous reduction in battery costs, making electric mobility more accessible, directly boosts the demand for sophisticated integrated management solutions. Technological advancements, particularly in high-voltage isolation techniques and enhanced computational power within the BMS microcontrollers, are also key propelling factors, enabling the precise management of ever-larger and more complex battery configurations required in modern long-range EVs.

Integrated Battery Management System Market Executive Summary

The global Integrated Battery Management System market is experiencing dynamic growth, characterized by significant business model evolution, intense regional manufacturing expansion, and clear segmentation shifts toward high-voltage applications. Business trends indicate a strong move toward functional safety certification (ISO 26262 compliance) as standard practice, driving partnerships between semiconductor manufacturers and Tier 1 automotive suppliers to deliver fully validated hardware and software stacks. There is an increasing focus on developing standardized, modular integrated solutions that can be easily scaled across different battery chemistries and vehicle platforms, thereby reducing development overheads for OEMs and accelerating time-to-market for new electric vehicle models globally. Furthermore, competitive differentiation is increasingly centered on advanced predictive algorithms and cybersecurity measures embedded within the integrated hardware.

Regionally, Asia Pacific maintains its dominant market share, primarily fueled by massive electric vehicle production bases in China and the surging demand for affordable energy storage in emerging economies like India and Southeast Asia. Europe is demonstrating the fastest growth trajectory, propelled by aggressive emission reduction targets and heavy investments in localized battery gigafactories, which create immediate demand for advanced Integrated BMS solutions compliant with stringent EU environmental and safety directives. North America is characterized by robust investment in high-performance, long-range vehicle architectures and grid-scale ESS, emphasizing high-power throughput and robust integration with complex charging infrastructure standards.

Segment trends reveal that the market for centralized topology Integrated BMS is maturing rapidly, while the distributed and modular topologies are gaining traction, particularly for large battery packs where redundancy and serviceability are critical. By application, the Electric Vehicles segment remains the largest consumer, but the rapidly expanding Stationary Energy Storage segment is expected to show the highest CAGR over the forecast period, reflecting the global shift toward decarbonization and reliance on intermittent renewable power generation. Component segmentation is witnessing a critical shift toward highly integrated Application-Specific Integrated Circuits (ASICs) that incorporate multiple management functions, driving down cost and size, while advanced sensing components capable of high-accuracy measurements across extreme temperatures are seeing significant innovation.

AI Impact Analysis on Integrated Battery Management System Market

Common user questions regarding AI's influence on Integrated BMS revolve primarily around achieving unprecedented levels of safety, optimizing charging protocols for maximum battery longevity, and implementing predictive maintenance capabilities. Users are keen to understand how AI and machine learning (ML) algorithms can utilize vast streams of real-time operational data—such as temperature, current cycles, and voltage profiles—to move beyond traditional, rule-based BMS calculations. Key themes identified include the expectation of highly accurate State-of-Charge (SoC) and State-of-Health (SoH) estimations under varying environmental conditions, the automation of complex cell-balancing decisions, and the ability of AI to detect and preempt thermal runaway events before they become critical failures. The integration of edge computing capabilities within the integrated BMS hardware to process ML models locally is a major area of concern and expectation.

- AI enables real-time predictive analytics to forecast potential battery failures and schedule proactive maintenance, significantly reducing downtime.

- Machine learning algorithms optimize charging and discharging cycles based on historical usage patterns and environmental factors, extending battery lifespan by up to 15-20%.

- Deep learning models improve the accuracy of State-of-Health (SoH) and State-of-Charge (SoC) estimations, compensating for aging effects and temperature variations.

- AI-driven anomaly detection enhances functional safety by identifying subtle deviations from normal operation, providing faster response to potential thermal events.

- Reinforcement learning facilitates dynamic cell balancing strategies that adapt to the specific performance characteristics of individual cells within a large pack.

- AI integration supports smart grid interactions, allowing the BMS to optimize energy consumption and feed-in based on real-time electricity prices and grid stability requirements.

- The use of neural networks helps in identifying optimal degradation pathways, facilitating second-life applications for battery packs by accurately assessing remaining usable capacity.

DRO & Impact Forces Of Integrated Battery Management System Market

The market is strongly driven by the accelerating global adoption of Electric Vehicles (EVs) and the massive investment poured into renewable energy infrastructure, which inherently requires robust and safe energy storage solutions. Stringent safety mandates and government subsidies promoting green technologies act as powerful external drivers, compelling manufacturers to incorporate sophisticated integrated BMS technology that guarantees performance and longevity. Technological innovation in semiconductor integration, leading to smaller, more powerful, and cost-effective BMS chips, further accelerates market penetration. These driving factors create a strong foundation for sustained expansion, ensuring that advanced battery management remains a non-negotiable component in modern energy systems, directly impacting design requirements across automotive and utility sectors.

Conversely, the market faces significant restraints, primarily related to the high initial cost associated with complex integrated hardware and the necessity for highly specialized engineering expertise required for system design, calibration, and software validation, especially concerning functional safety standards like ISO 26262. Another crucial restraint is the inherent complexity in managing diverse battery chemistries (e.g., LFP, NMC, NCA) with a single integrated architecture, which demands continuous software updates and calibration efforts. Supply chain vulnerabilities, particularly concerning critical semiconductor components and power management integrated circuits (PMICs), pose substantial risks, impacting production scalability and market stability in the short term, especially given the global demand surge.

Tremendous opportunity lies in the burgeoning market for second-life battery utilization and recycling, where integrated BMS data provides invaluable information for accurate repurposing assessment, creating new value streams. The development of wireless battery management systems (wBMS) represents a paradigm shift, eliminating bulky wiring harnesses, reducing overall battery pack weight, and simplifying assembly processes, offering a critical growth avenue for integrated solutions. Furthermore, expanding applications in the aerospace and marine sectors, which require ultra-high reliability and lightweight power solutions, present high-value, albeit niche, market openings. The impact forces are overwhelmingly positive, driven by environmental mandates and technological maturity, overcoming restraints through economies of scale and iterative technological improvements in integration density and software intelligence.

Segmentation Analysis

The Integrated Battery Management System market is systematically segmented based on Component, Topology, Application, and End-User, allowing for granular analysis of market demand drivers and technological focus areas. Segmentation by Component helps identify the investment priorities between hardware elements, such as highly integrated Application-Specific Integrated Circuits (ASICs) and supporting sensors, and the critical software components, including algorithms for State-of-Charge estimation and advanced diagnostics. Topology segmentation (Centralized, Distributed, Modular, and Wireless) is vital for understanding design preferences across different battery pack sizes and voltage levels, with centralized dominating smaller systems and distributed/wireless gaining traction in large-scale EV and ESS deployments. This detailed categorization facilitates tailored market strategies and focused product development efforts aimed at maximizing performance and cost efficiency for specific use cases.

- By Component:

- Hardware (Integrated Circuits, Sensors, Communication Modules, Power Management Devices)

- Software (Operating Systems, Monitoring and Control Algorithms, Diagnostics and Analytics)

- By Topology:

- Centralized BMS

- Distributed BMS

- Modular BMS

- Wireless BMS (wBMS)

- By Application:

- Electric Vehicles (BEVs, PHEVs, HEVs)

- Stationary Energy Storage Systems (Grid-scale, Residential, Commercial)

- Consumer Electronics

- Drones and Robotics

- Aerospace and Defense

- By End-User:

- Automotive Original Equipment Manufacturers (OEMs)

- Energy Storage System Integrators

- Renewable Energy Developers

- Consumer Device Manufacturers

Value Chain Analysis For Integrated Battery Management System Market

The value chain for the Integrated BMS market begins upstream with the raw material suppliers and crucial component providers, particularly semiconductor fabricators. Upstream activities are dominated by specialized silicon foundries and sensor manufacturers that provide the high-precision analog front ends (AFEs), microcontrollers, and communication chips essential for integrated solutions. Access to stable and high-quality semiconductor supply is a critical determinant of manufacturing capability and cost structure within the market. Given the highly technical nature of the product, relationships with advanced material providers for thermal interface materials and encapsulation techniques are also crucial at this stage, ensuring the final integrated system can withstand harsh operational environments while maintaining thermal stability.

The core value addition occurs in the middle segment, involving Integrated Circuit design houses (like Analog Devices or Texas Instruments) and specialized BMS developers. These entities focus on creating highly optimized integrated circuits (ASICs) that combine monitoring, control, and communication functions onto a single die, alongside the proprietary software and algorithms that determine system performance and safety (e.g., SoH estimation algorithms). Distribution channels for Integrated BMS are multifaceted: Direct channels involve IC manufacturers selling directly to large Automotive Tier 1 suppliers or major EV OEMs for system integration. Indirect channels utilize specialized electronics distributors and value-added resellers who provide localized technical support and smaller volume deliveries to custom ESS integrators or regional vehicle modifiers, broadening market reach and facilitating adoption across diverse applications.

Downstream, the value chain culminates with system integration and end-user deployment. Integrated BMS units are assembled into final battery packs by battery pack manufacturers or directly by Automotive OEMs and Stationary ESS integrators. The final stages involve rigorous testing, certification (such as ISO 26262), and post-sales service, which often includes data analytics derived from the installed BMS fleet to refine algorithms and provide predictive maintenance alerts. Potential customers or end-users, such as global electric vehicle companies and utility-scale energy storage providers, drive demand signals backward through the chain, demanding higher integration, greater functional safety, and interoperability standards, thereby constantly pushing for innovation in the upstream component and design phases.

Integrated Battery Management System Market Potential Customers

Potential customers for Integrated Battery Management Systems are highly diverse but heavily concentrated within sectors undergoing significant electrification and digitalization. The primary buyers are Automotive OEMs and Tier 1 suppliers, such as Tesla, Volkswagen, BYD, and LG Energy Solution, who require millions of high-reliability integrated units annually for their electric vehicle platforms. These customers prioritize adherence to stringent automotive safety integrity levels (ASIL) and seamless integration into complex vehicle architectures, driving demand for specialized, high-voltage integrated circuits and advanced software stacks tailored for high-speed communication like CAN or Ethernet, coupled with fail-safe mechanisms necessary for passenger safety in critical conditions.

Another major customer segment includes utility-scale and residential Energy Storage System (ESS) integrators, such as Fluence, Tesla Energy, and local microgrid developers. These buyers require robust, long-duration integrated BMS solutions capable of handling large-format battery cells and providing comprehensive system-level diagnostics for long operational lifetimes (often 10-20 years). Their purchasing decisions are often based on system efficiency, reliability in diverse climates, and seamless integration with existing grid infrastructure protocols. Furthermore, specialized markets like high-end portable power tool manufacturers, drone and robotics companies, and medical device producers form niche but high-value customer groups, demanding highly optimized, lightweight integrated solutions where power density and minimal footprint are critical design constraints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 16.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Analog Devices, Texas Instruments, Renesas Electronics, NXP Semiconductors, Infineon Technologies, STMicroelectronics, Microchip Technology, Sensata Technologies, Eaton, LG Energy Solution (BMS division), Contemporary Amperex Technology Co. Limited (CATL), Johnson Matthey, Vitesco Technologies, Dana Incorporated, TDK Corporation, Nuvation Energy, L&T Technology Services, BMS PowerSafe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integrated Battery Management System Market Key Technology Landscape

The current technology landscape of the Integrated BMS market is rapidly shifting toward higher integration densities and advanced communication protocols to handle the complexity of next-generation battery packs. Key technological advancements include the maturation of high-voltage isolation techniques (such as using capacitive or inductive isolation barriers integrated directly onto the chip) which is vital for safe operation in 400V and 800V EV architectures. Furthermore, the development of highly accurate, multi-channel sigma-delta Analog-to-Digital Converters (ADCs) embedded within the BMS ICs allows for simultaneous and precise measurement of cell voltages and temperatures, crucial for reliable SoC and SoH estimations. The focus on reducing latency and increasing data throughput has led to the adoption of automotive Ethernet and daisy-chain communication structures over traditional CAN protocols, facilitating faster data exchange among distributed modules within large battery systems.

A transformative technology is the emergence of Wireless Battery Management Systems (wBMS), which utilizes robust, low-power wireless communication standards (e.g., Bluetooth Low Energy or proprietary industrial wireless standards) to link individual battery monitoring units (BMUs) to a central control unit. This innovation eliminates up to 90% of the complex, heavy, and failure-prone wiring harness typically found in modular packs, drastically simplifying assembly, reducing weight, and freeing up space for more cells, thereby enhancing energy density. While wBMS presents challenges related to signal reliability in electromagnetically noisy automotive environments and achieving comparable functional safety levels to wired systems, major industry players are heavily investing in this domain, viewing it as the future standard for large-format EV and ESS batteries.

Functional safety and cybersecurity are no longer optional features but foundational technological requirements. Modern Integrated BMS solutions must incorporate hardware and software designed to meet ISO 26262 ASIL D standards, necessitating built-in redundancies, self-testing diagnostics, and fault-tolerant architectures directly into the integrated circuits. Furthermore, the increasing connectivity of electric vehicles necessitates robust cybersecurity layers embedded within the BMS firmware to prevent unauthorized access or malicious manipulation of charging parameters or critical safety limits. Technologies like hardware security modules (HSMs) and secure boot mechanisms are becoming standard components within advanced integrated BMS processors, safeguarding the system from potential external threats and ensuring long-term operational integrity and regulatory compliance across global markets.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the Integrated BMS market, driven primarily by China's dominant position in EV production and the largest installed base of battery manufacturing capacity globally. Government policies in countries like China, Japan, and South Korea aggressively support New Energy Vehicle (NEV) adoption and grid modernization efforts, creating immense demand. The region benefits from a dense and competitive ecosystem of specialized semiconductor suppliers and battery pack integrators, resulting in highly cost-competitive and technologically advanced integrated solutions tailored for both mass-market and high-performance applications. The rapid expansion of electric scooter and three-wheeler markets in India and Southeast Asia further necessitates robust, affordable integrated BMS solutions for two and three-wheeled mobility.

- Europe: Europe represents the fastest-growing region, characterized by strong regulatory push toward electrification and significant regional investment in gigafactories. The market here is defined by a high focus on premium, high-voltage (800V) architectures and the need for strict compliance with European safety and environmental standards. The demand is heavily concentrated in Germany, France, and the Nordics, driven by established automotive OEMs transitioning their entire fleets to electric. European firms emphasize robust functional safety (ASIL D) and sophisticated software integration, often leading the market in advanced diagnostic features and modular design topologies.

- North America: The North American market is driven by large-scale commercial vehicle electrification (heavy-duty trucks, buses) and significant investment in utility-scale energy storage systems, especially in California and Texas. Demand is centered on high-power output, durability, and integration with diverse charging infrastructure standards (e.g., CCS and NACS). US-based OEMs and technology companies are leading in the integration of AI/ML for predictive maintenance and optimization within their BMS frameworks. The market is also heavily influenced by government incentives, such as the Inflation Reduction Act (IRA), which promotes localized manufacturing and sourcing of critical components like integrated circuits and sensors for BMS applications.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets, primarily focused on localized small-scale ESS projects and initial phases of public transportation electrification. The adoption of Integrated BMS here is growing steadily but relies heavily on imported technology and favorable government policies. The demand in MEA, particularly, is tied to large-scale renewable energy projects (solar power) requiring stable grid-scale battery backup, driving interest in highly reliable, thermally managed integrated systems suitable for extreme ambient temperatures. Market growth often tracks the development of local assembly capabilities and infrastructure spending in major economies like Brazil, Saudi Arabia, and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integrated Battery Management System Market.- Analog Devices

- Texas Instruments

- Renesas Electronics

- NXP Semiconductors

- Infineon Technologies

- STMicroelectronics

- Microchip Technology

- Sensata Technologies

- Eaton

- LG Energy Solution (BMS division)

- Contemporary Amperex Technology Co. Limited (CATL)

- Johnson Matthey

- Vitesco Technologies

- Dana Incorporated

- TDK Corporation

- Nuvation Energy

- L&T Technology Services

- BMS PowerSafe

- Exide Industries

- Linear Technology (now Analog Devices)

Frequently Asked Questions

Analyze common user questions about the Integrated Battery Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a centralized and a distributed Integrated BMS?

A centralized Integrated BMS uses one master control unit for all cell monitoring and balancing, typically suitable for small battery packs. A distributed or modular system uses multiple localized monitoring units linked to a central controller, offering better scalability, redundancy, and simplified maintenance for large high-voltage EV and ESS battery packs.

How do Integrated BMS solutions enhance electric vehicle (EV) battery safety?

Integrated BMS enhances safety by providing real-time, high-accuracy thermal monitoring, implementing redundant circuitry, and utilizing advanced software to detect and quickly respond to hazardous conditions like overcharging or thermal runaway. Compliance with stringent functional safety standards, such as ISO 26262, is paramount for this segment.

What role does wireless technology play in the future of Integrated BMS?

Wireless BMS (wBMS) is crucial for the future as it eliminates heavy and complex wiring harnesses, drastically simplifying battery pack assembly, reducing overall weight, and improving manufacturing scalability. It relies on robust wireless communication (e.g., BLE) to transfer data between monitoring units and the central controller, accelerating the adoption of larger, modular battery architectures.

Which application segment drives the highest demand for Integrated BMS?

The Electric Vehicles (EVs) segment currently drives the highest volume demand for Integrated BMS globally due to the rapid growth in passenger car electrification. However, the Stationary Energy Storage Systems (ESS) segment is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) due to expanding grid stabilization projects and renewable energy integration needs.

What are the key technological challenges currently facing Integrated BMS manufacturers?

Manufacturers face challenges in achieving higher levels of integration while maintaining ultra-low power consumption and meeting stringent thermal management requirements. Integrating sophisticated AI/ML algorithms into compact chips and ensuring flawless interoperability and functional safety compliance (ASIL D) across diverse high-voltage architectures are significant technical hurdles requiring continuous innovation in semiconductor design.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager