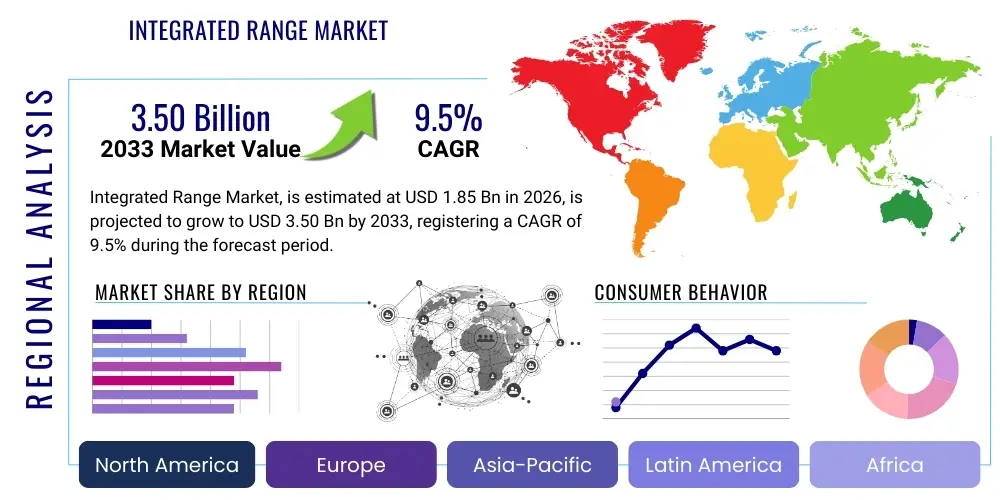

Integrated Range Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437335 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Integrated Range Market Size

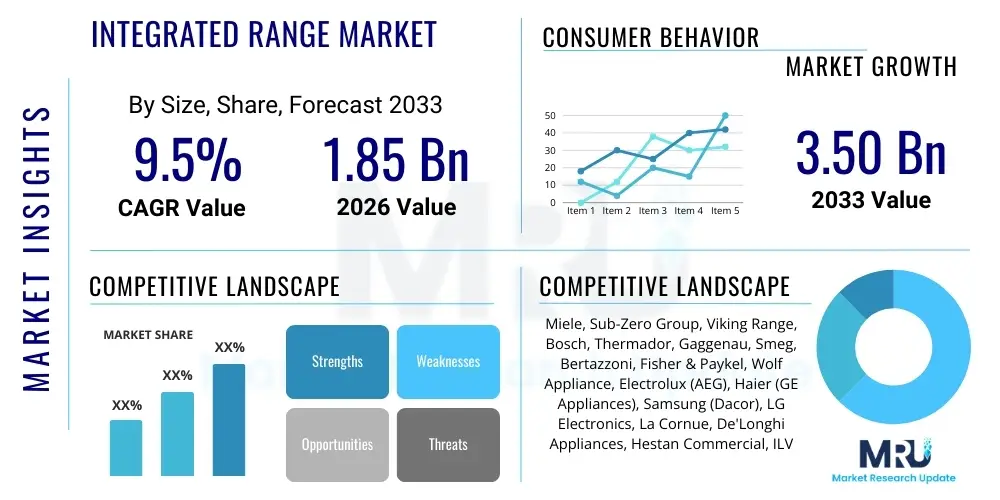

The Integrated Range Market is projected to grow at a Compound Annual Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.50 Billion by the end of the forecast period in 2033.

Integrated Range Market introduction

The Integrated Range Market represents the pinnacle of modern kitchen appliance technology, focusing on cooking units—which include cooktops and ovens—that are meticulously engineered to harmonize with the surrounding cabinetry and interior architecture, achieving a 'built-in' or 'invisible' aesthetic. This market segment transcends traditional functionality by prioritizing sophisticated design, often featuring flush installation, handle-less operation, and customizable panel fronts that seamlessly blend with kitchen furniture. The core product offering extends far beyond basic cooking capabilities, integrating features like precise induction heating, high-efficiency burners, pyrolytic self-cleaning ovens, and advanced connectivity protocols. These appliances are fundamentally defined by their ability to provide professional-grade performance while maintaining a minimalist and streamlined visual profile, making them indispensable in contemporary, open-plan residential and high-end commercial kitchen designs across major global economic hubs. The evolution of this market is tied directly to the rising trend of luxury minimalism in home design.

The application spectrum for Integrated Ranges is predominantly concentrated within the luxury residential sector, targeting consumers who demand both unparalleled performance and aesthetic perfection. This includes major new construction projects, where developers install integrated systems as standard high-value amenities, and extensive kitchen remodeling, where homeowners seek to upgrade outdated kitchens with modern, high-tech features that enhance property value and lifestyle quality. Beyond residential use, integrated ranges are strategically deployed in specialized commercial environments, such as executive culinary labs, high-end show kitchens, and exclusive hotel suites, where performance must be delivered without compromising the upscale, tailored interior design. The integration often includes seamless venting solutions (downdraft or ceiling-mounted ventilation) that complement the flush installation, addressing both odor management and visual coherence in shared living spaces. This specific focus on architectural synergy distinguishes integrated ranges from their less aesthetically demanding freestanding counterparts, making them a necessity in premium markets.

The market expansion is robustly driven by several confluent factors: increasing global wealth concentrating in high-net-worth households, a persistent cultural emphasis on home-based culinary excellence, and continuous breakthroughs in smart appliance technology. Key benefits attracting consumers include exceptional energy efficiency, particularly with advanced induction models which boast minimal heat loss, enhanced safety features such as automatic shut-offs and cool-to-touch surfaces, and the convenience of remote monitoring and control via smart devices. These technological advancements, coupled with the unwavering consumer demand for bespoke, architecturally refined interiors, position the Integrated Range Market for sustained, high-value growth throughout the forecast period. Furthermore, the commitment of leading manufacturers to developing sustainable and long-lasting products resonates strongly with environmentally conscious luxury consumers, solidifying their market relevance and justifying the substantial premium pricing associated with this category of sophisticated cooking technology.

Integrated Range Market Executive Summary

The global Integrated Range Market is experiencing vigorous expansion, underpinned by significant shifts in consumer preference toward smart home infrastructure and high-end design aesthetics. Current business trends highlight an intensified focus on software development and data analytics, as manufacturers compete not just on hardware performance but also on the intelligence and user experience offered by their connected platforms. Strategic acquisitions and joint ventures between appliance manufacturers and smart home technology providers are defining the competitive landscape, aimed at creating synergistic ecosystems that simplify installation and maximize user convenience. Furthermore, supply chain resilience, particularly concerning the sourcing of microchips and sophisticated sensor technology, remains a key operational challenge and a major determinant of production capacity and pricing stability across the market, forcing companies to invest in diverse sourcing strategies and closer supplier relationships to mitigate component shortages and maintain high-volume production schedules.

Regional market dynamics showcase a distinct bifurcation of growth trajectories. While North America and Western Europe maintain the largest absolute market values, owing to established luxury markets and high average transaction prices for integrated appliances, the Asia Pacific (APAC) region is demonstrating explosive growth potential. This acceleration in APAC is fueled by the rapid expansion of urban affluent populations and increasing adoption of modern, built-in kitchen layouts in new residential developments. Specific regional product preferences persist; for instance, European consumers predominantly favor compact, highly efficient induction units due to space constraints and high energy costs, often influenced by environmental regulations. Conversely, North American consumers continue to favor larger, high-output dual-fuel models that cater to extensive home cooking requirements and entertainment needs, reflecting larger average kitchen sizes and higher utility consumption tolerance, impacting regional product standardization and inventory management.

Segmentation analysis reveals crucial shifts in purchasing patterns. The induction technology segment is unequivocally the leader in growth rate, continuously stealing market share from traditional gas and electric coil integrated ranges, catalyzed by regulatory pressures for electrification and consumer demand for safety and efficiency. Within the application segment, residential renovation and remodeling projects are proving to be particularly lucrative, as these projects typically involve older homes being upgraded to incorporate the latest technological and design standards, necessitating the replacement of freestanding units with integrated systems. This remodeling trend is less susceptible to economic downturns than new construction, providing a degree of stability to the high-end integrated appliance market. Additionally, premium features such as steam cooking, sous vide functionality, and professional-grade self-cleaning cycles are becoming standard expectations in new product introductions, pushing manufacturers to continuously innovate their product lines to maintain perceived value and price competitiveness against lower-cost alternatives.

AI Impact Analysis on Integrated Range Market

The discussion surrounding AI integration in the Integrated Range Market is driven by consumer curiosity about practicality, automation, and data security. Common user inquiries revolve around how machine learning can interpret nuanced cooking instructions, such as achieving perfect searing or ideal baking humidity, without continuous manual oversight. Users frequently question the scope of AI in recipe adherence—can the range identify ingredients via internal camera and guide the user through complex steps, correcting errors in real-time? A substantial concern centers on the privacy implications of allowing an appliance to monitor and transmit detailed family eating and usage patterns, necessitating transparent data governance policies from manufacturers. The consensus expectation is that AI must transform the integrated range into a highly intuitive, learning apparatus that not only cooks but also contributes to proactive energy management and long-term culinary skill enhancement, justifying the significant investment in high-tech kitchen solutions.

The implementation of AI algorithms significantly enhances the operational intelligence of integrated ranges, moving them beyond basic smart functionality. AI allows ranges to utilize sophisticated sensor data—including temperature, humidity, airflow, and even gas composition—to make instantaneous adjustments to power output, fan speed, and heat distribution. For example, in oven operation, AI can learn the thermal inertia of a specific oven cavity over time and predict the exact duration required to maintain a precise temperature, compensating automatically for door openings or ingredient placement variations. This level of environmental awareness and predictive control ensures consistently professional cooking results and maximizes energy efficiency by eliminating wasteful power spikes or prolonged preheating cycles. Furthermore, AI-driven natural language processing is being incorporated to allow users to interact with their ranges using complex, conversational instructions, simplifying the interface and reducing the reliance on intricate manual settings, which is a major convenience factor for busy professionals.

Beyond performance, AI fundamentally revolutionizes the service and lifespan of integrated ranges. Through constant self-monitoring and deep learning analysis of operational telemetry, AI can identify minute deviations in component behavior indicative of impending failure (e.g., slight resistance in a motor, fluctuating sensor readings). This capability facilitates true predictive maintenance, allowing the range to notify the user or service center proactively to schedule repairs before a catastrophic breakdown occurs. This enhanced reliability is a key selling point in the premium market, mitigating the high cost associated with servicing specialized integrated appliances and bolstering consumer confidence in the long-term investment. Furthermore, AI contributes to user-interface optimization, adapting the control screen layout and complexity based on the user's observed skill level and frequency of use, thus simplifying operation for novice and expert chefs alike, thereby improving overall user satisfaction and increasing brand loyalty.

- Deployment of neural networks for recognizing food types and adjusting pre-programmed cooking cycles.

- Predictive heat management algorithms optimizing energy use based on usage history and utility pricing.

- Integration of AI-driven voice commands for entirely hands-free operation and guidance.

- Advanced anomaly detection for predictive diagnostics of mechanical and electronic components.

- Personalized user profiles and preferences stored and recalled via cloud integration.

- Optimization of ventilation rates based on real-time smoke and steam detection.

- Automated regulation of internal oven humidity and steam injection based on AI analysis of the cooking process.

- Seamless integration with broader home energy management systems (HEMS) for load balancing.

DRO & Impact Forces Of Integrated Range Market

The market trajectory for integrated ranges is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities. A crucial driver is the pervasive and increasing global preference for minimalist and highly personalized interior design, where the visibility of appliances is deliberately minimized to create sleek, uncluttered kitchen spaces. This aesthetic trend is reinforced by the persistent expansion of the luxury real estate sector, which increasingly mandates high-performance, flush-mounted appliances as standard features that elevate property valuation. Furthermore, rapid innovation in induction technology, offering unparalleled efficiency, speed, and safety, acts as a continuous technological driver, pushing consumers to upgrade older, less efficient cooking systems. The alignment of luxury aesthetics with cutting-edge, sustainable technology provides a foundational platform for market expansion and sustained premium pricing, driving high revenue per unit for market leaders focused on design and performance.

Despite strong drivers, the Integrated Range Market faces considerable systemic restraints that limit its penetration outside of the ultra-affluent segment. The most significant barrier is the exceptionally high capital outlay required for both the appliance purchase and its specialized installation. Integrated units are substantially more expensive than comparable freestanding models and demand highly skilled, often proprietary, installation processes involving bespoke cabinetry work and complex utility routing. This high cost severely restricts the addressable market size, limiting sales primarily to the top 5-10% of global households by income. Furthermore, complexity translates into higher lifecycle costs, as proprietary parts and specialized servicing are necessary, creating consumer reluctance regarding long-term maintenance burdens and potential service delays, especially in emerging markets where certified technicians trained on these specific luxury brands are scarce, thereby constraining geographical reach.

Strategic opportunities exist that promise to mitigate these restraints and unlock new growth avenues, particularly through standardization and technological democratization. A major opportunity lies in the modularization and standardization of integrated installation systems, which could potentially reduce complexity and lower overall installation costs, making the technology accessible to the upper-middle class and increasing the velocity of renovation projects. Additionally, manufacturers can capitalize on the growing demand for connectivity by developing open-source APIs that allow seamless integration with diverse smart home ecosystems, increasing the perceived utility and future-proofing of the investment, thereby commanding a larger segment of the overall smart home budget. Geographical expansion into rapidly developing urban centers in Asia, coupled with offering localized features—such as integrated wok burners or specialized steam cooking functions tailored to regional cuisine—provides a crucial pathway for penetrating high-growth emerging markets and diversifying global revenue streams, ensuring long-term resilience and market leadership in sophisticated cooking technologies.

Segmentation Analysis

The comprehensive segmentation of the Integrated Range Market is essential for targeted marketing and strategic product development, with core classifications determined by the cooking method, physical size, and end-user application. The most impactful segmentation revolves around Technology Type, where Induction Integrated Ranges are rapidly accelerating their market share due to unparalleled energy efficiency, safety credentials, and rapid thermal response. Induction is particularly favored by green building initiatives and urban consumers conscious of both utility costs and indoor air quality, making it a regulatory-compliant and consumer-preferred choice in Europe and specific North American jurisdictions. In contrast, Dual-Fuel Integrated Ranges, which combine the precision of gas cooktops with the even heat distribution of electric ovens, continue to command a significant presence in North American luxury homes where high-volume cooking and perceived professional-grade performance are paramount, catering to the traditional preferences of executive chefs and serious home cooks who demand immediate, visual heat control.

Segmentation by Size and Configuration addresses the critical constraints of kitchen architecture globally, reflecting diverse housing markets. Standard widths (30-inch and 36-inch) form the bulk of the market, serving typical residential kitchen layouts across suburban and metropolitan areas. However, the burgeoning demand for Professional Integrated Ranges (48-inch and 60-inch+) is driven by high-end, bespoke residential projects that require multiple ovens, warming drawers, and specialized cooking surfaces, often mirroring commercial kitchen capacity for large-scale entertaining. Conversely, smaller integrated units (24-inch) are increasingly important in densely populated urban environments, particularly in Europe and Asia, where space optimization is a primary design mandate, requiring manufacturers to miniaturize high-performance components without sacrificing cooking power or aesthetic quality, further complicating the engineering requirements for compact, high-output appliances designed for small footprint kitchens.

The Application segmentation distinguishes between Residential and Commercial use, with the Residential segment further broken down into New Construction and Renovation. The Renovation sub-segment holds immense value, characterized by consumers who, having lived in their homes, fully understand their needs and are willing to pay a premium for high-quality, long-lasting integrated upgrades that significantly increase property resale value. New construction, while volume-driven, is often more sensitive to builder budgets, sometimes opting for high-quality baseline integrated models rather than the top-tier luxury variants found in custom renovations. Commercial applications, focused on specialized high-end hospitality and corporate facilities, prioritize extreme durability, regulatory compliance (venting, heat dissipation), and consistency, demanding ranges built to withstand continuous heavy use while retaining their integrated aesthetic appeal and minimizing downtime due to equipment failure, necessitating robust commercial-grade components and servicing agreements.

- By Technology Type:

- Induction Integrated Ranges: Fastest growing, driven by efficiency, safety, and rapid thermal control.

- Gas Integrated Ranges: Persistent presence in markets with traditional gas preferences and low utility costs.

- Electric Integrated Ranges (Radiant/Coil): Niche market, typically utilized in budget-conscious integrated solutions.

- Dual-Fuel Integrated Ranges: High performance; strong demand in large, luxury kitchens, especially North America.

- By Size/Configuration:

- Small (24-inch): Crucial for high-density urban housing and auxiliary kitchen spaces.

- Standard (30-inch, 36-inch): Represents the majority of residential integrated range sales volume.

- Large/Professional (48-inch, 60-inch): Cater to the ultra-luxury segment requiring expansive cooking capacity.

- By Application:

- Residential (New Construction): Driven by developer specifications and mass procurement contracts.

- Residential (Renovation/Replacement): High-margin segment focused on lifestyle upgrade and aesthetic improvement.

- Commercial (Hotels, Restaurants, Boutique Facilities): Requires industrial durability with high-end integrated design.

Value Chain Analysis For Integrated Range Market

The upstream segment of the Integrated Range value chain is highly sophisticated and globally distributed, centered on sourcing specialized, high-precision components that are essential for the appliance's performance and integrated design. This includes procuring high-grade thermal insulation materials, proprietary induction coils manufactured to tight tolerances, advanced electronic control units (ECUs) integrating complex AI-enabled software, and specialized glass-ceramic surfaces designed to withstand extreme thermal stress while offering a seamless aesthetic. Dependency on global suppliers for microprocessors, touch sensors, and connectivity modules (Wi-Fi/Bluetooth chips) exposes manufacturers to geopolitical risks and supply chain volatility, emphasizing the need for robust risk management strategies and long-term contracts. Strategic partnerships with key component providers and investment in vertically integrated component manufacturing are crucial for competitive advantage, ensuring both quality control and reliable production flow to meet demanding installation schedules of custom home projects.

Midstream activities involve the high-precision assembly, advanced manufacturing, and rigorous quality assurance processes essential for integrated ranges. The manufacturing stage includes complex metal stamping for chassis integration, robotic assembly of oven components, and the delicate process of bonding glass and electronic elements. Unlike standard appliance manufacturing, integrated ranges require exceptional precision during assembly to ensure perfect alignment for flush installation—even minor deviations can render the unit aesthetically unacceptable for the luxury market. Rigorous testing protocols, including prolonged thermal stress tests, comprehensive software integration verification, and long-term durability simulations, are mandated to justify the premium price point. Manufacturers often centralize core intellectual property related to proprietary burner technology, precise temperature calibration, and oven cavity design within highly specialized facilities, relying on skilled engineering teams for final assembly, calibration, and aesthetic verification prior to packaging and complex logistics management.

Downstream success hinges on specialized distribution and meticulous after-sales support, reflecting the product's high-value, bespoke nature and the necessity of white-glove service. The primary distribution channel utilizes luxury appliance showrooms, certified dealer networks, and direct relationships with architectural firms and custom builders, effectively bypassing conventional mass-market retail channels. The distribution process must account for the substantial size, weight, and fragility of many integrated ranges, requiring specialized logistics for careful handling and scheduled delivery coordinated with construction timelines. The installation phase is critical; due to the requirement for flush mounting and complex smart home integration, manufacturers must provide extensive, often proprietary, training and certification for installation technicians. Post-sale, strong customer relationship management, including robust, non-negotiable warranties and immediate access to highly specialized repair services using certified parts, is mandatory to protect brand reputation and ensure customer lifetime value within the highly discerning luxury consumer base.

Integrated Range Market Potential Customers

The archetypal potential customer for the Integrated Range Market is the high-net-worth individual or family residing in luxury single-family homes or high-end urban condominiums. These customers are deeply engaged in or are commissioning bespoke kitchen design projects, prioritizing sophisticated aesthetics, brand prestige, and uncompromising culinary performance. Their purchase decisions are heavily influenced by the advice of top-tier architects and interior designers, who act as gatekeepers for brand selection, and they view the integrated range not just as an appliance, but as an integral piece of kitchen architecture that reflects their status and appreciation for design innovation. Key characteristics of this segment include high disposable income, a strong affinity for connectivity and smart technology, and a low tolerance for maintenance issues or visual flaws, leading them to select brands known for reliability and impeccable customer service, often making the purchase a long-term lifestyle investment.

A second major customer category includes real estate developers specializing in luxury multi-unit residential projects, encompassing high-rise apartments and premium housing tracts. For developers, the integrated range is a critical marketing tool used to differentiate their properties in competitive markets, signifying quality and modern living to prospective buyers. While highly concerned with cost efficiency and timeline adherence, developers seek reliable, contract-grade integrated models that offer a favorable balance between performance, aesthetic integration, and proven durability to minimize costly warranty claims post-sale. Manufacturers target this segment through dedicated builder programs, offering volume discounts, favorable financing terms, and streamlined supply chain logistics to meet tight construction deadlines, making ease of standardized, repeatable installation a paramount selling factor for this institutional client base, demanding products with minimal variation and robust quality control.

The third significant customer segment includes professional architects, kitchen designers, and custom contractors, who act as influential buyers by recommending and specifying integrated range models into client projects. Although they do not consume the product directly, their endorsement drives final consumer purchasing decisions due to their expertise and authority over the design process. Manufacturers must cultivate strong, technical relationships with this professional segment by offering specialized technical training, detailed installation guides, technical documentation focused on integration challenges, and access to unique finishes and customized product configurations that solve unique spatial or aesthetic demands. Their buying criteria emphasize installation flexibility, long-term product reliability, energy certification compliance, and the availability of sophisticated CAD models and real-time technical support to ensure seamless incorporation into complex, highly detailed kitchen schematics and material specifications, often necessitating dedicated liaison teams from the manufacturer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.50 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miele, Sub-Zero Group, Viking Range, Bosch, Thermador, Gaggenau, Smeg, Bertazzoni, Fisher & Paykel, Wolf Appliance, Electrolux (AEG), Haier (GE Appliances), Samsung (Dacor), LG Electronics, La Cornue, De'Longhi Appliances, Hestan Commercial, ILVE, Fulgor Milano, Beko. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Integrated Range Market Key Technology Landscape

The technological sophistication of integrated ranges is rapidly escalating, fundamentally driven by the convergence of material science, energy management, and embedded systems, all aimed at delivering superior culinary results while maintaining aesthetic integrity. The centerpiece remains advanced induction technology, which has evolved to include full-surface induction, allowing complete flexibility in placing cookware anywhere on the hob, and incorporating virtual flame projection to provide visual feedback traditionally associated with gas cooking, easing the transition for traditional chefs. Manufacturers are also heavily investing in self-regulating temperature control features, utilizing infrared sensors embedded beneath the glass surface to maintain ultra-precise temperatures for delicate tasks like tempering chocolate or slow simmering, offering professional-level control unmatched by conventional resistance heating elements and significantly improving cooking consistency.

Connectivity (IoT) features and AI integration represent the second critical axis of technological innovation. Modern integrated ranges utilize robust IoT platforms to facilitate remote monitoring, control, and, importantly, secure over-the-air software updates that continuously enhance functionality and patch security vulnerabilities over the product lifespan. The incorporation of high-resolution internal cameras, paired with machine vision technology, allows the oven to monitor the doneness of food, recognizing browning levels or internal temperature fluctuations, and communicating progress directly to the user's mobile device or smart watch. Furthermore, advanced ranges integrate specialized filtration and ventilation systems that communicate directly with the cooktop, automatically adjusting extraction rates based on the intensity of cooking, ensuring that odor and moisture management is as seamless as the appliance's physical integration into the surrounding environment, a crucial feature for open-plan living spaces.

Finally, durability and sustainable design are pushing technological boundaries, particularly in materials and thermal engineering. High-efficiency oven cavities are being developed using multi-layer insulation technologies that drastically reduce heat loss and maximize energy conservation during high-temperature operations like pyrolytic cleaning, minimizing operational costs and environmental impact. The control interfaces themselves are evolving toward fully invisible, capacitive touch-sensitive glass panels that only illuminate when required, maintaining the sleek, uninterrupted aesthetic sought by designers and architects. Integrated ranges are also increasingly being designed with modular components that simplify replacement and servicing, countering the historical restraint of complex repair procedures and enhancing the appliance’s circular economy credentials, appealing strongly to the modern luxury consumer concerned with long-term ecological impact and product longevity, justifying the premium price point.

Regional Highlights

North America (NA) maintains its status as the most valuable market for integrated ranges, primarily sustained by a high concentration of affluent households and a cultural preference for large, high-capacity kitchen appliances suitable for entertainment and large family cooking. The US market, in particular, showcases strong demand for professional-style integrated ranges (48-inch and 60-inch widths), often favoring dual-fuel configurations that offer the best of gas and electric cooking technology combined. The market here is highly competitive, driven by strong domestic luxury brands and robust custom home building activity, especially in affluent suburbs. Consumer willingness to adopt new technologies, especially smart features and sophisticated connectivity that interface with whole-house automation systems, keeps NA at the forefront of innovation adoption, despite higher installation costs being widely accepted as part of the necessary luxury kitchen investment, solidifying its dominant revenue position.

Europe presents a highly mature yet structurally different market, characterized by stringent environmental regulations and spatial constraints in dense urban areas. The European integrated range market is overwhelmingly dominated by high-efficiency induction technology, often in smaller, 60cm (24-inch) or 90cm (36-inch) formats that prioritize energy savings and precise cooking control to comply with strict energy usage directives. Countries like Germany and the Nordic regions lead in adoption, driven by strong governmental emphasis on electrification and low-carbon residential solutions. European manufacturers excel in design integration, often offering highly proprietary flush-mount systems and advanced downdraft ventilation solutions that eliminate the need for traditional overhead hoods, reinforcing the minimalist aesthetic that defines contemporary European interior design practices, where functionality must be discreet and highly efficient, driving continuous engineering investment in miniaturization.

Asia Pacific (APAC) is emerging as the future powerhouse of the Integrated Range Market, exhibiting the highest projected CAGR. This growth is intrinsically linked to soaring rates of luxury residential construction and the rapid Westernization of kitchen culture across major Asian metropolises, including Shanghai, Singapore, and Mumbai. Affluent Asian consumers are increasingly investing in sophisticated, built-in kitchen systems as a symbol of modernity and status. While initial adoption rates were lower due to high cost barriers, aggressive marketing by global brands, coupled with localized product adjustments—such as incorporating high-powered wok zones and adapting oven functions for diverse Asian baking and roasting traditions—are accelerating market penetration. The regulatory environment is less uniform than in Europe, allowing for varied product offerings, but the demand for smart, connected appliances remains consistently high across the wealthy urban demographic, necessitating highly localized sales and servicing strategies.

Latin America (LATAM) and the Middle East & Africa (MEA) collectively represent significant untapped potential. In the Middle East, particularly the GCC countries (UAE and Qatar), market demand is concentrated in ultra-luxury real estate projects, often mirroring the large-scale, professional-grade preferences of North America, driven by high wealth per capita in the region and a penchant for conspicuous consumption. Economic instability and differing political landscapes, however, contribute to market volatility in LATAM and parts of MEA. In LATAM, growth is centered around major capital cities and high-income clusters. Infrastructure challenges, including varying quality of electrical grids and gas supplies, require manufacturers to offer robust, adaptable integrated ranges capable of handling local utility conditions. Successful market entry in both regions depends heavily on establishing reliable, certified service networks to overcome the installation and maintenance complexities inherent to integrated appliances and build consumer trust.

- North America: Dominant market value; strong demand for large dual-fuel and high-power induction; leading early adopter of smart connectivity in luxury homes.

- Europe: Leading adoption of compact induction technology; driven by stringent energy efficiency directives and minimalist design trends.

- Asia Pacific (APAC): Highest CAGR forecast; fueled by urbanization and rising luxury real estate development; requires product adaptation for regional cuisine.

- Middle East & Africa (MEA): Growth concentrated in affluent GCC nations; demand focused on high-specification, large-format integrated ranges for luxury projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Integrated Range Market.- Miele

- Sub-Zero Group

- Viking Range

- Bosch

- Thermador

- Gaggenau

- Smeg

- Bertazzoni

- Fisher & Paykel

- Wolf Appliance

- Electrolux (AEG)

- Haier (GE Appliances)

- Samsung (Dacor)

- LG Electronics

- La Cornue

- De'Longhi Appliances

- Hestan Commercial

- ILVE

- Fulgor Milano

- Beko

Frequently Asked Questions

Analyze common user questions about the Integrated Range market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines an integrated range compared to a standard freestanding range?

An integrated range is specifically engineered to install flush with cabinetry and countertops, offering a seamless, custom-built appearance that minimizes visual disruption. Unlike freestanding models, integrated units require specialized installation and often feature hidden controls or panel-ready options to align with minimalist kitchen aesthetics, targeting high-end design markets.

Is induction technology the dominant trend in the Integrated Range Market?

Yes, induction technology is rapidly becoming the dominant and fastest-growing segment, particularly in high-end integrated ranges. This dominance is due to superior energy efficiency, precise temperature control, faster heating capabilities, and enhanced safety features (such as reduced surface heat), aligning perfectly with modern performance and sustainability demands.

How does AI technology benefit the performance of integrated ranges?

AI technology enhances performance by providing features such as predictive maintenance diagnostics, personalized recipe guidance based on usage history, and real-time adjustment of power and heat settings for optimal cooking results. This elevates the appliance from a manual tool to an active, intelligent culinary assistant within the smart home ecosystem.

What are the primary factors restraining the global adoption of integrated ranges?

The primary restraints on global adoption include the significantly high initial purchasing price, which limits accessibility to affluent consumers, and the complexity and high cost of specialized installation, which often requires custom cabinetry modifications and certified technicians, increasing the total cost of ownership.

Which geographic region offers the highest growth opportunity for integrated range manufacturers?

The Asia Pacific (APAC) region, driven by rapid urbanization, substantial increases in disposable income, and a growing trend toward luxury, Western-style kitchen aesthetics in major economies like China and India, is projected to offer the highest compound annual growth rate (CAGR) and market expansion opportunity.

Are integrated ranges more energy efficient than traditional ranges?

Generally, yes, especially integrated ranges utilizing induction technology. Induction ranges convert electrical energy directly into magnetic heat in the cookware with minimal waste, resulting in significantly higher energy efficiency compared to traditional radiant electric or gas ranges. Manufacturers prioritize efficiency to meet luxury consumer demand and international energy standards.

What role do architects and designers play in purchasing decisions?

Architects and kitchen designers serve as critical gatekeepers and specifiers in the integrated range market. Due to the complex installation requirements and aesthetic demands, designers typically dictate the brand and model choices to the affluent end-user, prioritizing products that offer superior technical integration, reliability, and visual continuity with the overall kitchen concept.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager