Intellectual Property (IP) Law Firm Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432054 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Intellectual Property (IP) Law Firm Services Market Size

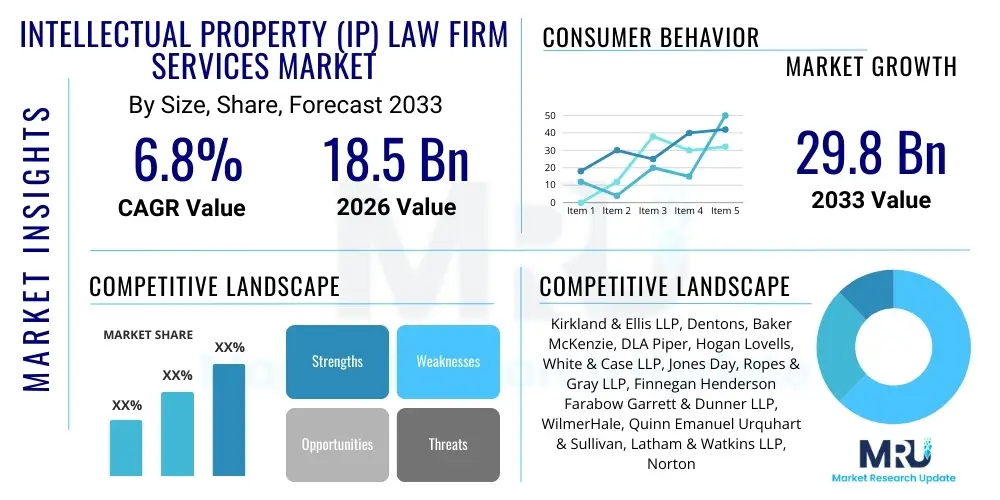

The Intellectual Property (IP) Law Firm Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 billion in 2026 and is projected to reach USD 29.8 billion by the end of the forecast period in 2033.

Intellectual Property (IP) Law Firm Services Market introduction

The Intellectual Property (IP) Law Firm Services Market encompasses specialized legal and advisory services designed to protect, enforce, and monetize intangible assets such as patents, trademarks, copyrights, and trade secrets. This critical sector provides essential support for global innovation economies, offering services ranging from initial registration and prosecution to complex cross-border litigation and portfolio management. The core services are centered around securing exclusive rights for creators and businesses, ensuring competitive advantage, and safeguarding investments in research and development (R&D). The market is characterized by high expertise requirements, often necessitating specialization in technical fields like biotechnology, pharmaceuticals, or artificial intelligence, alongside profound legal understanding.

Major applications of these services span across virtually every industry, including Technology and Telecommunications (securing software patents and industrial designs), Life Sciences (managing pharmaceutical patents and regulatory approvals), Manufacturing (protecting trade secrets and industrial processes), and Media and Entertainment (handling copyright and licensing issues). The demand for robust IP protection has intensified due to increased globalization, which necessitates securing rights across multiple jurisdictions, and the rapid pace of technological obsolidation, driving continuous R&D investment. Law firms in this space leverage deep domain knowledge combined with sophisticated legal technologies (LegalTech) to handle voluminous documentation and complex legal standards efficiently.

Key benefits derived from utilizing specialized IP law firm services include maximizing the economic value of intangible assets, mitigating risks associated with infringement claims, and establishing strong legal barriers against competitors. Driving factors propelling market expansion include escalating global R&D expenditure, particularly in emerging technologies such as 5G, quantum computing, and personalized medicine, which inherently generate vast amounts of protectable IP. Furthermore, a rising trend in IP monetization—where companies actively license or sell their patents and trademarks—fuels the need for specialized transactional and valuation services provided by these law firms. The increasing complexity of international trade disputes often involving IP rights also contributes significantly to market growth.

Intellectual Property (IP) Law Firm Services Market Executive Summary

The Intellectual Property (IP) Law Firm Services Market is undergoing a significant transformation driven by digitalization, geopolitical shifts, and the proliferation of AI tools. Business trends indicate a shift away from traditional purely litigation-focused models toward comprehensive advisory and strategic portfolio management services, particularly targeting large multinational corporations and technology startups seeking to maximize IP valuation ahead of major funding rounds or acquisitions. Law firms are investing heavily in LegalTech platforms, utilizing advanced data analytics for prior art searching and predictive modeling for litigation outcomes, leading to increased efficiency but also requiring substantial investment in upskilling legal professionals. Consolidation among boutique IP firms and full-service corporate law practices is a noted trend, aiming to offer seamless, integrated legal and technical expertise to clients operating globally. Cybersecurity concerns related to trade secrets and IP management systems are also driving demand for specialized compliance and breach prevention advisory services.

Regionally, North America and Europe remain the core revenue generators, characterized by mature legal frameworks, high R&D spending, and established mechanisms for IP enforcement, particularly patent protection. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by substantial increases in domestic patent filings in countries like China, South Korea, and Japan, alongside a growing emphasis on strengthening IP enforcement measures across the region to comply with international trade agreements. Latin America and the Middle East and Africa (MEA) are emerging markets, where growth is currently tied to economic diversification efforts and the establishment of robust national IP regimes, attracting foreign direct investment (FDI) that requires corresponding legal protection for technology transfer and local manufacturing.

Segmentation trends highlight the dominance of Patent Prosecution and Litigation services, which constitute the largest revenue stream due to the inherent complexity and high stakes involved in patent matters, especially within the pharmaceutical and high-tech sectors. Trademark services, while more transactional in nature, show steady growth driven by global branding efforts and the rise of e-commerce, necessitating extensive trademark monitoring and enforcement online. Services categorized by end-users demonstrate robust demand from the Technology sector, particularly for securing software and hardware innovations, followed closely by the Life Sciences and Biotechnology segments, where the prolonged duration and critical nature of patent exclusivity directly impact market access and profitability. Specialized services focusing on trade secret protection are gaining traction as companies seek alternatives to complex, lengthy patent processes, especially in manufacturing and proprietary algorithm development.

AI Impact Analysis on Intellectual Property (IP) Law Firm Services Market

User queries regarding the impact of Artificial Intelligence (AI) on the Intellectual Property Law Services Market overwhelmingly focus on automation capabilities, ethical implications, and the changing definition of inventorship. Key themes include the potential for AI to significantly reduce the time and cost associated with routine tasks like prior art searching, document review, and basic patent drafting, leading to fears of displacement among paralegals and junior associates. Users frequently question how AI affects legal professional value proposition, shifting expectations toward high-level strategic counsel, complex litigation strategy, and specialized advisory regarding AI-generated content or inventions. Concerns also revolve around the intellectual property ownership of AI outputs—whether the AI itself, its developer, or the user holds the rights—which necessitates law firms developing novel legal theories and expertise in this rapidly evolving area. Expectations are high that AI will increase accuracy and speed in discovery processes, fundamentally enhancing the efficiency of IP enforcement and management.

- AI optimizes prior art searches and patent landscaping by analyzing vast global databases, drastically reducing manual review time and increasing the probability of discovering relevant existing art.

- Generative AI tools assist in drafting initial patent claims, descriptions, and legal documents, improving consistency and speeding up the patent application process (prosecution).

- AI-driven e-Discovery platforms enhance the efficiency of large-scale IP litigation by rapidly identifying relevant documents, emails, and data points critical for infringement and validity disputes.

- Machine learning models are increasingly used for IP portfolio valuation and risk assessment, predicting the likelihood of patent grant or litigation success based on historical data.

- The rise of AI-generated inventions necessitates new legal advisory services concerning inventorship determination, ownership rights, and the harmonization of international IP laws to accommodate non-human creation.

- AI tools improve trademark monitoring by autonomously tracking potential infringements across global e-commerce platforms and social media channels.

- Automation of repetitive administrative tasks such as docketing, compliance checks, and status reporting frees up senior lawyers to focus on high-value strategic consulting and client relationship management.

- Data privacy and cybersecurity compliance advisory becomes critical, as law firms handle sensitive proprietary R&D data leveraged by AI tools.

DRO & Impact Forces Of Intellectual Property (IP) Law Firm Services Market

The IP Law Firm Services Market is heavily influenced by dynamic global economic and technological factors. Key drivers include the exponential increase in global research and development expenditure, especially in high-growth sectors like biotechnology, fintech, and advanced materials, which continuously generate complex, protectable intellectual assets. Furthermore, increasing cross-border trade and investment necessitate multi-jurisdictional IP protection and enforcement strategies, significantly driving up the demand for international legal coordination and specialization. Restraints on market growth involve the exceptionally high costs associated with complex, multi-year patent litigation and prosecution, often making full IP protection economically unviable for smaller enterprises and startups, thereby limiting the client base. Jurisdictional uncertainties and lack of harmonization among global IP laws also introduce significant complexities and risks, acting as a frictional force slowing down efficient global portfolio management. Opportunities arise from the deployment of LegalTech solutions, including AI and blockchain, which promise to streamline processes and reduce costs, making IP services more accessible. The burgeoning field of IP monetization and licensing, driven by sophisticated clients seeking to derive income from dormant IP assets, presents a lucrative advisory avenue for law firms. The rapid implementation of specialized IP courts and efforts toward international harmonization, such as the Unified Patent Court in Europe, also create clearer, more enforceable legal environments, stimulating demand.

Impact forces in this market are predominantly structural and technological. The technological impact force, centered around AI and digital transformation, is reshaping service delivery by automating mundane tasks and augmenting attorney capabilities, simultaneously acting as both a driver (by creating new IP challenges) and a restraint (by requiring high upfront investment in technology). Economic impact forces, particularly global recessionary pressures or geopolitical trade disputes, directly influence R&D budgets and litigation willingness. For instance, economic downturns might lead to reduced patent filings but potentially increased focus on trade secret protection or IP enforcement to secure competitive advantage. Regulatory impact forces, driven by shifting governmental priorities regarding national innovation policies and international trade agreements, dictate the complexity and necessity of legal services. Increased governmental scrutiny on monopolistic practices related to standard-essential patents (SEPs) also significantly influences litigation volumes and strategies.

The combination of these forces creates a highly competitive environment where firms must differentiate based on specialized technical expertise (e.g., deep learning IP, CRISPR technology) and the efficiency of their service delivery. The requirement for firms to navigate complex, fragmented global regulatory landscapes, while simultaneously integrating cutting-edge technology into their operations, defines the strategic challenges. Success hinges on a firm’s ability to offer bespoke, high-value strategic counsel that addresses not just the immediate legal issue but the client’s broader commercial objectives, positioning IP protection as a central component of business strategy rather than a mere cost center. This strategic focus demands a multidisciplinary approach, blending legal expertise with economic and technical acumen.

Segmentation Analysis

The Intellectual Property Law Firm Services Market is segmented based on the Type of Service provided, the Industry End-User consuming the services, and the Geographic region of operation. Analysis of these segments is crucial for understanding specific growth pockets and evolving client needs. The primary service types—Patents, Trademarks, Copyrights, and Trade Secrets—reflect the fundamental categories of intellectual assets requiring legal protection. Patent services command the largest market share due to the high complexity, long lifecycle, and critical strategic value of technical innovation protection, spanning prosecution (filing and obtaining patents) and contentious matters (litigation and invalidation). Trademark services, encompassing registration, monitoring, and anti-counterfeiting efforts, maintain a high volume, driven by branding and e-commerce expansion. Industry segmentation reveals high dependency on high-R&D sectors, particularly Technology and Life Sciences, which generate the most valuable and complex IP portfolios, requiring continuous legal engagement across multiple international jurisdictions.

- By Service Type:

- Patent Services (Prosecution, Litigation, Licensing, Validity Opinions)

- Trademark Services (Registration, Monitoring, Enforcement, Anti-Counterfeiting)

- Copyright Services (Registration, Licensing, Digital Rights Management)

- Trade Secret Management and Litigation

- IP Portfolio Management and Strategy Consulting

- IP Valuation and Due Diligence

- By Industry End-User:

- Technology & Telecommunications (Software, Hardware, AI, Semiconductors)

- Life Sciences & Pharmaceuticals (Biotech, Medical Devices, Drugs)

- Manufacturing & Automotive (Industrial Designs, Process Patents)

- Media & Entertainment (Content Licensing, Digital Media Rights)

- Consumer Goods & Retail

- Finance & Fintech

- By Firm Size:

- Large International Law Firms

- Specialized IP Boutique Firms

- Regional Law Firms

Value Chain Analysis For Intellectual Property (IP) Law Firm Services Market

The value chain for Intellectual Property Law Firm Services is complex, involving multiple stages from initial asset creation to final enforcement and monetization, underpinned by technological and informational services. The upstream segment of the value chain is characterized by entities that facilitate the creation and management of IP documentation and data. This includes R&D departments within client organizations (the initial source of IP), independent inventors, and, crucially, providers of specialized legal technologies such as large-scale patent search databases (e.g., Clarivate, LexisNexis), docketing software providers, e-discovery solution vendors, and technical expert witnesses who supply foundational analysis. Effective utilization of these upstream resources, particularly advanced AI-powered searching tools, directly impacts the efficiency and quality of the law firm’s output, allowing for better prior art analysis and stronger patent applications. Law firms that integrate these technological tools efficiently gain a competitive advantage in cost and speed of delivery.

The core of the value chain involves the IP law firms themselves, acting as the transformation layer where legal expertise converts technical information into legally protected assets. This core function includes specialized roles such as patent agents (often with advanced technical degrees), IP attorneys, and litigation specialists. The distribution channel is predominantly direct, relying on direct consultation, relationship management, and bespoke service delivery to corporate clients. However, the rise of online IP platforms and managed legal services providers represents an increasingly important indirect channel, particularly for small businesses and routine trademark filings. For high-value services like cross-border litigation, the relationship remains highly personalized and direct, often involving significant travel and international coordination, relying heavily on professional networks and referral systems across different jurisdictions. The firm’s reputation and specialized knowledge act as significant barriers to entry in this direct distribution model.

The downstream segment of the value chain focuses on the consumption and realization of the IP assets. This includes the corporate clients (End-Users) utilizing the protected IP for competitive market positioning, licensing revenue generation, or defense against competitors. Enforcement mechanisms, such as national and international courts (e.g., US Federal Circuit, European Patent Office Boards of Appeal), represent the final stage of the enforcement value stream. The effectiveness of the law firm's advisory and litigation strategy directly determines the success of the client’s IP monetization or protection efforts in the downstream market. Furthermore, financial institutions and investment firms that specialize in IP-backed financing and M&A due diligence are increasingly integrating into the downstream, creating demand for highly specialized IP valuation and transaction advisory services.

Intellectual Property (IP) Law Firm Services Market Potential Customers

The Intellectual Property (IP) Law Firm Services Market caters to a diverse range of potential customers, spanning major multinational corporations to individual inventors, all sharing the necessity to legally protect their intangible assets to maintain market competitiveness and secure future revenue streams. The most significant revenue generation comes from large enterprises in technology, pharmaceuticals, and manufacturing, which consistently generate high volumes of complex intellectual property and require ongoing support for patent prosecution, global portfolio management, and high-stakes litigation. These clients demand specialized legal teams capable of integrating deep technical understanding with sophisticated legal strategy, often across dozens of jurisdictions simultaneously, driving demand for the largest international law firms or highly specialized boutique practices focused on specific technical niches, such as bioinformatics or aerospace engineering.

In addition to large corporate entities, Small and Medium-sized Enterprises (SMEs) and high-growth technology startups represent a rapidly expanding customer base, particularly those seeking early-stage patent filings to attract venture capital investment and secure critical market exclusivity before product launch. While these entities may require fewer litigation services initially, the demand for cost-effective prosecution, trademark registration, and initial strategic counsel regarding freedom-to-operate (FTO) opinions is substantial. Universities and governmental research institutions also constitute a crucial segment, utilizing IP law firms to manage technology transfer offices, patent the results of federally funded research, and license innovations to private sector partners, often requiring specialized knowledge of academic and regulatory compliance frameworks.

Finally, individual inventors and content creators utilize the market primarily for cost-effective trademark and copyright registrations, often accessing services through streamlined online platforms or local/regional firms. The buyers of these services are generally categorized as IP asset owners, technology licensing departments, corporate legal teams (who often outsource specialized IP work), and venture capital firms conducting deep due diligence on potential portfolio companies. The ability of a law firm to demonstrate a successful track record in the client’s specific technological domain and jurisdictional needs is the primary determinant of customer acquisition and retention in this competitive market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.8 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kirkland & Ellis LLP, Dentons, Baker McKenzie, DLA Piper, Hogan Lovells, White & Case LLP, Jones Day, Ropes & Gray LLP, Finnegan Henderson Farabow Garrett & Dunner LLP, WilmerHale, Quinn Emanuel Urquhart & Sullivan, Latham & Watkins LLP, Norton Rose Fulbright, Allen & Overy, Gowling WLG, WIPO (World Intellectual Property Organization) Services, USPTO Designated Service Providers, Marks & Clerk, Mayer Brown, K&L Gates |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intellectual Property (IP) Law Firm Services Market Key Technology Landscape

The technological landscape supporting the Intellectual Property Law Firm Services Market is rapidly evolving, moving beyond simple document management toward sophisticated analytical and automation tools. Core to this transformation are robust docketing and case management systems (CMS), which ensure stringent compliance with critical filing deadlines and procedural requirements across multiple global jurisdictions, mitigating the significant risk associated with administrative errors in high-stakes IP matters. These CMS platforms are increasingly integrated with client extranets, allowing for real-time portfolio visibility and collaborative decision-making. Furthermore, specialized prior art searching tools, leveraging semantic search capabilities and AI algorithms, are critical for conducting efficient novelty assessments, freedom-to-operate analyses, and validity opinions, forming the foundational technical competence expected of modern IP law firms. The adoption of cloud-based infrastructure allows these firms to handle massive data sets securely and offer scalable services globally, a requirement driven by multinational clients.

Beyond traditional legal software, the market is defined by the integration of advanced data science and machine learning. E-Discovery platforms, essential for litigation, utilize predictive coding and natural language processing (NLP) to review millions of documents quickly and accurately, drastically reducing discovery costs and duration. For trademark services, automated monitoring software continuously scans global registries and online marketplaces for potential infringement, providing proactive enforcement capabilities. A newer, yet highly significant, technology is blockchain. While not directly used in the legal advisory process itself, blockchain technology is emerging as a secure, decentralized method for time-stamping IP creation (e.g., copyright registration for digital assets) and managing complex licensing agreements and royalty distributions (smart contracts), offering new monetization avenues that require corresponding legal advice for implementation and enforcement. Law firms that successfully integrate these technologies into their workflows enhance efficiency, standardize quality, and gain a competitive edge by offering predictive analytics regarding legal outcomes.

The strategic deployment of these technologies necessitates significant capital expenditure and a shift in hiring practices, favoring professionals with hybrid legal and technical skills (Legal Engineers, Data Scientists). This technological dependency is creating a clear divide between firms that invest heavily in digitalization and those relying on traditional, manual processes. Effective utilization of technology not only streamlines existing services like patent annuity management and correspondence filing but also enables the creation of entirely new advisory products, such as sophisticated risk modeling for global patent litigation portfolios or advisory on cybersecurity protocols specifically designed to protect valuable trade secrets from digital espionage. The long-term trend points toward fully integrated 'Legal Operating Systems' that manage the entire IP lifecycle, from invention disclosure to post-grant maintenance and enforcement.

Regional Highlights

- North America (US and Canada): North America dominates the IP Law Firm Services Market, driven primarily by the highly innovative US economy, which leads globally in R&D spending, venture capital investment, and the filing of high-value patents, particularly in software, AI, and biotech. The robust legal infrastructure, including specialized federal courts like the Court of Appeals for the Federal Circuit (CAFC), ensures predictable and rigorous enforcement of patent rights, stimulating demand for sophisticated litigation services. Major IP law firms and technology companies headquartered here generate consistent demand for comprehensive patent prosecution, trade secret protection, and transactional advisory related to M&A and licensing. Canada also contributes significantly, especially in technology and natural resources IP, maintaining strong ties and harmonization efforts with the US legal system.

- Europe (Germany, UK, France): Europe constitutes a mature and influential market segment characterized by a complex, multi-layered IP system, currently undergoing transformation with the launch of the Unified Patent Court (UPC) and the Unitary Patent (UP). This development is creating immense opportunities for law firms specializing in cross-border European litigation and unified filing strategies, replacing fragmented national court systems. Germany remains the largest European market, highly focused on engineering, automotive, and industrial patents, known for efficient infringement proceedings. The UK, post-Brexit, maintains its status as a global center for IP litigation, particularly for pharmaceutical and life science disputes, commanding premium service fees. The growing emphasis on data protection (GDPR) also intertwines closely with IP strategy, driving demand for holistic data and IP compliance services.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC is the fastest-growing market, propelled by monumental increases in domestic patent filings, particularly in China, which now leads the world in application volume. This region is transitioning from a focus on manufacturing and imitation to genuine innovation and strengthening enforcement mechanisms. South Korea and Japan maintain global leadership in electronics, automotive, and robotics patents, demanding high-quality prosecution and strategic counseling. India is emerging as a significant market, driven by its large IT sector and growing pharmaceutical generic manufacturing capabilities, necessitating expertise in compulsory licensing and domestic IP disputes. The high volume and increasingly complex nature of IP assets generated in APAC require Western law firms to establish strong local partnerships or large regional offices.

- Latin America (Brazil, Mexico): The market in Latin America is characterized by high potential growth linked to foreign direct investment (FDI) and increasing regional economic integration. Brazil and Mexico are the largest economies and primary drivers of IP services demand, primarily focusing on trademark protection for consumer goods and pharmaceuticals, and patent prosecution related to technology transfer from multinational corporations. Challenges remain concerning the pace of IP office operations and judicial enforcement consistency, but legislative efforts to modernize IP laws are stimulating steady, albeit slower, growth in demand for both local and international legal counsel.

- Middle East and Africa (MEA): MEA represents an evolving market heavily influenced by government initiatives aimed at economic diversification (e.g., Saudi Vision 2030, UAE's focus on technology hubs). Demand for IP services is highly concentrated in specific jurisdictions (UAE, Saudi Arabia, Israel—a leading tech hub) and centers on trademark protection for luxury and consumer brands, and patent filings in areas like renewable energy and infrastructure development. The complexity of differing legal traditions (Civil Law, Common Law, Sharia Law) necessitates highly localized legal expertise, often focusing on advisory services concerning foreign company entry and compliance with nascent IP regulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intellectual Property (IP) Law Firm Services Market.- Kirkland & Ellis LLP

- Dentons

- Baker McKenzie

- DLA Piper

- Hogan Lovells

- White & Case LLP

- Jones Day

- Ropes & Gray LLP

- Finnegan Henderson Farabow Garrett & Dunner LLP

- WilmerHale

- Quinn Emanuel Urquhart & Sullivan, LLP

- Latham & Watkins LLP

- Norton Rose Fulbright

- Allen & Overy

- Gowling WLG

- Marks & Clerk

- Mayer Brown

- K&L Gates

- Morrison & Foerster LLP

- Freshfields Bruckhaus Deringer LLP

Frequently Asked Questions

Analyze common user questions about the Intellectual Property (IP) Law Firm Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the IP Law Firm Services Market?

The primary factor driving market growth is the exponential increase in global research and development (R&D) investments, particularly in complex emerging technologies like Artificial Intelligence, Biotechnology, and Fintech. This rapid innovation generates a continuous need for specialized legal services to secure, enforce, and monetize novel intellectual assets across multiple jurisdictions.

How is Legal Technology (LegalTech) influencing the cost structure of IP law firms?

LegalTech, including AI-powered prior art searching and automated e-Discovery platforms, significantly influences the cost structure by enhancing efficiency, automating routine tasks, and reducing the total hours required for prosecution and litigation preparation. This shift allows firms to handle higher volumes of complex work while offering potentially lower costs for administrative services.

Which service segment holds the largest market share within IP Law Firm Services?

Patent Services, encompassing both prosecution (filing and obtaining patents) and high-stakes litigation, holds the largest market share. This dominance is due to the inherent complexity, high strategic value, and prolonged legal lifecycles associated with technical invention protection, especially in sectors such as pharmaceuticals and high-technology manufacturing.

What challenges do law firms face regarding the globalization of IP protection?

Globalization presents challenges related to the fragmentation and lack of harmonization among national IP laws, requiring law firms to manage high complexity and administrative burden when filing and enforcing rights across numerous diverse legal systems. Geopolitical tensions and varying judicial enforcement standards further complicate cross-border portfolio management.

Are trade secret services becoming more important than patent services?

While patent services remain the largest segment, trade secret management and litigation services are growing significantly in importance. Companies, especially those in software and advanced manufacturing, are increasingly opting for trade secret protection as a cost-effective alternative for assets that are difficult to patent or rely heavily on internal proprietary processes, demanding specialized advisory on security protocols and confidentiality agreements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager