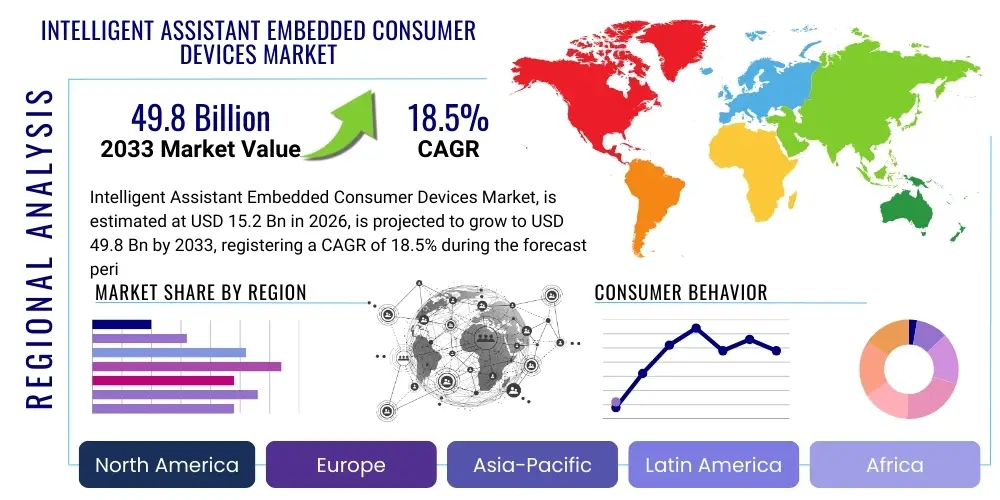

Intelligent Assistant Embedded Consumer Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436179 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Intelligent Assistant Embedded Consumer Devices Market Size

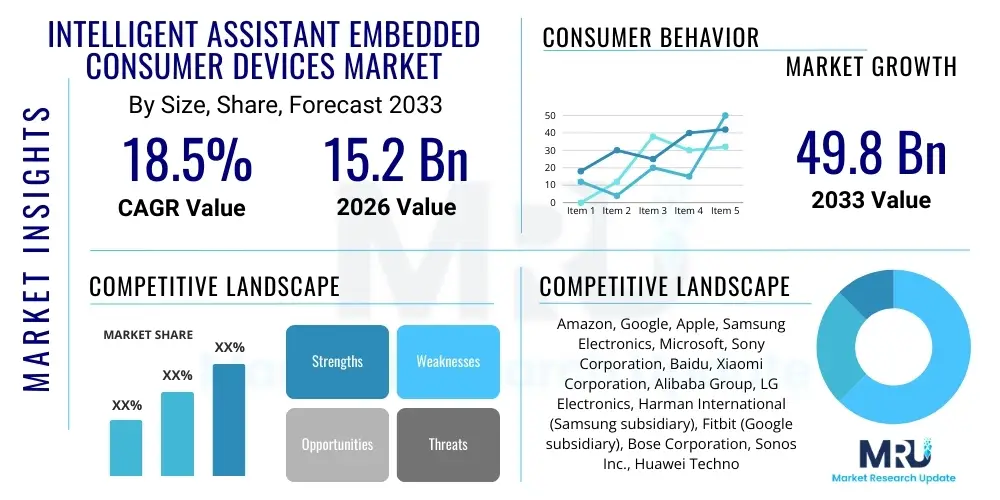

The Intelligent Assistant Embedded Consumer Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 49.8 Billion by the end of the forecast period in 2033.

Intelligent Assistant Embedded Consumer Devices Market introduction

The Intelligent Assistant Embedded Consumer Devices Market encompasses a diverse range of hardware integrating sophisticated AI-powered software designed to perform tasks, answer queries, and control other interconnected devices through natural language interfaces, primarily voice. These devices, which include smart speakers, smart displays, connected home appliances, advanced wearables, and smart automotive systems, function as nodes within the Internet of Things (IoT ecosystem). Their core value proposition lies in providing seamless, personalized, and intuitive human-device interaction, fundamentally altering how consumers manage their homes, health, entertainment, and daily routines.

Product descriptions vary significantly across the market landscape. Smart speakers, such as the Amazon Echo or Google Home, represent the most established segment, offering audio playback and smart home control. More recently, integration has expanded into white goods like refrigerators and ovens, where embedded assistants manage inventory, suggest recipes, and diagnose operational issues. The technological sophistication required for these integrations involves dedicated AI chipsets, high-fidelity microphone arrays, and robust connectivity modules capable of processing complex commands locally (edge computing) or transmitting data efficiently to cloud-based neural networks.

Major applications span residential automation, including lighting, climate control, and security systems; health and wellness monitoring via smart wearables that track physiological data and offer proactive feedback; and entertainment personalization through content recommendation engines. The key driving factors include the rapid global deployment of 5G infrastructure, which reduces latency for cloud processing; significant advancements in Natural Language Processing (NLP) leading to more human-like interactions; and the continued decline in the cost of sensor technology and specialized AI processors, making high-end intelligence accessible in mass-market devices. This convergence of hardware efficiency and software intelligence is fueling widespread consumer adoption.

Intelligent Assistant Embedded Consumer Devices Market Executive Summary

The market is currently characterized by intense platform competition, primarily between major technology conglomerates vying for ecosystem dominance, leading to rapid innovation cycles and aggressive pricing strategies aimed at market penetration. Business trends indicate a strong shift towards Edge AI processing, minimizing reliance on constant cloud connectivity and addressing consumer concerns regarding data privacy and real-time responsiveness, particularly in automotive and health-monitoring devices. Furthermore, there is an increasing trend of vertical integration, where manufacturers are developing proprietary AI assistants tailored specifically for their hardware ecosystem, enhancing device performance and user experience while locking users into a specific brand environment.

Regionally, North America and Europe currently hold the largest market shares due to high disposable income, established broadband penetration, and early adoption of smart home technology. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is driven by massive governmental initiatives promoting smart city development, a rapidly expanding middle class in countries like China and India, and the widespread adoption of customized, localized intelligent assistant solutions that cater to diverse linguistic and cultural requirements. Latin America and the Middle East & Africa are emerging markets, primarily focused on basic smart speaker adoption and integration into new residential construction projects.

Segment trends highlight the explosive growth in non-traditional device integration, moving beyond standard smart speakers to include complex appliances and specialized monitoring devices. The 'Hearables' segment (AI-enabled earbuds) is demonstrating significant traction, integrating health tracking and real-time language translation, turning passive listening devices into active personal assistants. Technology segments are dominated by hybrid processing architectures—a combination of efficient on-device processing for basic commands and cloud connectivity for complex learning tasks. This balanced approach ensures optimal performance, security, and sustainability for embedded consumer devices.

AI Impact Analysis on Intelligent Assistant Embedded Consumer Devices Market

Analysis of common user questions reveals critical themes centered on the practical evolution of intelligent assistants, specifically concerning data security, interoperability across different vendor ecosystems (e.g., Google Assistant vs. Alexa), and the assistant's ability to learn and anticipate user needs proactively. Users are increasingly questioning the privacy implications of always-on microphones and cameras, driving manufacturers to invest heavily in clear data governance policies and robust encryption standards. The expectation is shifting from reactive command processing to proactive, context-aware assistance, meaning the AI must understand complex multi-step intentions and manage various device interactions seamlessly without explicit user prompts.

The core influence of AI is the transition from simple Natural Language Understanding (NLU) to Natural Language Generation (NLG) and advanced personalization. Machine learning models are continuously refining voice biometrics for personalized responses and implementing federated learning techniques to improve models without compromising raw user data privacy. This advancement is crucial for high-stakes applications, such as healthcare monitoring, where precise interpretation of verbal cues and ambient sounds (e.g., potential emergencies) is essential. The market's future growth hinges on the ability of AI to break the current conversational limitations and achieve true contextual awareness.

Furthermore, AI is instrumental in enhancing the energy efficiency of these devices, especially in battery-powered wearables. Sophisticated algorithms optimize power consumption by only activating high-power processing units when complex commands are detected, relying on ultra-low-power microcontrollers for passive wake-word detection. This technical evolution, driven entirely by AI optimization, is expanding the usability and battery life of highly integrated consumer electronics, thereby accelerating market acceptance and enabling new form factors.

- AI drives hyper-personalization through advanced user profile modeling and predictive behavior analysis.

- Edge AI processors facilitate real-time, low-latency command execution and reduce reliance on cloud processing for common tasks.

- Enhanced Natural Language Processing (NLP) and contextual awareness improve accuracy in understanding complex, ambiguous, or multi-turn conversational inputs.

- AI algorithms are critical for advanced security features, including voice biometrics for device access and transaction authorization.

- Machine learning optimizes device battery life and energy consumption by intelligently managing processing load and sensor activity.

- Adoption of multimodal AI allows assistants to interpret inputs from voice, visual cues (smart displays), gestures, and ambient sensor data concurrently.

- AI powers proactive assistance, enabling devices to initiate helpful actions based on learned routines or external environmental factors.

DRO & Impact Forces Of Intelligent Assistant Embedded Consumer Devices Market

The Intelligent Assistant Embedded Consumer Devices Market is fundamentally shaped by a balance between technological pull and regulatory push. Key drivers include the exponential increase in IoT device adoption, the pervasive rollout of faster network technologies (5G and Wi-Fi 6), and a growing consumer demand for seamless automation and convenience in daily life. Opportunities are vast, primarily focusing on untapped verticals like healthcare, elderly care, and hyper-specialized professional tools utilizing embedded intelligence. However, the market faces structural restraints such as severe security vulnerabilities, consumer apprehension regarding data usage, and the ongoing challenge of achieving universal interoperability between competing assistant platforms, which limits holistic smart home experiences.

Impact forces are currently strong and positive, driven by high investment in silicon innovation and software development. The threat of substitutes is low, as dedicated embedded intelligence offers a level of convenience and integration that standalone apps or manual controls cannot replicate. Supplier power is moderate; while a few major companies dominate the core AI platform (Google, Amazon, Apple), the component supply chain (semiconductors, sensors) remains competitive. Buyer power is high due to fierce brand competition and the relatively low switching cost between assistant platforms for new purchases, compelling manufacturers to continually offer improved features, higher privacy standards, and competitive pricing.

Overall, the market dynamic favors disruptive innovation in security and context-awareness. Companies that successfully navigate the complex regulatory landscape, particularly concerning GDPR and CCPA compliance, while offering superior, reliable performance through edge computing solutions, are positioned for market leadership. The shift toward subscription-based services accompanying hardware (e.g., enhanced security monitoring, specialized health data analysis) represents a significant opportunity for sustainable revenue generation beyond initial device sales, further driving the competitive intensity in the services layer of the market.

Segmentation Analysis

The Intelligent Assistant Embedded Consumer Devices Market is segmented comprehensively based on the type of device, the underlying technology used for processing and communication, the primary application area, and the distribution channel through which these products reach the consumer. This detailed segmentation allows for a precise understanding of market dynamics, revealing that growth is unevenly distributed, with high-value segments increasingly driven by advanced AI processing capabilities and specialized health applications, whereas high-volume segments remain dominated by smart speakers and basic home automation tools sold through online retail channels.

- By Device Type:

- Smart Speakers and Displays

- Smart Home Appliances (Refrigerators, Ovens, Washers)

- Smart Wearables (Smartwatches, Fitness Bands, Hearables)

- Smart Entertainment Devices (Set-top Boxes, Smart TVs)

- Smart Automotive Systems (In-car Infotainment)

- By Technology:

- Voice Recognition Technology (Far-field and Near-field)

- Natural Language Processing (NLP)

- Machine Learning and Deep Learning (ML/DL)

- Biometric and Sensor Fusion Technology

- By Application:

- Home Automation and Security

- Entertainment and Media Control

- Health and Wellness Monitoring

- Communication and Information Services

- Retail and E-commerce Integration

- By Distribution Channel:

- Online Retail Channels (E-commerce platforms)

- Offline Retail Channels (Specialty Stores, Consumer Electronics Stores)

- Original Equipment Manufacturer (OEM) Direct Sales

Value Chain Analysis For Intelligent Assistant Embedded Consumer Devices Market

The value chain for Intelligent Assistant Embedded Consumer Devices is complex, spanning semiconductor fabrication, advanced software development, hardware assembly, and specialized distribution networks. Upstream activities are dominated by specialized component suppliers, including manufacturers of high-performance System-on-Chips (SoCs), micro-electro-mechanical systems (MEMS) microphones, high-fidelity sensors (optical, proximity, bio-impedance), and memory modules. The proficiency and cost-effectiveness of these suppliers directly influence the final product's latency, power consumption, and overall intelligence, often necessitating strategic partnerships between AI platform providers and silicon developers to optimize hardware-software integration.

Midstream activities involve Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs) responsible for device assembly, rigorous quality control testing, and final packaging. A critical part of this stage is the integration and calibration of the intelligent assistant software, often involving secure boot processes and over-the-air update mechanisms to ensure long-term functionality and security patch deployment. The supply chain demands high efficiency and scale, particularly for mass-market devices like smart speakers, pushing manufacturing towards high-volume, automated facilities in key Asian manufacturing hubs.

Downstream activities focus on reaching the end-user through various distribution channels. Direct channels involve OEMs selling devices through their own websites or branded physical stores, allowing greater control over the customer experience and data collection. Indirect distribution relies heavily on major e-commerce giants (Amazon, Alibaba) and large-format consumer electronics retailers. These indirect channels benefit from extensive reach and efficient logistics, often serving as the primary point of sale for the majority of consumer devices. Effective post-sale support, including software updates and troubleshooting, is essential to maintaining customer satisfaction and retaining users within a specific intelligent ecosystem.

Intelligent Assistant Embedded Consumer Devices Market Potential Customers

The primary consumers for Intelligent Assistant Embedded Consumer Devices are stratified across several key demographic and psychographic segments, all seeking enhanced convenience, connectivity, and data-driven personalization. The foundational market segment consists of affluent, tech-savvy early adopters and millennial homeowners (aged 25-45) who prioritize smart home integration, digital entertainment, and energy efficiency. These buyers frequently invest in interconnected ecosystems, purchasing multiple devices (speakers, thermostats, security systems) from a single dominant vendor for guaranteed interoperability and centralized control.

A rapidly expanding segment involves individuals focused on health and wellness, primarily targeted by advanced smart wearables and hearables. This demographic includes health-conscious younger users and, critically, the growing elderly population and their caregivers. For the latter, embedded assistants provide crucial monitoring functions, medication reminders, fall detection, and seamless communication with emergency services or family members, positioning these devices as essential tools for proactive and independent living support, often leading to higher average selling prices due to regulatory requirements and specialized functionality.

Furthermore, businesses and institutions represent a significant, though often specialized, end-user group. While this report focuses on consumer devices, there is an overlap in adoption, especially in hospitality (smart displays in hotel rooms), residential development (bulk installation in new homes), and retail environments (using assistants for inventory checks or customer service kiosks). These potential buyers look for robust security, scalability, and platform-agnostic solutions that can be easily managed and integrated into large existing networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 49.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon, Google, Apple, Samsung Electronics, Microsoft, Sony Corporation, Baidu, Xiaomi Corporation, Alibaba Group, LG Electronics, Harman International (Samsung subsidiary), Fitbit (Google subsidiary), Bose Corporation, Sonos Inc., Huawei Technologies, Nvidia Corporation, Intel Corporation, Cerence Inc., Tencent Holdings, JD.com. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Assistant Embedded Consumer Devices Market Key Technology Landscape

The technological landscape is defined by the symbiotic relationship between specialized hardware and continuously evolving AI software. Central to the market is the development and optimization of low-power, high-performance Edge AI processors (e.g., dedicated NPUs or ASICs) that allow complex inference tasks—such as wake-word detection, local language models, and basic command execution—to occur directly on the device. This edge computing architecture significantly improves response time, reduces network bandwidth requirements, and provides a crucial layer of privacy by processing sensitive data locally before encryption and potential cloud transmission. Far-field voice recognition technology, relying on sophisticated microphone arrays and acoustic echo cancellation (AEC), is also paramount to ensure accurate command capture in noisy consumer environments.

On the software front, advancements in Natural Language Understanding (NLU) and contextual reasoning are continually pushing the capabilities of these assistants. Deep learning models, particularly recurrent neural networks (RNNs) and transformer architectures, are utilized to interpret user intent, manage complex conversational context, and seamlessly switch between tasks. Furthermore, the integration of sensor fusion technology—combining data from microphones, accelerometers, gyroscopes, and ambient light sensors—enables the assistant to develop a more holistic understanding of the user's environment and emotional state, leading to truly personalized and proactive interactions. Biometric identification (voice and facial recognition) ensures secure user authentication for critical functions like financial transactions or unlocking smart locks.

Connectivity is the third major pillar, with the adoption of standards like Wi-Fi 6, Bluetooth Low Energy (BLE), and Matter (for seamless interoperability in smart homes) driving market expansion. 5G connectivity is critical for devices requiring high-speed, reliable data upload, such as real-time video streaming from smart cameras or continuous health monitoring data transmission. The emphasis remains on creating highly resilient, scalable, and energy-efficient communication protocols that support the massive density of interconnected devices expected in the residential environment throughout the forecast period.

Regional Highlights

Geographic market variations reflect differences in technological maturity, regulatory environments, and consumer willingness to invest in connected ecosystems.

- North America: Holds the largest market share characterized by early, mass adoption of smart speakers and displays, high internet penetration, and strong competition between platform giants (Amazon and Google). The region leads in premium segment adoption, particularly high-end smart home security and health monitoring wearables, driven by high disposable incomes and a strong focus on convenience and safety.

- Europe: Characterized by strong regulatory frameworks (e.g., GDPR), which heavily influence product development, emphasizing localized data processing and stringent privacy standards. Growth is steady, focusing on energy management and efficiency through smart thermostats and integrated home appliances. Western Europe (UK, Germany, France) is the primary driver, though linguistic diversity requires significant investment in multilingual NLP development.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid urbanization, massive investment in smart city infrastructure (especially in China, South Korea, and Singapore), and a large, tech-savvy young population. Localized players (Baidu, Xiaomi, Alibaba) dominate, offering tailored services that integrate seamlessly with regional payment systems and e-commerce platforms. Low-cost device manufacturing capabilities further drive high unit volumes.

- Latin America (LATAM): An emerging market showing increasing adoption, particularly in Brazil and Mexico. Market penetration is accelerating due to improved affordability of entry-level smart speakers and increasing smartphone ubiquity which familiarizes users with voice commands. The primary focus remains on entertainment and basic home control applications.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, supported by large government investments in luxurious, highly automated residential and commercial properties. The market requires bespoke solutions addressing cultural nuances and security concerns, leading to interest in devices that integrate robust security and localized language support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Assistant Embedded Consumer Devices Market.- Amazon

- Apple

- Samsung Electronics

- Microsoft

- Sony Corporation

- Baidu

- Xiaomi Corporation

- Alibaba Group

- LG Electronics

- Harman International (Samsung subsidiary)

- Fitbit (Google subsidiary)

- Bose Corporation

- Sonos Inc.

- Huawei Technologies

- Nvidia Corporation

- Intel Corporation

- Cerence Inc.

- Tencent Holdings

- JD.com

Frequently Asked Questions

Analyze common user questions about the Intelligent Assistant Embedded Consumer Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Intelligent Assistant Embedded Consumer Devices Market through 2033?

The market is forecast to exhibit robust growth, driven by an increasing Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. This growth is primarily fueled by the continued proliferation of IoT ecosystems, advancements in Edge AI processing, and expanding applications in health and home automation.

How is Edge AI influencing the development and consumer adoption of these embedded devices?

Edge AI is critical because it allows intelligent assistants to process commands and interpret data locally on the device rather than relying solely on cloud servers. This transition significantly enhances data privacy, reduces latency for real-time interactions, and improves device reliability, accelerating consumer trust and adoption, especially in sensitive areas like health monitoring and security.

What are the primary segments driving market revenue in the near term?

The market is currently segmented primarily by Device Type, with Smart Speakers and Displays remaining the largest volume segment. However, the highest revenue growth is anticipated in the Smart Wearables (Hearables and advanced smartwatches) and Smart Home Appliances segments, due to their higher average selling prices and integration of specialized sensors and proprietary AI features.

What major restraints are impacting the widespread adoption of intelligent embedded consumer devices?

The two most significant restraints are ongoing consumer concerns regarding data privacy and security vulnerabilities associated with always-listening devices, and the persistent challenge of achieving universal interoperability between the dominant, proprietary ecosystems (e.g., Amazon, Google, Apple), which limits a truly unified smart home experience for users owning multi-branded devices.

Which geographical region is expected to lead the market in terms of highest growth rate?

The Asia Pacific (APAC) region is projected to demonstrate the fastest growth rate throughout the forecast period. This acceleration is attributed to massive investments in smart infrastructure, rapid urbanization, the rise of a digitally native middle class, and strong competition among regional technology leaders offering localized and affordable intelligent assistant solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager