Intelligent Cash Registers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438738 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Intelligent Cash Registers Market Size

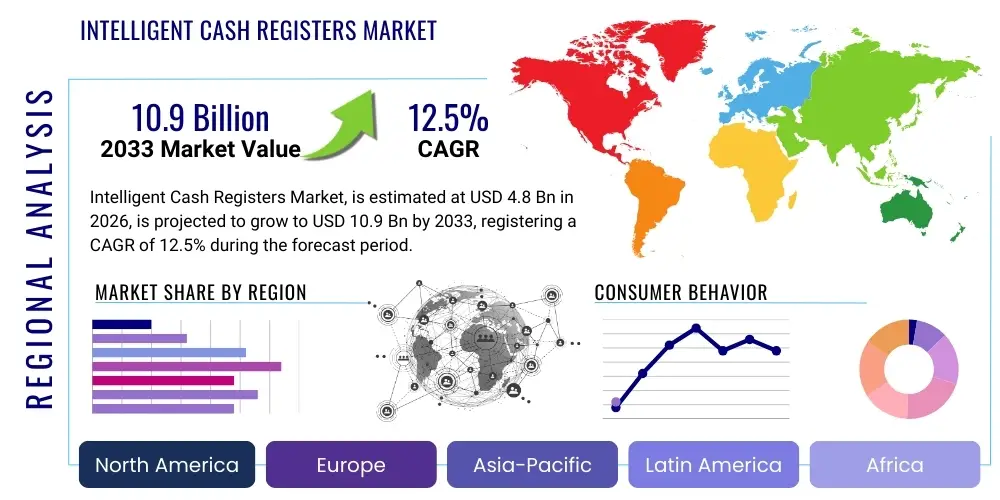

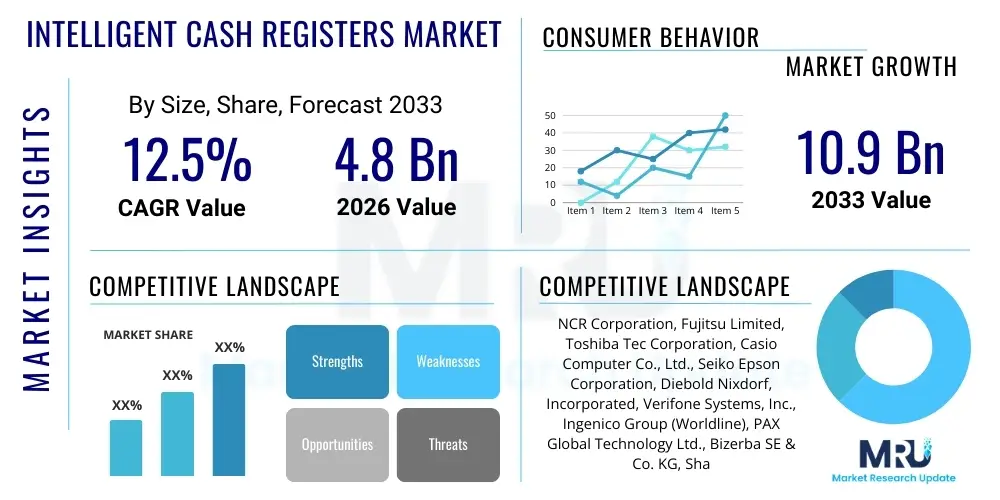

The Intelligent Cash Registers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated digitization of the retail and hospitality sectors, where traditional point-of-sale (POS) systems are being rapidly replaced by smart, interconnected devices capable of handling complex inventory management, customer relationship management (CRM), and advanced data analytics, moving beyond mere transaction processing to comprehensive business intelligence platforms.

The transition toward intelligent cash registers reflects a broader industry demand for optimized operational efficiency and enhanced customer experience, particularly in high-volume environments. These advanced systems, often cloud-connected, offer scalability and real-time synchronization across multiple store locations, providing management with instantaneous visibility into performance metrics. Furthermore, the integration of contactless payment capabilities, mobile POS (mPOS) features, and robust security protocols (PCI compliance) ensures that these systems meet the evolving consumer preferences for speed and security, solidifying their role as central components of modern retail infrastructure globally.

Intelligent Cash Registers Market introduction

The Intelligent Cash Registers Market encompasses sophisticated point-of-sale (POS) terminals that integrate advanced computational capabilities, connectivity, and often touch-screen interfaces, going far beyond the functionality of conventional electronic cash registers (ECRs). These devices function as holistic retail management tools, combining hardware components like processors, memory, and peripherals (scanners, receipt printers) with highly specialized software designed for inventory tracking, sales reporting, employee management, and loyalty program integration. Major applications span quick-service restaurants (QSRs), full-service restaurants, specialty retail stores, grocery chains, and temporary pop-up shops, catering to diverse operational needs requiring both fixed and mobile transactional solutions. The primary benefits include increased transaction speed, reduction in human error, enhanced data granularity for strategic decision-making, and seamless integration with enterprise resource planning (ERP) systems, leading to optimized supply chain efficiency and improved gross margins for businesses utilizing them.

Product descriptions for these intelligent systems often highlight features such as modular design, high-definition displays, robust operating systems (Android, Windows, or specialized Linux distributions), and the capacity for third-party application integration via open APIs, transforming the cash register into a customizable business hub. The core driving factors fueling market growth include the global trend toward cashless transactions, increasing labor costs necessitating automation at the checkout, and aggressive competition within the retail sector that mandates the adoption of technologies to deliver superior and personalized customer experiences. Moreover, government mandates related to electronic invoicing and tax compliance in various developing economies are creating a mandatory replacement cycle for legacy systems, further propelling the demand for intelligent, traceable cash register solutions that simplify regulatory adherence and ensure operational transparency, fundamentally reshaping how commerce is conducted worldwide.

Intelligent Cash Registers Market Executive Summary

The Intelligent Cash Registers Market is characterized by rapid technological assimilation, particularly the merging of POS functionality with advanced data analytics and cloud computing, shifting the industry focus from hardware sales to recurring software-as-a-service (SaaS) revenue models. Key business trends include the strong preference for mPOS solutions in sectors prioritizing mobility and smaller footprints, such as coffee shops and food trucks, and the increased investment by major vendors in securing data privacy and enhancing system resilience against cybersecurity threats, recognizing that data integrity is paramount for retaining enterprise clients. Segment trends indicate robust growth in the software component market, driven by recurring subscription revenues for sophisticated analytics packages and specialized vertical applications, while the hardware segment benefits from the continuous need for ruggedized, high-throughput devices capable of handling complex tasks and demanding operating environments, pushing innovation in processor power and peripheral integration.

Regionally, North America and Europe maintain leading positions due to established retail infrastructure and early adoption of contactless and mobile payment technologies, alongside high regulatory standards compelling businesses to upgrade systems frequently. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive digital transformation initiatives in emerging economies like India and Southeast Asia, coupled with substantial government support for financial inclusion and digitized payments, creating a vast greenfield market for intelligent POS deployment in small and medium-sized enterprises (SMEs). Overall, the market trajectory is highly dependent on interoperability standards, the ease of integration with existing back-office systems, and the ability of providers to offer comprehensive, end-to-end solutions that minimize complexity for the end-user, ensuring smooth operational transitions and maximizing return on investment from these integrated technologies.

AI Impact Analysis on Intelligent Cash Registers Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally change the role of the intelligent cash register, specifically focusing on automation, predictive inventory management, personalized customer engagement, and minimizing shrinkage. Key themes revolve around whether AI will replace human cashiers entirely, how predictive analytics can reduce waste and optimize stock levels in real-time, and the capacity of AI-driven systems to tailor promotions based on instantaneous purchasing patterns observed at the checkout. Consumers and business owners alike express high expectations regarding AI's ability to interpret complex, unstructured sales data, such as peak transaction times or product co-purchasing probabilities, turning raw transactional information into actionable strategic insights without requiring specialized data science intervention, thus democratizing sophisticated analytics for smaller businesses. Additionally, security concerns regarding AI-powered fraud detection at the point of sale are a recurring topic, emphasizing the need for robust, trustworthy algorithms that enhance loss prevention measures while maintaining transaction speed.

The integration of AI is transforming intelligent cash registers from passive transaction points into active decision-support systems. AI algorithms are now embedded within the POS software to monitor sales velocity and autonomously trigger low-stock alerts or suggest optimal pricing adjustments based on competitive analysis and seasonal demand fluctuations, directly impacting profitability. Furthermore, utilizing AI for facial recognition or behavioral analysis at self-checkout terminals is enhancing security and reducing instances of 'mistaken' scanning (known as 'pass-offs'), addressing a significant challenge in self-service retail environments and providing a crucial layer of loss prevention. This operational enhancement extends to predictive maintenance, where AI monitors system performance and anticipates potential hardware failures before they occur, allowing for proactive servicing and maximizing system uptime, a critical factor for high-volume retailers where downtime translates directly into substantial financial loss and customer frustration, thereby positioning AI as an essential component for system reliability.

AI's impact also profoundly influences customer-facing operations. Intelligent registers are beginning to utilize machine learning to analyze the current transaction alongside historical purchase data to instantly suggest relevant upselling or cross-selling items to the cashier or directly to the customer on an integrated display, significantly increasing average transaction value. For instance, in a restaurant setting, the system might learn that customers buying a specific entree often purchase a premium dessert, prompting a tailored suggestion. This shift toward hyper-personalized, real-time marketing at the physical point of sale—a capability previously reserved for e-commerce platforms—is setting a new standard for customer experience in physical retail. This ability to integrate dynamic pricing, targeted promotions, and behavioral insights directly into the checkout process ensures that the intelligent cash register remains relevant and highly valuable amidst the rise of pure online retail and mobile ordering platforms.

- Enhanced predictive inventory management through machine learning models analyzing sales velocity and external factors (weather, local events).

- Real-time dynamic pricing adjustments based on demand elasticity and current stock levels.

- Automated fraud detection and loss prevention via behavioral recognition and transaction pattern analysis.

- Personalized customer engagement and loyalty program integration driven by AI-powered purchase suggestions and tailored offers at checkout.

- Natural Language Processing (NLP) integration for simplified voice-command inputs for complex order management in hospitality settings.

- Predictive maintenance analytics ensuring proactive servicing of hardware and maximizing system operational reliability.

DRO & Impact Forces Of Intelligent Cash Registers Market

The Intelligent Cash Registers Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces steering its development and adoption trajectory. Key drivers include the overwhelming global shift from cash to digital payment methods, necessitating integrated systems capable of processing diverse card, mobile wallet, and biometric payments seamlessly, often driven by consumer demand for frictionless checkout experiences. Simultaneously, the inherent competitive pressures within the retail and hospitality industries push businesses to adopt sophisticated data collection tools to optimize operations and improve margin capture, making the data generated by intelligent registers a critical strategic asset. However, the market faces significant restraints, primarily related to the substantial initial capital investment required to transition from legacy ECRs to complex intelligent POS systems, which often proves prohibitive for small, cash-strapped businesses, particularly in developing markets. Furthermore, pervasive concerns over data security and the perceived risk of system downtime during peak business hours act as psychological barriers to adoption for conservative operators, slowing market penetration in certain segments where reliability is prioritized above all else.

Opportunities for growth are heavily concentrated in the expansion of cloud-based subscription models, which significantly reduce the upfront cost burden and allow smaller merchants access to enterprise-level functionality via affordable monthly fees, democratizing advanced retail technology. Another major opportunity lies in the specialization of intelligent POS systems for niche vertical markets, such as healthcare clinics, specialized craft breweries, or pop-up retail, where bespoke software features (e.g., patient records management integrated with payment processing or production tracking) create high-value propositions that standard registers cannot address. The intensifying impact forces are generally weighted toward market expansion, particularly driven by technological maturity and increased vendor competition, which is pushing down average selling prices (ASPs) for hardware while simultaneously increasing the value offered through complementary software services. The necessity for regulatory compliance regarding tax reporting and digital invoicing in many jurisdictions also acts as a powerful external force compelling system upgrades, ensuring a baseline demand regardless of immediate economic fluctuations.

The overall market impact is characterized by continuous evolution, where system intelligence is becoming the primary differentiator, overshadowing hardware specifications. Restraints concerning cybersecurity are continually being addressed through advanced encryption and compliance certifications (e.g., Europay, Mastercard, and Visa or EMV standards), transforming security from a market restraint into a core competitive feature. As businesses realize the long-term operational savings and revenue uplift potential offered by advanced inventory and sales analytics, the initial investment hurdle diminishes in significance. Therefore, the strongest impact force is the undeniable business value derived from data monetization and operational optimization that intelligent cash registers enable, cementing their status as indispensable tools for contemporary commerce rather than mere transactional equipment.

Segmentation Analysis

The Intelligent Cash Registers Market is primarily segmented based on components, operating systems, type, and end-user application, reflecting the diverse needs of the retail and hospitality landscapes. The segmentation by component distinguishes between the physical hardware (terminals, peripherals, displays) and the software (operating systems, application suites, cloud services), with software increasingly becoming the dominant revenue stream due to high-margin subscription models for analytics and integration services. Operating system segmentation highlights the competition between proprietary systems, open-source Linux solutions, Android platforms, and Windows-based systems, each catering to different levels of customization and security requirements. Segmentation by type differentiates between fixed POS systems, which offer robust, stationary capabilities ideal for large supermarkets, and highly flexible mobile POS (mPOS) systems, which prioritize portability and are increasingly favored by quick-service establishments and field sales operations requiring transactional agility.

The end-user segmentation is the most critical for strategic analysis, covering diverse sectors such as retail, hospitality, entertainment, and healthcare. Within retail, specific requirements vary significantly between grocery stores needing complex weighing and scanning integration, specialty shops requiring high CRM capabilities, and department stores needing multi-lane, networked system resilience. The hospitality segment, including full-service restaurants and QSRs, demands high speed, integrated table management, and order modification capabilities, often utilizing kitchen display systems (KDS) linked directly to the cash register interface. Analyzing these segments provides vendors with crucial insights into customizing both hardware aesthetics (e.g., sleek, minimalist designs for high-end boutiques) and software functionalities (e.g., tip management and labor scheduling for restaurants) to maximize market penetration across varied operational environments, ensuring tailored solutions meet the precise pain points of specific customer groups.

- By Component:

- Hardware (Terminal Devices, Displays, Printers, Scanners)

- Software (Operating Systems, Application Suites, Cloud Services)

- By Operating System:

- Android-Based Systems

- Windows-Based Systems

- Proprietary/Linux Systems

- By Type:

- Fixed Intelligent POS

- Mobile Intelligent POS (mPOS)

- By End User:

- Retail (Grocery Stores, Specialty Retail, Department Stores)

- Hospitality (QSR, Full-Service Restaurants, Cafés)

- Healthcare and Pharmacies

- Entertainment (Theaters, Sports Venues)

Value Chain Analysis For Intelligent Cash Registers Market

The value chain for the Intelligent Cash Registers Market begins with upstream activities focused on the procurement of critical components and the development of core technology. Upstream analysis involves sourcing specialized microprocessors, high-definition touchscreens, secure payment modules (e.g., chip readers), and ruggedized enclosure materials from global electronic suppliers. Key activities at this stage include R&D efforts aimed at miniaturization, energy efficiency, and enhancing processing power to support complex software applications and AI integration. Relationships with semiconductor manufacturers and display technology providers are crucial, as innovation and cost control at this stage directly influence the final product’s performance and profitability, necessitating long-term strategic partnerships to secure favorable pricing and component supply continuity in a volatile global semiconductor market, ensuring manufacturing scalability.

Midstream involves the manufacturing and assembly process, where original equipment manufacturers (OEMs) design the cash register hardware, integrate the operating system, and conduct rigorous quality control and compliance testing (EMV, PCI DSS). Downstream activities focus heavily on distribution, deployment, and crucial after-sales support. The distribution channel is multifaceted, relying on both direct sales to large enterprise retailers (ensuring custom integration and bulk discounts) and indirect channels through value-added resellers (VARs), system integrators, and independent software vendors (ISVs) who specialize in local deployment, regional maintenance, and customizing software for specific regional regulatory requirements and vertical market needs. The shift towards cloud-based systems further necessitates a strong network of managed service providers (MSPs) to handle software updates, cloud hosting, and data security maintenance, creating an ongoing revenue stream post-sale.

The distinction between direct and indirect distribution is critical: direct sales offer high control and margin for vendors targeting national or international chains, facilitating rapid deployment standardization. Conversely, the indirect channel, dominated by VARs, is essential for reaching the vast number of small and medium-sized enterprises (SMEs) that require personalized consultation, localized training, and integration with legacy financial systems. Effective value chain management requires robust supply chain logistics to handle the complexity of global component sourcing, coupled with a highly responsive, localized downstream support network to manage software updates, hardware repairs, and rapid troubleshooting, recognizing that efficient installation and minimizing operational disruption are paramount for customer satisfaction and long-term retention in this competitive technology sector.

Intelligent Cash Registers Market Potential Customers

The primary end-users and buyers of intelligent cash registers span the entire spectrum of physical commerce, ranging from independent small business owners to large multinational corporations operating thousands of outlets globally. The largest segment of potential customers resides within the retail sector, encompassing diverse sub-segments such as fast-moving consumer goods (FMCG) stores, supermarkets, specialized apparel boutiques, and convenience stores, all seeking solutions that offer speed, inventory precision, and seamless integration with supply chain management systems to reduce stockouts and optimize floor space utilization. For small and medium-sized enterprises (SMEs), the appeal often lies in mPOS solutions that are budget-friendly, highly portable, and offer built-in simplified analytics tools that require minimal technical expertise to manage, effectively acting as an all-in-one business management dashboard replacing complex manual processes previously used for reporting and tracking.

The hospitality industry represents another immensely fertile ground for adoption, including quick-service restaurants (QSRs), fine dining establishments, bars, and catering operations. These buyers prioritize systems robust enough to handle high transaction volumes during peak hours, capable of integrating kitchen management workflows, table service allocation, and complex tipping and payroll features unique to the sector. Potential customers here often seek integrations with third-party delivery aggregators (Uber Eats, DoorDash) directly into the POS system to streamline order handling and consolidate reporting, making the register a central hub for omni-channel order fulfillment. Furthermore, institutions like schools, universities, and healthcare providers are emerging as significant potential customers, requiring intelligent systems not just for retail operations (cafeterias, bookstores) but also for integrating payment processes related to fees, admissions, and inventory management for supplies, demanding high security and compliance with regulatory standards specific to their respective sectors.

The buying decision for large enterprises is heavily influenced by factors such as scalability, centralized reporting capabilities across geographically dispersed locations, and the vendor's capacity to provide comprehensive Service Level Agreements (SLAs) for maintenance and disaster recovery, ensuring business continuity. Conversely, smaller businesses focus primarily on ease of use, upfront cost minimization (often preferring subscription models), and rapid deployment. Therefore, successful market penetration requires vendors to offer a tiered product strategy: high-end, customizable, and network-centric solutions for enterprise customers, and streamlined, affordable, cloud-first mPOS solutions for independent entrepreneurs and small multi-site operators, aligning product complexity and pricing structure directly with the sophistication and budget constraints of the specific end-user category being targeted, ensuring broad market accessibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NCR Corporation, Fujitsu Limited, Toshiba Tec Corporation, Casio Computer Co., Ltd., Seiko Epson Corporation, Diebold Nixdorf, Incorporated, Verifone Systems, Inc., Ingenico Group (Worldline), PAX Global Technology Ltd., Bizerba SE & Co. KG, Sharp Corporation, Elavon Inc. (U.S. Bank), Square, Inc. (Block, Inc.), Clover Network, LLC, Toast, Inc., Datalogic S.p.A., Honeywell International Inc., Posiflex Technology, Inc., Star Micronics Co., Ltd., Wincor Nixdorf International GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Cash Registers Market Key Technology Landscape

The technological landscape of the Intelligent Cash Registers Market is rapidly evolving, driven by the convergence of cloud computing, advanced payment processing standards, and ubiquitous network connectivity. The core technology centers on robust, high-performance System-on-Chip (SoC) processors that enable multi-tasking and handle complex encryption algorithms essential for secure transaction processing (PCI compliance). The shift from localized, proprietary databases to decentralized, cloud-based architectures utilizing scalable services (like AWS or Google Cloud) is fundamental. This cloud transition facilitates real-time data synchronization across multiple stores, enables subscription-based SaaS models for software delivery, and critically allows for seamless, over-the-air software updates and security patches, drastically improving system agility and reducing the maintenance burden on individual retailers. Furthermore, the adoption of open Application Programming Interfaces (APIs) is standardizing integration, allowing retailers to easily connect their intelligent registers with third-party software for accounting, e-commerce, and specialized loyalty programs, moving away from closed ecosystems and promoting a rich developer environment, ensuring long-term technological relevance.

Payment technology integration forms another cornerstone of the landscape. Modern intelligent cash registers must incorporate Near Field Communication (NFC) capabilities for contactless payments (e.g., Apple Pay, Google Wallet), support chip-and-PIN (EMV) transactions, and increasingly, be prepared for biometric payment authentication methods. The development of robust, secure hardware modules, often certified by payment networks, is non-negotiable for market viability. Alongside payment innovation, the rise of specialized peripheral technologies is optimizing the checkout process. This includes 2D image scanners capable of reading complex QR and barcodes rapidly, high-speed thermal printers for efficient receipt generation, and integrated customer-facing displays that handle digital advertising and personalized offers, transforming the counter space into an interactive marketing touchpoint. The deployment of Android-based operating systems, preferred for their lower licensing costs and open framework, is rapidly challenging traditional Windows dominance, particularly in the mPOS segment seeking portability and application diversity, fostering greater accessibility for smaller businesses requiring versatile and cost-effective solutions.

Crucially, the ongoing integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is the key technology differentiator propelling the market forward. AI is utilized for analyzing sales data patterns to optimize staffing schedules at the counter, forecasting product demand with higher accuracy than traditional statistical models, and implementing sophisticated loss prevention tools by flagging suspicious transaction behavior or identifying visual anomalies at self-checkout terminals. Edge computing is also gaining traction, wherein some data processing and decision-making (e.g., rapid product identification) occurs directly on the register device rather than waiting for cloud confirmation, ensuring transactional speed and resilience even during temporary network outages. This focus on intelligent, highly secure, and interconnected technology ensures that the intelligent cash register remains a powerful, future-proof investment, capable of adapting to evolving consumer behaviors and complex regulatory environments while providing a centralized platform for all in-store operational data.

Regional Highlights

North America dominates the Intelligent Cash Registers Market, primarily driven by the high rate of technological adoption, stringent security regulations (such as mandatory EMV chip migration), and a mature, competitive retail landscape that demands operational efficiency and sophisticated customer data analytics. The region, particularly the United States, sees high deployment rates of cloud-based POS and mPOS solutions, fueled by the strong presence of influential tech vendors (like Square and Clover) and a highly competitive quick-service restaurant (QSR) sector continually seeking to streamline order management and increase throughput. Investment in AI-powered loss prevention and advanced loyalty programs integrated at the point of sale is substantially higher here compared to other regions, creating continuous demand for system upgrades and specialized software integration services. The market structure favors enterprise solutions but also exhibits significant growth in the SME sector due to easily accessible, low-cost mPOS options that scale effectively.

Europe constitutes another major market, characterized by rapid modernization and fragmentation due to diverse local payment preferences, high labor costs, and complex, country-specific tax regulations (e.g., electronic invoicing mandates in Southern Europe). The focus in Europe is heavily skewed toward robust data privacy compliance (GDPR) and the seamless integration of diverse pan-European payment methods. Germany, the UK, and France are key contributors, emphasizing durability and precision in their retail systems. Northern European countries show high penetration of unattended retail solutions and self-checkout systems, driven by high consumer acceptance of automation. Vendors must navigate highly specialized regulatory environments, leading to strong demand for highly customizable and locally compliant POS software, often necessitating deep partnerships with regional system integrators to manage deployment complexity effectively and adhere to strict fiscal regulations that vary significantly between member states, which acts as a key barrier and opportunity simultaneously.

Asia Pacific (APAC) is projected to register the highest growth rate during the forecast period. This explosive expansion is underpinned by massive urbanization, the rapid growth of the middle class, and aggressive digital transformation strategies across economies such as China, India, and Southeast Asian nations. APAC represents a significant greenfield opportunity where businesses are leapfrogging legacy technology, often moving directly from manual operations to modern cloud-based mPOS systems, spurred by the widespread adoption of mobile payments (e.g., WeChat Pay, Alipay). Government initiatives promoting financial inclusion and digital infrastructure development in countries like India further accelerate POS deployment in Tier II and Tier III cities. While price sensitivity remains high, the sheer volume of new retail and hospitality establishments entering the market guarantees substantial growth, particularly for affordable, Android-based intelligent systems that can support multiple local languages and currencies effectively.

Latin America (LATAM) is experiencing steady, albeit slower, adoption, highly correlated with economic stability and infrastructure investment. Brazil and Mexico are the dominant markets, where the necessity to combat high levels of commercial fraud drives the demand for secure, traceable POS systems that comply with evolving local tax reporting requirements, which are often highly complex and strictly enforced. The increasing penetration of formal retail chains and the growing use of credit and debit cards, replacing cash, provide a fundamental tailwind for the intelligent cash register market. However, challenges related to currency volatility, connectivity issues in remote areas, and the existence of a large informal economy necessitate robust, offline-capable systems and competitive financing options to facilitate adoption by smaller businesses operating under difficult economic conditions, thereby limiting immediate large-scale enterprise deployments but promising substantial long-term potential as economic stability improves.

Middle East and Africa (MEA) represents a nascent but rapidly growing market, driven by large-scale infrastructure investments in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) and the burgeoning e-commerce sector requiring efficient fulfillment logistics. The high growth in tourism and hospitality sectors in the UAE and Qatar particularly demands sophisticated POS systems capable of high transactional speed and multi-currency processing. In Africa, adoption is concentrated in South Africa and Nigeria, where mobile money penetration is extremely high, creating demand for intelligent registers that seamlessly integrate mobile wallets and alternative payment methods. The overall regional growth is stimulated by ambitious government visions (like Saudi Vision 2030) focused on diversifying economies and accelerating digitization, creating a substantial, albeit geographically concentrated, market for advanced retail technology, requiring vendors to provide localized support to manage the complex cultural and regulatory nuances unique to this dynamic region.

- North America: Market leader, high adoption of cloud POS, strong presence of key technology vendors, driving innovation in AI and self-checkout.

- Europe: Mature market, high emphasis on data security (GDPR), fragmented regulatory landscape requiring locally customized software, strong growth in contactless payments.

- Asia Pacific (APAC): Highest CAGR, driven by mass digital transformation, mobile payment proliferation, and rapid growth in new retail outlets across emerging economies.

- Latin America: Steady growth, demand fueled by regulatory compliance needs and fraud prevention, concentrated in Brazil and Mexico, focusing on affordable and localized solutions.

- Middle East and Africa (MEA): Emerging market, accelerated by government-led digitization initiatives and massive investments in hospitality and retail infrastructure in the GCC region, high demand for multi-currency processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Cash Registers Market.- NCR Corporation

- Fujitsu Limited

- Toshiba Tec Corporation

- Casio Computer Co., Ltd.

- Seiko Epson Corporation

- Diebold Nixdorf, Incorporated

- Verifone Systems, Inc.

- Ingenico Group (Worldline)

- PAX Global Technology Ltd.

- Bizerba SE & Co. KG

- Sharp Corporation

- Elavon Inc. (U.S. Bank)

- Square, Inc. (Block, Inc.)

- Clover Network, LLC (First Data/Fiserv)

- Toast, Inc.

- Datalogic S.p.A.

- Honeywell International Inc.

- Posiflex Technology, Inc.

- Star Micronics Co., Ltd.

- Wincor Nixdorf International GmbH

Frequently Asked Questions

Analyze common user questions about the Intelligent Cash Registers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between an Intelligent Cash Register and a traditional POS system?

An Intelligent Cash Register integrates advanced features like real-time cloud connectivity, open architecture for third-party apps, comprehensive operational data analytics, and built-in AI capabilities for functions like demand forecasting and personalized customer engagement, extending its function far beyond basic transaction processing found in older, closed-loop POS systems. Traditional systems are often hardware-centric and lack the robust networking and software extensibility inherent in intelligent registers.

How does the shift to cloud-based intelligent registers benefit SMEs?

Cloud-based intelligent registers significantly lower the total cost of ownership (TCO) for SMEs by minimizing upfront hardware investment and removing the need for complex, on-site server maintenance. They enable access to enterprise-level software features, such as sophisticated analytics and multi-location management, through affordable, scalable monthly subscription fees (SaaS model), ensuring SMEs can compete effectively using modern technological tools previously exclusive to large retailers.

What are the primary security concerns associated with intelligent POS adoption?

The main security concerns revolve around data breaches, as intelligent registers store vast amounts of sensitive customer and transaction data. Users are concerned about compliance with PCI DSS and GDPR, securing the cloud-data transfer pipeline, and protection against malware targeting the open-source operating systems frequently used. Vendors mitigate this through end-to-end encryption, multi-factor authentication, and regular, mandated software security updates delivered over the cloud.

Which end-user segment is driving the highest demand for mPOS solutions?

The hospitality sector, specifically Quick-Service Restaurants (QSRs) and full-service dining, along with specialty mobile retail (e.g., kiosks, pop-ups), drives the highest demand for mobile POS (mPOS) solutions. These environments prioritize speed, portability, and the ability to take orders and payments tableside or away from a fixed counter, improving service efficiency and table turnover rates, which is crucial for maximizing revenue in high-volume operations.

How is Artificial Intelligence (AI) specifically integrated into the modern intelligent cash register?

AI is integrated to enhance three core areas: loss prevention (using visual or behavioral analysis to detect fraud at checkout), inventory optimization (predicting optimal stock levels based on complex data inputs), and personalized marketing (generating real-time, tailored cross-selling suggestions displayed during the transaction). These integrations automate decision-making, improving both operational efficiency and customer engagement without human intervention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager