Intelligent Chassis Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435089 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Intelligent Chassis Market Size

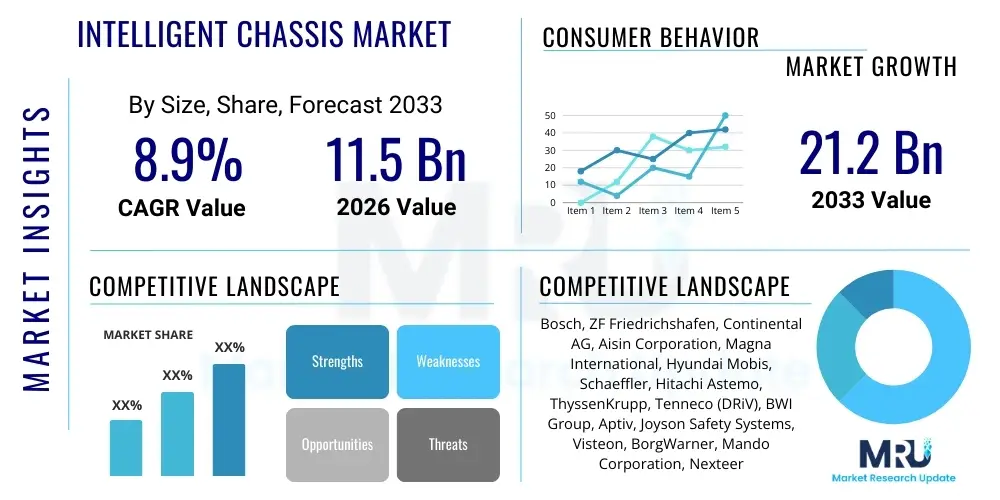

The Intelligent Chassis Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 21.2 Billion by the end of the forecast period in 2033.

Intelligent Chassis Market introduction

The Intelligent Chassis Market encompasses the integration of advanced electronic control units (ECUs), sensors, actuators, and sophisticated software that collectively manage critical vehicle dynamics, including steering, braking, and suspension systems. This integrated approach moves beyond conventional mechanical linkages, adopting ‘by-wire’ technologies such as steer-by-wire (SBW), brake-by-wire (BBW), and active suspension systems. The core objective is to enhance vehicle safety, optimize performance, improve energy efficiency, and provide the foundational dynamic control necessary for Level 3 and higher autonomous driving functionalities. These systems facilitate rapid, precise, and coordinated responses to complex driving scenarios, which is crucial for maximizing occupant comfort and ensuring vehicle stability across diverse terrains and speed profiles.

Product descriptions within this market focus heavily on modularity and centralized electronic/electrical (E/E) architectures. An intelligent chassis often serves as a unified platform where individual subsystems communicate seamlessly over high-speed automotive networks like CAN FD or Ethernet. Major applications span passenger vehicles, commercial trucks, and specialized autonomous shuttles, where the necessity for redundant safety mechanisms and fine-tuned control is paramount. The benefits derived from deploying intelligent chassis solutions include reduced mechanical wear, lower vehicle weight, enhanced packaging flexibility for electric vehicles (EVs), and the ability to implement Over-The-Air (OTA) software updates to improve or introduce new chassis functionalities post-sale.

Driving factors for market expansion are primarily centered on the rigorous global implementation of stringent safety standards, particularly concerning vehicle stability control and emergency braking performance. Furthermore, the rapid growth in the adoption of electric vehicles mandates a fundamental redesign of vehicle architecture, favoring integrated, electronically controlled chassis systems that can efficiently manage the high torque and unique weight distribution characteristics of battery packs. The shift towards software-defined vehicles (SDVs) also accelerates market growth, positioning the intelligent chassis as a vital subsystem that enables high levels of customization and functional upgrades throughout the vehicle lifecycle, attracting sustained investment from both traditional automotive giants and new mobility providers.

Intelligent Chassis Market Executive Summary

The Intelligent Chassis Market is characterized by intense technological convergence, driven predominantly by the mass adoption of electric vehicles and the accelerated development of advanced autonomous driving systems. Key business trends include the consolidation of Tier 1 suppliers through strategic acquisitions to offer comprehensive ‘full-stack’ chassis solutions and a significant shift in value proposition from hardware components to proprietary control software and integrated middleware. Suppliers are focusing on developing fail-operational systems and high-performance domain controllers that manage chassis functions, allowing OEMs to reduce complexity and cost while enhancing safety redundancy. The increasing demand for customization in driving feel and performance, facilitated by active suspension and sophisticated damper control algorithms, is compelling manufacturers to prioritize software development capabilities.

Regionally, Asia Pacific (APAC), led by China and South Korea, exhibits the most aggressive growth trajectory, primarily fueled by massive governmental support for EV manufacturing and the high volume production of L2/L3 equipped vehicles. North America and Europe, however, lead in technological maturity and the adoption of cutting-edge technologies like centralized E/E architecture and highly redundant steer-by-wire systems, largely driven by strict regulatory mandates regarding road safety and autonomous vehicle testing. The European market, in particular, shows strong demand for integrated safety systems that exceed minimum requirements, pushing innovations in electronic stability control and predictive braking systems across premium and mainstream segments.

Segment trends reveal that the steer-by-wire segment is poised for the highest CAGR, overcoming earlier regulatory hurdles as its reliability and functional safety achieve critical standards, providing indispensable flexibility for future autonomous vehicle cabin design. Furthermore, the suspension component segment, specifically adaptive damping and active roll stabilization, is witnessing rapid innovation, moving away from purely passive systems to complex, predictive electro-hydraulic or electromagnetic setups. The integration of these components into a single chassis domain controller is defining the competitive landscape, where efficiency in system communication and real-time data processing capabilities are becoming crucial differentiating factors among market participants.

AI Impact Analysis on Intelligent Chassis Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Intelligent Chassis Market primarily revolve around how AI enhances real-time decision-making, improves predictive maintenance, and optimizes dynamic vehicle stability and ride comfort far beyond traditional algorithmic control. Common concerns include the reliability of deep learning models in safety-critical applications, the necessary computational power required for AI-driven chassis control, and how machine learning algorithms will personalize driving dynamics based on driver or passenger preferences. Users are keenly interested in the shift from rule-based control logic to adaptive control systems capable of learning from sensor data streams, thereby offering superior performance in unpredictable or highly dynamic driving environments, especially concerning advanced maneuvering and collision avoidance scenarios.

AI’s integration is fundamentally transforming the chassis control philosophy from reactive management to proactive and predictive optimization. AI algorithms, particularly those based on neural networks, analyze massive datasets generated by sensors—including LiDAR, radar, cameras, and vehicle dynamics sensors—to anticipate road conditions, vehicle load changes, and even driver behavior microseconds before an action is required. This predictive capability allows the chassis systems, such as adaptive cruise control or active suspension, to adjust damping coefficients and ride height instantaneously, ensuring optimal tire contact patch management and unparalleled vehicle stability under high-speed cornering or sudden braking events. Moreover, AI facilitates advanced sensor fusion, minimizing noise and maximizing accuracy across diverse operating conditions, which is essential for maintaining integrity in autonomous mode.

The implementation of machine learning also yields significant benefits in component reliability and operational efficiency. By continuously monitoring the acoustic signatures, vibration patterns, and operational parameters of components like brake calipers, steering motors, and shock absorbers, AI systems can accurately predict potential failures or performance degradation. This capability supports sophisticated predictive maintenance scheduling, significantly reducing unexpected downtime and total cost of ownership for fleet operators. Furthermore, AI-driven energy management optimizes the usage of electrified components within the chassis, such as electric power steering (EPS) and regenerative braking systems, maximizing energy recovery and extending the range of electric vehicles, solidifying AI as a cornerstone technology for the future of dynamic vehicle control.

- AI enables predictive maintenance of mechanical and electrical chassis components, reducing downtime and operational costs.

- Real-time deep learning models optimize damping and suspension settings based on road surface prediction and driving style.

- Machine learning algorithms enhance sensor fusion across braking, steering, and stability systems, crucial for redundancy in autonomous vehicles.

- AI facilitates complex trajectory planning and dynamic stability control in emergency maneuvers by analyzing high-dimensional data inputs.

- Adaptive control systems use reinforcement learning to personalize handling characteristics and ride comfort for individual drivers or occupants.

DRO & Impact Forces Of Intelligent Chassis Market

The Intelligent Chassis Market is significantly influenced by a powerful combination of drivers, restraints, and opportunities (DRO), which collectively shape its trajectory and competitive landscape. The primary drivers are the escalating global focus on automotive safety, mandating the adoption of advanced control systems like Electronic Stability Control (ESC) and Anti-lock Braking Systems (ABS), which form the backbone of intelligent chassis architecture. Coupled with this is the transformative impact of electrification; the unique weight distribution and performance characteristics of EVs necessitate highly sophisticated and often redundant electronic chassis systems to manage regenerative braking and torque vectoring efficiently. These regulatory and technological pressures create strong inherent demand, pushing OEMs to integrate these complex, interconnected systems as standard features.

Conversely, the market faces considerable restraints, primarily stemming from the inherent complexity and high manufacturing costs associated with integrating numerous sensors, ECUs, and high-performance communication networks required for reliable functional safety. Developing and validating fail-operational systems, especially for steer-by-wire and brake-by-wire, requires rigorous testing and sophisticated software, leading to elevated initial capital expenditure. Moreover, the integration of components from multiple Tier 1 suppliers into a cohesive E/E architecture presents significant challenges in software compatibility and standardization, which can slow down mass market adoption, particularly in cost-sensitive vehicle segments.

Despite these hurdles, substantial opportunities exist, driven mainly by the evolution towards centralized E/E architectures and software-defined vehicles (SDVs). The ability to deploy Over-The-Air (OTA) updates allows manufacturers to continuously improve chassis performance, introduce new features, and patch security vulnerabilities remotely, transforming the chassis into a continuously evolving, marketable product. Furthermore, the massive shift towards autonomous mobility necessitates the development of new, highly redundant chassis platforms specifically designed for driverless operations, opening lucrative avenues for specialized software and component providers focused on Level 4 and Level 5 autonomy features. This combination of forces positions the market for sustained high growth, prioritizing innovation in software integration and system reliability.

Segmentation Analysis

The Intelligent Chassis Market is comprehensively segmented based on technology, component, application (vehicle type), and level of autonomy, allowing for granular analysis of market demand and growth potential across various dimensions. The technological segmentation focuses on the shift from conventional hydraulic systems to fully electronic and electro-mechanical ‘by-wire’ solutions, reflecting the industry's drive towards higher efficiency, faster response times, and easier integration with centralized domain controllers. Component segmentation analyzes the value contribution of individual parts, such as the steering system (EPS, SBW), braking system (BBW, ESP), and suspension system (active damping, air suspension), providing insights into where R&D investment is most concentrated.

Further analysis by application differentiates between passenger vehicles (which prioritize comfort and high-volume production efficiency) and commercial vehicles (which emphasize load management, durability, and operational safety for heavy transport). This distinction highlights the tailored design requirements and regulatory compliance needed for each segment. Finally, segmentation by autonomy level (L2/L3 versus L4/L5) is critical as the functional requirements and necessary redundancy levels of the chassis drastically increase with higher automation. L4 and L5 vehicles require fundamentally different chassis designs capable of operating without human intervention, demanding maximum reliability and fail-operational capabilities across all dynamic control systems.

- By Technology:

- Electronic Control Systems

- Electro-Hydraulic Systems

- By-Wire Systems (Steer-by-Wire, Brake-by-Wire)

- Integrated Domain Controllers

- By Component:

- Braking Systems (ABS, ESP, BBW)

- Steering Systems (EPS, SBW)

- Suspension Systems (Active Suspension, Semi-Active Suspension, Air Suspension)

- Sensors and Actuators

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Crossovers)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- Autonomous Shuttles and Robotaxis

- By Autonomy Level:

- Level 2 & Level 3 Vehicles

- Level 4 & Level 5 Vehicles

Value Chain Analysis For Intelligent Chassis Market

The value chain for the Intelligent Chassis Market is highly complex and integrated, starting with the upstream supply of specialized raw materials, particularly high-performance semiconductors, microcontrollers, and advanced sensor components like Inertial Measurement Units (IMUs) and wheel speed sensors. This upstream segment is characterized by high barriers to entry due to stringent quality and functional safety standards (ISO 26262). Key suppliers in this phase are technology firms specializing in silicon manufacturing and highly reliable electronic components essential for processing real-time vehicle dynamics data. Securing a stable and high-quality supply of these electronic components is a critical bottleneck, especially given global supply chain constraints and the demand surge driven by vehicle electrification.

The midstream of the value chain is dominated by Tier 1 automotive suppliers who act as system integrators. These companies procure the upstream components and specialize in designing, developing, and manufacturing complete chassis subsystems—such as integrated braking modules, electronic power steering racks, and active suspension units. They are responsible for the complex software development and calibration necessary to achieve functional safety compliance and performance targets defined by OEMs. This phase involves intensive R&D to harmonize the communication protocols between disparate systems (steering, braking, traction control) and integrate them into a centralized domain controller. Tier 1s also manage the direct and indirect distribution channels, supplying modules directly to OEM assembly lines globally (direct) or through aftermarket service networks (indirect).

The downstream segment primarily consists of Original Equipment Manufacturers (OEMs), who undertake the final integration of the intelligent chassis systems into the vehicle platform. OEMs focus heavily on branding, consumer interface, and the development of vehicle-specific control software that dictates the driving experience, utilizing the underlying hardware provided by Tier 1s. Distribution channels for the final product are predominantly the OEM dealership networks, supplemented by fleet operators and specialized mobility service providers for autonomous vehicles. The service and aftermarket segment, supported by indirect distribution, focuses on diagnostics, software updates (OTA), and maintenance, which is increasingly becoming a high-value revenue stream due to the software-centric nature of these systems.

Intelligent Chassis Market Potential Customers

The primary customers for Intelligent Chassis systems are Original Equipment Manufacturers (OEMs) across the spectrum of passenger and commercial vehicle production. For passenger vehicle manufacturers, the adoption is driven by the necessity to comply with global safety regulations, enhance brand image through superior vehicle dynamics (handling and comfort), and future-proof their platforms for advanced driver-assistance systems (ADAS) and eventual full autonomy. Premium and luxury automakers are particularly significant buyers, driving demand for the highest-end components like active roll stabilization and predictive air suspension systems to deliver a highly differentiated ride experience. The shift to dedicated EV architectures means that all major OEMs require integrated e-Chassis solutions to manage the new dynamic loads of battery packs and utilize advanced regenerative braking capabilities.

A second crucial segment consists of Commercial Vehicle (CV) manufacturers, including those producing heavy-duty trucks, buses, and light commercial vans. These end-users prioritize durability, efficiency, and operational safety, especially for large fleet operations where stability control under heavy load conditions and precise steering for long-haul driving are critical. CV adoption is accelerating due to mandates for electronic stability systems and the introduction of autonomous trucking pilots, requiring fail-operational steering and braking redundancy. The buyer’s decision here is strongly influenced by Total Cost of Ownership (TCO) calculations, favoring systems that offer long service life and contribute significantly to fuel efficiency or reduced maintenance via predictive analytics.

Furthermore, specialized mobility service providers and autonomous technology developers constitute a growing customer base. Companies developing Robotaxis and autonomous delivery vehicles are captive buyers of integrated intelligent chassis platforms, often procuring bespoke solutions designed specifically for Level 4 and Level 5 applications where no human driver backup exists. Their focus is solely on maximum functional safety, redundancy, and robust reliability under continuous operation. These buyers are typically early adopters of cutting-edge technology, including fully redundant steer-by-wire systems and advanced decentralized domain control architectures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Growth Rate | CAGR 8.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, ZF Friedrichshafen, Continental AG, Aisin Corporation, Magna International, Hyundai Mobis, Schaeffler, Hitachi Astemo, ThyssenKrupp, Tenneco (DRiV), BWI Group, Aptiv, Joyson Safety Systems, Visteon, BorgWarner, Mando Corporation, Nexteer Automotive, Knorr-Bremse, WABCO (ZF), FEV Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Chassis Market Key Technology Landscape

The technological landscape of the Intelligent Chassis Market is defined by the convergence of software and high-speed electrical components, moving away from purely mechanical and hydraulic linkages towards fully electrified and decentralized control systems. A pivotal technology is the robust deployment of 'by-wire' systems, particularly Steer-by-Wire (SBW) and Brake-by-Wire (BBW), which eliminate physical connections between the driver inputs (steering wheel/pedal) and the final actuators. SBW is crucial for L4/L5 autonomy as it enables flexible cabin design and provides precise, electronic control input necessary for automated parking and collision avoidance algorithms. Similarly, BBW offers ultra-fast response times and precise integration with regenerative braking in EVs, optimizing energy recovery while ensuring functional safety through mandatory redundancy architecture.

Another fundamental technology driving innovation is the utilization of advanced sensor suites and sensor fusion capabilities. Intelligent chassis systems rely heavily on high-fidelity sensors, including advanced Inertial Measurement Units (IMUs) and sophisticated wheel-speed sensors, which provide real-time data on vehicle movement, orientation, and tire grip. This data is processed by Domain Controllers (DCs) or centralized Vehicle Control Units (VCUs) using complex software algorithms to determine optimal steering angle, braking force distribution, and suspension damping. The migration towards a centralized E/E architecture, often involving high-performance computing (HPC) platforms, allows for system-wide optimization of dynamics that was previously impossible when subsystems operated in isolation.

Furthermore, the evolution of suspension technology from semi-active to fully active and predictive systems represents a major technological advancement. Active suspension systems, which may use electro-hydraulic or electromagnetic actuators (e.g., magnetorheological dampers), are capable of adjusting suspension characteristics dynamically in milliseconds, predicting and compensating for road imperfections before the wheel even hits them. Technologies like predictive chassis control leverage external sensors (cameras/LiDAR) and onboard AI to precondition the vehicle dynamics for upcoming road geometry, significantly enhancing both safety and passenger comfort. This tight integration of high-level sensing and sophisticated electronic actuation characterizes the most competitive solutions in the intelligent chassis domain.

Regional Highlights

The global Intelligent Chassis Market exhibits distinct regional growth patterns, largely dictated by local automotive production volume, regulatory mandates regarding safety features, and the pace of Electric Vehicle (EV) adoption and autonomous driving infrastructure development.

- Asia Pacific (APAC): APAC, particularly China, Japan, and South Korea, is projected to be the fastest-growing and largest market due to its dominance in global vehicle production, especially electric vehicles. Government incentives promoting NEVs (New Energy Vehicles) and rapid infrastructure development for autonomous mobility have driven high adoption rates of integrated chassis systems. China’s push for L2+ automation in mass-market vehicles creates immense volume demand for sophisticated braking and steering components.

- Europe: Europe represents a highly mature market characterized by strict safety standards (like mandatory ESC) and a strong demand for high-performance and premium features. The region leads in the adoption of advanced active suspension technologies and sophisticated domain control architectures, driven by high-end vehicle manufacturers prioritizing superior handling and ride comfort. Regulatory pressure for improved safety systems continues to sustain steady growth.

- North America: North America is a significant market, focusing heavily on technology innovation and the deployment of L3 and L4 autonomous test fleets, particularly in the US. Demand is concentrated on redundant 'by-wire' systems essential for full autonomy and high-performance electronic steering systems required for large SUVs and light trucks. The rapid electrification of truck fleets is also a key market driver in this region.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets, primarily driven by the increasing implementation of basic safety features (ABS, ESC) mandated by local governments. Growth is slower compared to APAC or Europe, but rising disposable incomes and expanding vehicle production bases indicate future opportunities for mid-level intelligent chassis components, focusing initially on cost-effective electronic stability solutions rather than full by-wire systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Chassis Market.- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Aisin Corporation

- Magna International Inc.

- Hyundai Mobis Co., Ltd.

- Schaeffler AG

- Hitachi Astemo, Ltd.

- ThyssenKrupp AG

- Tenneco Inc. (DRiV)

- BWI Group

- Aptiv PLC

- Joyson Safety Systems

- Visteon Corporation

- BorgWarner Inc.

- Mando Corporation

- Nexteer Automotive

- Knorr-Bremse AG

- WABCO Holdings Inc. (Acquired by ZF)

- FEV Group GmbH

- Veoneer Inc. (Acquired by Qualcomm/Magna)

- Denso Corporation

- Hella GmbH & Co. KGaA (Now part of Forvia)

- PACCAR Inc.

Frequently Asked Questions

Analyze common user questions about the Intelligent Chassis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between a traditional chassis and an intelligent chassis?

An intelligent chassis integrates complex electronic control units, sensors, and actuators to manage vehicle dynamics (steering, braking, suspension) electronically, often using 'by-wire' technology. Unlike traditional mechanical chassis, the intelligent version offers real-time adaptability, higher performance optimization, and the necessary redundancy for autonomous driving functions.

How does the shift to electric vehicles (EVs) impact the design of the intelligent chassis?

EVs mandate fundamental changes, requiring intelligent chassis systems to manage heavier battery loads and maximize energy recovery through precise regenerative braking control. Components like brake-by-wire (BBW) and electric power steering (EPS) are crucial for efficiently handling the high torque and unique weight distribution of electrified platforms, optimizing range and stability.

Which component segment is experiencing the fastest technological growth in the intelligent chassis market?

The steering component segment, specifically Steer-by-Wire (SBW) systems, is witnessing rapid technological advancement. SBW is vital for future autonomous vehicles (L4/L5) as it eliminates mechanical linkages, enabling rapid response, precise maneuvering, and necessary design flexibility for driverless cabins, driving its high growth rate.

What role does AI play in enhancing vehicle safety through intelligent chassis systems?

AI utilizes sensor fusion and predictive algorithms to anticipate road conditions and vehicle behavior in real-time. This allows the chassis systems to proactively adjust suspension, braking pressure, and steering ratio milliseconds before events occur, significantly improving stability, tire grip, and collision avoidance capabilities far beyond human reaction time.

What are the primary restraints hindering the widespread adoption of advanced intelligent chassis systems?

The primary restraints are the high complexity and cost associated with developing, validating, and manufacturing safety-critical 'by-wire' systems. Achieving Functional Safety compliance (ISO 26262) for highly redundant electronic architectures requires extensive testing and specialized software development, increasing the total unit cost significantly.

Are centralized E/E architectures mandatory for advanced intelligent chassis design?

While not strictly mandatory, centralized Electronic/Electrical (E/E) architectures, often featuring a Chassis Domain Controller, are becoming the preferred design. This centralization simplifies component communication, allows for holistic vehicle dynamics optimization, and facilitates Over-The-Air (OTA) software updates, which are essential for long-term functional improvement and maintenance.

How does active suspension contribute to energy efficiency in modern vehicles?

Active suspension systems manage the vehicle's height and damping characteristics to optimize aerodynamic drag at high speeds, particularly in EVs. By dynamically adjusting the ride height, they reduce air resistance, thereby marginally increasing battery efficiency and overall vehicle range, in addition to improving comfort and handling.

Which regional market holds the largest market share for intelligent chassis components?

The Asia Pacific (APAC) region currently holds the largest market share, driven primarily by the massive volume of vehicle production in China, high adoption rates of electric vehicles, and supportive governmental policies accelerating the deployment of advanced driver-assistance systems (ADAS) that rely on intelligent chassis components.

What is the concept of ‘fail-operational’ architecture in brake-by-wire systems?

Fail-operational architecture ensures that if a primary component or system fails (e.g., a sensor or power supply), a redundant backup system immediately takes over seamlessly. This is critical for brake-by-wire systems in autonomous vehicles, guaranteeing the vehicle can still brake safely and come to a controlled stop, thereby maintaining the highest levels of functional safety (ASIL D).

What is the future outlook for the integration of sensors within the intelligent chassis?

The future involves tighter integration and increasing sophistication of sensors, moving towards low-cost, high-reliability micro-electro-mechanical systems (MEMS) sensors embedded directly into suspension and steering components. This will facilitate continuous monitoring of component health and highly localized data inputs for predictive control algorithms, crucial for L4/L5 operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager