Intelligent Excavator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432489 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Intelligent Excavator Market Size

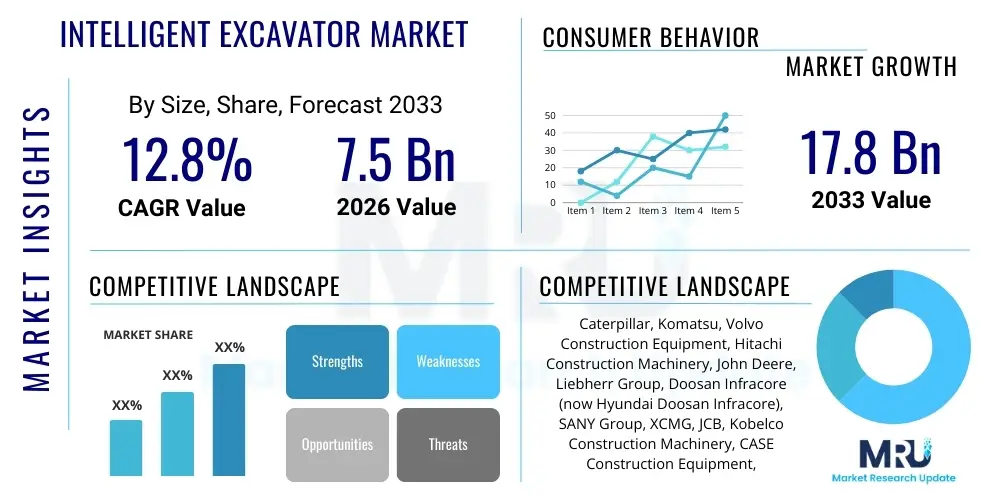

The Intelligent Excavator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $17.8 Billion by the end of the forecast period in 2033.

Intelligent Excavator Market introduction

The Intelligent Excavator Market encompasses advanced construction machinery integrated with sophisticated sensing, telematics, machine control, and automation technologies, enabling semi-autonomous or fully autonomous operation and enhanced performance. These excavators utilize Global Navigation Satellite System (GNSS), Inertial Measurement Units (IMUs), LiDAR, and complex software algorithms to execute tasks with unprecedented precision, speed, and safety. The primary value proposition of these machines lies in their ability to minimize human error, optimize material handling, reduce operational costs through fuel efficiency, and accelerate project timelines in large-scale infrastructure and mining projects. Key applications span across heavy construction, infrastructure development (roads, bridges, utilities), mining operations, and specialized earthmoving tasks where high accuracy grading and trenching are essential.

The shift towards intelligent excavators is fundamentally driven by the global imperative for productivity gains and enhanced site safety in the construction sector. As labor shortages become increasingly pronounced in developed economies, automation capabilities offered by intelligent machinery provide a crucial solution for maintaining operational throughput. Furthermore, the stringent regulatory environment concerning emissions and noise pollution favors intelligent systems, which often incorporate optimized engine management and more efficient hydraulic systems facilitated by real-time data analysis. These systems enable predictive maintenance, significantly reducing unexpected downtime and improving overall equipment utilization rates (EUR).

Major driving factors include the rapid urbanization trends, substantial government investment in smart city infrastructure, and the continuous technological maturation of connectivity platforms such as 5G, which facilitate seamless data transmission between the excavator, site management systems, and cloud platforms. Benefits derived from deploying intelligent excavators are comprehensive, spanning superior operational accuracy (often down to centimeter level), reduced rework, lower fuel consumption due to optimized operational cycles, and a dramatic decrease in workplace accidents, thereby enhancing profitability and sustainability across the industry value chain. The adoption curve is accelerating, particularly in regions prioritizing technological integration in capital equipment.

Intelligent Excavator Market Executive Summary

The Intelligent Excavator Market is characterized by robust growth, primarily fueled by the accelerating adoption of automation and digitalization in the construction and mining sectors globally. Business trends indicate a strong move towards subscription-based software services and advanced telematics platforms offered by Original Equipment Manufacturers (OEMs), shifting the revenue model beyond initial capital expenditure. Strategic partnerships between traditional heavy machinery manufacturers and specialized technology providers focusing on AI, LiDAR, and machine vision are defining the competitive landscape, pushing the boundaries of semi-autonomous capabilities and advanced safety features. Key segments like automatic grade control systems and integrated monitoring solutions are witnessing the fastest uptake, reflecting the immediate need for productivity improvements on construction sites.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, driven by massive infrastructure projects in China and India, coupled with governmental mandates favoring construction modernization. North America and Europe maintain high maturity in adopting intelligent systems, focusing heavily on integrating advanced safety protocols and utilizing predictive analytics powered by machine learning for fleet management. Emerging markets in Latin America and the Middle East and Africa (MEA) are seeing initial large-scale deployments, specifically within greenfield mining sites and critical energy infrastructure developments, where the return on investment (ROI) from efficiency gains is highly attractive.

Segmentation trends reveal that the medium-sized excavator category (20-40 tons) holds the largest market share due to its versatility across general construction and excavation duties, making it the primary target for intelligence integration. However, the small excavator segment is poised for the highest growth rate, driven by compact, autonomous solutions for urban construction and specialized utility work. Furthermore, the integration level segment shows a clear preference for semi-autonomous machine control solutions, as fully autonomous systems still face regulatory and operational hurdles in varied, complex worksite environments, though research and development into full autonomy continues to attract significant investment.

AI Impact Analysis on Intelligent Excavator Market

User queries regarding the impact of Artificial Intelligence (AI) on the Intelligent Excavator Market primarily revolve around practical implementation challenges, ROI justification, and the future of job roles. Users frequently question how AI algorithms enhance operational decision-making beyond basic automation, seeking specifics on predictive maintenance accuracy, real-time path planning optimization, and how machine learning (ML) models adapt to varying soil conditions or complex geometries. There is significant interest in understanding AI's role in multi-machine coordination on job sites and its ability to process vast amounts of sensor data (LiDAR, GPS, cameras) to achieve higher precision and safety standards than conventional systems. Concerns often center on data security, the required technological infrastructure (e.g., high bandwidth connectivity), and the necessary skill evolution for equipment operators transitioning from manual control to monitoring AI-driven machinery.

AI is transforming intelligent excavators by enabling them to move beyond mere programmed tasks to genuinely adaptive and learning systems. AI algorithms, particularly deep learning models, are employed to analyze telematics data, optimize hydraulic power distribution based on real-time load requirements, and improve fuel efficiency by dynamically adjusting engine output. Crucially, AI powers predictive maintenance systems, identifying subtle anomalies in vibration, temperature, or oil pressure patterns, often weeks before a failure occurs. This capability drastically reduces costly unplanned downtime, shifting maintenance strategies from reactive to proactive, thereby maximizing asset lifespan and utilization. Furthermore, AI facilitates complex visual processing, enabling systems to accurately classify objects, identify restricted zones, and implement collision avoidance in dynamic and cluttered construction environments.

The future trajectory involves AI enabling true swarm robotics and fully adaptive site management. As AI models become more sophisticated, they will manage entire fleets of excavators and ancillary equipment, optimizing logistics, material movement, and scheduling across vast project scopes without human intervention. This shift elevates the role of the operator to a supervisory or specialized technician role, focusing on monitoring system health and intervening only during unusual exceptions. The immediate impact, however, is the democratization of skilled operations, where advanced AI machine control systems allow less experienced operators to achieve the precision and efficiency typically associated with highly seasoned professionals, addressing critical labor shortages.

- AI-driven real-time operational optimization enhances cycle times and material output efficiency.

- Machine Learning (ML) algorithms power advanced predictive maintenance, significantly reducing unplanned downtime.

- Deep Neural Networks (DNNs) improve sensor fusion and perception capabilities for superior obstacle avoidance and safety.

- AI facilitates autonomous trajectory planning and high-precision grade control in variable soil conditions.

- Natural Language Processing (NLP) is emerging for simplified voice command interfaces and advanced diagnostics reporting.

- AI enables sophisticated multi-machine coordination and fleet management for integrated site logistics.

- Computer vision based on AI automatically verifies work quality against 3D models (BIM integration).

- Enhanced energy management systems utilize AI to optimize battery usage and load distribution in electric intelligent excavators.

- AI assists in dynamic regulatory compliance checking, ensuring operations adhere to site-specific safety boundaries.

DRO & Impact Forces Of Intelligent Excavator Market

The Intelligent Excavator Market is heavily influenced by a confluence of driving factors related to efficiency and safety, counterbalanced by significant technological and economic restraints, while vast opportunities emerge from technological convergence and urbanization. The primary drivers include the global push for construction site digitalization, the critical need for improved labor productivity amid skilled worker scarcity, and mandatory safety regulations that favor automated collision avoidance systems. Restraints are predominantly centered around the high initial capital investment required for these advanced machines, the complexity and cost associated with training operators and maintenance technicians, and the lack of robust, standardized communication infrastructure (e.g., consistent 5G coverage) in remote or rural construction sites. These factors dictate the pace of adoption, often favoring large corporations capable of absorbing substantial upfront costs.

Opportunities are largely concentrated in emerging technologies such as 5G integration for low-latency teleoperation, advanced sensor miniaturization leading to cost reduction, and the application of standardized modular components that allow for retrofitting existing fleets with intelligent capabilities. Furthermore, the burgeoning demand for specialized autonomous equipment in hazardous environments, such as contaminated sites or deep-sea excavation, presents niche yet high-value market openings. The impact forces acting on this market are substantial: technological forces, driven by AI and IoT maturation, exert a strong upward pressure on innovation and capability; economic forces, primarily the fluctuating costs of raw materials and energy, influence OEM pricing strategies and customer ROI calculations; and regulatory forces continue to shape minimum safety and environmental performance standards, thereby accelerating the adoption of cleaner, smarter machines.

The long-term success of the market depends on overcoming infrastructure hurdles and developing more standardized, interoperable platforms. If the industry can achieve greater standardization in data formats (e.g., for BIM integration) and significantly reduce the total cost of ownership (TCO) through mass production and reliable servicing networks, the adoption rate will surge. The key impact force remains the competitive pressure among major OEMs to integrate advanced proprietary intelligence systems, making technological differentiation the most critical factor influencing purchasing decisions among large contractors and rental fleets. Successful market penetration hinges on demonstrating quantifiable, long-term ROI in terms of reduced operating expenses (OPEX) and higher project completion speed.

Segmentation Analysis

The Intelligent Excavator Market is broadly segmented based on crucial attributes including the Level of Automation, Machine Type (size class), Component, and Application, each reflecting distinct market demands and technological maturity levels. Analyzing these segments provides a granular view of investment trends and adoption patterns. The Level of Automation segmentation—encompassing semi-autonomous, fully autonomous, and remote-controlled systems—is pivotal, as it reflects the current operational viability and regulatory constraints. Semi-autonomous systems, which augment human operators with precision assistance (e.g., automatic grading), currently dominate the market due to their practicality and flexibility on dynamic job sites, while fully autonomous solutions are mainly confined to highly controlled mining and quarrying operations.

Segmentation by Machine Type (Small, Medium, Large) is critical for understanding where capital expenditure is prioritized. Medium excavators form the bulk of market value due to their versatility in general construction, but the high-growth trajectory observed in the small (compact) segment is driven by urban utility work and the emergence of fully electric, intelligently controlled compact machines. The Component segmentation—covering hardware (sensors, GNSS, control units) and software (telematics, machine control applications)—demonstrates the rapid migration of value from physical machinery to proprietary, recurring software services. This shift is crucial for long-term revenue generation for OEMs and third-party technology suppliers.

Application analysis clearly defines the end-user requirements, with Construction and Infrastructure consistently accounting for the largest market share, driven by global urbanization and road development projects. Mining and Quarrying, while smaller in volume, represent the highest investment in deep automation, given the safety imperatives and high repetition required in extraction activities. Understanding these segment dynamics is essential for market players to tailor product development, pricing strategies, and regional marketing efforts, focusing resources on areas promising the highest returns based on regional infrastructure cycles and regulatory environments.

- By Level of Automation:

- Semi-Autonomous Excavators (Dominant segment due to regulatory flexibility)

- Fully Autonomous Excavators (Niche applications in controlled environments like mining)

- Remote-Controlled/Teleoperated Excavators (Growing rapidly for hazardous site operations)

- By Machine Type (Size Class):

- Small Excavators (Under 10 Metric Tons - Highest CAGR, driven by urban utility)

- Medium Excavators (10 to 40 Metric Tons - Largest market share, general construction)

- Large Excavators (Above 40 Metric Tons - High investment in mining and heavy infrastructure)

- By Component:

- Hardware (Sensors, Controllers, GPS/GNSS Receivers, Communication Modules, Displays)

- Software & Services (Telematics Platforms, Machine Control Systems, Data Analytics, Cloud Services, Firmware Updates)

- By Application:

- Construction & Infrastructure (Roads, Bridges, Commercial Buildings)

- Mining & Quarrying (Bulk material handling, hazardous environment excavation)

- Utility & Earthmoving (Pipeline installation, cable laying, trenching)

- Forestry & Agriculture (Specialized terrain management)

Value Chain Analysis For Intelligent Excavator Market

The value chain of the Intelligent Excavator Market is complex and highly integrated, extending from raw material sourcing and component manufacturing to sophisticated end-user services and eventual equipment disposal. Upstream analysis highlights the critical reliance on specialized component suppliers, particularly those providing high-precision sensors (LiDAR, MEMS gyroscopes, ultrasonic sensors), robust control systems (ECUs), and advanced telecommunications hardware (5G modems). The integration of software intellectual property, often sourced from specialized technology startups or in-house R&D, is the primary value addition at this stage. OEMs (Original Equipment Manufacturers) act as integrators, assembling the physical chassis, hydraulic systems, and engine components while simultaneously integrating the complex electronic architecture and proprietary intelligent software platforms.

The manufacturing stage involves rigorous testing and calibration, ensuring the seamless operation of the machine control systems with the mechanical components. Downstream activities involve distribution channels, which are characterized by a mix of direct sales channels, particularly for large fleet orders, and an extensive global network of authorized dealers. These dealers not only handle sales and financing but are increasingly responsible for providing technical training, localized support for complex software systems, and spare parts inventory management. The service segment, including software subscriptions (SaaS models for telematics) and predictive maintenance contracts, represents a rapidly growing and high-margin segment of the downstream value chain, shifting the focus from a one-time capital sale to long-term client relationships.

Direct distribution is prevalent for strategic corporate clients (major mining houses, tier-one construction firms) seeking customized fleet intelligence solutions and demanding close collaboration with the OEM. Indirect distribution through third-party rental companies is also a significant route, especially for smaller contractors who prefer leasing intelligent excavators to avoid high initial capital expenditure. Furthermore, the increasing importance of data acquisition and analysis means that the value chain extends into data monetization, where operational insights gathered via telematics are used by OEMs to refine product design and by end-users to optimize site operations. Effective management of this data flow is becoming a crucial determinant of competitive advantage within the value chain.

Intelligent Excavator Market Potential Customers

The primary customers for intelligent excavators are large-scale construction and infrastructure development companies, multinational mining corporations, and substantial equipment rental and leasing firms. These entities possess the financial capability to invest in high-cost capital equipment and the operational scale necessary to realize significant ROI through efficiency gains and reduced labor dependency. Construction firms leverage intelligent excavators primarily for complex grading, utility trenching, and foundation preparation, where the guaranteed accuracy minimizes rework and ensures compliance with strict engineering specifications. Infrastructure projects, such as high-speed rail development or expansive highway construction, specifically require the speed and precision offered by machine control systems integrated into large fleets.

Mining companies represent another critical customer segment, especially those operating large open-pit or quarrying sites, where automation addresses severe safety concerns related to human presence in hazardous blasting and extraction zones. For these customers, fully autonomous intelligent excavators offer unparalleled operational consistency 24/7, maximizing yield and reducing operational costs related to fuel and human resources. Government agencies, particularly those managing public works and emergency disaster response, are also emerging customers, valuing the remote-control capabilities for operations in compromised or difficult-to-access environments, demonstrating an increasing shift towards technology adoption in public service infrastructure management.

Finally, global equipment rental companies are essential intermediaries, facilitating the penetration of intelligent technology into the small and medium enterprise (SME) construction sector. By offering intelligent excavators on flexible leasing terms, rental firms mitigate the financial barrier for smaller contractors who benefit from improved productivity without the burden of heavy capital investment. These rental fleets necessitate robust, easily serviceable intelligent systems and comprehensive operator training modules provided by the OEMs, highlighting the interdependence between technology providers, rental agencies, and the end-users seeking temporary access to high-precision machinery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $17.8 Billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar, Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, John Deere, Liebherr Group, Doosan Infracore (now Hyundai Doosan Infracore), SANY Group, XCMG, JCB, Kobelco Construction Machinery, CASE Construction Equipment, Leica Geosystems (Hexagon AB), Trimble Inc., Topcon Corporation, Epiroc, Sandvik, Zoomlion Heavy Industry, LiuGong. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Excavator Market Key Technology Landscape

The Intelligent Excavator Market is characterized by the convergence of several high-growth technologies, primarily centered around achieving precise machine control, robust communication, and advanced perception. The core technological foundation relies on high-accuracy GNSS/GPS systems (often Real-Time Kinematic - RTK) combined with Inertial Measurement Units (IMUs) to provide centimeter-level positional accuracy, crucial for tasks like fine grading and utility installation. This positional data is fed into sophisticated Machine Control Systems (MCS) software, which translates 3D design models (often derived from Building Information Modeling or BIM) into precise hydraulic movements. Furthermore, the integration of advanced sensors such as LiDAR and radar provides real-time environmental mapping and collision avoidance capabilities, significantly enhancing safety and operational awareness in dynamic environments.

Connectivity and data processing form the second pillar of the technology landscape. Telematics systems utilize cellular networks (increasingly 4G LTE and 5G) to transmit operational data—including fuel consumption, cycle times, payload, and system health—to centralized cloud platforms. This allows fleet managers to conduct real-time monitoring and advanced data analytics. The low-latency communication provided by 5G is particularly transformative, enabling reliable and responsive teleoperation (remote control) over vast distances, which is vital for hazardous or remote job sites. The processing power is increasingly shifting to edge computing, where AI algorithms run locally on the excavator’s control unit to make immediate operational adjustments without reliance on constant cloud connectivity.

A crucial emerging technology is the adoption of electric and hybrid powertrain systems combined with intelligence. These electrified platforms are inherently easier to control digitally and offer opportunities for highly optimized energy management, managed by AI. This movement towards cleaner energy sources aligns with global sustainability goals and regulatory pressures for reduced emissions on construction sites. Moreover, modular and open-architecture software platforms are gaining traction, allowing third-party developers to create specialized applications, fostering a dynamic ecosystem around intelligent excavator usage and specialized task execution, moving the industry toward standardized, interoperable intelligent components rather than proprietary, closed systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for intelligent excavators, primarily driven by massive government-led investments in infrastructure (China's Belt and Road Initiative, India's large-scale urbanization projects). The high demand for construction machinery coupled with increasing labor costs and a strong push for productivity improvement in countries like Japan and South Korea, which are early adopters of automation technology, fuels this growth.

- North America: This region is characterized by high technological maturity and a strong focus on total cost of ownership (TCO) reduction. The adoption rate of semi-autonomous machine control systems (MCS) is exceptionally high, particularly in the US and Canada, driven by rigorous safety standards and the widespread use of sophisticated 3D modeling and BIM technologies in large civil engineering projects.

- Europe: Europe exhibits robust growth spurred by stringent environmental regulations and a focus on sustainability, leading to accelerated adoption of electric and hybrid intelligent excavators. Germany, the UK, and the Nordic countries are leaders in implementing intelligent telematics and predictive maintenance systems, leveraging strong regional technology expertise and well-developed connectivity infrastructure.

- Latin America: Adoption is currently focused on the mining sector in countries like Chile, Brazil, and Peru, where large-scale extraction operations benefit most significantly from autonomous and semi-autonomous large excavators to improve safety and operational yield. Construction segment adoption is slower, often constrained by economic stability and infrastructure investment fluctuations.

- Middle East and Africa (MEA): This region shows significant potential, propelled by mega-projects (e.g., NEOM in Saudi Arabia and large utility projects in the UAE). The demand here is centered on highly reliable, technologically advanced machines capable of operating efficiently in harsh climatic conditions, with a growing emphasis on remote monitoring and teleoperation capabilities due to logistics challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Excavator Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment (Volvo CE)

- Hitachi Construction Machinery Co., Ltd.

- John Deere (Deere & Company)

- Liebherr Group

- Hyundai Doosan Infracore (formerly Doosan Infracore)

- SANY Group

- XCMG Group

- JCB (J.C. Bamford Excavators Ltd.)

- Kobelco Construction Machinery Co., Ltd.

- CASE Construction Equipment (CNH Industrial)

- Leica Geosystems (Part of Hexagon AB)

- Trimble Inc.

- Topcon Corporation

- Epiroc AB

- Sandvik AB

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- LiuGong Machinery Co., Ltd.

- Takeuchi Manufacturing Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Intelligent Excavator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Intelligent Excavator Market?

The primary driver is the pervasive global demand for enhanced construction site productivity and accuracy, coupled with critical shortages of skilled labor. Intelligent excavators, by minimizing rework and optimizing operational cycles through automated machine control (AMC) and AI-driven systems, directly address these efficiency and labor gap challenges.

How do semi-autonomous excavators differ from fully autonomous ones in current market applications?

Semi-autonomous excavators augment human operators by automating specific high-precision tasks like grading or trenching while requiring human supervision for overall navigation and complex decision-making. Fully autonomous excavators operate without continuous human intervention and are currently primarily deployed in highly controlled, repetitive environments such as large-scale mining operations or quarries.

What are the main financial barriers to the wider adoption of intelligent excavators?

The main financial barrier is the significantly higher initial capital expenditure (CapEx) compared to conventional machinery due to the cost of advanced sensors (LiDAR, GNSS), complex control units, and proprietary software licenses. However, this cost is typically offset over time by reduced operating expenses (OpEx), lower fuel consumption, and minimized rework costs.

Which geographical region is currently leading the market adoption and why?

The Asia Pacific (APAC) region leads the market in terms of volume and growth rate. This dominance is driven by massive infrastructure spending in China and India, rapid urbanization, and regional manufacturers’ commitment to integrating cost-effective automation technology into medium- and small-sized equipment fleets.

What role does 5G technology play in the future development of intelligent excavators?

5G technology is crucial as it provides the high bandwidth and ultra-low latency necessary for reliable real-time teleoperation (remote control) and the seamless transmission of large volumes of sensor and telematics data. This enables centralized fleet management, instant software updates, and advanced, responsive cloud-based AI processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager