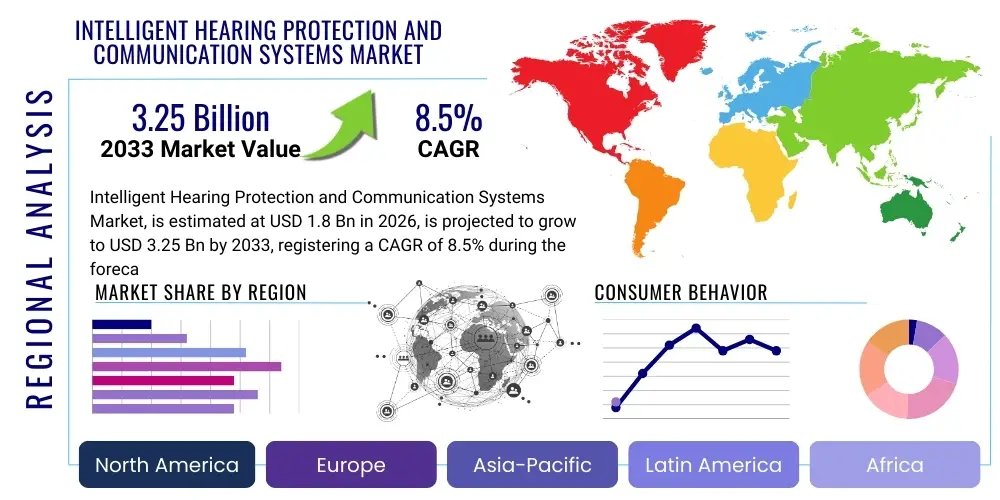

Intelligent Hearing Protection and Communication Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435429 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Intelligent Hearing Protection and Communication Systems Market Size

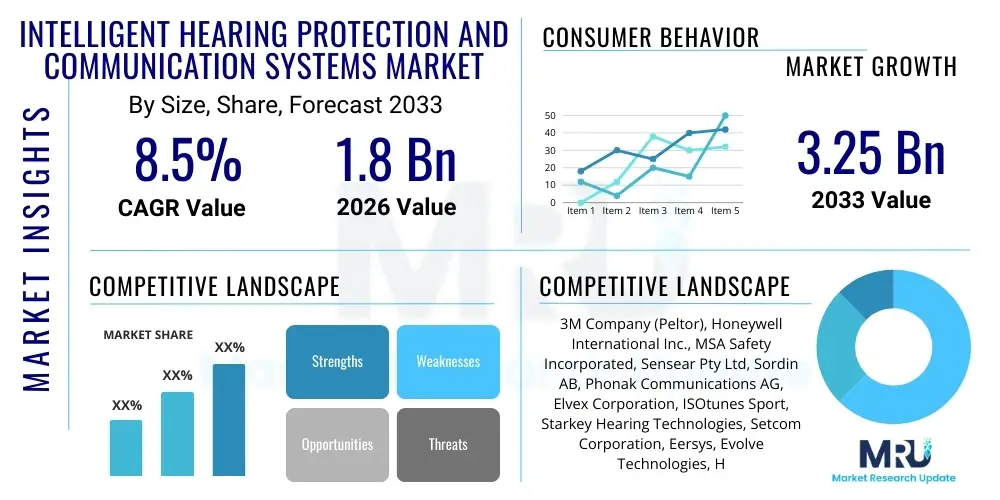

The Intelligent Hearing Protection and Communication Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Intelligent Hearing Protection and Communication Systems Market introduction

The Intelligent Hearing Protection and Communication Systems Market encompasses advanced wearable devices designed not only to mitigate hazardous noise exposure but also to enhance situational awareness and facilitate seamless communication in loud industrial, military, and recreational environments. These systems leverage sophisticated digital signal processing (DSP), active noise cancellation (ANC), and sound localization technologies to protect workers from long-term hearing damage while ensuring critical verbal instructions and environmental warnings are clearly audible. The primary products include smart earmuffs, advanced earplugs, and integrated helmet systems that connect wirelessly to communication networks, often complying with strict occupational health and safety regulations across global jurisdictions.

The major applications of these intelligent systems span heavy industries such as manufacturing, construction, mining, and oil & gas, where noise levels frequently exceed permissible exposure limits. Furthermore, the defense sector utilizes these systems extensively for tactical communication and blast protection, while aviation and motorsports rely on them for high-fidelity communication in high-noise cockpits and pits. The key benefit derived from adopting these intelligent solutions is the improved compliance with safety standards, leading to a demonstrable reduction in occupational hearing loss cases, coupled with enhanced productivity stemming from better team communication and decreased cognitive load on the user.

Driving factors propelling this market include increasingly stringent regulatory frameworks enacted by bodies like OSHA and the EU, which mandate effective hearing protection alongside clear communication capabilities. Technological advancements, particularly in miniaturization, battery life, and wireless connectivity (such as Bluetooth LE and specialized mesh networks), are making these devices more practical and comfortable for all-day use. Furthermore, the growing global focus on worker safety and the consequential financial liabilities associated with occupational deafness are pushing organizations toward proactive, intelligent solutions that offer superior protection compared to traditional passive alternatives.

Intelligent Hearing Protection and Communication Systems Market Executive Summary

The Intelligent Hearing Protection and Communication Systems Market is currently experiencing robust growth, driven by the global imperative for improved occupational safety and the integration of advanced digital technologies into personal protective equipment (PPE). Key business trends highlight a significant shift from passive noise attenuation devices to active, feature-rich electronic communication platforms that offer customizable hearing profiles and integration with Industrial Internet of Things (IIoT) frameworks. Strategic alliances between traditional PPE manufacturers and technology developers are accelerating innovation, focusing on improved voice intelligibility algorithms and enhanced battery longevity for extended work shifts. Investment flows indicate strong venture capital interest in startups specializing in deep-learning algorithms for selective noise filtering and spatial audio enhancement.

Regionally, North America and Europe dominate the market, primarily due to well-established industrial sectors, high regulatory compliance rates, and substantial budgets allocated for worker safety programs. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market segment. This accelerated growth in APAC is attributed to rapid industrialization, particularly in countries like China and India, coupled with increasing awareness of occupational health risks and the gradual adoption of global safety standards. Governments in these regions are playing a crucial role by mandating the use of certified safety gear, thus creating massive scale opportunities for intelligent systems providers. The Middle East and Africa (MEA) and Latin America are poised for moderate growth, contingent upon infrastructure investment in heavy industries.

Segment trends reveal that the Defense & Military end-user segment commands a significant market share, driven by continuous demand for high-performance tactical communication and protection systems suitable for extreme environments. Conversely, the Industrial segment, particularly construction and manufacturing, is projected to exhibit the highest CAGR, propelled by the sheer volume of personnel requiring compliant protection. Technology segmentation emphasizes the rapid uptake of in-ear devices (earplugs) due to their enhanced comfort and lighter form factor compared to over-the-head earmuffs. Furthermore, systems incorporating AI-enabled situational awareness are beginning to penetrate high-risk environments, marking a transition toward predictive and adaptive hearing protection solutions.

AI Impact Analysis on Intelligent Hearing Protection and Communication Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on intelligent hearing systems frequently center on the ability of AI to differentiate between critical warning signals (e.g., alarms, reversing beeps) and continuous damaging noise, and how quickly these systems can adapt to dynamic sound environments. Users are highly concerned about the reliability of selective sound amplification (transparency mode) and whether AI algorithms can be tailored to individual hearing profiles and specific workplace acoustics. Key themes also include the potential for AI-driven data analytics on noise exposure levels to improve safety protocols, and concerns over data privacy when integrating hearing protection devices with cloud-based AI processing units. Users expect AI to move beyond simple noise cancellation to truly intelligent acoustic management.

The integration of AI, particularly machine learning (ML) and deep learning (DL), is fundamentally transforming the capabilities of intelligent hearing protection systems, enabling a level of precision and personalization previously unattainable. AI algorithms are now deployed to perform advanced sound classification, allowing the device to selectively attenuate specific frequencies associated with hazardous machinery while simultaneously prioritizing human speech (Voice over Noise). This sophisticated processing reduces the cognitive load on the worker and significantly improves communication efficiency in complex, multi-source noise environments. Furthermore, predictive AI models are being utilized to analyze accumulated noise exposure data over time, providing proactive alerts to both users and safety managers regarding potential threshold shifts and non-compliance risks, thereby strengthening the overall safety ecosystem.

The market impact is characterized by the emergence of highly specialized product tiers that leverage proprietary neural networks trained on vast datasets of industrial noise profiles. This has led to the development of next-generation features such as adaptive noise reduction—where the suppression level adjusts instantly based on the intensity and characteristics of incoming sound—and improved spatial awareness capabilities that help users accurately locate the source of critical sounds. As AI processing becomes further miniaturized and optimized for edge computing within the device itself, concerns regarding latency and continuous connectivity are being addressed, solidifying the role of AI as a central differentiator in high-end intelligent hearing and communication solutions.

- Enhanced Selective Noise Filtering (Speech Intelligibility): AI isolates and amplifies human speech while suppressing non-speech noise, dramatically improving communication fidelity.

- Adaptive Noise Reduction: Machine learning models allow the system to adjust noise attenuation levels in real-time based on the instantaneous change in environmental noise characteristics.

- Critical Warning Detection: Deep learning enables reliable identification and alerting for specific, critical sounds (e.g., sirens, alarms, machinery faults) often obscured by continuous background noise.

- Personalized Acoustic Profiles: AI tailors noise exposure limits and sound amplification based on individual auditory sensitivity and historical exposure data.

- Predictive Maintenance and Safety Analytics: Utilization of collected noise data to forecast equipment failure or identify high-risk areas in a facility.

DRO & Impact Forces Of Intelligent Hearing Protection and Communication Systems Market

The market dynamics of Intelligent Hearing Protection and Communication Systems are fundamentally shaped by a complex interplay of stringent safety regulations and rapid technological evolution. The primary driver is the non-negotiable regulatory compliance imposed globally, which forces industries to adopt certified PPE solutions to mitigate irreversible hearing damage and avoid hefty penalties. This is synergized by continuous innovation in digital signal processing and battery technology, making intelligent devices more user-friendly and reliable for deployment in harsh conditions. However, the market faces restraints, chiefly the high initial procurement cost associated with advanced electronic systems compared to passive alternatives, posing a barrier to adoption for small and medium-sized enterprises (SMEs) and developing economies. Opportunities abound in integrating these systems with broader IIoT platforms, offering comprehensive safety data analytics, and expanding penetration into emerging sectors like clean energy infrastructure and high-tech agricultural operations.

The impact forces influencing the market trajectory are predominantly technological and regulatory. The rapid pace of miniaturization allows manufacturers to pack powerful processing capabilities into comfortable, inconspicuous form factors, accelerating user acceptance. Furthermore, the increasing global focus on proactive wellness programs, moving beyond mere compliance, encourages investment in systems that actively track and report noise exposure data. The availability of high-speed, low-latency wireless communication standards (e.g., 5G, specialized mesh networks) is critical, transforming the hearing protector from a solitary PPE item into an interconnected node within a facility's communication infrastructure.

The long-term success of market participants hinges on their ability to overcome the training and maintenance challenges associated with advanced electronics in rugged environments. While the replacement cycles for intelligent systems are longer than passive products, the complexity of sensor calibration, software updates, and battery management necessitates robust after-sales service and user training. Successfully addressing user apprehension regarding the durability and complexity of these devices will unlock significant latent demand, solidifying the market's transition towards digitally managed, intelligent safety ecosystems. The rising awareness of the long-term economic and human cost of occupational hearing loss serves as a constant, underlying force compelling industries toward investment.

Segmentation Analysis

The Intelligent Hearing Protection and Communication Systems Market is meticulously segmented based on product type, technology, end-user industry, and regional geography, allowing for targeted product development and strategic market penetration. Segmentation by product type differentiates between over-the-head earmuffs, preferred for maximum attenuation and ease of sharing, and in-ear plugs, favored for comfort, lighter weight, and continuous wearability. The technology segmentation highlights the core differentiation between traditional passive noise reduction and modern active noise control (ANC) systems, which use sophisticated electronics to cancel incoming noise waves, alongside advanced digital sound processing (DSP) for clear communication.

End-user segmentation is critical, illustrating the varied requirements across different hazardous environments. The Military & Defense sector demands extreme ruggedness, blast protection, and secure tactical communication, justifying higher price points. Conversely, the Manufacturing and Construction sectors require durable, cost-effective solutions capable of continuous operation in environments dominated by machine noise, focusing heavily on clear site-wide communication. The ongoing convergence of these segments, driven by shared technological needs for speech clarity and adaptive noise management, is leading manufacturers to develop modular and highly customizable system architectures to serve multiple client bases efficiently.

Geographically, the market is analyzed across major regions including North America, Europe, Asia Pacific, Latin America, and MEA. Each region exhibits unique characteristics, dictated by regional regulatory adherence and the maturity of its industrial base. The detailed segmentation analysis provides stakeholders with the necessary granularity to assess investment potential, understand competitive positioning, and allocate resources effectively to exploit emerging opportunities, particularly in high-growth segments such as telematics integration within construction equipment and enhanced safety protocols in the renewable energy sector.

- By Product Type:

- Intelligent Earmuffs

- Intelligent Earplugs (In-ear Systems)

- Integrated Helmet Systems

- By Technology:

- Active Noise Control (ANC)

- Digital Sound Processing (DSP)

- Situational Awareness Technology

- Wireless Communication (Bluetooth, DECT, Mesh Networks)

- By End-User Industry:

- Industrial Manufacturing

- Construction

- Mining

- Oil & Gas

- Defense & Military

- Aviation & Aerospace

- Fire & Emergency Services

- Sports & Recreation (e.g., Motorsports, Shooting)

- By Sales Channel:

- Direct Sales

- Distributors and Resellers

- Online Retail

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Intelligent Hearing Protection and Communication Systems Market

The value chain for Intelligent Hearing Protection and Communication Systems begins with the upstream segment, which involves the sourcing and manufacturing of highly specialized components. This includes the development and procurement of micro-electromechanical systems (MEMS) microphones, high-fidelity speakers, advanced battery solutions (often rechargeable lithium-ion), and sophisticated semiconductor chips responsible for DSP and AI processing. Key activities in this stage focus on optimizing component quality, ensuring robust supply chain management for critical electronic components, and investing in R&D to enhance acoustic algorithms. Supplier relationships are critical, particularly with specialized electronic component manufacturers who can meet the stringent durability and miniaturization requirements necessary for industrial-grade PPE.

The midstream involves the core manufacturing, assembly, and integration processes where component parts are assembled into the final intelligent device (earmuffs or earplugs). This stage includes critical activities such as acoustic tuning, rigorous quality control testing to ensure NRR (Noise Reduction Rating) compliance, and the development of proprietary firmware and software interfaces. Direct distribution channels, where manufacturers sell directly to large governmental organizations (defense) or major industrial accounts, offer higher margins but require significant internal sales infrastructure. Indirect distribution channels, utilizing specialized industrial safety equipment distributors and PPE resellers, are essential for reaching the fragmented SME market and ensure wide geographic coverage, leveraging the distributor's existing logistical and customer support networks.

The downstream segment focuses on the deployment, training, and maintenance of the systems for the end-user. This includes providing specialized consultation to ensure the correct device type (earmuff vs. earplug) is selected for the specific noise environment, mandatory user training on electronic functionality and battery management, and offering repair or replacement services. Potential customers, or end-users, play a critical role in providing feedback that informs the next generation of product development, particularly concerning comfort, ease of use, and integration with other necessary PPE, such as helmets and respiratory equipment. The effectiveness of the overall value chain relies on seamless data flow and collaboration between component suppliers, core manufacturers, and regional safety distributors.

Intelligent Hearing Protection and Communication Systems Market Potential Customers

The potential customer base for Intelligent Hearing Protection and Communication Systems is highly diversified, spanning any organization or individual operating in environments where excessive noise poses a risk to hearing health, and communication clarity is paramount to operational safety. Major customers are predominantly large, multinational organizations within the industrial complex, specifically those mandated by law to maintain comprehensive hearing conservation programs. These entities prioritize systems that offer verifiable exposure tracking and seamless integration with existing organizational safety management systems. Procurement decisions are typically centralized, focusing on total cost of ownership, durability, and compliance with industry-specific standards like MIL-STD for defense or specific ANSI/CE standards for industrial applications.

Beyond the core industrial and defense sectors, a rapidly growing customer segment includes specialized public safety organizations, such as fire departments, emergency medical services, and police tactical units, where clear communication amidst chaotic environments is a matter of life and death. These customers demand extremely rugged, reliable, and often intrinsically safe systems that can interface with land mobile radio (LMR) systems. Furthermore, private individuals involved in high-noise recreational activities, such as shooting sports, motorsports, and heavy equipment operation on hobby farms, represent a significant, though more fragmented, consumer segment, driven by self-preservation and a desire for enhanced functionality like Bluetooth streaming capabilities alongside protection.

The procurement criteria for potential customers are increasingly shifting from focusing solely on the Noise Reduction Rating (NRR) to evaluating the total intelligent functionality package. Customers now seek devices that offer enhanced situational awareness (hearing ambient sound safely), superior voice clarity, cross-platform compatibility, and robust data logging features for regulatory reporting. Manufacturers must tailor their marketing and distribution efforts to address the distinct needs of each end-user vertical, recognizing that a military customer values tactical robustness and secure encryption, while a manufacturing customer values comfort for 12-hour shifts and integration with standard two-way radios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company (Peltor), Honeywell International Inc., MSA Safety Incorporated, Sensear Pty Ltd, Sordin AB, Phonak Communications AG, Elvex Corporation, ISOtunes Sport, Starkey Hearing Technologies, Setcom Corporation, Eersys, Evolve Technologies, Hellberg Safety, Shothunt, Sonetics Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Hearing Protection and Communication Systems Market Key Technology Landscape

The technology landscape of the Intelligent Hearing Protection and Communication Systems market is defined by continuous innovation in acoustics, digital processing, and connectivity protocols, moving far beyond traditional passive dampening materials. Central to the current technology is Active Noise Control (ANC) and its advanced variants, which utilize phase inversion techniques to actively neutralize low-frequency and continuous noise, enhancing the overall NRR effectiveness without relying solely on bulky physical material. Crucially, sophisticated Digital Signal Processing (DSP) chips are employed to manage multiple input sources—internal microphones for communication, external microphones for situational awareness, and the user’s own voice—ensuring a crystal-clear communication feed that is prioritized over ambient noise, which is a significant technical achievement in high-decibel environments.

A second major technological pillar involves enhanced Situational Awareness (SA) systems, often referred to as "Talk-Through" functionality. These systems use external microphones to capture environmental sounds, process them through limiting circuitry to ensure they remain below safe levels, and then deliver them to the user's ear. Recent advancements involve spatial sound processing, enabling the user to accurately determine the direction and distance of sounds (e.g., approaching vehicles or warning shouts), which dramatically improves safety in dynamic industrial settings. Furthermore, advanced AI and machine learning algorithms are increasingly being embedded at the edge (within the device) to instantaneously classify sounds, allowing the system to pass through speech or alarms while aggressively suppressing machinery noise, customizing the sound experience based on real-time acoustic signatures.

Connectivity and integration represent the third critical area of technological focus. The transition from basic analog radio connections to advanced digital wireless standards, including robust Bluetooth protocols and proprietary mesh networking technologies (like DECT or specialized IIoT connectivity), allows for seamless, multi-user communication across large operational areas without relying on line-of-sight. Manufacturers are heavily investing in improving battery efficiency and miniaturization to support the power demands of advanced DSP and ANC circuitry for full-shift operation. The integration of these systems with wearable sensors and broader IIoT platforms for real-time noise exposure monitoring and compliance reporting is transforming these communication devices into essential components of enterprise safety data infrastructure.

Regional Highlights

- North America: North America, particularly the United States, commands a dominant share of the global market. This leadership position is underpinned by highly stringent workplace safety regulations enforced by OSHA, substantial military spending on tactical communication gear, and a mature industrial base that readily adopts advanced safety technologies. The region is a hotbed for innovation, characterized by high adoption rates of AI-enabled situational awareness systems and robust integration of intelligent hearing protection with wider Industrial Internet of Things (IIoT) platforms for centralized safety monitoring. Growth is sustained by continuous investment in major infrastructure projects and robust demand from the aerospace and heavy manufacturing sectors.

- Europe: Europe represents another crucial market, driven primarily by the EU’s comprehensive directives regarding occupational noise exposure (Directive 2003/10/EC). Countries like Germany and the Nordic nations exhibit high rates of adoption, emphasizing ergonomic design, long-term wearer comfort, and cross-compatibility standards. Key market trends include a strong preference for high-quality, durable intelligent earmuffs and earplugs suitable for construction sites and petrochemical facilities. Technological development focuses on systems that offer seamless integration with specialized European radio communication systems (e.g., TETRA/TETRAPOL) used by public safety and industrial sectors.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive industrialization, particularly in emerging economies such as China, India, and Southeast Asia, leading to a burgeoning workforce exposed to hazardous noise. While regulatory enforcement is historically varied, it is rapidly strengthening in response to international pressure and internal governmental initiatives prioritizing worker health. Market opportunities are vast for cost-effective, durable intelligent systems, and there is a high uptake of systems capable of supporting large work teams in manufacturing and mining operations.

- Latin America (LATAM): The LATAM market is characterized by moderate but steady growth, heavily influenced by the mining, oil & gas, and construction sectors in countries like Brazil and Mexico. Market penetration is often dependent on large multinational corporations operating in the region enforcing global safety standards. Challenges include fragmented distribution channels and price sensitivity, necessitating solutions that offer a strong balance between advanced features and economic feasibility. The demand is slowly shifting towards intelligent earplugs due to local preference for lighter PPE in warmer climates.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale government investments in mega-projects, especially in the construction and energy sectors (oil, gas, and renewable energy) within the Gulf Cooperation Council (GCC) countries. Strict safety protocols related to major energy infrastructure often mandate the use of high-end intelligent communication systems. The market size, while smaller than North America or Europe, features high per-unit spending in the military and petrochemical segments, where extreme environment resistance and certified ingress protection ratings are critical purchasing criteria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Hearing Protection and Communication Systems Market.- 3M Company (Peltor Communications)

- Honeywell International Inc.

- MSA Safety Incorporated

- Sensear Pty Ltd

- Sordin AB

- Phonak Communications AG (Sonova Group)

- Elvex Corporation

- ISOtunes Sport

- Starkey Hearing Technologies

- Setcom Corporation

- Eersys

- Evolve Technologies

- Hellberg Safety

- Shothunt

- Sonetics Corporation

- Tasco Corporation

- Safe Technology (E-A-R)

- Sena Technologies, Inc.

- Silent Guardian (Acoustic Control Systems)

- Otto Engineering, Inc.

Frequently Asked Questions

Analyze common user questions about the Intelligent Hearing Protection and Communication Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What differentiates intelligent hearing protection from traditional hearing protection?

Intelligent hearing protection utilizes active electronic components like Active Noise Control (ANC) and Digital Signal Processing (DSP) to not only reduce noise but also enhance critical sounds (situational awareness) and facilitate clear two-way communication, whereas traditional methods rely solely on passive material attenuation.

How does AI improve safety performance in these communication systems?

AI integrates machine learning to classify and selectively filter sounds in real-time, ensuring only damaging noise is blocked while human speech and critical warning alarms are passed through clearly, thus significantly enhancing user situational awareness and reducing the risk of accidents.

Which industry segment is the primary driver of market growth?

The Industrial segment, encompassing Manufacturing, Construction, and Mining, is the primary driver of volume growth due to strict regulatory compliance mandates and the large volume of personnel requiring certified protection and communication capabilities in hazardous, high-noise environments.

What are the key technological restraints limiting wider adoption?

Key restraints include the high initial procurement cost compared to passive solutions, which affects adoption among SMEs, and the technical challenge of ensuring extended battery life and durable electronics maintenance in extremely harsh industrial conditions.

What is the projected CAGR for the Intelligent Hearing Protection market between 2026 and 2033?

The Intelligent Hearing Protection and Communication Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% during the 2026–2033 forecast period, driven by regulatory pressures and technological advancements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager