Intelligent Pills Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437267 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Intelligent Pills Market Size

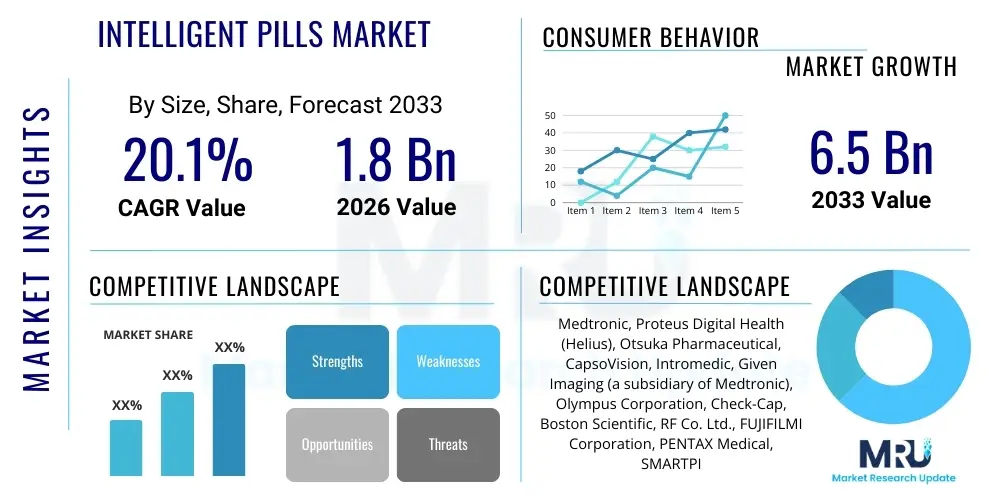

The Intelligent Pills Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.1% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Intelligent Pills Market introduction

Intelligent pills, often referred to as ingestible sensors or capsule endoscopy systems, represent a revolutionary class of medical devices designed for non-invasive diagnostics, therapeutic delivery, and medication adherence monitoring. These micro-electronic systems are typically encapsulated in a biocompatible shell, allowing patients to swallow them naturally. Once ingested, they utilize miniaturized components such as CMOS cameras, sophisticated sensors (pH, temperature, pressure), microprocessors, and wireless communication modules (usually employing radio frequency or Bluetooth Low Energy) to capture vital information about the gastrointestinal (GI) tract or ensure precise drug release schedules. The primary function shifts between high-resolution visualization of the mucosal lining, critical for detecting small bowel disorders often missed by conventional endoscopies, and highly precise monitoring of internal physiological parameters necessary for personalized medicine.

The product scope of intelligent pills encompasses several distinct application areas, predominantly categorized into diagnostics and therapeutic management. Diagnostic applications, led by capsule endoscopy, provide clinicians with panoramic views of the entire GI tract, significantly improving the early detection rates for conditions such as obscure GI bleeding, Crohn’s disease, celiac disease, and small intestinal tumors. Therapeutic applications are rapidly emerging, focusing on targeted drug delivery systems (TDDS) that release medication only upon reaching specific anatomical locations or in response to predetermined physiological triggers, thus maximizing efficacy while minimizing systemic side effects. Furthermore, digital ingestion tracking systems, which confirm if and when a pill containing a sensor was taken, are crucial in clinical trials and for managing complex chronic conditions where adherence is paramount.

Key benefits driving market adoption include the minimally invasive nature of the procedure, eliminating the need for sedation and lengthy recovery times associated with traditional endoscopies. For patients, this translates to improved comfort and reduced anxiety. For healthcare systems, it offers a high throughput diagnostic tool that is generally safer and potentially more cost-effective for screening high-risk populations. Major driving factors include the surging global prevalence of chronic gastrointestinal disorders, such as inflammatory bowel disease (IBD) and colorectal cancer, coupled with continuous technological miniaturization allowing for enhanced battery life, superior image quality, and increased sensor functionality within the capsule format. The growing emphasis on preventative screening and early intervention further solidifies the role of intelligent pills as indispensable diagnostic and monitoring tools in modern gastroenterology.

Intelligent Pills Market Executive Summary

The Intelligent Pills Market is experiencing robust growth driven by the convergence of digital health technologies, advanced micro-electronics, and pharmaceutical innovation. Key business trends indicate a strong shift toward integration capabilities, particularly the incorporation of artificial intelligence (AI) and machine learning (ML) algorithms for automated image analysis and data processing in diagnostic capsules. This integration is vital for reducing the burden on clinicians who review thousands of images per procedure, thereby improving diagnostic speed and accuracy. Furthermore, pharmaceutical companies are increasingly collaborating with MedTech firms to develop intelligent pills specifically designed for enhanced bioavailability and real-time pharmacokinetic monitoring during clinical development, signifying a maturation of the therapeutic segment and moving beyond pure diagnostics into sophisticated drug delivery platforms.

Regional trends reveal that North America currently dominates the market share due to high healthcare expenditure, established reimbursement policies for capsule endoscopy procedures, and the strong presence of key technology developers and early adopters in the region. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate over the forecast period. This rapid expansion in APAC is primarily fueled by improving healthcare infrastructure, a large patient pool suffering from GI tract diseases, and increasing governmental focus on providing access to minimally invasive diagnostic tools. European markets maintain stable growth, characterized by stringent regulatory environments but robust clinical acceptance, particularly in countries with centralized healthcare systems that prioritize efficiency and non-invasive patient pathways.

Segment trends underscore the rising dominance of the Diagnostics/Imaging application segment, which benefits from high clinical utility and widespread adoption globally, particularly small bowel capsule endoscopy. Within the component segment, Cameras and Sensors retain the largest share, reflecting the high cost and complexity associated with miniaturized optical and chemical sensing systems. Nonetheless, the Software and Data Recorder segment is expected to exhibit exponential growth due to the necessity for sophisticated cloud-based platforms, secure data storage, and AI-powered analytical tools required to manage the massive datasets generated by ingestible sensors. This shift emphasizes that the market value is increasingly moving from hardware manufacturing toward advanced data intelligence and interpretation services.

AI Impact Analysis on Intelligent Pills Market

Common user questions regarding AI's impact on intelligent pills revolve intensely around automation efficiency, diagnostic reliability, and the implications for patient privacy. Users frequently inquire: "Can AI truly replace human review of capsule endoscopy footage?", "How accurate are AI algorithms in detecting subtle lesions compared to experienced gastroenterologists?", and "What are the regulatory frameworks governing AI-driven diagnostics derived from ingestible devices?" The core themes center on expectations of reduced diagnostic reporting time, concerns over potential algorithmic bias or false negatives in critical disease identification, and the need for standardized data handling protocols given the sensitivity of GI tract data. Users universally anticipate that AI will enhance throughput and accessibility, particularly in remote settings, but demand robust validation studies to confirm the technology's clinical superiority and safety.

AI’s influence is transformative, fundamentally reshaping how data captured by intelligent pills is processed and utilized. Machine learning models, particularly deep learning convolutional neural networks (CNNs), are being trained on vast repositories of capsule endoscopy images to autonomously identify anomalies such as polyps, bleeding sites, angioectasias, and inflammatory changes characteristic of Crohn’s disease. This automated pre-screening dramatically reduces the review time required by clinicians, potentially cutting review periods from several hours to mere minutes, thereby enhancing clinic productivity and reducing diagnostic latency. Moreover, AI allows for quantitative analysis of motility and transit time, crucial parameters for understanding GI function, which are difficult to assess subjectively.

Beyond diagnostics, AI is crucial in optimizing the functionality of therapeutic intelligent pills. In drug delivery systems, ML models can synthesize real-time sensor data (such as pH levels, temperature, and localized pressure) to trigger the precise release of therapeutics only when the optimal absorption environment is confirmed, maximizing the drug's therapeutic window. Furthermore, AI algorithms are vital for data integrity and security, ensuring that the sensitive physiological data collected by ingestible sensors is anonymized, stored securely in compliance with regulations like HIPAA or GDPR, and accurately transmitted to the monitoring physician, thereby addressing key ethical and privacy concerns raised by end-users and regulatory bodies.

- Automated Image Analysis: Deep learning algorithms accelerate the detection of GI lesions (e.g., polyps, ulcers) in capsule endoscopy footage, improving diagnostic speed and reducing clinician fatigue.

- Data Triage and Prioritization: AI models prioritize critical findings, flagging urgent cases for immediate physician review, thereby optimizing clinical workflow efficiency.

- Enhanced Diagnostic Accuracy: ML assists in standardizing the detection process, minimizing inter-observer variability, and improving the sensitivity for subtle findings.

- Personalized Drug Release: Real-time physiological data interpretation by AI enables smarter drug delivery systems to target specific therapeutic zones based on individual patient parameters.

- Regulatory Compliance Support: AI assists in maintaining secure, auditable data trails for ingestible sensor data, supporting stringent healthcare regulatory requirements.

DRO & Impact Forces Of Intelligent Pills Market

The Intelligent Pills Market is shaped by a complex interplay of strong drivers, significant restraints, and evolving opportunities, which collectively define the Impact Forces governing its trajectory. A primary driver is the pervasive demand for minimally invasive diagnostic tools, fueled by increasing patient preference for less painful and non-sedative procedures compared to traditional wired endoscopy, especially for small bowel visualization. Coupled with this is the escalating global incidence of chronic GI diseases, including Inflammatory Bowel Disease (IBD) and colorectal cancer, necessitating frequent, accurate, and repeatable monitoring solutions. These drivers create a powerful upward force, compelling healthcare providers to adopt advanced ingestible technologies that improve patient compliance and accessibility.

However, the market faces considerable restraints, notably the high initial cost associated with intelligent pill systems and the subsequent lack of standardized global reimbursement policies. While the procedure offers long-term benefits, the upfront expense for the sophisticated disposable capsules remains a barrier, particularly in emerging markets or under-resourced healthcare settings. Furthermore, challenges related to data management—specifically the huge volume of high-resolution images generated and the need for robust, secure storage and transmission—require significant IT infrastructure investment. Clinical limitations, such as the inability to control the capsule's movement (which can lead to missed areas) and the lack of therapeutic intervention capability (like biopsy or polyp removal), also present constraints that limit the technology’s utility compared to conventional endoscopy.

The core opportunities revolve around technological convergence and expanded applications. The integration of advanced micro-electromechanical systems (MEMS) and enhanced power sources (micro-batteries) promises longer operation times and smaller form factors. A substantial opportunity lies in integrating intelligent pills into personalized medicine strategies, using them for real-time biomarker sensing and targeted gene therapy delivery. Moreover, the development of magnetically steered or actively propelled capsules addresses the current limitation of uncontrolled transit, transforming diagnostic efficiency. These collective drivers and opportunities exert a strong positive impact force, indicating rapid market penetration, provided the industry successfully navigates the regulatory hurdles and achieves greater cost efficiency through scale and manufacturing optimization.

Segmentation Analysis

The Intelligent Pills Market segmentation provides a granular view of distinct product categories and end-user applications, essential for strategic planning and resource allocation. The market is primarily segmented based on Application, Component, and Target Area. The Application segment differentiates between using the capsules for pure diagnostic imaging versus using them for active drug delivery and adherence monitoring. Component segmentation highlights the technological building blocks critical to the device's functionality, reflecting R&D investment priorities. Analyzing these segments helps stakeholders understand where technological differentiation is most impactful and which end-user needs are driving current revenue streams and future growth opportunities.

- By Application:

- Diagnostics/Imaging (Capsule Endoscopy)

- Drug Delivery/Monitoring (Digital Health Pills, TDDS)

- By Component:

- Cameras & Sensors (CMOS chips, pH sensors, pressure sensors)

- Data Recorder & Workstation

- Microchips/Electronic Circuits

- Software & Services

- By Target Area:

- Small Intestine (Primary use of current capsule endoscopy)

- Esophagus

- Stomach

- Large Intestine (Colon)

Value Chain Analysis For Intelligent Pills Market

The value chain for the Intelligent Pills Market is highly specialized and technologically intensive, commencing with the upstream segment focused on crucial component manufacturing. This stage involves the development and procurement of highly miniaturized, highly specialized components such as CMOS imaging sensors (requiring advanced semiconductor fabrication), biocompatible polymers for encapsulation, micro-batteries with long life spans, and proprietary radio frequency communication chips. Key players in this upstream segment often include specialized electronics suppliers and medical-grade material manufacturers. The complexity of integrating these elements into a millimeter-scale device necessitates stringent quality control and proprietary intellectual property, creating high barriers to entry for new competitors in the component supply market.

The midstream phase involves the core activity of design, assembly, and clinical validation. Market leaders focus heavily on R&D to enhance image resolution, optimize battery efficiency, and improve sensor specificity. Assembly processes must adhere to strict sterile medical device manufacturing standards (e.g., ISO 13485) and are often highly automated. Clinical validation, including rigorous trials to prove efficacy and safety for specific indications (e.g., small bowel surveillance), is a mandatory and capital-intensive step before regulatory clearance. Successful navigation of this phase is crucial for establishing credibility and securing reimbursement codes essential for commercialization.

Downstream activities include distribution, sales, and post-market support. Distribution channels are typically a mix of direct sales forces (for large hospital systems and academic medical centers) and specialized third-party medical device distributors. Direct channels allow for greater control over product training and technical support, vital given the novelty of the technology. Indirect channels offer broader geographic reach, particularly in fragmented markets. Post-market support encompasses data management platforms (often cloud-based) and software updates, forming a crucial service revenue stream. The ability to provide robust, secure, and user-friendly data analysis software is increasingly determining success in the downstream market.

Intelligent Pills Market Potential Customers

The primary end-users and potential customers of intelligent pills technology are broad-ranging within the healthcare ecosystem, centered around specialized medical institutions and pharmaceutical companies. Gastroenterologists represent the largest group of direct professional buyers, utilizing capsule endoscopy systems for diagnosing and monitoring conditions that affect the small bowel, which is inaccessible via traditional endoscope methods. Hospitals, specialized endoscopy centers, and ambulatory surgical centers (ASCs) are the primary institutional buyers, acquiring the systems and software necessary to perform the procedures and manage the resulting diagnostic data. Their purchasing decisions are often influenced by procedure volumes, reimbursement rates, and the need for cutting-edge, minimally invasive diagnostic offerings.

A rapidly expanding customer segment includes pharmaceutical and biotechnology companies. These entities utilize intelligent pills, particularly those equipped with sensors for adherence and pharmacokinetic monitoring, primarily during clinical trial phases (Phase II and III). Real-time, objective data regarding drug ingestion timing and localized GI environmental conditions helps pharmas optimize dosing regimens, ensure patient compliance in complex trials, and gain deeper insights into drug absorption mechanisms. This segment values data accuracy, security, and the ability of the ingestible sensors to integrate seamlessly into existing clinical trial management platforms, viewing the technology as a crucial tool for accelerating drug development timelines and reducing costly trial failures linked to non-adherence.

Additionally, population health management organizations and governmental healthcare agencies are emerging potential customers, particularly those focused on screening programs for high-risk populations. Intelligent pills offer a scalable, non-invasive method for screening conditions like colorectal cancer precursors in large groups, reducing reliance on invasive colonoscopy unless clinically necessary. Their attractiveness to this segment lies in their capacity to enhance preventative care efficiency and reduce the overall systemic costs associated with late-stage disease diagnosis and treatment. This growing acceptance across diverse end-user groups validates the technology's broad clinical utility and market applicability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 20.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Proteus Digital Health (Helius), Otsuka Pharmaceutical, CapsoVision, Intromedic, Given Imaging (a subsidiary of Medtronic), Olympus Corporation, Check-Cap, Boston Scientific, RF Co. Ltd., FUJIFILMI Corporation, PENTAX Medical, SMARTPILL (a subsidiary of CapsoVision), JINSHAN Science & Technology, Micro-Leads Inc., Bio-Vascular Inc., Kapsch AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Intelligent Pills Market Key Technology Landscape

The technological landscape of the Intelligent Pills Market is defined by the continual miniaturization of complex electronics and advancements in wireless communication and power management. Central to this technology is the utilization of Complementary Metal-Oxide-Semiconductor (CMOS) imaging chips, which have enabled high-resolution video capture within the constrained volume of an ingestible capsule. Concurrently, specialized sensors, including micro-pH, pressure, and temperature sensors, are integrated to provide concurrent physiological data streams alongside visual information. Progress in biocompatible packaging and sealing techniques ensures the safety and integrity of the device as it traverses the human body, meeting rigorous standards for non-toxicity and mechanical robustness against gastric acids and peristalsis.

Powering these devices efficiently remains a significant technological challenge and a key area of innovation. Traditional ingestible sensors relied on small, non-rechargeable batteries, limiting operational time and functional complexity. Recent advancements focus on higher energy density batteries, ultra-low power microprocessors, and novel energy harvesting techniques, potentially utilizing movement or localized temperature gradients to extend operational duration. Furthermore, sophisticated wireless telemetry systems, often employing proprietary algorithms to optimize data transfer rates and reduce power consumption, are essential for securely transmitting gigabytes of image and sensor data from within the GI tract to an external data recorder worn by the patient, overcoming signal attenuation issues inherent in biological tissues.

Looking ahead, the technological frontier is dominated by active control and therapeutic capability integration. Research into Magnetically Controlled Capsule Endoscopy (MCCE) allows physicians to externally guide the pill using external magnetic fields, overcoming the passive limitation of current systems and enabling targeted examination of areas like the stomach and colon. Simultaneously, micro-actuators and programmable drug release mechanisms (using materials responsive to localized pH or enzymes) are being integrated to transition the technology from a purely diagnostic tool to an active therapeutic platform, signaling a major technological shift that will dramatically expand the market's addressable use cases beyond conventional endoscopy and imaging.

Regional Highlights

Regional analysis reveals significant disparities in market maturity, adoption rates, and regulatory frameworks affecting the Intelligent Pills Market. North America, particularly the United States, commands the largest market share, driven by rapid technological adoption, robust healthcare infrastructure, and high per capita healthcare spending. Key drivers in this region include well-established reimbursement codes for capsule endoscopy procedures (especially for small bowel imaging), a strong competitive landscape with leading manufacturers headquartered locally, and a high prevalence of GI diseases demanding effective screening and diagnostic solutions. The U.S. remains the primary hub for clinical trials involving advanced therapeutic intelligent pills and digital adherence monitoring systems, positioning it at the forefront of innovation and commercialization.

Europe represents the second-largest market, characterized by stringent regulatory pathways (e.g., MDR compliance) which ensure high product quality but sometimes slow market entry. Adoption is strong in Western European nations (such as Germany, UK, and France), where healthcare systems are increasingly recognizing the cost-effectiveness and patient comfort benefits of non-invasive diagnostics. While reimbursement structures vary significantly by country, the focus on preventative care and efficiency in publicly funded healthcare systems supports steady, predictable growth. Market expansion in Europe is increasingly focused on integrating AI-assisted diagnostic software to manage high patient volumes efficiently.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This exponential growth is underpinned by substantial improvements in healthcare access and infrastructure, particularly in countries like China, India, and Japan. Factors driving this rapid expansion include the sheer size of the population susceptible to GI disorders, rising medical tourism for high-tech procedures, and increasing governmental investments in modernizing diagnostic capabilities. Furthermore, local manufacturing capabilities and rising clinical acceptance of technology developed in countries such as Japan and South Korea contribute to greater product affordability and market availability, positioning APAC as the primary future growth engine for intelligent pills.

- North America: Market leader due to advanced infrastructure, favorable reimbursement policies, and high adoption of digital health solutions, especially for medication adherence monitoring.

- Europe: Stable growth driven by centralized healthcare systems prioritizing minimally invasive methods and regulatory push towards high device standards (MDR compliance).

- Asia Pacific (APAC): Highest CAGR, fueled by massive patient populations, expanding middle-class access to advanced healthcare, and increasing governmental focus on early disease diagnosis.

- Latin America (LATAM): Emerging market characterized by increasing private healthcare investment and demand for less expensive diagnostic alternatives to conventional endoscopy.

- Middle East and Africa (MEA): Growth concentrated in affluent Gulf Cooperation Council (GCC) countries, driven by high technology investment and partnerships with global MedTech firms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Intelligent Pills Market.- Medtronic

- Proteus Digital Health (Helius)

- Otsuka Pharmaceutical

- CapsoVision

- Intromedic

- Given Imaging (a subsidiary of Medtronic)

- Olympus Corporation

- Check-Cap

- Boston Scientific

- RF Co. Ltd.

- FUJIFILMI Corporation

- PENTAX Medical

- SMARTPILL (a subsidiary of CapsoVision)

- JINSHAN Science & Technology

- Micro-Leads Inc.

- Bio-Vascular Inc.

- Kapsch AG

- Shanghai Ankon Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Intelligent Pills market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific GI tract conditions are best diagnosed using intelligent capsule endoscopy systems?

Intelligent capsule endoscopy is predominantly utilized for diagnosing conditions within the small intestine, which is difficult to visualize with conventional flexible endoscopy. Key indications include obscure gastrointestinal bleeding (OGIB), monitoring of Crohn’s disease activity, identification of small intestinal tumors, and diagnosis of celiac disease complications. Newer systems are also expanding use into the esophagus and colon screening.

How does the cost of intelligent pill diagnostics compare to traditional endoscopy?

While the intelligent pill (capsule) itself is expensive and disposable, the procedure generally avoids the high costs associated with sedation, operating room time, and hospitalization often required for traditional flexible endoscopy. The overall clinical cost-effectiveness is favorable, especially when considering the improved safety profile and lower requirement for professional staffing compared to invasive alternatives.

Are intelligent pills equipped with sensors capable of delivering drugs or therapeutic interventions?

Yes, the market is rapidly evolving beyond purely diagnostic capsules. Next-generation therapeutic intelligent pills are equipped with advanced sensors and micro-actuators that enable targeted drug delivery systems (TDDS). These systems can release therapeutics precisely when they detect specific physiological markers (like pH or temperature) in the desired location, significantly enhancing treatment efficacy and reducing systemic side effects.

What are the key technical limitations still faced by ingestible smart capsule technology?

The primary technical limitations include the inability to control the capsule’s transit speed or direction, which risks missing pathological areas, and the lack of interventional capability (such as taking biopsies or removing polyps). Furthermore, power limitations restrict extended operational duration, and managing the vast amounts of generated high-definition data requires robust and expensive external recording and processing infrastructure.

What role does Artificial Intelligence play in improving the clinical utility of intelligent pills?

AI, specifically deep learning, plays a critical role in automating the review of the thousands of images generated by capsule endoscopy. AI algorithms are trained to quickly and accurately detect and classify lesions, ulcers, and bleeding sites, significantly reducing the diagnostic review time for gastroenterologists (data triage) and minimizing the likelihood of human error or overlooked pathologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager