Interactive wall and floor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432847 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Interactive wall and floor Market Size

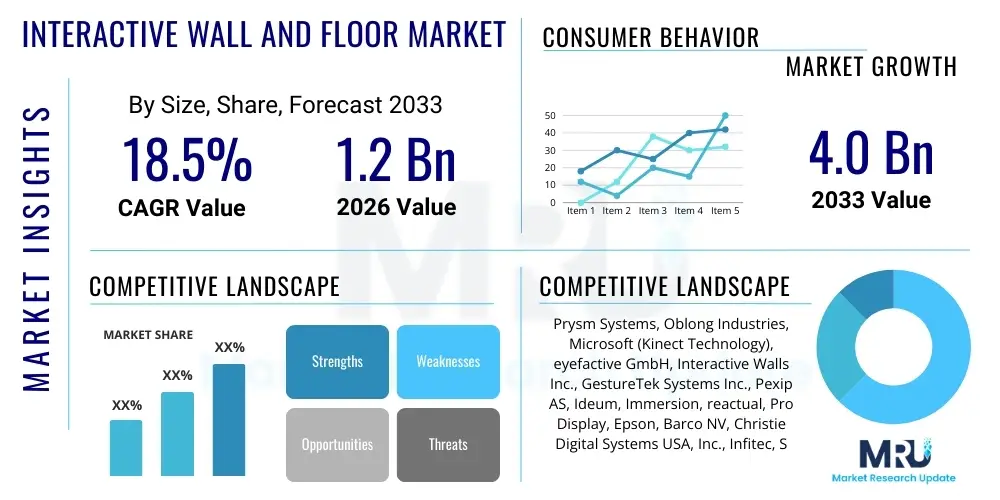

The Interactive wall and floor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033. This robust growth is primarily fueled by the increasing demand for immersive and experiential digital environments across sectors like retail, entertainment, and education, where novel forms of digital engagement are crucial for attracting and retaining consumers and learners. The integration of advanced sensory technologies, including high-definition projectors, sophisticated depth cameras, and pressure sensors, is making interactive surfaces more accessible and versatile for large-scale deployments globally.

Interactive wall and floor Market introduction

The Interactive Wall and Floor Market encompasses specialized projection systems, LED/OLED displays, and sensor arrays designed to transform standard surfaces into dynamic, reactive digital environments. These systems utilize motion-sensing technology (such as infrared sensors, LiDAR, and computer vision) and interactive software platforms to track user movement, gestures, and presence, allowing real-time interaction with projected or displayed content. The primary product offering includes interactive floor systems used for gaming and advertisement, and interactive walls deployed in retail settings, museums, and corporate lobbies for experiential marketing and information dissemination. These immersive installations create multi-sensory experiences, driving higher levels of customer engagement and data capture, significantly enhancing traditional signage and passive display methods.

Major applications of interactive surfaces span across diverse commercial and public domains. In the retail sector, they are pivotal for creating digital window displays and virtual try-on experiences, while in entertainment, they power augmented reality games and immersive theme park attractions. Educational institutions leverage these technologies for 'edutainment' and collaborative learning environments, transforming classrooms into dynamic, responsive spaces. Furthermore, the healthcare sector is increasingly adopting interactive floors for rehabilitation exercises and therapeutic applications, demonstrating the technology's breadth beyond pure commercial use. The core benefit of these systems lies in their ability to offer personalized, memorable, and highly engaging interactions, thereby maximizing the impact of marketing messages and enhancing user learning retention.

Driving factors for market expansion include the decreasing cost of high-quality sensors and projection hardware, coupled with continuous advancements in software platforms that simplify content creation and deployment. The shift toward experiential marketing, where brands focus on creating memorable physical interactions, heavily relies on interactive technology. Additionally, the proliferation of digital transformation initiatives in public spaces and corporate environments, aimed at improving accessibility and efficiency, further solidifies the market's trajectory. These factors collectively position the Interactive wall and floor Market as a key component of the future digital experience economy, merging physical space with digital content seamlessly.

Interactive wall and floor Market Executive Summary

The Interactive wall and floor Market is characterized by vigorous growth, driven by technological convergence and the rising necessity for personalized, high-impact user experiences across key verticals. Business trends indicate a strong move towards modular, scalable, and cloud-managed interactive solutions, allowing enterprises to deploy large-scale, networked systems that can be updated and customized remotely. Furthermore, the emphasis on data analytics derived from user interactions—such as dwell time, interaction patterns, and conversion rates—is transforming these installations from mere displays into powerful data acquisition tools, attracting significant investment from marketing and IT budgets globally. Strategic partnerships between hardware manufacturers, software developers specializing in generative content, and creative agencies are becoming standard, aiming to offer end-to-end integrated solutions that address complex client needs, particularly within high-footfall areas like airports and shopping centers.

Regionally, North America maintains market dominance due to high early adoption rates in retail and entertainment sectors, underpinned by robust technological infrastructure and the presence of major key players specializing in projection mapping and sensing hardware. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, propelled by rapid urbanization, massive infrastructure development, and increasing governmental investments in smart city projects that incorporate large-scale public digital installations. Europe shows steady growth, focusing particularly on heritage sites, museums, and education, leveraging interactive surfaces for cultural preservation and innovative pedagogical methods, driven by stringent regulatory environments favoring high-quality, durable installations. This regional dynamism ensures diversified demand and continuous innovation tailored to local market specifications, spanning regulatory compliance and cultural content preferences.

Segment trends reveal that the projective segment, leveraging advanced short-throw projectors and laser technology, currently holds the largest market share due to its flexibility and capacity to transform large areas quickly without requiring physical display installation across the entire surface. However, the LED/OLED segment, particularly for floor applications requiring high durability and brightness in well-lit environments, is gaining traction rapidly. Application-wise, the entertainment and retail sectors remain the primary revenue generators, although education and healthcare segments are showing accelerating demand for specialized interactive content designed for learning and therapy. The market is also witnessing a strong trend towards integration with Augmented Reality (AR) and Internet of Things (IoT) ecosystems, enhancing the interactive feedback loop and expanding the range of potential applications from simple gaming to complex environmental control systems.

AI Impact Analysis on Interactive wall and floor Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Interactive Wall and Floor Market center around several crucial themes: the potential for hyper-personalized experiences, the improvement of gesture and behavioral recognition accuracy, and the ability of AI to autonomously generate dynamic, real-time content. Users frequently ask how AI-driven analytics can optimize content placement to maximize engagement and how machine learning (ML) models are enhancing the robustness and security of sensor-based systems. A primary expectation is that AI will move these surfaces beyond pre-programmed responses towards truly intelligent environments that anticipate user needs and adapt interfaces dynamically based on demographics, time of day, and collected user interaction data. Key concerns revolve around data privacy when sophisticated behavioral tracking is employed, and the complexity associated with integrating varied sensor data streams into unified AI control platforms, necessitating a strong focus on edge computing and ethical data governance frameworks.

- AI enables real-time content adaptation and personalization based on detected user demographics and emotional state.

- Machine learning algorithms significantly enhance the accuracy and robustness of gesture recognition, reducing false positives and improving responsiveness.

- Predictive analytics driven by AI optimizes advertising placement on interactive surfaces, maximizing conversion rates for retail applications.

- AI-powered generative content systems automatically create dynamic visual experiences, eliminating the need for constant manual content updates.

- Edge AI processing ensures low latency for critical interactions, supporting rapid decision-making in high-speed gaming or therapeutic applications.

- Deep learning models improve fault detection and remote diagnostic capabilities for complex projection and sensing hardware, increasing system uptime.

- Computer vision models track user flow and interaction density, providing valuable spatial analytics for venue optimization and capacity planning.

DRO & Impact Forces Of Interactive wall and floor Market

The Interactive wall and floor Market is primarily driven by the escalating global demand for creating memorable, experiential retail environments and highly engaging public spaces that differentiate brands and locations. A significant force driving adoption is the continuous decrease in the unit cost of high-performance sensory hardware, including LiDAR and advanced time-of-flight cameras, making large-scale deployments more economically viable for a broader range of businesses, particularly SMEs. This cost reduction, coupled with the increasing consumer expectation for seamless, technology-enhanced interactions, accelerates the replacement of static signage with dynamic, interactive installations. Conversely, the market faces restraints such as the relatively high initial capital expenditure required for premium installations and the technical complexity involved in content creation, calibration, and long-term maintenance, especially in environments exposed to fluctuating conditions like moisture or high ambient light. The necessity for highly specialized technical expertise for installation and troubleshooting also poses a logistical barrier in developing markets, limiting rapid expansion.

Opportunities for profound market expansion lie primarily in two emerging areas: the integration of interactive surfaces with Augmented Reality (AR) technology and the specialized application of these systems in therapeutic and healthcare settings. By integrating AR headsets or smartphone overlays, interactive walls can serve as gateways to the Metaverse, providing layered digital information that blends seamlessly with the physical environment, thus expanding marketing and informational utility significantly. In healthcare, interactive floors are revolutionizing physical therapy by providing gamified, measurable rehabilitation exercises, particularly for neurological conditions and balance training. Furthermore, the growing trend of 'smart cities' and connected urban infrastructure offers a fertile ground for large-scale, public-facing interactive information hubs, integrating data visualization and community engagement tools, moving beyond pure commercial use into essential public utility.

Impact forces governing the market trajectory include technological innovation, which acts as the primary accelerator, particularly advancements in touchless interaction methods and higher fidelity projection systems capable of operating under brighter ambient light. Economic volatility, however, acts as a decelerator, as interactive installations are often classified as non-essential capital expenditures, making them vulnerable to budget cuts during economic downturns. Regulatory impact, particularly regarding data privacy laws (like GDPR), is becoming increasingly influential, requiring manufacturers to develop transparent and compliant data collection mechanisms for the behavioral analytics derived from user interactions. Overall, the transformative force of consumer desire for unique digital experiences strongly outweighs the typical budgetary restraints, ensuring sustained upward momentum for the market, provided technological complexity can be continuously simplified through enhanced user interfaces and modular software architectures.

- Drivers (D): Demand for experiential marketing, decreasing cost of sensing hardware, growth in digital signage replacement, and increasing investment in 'smart' retail and public spaces.

- Restraints (R): High initial capital investment, technical complexity in content development and system calibration, and concerns regarding user data privacy associated with tracking systems.

- Opportunity (O): Integration with Augmented Reality (AR) and IoT frameworks, expansion into therapeutic rehabilitation applications, and demand from emerging markets, especially for entertainment centers.

- Impact Forces: High positive impact from technological innovation, medium positive impact from consumer engagement trends, medium negative impact from economic volatility, and growing regulatory scrutiny over data capture.

Segmentation Analysis

The Interactive wall and floor Market is comprehensively segmented primarily based on the core Technology utilized, the specific Component structure of the system, the Application where the systems are deployed, and the geographic distribution. Technology segmentation differentiates between projective systems, which use light beams to create interactive areas, and display-based systems (LED/OLED), which offer higher brightness and resolution but often at a higher cost. Component segmentation analyzes the market share of hardware (sensors, projectors, displays), software (content management, tracking algorithms), and professional services (installation, maintenance). Application analysis is critical, as market dynamics vary widely across high-growth sectors such as Retail, Entertainment, Education, and Corporate environments, each requiring distinct hardware specifications and tailored software solutions. This granular segmentation allows market stakeholders to identify niche opportunities and allocate resources strategically based on sector-specific demand patterns and required technological sophistication.

The market share distribution currently favors the projective technology segment due to its versatility in covering very large and irregular surfaces, making it highly suitable for large-scale public installations like museums and shopping mall atriums. However, the display-based segment is experiencing accelerated growth driven by advancements in durable, modular LED tiles that can withstand high foot traffic in interactive floor environments, offering superior visibility even in brightly lit areas. Geographically, segmentation highlights the maturity of markets like North America and Europe, which focus on sophisticated software and personalized content upgrades, versus the rapid infrastructure expansion seen in APAC, which drives volume demand for core hardware components. Understanding these segmented demands is crucial for optimizing supply chains and ensuring product offerings meet the diverse technical and commercial requirements presented by varying end-user environments globally.

- By Technology:

- Projective (Standard Throw, Short Throw, Ultra-Short Throw)

- Display-Based (LED Walls, OLED Floors, LCD Screens)

- By Component:

- Hardware (Sensors, Projectors, Displays, Cameras)

- Software (Content Management Systems, Gesture Recognition Software, Calibration Tools)

- Services (Installation, Maintenance and Support, Content Customization)

- By Application:

- Retail and Advertising (Digital Signage, Experiential Marketing)

- Entertainment and Gaming (Arcades, Theme Parks, E-Sports Arenas)

- Education and Training (Classrooms, Libraries, Corporate Training Centers)

- Healthcare and Therapeutic (Rehabilitation Centers, Hospitals)

- Corporate and Public Spaces (Museums, Lobbies, Airports)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Interactive wall and floor Market

The value chain for the Interactive wall and floor Market begins with upstream activities dominated by component manufacturers specializing in high-definition optics, advanced sensor technology (e.g., thermal, infrared, depth cameras), and durable display panels (LED/OLED tiles). These suppliers face intense competition, driving continuous innovation in resolution, latency reduction, and energy efficiency. Midstream activities involve the crucial integration stage, where specialized system integrators combine hardware components with proprietary software platforms to create functional interactive systems, requiring expertise in calibration, networking, and spatial computing. This stage is highly value-added, as it determines the final product's quality, responsiveness, and ability to handle complex multi-user interactions effectively.

Downstream activities focus on the distribution channels and the final deployment to end-users. Distribution is multifaceted, involving both direct sales models, where large system integrators contract directly with major corporate clients (e.g., theme parks, global retailers), and indirect channels, utilizing value-added resellers (VARs) and localized distributors who offer regional support and maintenance. The final deployment includes installation services, which are critical due to the precise calibration required for projection mapping and sensor alignment, often necessitating specialized technicians. Post-deployment, the focus shifts to ongoing software content management and maintenance contracts, which generate significant recurring revenue for integrators and software providers, ensuring system longevity and continuous content freshness for sustained user engagement.

The market relies heavily on robust service delivery, particularly in the indirect channel, where VARs act as trusted local partners. Direct channel sales are preferred for high-value, bespoke projects requiring deep customization and long-term strategic partnerships. The continuous feedback loop between end-users and software developers regarding interaction quality and content requirements is vital, driving iterative improvements in gesture algorithms and content management features. Efficiency in the value chain is increasingly measured by the ease of system scaling and the seamlessness of cloud-based content updates, reducing the need for expensive on-site visits and minimizing system downtime, enhancing the overall profitability of the service segment.

Interactive wall and floor Market Potential Customers

Potential customers for interactive wall and floor systems are diverse, extending beyond traditional retail to any environment seeking to enhance physical space through digital immersion and measurable interaction. The largest segment of end-users includes major retailers and advertising agencies, who utilize these surfaces for high-impact product launches, dynamic window displays, and point-of-sale engagement to influence immediate purchasing decisions. Entertainment venues, such as museums, science centers, theme parks, and family entertainment centers (FECs), are significant buyers, leveraging the technology to create immersive storytelling experiences and differentiated attractions that justify premium pricing and encourage repeat visits, relying heavily on durable, high-throughput systems.

A rapidly expanding customer base is found within the institutional sector, specifically educational facilities and corporate training centers. Educational institutions deploy interactive floors and walls to facilitate collaborative learning, transforming abstract concepts into tangible, interactive exercises, catering particularly well to kinesthetic learners. Corporate entities, including high-tech firms and major financial institutions, use these systems in lobbies, experience centers, and trade show booths to convey complex branding messages and data visualizations in an engaging, modern format, aiming to impress stakeholders and potential employees. Furthermore, the specialized healthcare sector, including rehabilitation clinics and elderly care facilities, represents a highly valuable niche seeking medically certified, reliable interactive platforms for therapeutic use, requiring specialized content compliant with medical standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysm Systems, Oblong Industries, Microsoft (Kinect Technology), eyefactive GmbH, Interactive Walls Inc., GestureTek Systems Inc., Pexip AS, Ideum, Immersion, reactual, Pro Display, Epson, Barco NV, Christie Digital Systems USA, Inc., Infitec, Sharp Corporation, Sony Corporation, UGO, Visiology, IntuiLab |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interactive wall and floor Market Key Technology Landscape

The technological backbone of the Interactive wall and floor Market is highly dependent on the synergistic combination of advanced projection systems, sophisticated sensing hardware, and real-time computer vision software. Projection technology is rapidly moving towards laser-phosphor and solid-state illumination (SSI) light sources, replacing traditional lamps due to their superior brightness, longer operational life, and lower maintenance costs, which are critical for installations requiring 24/7 operation in public spaces. Ultra-short throw and short-throw lenses are dominant, minimizing shadows and maximizing the available interactive space, particularly in constrained environments. Concurrently, the rise of specialized high-resolution LED and MicroLED tiles is transforming the floor segment, offering unparalleled durability and high contrast necessary for applications subjected to intense pedestrian traffic and high ambient light conditions.

Sensing technology is perhaps the most dynamic area, with high-fidelity depth cameras (such as LiDAR and Time-of-Flight sensors) replacing simpler infrared matrix sensors. These new sensors provide much more precise three-dimensional mapping of user movements, allowing for complex gesture recognition, multi-user tracking without interference, and highly accurate calibration regardless of ambient light variations. This precision is fundamental for enabling the seamless integration of Augmented Reality overlays and providing the input data required for AI-driven behavioral analytics. The move towards specialized system-on-chip (SoC) integration for processing sensor data directly at the edge is reducing latency, a critical factor for highly responsive gaming and interactive training applications where delays can severely degrade the user experience and reduce engagement effectiveness.

Software platforms are increasingly adopting modular architectures, supporting cloud-based content delivery and remote diagnostics, crucial for managing geographically dispersed networks of interactive displays. Key software technologies include advanced proprietary algorithms for spatial distortion correction (required for projection mapping on non-flat surfaces), robust content management systems (CMS) that support drag-and-drop content updates, and highly optimized computer vision libraries. There is a noticeable trend toward Open Frameworks and SDKs that enable third-party developers to create specialized content, fostering an ecosystem of innovative interactive applications tailored for niche markets like rehabilitation or specific educational curricula. Furthermore, cybersecurity protocols are being rigorously implemented within these software solutions to protect the sensitive user interaction data collected by the sensing hardware, ensuring compliance with evolving data protection regulations globally.

Regional Highlights

The regional analysis of the Interactive wall and floor Market reveals distinct maturity levels and growth trajectories across different geographical areas, heavily influenced by technological infrastructure, consumer spending power, and governmental digital initiatives. North America is the market leader, characterized by early adoption across the retail, corporate, and entertainment sectors. The region benefits from significant investments in advanced experiential technologies by major tech firms and established retail chains seeking competitive differentiation. High consumer acceptance of interactive digital experiences, combined with a strong innovation ecosystem focused on sophisticated software and sensor fusion, ensures that North America continues to drive trends in personalized and data-intensive interactive solutions. Major metropolitan areas act as primary hubs for pilot projects involving large-scale public installations and advanced AR integration.

Europe demonstrates steady, mature growth, focusing heavily on quality and cultural applications. Western European countries, particularly the UK, Germany, and France, show high demand from the cultural and educational sectors, utilizing interactive technology for preserving and presenting heritage information in modern museums and galleries. The European market prioritizes durability, energy efficiency, and compliance with stringent privacy regulations (GDPR), influencing the design of hardware and the transparency of data capture systems. While retail adoption is strong, the public sector's investment in smart education and therapeutic applications provides a reliable, albeit slower, growth vector, emphasizing solutions that offer long-term societal benefits over short-term commercial returns. Scandinavian countries, known for technological readiness, are leading adoption in smart libraries and public service information points.

Asia Pacific (APAC) is the engine of future market growth, expected to register the highest CAGR throughout the forecast period. This rapid expansion is fueled by unprecedented urbanization, massive infrastructural projects, and increasing disposable incomes leading to a boom in entertainment centers, high-end retail malls, and theme park developments across China, India, and Southeast Asia. The focus in APAC is often on high-volume, high-impact installations suitable for crowded public spaces, driving demand for cost-effective yet robust hardware components. Government initiatives pushing digital transformation, particularly in smart cities and modernizing educational facilities, further unlock significant procurement opportunities for interactive technology providers. Furthermore, local manufacturing capabilities and aggressive digital marketing strategies contribute significantly to the rapid deployment of interactive solutions across key urban clusters in the region.

- North America: Dominant market share; driven by high retail and corporate demand; focused on software sophistication, AI integration, and personalized marketing experiences.

- Europe: Steady growth; strong demand from cultural, educational, and public sectors; characterized by stringent regulatory compliance needs and preference for high-quality, durable hardware.

- Asia Pacific (APAC): Highest CAGR; rapid urbanization, infrastructure development, and mass adoption in entertainment and large-scale retail; focus on high-volume hardware deployment and smart city initiatives.

- Latin America (LATAM): Emerging potential; gradual increase in retail and commercial adoption, particularly in Brazil and Mexico; growth highly sensitive to economic stability and infrastructure investment.

- Middle East & Africa (MEA): Niche market with high-growth pockets, mainly driven by large-scale tourism and entertainment investments in the UAE and Saudi Arabia; focus on high-end, luxury installations and bespoke experiential projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interactive wall and floor Market.- Prysm Systems

- Oblong Industries

- Microsoft (Kinect Technology)

- eyefactive GmbH

- Interactive Walls Inc.

- GestureTek Systems Inc.

- Pexip AS

- Ideum

- Immersion

- reactual

- Pro Display

- Epson

- Barco NV

- Christie Digital Systems USA, Inc.

- Infitec

- Sharp Corporation

- Sony Corporation

- UGO

- Visiology

- IntuiLab

Frequently Asked Questions

Analyze common user questions about the Interactive wall and floor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between interactive walls and digital signage systems?

Interactive walls and floors provide bi-directional communication, meaning they track and react to user inputs, gestures, or presence in real-time, delivering dynamic, personalized experiences. Standard digital signage is typically uni-directional, displaying pre-programmed, static, or linear content without sensing user interaction, focusing primarily on passive viewing rather than active engagement.

How is Artificial Intelligence (AI) currently improving the performance of interactive floor systems?

AI significantly enhances interactive floor performance by utilizing machine learning for superior gesture recognition accuracy, filtering out ambient noise and irrelevant movements. Furthermore, AI-driven analytics track user behavioral patterns, optimizing content delivery dynamically to maximize engagement and collect granular data on foot traffic and interaction duration.

What are the typical maintenance requirements and lifespan of an interactive projection system?

Modern interactive projection systems, particularly those utilizing laser-phosphor technology, require minimal maintenance compared to older lamp-based systems, offering typical lifespans of 20,000 to 30,000 operational hours before needing major servicing. Maintenance usually involves routine sensor calibration checks, software updates, and ensuring projection surfaces remain clean and undamaged for optimal performance.

Which industry segment is expected to show the highest growth rate for interactive surfaces?

The Entertainment and Gaming segment, followed closely by Healthcare (specifically for rehabilitation and therapeutic use), is projected to exhibit the highest growth rate. This accelerated adoption is driven by the need for unique, immersive attractions in theme parks and the clinical efficacy demonstrated by gamified therapeutic applications using interactive floors.

What major technological advancement is driving the cost reduction of high-end interactive walls?

The major advancement driving cost reduction is the mass production and commercialization of advanced depth-sensing hardware, such as Time-of-Flight (ToF) cameras and sophisticated LiDAR sensors. These components, initially expensive, are now widely used in consumer electronics, leading to economies of scale that make high-fidelity, low-latency interaction systems more affordable for commercial deployment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager