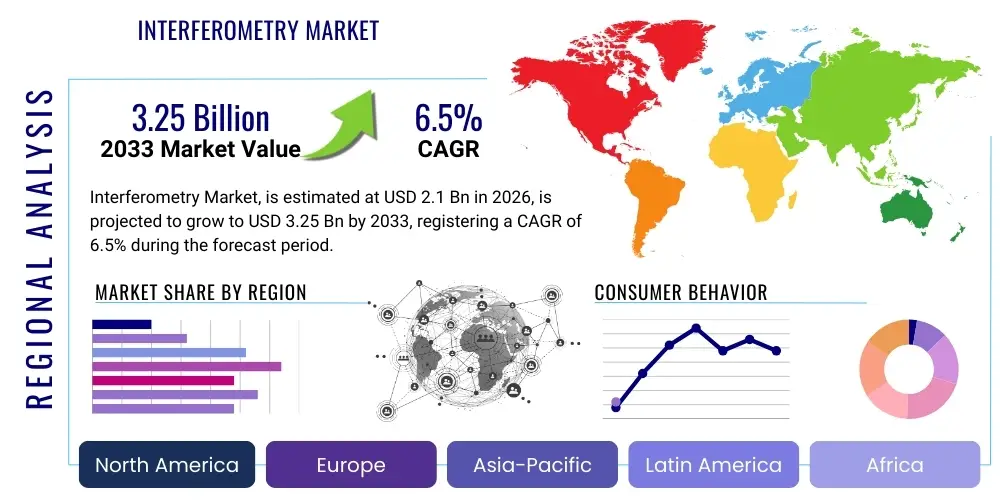

Interferometry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438831 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Interferometry Market Size

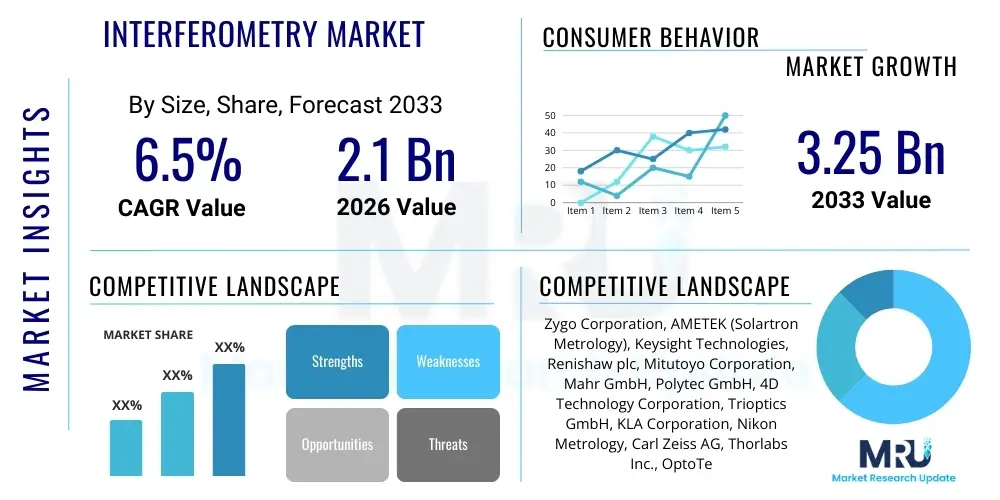

The Interferometry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global requirement for ultra-high-precision measurement and non-contact inspection techniques, particularly within advanced manufacturing sectors such as semiconductors, aerospace, and biomedical devices, where tolerances are measured in nanometers.

Interferometry Market introduction

The Interferometry Market encompasses the design, manufacturing, and application of specialized optical instruments that utilize the principle of light wave interference to perform extremely precise measurements of surface topology, distance, displacement, shape, vibration, and material properties. These instruments are paramount in modern high-technology environments because they offer non-destructive, full-field analysis with unparalleled resolution, often surpassing the capabilities of conventional mechanical or electronic gauges. Interferometers are crucial tools in metrology, serving as the benchmark for quality assurance and control across industries demanding micron or sub-micron accuracy.

Key products within this market include various interferometer types such as Fizeau, Michelson, Fabry-Perot, and Twyman-Green systems, categorized based on their optical configuration and intended application. Major applications span wafer flatness measurement in semiconductor lithography, precise component inspection in the aerospace and defense sectors, and sophisticated biological imaging in life sciences research. The intrinsic benefits of interferometry—high sensitivity, accuracy, minimal measurement uncertainty, and speed—position it as an indispensable technology for research and industrial scaling.

The market is primarily driven by the continuous miniaturization of electronic components, necessitating stricter quality control protocols for nanoscale manufacturing processes, and the increasing investment in research and development activities focused on advanced materials and quantum technologies. Furthermore, the growing adoption of automated metrology solutions integrated within production lines is fueling demand for robust and rapid interferometric systems capable of continuous operation and real-time data feedback, ensuring yield optimization in high-volume production environments.

Interferometry Market Executive Summary

The global Interferometry Market is experiencing robust growth fueled by technological advancements aimed at enhancing system portability, speed, and automation capabilities. Business trends indicate a strong move toward fiber-optic-based interferometers, which offer greater immunity to electromagnetic interference, compactness, and flexibility, thereby enabling their integration into harsh industrial environments. Key market participants are focusing on developing integrated software solutions utilizing machine learning algorithms for enhanced data processing, noise reduction, and automated interpretation of complex fringe patterns, streamlining the measurement workflow for end-users and reducing reliance on highly specialized operators.

Regionally, the Asia Pacific (APAC) stands out as the dominant market, largely attributed to the concentration of global semiconductor foundries, advanced electronics manufacturing hubs in countries like South Korea, Taiwan, China, and Japan, and significant governmental investment in high-tech research infrastructure. North America and Europe, while representing mature markets, maintain high demand, particularly in the aerospace, defense, and specialized medical device manufacturing sectors, focusing on cutting-edge research applications and the production of extremely high-value, tight-tolerance components. These regions are also spearheading the innovation curve, particularly in the development of coherent scanning interferometry (CSI) and white light interferometry (WLI) systems.

Segment trends reveal that the application segment related to surface metrology and profile measurement holds the largest market share due to its essential role in quality control for lenses, mirrors, and precision mechanical parts. The segment comprising Fizeau interferometers remains critical, especially for large-diameter optics testing, while advanced techniques like Doppler velocity interferometry (DVI) are gaining traction in specialized fields such as high-velocity impact studies and shock physics research. The relentless pursuit of smaller, faster, and more complex integrated circuits (ICs) ensures that the semiconductor end-use segment will continue to be the primary engine driving market expansion throughout the forecast period.

AI Impact Analysis on Interferometry Market

Common user questions regarding AI's influence on the Interferometry Market often revolve around how artificial intelligence can simplify the complex interpretation of interferometric data, whether AI can enhance the speed and accuracy of measurements, and if automation through AI will reduce the need for expert optical scientists. Users are keenly interested in predictive maintenance for complex interferometer hardware and the capability of AI to compensate for environmental variables (like temperature drift or air turbulence) that traditionally limit measurement precision in non-laboratory settings. The primary expectation is that AI will democratize interferometry, making ultra-precise metrology accessible for real-time, in-line industrial quality control rather than being confined to high-end, off-line inspection labs. The analysis confirms that AI is pivotal for automating data processing, improving signal-to-noise ratios, and enabling robust system diagnostics.

- AI algorithms significantly enhance the automated analysis of fringe patterns, enabling faster and more accurate phase unwrapping and surface reconstruction, reducing human error.

- Machine learning models are employed for intelligent noise reduction and signal processing, particularly in systems operating under industrial vibration or environmental instability.

- AI facilitates real-time defect classification and automated decision-making in production lines, drastically improving throughput for semiconductor and optics manufacturing.

- Predictive maintenance driven by AI monitors the performance metrics of laser sources, detectors, and optics, anticipating hardware failure and minimizing system downtime.

- Deep learning is increasingly used to calibrate and compensate for systematic errors inherent in the optical setup, leading to improved measurement traceability and precision.

DRO & Impact Forces Of Interferometry Market

The Interferometry Market is dynamically shaped by powerful drivers and challenging restraints, creating significant opportunities that are mediated by critical impact forces. A primary driver is the accelerating demand for high-performance optical components and integrated circuits, which mandate measurements with Ångström-level precision, directly benefiting technologies like Coherence Scanning Interferometry (CSI) and Phase-Shifting Interferometry (PSI). Coupled with this is the global push towards automation in manufacturing, which requires non-contact, high-speed metrology solutions capable of functioning seamlessly within complex production ecosystems, propelling the adoption of robust, integrated interferometric sensors. However, the market faces significant restraints, notably the high initial capital investment required for advanced interferometric systems, which often includes complex laser sources, high-resolution detectors, and proprietary analysis software. Furthermore, the operational complexity of these systems and the necessity for highly skilled personnel to set up, calibrate, and interpret results represent a substantial barrier to entry for smaller enterprises or those in less technologically mature industries.

The opportunities within the market are vast, particularly stemming from the burgeoning fields of quantum computing and advanced additive manufacturing (3D printing). Quantum technologies require exquisite control over optical paths and component quality, creating new niche applications for ultra-stable interferometers. Similarly, the structural complexity and fine feature resolution achievable with new additive manufacturing techniques require sophisticated metrology tools to validate quality, offering a fertile ground for market expansion. The impact forces acting on the market primarily include technological obsolescence pressure, driven by rapid innovations in alternative non-contact sensing methods such as advanced microscopy, and regulatory requirements, especially in defense and medical sectors, which demand stringent calibration standards and traceability for all measurement instruments, thereby driving continuous improvement in system fidelity and documentation.

The crucial impact force remains the technological convergence between optics, electronics, and computational science. Advancements in camera technology (higher frame rates and pixel density) and powerful processing units enable faster data acquisition and analysis, mitigating the traditional slowness constraint of many interferometry techniques. This convergence allows for the creation of compact, ruggedized systems suitable for deployment outside controlled laboratory environments. Additionally, the strategic shift of major players toward providing integrated hardware-software packages that simplify operation and maintenance is a key force accelerating broader industrial adoption, effectively lowering the complexity barrier and translating high-precision measurements into actionable manufacturing intelligence.

Segmentation Analysis

The Interferometry Market is strategically segmented based on several technical and application-oriented criteria, allowing for a precise understanding of specialized demand across different end-user sectors. Key segmentation axes include the type of interferometer used (distinguished by their optical path configuration), the type of measurement performed (covering surface analysis, displacement, and shape), and the specific end-use industry where the instruments are deployed (such as semiconductors, healthcare, or aerospace). This multi-dimensional segmentation highlights the versatility of interferometric technology, reflecting its application from nanoscale quality control in silicon wafers to large-scale component geometry verification in turbine blade manufacturing.

- By Type:

- Fizeau Interferometer (Dominant in large optics testing)

- Michelson Interferometer (Common for coherence studies and general metrology)

- Fabry-Perot Interferometer (Used primarily for high-resolution spectroscopy and filtering)

- Twyman-Green Interferometer (Used for lenses and prisms testing)

- Coherence Scanning Interferometer (CSI) / White Light Interferometer (WLI)

- Other Types (e.g., Sagnac, Mach-Zehnder)

- By Measurement Type:

- Surface Roughness and Profile Measurement

- Displacement and Vibration Measurement

- Shape and Form Measurement (e.g., flatness, sphericity)

- Thickness Measurement

- By Spectrum:

- Visible Light Interferometry

- Infrared Interferometry

- X-ray Interferometry (Niche, high-end applications)

- By End-Use Industry:

- Semiconductors and Electronics

- Aerospace and Defense

- Automotive and Manufacturing

- Research and Development (Academia and Government Labs)

- Medical and Healthcare (Ophthalmology, biomedical imaging)

Value Chain Analysis For Interferometry Market

The value chain of the Interferometry Market is characterized by a high degree of integration between specialized component suppliers and system integrators. The upstream segment involves highly sophisticated manufacturing of crucial components, including ultra-stable, narrow-linewidth laser sources (He-Ne, diode lasers), high-quality optical components (beam splitters, reference flats, precision mirrors), and advanced high-speed detectors and cameras (CCD/CMOS sensors). Suppliers in this segment operate in highly niche, oligopolistic markets where quality, reliability, and precision are paramount. The cost of these foundational components significantly influences the final price of the complete interferometric system.

The core stage of the value chain is occupied by key market players responsible for system integration, hardware design, and, critically, software development. System integrators combine the upstream optical and electronic components into coherent, stable interferometric setups and develop the proprietary software necessary for phase shifting control, fringe analysis, 3D reconstruction, and data visualization. Differentiation at this stage relies heavily on patented algorithms for accuracy improvement (e.g., noise filtering, turbulence compensation) and user interface design for enhanced ease of use. Distribution channels are typically a mix of direct sales teams for high-value, customized systems targeting large manufacturing firms (semiconductor fabs, aerospace primes) and indirect distribution through specialized regional distributors or system integration partners who provide localized technical support and sales for standard product lines.

The downstream analysis focuses on the application and maintenance of interferometers within end-user facilities. Direct channels are crucial here, as customers often require extensive pre-sales consultation and post-sales technical support, training, and regular calibration services to maintain instrument accuracy. The strong reliance on accurate measurement mandates long-term service contracts and updates for proprietary software. This service component contributes significantly to the revenue stream of major manufacturers. The close interaction between manufacturers and end-users in the downstream segment facilitates continuous feedback loops, driving iterative product improvement and customization tailored to highly specific industrial metrology challenges.

Interferometry Market Potential Customers

The potential customers for interferometry products are concentrated in industries that mandate the highest levels of geometric and surface measurement accuracy for performance-critical components. The primary buyers are multinational semiconductor fabrication plants (fabs) and integrated device manufacturers (IDMs) requiring tools for mask inspection, wafer flatness, and lithography lens quality control. These entities represent the largest procurement segment due to the inherent criticality of nanoscale feature sizes in microchip production. Another significant customer base includes original equipment manufacturers (OEMs) specializing in precision optics, such as those producing high-performance telescope mirrors, camera lenses, and industrial laser optics, where surface form deviation must be minimized to ensure system functionality.

Further expansion of the customer base includes Tier 1 and Tier 2 suppliers in the aerospace and defense industries, particularly those involved in the manufacturing of propulsion components, advanced avionics sensors, and precision mechanical parts for satellites and military hardware. In these sectors, interferometers are utilized for measuring the deformation, vibration, and dimensional accuracy of components like turbine blades and rocket nozzles under simulated operating conditions. The biomedical sector, including manufacturers of high-precision surgical instruments, specialized lenses for ophthalmology (e.g., intraocular lenses), and advanced microscopy systems, constitutes a rapidly growing segment of buyers seeking non-contact, high-resolution metrology tools essential for product safety and regulatory compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zygo Corporation, AMETEK (Solartron Metrology), Keysight Technologies, Renishaw plc, Mitutoyo Corporation, Mahr GmbH, Polytec GmbH, 4D Technology Corporation, Trioptics GmbH, KLA Corporation, Nikon Metrology, Carl Zeiss AG, Thorlabs Inc., OptoTech GmbH, Holoeye Photonics AG, Tosei Engineering Corp., Wuxi Opton Sensing Technology, Sensofar Metrology, FISBA AG, Ametek Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interferometry Market Key Technology Landscape

The Interferometry Market’s technology landscape is defined by continuous innovation focused on enhancing stability, increasing measurement speed, and enabling in-situ measurements outside of controlled laboratory environments. A key technological focus is the evolution of Phase-Shifting Interferometry (PSI), which uses multiple intensity measurements recorded at precisely controlled phase steps to calculate the surface topography, providing superior accuracy compared to simple fringe pattern analysis. Advancements in piezoelectric transducers (PZTs) used for phase shifting have improved the speed and repeatability of these systems. Furthermore, the development of dynamic interferometry, which utilizes high-speed cameras and specialized algorithms to capture accurate data even in the presence of severe vibration or air turbulence, is revolutionizing its applicability in industrial shop floor environments, directly addressing a long-standing constraint of the technology.

Another dominant trend involves the miniaturization and ruggedization of interferometric systems through the increased use of fiber optics and integrated photonic circuits. Fiber-optic interferometers offer inherent immunity to electromagnetic interference and allow for remote sensing over long distances, crucial for monitoring large structures or processes in hazardous areas. White Light Interferometry (WLI), also known as Coherence Scanning Interferometry (CSI), has gained significant traction for measuring complex surface geometries and analyzing surfaces with large step heights or discontinuities, leveraging the short coherence length of broadband light sources to achieve highly localized vertical resolution. The convergence of WLI with robust automation software enables rapid, non-contact 3D surface mapping in a fraction of the time required by traditional contact probes.

Digital Holographic Interferometry (DHI) represents a cutting-edge area, offering the ability to record phase and intensity information simultaneously without mechanical movement, allowing for dynamic analysis of object deformation, stress, and flow fields in real-time. This technology is particularly valuable in non-destructive testing (NDT) applications and fluid dynamics research. The strategic incorporation of advanced laser technologies, such as frequency-stabilized lasers and tunable external cavity diode lasers, continues to push the limits of measurement precision, directly supporting applications in high-end optical fabrication and the emerging fields of gravitational wave detection and ultra-precise length standards.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the interferometry market, primarily driven by massive investments in semiconductor manufacturing (especially 7nm and 5nm nodes and beyond) in Taiwan, South Korea, and China. The region's dominance is underpinned by a robust electronics supply chain and strong governmental support for R&D in advanced optics and precision engineering. Japan remains a critical hub for high-quality instrument manufacturing and advanced metrology research.

- North America: North America holds a significant market share, characterized by high adoption rates in the aerospace, defense, and specialized biomedical device sectors. The U.S. is home to several key innovators and market leaders, driving demand for complex, high-performance interferometric systems used in defense research and the manufacturing of satellite components and high-energy laser optics.

- Europe: Europe represents a mature but technologically demanding market, particularly in Germany and the UK. Growth is primarily driven by the stringent quality control requirements in the automotive industry (especially for electric vehicle component precision), high-end industrial machinery, and academic research in quantum optics and high-resolution microscopy.

- Latin America, Middle East, and Africa (LAMEA): This region currently holds a smaller market share, but growth is projected to accelerate, fueled by increasing industrialization, particularly in the oil and gas sector (requiring high-precision sensor calibration) and infrastructure development, which necessitate robust quality control solutions for material science applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interferometry Market.- Zygo Corporation (An Ametek Company)

- AMETEK, Inc. (Solartron Metrology)

- Keysight Technologies, Inc.

- Renishaw plc

- Mitutoyo Corporation

- Mahr GmbH

- Polytec GmbH

- 4D Technology Corporation

- Trioptics GmbH

- KLA Corporation

- Nikon Metrology

- Carl Zeiss AG

- Thorlabs Inc.

- OptoTech GmbH

- Holoeye Photonics AG

- Tosei Engineering Corp.

- Wuxi Opton Sensing Technology

- Sensofar Metrology

- FISBA AG

- Ametek Co.

Frequently Asked Questions

Analyze common user questions about the Interferometry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Interferometry Market?

The primary driver is the accelerating demand for ultra-high-precision measurement and quality control, particularly within the semiconductor industry, driven by the continuous reduction in feature sizes (nanoscale lithography) and the necessity for highly accurate, non-contact inspection of wafers and optical components.

How does White Light Interferometry (WLI) differ from Phase-Shifting Interferometry (PSI)?

WLI, or Coherence Scanning Interferometry (CSI), uses a broadband light source with a short coherence length, allowing it to measure complex surfaces with large step heights and rough textures by locating the zero-path difference. PSI uses a monochromatic, highly coherent light source and mechanical phase shifts to achieve extremely high vertical resolution on smooth surfaces but struggles with discontinuities.

Which industry segment holds the largest share in the Interferometry Market?

The Semiconductors and Electronics segment holds the largest market share. Interferometers are essential tools for validating the flatness, thickness uniformity, and micro-structure alignment of silicon wafers, photolithography masks, and high-numerical-aperture (NA) lenses critical to integrated circuit manufacturing.

What major restraints challenge the adoption of interferometric systems globally?

The main restraints are the high initial acquisition cost of advanced interferometers, which often includes highly precise optics and complex laser systems, and the requirement for specialized technical expertise and training necessary for accurate system operation, calibration, and sophisticated data interpretation.

What role does AI play in improving interferometric measurements in industrial settings?

AI significantly improves industrial interferometry by automating complex data analysis, facilitating robust noise reduction algorithms to compensate for shop floor vibration, and enabling predictive maintenance for the optical hardware, thus enhancing speed, reliability, and minimizing the necessity for human intervention in quality assurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager