Interior Wall Coverings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437623 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Interior Wall Coverings Market Size

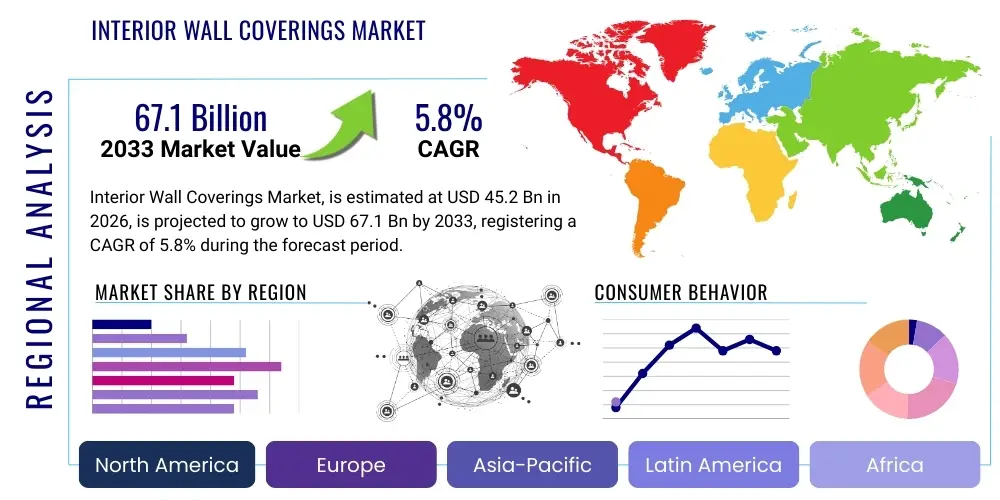

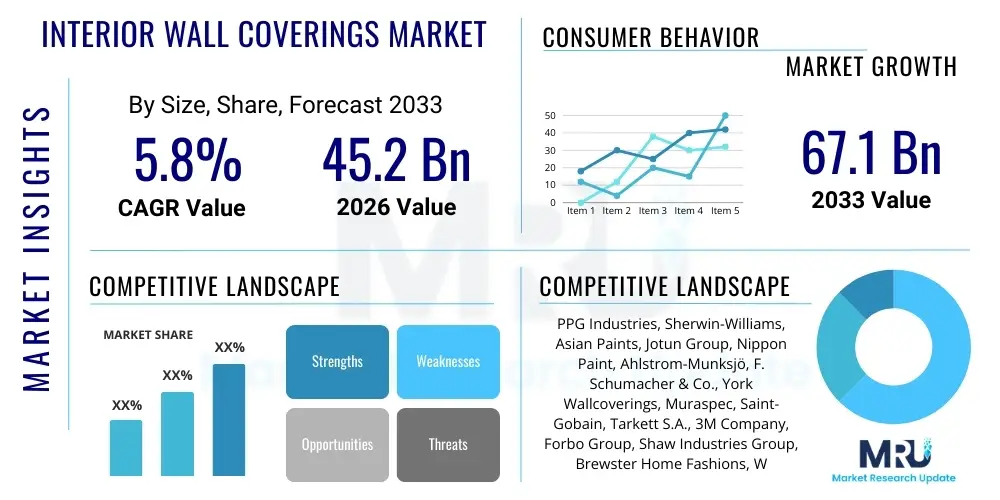

The Interior Wall Coverings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 67.1 Billion by the end of the forecast period in 2033.

Interior Wall Coverings Market introduction

The Interior Wall Coverings Market encompasses a broad range of materials designed to enhance the aesthetic appeal, functional performance, and durability of interior walls in residential, commercial, and institutional settings. These materials go beyond traditional paint, including specialized wallpapers, decorative panels, ceramic and porcelain tiles, fabric and textile coverings, and advanced stucco or plaster systems. The demand for these products is intrinsically linked to global construction activity, urbanization trends, and rising consumer preferences for personalized and high-quality interior design. Products are increasingly incorporating features such as sustainability, acoustic dampening, improved insulation, and antibacterial properties, catering to evolving regulatory standards and wellness demands in modern architecture. The fundamental application remains the protection and decoration of surfaces, yet innovation is shifting focus toward integrated smart functionality and health-centric materials, particularly within healthcare and high-end residential segments.

Major applications of interior wall coverings span across newly constructed buildings, including both the residential sector (single-family homes, multi-family apartments) and the commercial sector (offices, hotels, retail outlets, educational institutions). Furthermore, the substantial and often overlooked renovation and remodeling segment forms a critical application area, driven by aging infrastructure in developed economies and the continuous need for aesthetic refreshment. Key benefits derived from utilizing sophisticated wall coverings include enhanced longevity of walls, protection against moisture and abrasions, significant aesthetic customization through texture and color, and functional improvements like noise reduction or thermal efficiency. These benefits position specialized wall coverings as essential components in achieving specific design outcomes and meeting stringent performance requirements, particularly in high-traffic or specialized environments like operating theaters or luxury hotel lobbies.

The driving factors propelling market growth are multifaceted. A primary driver is the rapid global urbanization, especially in emerging economies, which necessitates extensive commercial and residential construction. Simultaneously, growing disposable incomes allow consumers to invest more heavily in premium, decorative, and performance-oriented wall finishing materials. Technological advancements, such as digital printing for custom wallpapers and the development of lightweight, easy-to-install panels, are making high-end finishes more accessible and versatile. Moreover, stringent building codes promoting energy efficiency and sustainable construction practices are fostering demand for eco-friendly and low volatile organic compound (VOC) wall coverings, pushing manufacturers toward greener material science and responsible production processes, further stimulating market expansion.

Interior Wall Coverings Market Executive Summary

The global Interior Wall Coverings Market is currently defined by significant shifts toward sustainable and smart materials, underpinned by robust growth in the residential renovation sector across mature economies and substantial new construction activity in Asia Pacific. Business trends indicate a strong focus on direct-to-consumer (DTC) models and enhanced supply chain resilience, allowing companies to mitigate geopolitical risks and fluctuating raw material costs, particularly those related to plastics and wood pulp. Manufacturers are prioritizing portfolio diversification, integrating advanced technologies like digital customization capabilities and materials offering enhanced functionalities such as air purification or anti-microbial surfaces. The competitive landscape is becoming increasingly segmented, with specialized niche players focusing on high-performance materials coexisting alongside large, diversified conglomerates that leverage economies of scale and extensive distribution networks to dominate traditional segments like paint and basic wallpaper.

Regional trends reveal Asia Pacific as the undeniable epicenter of market expansion, driven primarily by India and China's massive infrastructure and housing projects, fueling demand for both value-based and luxury products. North America and Europe, while exhibiting slower growth in new construction, maintain high-value markets propelled by continuous replacement cycles, stringent environmental regulations necessitating adoption of sustainable and low-emission products, and a strong preference for designer and bespoke coverings. The European market, in particular, is witnessing rapid innovation in textile and natural fiber coverings due to strong consumer environmental consciousness. Furthermore, digital transformation is rapidly streamlining procurement and design processes globally, with virtual reality tools assisting architects and end-users in visualizing and selecting complex covering options, thereby shortening the sales cycle and influencing regional purchasing patterns.

Segment trends underscore the enduring dominance of paint and basic coatings, although decorative panels (including 3D panels and synthetic stone/wood veneers) are rapidly gaining market share due to their ease of installation, durability, and visual impact, particularly in commercial hospitality and retail environments seeking rapid, cost-effective aesthetic updates. The wallpaper segment is experiencing a renaissance, moving away from dated designs towards high-definition digitally printed custom murals and textured finishes that mimic natural materials. Sustainability is a critical segmentation factor; products certified as eco-friendly or made from recycled content command a significant price premium and are increasingly preferred in institutional and governmental projects. The residential application segment, especially renovation, maintains the largest volume share, while the commercial sector drives innovation in high-durability and specialized functional coatings required for sterile or high-traffic areas.

AI Impact Analysis on Interior Wall Coverings Market

Common user questions regarding AI’s impact frequently center on how generative AI tools can revolutionize interior design workflows, specifically concerning material selection, pattern generation, and visualization. Users often inquire about AI’s capability to predict material trends, optimize supply chain logistics for custom orders, and enhance the manufacturing process through quality control and waste reduction. Key concerns revolve around data privacy when utilizing large datasets of proprietary designs and the potential displacement of human designers in basic customization tasks. Overall, users expect AI to significantly accelerate the design phase, offer hyper-personalized product recommendations based on room metrics and desired aesthetic cues, and improve operational efficiency across the value chain, from raw material sourcing to final installation guidance.

- AI-powered generative design tools automate pattern creation and color palette selection based on existing architectural styles and user preferences.

- Predictive analytics utilizing machine learning models forecast consumer design trends, optimizing inventory levels and reducing obsolescence risk for high-fashion coverings.

- Enhanced supply chain management through AI-driven optimization, minimizing lead times for custom orders and improving efficiency in raw material procurement.

- Automated visual quality inspection systems in manufacturing, ensuring consistency in texture, color, and defect identification on production lines.

- Personalized recommendations and visualization engines (AR/VR integrated with AI) enhance the customer experience, enabling instant virtual placement and material simulation.

- Optimization of paint and coating formulations through AI simulations, leading to improved durability, lower VOC content, and faster development cycles for new chemistries.

DRO & Impact Forces Of Interior Wall Coverings Market

The market dynamics are governed by a complex interplay of substantial growth drivers, structural restraints, and emerging opportunities, all magnified by critical impact forces related to environmental mandates and technological adoption. The key driver is the accelerated pace of global construction and infrastructure development, particularly in Asia, alongside the persistent momentum in residential remodeling across developed economies, which fuels steady replacement demand. However, the market faces significant restraints, primarily volatile input costs for petrochemicals (plastics/vinyl) and wood pulp, coupled with increasing environmental regulations that necessitate costly transitions to greener, compliant materials. Opportunities are abundant in the development of multi-functional wall coverings that offer integrated technologies such as smart sensors, improved thermal properties, and bio-based materials, catering to the growing wellness-centric building movement. These internal forces are amplified by macro impact forces like climate policy shifts demanding sustainable production and the transformative potential of digital integration in the sales and design processes.

Driving factors are concentrated on urbanization and disposable income growth, creating a massive end-user base capable of affording premium finishes, thereby shifting demand away from basic paint towards specialized, textured, and custom wall solutions. The increasing global focus on high-quality indoor air quality (IAQ) also mandates the adoption of low-VOC and anti-microbial coverings, compelling innovation. Conversely, key restraints include the fragmented nature of the market, which complicates standardization and large-scale manufacturing efficiency, and the dependence on skilled labor for complex installations, which can increase project costs and timelines. The relatively long replacement cycle for high-durability products, particularly commercial-grade tiles and panels, also acts as a dampener on continuous short-term sales volume, requiring manufacturers to continuously innovate in aesthetics to encourage quicker replacement cycles.

Opportunities lie predominantly in emerging market penetration and technological leaps. Developing sustainable, circular economy models for wall covering materials, involving advanced recycling and material harvesting, presents a substantial future growth path. Furthermore, the integration of digital fabrication and rapid prototyping allows for personalized, niche product offerings at scalable volumes, opening new revenue streams in the bespoke design sector. The impact forces emphasize the power of regulation; stricter fire codes and sustainability standards in regions like the EU and North America are forcing a rapid obsolescence of older, non-compliant materials, creating immediate market gaps for advanced alternatives. Ultimately, the confluence of technological advancement in material science and heightened regulatory pressure is restructuring the market toward performance and environmental responsibility, shaping investment priorities for the next decade.

Segmentation Analysis

The Interior Wall Coverings Market is meticulously segmented based on the type of product, the application area where the covering is deployed, the material composition used in manufacturing, and the specific distribution channel employed for sales. Product segmentation highlights the diversity of options available, ranging from traditional high-volume segments like paint and vinyl wallpaper to specialty, high-margin products such as 3D decorative panels and high-performance acoustic materials. Application segmentation distinguishes between the high-volume but competitive residential sector and the high-specification, functional-driven commercial and industrial sectors, where performance metrics like durability and hygiene are paramount. The segmentation analysis is crucial for stakeholders to identify specific market niches, tailor product development strategies, and optimize marketing efforts to reach disparate consumer and B2B segments effectively.

- By Product Type:

- Wallpaper (Vinyl, Non-woven, Paper-backed, Fabric-backed)

- Paint & Coatings (Interior Emulsions, Specialized Performance Coatings)

- Decorative Panels (Wood Panels, 3D Panels, Stone Veneer, Metal Panels)

- Fabric/Textile Coverings (Natural Fibers, Synthetic Textiles)

- Tiles (Ceramic, Porcelain, Glass, Mosaics)

- Plaster & Stucco Systems (Traditional, Synthetic)

- By Application:

- Residential (New Construction, Renovation & Remodeling)

- Commercial (Hospitality, Office & Corporate, Retail, Healthcare, Education)

- Industrial

- By Material:

- Natural Materials (Wood, Stone, Cork, Bamboo)

- Synthetic Materials (Vinyl, PVC, Fiberglass, Metal Alloys)

- Natural Fiber Materials (Cotton, Jute, Linen)

- By Distribution Channel:

- Offline (Specialty Stores, Home Centers & DIY Retailers, Architects & Designers)

- Online Retail & E-commerce Platforms

Value Chain Analysis For Interior Wall Coverings Market

The Interior Wall Coverings value chain initiates with upstream activities focused on the procurement and processing of diverse raw materials, which include petrochemical derivatives for vinyl and paint, wood pulp for paper products, natural stone and clay for tiles, and specialized resins and pigments. Efficiency in this upstream segment is critical, as volatility in oil and forestry markets directly impacts the final product cost. Key players here include chemical manufacturers, pulp and paper suppliers, and mineral extractors. Midstream operations involve the core manufacturing processes—compounding, printing, coating application, and panel pressing—where technological investment in digital printing and sustainable production methods (like water-based inks and solvent-free coatings) determines competitive advantage. Manufacturers must manage complex inventory and stringent quality control, especially for customized and luxury items.

Downstream activities involve the distribution, sales, and installation of the finished products. Distribution channels are varied, encompassing direct sales to large construction projects and wholesalers, sales through specialized retail outlets and massive home improvement stores (DIY), and increasingly, sales via highly optimized e-commerce platforms. The influence of architects, interior designers, and professional contractors (often termed the 'specifier channel') is immense, particularly for high-end commercial projects, as they dictate material choice early in the design phase. The final installation step, often requiring skilled craftsmanship for wallpaper and paneling, closes the value loop. Bottlenecks in the value chain frequently arise due to logistics challenges in transporting bulky or fragile goods and managing highly customized, just-in-time inventory.

Distribution is fundamentally split between direct and indirect channels. Direct sales are typically favored for major construction or bulk industrial orders, allowing manufacturers greater control over pricing and customer service relationships. Indirect channels, which involve distributors, wholesalers, and retail partners, provide the essential reach necessary to serve the highly fragmented residential and small commercial sectors. E-commerce platforms act as a powerful indirect channel, offering extensive product catalogs and visualization tools directly to consumers and small contractors, bypassing traditional brick-and-mortar limitations. Successful market penetration necessitates a hybrid approach, balancing the high-margin control of direct engagement with the extensive reach and convenience provided by a robust, multi-tiered indirect distribution network, ensuring the availability of diverse product types across all geographic and demographic market segments efficiently.

Interior Wall Coverings Market Potential Customers

The primary customer base for interior wall coverings is highly diverse, categorized broadly into institutional, commercial, and residential end-users, each having unique purchasing criteria and demand drivers. Residential customers, spanning both new homeowners and those undertaking renovations, are characterized by a strong focus on aesthetics, affordability, and DIY potential, prioritizing style trends and ease of application. Commercial clients, including developers of hospitality, retail, and office spaces, prioritize functional attributes such as fire resistance, durability, ease of maintenance, and compliance with institutional standards, often purchasing through architectural firms or general contractors who specify performance criteria over simple decoration. This segment typically involves high-volume, performance-driven procurement cycles demanding certifications and long warranties.

Institutional customers, such as healthcare facility operators, educational bodies, and governmental organizations, represent a critical segment driven almost exclusively by strict regulatory requirements, hygiene standards (requiring anti-microbial surfaces), long-term value, and sustainability mandates. These buyers demand products that offer superior performance in high-stress environments, such as scratch resistance and easy cleaning in hospitals or high-durability coatings in schools. Consequently, procurement often involves detailed public tenders and reliance on established, certified suppliers with proven track records in specialized material science. The decision-making process for institutional buyers is typically slow and highly collaborative, involving facilities management, safety officers, and procurement specialists, valuing compliance and longevity above immediate cost savings.

A rapidly growing segment comprises interior designers, architects, and professional specifiers who act as crucial intermediaries and decision-makers, especially in the premium and luxury markets. These professionals are not the end-users but influence the purchase of nearly all high-value coverings by setting project specifications. Manufacturers must prioritize relationships with this group, offering Continuing Education Units (CEUs), product samples, and advanced digital tools to ensure their products are included in preliminary design documents. Their purchasing behavior is guided by material innovation, environmental product declarations (EPDs), and the ability of a product to achieve a specific design vision, making them key leverage points for market share growth and trend adoption in the broader construction ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 67.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PPG Industries, Sherwin-Williams, Asian Paints, Jotun Group, Nippon Paint, Ahlstrom-Munksjö, F. Schumacher & Co., York Wallcoverings, Muraspec, Saint-Gobain, Tarkett S.A., 3M Company, Forbo Group, Shaw Industries Group, Brewster Home Fashions, Wuxi Huahong, LG Hausys, Knauf Gips KG, Armstrong World Industries, Roppe Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interior Wall Coverings Market Key Technology Landscape

The technological landscape of the Interior Wall Coverings Market is rapidly evolving, driven primarily by advancements in digital manufacturing, material science, and sustainable production techniques. A cornerstone technology is high-resolution digital printing, which allows for the rapid creation of highly customized, non-repeating patterns, murals, and textured effects on substrates like non-woven fabric and vinyl. This technology drastically reduces setup costs and minimum order quantities, democratizing access to bespoke interior design solutions and enabling quick response to rapidly changing aesthetic trends. Furthermore, the development of advanced polymer chemistry is crucial, leading to the creation of performance coatings with enhanced properties such as anti-graffiti surfaces, self-cleaning mechanisms (hydrophobic materials), and superior resistance to abrasion and chemical exposure, vital for high-traffic commercial environments. The move towards water-based, ultra-low VOC formulations in paint and adhesives represents a major technological shift mandated by increasing environmental and health regulations globally, focusing on minimizing atmospheric pollution and improving indoor air quality.

Another significant technological driver is the integration of smart and functional materials into traditional wall coverings. This includes the incorporation of micro-encapsulated phase change materials (PCMs) into coatings and panels to improve thermal insulation and manage internal temperatures passively, contributing directly to energy efficiency in buildings. Acoustic performance technology is also paramount, with multilayered, porous panels and specialized foam-backed textiles designed to absorb sound waves, reducing noise pollution in open-plan offices and residential buildings. These functional technologies transform the wall from a static decorative element into an active component of the building envelope, addressing multiple performance criteria simultaneously. The shift is from purely aesthetic products to multi-utility architectural finishes that require complex engineering and material layering.

Finally, the proliferation of digital tools in the pre-purchase and installation phases represents a crucial technological shift influencing the market structure. Augmented Reality (AR) and Virtual Reality (VR) visualization apps allow customers and designers to accurately preview how wall coverings will look in a specific space before purchase, significantly reducing customer uncertainty and return rates. Building Information Modeling (BIM) compatibility is becoming standard for panel and tile manufacturers, ensuring seamless integration of product specifications into large-scale construction project management systems. This digital integration across the design, procurement, and installation cycle streamlines workflow, reduces installation errors, and ultimately enhances overall project efficiency, solidifying technology's role as a competitive differentiator beyond mere product aesthetics.

Regional Highlights

- Asia Pacific (APAC): Dominates the market in terms of volume growth due to unprecedented levels of new residential, commercial, and infrastructure construction, especially in rapidly urbanizing economies like China, India, and Southeast Asia. The region exhibits high demand for both affordable, mass-produced coverings (paint and vinyl wallpaper) and a fast-growing luxury segment catering to high-net-worth individuals and premium hospitality projects. The focus here is on rapid production scalability and increasingly, on adopting basic sustainability practices in manufacturing processes.

- North America: Characterized by a mature market where growth is heavily reliant on the robust renovation and remodeling sector, alongside strong demand for high-performance, specialized wall coverings. Stringent environmental regulations and high consumer awareness drive the preference for low-VOC paints, sustainable materials (cork, recycled content), and functional wall panels (acoustic, anti-microbial). The integration of e-commerce and specialized designer channels is highly advanced, influencing purchasing patterns significantly.

- Europe: A high-value, innovation-driven market prioritizing sustainability, design originality, and premium natural materials. European consumers and regulators demand strict adherence to environmental, social, and governance (ESG) criteria, pushing manufacturers towards bio-based resins, recyclable paper, and textile coverings. Western Europe leads in technological adoption of digital printing and smart functional coatings. The market structure favors specialty manufacturers focused on niche, high-quality, and aesthetically sophisticated products.

- Latin America (LATAM): Exhibits strong potential, driven by recovering construction sectors and improving economic stability in major economies such as Brazil and Mexico. The market is price-sensitive but shows accelerating demand for mid-range, aesthetically appealing wall coverings as disposable incomes rise. Focus is currently on basic, durable coverings, though modern architectural trends are slowly increasing the demand for decorative panels and high-quality paint finishes.

- Middle East and Africa (MEA): Growth is primarily fueled by large-scale hospitality, commercial, and luxury residential projects in the GCC countries (UAE, Saudi Arabia). These projects demand premium, durable, and often highly customized decorative finishes suitable for extreme climate conditions (e.g., UV resistance, high-humidity tolerance). Africa presents a nascent market with significant future volume potential, currently focused on basic paint and economically viable decorative options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interior Wall Coverings Market.- PPG Industries

- Sherwin-Williams

- Asian Paints

- Jotun Group

- Nippon Paint

- Ahlstrom-Munksjö

- F. Schumacher & Co.

- York Wallcoverings

- Muraspec

- Saint-Gobain

- Tarkett S.A.

- 3M Company

- Forbo Group

- Shaw Industries Group

- Brewster Home Fashions

- Wuxi Huahong

- LG Hausys

- Knauf Gips KG

- Armstrong World Industries

- Roppe Corporation

Frequently Asked Questions

Analyze common user questions about the Interior Wall Coverings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently shaping the Interior Wall Coverings Market?

The market is predominantly shaped by the growing demand for sustainable, low-VOC (Volatile Organic Compound) materials, the widespread adoption of digital printing for hyper-customized designs, and the integration of functional properties such as acoustic dampening and anti-microbial surfaces into wall coverings for both commercial and residential applications.

How does the commercial sector differ from the residential sector in terms of wall covering demand?

The commercial sector (e.g., hospitals, hotels) prioritizes performance attributes such as extreme durability, fire resistance, easy maintenance, and hygiene certifications (anti-microbial coatings), often driving demand for high-specification panels and vinyl. The residential sector focuses more on aesthetic trends, ease of installation (DIY), and affordability.

Which geographic region is expected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive ongoing urbanization, robust infrastructure development, and substantial expansion in the residential and commercial construction pipeline across economies such as China and India.

What are the primary restraints affecting the growth of the wall coverings industry?

Key restraints include the volatile cost fluctuations of raw materials, particularly petrochemical derivatives used in vinyl and paints; the increasing regulatory burden requiring expensive shifts toward eco-friendly production methods; and localized shortages of specialized skilled labor for complex installation projects.

What role does technology play in modern wall covering material selection?

Technology plays a critical role through advanced material science, creating multi-functional, performance-enhancing products (e.g., thermal insulation coatings). Furthermore, digital tools like Augmented Reality (AR) and Building Information Modeling (BIM) streamline the specification and visualization process for architects and end-users, enhancing selection accuracy and project efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager