Interior Wall Putty Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436493 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Interior Wall Putty Powder Market Size

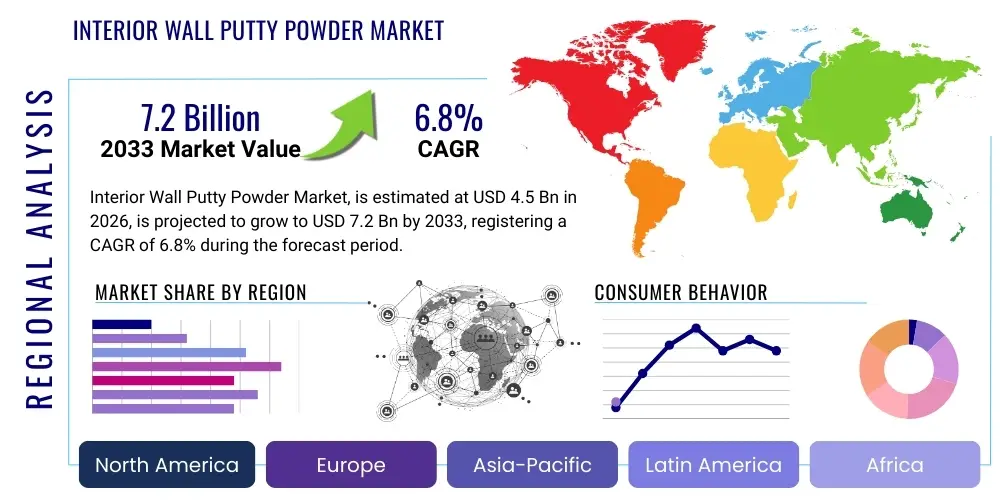

The Interior Wall Putty Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Interior Wall Putty Powder Market introduction

Interior Wall Putty Powder is a white cement-based fine powder used to create a smooth, protective base surface for painting on interior walls. It functions as a leveling material, filling minor cracks, pinholes, and unevenness in plastered surfaces, enhancing the durability and aesthetics of the final paint job. This product is formulated primarily from white cement, polymer additives, mineral fillers, and specialized chemicals that improve workability, adhesion strength, and water resistance, making it superior to traditional lime-based or gypsum-based fillers for modern construction applications. Its ease of application and quick drying time contribute significantly to its high adoption rate across residential and commercial construction sectors globally.

The primary applications of interior wall putty include preparation of new walls, renovation projects, and surface enhancement in high-end architectural designs where a flawless finish is mandatory. Benefits associated with using high-quality interior wall putty powder encompass increased paint lifespan, reduction in paint consumption due to lower surface porosity, superior resistance to peeling and flaking, and excellent bonding capabilities with various substrate materials. The aesthetic enhancement provided by a perfectly smooth wall surface is a major driving factor, particularly in rapidly developing urban centers seeking premium interior finishes.

Driving factors propelling the market expansion are multifaceted, centering on robust growth in the global construction industry, particularly in the Asia-Pacific region due to rapid urbanization and infrastructure development. Government initiatives promoting affordable housing and increased consumer focus on home aesthetics and renovation activities further amplify demand. Technological advancements leading to improved polymer modifications result in putties offering enhanced performance characteristics, such as better crack resistance and increased water repellency, making these products indispensable in modern interior finishing processes.

Interior Wall Putty Powder Market Executive Summary

The Interior Wall Putty Powder Market demonstrates substantial growth, primarily fueled by global construction boom, shifting consumer preferences towards high-quality, durable interior finishes, and innovation in polymer chemistry enhancing product performance. Business trends indicate a strong focus on sustainability, with leading manufacturers investing in low-VOC (Volatile Organic Compound) and eco-friendly formulations to meet stringent environmental regulations and consumer health concerns. Strategic expansion into emerging markets, coupled with mergers and acquisitions aimed at consolidating raw material supply chains and distribution networks, defines the competitive landscape.

Regionally, the Asia Pacific (APAC) dominates the market, driven by massive infrastructural projects and high-volume residential construction activities in countries like China and India, which account for the highest consumption of cement-based construction chemicals. North America and Europe show steady, maturity-driven growth, characterized by high adoption of specialized, high-performance polymer putties used primarily in renovation and high-end commercial sectors. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, spurred by tourism infrastructure investments and urbanization efforts.

Segment trends reveal that the cement-based putty powder segment holds the largest market share due to its cost-effectiveness and widespread availability, particularly in developing economies. However, the specialized polymer-modified segment, offering superior adhesion and water resistance, is registering the highest CAGR. In terms of application, the residential sector remains the largest consumer, although the commercial sector, driven by increasing demands for specialized aesthetic finishes in offices, hospitals, and retail spaces, is expanding rapidly.

AI Impact Analysis on Interior Wall Putty Powder Market

Common user questions regarding AI's impact on the Interior Wall Putty Powder Market typically revolve around optimizing material formulation, enhancing quality control during manufacturing, and predicting demand fluctuations in geographically diverse construction markets. Users are keen to understand how AI can reduce production waste, automate complex quality testing procedures, and forecast the required inventory levels for specific construction phases. Key themes center on utilizing machine learning algorithms to analyze raw material variations (such as mineral content and polymer quality) instantly, thus ensuring consistency in the final putty blend. Concerns often address the implementation cost of advanced AI systems in traditional manufacturing plants and the necessity for specialized data scientists to maintain and interpret these systems within the often low-margin construction chemicals industry. Expectations are high regarding AI-driven predictive maintenance for manufacturing equipment, minimizing downtime and increasing overall production efficiency and throughput.

- AI-driven optimization of polymer and additive ratios for superior workability and crack resistance.

- Predictive analytics utilized for demand forecasting based on regional construction project timelines and climatic data.

- Machine learning algorithms applied to quality control for instant defect detection in manufactured batches.

- Automation of inventory management and supply chain logistics using AI systems to minimize holding costs.

- Implementation of smart sensors on production lines for real-time monitoring of consistency and moisture levels.

- Enhanced customization of putty formulations for specific regional climatic requirements using AI modeling.

DRO & Impact Forces Of Interior Wall Putty Powder Market

The Interior Wall Putty Powder Market is significantly shaped by a confluence of influential factors: robust infrastructure spending (Drivers), reliance on the cyclical nature of the construction industry (Restraints), and the emergence of sustainable, functional product innovations (Opportunities). The primary impact forces include the increasing global shift toward aesthetically superior and durable interior finishes, strict regulatory standards promoting eco-friendly building materials, and volatile raw material pricing, particularly for polymers and white cement. The market dynamics are highly sensitive to macroeconomic stability, influencing consumer willingness to invest in home renovation and luxury construction projects.

Drivers include the continuous expansion of the residential sector, driven by population growth and urbanization across APAC and MEA, necessitating large volumes of surface preparation materials. The superior performance attributes of polymer-modified putties over conventional fillers, offering better adhesion and water resistance, cement their status as essential building consumables. Moreover, rising disposable income levels globally enable consumers to opt for higher-quality, premium finish products, which rely heavily on a perfectly smooth putty base. The increasing awareness among contractors and builders regarding the long-term cost benefits of using high-quality wall preparation materials further fuels adoption.

Restraints primarily involve the inherent dependence of the market on the highly cyclical construction industry, making it susceptible to economic downturns, rising interest rates, and regulatory delays in project approvals. Price volatility and supply chain disruptions affecting key raw materials like petrochemical-derived polymers and specialty chemicals pose significant cost pressures on manufacturers. Additionally, the proliferation of low-quality, unorganized sector products, particularly in price-sensitive emerging markets, presents a competitive challenge to organized, premium brands, sometimes misleading consumers regarding product performance and durability.

Opportunities for market stakeholders lie in developing and commercializing specialized, value-added products, such as putties with anti-microbial properties, thermal insulation capabilities, or enhanced crack bridging performance suitable for high seismic zones. Furthermore, focusing on the green building movement by developing ultra-low VOC and sustainable formulations derived from renewable resources provides a substantial competitive advantage. Expanding distribution channels, especially e-commerce platforms and direct-to-consumer models, allows manufacturers to reach diverse contractor bases and individual home renovators efficiently, penetrating previously underserved secondary and tertiary markets.

Segmentation Analysis

The Interior Wall Putty Powder Market is comprehensively segmented based on its fundamental composition (product type), the nature of the application environment, and the ultimate end-user group, allowing for detailed market assessment and strategic targeting. The segmentation by product type primarily differentiates between cement-based formulations and specialized polymer-based or acrylic-based putties, reflecting differences in cost structure, application versatility, and performance metrics such as elasticity and moisture resistance. Geographic segmentation highlights critical regional demand patterns influenced by climate, construction regulations, and local material availability.

Further analysis of segmentation reveals that the type of polymer modifier used (e.g., redispersible polymer powder, cellulose ether) significantly impacts the final product quality, defining sub-segments within the polymer-modified category. Segmentation by end-use provides critical insight into demand volumes, with the residential sector dominating volume consumption due to the sheer scale of housing projects, while the commercial sector drives demand for higher-specification, niche products requiring premium finishes and specific functional properties like fire resistance or anti-fungal attributes. Understanding these segments is crucial for manufacturers to tailor their marketing and product development strategies to specific consumer needs and regional construction methodologies.

- By Product Type

- White Cement-Based Putty Powder

- Polymer-Based Putty Powder (Acrylic, Vinyl Acetate)

- Gypsum-Based Putty Powder (Less common for interiors, but used in specific markets)

- By End-Use Application

- Residential Construction

- Commercial Construction (Office Spaces, Retail, Hospitality)

- Industrial Construction

- Renovation and Repair

- By Nature

- Standard Grade

- Premium Grade (High Polymer Content, Specialized Additives)

- By Distribution Channel

- Direct Sales (B2B to large construction companies)

- Distributors/Wholesalers

- Retail Stores (Hardware stores, specialized paint shops)

- Online Sales

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Interior Wall Putty Powder Market

The value chain for the Interior Wall Putty Powder Market commences with the upstream supply of core raw materials, predominantly white cement, calcium carbonate (mineral fillers), and specialized petrochemical derivatives such as redispersible polymer powders (RDP) and cellulose ethers. Raw material procurement is critical, as the quality and consistency of these inputs directly affect the performance characteristics, setting time, and final finish of the putty. Manufacturers often maintain long-term agreements with specialized chemical suppliers to mitigate price volatility and ensure a steady, high-quality material flow. Efficient processing involves blending, milling, and rigorous quality control checks to meet diverse regulatory and application requirements.

The manufacturing stage involves blending the dry components in precise ratios and packaging the final powder product. The distribution channel plays a pivotal role in market penetration; it typically involves a mix of direct and indirect channels. Direct distribution is common for large institutional buyers (e.g., major real estate developers and government contractors) who purchase in bulk. Indirect channels rely heavily on a robust network of regional distributors, wholesalers, and thousands of specialized hardware and paint retail outlets, crucial for reaching individual contractors and smaller renovation projects across vast geographic areas. The cost structure through indirect channels often includes higher markups but allows for greater market reach.

Downstream analysis focuses on the product application, primarily driven by professional contractors, painters, and skilled laborers who utilize the putty for surface preparation before final painting. The end-users—residential homeowners, commercial property developers, and industrial facility managers—drive final consumption decisions based on factors like product reliability, ease of application, and cost-effectiveness. Post-sales service, including technical support and product usage training provided by manufacturers, adds value, particularly for specialized premium formulations, strengthening brand loyalty within the contracting community.

Interior Wall Putty Powder Market Potential Customers

The core potential customers and end-users of Interior Wall Putty Powder are defined by entities responsible for the construction, renovation, or aesthetic maintenance of interior wall surfaces. The largest consumer base comprises residential property developers who utilize standard and premium grade putties extensively in new housing projects, ranging from large-scale affordable housing complexes to high-end luxury apartments. These buyers prioritize bulk volume, competitive pricing, and reliable quality consistent with regulatory standards for modern housing structures.

A second major segment consists of professional painting contractors and specialized renovation firms. These buyers often possess deep technical knowledge and prefer polymer-modified putties that offer superior performance characteristics, such as excellent adhesion, minimal shrinkage, and fast drying times, which directly translate into reduced project completion timelines and enhanced customer satisfaction. The commercial sector, including hospitality (hotels), healthcare (hospitals), and corporate real estate, demands niche products that provide specific functionalities, such as enhanced smoothness for specialized finishes or anti-microbial properties for hygiene-sensitive environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asian Paints, Sika AG, UltraTech Cement Ltd., Berger Paints India Ltd., Walplast Products Pvt. Ltd., J.K. Cement Ltd., AkzoNobel N.V., The Dow Chemical Company, Weber Saint-Gobain, Dulux, Nippon Paint Holdings Co. Ltd., Fosroc International Ltd., Pidilite Industries Ltd., Myk Laticrete India Pvt. Ltd., Sakarni Plaster P. Ltd., Magicrete Building Solutions Pvt. Ltd., Prism Johnson Limited, Roff (Pvt) Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Interior Wall Putty Powder Market Key Technology Landscape

The technology landscape governing the Interior Wall Putty Powder Market is predominantly focused on the chemical engineering of dry-mix formulations to enhance functional attributes such as adhesion, flexibility, and durability. A crucial area of innovation involves the utilization of Redispersible Polymer Powders (RDPs), which significantly improve the binding capability, water retention, and anti-cracking properties of cementitious putties. Manufacturers are continuously optimizing the molecular structure of these RDPs, primarily based on vinyl acetate-ethylene (VAE) or styrene-butadiene (SBR) co-polymers, to ensure superior performance even in challenging environments like high humidity or temperature fluctuations, directly enhancing the service life of the finished wall surface.

Another significant technological advancement centers on incorporating specialized cellulose ethers, which function as thickening agents and water retention aids. These additives are essential for controlling the consistency and workability of the putty when mixed with water, ensuring smooth application without segregation or premature drying. Modern technology employs highly purified and modified cellulose ethers to allow for extended open time and superior trowel application, catering to the efficiency requirements of large-scale construction sites. The integration of high-precision blending and mixing technologies within manufacturing plants ensures homogenous dispersion of all chemical additives, guaranteeing batch-to-batch consistency—a critical factor for brand reputation.

Furthermore, sustainable material science is gaining traction, pushing R&D towards developing putties with reduced carbon footprints. This involves exploring alternative, low-clinker cement substitutes and incorporating recycled mineral fillers. Advanced manufacturing processes also incorporate micronization technology to achieve ultrafine particle size distributions, which facilitates better filling of micro-pores and cracks, resulting in an exceptionally smooth and dense surface, thereby justifying the premium pricing of advanced formulations in the highly competitive market. Digitalization of quality control, using infrared spectroscopy and automated rheology testing, ensures that every product adheres strictly to international standards.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by unprecedented rates of urbanization, massive government investments in affordable housing schemes (e.g., in India and Southeast Asia), and rapid infrastructural expansion, particularly commercial high-rises. China and India are the primary consumption hubs, characterized by a preference for cost-effective, high-volume white cement-based putties, although demand for polymer-modified premium products is accelerating in metropolitan areas due to rising construction standards and aesthetic demands. The dense network of local manufacturers and highly competitive pricing structure defines this region.

- North America: This region is characterized by steady, mature growth focused predominantly on renovation, remodeling, and adherence to stringent environmental regulations (e.g., low-VOC requirements). Demand here is concentrated on high-quality, specialized polymer-based putties that offer superior performance, crack resistance, and quick drying times. The market is heavily influenced by technical specifications set by major contractors and a high consumer propensity for DIY renovation projects, particularly in the US and Canada.

- Europe: Similar to North America, European demand is driven by high-specification requirements, emphasizing sustainable, eco-labeled products and renovation activities, particularly in Western European nations like Germany, France, and the UK. Strict EU regulations regarding construction chemicals necessitate advanced research into non-hazardous, sustainable formulations. Eastern Europe presents faster growth potential due to ongoing infrastructure modernization and increasing integration of EU construction standards, raising the demand for high-performance dry-mix mortars and putties.

- Middle East and Africa (MEA): This region exhibits high growth, spurred by massive real estate and hospitality projects (e.g., UAE, Saudi Arabia) and rapid population growth in urban centers across Africa. The extreme climatic conditions (high heat and humidity) in the GCC countries necessitate specialized putty formulations with enhanced water resistance and high bond strength, driving demand for premium polymer-modified products. Infrastructure spending related to diversifying economies away from oil revenue further fuels demand for construction chemicals.

- Latin America (LATAM): Growth in LATAM is variable, tied closely to economic stability in major markets like Brazil and Mexico. Demand is increasing due to expanding middle-class populations and investment in mid-range residential housing. The market is price-sensitive, leading to a balanced mix of traditional cementitious putties and gradually increasing adoption of specialized products aimed at improving surface durability and reducing maintenance costs in areas prone to seismic activity or high moisture levels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Interior Wall Putty Powder Market.- Asian Paints

- Sika AG

- UltraTech Cement Ltd.

- Berger Paints India Ltd.

- Walplast Products Pvt. Ltd.

- J.K. Cement Ltd.

- AkzoNobel N.V.

- The Dow Chemical Company

- Weber Saint-Gobain

- Dulux

- Nippon Paint Holdings Co. Ltd.

- Fosroc International Ltd.

- Pidilite Industries Ltd.

- Myk Laticrete India Pvt. Ltd.

- Sakarni Plaster P. Ltd.

- Magicrete Building Solutions Pvt. Ltd.

- Prism Johnson Limited

- Roff (Pvt) Ltd.

- CEMEX S.A.B. de C.V.

- HeidelbergCement AG

Frequently Asked Questions

Analyze common user questions about the Interior Wall Putty Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Interior Wall Putty Powder Market?

The Interior Wall Putty Powder Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% over the forecast period from 2026 to 2033, driven primarily by construction sector growth in Asia Pacific.

Which region dominates the global consumption of interior wall putty powder?

The Asia Pacific (APAC) region currently dominates the market share for Interior Wall Putty Powder, largely due to extensive urbanization and high-volume residential and commercial construction activities in nations like China and India.

What are the primary raw materials used in manufacturing interior wall putty?

The key raw materials include white cement, fine mineral fillers (calcium carbonate), and performance-enhancing additives such as Redispersible Polymer Powders (RDPs) and cellulose ethers, which dictate the final product quality and application characteristics.

How does polymer modification affect the performance of wall putty?

Polymer modification significantly enhances putty performance by improving adhesion strength, increasing flexibility to resist minor cracks, enhancing water resistance, and providing a smoother, more durable base for subsequent painting applications.

What are the key opportunities driving innovation in this market?

Key opportunities involve developing sustainable, eco-friendly formulations (low-VOC content) and specialized value-added products, such as putties with anti-microbial properties or enhanced thermal insulation capabilities, catering to niche market demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager