Internal Audit Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432082 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Internal Audit Services Market Size

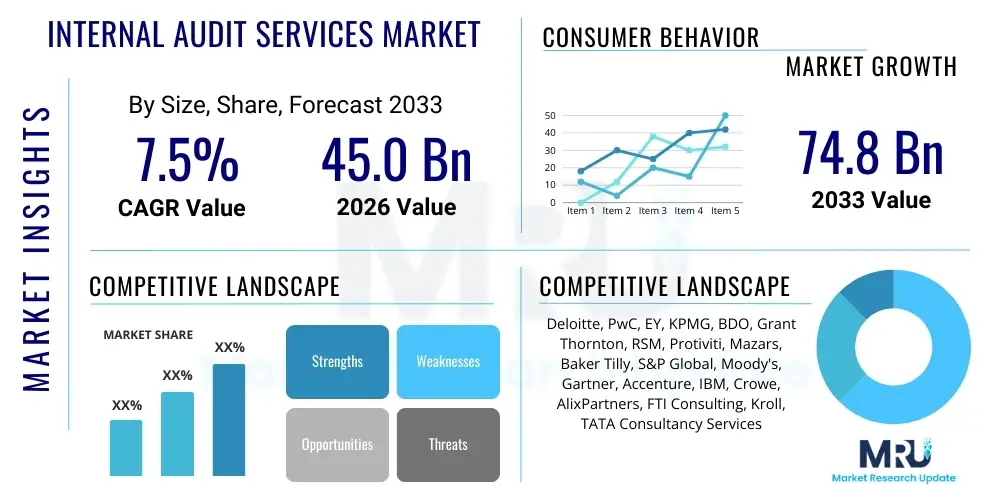

The Internal Audit Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 45.0 Billion in 2026 and is projected to reach USD 74.8 Billion by the end of the forecast period in 2033.

Internal Audit Services Market introduction

The Internal Audit Services Market encompasses advisory and assurance activities designed to add value and improve an organization's operations. These services help organizations accomplish their objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. Product offerings range from full outsourcing and co-sourcing arrangements to specialized consulting in IT auditing, regulatory compliance, fraud examination, and enterprise risk management (ERM). Given the escalating complexity of global regulations, technological disruption, and heightened stakeholder expectations regarding corporate accountability, internal audit has shifted from a primarily compliance-focused function to a strategic business partner.

Major applications of internal audit services span across heavily regulated sectors such as Banking, Financial Services, and Insurance (BFSI), healthcare, and government, where adherence to frameworks like SOX, GDPR, and stringent financial reporting standards is mandatory. Key benefits derived include enhanced operational efficiency, improved risk identification and mitigation, better alignment of audit plans with strategic objectives, and fortified corporate governance structures. Furthermore, external service providers bring specialized technological expertise, particularly in areas like data analytics, cybersecurity assurance, and forensic auditing, which many internal departments lack, thereby justifying the substantial market growth.

Driving factors for this market expansion include the increasing volume and complexity of data requiring automated auditing techniques, the global rise in sophisticated cyber threats necessitating robust IT audit frameworks, and pressure from boards and regulators for greater transparency and control effectiveness. The adoption of advanced audit technologies, such as Artificial Intelligence (AI) and Robotic Process Automation (RPA), is fundamentally reshaping how audits are performed, moving towards continuous auditing and real-time risk assessment, thereby stimulating demand for specialized external expertise.

Internal Audit Services Market Executive Summary

The Internal Audit Services Market is characterized by robust growth driven by mandatory regulatory compliance frameworks, the proliferation of digital transformation initiatives, and the need for sophisticated risk management strategies across global organizations. Business trends indicate a pronounced shift toward technology-enabled audit methodologies, where data analytics and continuous monitoring are paramount, moving away from traditional sampling-based approaches. Organizations are increasingly leveraging co-sourcing models to access specialized skills in emerging risks like cybersecurity and environmental, social, and governance (ESG) reporting, which often fall outside the core competencies of in-house teams. The market is consolidating, with the "Big Four" professional services firms maintaining dominant positions due to their expansive global reach and comprehensive service portfolios, although specialized boutique firms are gaining traction in niche technology audit segments.

Regional trends highlight North America and Europe as mature markets, primarily driven by stringent regulatory environments (e.g., SOX compliance in the US, MiFID II in Europe) and high corporate governance standards. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid economic development, increasing foreign direct investment, and maturing regulatory landscapes in countries like China, India, and Southeast Asia. These emerging markets are seeing greater investment in establishing formal internal audit functions, often relying heavily on external consultants to build foundational frameworks and comply with international financial reporting standards (IFRS).

Segment trends emphasize the rapid expansion of technology-focused audit services, particularly within IT and cybersecurity risk assurance. Outsourcing remains a stable segment, especially for smaller and medium-sized enterprises (SMEs) that find it more cost-effective than maintaining a large, dedicated internal team. However, the co-sourcing segment, which blends internal resources with external expertise, is experiencing accelerated adoption due to its flexibility and ability to efficiently address highly specialized and temporary audit needs. Industry-wise, the BFSI sector continues to be the largest consumer of internal audit services, reflecting the sector’s intrinsic high-risk profile and intensive regulatory scrutiny, followed closely by the fast-growing IT and Telecom sector.

AI Impact Analysis on Internal Audit Services Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Internal Audit Services primarily revolve around job displacement, the reliability and ethics of AI-driven audit findings, and the necessity for upskilling auditors in data science and machine learning. Common questions include: "Will AI replace human internal auditors?", "How can AI enhance continuous auditing processes?", and "What are the regulatory risks associated with auditing AI systems themselves?" This analysis reveals a consensus that AI will not eliminate the role but fundamentally transform it, moving the focus of human auditors from routine transaction testing to advanced analysis, strategic risk assessment, and oversight of AI governance models. Users are concerned about maintaining independence and objectivity when relying on automated tools, and there is a high expectation that AI will deliver real-time insights, allowing for proactive intervention rather than retrospective compliance checks.

AI's primary impact is on enhancing audit efficiency and scope. By automating mundane data collection, reconciliation, and initial control testing tasks, AI tools, including Machine Learning (ML) algorithms and Robotic Process Automation (RPA), free up auditors to concentrate on complex, judgmental areas and emerging risks. This shift allows for the analysis of 100% of transactions (continuous auditing) rather than statistical samples, significantly increasing the assurance provided and reducing the likelihood of undetected fraud or control failures. Furthermore, AI is critical in developing advanced predictive models for risk scoring, enabling audit teams to prioritize resources based on anticipated vulnerability, thus maximizing the strategic value delivered to the board and management.

The integration of AI necessitates the rapid evolution of audit service offerings to include "auditing the machine," meaning the evaluation of the controls, transparency, bias, and security embedded within an organization's AI systems. This new technical requirement drives market demand for external expertise skilled in AI assurance and algorithmic accountability. Service providers must invest heavily in proprietary AI-powered audit platforms that can handle massive, disparate datasets and provide intuitive visualizations of risk hotspots. This technological imperative further polarizes the market, giving a significant advantage to large firms capable of substantial R&D investments, while forcing smaller competitors to specialize intensely in specific technology niches.

- AI drives shift from sample-based testing to continuous auditing and 100% transaction coverage.

- Increased accuracy in fraud detection through pattern recognition algorithms and anomaly identification.

- Automation of routine tasks (RPA) leading to substantial efficiency gains and reduced labor costs.

- Emergence of new service line: AI Assurance, focusing on auditing algorithmic fairness, data quality, and model governance.

- Predictive risk modeling utilizing ML to prioritize audit resources based on anticipated future vulnerabilities.

- Need for significant upskilling of internal audit teams in data science, cloud computing, and AI ethics.

- Enhanced reporting capabilities through AI-powered visualization tools providing real-time insights to executive leadership.

DRO & Impact Forces Of Internal Audit Services Market

The Internal Audit Services Market is fundamentally shaped by powerful drivers, strict restraints, and lucrative opportunities, collectively forming the core impact forces that dictate its direction and growth trajectory. Key drivers center on the global acceleration of digital transformation, which introduces complex technological risks (cybersecurity, data privacy) demanding sophisticated audit responses, coupled with the perpetual increase in regulatory mandates, such as global tax transparency initiatives and industry-specific regulations like Dodd-Frank or Solvency II. These drivers create non-negotiable demand for external expert intervention to ensure compliance and effective risk mitigation. However, the market faces restraints, primarily the high cost associated with premium external auditing services and the persistent global shortage of talent specialized in integrated audit domains (combining financial expertise with IT and data science skills), making it difficult for both internal departments and service providers to scale effectively.

Opportunities in the market are prominently anchored in advisory services related to Environmental, Social, and Governance (ESG) reporting and assurance, which is rapidly moving from voluntary disclosure to regulatory requirement in many jurisdictions. Furthermore, the proliferation of cloud computing and third-party vendor ecosystems (supply chain risk) generates significant demand for specialized vendor risk assessment and cloud security audits. The primary opportunity force is the shift in perceived value, where internal audit transitions from a cost center focused on historical compliance to a proactive, strategic partner advising on future enterprise risks and performance improvement, thereby justifying higher service fees and expanding the scope of engagement.

The impact forces are largely characterized by a high degree of technological disruption and regulatory intensity. Technological adoption acts as a double-edged sword: while it drives demand for specialized services, it also standardizes and automates simpler tasks, putting price pressure on commoditized audit work. Regulatory pressures, especially those requiring integrated financial and IT controls (like SOX), ensure sustained demand for expert assurance. The balance between these forces compels service providers to continuously innovate their methodologies, focusing on high-value, tech-enabled services (e.g., forensic data analytics and cognitive automation) to maintain margin and strategic relevance in a highly competitive professional services landscape.

Segmentation Analysis

The Internal Audit Services Market is segmented based on the type of service delivery, the size of the client organization, the specific industry vertical, and the focus area of the audit. This structure reflects the diverse needs of the global corporate landscape, ranging from routine compliance checks to highly complex, specialized forensic investigations. The segmentation helps service providers tailor their offerings, allocate specialist resources efficiently, and target sectors facing unique regulatory or technological challenges. Understanding these segments is critical for anticipating future demand patterns, particularly the rising need for specialized technology audit services across all verticals.

The primary dimension is Service Type, differentiating between full Outsourcing, Co-sourcing, and Internal Audit Transformation services. Outsourcing dominates among SMEs and organizations seeking standardized assurance at predictable costs. Co-sourcing, which involves the external provider complementing the in-house team with specific expertise (e.g., IT audit, derivatives expertise), is the fastest-growing model among large enterprises due to its efficiency and flexibility. Industry Vertical segmentation confirms that BFSI and IT & Telecom remain the largest segments due to data intensity and stringent compliance requirements, while Healthcare and Manufacturing show rapid expansion driven by complex supply chain risks and quality assurance needs. Segmentation by Organization Size dictates the scope and depth of engagement, with Large Enterprises demanding integrated global audit solutions and SMEs preferring scalable, cost-effective outsourced models.

- By Service Type:

- Internal Audit Outsourcing

- Internal Audit Co-sourcing/Managed Services

- Internal Audit Transformation and Improvement

- Specialized Assurance (e.g., Forensic Audit, ESG Assurance)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare and Life Sciences

- Manufacturing and Automotive

- Retail and Consumer Goods

- Government and Public Sector

- Energy and Utilities

- By Organization Size:

- Large Enterprises (Annual Revenue > USD 1 Billion)

- Small and Medium-sized Enterprises (SMEs)

- By Audit Focus Area:

- Financial and Operational Audit

- IT and Cybersecurity Audit

- Compliance and Regulatory Audit

- Enterprise Risk Management (ERM) Consulting

Value Chain Analysis For Internal Audit Services Market

The value chain for Internal Audit Services is primarily knowledge- and service-driven, beginning with talent acquisition and technology platform development (upstream activities) and concluding with the delivery of high-quality assurance reports and strategic advisory services (downstream activities). Upstream, significant investment is required in recruiting auditors with specialized certifications (e.g., CIA, CISA, CFE) and, increasingly, expertise in data analytics, AI tools, and sector-specific regulations. Firms must also continuously develop proprietary or licensed audit management software and analytical tools that form the technological backbone of modern audit engagements. The strategic differentiation at this stage often lies in proprietary methodologies and specialized training programs that ensure consistent service quality globally.

Midstream activities involve core service delivery, encompassing risk assessment planning, fieldwork execution, evidence gathering, and documentation. This stage is heavily influenced by quality control mechanisms and regulatory standards (such as IIA Standards). The integration of technology, particularly in data extraction and automated control testing, determines the efficiency of the fieldwork. Downstream, the value chain focuses on reporting, communication of findings, strategic recommendations, and follow-up on corrective actions. This is the crucial point where assurance translates into tangible business value, requiring strong communication skills to present complex findings to boards and executive management, thereby enhancing governance and risk culture.

The distribution channel in this market is predominantly direct, characterized by long-term contractual relationships between the audit firm and the client organization, often overseen by the client’s audit committee. Indirect channels are virtually non-existent for core audit services, though technology vendors and specialist software providers form a vital component of the supply side, equipping auditors with the necessary tools. Direct engagement ensures strict adherence to independence requirements and allows for deep customization of the audit program based on the client's unique risk profile and organizational structure. The primary goal is establishing a trusted advisory relationship that extends beyond mandatory compliance checks.

Internal Audit Services Market Potential Customers

The primary buyers and end-users of Internal Audit Services span the entire spectrum of the corporate and public sectors, encompassing any entity subject to complex governance requirements, significant operational risks, or stringent regulatory oversight. Historically, large, publicly traded companies across developed economies were the core customer base, mandated by legislation (like the Sarbanes-Oxley Act) to maintain robust internal controls and assurance functions. Today, the customer base has broadened significantly to include large private companies, non-profit organizations, and government entities grappling with resource constraints and the need to manage sophisticated operational and cyber risks.

The most lucrative customer segments remain those with intensive data processing and highly sensitive customer information, such as the BFSI sector (banks, insurance companies, asset managers), which requires specialized audits in areas like anti-money laundering (AML), capital adequacy, and treasury operations. Similarly, the Healthcare and Life Sciences sector is a high-demand segment due to the critical nature of patient data privacy (HIPAA, GDPR) and complex drug development compliance processes. These organizations seek external auditors not just for compliance assurance but for strategic advice on managing emerging risks, optimizing control frameworks, and implementing GRC (Governance, Risk, and Compliance) technologies efficiently.

Furthermore, Small and Medium-sized Enterprises (SMEs), particularly those in high-growth or regulated sectors, represent a rapidly expanding customer group. These SMEs often lack the scale to support a fully equipped internal audit department capable of handling cybersecurity or sophisticated financial reporting standards. For these customers, full outsourcing services provide a cost-effective solution, granting them access to high-caliber expertise and standardized audit methodologies necessary to attract investment, satisfy bank covenants, and prepare for potential IPOs or mergers and acquisitions. Therefore, potential customers are defined less by size and more by the complexity and criticality of their risk and compliance environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.0 Billion |

| Market Forecast in 2033 | USD 74.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, PwC, EY, KPMG, BDO, Grant Thornton, RSM, Protiviti, Mazars, Baker Tilly, S&P Global, Moody's, Gartner, Accenture, IBM, Crowe, AlixPartners, FTI Consulting, Kroll, TATA Consultancy Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Internal Audit Services Market Key Technology Landscape

The modern Internal Audit Services Market is highly reliant on a rapidly evolving technology landscape that underpins efficiency, scope, and strategic value delivery. The foundational technology remains integrated Audit Management Software (AMS) and Governance, Risk, and Compliance (GRC) platforms, which centralize risk registers, audit schedules, control documentation, and issue tracking. However, the most significant shift is the incorporation of advanced data analytics tools, enabling auditors to process vast, disparate datasets from multiple enterprise resource planning (ERP) systems and operational sources. This facilitates the identification of anomalies, process inefficiencies, and potential fraud indicators far quicker and more comprehensively than manual methods. Technology adoption determines a firm's competitive edge, moving from basic documentation to sophisticated continuous monitoring systems.

Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) represent the cutting edge of audit technology. RPA is widely deployed to automate repetitive tasks such as journal entry testing, reconciliation, and control verification, significantly reducing the cost base for high-volume, low-complexity audits. ML algorithms are used for predictive modeling, allowing audit teams to forecast which areas or transactions are most likely to fail controls or present fraud risk, thereby optimizing resource allocation. Furthermore, cloud computing infrastructure is essential, enabling service providers to offer secure, scalable, and remote audit platforms, which became critically important for business continuity during global disruptions.

A crucial emerging technology area is the utilization of Blockchain technology audit tools, especially relevant for clients dealing with digital assets or complex supply chains. While still nascent, blockchain auditors focus on ensuring the integrity, immutability, and transparency of decentralized ledger systems, representing a necessary future skill set. Overall, the technological landscape mandates that service providers act as technology integrators, utilizing a diverse suite of tools—from sophisticated visualizations to Natural Language Processing (NLP) for reviewing contracts and policies—to deliver proactive and comprehensive assurance that meets the demands of digitally transformed organizations.

Regional Highlights

- North America: Market Maturity and Regulatory Intensity

North America, particularly the United States, holds the largest market share due to the early adoption of stringent governance and compliance standards, notably the Sarbanes-Oxley Act (SOX). This legislation mandates robust internal controls and external assurance, driving consistent, high-value demand. The region is a hub for innovation, leading the global market in adopting advanced audit technologies, including AI, predictive analytics, and cybersecurity assurance. Demand is exceptionally high within the BFSI and Technology sectors, driven by complex data privacy regulations (like CCPA) and the sheer scale of publicly traded companies requiring external expertise to manage globally dispersed operations and highly sophisticated cyber risks. The market here is highly competitive, dominated by large, established global consultancies.

- Europe: Focus on Data Privacy and ESG Compliance

Europe represents the second-largest market, characterized by fragmentation but unified by regional directives like GDPR (General Data Protection Regulation) and various EU financial market directives (e.g., MiFID II, Solvency II). The market growth is strongly influenced by the recent acceleration of mandatory Environmental, Social, and Governance (ESG) reporting requirements, such as the Corporate Sustainability Reporting Directive (CSRD). This has opened a major new segment for internal audit services focused on non-financial reporting assurance. European companies increasingly seek co-sourcing arrangements to bring specialist knowledge in data ethics, sustainability metrics, and complex cross-border tax compliance. Germany, the UK, and France are the major revenue contributors, driven by manufacturing and financial services sectors.

- Asia Pacific (APAC): Highest Growth Trajectory and Digitization

The APAC region is projected to register the fastest CAGR during the forecast period. This accelerated growth is attributed to rapid industrialization, increasing foreign investment, and the maturation of corporate governance frameworks across countries like China, India, and Australia. Many regional companies are undergoing significant digital transformation, resulting in a spike in demand for IT security, cloud migration audits, and operational efficiency reviews. Governments and emerging regulatory bodies are establishing stricter compliance rules, pushing local enterprises to adopt international best practices, often through full internal audit outsourcing until internal capabilities are built. The dynamic nature of the market, coupled with high urbanization rates, fuels demand in technology, telecommunications, and infrastructure sectors.

- Latin America (LATAM): Economic Volatility and Fraud Risk

The LATAM market is growing steadily, though often influenced by regional economic volatility and higher perceived risks related to corruption and fraud. Internal audit services here frequently focus heavily on forensic auditing, anti-corruption compliance (based on local laws and US FCPA/UK Bribery Act), and enhancing core financial controls. Companies utilize external services to bolster investor confidence and manage risks associated with complex trade regulations and currency fluctuations. Brazil and Mexico are the dominant markets, where local compliance requirements necessitate specialized regional expertise, leading to high utilization of co-sourcing models.

- Middle East and Africa (MEA): Governance Modernization and Oil Dependency

Growth in the MEA region is spurred by economic diversification initiatives away from oil dependency and significant governance reforms aimed at attracting international capital. Countries within the GCC (Gulf Cooperation Council) are investing heavily in modernizing their regulatory environments and adopting advanced technology. This drives demand for internal audit services focused on public sector governance, large infrastructure project auditing, and financial crime prevention (AML/CFT). The African market is primarily driven by multinational corporations operating in highly regulated extractive industries and the burgeoning financial technology (FinTech) sector, requiring specialized risk and compliance advisory services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Internal Audit Services Market.- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- Ernst & Young Global Limited (EY)

- KPMG International Limited

- BDO Global

- Grant Thornton International Ltd

- RSM International

- Protiviti Inc. (A wholly owned subsidiary of Robert Half)

- Mazars Group

- Baker Tilly International

- Accenture PLC

- IBM Corporation

- TATA Consultancy Services (TCS)

- AlixPartners, LLP

- FTI Consulting, Inc.

- Crowe Global

- Kroll (Duff & Phelps)

- S&P Global

- Gartner, Inc.

- Wipro Limited

Frequently Asked Questions

Analyze common user questions about the Internal Audit Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized Internal Audit Services?

The primary driver is the increasing complexity of technological risks, particularly cybersecurity and data governance, coupled with stringent global regulatory compliance requirements (e.g., SOX, GDPR, ESG mandates) that necessitate specialized external expertise beyond internal resource capabilities.

How is Artificial Intelligence (AI) changing the role of internal auditors?

AI is transforming the internal auditor's role by automating routine transaction testing and enabling continuous auditing, shifting the focus from manual control verification to strategic risk assessment, advanced data analysis, and oversight of algorithmic governance and bias.

Which service delivery model is experiencing the fastest growth in the market?

The Co-sourcing service delivery model is experiencing the fastest growth. This model allows organizations to efficiently leverage external specialists for targeted areas—such as IT audit or complex regulatory compliance—while retaining core audit functions internally, optimizing resource allocation and flexibility.

Which geographical region holds the largest market share for Internal Audit Services?

North America currently holds the largest market share, driven by its highly mature regulatory landscape, particularly the pervasive requirements stemming from the Sarbanes-Oxley Act (SOX), and the region's leading adoption of advanced audit technologies and robust corporate governance standards.

What is the significance of ESG in the future growth of the Internal Audit Services Market?

ESG (Environmental, Social, and Governance) is critical for future growth as regulatory bodies increasingly mandate sustainability reporting. Internal audit services are expanding rapidly to provide assurance over non-financial data quality, governance structures related to climate risk, and compliance with emerging sustainability directives, establishing it as a major new revenue stream.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager