Internal Resistance Tester Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435502 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Internal Resistance Tester Market Size

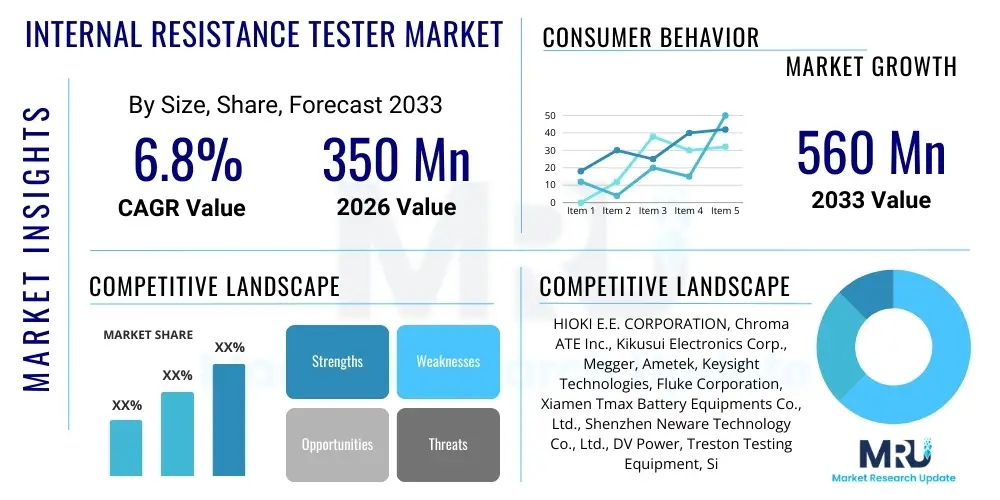

The Internal Resistance Tester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $560 Million USD by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the exponential expansion of the electric vehicle (EV) sector, the increasing deployment of large-scale energy storage systems (ESS), and the stringent quality and safety regulations governing battery performance across consumer electronics and industrial applications. Internal resistance testing is a non-destructive, crucial method for assessing battery health, degradation, and overall lifespan, making it indispensable in modern power management systems.

Internal Resistance Tester Market introduction

The Internal Resistance Tester Market encompasses specialized electronic devices designed to measure the impedance or internal resistance of energy storage components, predominantly batteries and supercapacitors. Internal resistance is a critical parameter reflecting a battery's ability to deliver current and is inversely proportional to its state of health (SOH) and overall efficiency. These testers utilize techniques such as AC impedance methods, which inject a small AC current and measure the resulting voltage drop to calculate resistance accurately without significantly discharging the battery. Major applications span battery manufacturing quality control, automotive battery management systems (BMS), maintenance of uninterruptible power supplies (UPS), and testing of consumer electronics. The primary benefit of employing these testers is the proactive identification of failing cells, enabling timely replacement, preventing catastrophic failures, and significantly extending the operational lifetime of battery banks. Key driving factors include the global shift towards renewable energy integration, requiring stable and reliable grid storage, and the pervasive electrification across transportation sectors, which demands highly precise battery diagnostics.

Internal Resistance Tester Market Executive Summary

The Internal Resistance Tester market is characterized by robust commercial activity fueled by innovation in high-speed, high-accuracy testing solutions optimized for lithium-ion batteries. Current business trends indicate a strong move toward integrated, multi-functional testing equipment that combines resistance measurement with capacity testing and voltage analysis, often incorporating cloud connectivity for large-scale data logging and predictive analytics crucial for industrial battery fleets. Segment trends show the automotive application segment dominating the market due to the stringent performance requirements and volume of batteries used in electric vehicles, alongside rapid growth in the energy storage segment driven by utility-scale projects. Regionally, Asia Pacific (APAC) holds the largest market share, stemming from its overwhelming dominance in global battery production capacity, particularly in China, South Korea, and Japan. Europe and North America follow, propelled by significant government investment in EV infrastructure and stringent battery recycling and maintenance mandates, ensuring sustained demand for advanced diagnostic tools.

AI Impact Analysis on Internal Resistance Tester Market

User queries regarding AI's influence typically revolve around how artificial intelligence can transform conventional internal resistance data into actionable, predictive maintenance strategies, particularly in large, complex battery systems like EV packs or grid storage facilities. Users are intensely interested in AI's capability to correlate subtle resistance fluctuations with specific degradation mechanisms (such as calendar aging vs. cycle aging), thereby moving beyond simple pass/fail metrics. The key themes emerging include the transition from periodic manual testing to continuous, AI-driven monitoring; the expectation that AI will dramatically reduce false positives and enhance diagnostic accuracy; and the desire for testers that are natively compatible with edge computing and machine learning platforms for on-site data processing and real-time anomaly detection. There is a general anticipation that AI integration will shift the market focus from merely providing accurate resistance values to offering comprehensive, prognostic battery health platforms.

AI is set to revolutionize the internal resistance tester market by fundamentally improving the efficiency and depth of battery diagnostics. By leveraging deep learning algorithms, AI can analyze vast historical datasets of resistance, temperature, and cycling profiles to establish highly precise degradation models specific to different battery chemistries and operational environments. This allows maintenance professionals and OEMs to forecast the remaining useful life (RUL) of individual cells or modules with unprecedented accuracy, enabling proactive servicing rather than reactive replacement. Furthermore, AI facilitates the optimization of testing parameters itself, dynamically adjusting current frequencies or measurement intervals based on real-time data, thereby enhancing the speed and non-invasiveness of the testing process.

The practical application of AI results in the development of 'smart' testers that do not just measure resistance but interpret the measurement within the context of the entire battery history, providing diagnostic outputs that are instantly integrated into Battery Management Systems (BMS). This shift elevates the internal resistance tester from a simple measurement device to a core component of an intelligent predictive maintenance ecosystem. For manufacturers, AI-enhanced quality control during production can swiftly identify latent manufacturing defects by detecting minor resistance anomalies that traditional fixed-limit testing might overlook, leading to vastly improved outgoing quality and reduced warranty claims, further accelerating the adoption of high-precision testers.

- AI facilitates predictive maintenance through accurate Remaining Useful Life (RUL) calculation.

- Machine learning algorithms correlate resistance trends with specific degradation pathways.

- Enhancement of quality control processes by detecting subtle manufacturing flaws based on resistance signatures.

- Integration with cloud platforms for continuous monitoring and fleet-wide diagnostic reporting.

- Optimization of testing frequency and parameters for increased efficiency and reduced invasiveness.

- Development of intelligent, self-calibrating diagnostic tools embedded with proprietary models.

DRO & Impact Forces Of Internal Resistance Tester Market

The market dynamics are governed by powerful drivers such as the relentless global proliferation of Electric Vehicles (EVs) and the critical need for reliable grid energy storage systems (ESS), which necessitates rigorous and frequent battery health assessment. However, growth is tempered by restraints including the high initial cost of advanced, high-accuracy testers, particularly those utilizing complex Electrochemical Impedance Spectroscopy (EIS) techniques, and the technical challenge of accurately measuring extremely low internal resistance values in large, low-impedance battery packs. Significant opportunities arise from the mandatory adoption of stricter international safety standards for industrial batteries, driving demand for certification-grade testing equipment, alongside the expansion of the secondary (aftermarket) testing service sector focusing on battery refurbishment and recycling. These factors collectively exert a strong impact force, pushing manufacturers towards developing faster, more portable, and technologically integrated diagnostic instruments that cater to both high-volume production lines and field service applications.

Key drivers include regulatory mandates in the automotive sector compelling comprehensive battery diagnostics to ensure passenger safety and performance longevity, coupled with the expansion of renewable energy sources that rely heavily on stable, long-lasting battery storage infrastructure. The increase in global EV production directly translates to a proportionate increase in demand for testers used both on the assembly line for quality assurance and in service centers for rapid diagnostics. Furthermore, the inherent sensitivity of lithium-ion batteries to internal degradation—where slight resistance increases can dramatically reduce power output and increase heat generation—makes precise internal resistance measurement a non-negotiable step in battery maintenance protocols globally. This technological necessity firmly anchors demand for these diagnostic tools across all major electrified industries.

Despite these accelerators, the market faces headwinds primarily related to standardization and complexity. The diversity in battery chemistries (e.g., LFP, NMC, solid-state) means that a single tester architecture may not be optimally suited for all applications, requiring end-users to invest in multiple, specialized instruments. Moreover, while DC load testing provides a direct measure of power delivery capability, AC impedance testing, preferred for its non-invasiveness and speed, faces challenges related to accurately correlating AC impedance results with true DC performance under all operational conditions, leading to ongoing technological refinement needs. Nonetheless, the opportunity derived from massive investment in battery Gigafactories across North America and Europe, alongside emerging markets for second-life battery applications, ensures a continuous and escalating need for reliable, high-throughput internal resistance testing solutions that can handle the sheer volume and complexity of future energy storage systems.

Segmentation Analysis

The Internal Resistance Tester market is intricately segmented based on technology, application, and end-user, reflecting the diverse needs across the battery lifecycle, from raw material processing to end-of-life repurposing. Segmentation by technology type, particularly the distinction between AC impedance and DC load testing methods, is critical, as AC methods dominate high-speed production and portable maintenance due to their non-destructive nature, while DC methods are often utilized for detailed, capacity-related laboratory analysis. Application segmentation highlights the dominance of the automotive sector, driven by complex EV battery packs requiring granular cell-level diagnostics, closely followed by the energy storage sector, where testers are crucial for maintaining the long-term reliability of grid-scale installations. The market structure emphasizes specialized instruments tailored to specific battery chemistries (e.g., lead-acid, Li-ion, NiMH), ensuring optimal diagnostic performance tailored to the unique electrochemical properties of each system.

- By Technology Type:

- AC Resistance Measurement

- DC Resistance Measurement (Load Testing)

- Electrochemical Impedance Spectroscopy (EIS)

- By Battery Type:

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Nickel-Based Batteries

- Others (e.g., Flow Batteries, Supercapacitors)

- By Application:

- Battery Manufacturing and Quality Control

- Automotive (EVs and Hybrid Vehicles)

- Energy Storage Systems (Grid and Residential)

- Consumer Electronics

- Telecommunications (Data Centers and UPS)

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Testing Service Providers

- Research & Development Institutions

- Aftermarket and Maintenance Services

Value Chain Analysis For Internal Resistance Tester Market

The value chain for the Internal Resistance Tester market begins with upstream activities centered on the procurement of high-precision electronic components, sophisticated microcontrollers, high-speed analog-to-digital converters (ADCs), and specialized current injection/measurement circuitry necessary for accurate impedance calculation. Key suppliers in the upstream segment are semiconductor manufacturers and specialized sensor producers who ensure the high degree of stability and repeatability required for metrology-grade equipment. The midstream involves the design, software development, assembly, and rigorous calibration of the final testing units, where core competencies in electrical engineering and battery chemistry knowledge are paramount. Manufacturers focus intensely on software integration, user interface design, and compliance with industrial standards (e.g., ISO, IEC).

Downstream activities involve complex distribution channels that must efficiently move high-value, specialized equipment from manufacturing hubs to highly technical end-users worldwide. Direct distribution is common for high-volume sales to large Original Equipment Manufacturers (OEMs) in the automotive and energy storage sectors, allowing for customized integration and direct technical support. In contrast, indirect distribution relies heavily on specialized industrial equipment distributors, value-added resellers (VARs), and regional sales agents who provide localized calibration, training, and post-sale maintenance services, particularly crucial for small to medium-sized maintenance service providers and research institutions. The effectiveness of the value chain is largely dependent on the robustness of the service and support network, given the mission-critical nature of battery diagnostics.

A critical element of the downstream segment is the provision of integrated software and data analytics platforms, often sold alongside the hardware. As testers become 'smarter' through connectivity and AI integration, the maintenance and update of proprietary diagnostic software represent a significant value-add component. Manufacturers must also strategically manage supply chain resilience, especially concerning sensitive components, to mitigate risks associated with global semiconductor shortages and ensure consistent production capacity to meet the accelerating demand from new Gigafactories globally. Efficient logistics and expert technical support are non-negotiable elements distinguishing leading market participants.

Internal Resistance Tester Market Potential Customers

The potential customer base for internal resistance testers is highly diversified yet acutely focused on sectors where battery reliability, safety, and longevity are operational imperatives. The largest cohort comprises Original Equipment Manufacturers (OEMs) specializing in the production of electric vehicles, consumer electronics (smartphones, laptops, power tools), and industrial machinery requiring integrated power solutions. These manufacturers utilize testers extensively during the research and development phase for validating new battery chemistries and optimizing thermal management, and critically, during mass production for 100% quality control screening of incoming cells and finished packs to prevent defective units from entering the supply chain. Accurate resistance measurement at this stage is essential for binning cells and ensuring module uniformity.

Another major customer segment consists of third-party battery testing and certification laboratories, as well as academic and corporate Research & Development (R&D) institutions. These entities use advanced, high-precision testers, particularly those featuring Electrochemical Impedance Spectroscopy (EIS), to conduct deep-dive electrochemical analysis, study degradation kinetics, and develop next-generation battery technologies. For R&D, the ability to measure internal resistance across a wide frequency spectrum provides vital insights into the contributions of ohmic, charge transfer, and diffusion resistance components to overall impedance, supporting innovation in high-power and long-duration storage cells.

Furthermore, the rapidly growing aftermarket and maintenance service sector represents a substantial pool of potential buyers. This includes EV service garages, fleet operators (e.g., telecommunication companies maintaining remote cell towers, logistics companies operating electric trucks), and utility companies managing large Uninterruptible Power Supply (UPS) systems and grid-scale Energy Storage Systems (ESS). For these end-users, portability, speed, and ease of use are crucial, as testers are deployed in the field to assess battery health, guide preventative maintenance schedules, and efficiently determine if a battery pack should be retired, refurbished, or repurposed for a secondary life application. This segment prioritizes tools that offer rapid, non-invasive diagnostics under real-world conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $560 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HIOKI E.E. CORPORATION, Chroma ATE Inc., Kikusui Electronics Corp., Megger, Ametek, Keysight Technologies, Fluke Corporation, Xiamen Tmax Battery Equipments Co., Ltd., Shenzhen Neware Technology Co., Ltd., DV Power, Treston Testing Equipment, Sika AG, Midtronics, Eagle Eye Power Solutions, B&K Precision, Shandong Rike Testing Instrument Co., Ltd., Sonel S.A., CHT (Chiyang) Testing Equipment, E-T-A Elektrotechnische Apparate GmbH, ZES ZIMMER. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Internal Resistance Tester Market Key Technology Landscape

The technological landscape of the Internal Resistance Tester market is highly specialized, dominated primarily by three methods: AC Resistance Measurement, DC Resistance Measurement, and Electrochemical Impedance Spectroscopy (EIS). AC resistance measurement is the prevailing method for high-speed, non-destructive testing, particularly on production lines and in field maintenance. This technique injects a small, low-frequency AC current (typically 1kHz) into the battery and measures the voltage response. Key technological advancements in this area focus on reducing noise interference, particularly for measuring sub-milliohm resistance in large EV battery modules, and enhancing the speed of measurement, often achieving testing times under one second per cell, crucial for high-throughput manufacturing environments. The reliability of contact resistance compensation mechanisms is also a crucial differentiator among high-end models.

Electrochemical Impedance Spectroscopy (EIS) represents the most advanced diagnostic technology. Unlike the single-frequency AC method, EIS measures impedance across a broad frequency range (from millihertz to kilohertz). This frequency domain analysis allows researchers and advanced engineers to separate the total internal resistance into its constituent parts: ohmic resistance (related to cell components like electrodes and electrolyte), charge transfer resistance (related to kinetics at the electrode-electrolyte interface), and diffusion resistance. The technological challenge for EIS is miniaturization and accelerating the measurement process, as traditional EIS scans can be time-consuming. However, the rise of portable EIS devices and integrated, automated systems is making this high-resolution diagnostic capability more accessible for complex R&D and failure analysis in the field.

Modern testers are increasingly characterized by high connectivity features, including integration with Industrial Internet of Things (IIoT) frameworks and cloud-based data storage. This enables real-time monitoring and fleet management, where resistance data from thousands of cells can be aggregated, analyzed, and leveraged by AI for predictive maintenance alerts. Furthermore, advancements in specialized Kelvin connection techniques ensure highly accurate, four-wire measurements that eliminate measurement errors caused by lead resistance, a necessity given the extremely low impedance values in modern lithium-ion cells. The convergence of hardware precision, high-speed processing, and sophisticated software analysis defines the cutting edge of internal resistance tester technology.

Regional Highlights

The Internal Resistance Tester Market demonstrates significant geographic variation, largely correlating with global battery manufacturing hubs and the pace of Electric Vehicle (EV) adoption and renewable energy integration. Asia Pacific (APAC) stands as the undisputed market leader, accounting for the largest share due to the concentration of the world’s major lithium-ion battery production facilities in countries like China, South Korea, and Japan. These countries have massive demand for automated, high-throughput testers required for Quality Control (QC) during cell and module assembly. Furthermore, government policies supporting EV production and large-scale energy storage deployments in this region sustain intense demand for advanced testing equipment. Investment in next-generation battery R&D also drives the need for sophisticated EIS-based testers.

Europe represents the fastest-growing region, driven by ambitious decarbonization goals, substantial public and private investment in building domestic Gigafactories (e.g., Germany, Sweden, Hungary), and stringent EU regulations concerning battery safety and end-of-life management. The rapid expansion of the European EV market necessitates the growth of a robust aftermarket service infrastructure, significantly boosting demand for portable, highly accurate resistance testers for diagnostics and certification in service centers. Regulatory pressures promoting battery recycling and second-life applications further solidify Europe’s position as a key growth engine for specialized testing equipment.

North America maintains a strong market presence, particularly in the premium and high-end industrial segment, fueled by the massive automotive industry shift toward electrification, supported by policy initiatives like the Inflation Reduction Act (IRA). Demand is focused on industrial-grade testers for EV battery assembly plants and high-reliability systems, such as data center UPS units and military applications. While North America lacks APAC’s scale in manufacturing volume, its demand for high-specification, sophisticated diagnostic tools that integrate seamlessly with complex Battery Management Systems (BMS) ensures sustained market growth and high average selling prices for advanced testing solutions.

- Asia Pacific (APAC): Dominates the market share due to the presence of major global battery manufacturers (China, South Korea) and high volume EV production. Focus is on high-speed QC testers for Gigafactories.

- Europe: Exhibits the highest growth rate, driven by EU Green Deal initiatives, establishment of new domestic Gigafactories, and strict aftermarket servicing regulations for EVs and stationary storage.

- North America: Strong demand from the automotive sector, data centers (UPS maintenance), and defense industries, prioritizing high-accuracy, integrated, and reliable industrial-grade testers.

- Latin America & MEA: Emerging markets with increasing adoption of telecom backup power solutions and nascent EV adoption, creating moderate, project-based demand for durable, portable testers for maintenance services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Internal Resistance Tester Market.- HIOKI E.E. CORPORATION

- Chroma ATE Inc.

- Kikusui Electronics Corp.

- Megger

- Ametek

- Keysight Technologies

- Fluke Corporation

- Xiamen Tmax Battery Equipments Co., Ltd.

- Shenzhen Neware Technology Co., Ltd.

- DV Power

- Treston Testing Equipment

- Sika AG

- Midtronics

- Eagle Eye Power Solutions

- B&K Precision

- Shandong Rike Testing Instrument Co., Ltd.

- Sonel S.A.

- CHT (Chiyang) Testing Equipment

- E-T-A Elektrotechnische Apparate GmbH

- ZES ZIMMER

Frequently Asked Questions

Analyze common user questions about the Internal Resistance Tester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Internal Resistance Tester in battery maintenance?

The primary function is to measure a battery’s impedance or internal resistance, which serves as a rapid, non-destructive indicator of its State of Health (SOH) and degradation level. High internal resistance correlates directly with reduced power output, increased heat generation, and imminent failure, allowing users to proactively schedule maintenance or replacement.

How does the measurement of internal resistance relate to the battery's Remaining Useful Life (RUL)?

Internal resistance is directly linked to RUL; as a battery ages, internal resistance typically increases due to degradation mechanisms like corrosion and loss of active material. By tracking this resistance increase over time and correlating it with established degradation models, sophisticated testers, often utilizing AI, can accurately estimate the battery's RUL.

What is the difference between AC resistance measurement and Electrochemical Impedance Spectroscopy (EIS)?

AC resistance (or conductance) measures impedance at a single frequency (usually 1 kHz) for fast quality checks. EIS is a more complex technique that measures impedance across a wide range of frequencies, allowing diagnostic engineers to distinguish between ohmic resistance and electrochemical polarization resistances, providing deeper insight into specific failure mechanisms.

Which application segment drives the highest demand in the Internal Resistance Tester Market?

The Automotive sector, specifically the Electric Vehicle (EV) segment, drives the highest demand. The necessity for precise, high-speed, and reliable diagnostics for large, multi-cell lithium-ion battery packs, both in manufacturing quality control and subsequent aftermarket servicing, mandates the widespread adoption of specialized resistance testing equipment.

What key technological trend is transforming internal resistance testing in industrial settings?

The key transforming trend is the integration of advanced data analytics and Artificial Intelligence (AI). AI enables the correlation of real-time resistance data with temperature, usage history, and voltage to provide accurate predictive maintenance alerts and precise fault localization within large battery fleets, moving beyond simple measurement to full diagnostic prognostics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager