Internal Threading Tool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435538 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Internal Threading Tool Market Size

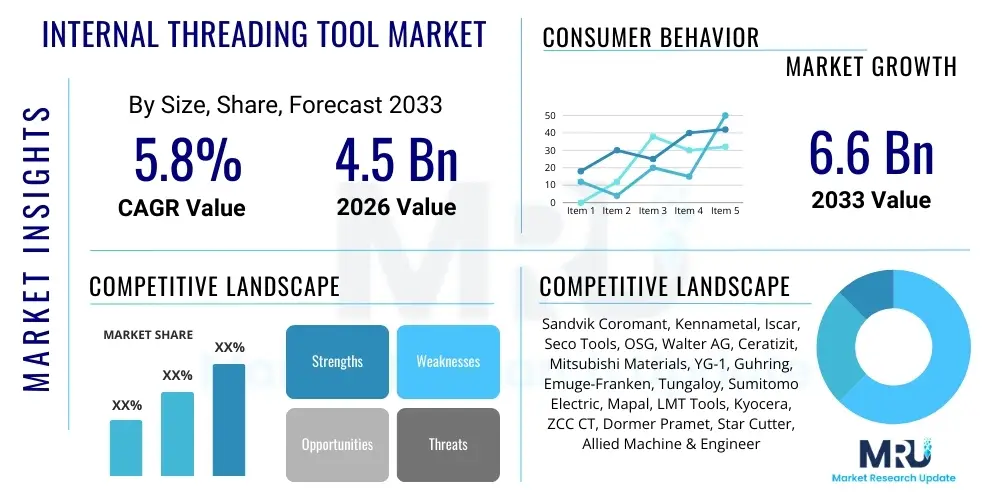

The Internal Threading Tool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the sustained growth of the global manufacturing sector, particularly in precision-intensive industries such as automotive, aerospace, and medical device manufacturing. The demand for advanced materials and complex component geometries necessitates higher quality, durable, and highly efficient threading solutions, pushing manufacturers toward premium cemented carbide and coated tools.

The market valuation reflects increasing capital expenditure in developing economies focused on infrastructure and industrial modernization. These investments necessitate robust machining processes where internal threading is a crucial, non-negotiable step. Furthermore, the push for automated and unmanned machining environments is driving the adoption of high-performance threading tools capable of extended tool life and predictable wear characteristics, thereby reducing machine downtime and optimizing production throughput. The stability of the market is underpinned by the essential nature of internal threading tools in creating standardized, secure mechanical fastenings across almost all engineered products.

Internal Threading Tool Market introduction

The Internal Threading Tool Market encompasses a diverse range of cutting tools specifically designed to generate internal helical screw threads within boreholes or cavities. These tools are fundamental components of modern machining operations, utilized extensively for creating functional threads required for fastening, power transmission, or fluid sealing applications. Key product categories include taps (both forming and cutting), thread mills, and specialized thread inserts and dies. The performance of these tools is critical, directly influencing the quality, durability, and standardization of the final manufactured product, making material composition, coating technology, and geometry crucial differentiating factors among market offerings.

Major applications for internal threading tools span virtually all industrial sectors that rely on mechanical assembly. The automotive industry is a primary consumer, utilizing these tools for engine blocks, chassis components, and transmission systems. Aerospace and defense necessitate extremely high-precision threading for mission-critical components subjected to extreme stresses and temperatures. Furthermore, the general engineering sector, encompassing machine building, tooling, and mold making, provides a consistent baseline demand. The essential benefits derived from utilizing high-quality internal threading tools include enhanced thread accuracy, improved surface finish, extended tool life, and significant reduction in production cycle times, especially when leveraging advanced techniques like thread milling over traditional tapping.

The market growth is fundamentally driven by several intertwined factors, including the increasing complexity of materials being machined (e.g., titanium alloys, stainless steels, and inconel), which necessitates tools with superior thermal and wear resistance. Furthermore, the global proliferation of CNC machines and multi-axis machining centers supports the adoption of more sophisticated threading methods like synchronized tapping and high-feed thread milling. The continuous focus on minimizing operational costs and maximizing efficiency in high-volume production environments serves as a perpetual accelerator for innovation within the internal threading tool segment, compelling manufacturers to develop new geometries and proprietary coatings.

Internal Threading Tool Market Executive Summary

The Internal Threading Tool Market is characterized by steady technological refinement aimed at addressing the challenges posed by difficult-to-machine materials and the persistent industry demand for shorter cycle times. Current business trends indicate a strong shift towards integrated tooling solutions, where thread creation tools are bundled with monitoring systems or optimized specifically for automated manufacturing cells. Key market players are heavily investing in proprietary PVD and CVD coating technologies to dramatically improve tool longevity and performance repeatability, especially under dry or minimum quantity lubrication (MQL) conditions. Consolidation through strategic mergers and acquisitions remains a significant activity as companies seek to expand their geographic footprint and acquire specialized expertise, particularly in advanced thread milling techniques.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive expansion in automotive and electronics manufacturing in countries like China, India, and South Korea. This region exhibits high volume demand, often prioritizing cost-effectiveness alongside reliability. North America and Europe, while mature, remain crucial markets focused on high-performance tooling for aerospace, medical, and high-tech general engineering sectors, demanding premium pricing for innovation in material science and digital integration. These developed regions are the earliest adopters of Industry 4.0 paradigms, integrating smart tooling capable of real-time performance feedback.

Segmentation trends highlight the increasing prominence of thread milling tools, which offer greater versatility, enhanced stability, and the ability to process large-diameter threads with reduced power consumption compared to traditional tapping. Material-wise, cemented carbide tools, particularly those featuring advanced multi-layer coatings, dominate the high-performance segment due to their superior hardness and thermal stability. Application analysis confirms that the automotive industry retains the largest market share, though aerospace and medical device sectors are experiencing the fastest growth rates due to stringent quality requirements and continuous demand for complex, miniature threaded components.

AI Impact Analysis on Internal Threading Tool Market

User queries regarding the impact of Artificial Intelligence (AI) on the Internal Threading Tool Market predominantly center on how AI can optimize tool usage, predict wear, and automate process planning. Key concerns revolve around the integration cost of AI-driven monitoring systems, the accuracy of predictive maintenance algorithms in dynamic machining environments, and the ability of AI to select the optimal threading tool and cutting parameters for novel materials. Users expect AI to significantly reduce unplanned downtime by anticipating tool failure and to improve overall thread quality consistency through real-time adaptive process control. Furthermore, content consumers are highly interested in AI’s role in automating tool design and geometry optimization based on extensive performance data gathered in diverse industrial settings, transitioning tool development from iterative physical testing to accelerated digital simulation.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, acoustic emission, and power consumption data to accurately forecast the remaining useful life of threading tools, minimizing catastrophic failures.

- Optimized Process Parameter Selection: AI systems recommend the ideal spindle speed, feed rate, and lubricant application based on material properties, machine rigidity, and tool geometry, leading to enhanced performance and extended tool life.

- Automated Quality Control: Integration of machine vision and AI for real-time inspection of manufactured threads, instantly identifying defects like chips, tears, or incorrect pitch, ensuring zero-defect output.

- Smart Tool Design and Simulation: AI accelerates the development cycle by simulating tool performance under various cutting conditions, identifying optimal geometries and coating compositions faster than traditional trial-and-error methods.

- Inventory and Supply Chain Optimization: AI models predict future tool consumption based on production schedules, enabling just-in-time inventory management for specific threading tool types and reducing capital tied up in excess stock.

DRO & Impact Forces Of Internal Threading Tool Market

The dynamics of the Internal Threading Tool Market are shaped by a powerful confluence of drivers (D) related to manufacturing complexity and efficiency mandates, significant restraints (R) stemming from technological barriers and material costs, and compelling opportunities (O) found in digitalization and emerging industrial sectors. The primary drivers include the mandatory shift towards high-performance machining driven by complex material usage in high-growth sectors like aerospace and energy, alongside the global trend of manufacturing automation requiring predictable, long-lasting tools. Restraints are predominantly centered on the high initial investment required for advanced carbide and specialized coating technologies, coupled with the persistent challenge of managing chip evacuation and thermal load when machining deep internal threads in tough materials.

Opportunities for growth are plentiful, particularly in the integration of tooling with Industry 4.0 ecosystems, allowing for digital twin creation and remote performance monitoring. The rising demand for miniature and micro-threading tools, driven by the expanding medical device and micro-electronics industries, presents a lucrative niche. Furthermore, sustainability pressures are creating opportunities for innovative tool reconditioning services and the development of tools optimized for minimum quantity lubrication (MQL) or dry machining environments, reducing reliance on conventional coolants. These forces interact to create a moderately competitive but technologically progressive market landscape.

The impact forces influencing the market trajectory are categorized by rapid technological shifts in tool materials and coatings, intense pricing pressure from Asian manufacturers affecting standard HSS tools, and strict regulatory requirements, especially in safety-critical sectors like aerospace, mandating verifiable thread quality. These external forces compel market participants to maintain a continuous cycle of innovation, ensuring that their product portfolios address both performance maximization for premium segments and cost-efficiency for mass-production environments, ultimately accelerating the obsolescence cycle for older, less efficient tooling technologies.

Segmentation Analysis

The Internal Threading Tool Market is comprehensively segmented based on Type, Material, Application, and Geometry, reflecting the diversity of machining processes and end-user requirements. This granular classification allows for precise market sizing and strategic focus, highlighting areas where technological innovation yields the highest returns. Segmentation by Type, dividing the market into taps, thread mills, and dies, shows distinct growth patterns, with thread mills gaining traction due to their flexibility and superior control over chip formation in difficult materials. Material segmentation (HSS, Carbide, Ceramic) dictates tool performance and cost structure, with cemented carbide dominating the value segment due to its unparalleled hardness and wear resistance in high-speed applications.

Application-based segmentation provides insight into end-user spending behavior, confirming that the automotive sector represents the largest demand volume, while aerospace and medical sectors prioritize quality and specialized tool geometries, driving average selling prices upwards. Geometry-based classification (straight flutes, spiral flutes, thread forming, relief geometries) is critical as it directly addresses specific operational challenges, such as through-hole vs. blind-hole threading and the nature of the material being cut. Analyzing these segments reveals a market trajectory leaning heavily towards complex, application-specific tools capable of maximizing efficiency in automated, high-precision manufacturing environments.

- Type:

- Taps (Cutting Taps, Forming Taps)

- Thread Mills (Indexable Insert Thread Mills, Solid Carbide Thread Mills)

- Dies and Die Heads

- Thread Inserts

- Material:

- High-Speed Steel (HSS)

- Carbide (Solid Carbide, Cemented Carbide)

- High-Performance Ceramics

- Diamond/CBN-Tipped Tools

- Application:

- Automotive Industry

- Aerospace and Defense

- General Engineering and Machine Building

- Oil and Gas (Energy)

- Medical Devices

- Die and Mold Industry

- Coating Technology:

- PVD Coatings (TiAlN, AlCrN)

- CVD Coatings

- Uncoated/Minimal Coatings

Value Chain Analysis For Internal Threading Tool Market

The value chain for the Internal Threading Tool Market initiates with upstream activities focused on the sourcing and processing of raw materials, primarily tungsten carbide powder, high-speed steel alloys, and various coating precursors (e.g., Titanium, Aluminum compounds). This phase is capital intensive and highly reliant on a few specialized material suppliers who dictate commodity pricing volatility. Manufacturers then engage in core processes: powder metallurgy, sintering (for carbide tools), grinding, and advanced surface finishing, often utilizing proprietary grinding wheel technologies to achieve precise tool geometries. The integration of advanced coating facilities, typically either PVD (Physical Vapor Deposition) or CVD (Chemical Vapor Deposition), adds significant value and differentiation potential to the tools, enhancing their thermal resistance and wear characteristics.

Downstream activities involve complex distribution channels characterized by a mixture of direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through extensive networks of specialized industrial distributors, tool crib providers, and machine tool resellers. Direct sales offer maximum control and deep technical support for high-volume or highly specialized orders, particularly in aerospace and automotive Tiers 1 and 2. Conversely, the indirect channel is essential for reaching small to medium-sized enterprises (SMEs) and maintaining geographically dispersed market penetration, relying heavily on the distributor’s inventory management and local technical expertise. Digital platforms are increasingly used to bypass traditional channels for standard catalog items, particularly in mature markets.

The efficiency of the value chain is largely determined by logistics and the ability of manufacturers to provide rapid, localized technical support and reconditioning services. Lead times for customized or highly specialized tools are critical in modern manufacturing environments. Companies that successfully integrate their sales force with technical application engineers and maintain strong partnerships with downstream distributors capable of providing timely technical assistance and inventory holding are best positioned to capture market share and maintain high customer retention rates. The trend toward tool management contracts further centralizes the downstream control, integrating supply and usage monitoring directly with the tool manufacturer.

Internal Threading Tool Market Potential Customers

The primary end-users and buyers of internal threading tools are manufacturing organizations engaged in precision metalworking across a vast spectrum of industries. The largest customer base resides within the automotive sector, including large vehicle manufacturers (OEMs) and their Tier 1 and Tier 2 suppliers who require enormous volumes of standardized threading tools for engine, chassis, and drivetrain component production. These customers prioritize high repeatability, long tool life, and consistent quality to support high-throughput, automated production lines. The shift towards electric vehicles (EVs) is subtly changing demand, requiring specialized tools for lighter materials (e.g., aluminum) used in battery casings and chassis components.

Another crucial customer segment is the aerospace and defense industry, including aircraft manufacturers and component suppliers. These buyers represent the premium segment, demanding tools capable of machining exotic, high-nickel alloys (e.g., Inconel and Titanium) under highly stringent quality control standards. For this group, tool reliability and precision accuracy are paramount, often outweighing cost considerations. The third major segment is general engineering, encompassing machine tool builders, mold and die makers, and heavy machinery manufacturers. This segment requires a broad range of standard and semi-standard tools for general maintenance, repair, and operational (MRO) activities, as well as new machine construction, driving demand for versatile, multi-purpose tooling solutions.

Emerging and high-growth potential customers include manufacturers in the medical device industry, who rely on internal threading tools to create extremely small, precise threads for surgical instruments, implants, and diagnostic equipment. Similarly, the energy sector, particularly oil and gas drilling equipment and power generation turbine manufacturers, requires exceptionally robust and specialized threading tools to handle high-strength steels and deep-hole threading applications where thermal and mechanical stresses are extreme. These varied end-user requirements necessitate that tool providers offer tailored product lines, focusing on application-specific geometries and coatings for maximum customer value.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik Coromant, Kennametal, Iscar, Seco Tools, OSG, Walter AG, Ceratizit, Mitsubishi Materials, YG-1, Guhring, Emuge-Franken, Tungaloy, Sumitomo Electric, Mapal, LMT Tools, Kyocera, ZCC CT, Dormer Pramet, Star Cutter, Allied Machine & Engineering |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Internal Threading Tool Market Key Technology Landscape

The technological landscape of the Internal Threading Tool Market is defined by continuous advancements in tool material science, geometry optimization, and surface engineering. The core technological imperative is to enhance tool resistance against heat, abrasion, and fracture, especially when processing modern, difficult-to-machine superalloys. Key innovations include the development of new cemented carbide grades with finer grain structures and higher cobalt content, offering an optimal balance of hardness and toughness. Simultaneously, manufacturers are perfecting novel PVD (Physical Vapor Deposition) and CVD (Chemical Vapor Deposition) multilayer coatings, often incorporating elements like aluminum chromium nitride (AlCrN) and nanostructured layers, which provide superior thermal barriers and reduced friction, dramatically extending tool life in high-speed and dry cutting operations.

In terms of tool design, a significant technological shift is the increasing sophistication of thread milling solutions. Modern solid carbide thread mills incorporate advanced helix and flute geometries designed explicitly for superior chip evacuation and minimized cutting forces. This technology is gaining momentum because it allows for high-quality threading in deep holes and hard materials where tapping breakage risks are high. Furthermore, synchronized tapping technology, which precisely coordinates spindle rotation and feed rate, relies on high-precision tool shanks and rigorous geometric stability to ensure optimal thread accuracy, driving demand for tighter manufacturing tolerances in the tools themselves.

Digitalization represents another crucial layer of technological advancement. Modern threading tools are increasingly integrated into smart manufacturing ecosystems. This includes the implementation of RFID chips or data matrix codes on tool holders, allowing automated machine recognition and tracking of tool life history. This integration facilitates predictive maintenance, automated parameter setting, and closed-loop manufacturing feedback. The use of advanced simulation software also allows tool manufacturers and end-users to predict threading performance before physical cutting, optimizing tool paths and mitigating risk when moving to new materials or complex geometries, ultimately driving up efficiency across the production floor.

Regional Highlights

The global distribution of demand and manufacturing capacity dictates regional market performance, with distinct drivers influencing each major geographical zone.

- Asia Pacific (APAC): This region is the undisputed leader in both consumption volume and growth rate. Dominance is driven by the massive scale of the manufacturing bases in China and India, particularly in the automotive, consumer electronics, and general machinery sectors. High investment in infrastructure and urbanization continues to fuel demand for standard and high-volume threading solutions. The shift of global supply chains towards Southeast Asian nations further strengthens the regional market.

- North America: Characterized by a strong emphasis on high-performance tooling, particularly for the aerospace, oil & gas, and medical device industries. North America is a key early adopter of advanced technologies like specialized thread mills and digitally integrated tooling. Demand here is focused less on volume and more on precision, reliability, and the ability to process challenging materials like titanium and nickel-based superalloys.

- Europe: A mature market defined by strong technical expertise and high standards, particularly in Germany (machine building, automotive) and France/UK (aerospace). European demand favors premium, environmentally compliant tools optimized for Minimum Quantity Lubrication (MQL). The region leads in the standardization of threading quality and adherence to strict manufacturing tolerances, promoting continuous innovation in coating technology and tool geometry.

- Latin America (LATAM): Growth in this region is volatile but significant, primarily driven by automotive production (Brazil, Mexico) and resource extraction industries. The market often balances cost-effectiveness with performance, leading to a strong demand mix of HSS and entry-level carbide tooling, though investment in high-end machinery is steadily increasing.

- Middle East and Africa (MEA): Demand is highly concentrated in the oil and gas sector, requiring extremely robust threading tools for drilling, piping, and specialized infrastructure components. High-pressure, high-temperature applications necessitate specialized thread forms and durable tool materials. Non-oil economies show gradual growth linked to infrastructure and local assembly operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Internal Threading Tool Market.- Sandvik Coromant

- Kennametal

- Iscar

- Seco Tools

- OSG

- Walter AG

- Ceratizit

- Mitsubishi Materials

- YG-1

- Guhring

- Emuge-Franken

- Tungaloy

- Sumitomo Electric

- Mapal

- LMT Tools

- Kyocera

- ZCC CT

- Dormer Pramet

- Star Cutter

- Allied Machine & Engineering

Frequently Asked Questions

Analyze common user questions about the Internal Threading Tool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using thread milling over traditional tapping?

Thread milling offers enhanced versatility, superior chip evacuation, and allows for threading of extremely hard materials or large diameters with lower power requirements. It mitigates the risk of catastrophic tool breakage, especially in blind holes, and often achieves a better surface finish and higher thread quality.

How does the shift towards electric vehicles (EVs) impact the demand for internal threading tools?

The EV shift reduces demand for complex engine block threading tools but increases the need for high-performance tools capable of accurately threading aluminum and composite materials used in battery enclosures, chassis components, and lighter structural parts, driving innovation toward specialized geometries.

Which tool material segment exhibits the fastest growth in the internal threading tool market?

Cemented carbide tools, particularly solid carbide thread mills and inserts, show the fastest growth. This is due to their superior hardness, heat resistance, and performance when coupled with advanced PVD/CVD coatings, enabling higher cutting speeds and longer tool life required by automated manufacturing.

What role does Industry 4.0 integration play in modern internal threading tool technology?

Industry 4.0 facilitates the use of smart tooling embedded with sensors or RFID tags, enabling real-time performance monitoring, predictive wear analysis via AI, and automated feedback loops for adaptive process control, significantly boosting overall equipment effectiveness (OEE) and quality consistency.

What are the critical factors determining the choice between a cutting tap and a thread forming tap?

Cutting taps are suitable for harder, abrasive materials and produce chips, requiring efficient chip evacuation. Forming taps (or roll taps) are ideal for ductile materials, produce no chips, offer stronger threads, and have longer tool life, but require more torque and specific material ductility.

The market analysis further elaborates on the competitive ecosystem, detailing the strategic positioning of key market participants. Companies like Sandvik Coromant, Kennametal, and Iscar maintain leadership through continuous investment in proprietary material science, focusing on high-end carbide grades and specialized coating systems tailored for aerospace and medical applications. Their dominance is supported by extensive global distribution networks and comprehensive technical support services, which are critical differentiators in the premium segment. Conversely, Asian manufacturers, exemplified by OSG and YG-1, focus heavily on volume manufacturing and broad product lines, often driving price competitiveness in the standard HSS and entry-level carbide segments, particularly targeting the robust growth in the APAC region's general engineering and automotive Tier 2 markets.

Emerging market dynamics suggest increased collaboration between tool manufacturers and machine tool builders to develop integrated solutions. This strategy ensures that threading tools are perfectly optimized for new high-speed or multi-tasking CNC machinery, reducing implementation time and maximizing efficiency for end-users. The continuous pursuit of miniaturization, driven by the electronics and medical sectors, mandates significant R&D spending on micro-threading tools, requiring ultra-precise grinding capabilities and microscopic coating application techniques. Furthermore, environmental regulations are placing greater pressure on manufacturers to adopt sustainable practices, fostering the development of reconditioning programs and tools designed to operate effectively with minimal or no coolants, transforming the operational cost structure for end-users.

In conclusion, the Internal Threading Tool Market remains essential to global manufacturing infrastructure, evolving primarily through technological innovation rather than simple capacity expansion. The market trajectory is intrinsically linked to macro-industrial trends, including the increasing penetration of automation, the adoption of advanced materials across high-stress applications, and the imperative for zero-defect production facilitated by digital integration. Success in this market is highly dependent on a manufacturer's ability to provide not just a tool, but a precision engineered solution integrated into the broader manufacturing process, offering verifiable improvements in efficiency and thread quality across diverse and challenging materials. The projected growth reflects a resilient industrial core driven by precision engineering demands worldwide, ensuring sustained investment in advanced tooling technologies throughout the forecast period.

A deeper dive into regional investment patterns reveals that governmental incentives for domestic manufacturing, particularly in North America and Europe, aimed at securing supply chains, are indirectly boosting demand for high-quality, domestically or regionally sourced threading tools. This trend emphasizes reliability and technical compliance, often favoring established market leaders who can meet stringent certifications. Conversely, rapid industrialization across parts of Southeast Asia is creating massive greenfield opportunities, where tool selection is heavily influenced by total cost of ownership (TCO) over raw initial price, reflecting growing sophistication among regional procurement managers.

The specialized sub-segment of threading inserts for indexable tool holders is experiencing notable growth. These inserts offer flexibility and cost efficiency, as only the cutting edge needs replacement rather than the entire tool. Technological breakthroughs here involve designing inserts with optimized chip breaker geometries and highly adhesive multi-layer coatings that resist thermal fatigue during intermittent cutting. This indexable technology is particularly favored in large-scale machining centers and for machining tougher materials where minimizing tool change time is critical to maintaining high throughput and machine utilization rates.

Furthermore, standardizations and regulatory compliance play a critical role, especially concerning thread measurement and quality assurance. Tools must consistently produce threads that meet ISO and ANSI standards. Leading tool providers often offer proprietary monitoring and gauging solutions that integrate directly with their tooling, ensuring compliance and providing customers with the necessary documentation for quality audits in sectors like aerospace and medical implants. This move towards bundled solutions—tool, measurement, and data integration—is a defining feature of the market's progression towards a service-oriented model, enhancing the overall value proposition beyond the physical cutting capability of the tool itself. This commitment to quality assurance is a powerful barrier to entry for smaller or less technically capable competitors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager