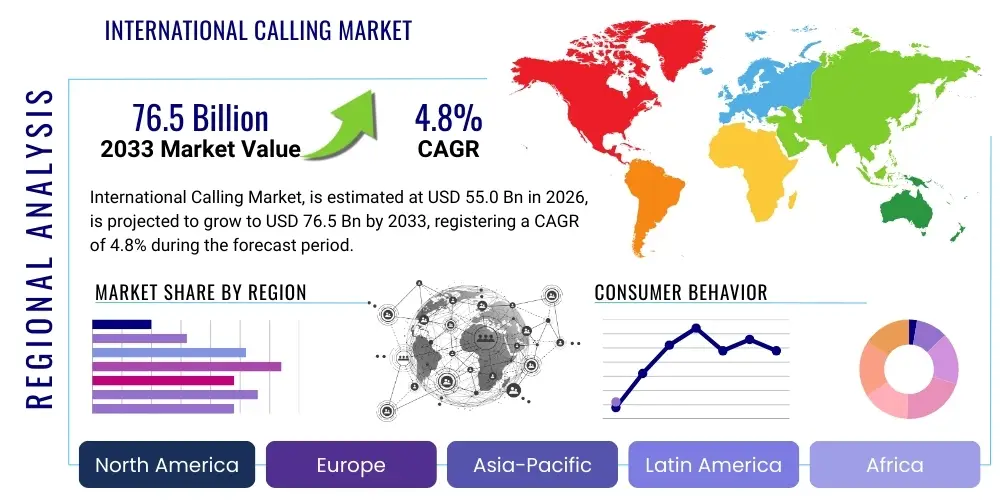

International Calling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434845 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

International Calling Market Size

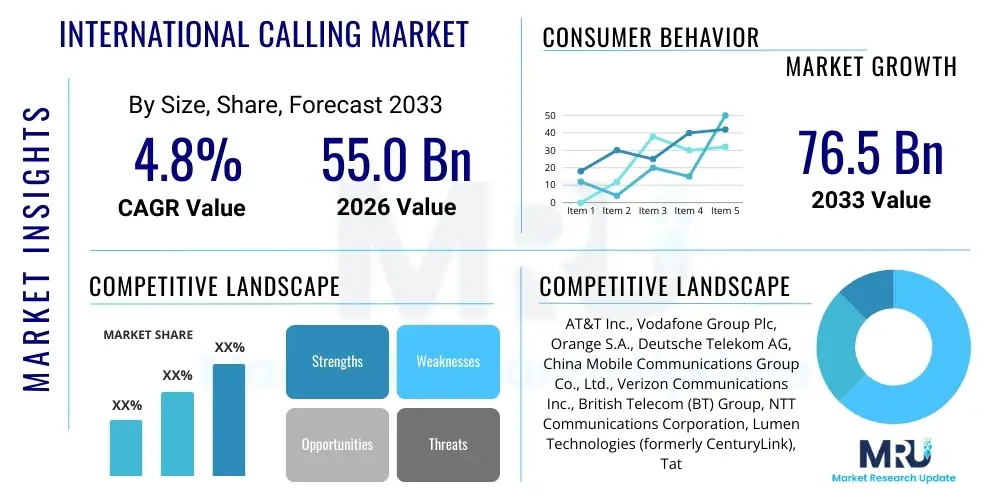

The International Calling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 55.0 Billion in 2026 and is projected to reach USD 76.5 Billion by the end of the forecast period in 2033.

The resilience of the international calling sector, despite intense competition from Over-The-Top (OTT) messaging and video calling applications, is driven primarily by the persistent demand for high-quality, reliable, and secure communication channels, particularly within the business and regulatory sectors. While consumer calling volume has shifted significantly towards free VoIP services, the wholesale termination market and enterprise-level voice solutions, including SIP trunking for global connectivity, continue to provide substantial revenue streams. Market growth is structurally supported by increasing global migration patterns, which necessitate cross-border communication, alongside the expansion of multinational corporations requiring seamless internal and external voice infrastructure across diverse geographical locations.

Furthermore, technological advancements, specifically the widespread deployment of 5G infrastructure, are enhancing the quality of service (QoS) for international voice calls, making proprietary telecom services more attractive for latency-sensitive applications compared to standard residential internet connections used by OTT platforms. Regulatory changes in developing economies, often leading to reduced international call termination rates, are democratizing access to global communication, stimulating volume growth even as per-minute tariffs decline. This balancing act between volume increase and price reduction defines the market's moderate but stable growth trajectory over the forecast period, emphasizing the shift from traditional circuit-switched networks to fully IP-based architectures.

International Calling Market introduction

The International Calling Market encompasses all telecommunication services facilitating voice communication between subscribers located in different sovereign nations. Historically dominated by Public Switched Telephone Network (PSTN) infrastructure utilizing traditional circuit-switching technology, the market has rapidly transitioned toward Voice over Internet Protocol (VoIP) solutions, leveraging the global infrastructure of the internet to transmit voice data efficiently and at reduced costs. This transformation has segmented the market into high-margin enterprise solutions, providing guaranteed Service Level Agreements (SLAs) for global business operations, and low-cost consumer services, often delivered through carrier-grade VoIP networks or competitive reseller channels. The core function of this market remains connecting individuals and businesses across borders, supporting global commerce, diplomacy, and social ties.

Major applications of international calling services span several crucial domains. In the corporate sphere, applications include setting up global contact centers, facilitating inter-office communication, supporting remote workforce operations, and ensuring business continuity through reliable global voice platforms. For consumers, the primary application is maintaining personal relationships across borders, highly dependent on migration flows. Key benefits driving market persistence include superior call quality and reliability compared to best-effort internet services, guaranteed Caller ID delivery (essential for business verification), integration with legacy Private Branch Exchange (PBX) systems, and compliance with national telecommunications regulations. These factors distinguish commercial international calling from free alternatives, particularly in high-stakes environments.

Driving factors for sustained market development include the increasing pace of globalization, which correlates directly with demand for international business connectivity; the continuous decline in bandwidth costs, which reduces the operational expenditure for voice transmission; and the rising necessity for multi-factor authentication (MFA) and verification services that rely on reliable international SMS and voice channels. Moreover, the emergence of hybrid models where traditional carriers partner with VoIP providers to offer optimized global routes is further streamlining service delivery, thereby expanding market reach and sustaining moderate revenue growth.

International Calling Market Executive Summary

The International Calling Market is undergoing a strategic recalibration, moving away from high-tariff per-minute pricing towards high-volume, flat-rate, subscription-based models, particularly targeting the enterprise segment. Current business trends indicate a strong prioritization of digital transformation initiatives, where multinational corporations are consolidating disparate voice infrastructures onto unified communications platforms, relying heavily on global SIP trunking providers for cross-border voice termination. This consolidation is putting pressure on legacy carriers but creating immense opportunity for cloud-based communication providers (CPaaS). Furthermore, heightened focus on network security and anti-fraud measures—especially concerning Call Detail Record (CDR) integrity and regulatory compliance—is becoming a critical differentiator, shaping vendor selection across all market tiers. The shift toward specialized routing algorithms that prioritize cost efficiency without sacrificing quality underscores the operational evolution of the market.

Regionally, the Asia Pacific (APAC) and Middle East & Africa (MEA) regions are exhibiting the fastest growth due to extensive labor migration corridors, increasing disposable income leading to higher international contact frequency, and significant infrastructure investments, particularly in 4G and 5G networks, which improve the feasibility and quality of IP-based international services. North America and Europe, while representing the largest revenue bases, are characterized by market saturation and intense competition, focusing more on quality enhancements, bundled services (data, voice, video), and advanced enterprise solutions such as Artificial Intelligence (AI)-driven call routing and predictive analytics. Regulatory fragmentation across emerging economies remains a challenge, necessitating complex operational strategies for market entry and tariff management.

Segmentation trends highlight the dominance of the Business User segment, valued for its higher average revenue per user (ARPU) and consistent demand for premium quality and security. Within technology, VoIP continues its trajectory as the standard for both wholesale and retail international calling, effectively marginalizing traditional circuit-switched infrastructure except in highly regulated or technologically constrained areas. Application-wise, corporate communications infrastructure maintenance and global supply chain management drive robust demand, contrasting with the relatively volatile and price-sensitive personal user segment, which is highly influenced by alternative free communication tools.

AI Impact Analysis on International Calling Market

User questions regarding the impact of Artificial Intelligence (AI) on the International Calling Market center around three key themes: efficiency gains in network operations, enhanced security against fraud, and the future role of real-time language translation. Users are primarily concerned with how AI optimization algorithms can dynamically select the cheapest, highest-quality international route (least-cost routing 2.0) and how machine learning can detect sophisticated fraudulent activities, such as interconnect bypass or robocalling, which cost carriers billions annually. Furthermore, there is significant interest in AI-powered natural language processing (NLP) to facilitate seamless, real-time multilingual conversations, potentially broadening the user base for direct voice calls by removing linguistic barriers.

AI is fundamentally reshaping the operational landscape of international calling from the core network to the end-user experience. Within network management, predictive analytics driven by AI models allow carriers to anticipate capacity constraints, dynamically allocate resources, and perform proactive fault detection, ensuring superior Service Quality Indicators (SQI) for international traffic. This not only minimizes service downtime but also optimizes capital expenditure by maximizing the utilization efficiency of existing global peering points and termination agreements. By automating these complex network decisions, AI contributes directly to reducing operational costs, a crucial factor in a market characterized by continuous price compression.

In the security domain, AI provides robust defense mechanisms against escalating telecommunications fraud. Machine learning models analyze Call Detail Records (CDRs) and behavioral patterns in real-time, identifying anomalies indicative of toll fraud, traffic pumping, or account takeovers far faster and more accurately than traditional rule-based systems. Moreover, the application of AI in customer service, utilizing intelligent virtual agents to handle routine international billing and technical support queries, significantly improves customer satisfaction and reduces the workload on human agents, further streamlining the service delivery chain and reinforcing the reliability image of paid international calling services.

- AI-Powered Least-Cost Routing (LCR 2.0) optimizes call termination paths based on real-time QoS and pricing models.

- Machine learning algorithms significantly enhance fraud detection rates (e.g., SIM boxing, PBX hacking) through behavioral analysis of traffic patterns.

- Real-time voice translation services driven by NLP increase accessibility for business and personal cross-lingual communication.

- Predictive network maintenance utilizes AI to anticipate congestion and resource demands on international routes, improving uptime.

- Intelligent Customer Support (Chatbots/Voicebots) handles international billing and technical inquiries, reducing operational overhead.

- AI aids in dynamic bandwidth allocation across global IP networks to maintain high voice quality despite varying internet conditions.

DRO & Impact Forces Of International Calling Market

The dynamics of the International Calling Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the market's impact forces. Key drivers include sustained global economic integration, high levels of international migration requiring constant cross-border contact, and the inherent reliability requirements of the business sector that cannot rely solely on consumer-grade internet connectivity for mission-critical voice communications. However, the market faces significant restraints, most notably the omnipresence of free Over-The-Top (OTT) communication applications like WhatsApp and Zoom, which capture the majority of the consumer leisure calling segment, and complex, often volatile, regulatory environments regarding international termination rates, particularly in developing markets, which introduce cost uncertainty.

Opportunities for growth are concentrated in the enterprise segment, specifically the proliferation of Unified Communications as a Service (UCaaS) platforms and global Contact Center as a Service (CCaaS) deployments, both of which require dedicated, high-quality international voice services often delivered via global SIP trunks. The deployment of 5G networks globally represents a substantial opportunity, promising ultra-low latency and enhanced mobile broadband, which significantly improves the quality and reliability of international mobile VoIP, thereby potentially attracting some consumers back to premium carrier-grade services. Additionally, specializing in niche high-security services, such as encrypted government or financial sector communications, offers lucrative avenues for specialized providers.

The impact forces are currently skewed toward technology disruption and price competition. The disruptive force of OTT platforms forces carriers to innovate or pivot their business models entirely towards wholesale termination or high-value enterprise services. Regulatory influence remains strong, as governmental decisions on mobile termination rates (MTRs) directly affect carrier profitability and consumer pricing strategies across the globe. Ultimately, the market trajectory is defined by the carrier's ability to provide differentiated value—be it through guaranteed security, superior quality, or seamless integration with modern cloud telephony systems—that free alternatives cannot replicate, ensuring that paid international calling maintains its essential role in global telecommunication infrastructure.

Segmentation Analysis

The International Calling Market is strategically segmented based on factors including the technology used, the type of user, and the application domain. This segmentation is crucial for understanding revenue streams and identifying specific growth areas, particularly as the market transitions from legacy infrastructure to cloud-native solutions. The Technology segment differentiates between traditional Circuit-Switched voice (decline phase) and modern VoIP (growth driver), reflecting the industry's investment priorities. User segmentation between Residential and Business clients highlights the disparity in quality expectations, price sensitivity, and resulting ARPU, with the Business segment being the most financially vital. Application segmentation clarifies the end-use, distinguishing critical corporate operations from general personal communication needs.

The segmentation strategy effectively allows market players to tailor service packages. For instance, services targeting the Corporate Application segment will prioritize robust SLAs, dedicated bandwidth, and advanced security features, regardless of the higher price point. Conversely, services aimed at the Residential User and Personal Application segments must be highly cost-competitive, often relying on prepaid models and high-volume, low-margin transactions. The technological shift underpinning these segments is pivotal; the maturity of VoIP technology has enabled specialized sub-segments such as wholesale VoIP termination, where high-volume traffic is traded between carriers at razor-thin margins, and retail VoIP, which focuses on branded consumer offerings.

Successful market participation now requires specialized knowledge across these segments. Providers focusing on the Value Added Services (VAS) sub-segment, such as global toll-free numbers, international call forwarding, or cloud PBX extensions for multi-national businesses, command higher pricing power. This specialization contrasts sharply with the bulk termination segment, where pricing is determined almost entirely by international regulatory termination caps and real-time supply and demand for high-quality routing paths, illustrating the vast structural and economic differences within the overall international calling ecosystem.

- By Technology

- Voice over Internet Protocol (VoIP)

- Circuit-Switched Networks (CSN)

- By User Type

- Residential Users (Consumer)

- Business Users (Enterprise)

- By Application

- Corporate Communication & Infrastructure

- Personal Communication

- Wholesale Termination

- By Service Type

- Prepaid Services

- Postpaid/Subscription Services

- Bundled Services (Voice/Data/SMS)

Value Chain Analysis For International Calling Market

The value chain of the International Calling Market is structurally complex, involving multiple layers from infrastructure ownership to final service delivery and monetization. Upstream activities begin with the development and maintenance of core telecommunications infrastructure, including submarine fiber optic cables, satellite networks, and global IP exchange points. Key upstream providers include cable consortiums and large Tier 1 carriers who own these physical assets. This segment is highly capital-intensive and characterized by long investment cycles. The transition to VoIP technology has significantly shifted resource allocation towards software-defined networking (SDN) and Network Function Virtualization (NFV) infrastructure, increasing reliance on specialized software vendors for switching and routing capabilities.

Midstream activities primarily involve aggregation, routing, and wholesale trading. Wholesale carriers and aggregators purchase capacity from upstream infrastructure providers and manage complex interconnections (peering agreements) to route calls across international borders. Their core competency lies in advanced Least-Cost Routing (LCR) algorithms, maintaining high QoS, and managing regulatory compliance for international voice termination rates. Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves large carriers selling services directly to enterprise clients or end-consumers via owned retail channels. Indirect distribution relies heavily on resellers, Mobile Virtual Network Operators (MVNOs), and specialized VoIP service providers who brand and package wholesale minutes for local distribution, leveraging existing local market penetration.

Downstream activities focus on the final retail delivery and customer engagement. This includes setting up billing systems, providing customer support, implementing anti-fraud measures specific to retail traffic, and marketing the services. The downstream segment is highly competitive and consumer-facing, requiring excellence in user experience, especially in prepaid models common in the residential segment. The profitability of the entire chain hinges on the efficiency of the midstream routing decisions and the ability of downstream providers to differentiate their service through value-added features like unified communication integration or specialized security protocols.

International Calling Market Potential Customers

The market for international calling services is broad yet stratified, targeting two primary groups: businesses and residential users, each with distinct volume, quality, and price requirements. Enterprise customers constitute the highest-value segment, encompassing multinational corporations (MNCs), small and medium-sized enterprises (SMEs) with global supply chains, e-commerce platforms, and governmental agencies. These buyers require robust, high-availability international connectivity for operational necessities such as global conferencing, maintaining international contact centers (CCaaS clients), establishing cloud PBX systems with global extensions, and ensuring secure communication lines for proprietary data transmission. Their purchasing criteria prioritize guaranteed SLAs, low latency, seamless integration capabilities (API access), and comprehensive security over marginal cost savings.

Residential users, the second major group, consist primarily of immigrants, expatriates, and individuals with family or social ties in other countries. Although this segment has been heavily cannibalized by free OTT applications for routine conversations, a consistent need persists for reliable, high-quality, and cost-effective services for contacts who lack reliable internet access or are situated in areas where OTT services are restricted or banned. Additionally, these users often require international calling for official purposes like contacting banks, hospitals, or government offices that strictly require traditional PSTN or reliable VoIP lines, positioning them as persistent, albeit price-sensitive, consumers of prepaid international calling cards and subscription plans.

A rapidly growing third segment comprises digital service providers and technology platforms that rely on international voice and SMS for authentication and operational processes. This includes financial technology (FinTech) firms requiring cross-border voice verification for transactions, Software as a Service (SaaS) providers needing global phone number registration, and bulk SMS aggregators utilizing the voice infrastructure for fallback authentication or critical alerts. These specialized business-to-business (B2B) consumers are driven by reliability and global coverage, often subscribing to SIP trunking services or wholesale minute bundles to support their core platform functions, thereby ensuring reliable international reach for millions of end-users globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Billion |

| Market Forecast in 2033 | USD 76.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AT&T Inc., Vodafone Group Plc, Orange S.A., Deutsche Telekom AG, China Mobile Communications Group Co., Ltd., Verizon Communications Inc., British Telecom (BT) Group, NTT Communications Corporation, Lumen Technologies (formerly CenturyLink), Tata Communications, Telefónica S.A., IDT Corporation, BICS, Telia Carrier, Vonage (Ericsson), RingCentral, Twilio Inc., GTT Communications, Airtel (Bharti Airtel), Etisalat Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

International Calling Market Key Technology Landscape

The International Calling Market is fundamentally driven by advancements in digital transmission and routing technologies. The overarching shift is the migration from legacy Time-Division Multiplexing (TDM) and Circuit-Switched Networks (CSN) to fully Internet Protocol (IP)-based systems, primarily using Voice over Internet Protocol (VoIP). Key technology components include Session Initiation Protocol (SIP) for signaling and establishing calls, Real-time Transport Protocol (RTP) for transmitting voice data, and high-capacity global IP networks for carrying the traffic. The efficiency of modern international calling hinges on sophisticated SIP trunking solutions that allow enterprises to connect their PBX systems to a global carrier network seamlessly, bypassing traditional, expensive dedicated lines. The quality of these services is increasingly guaranteed through stringent Quality of Service (QoS) mechanisms implemented across carrier backbones to prioritize voice packets and minimize jitter and latency, crucial for maintaining natural conversation flow over long distances.

The introduction and scaling of 5G wireless technology represent the next major wave of technological evolution impacting this sector. 5G’s enhanced capacity, speed, and drastically reduced latency make high-definition (HD) international voice calling viable on mobile devices, closing the quality gap between fixed-line and mobile communication and potentially increasing demand for premium mobile VoIP services. Furthermore, advanced routing technologies, often augmented by Artificial Intelligence and machine learning, are essential for managing the sheer complexity of global voice traffic. These technologies enable dynamic routing decisions, instantaneously evaluating hundreds of potential international routes based on real-time factors like congestion, cost, historical quality metrics, and regulatory compliance, optimizing carrier profitability while ensuring caller experience.

Security technologies are also a prominent feature of the modern landscape. Due to the high financial losses associated with telecommunications fraud (such as arbitrage, call hijacking, and revenue share fraud), carriers heavily invest in advanced signaling firewalls, deep packet inspection (DPI), and sophisticated fraud management systems (FMS). Encryption protocols, such as Secure Real-time Transport Protocol (SRTP), are increasingly demanded by enterprise customers to protect sensitive international communication from eavesdropping. The successful adoption of these layered technologies—from high-speed infrastructure (5G/Fiber) to intelligent routing (AI/SDN) and robust security (SRTP/FMS)—is essential for maintaining competitiveness and perceived value in the face of free communication alternatives.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market due to immense population density, extensive outbound and inbound labor migration (especially from India, China, the Philippines, and Bangladesh), and rapid deployment of mobile and internet infrastructure. The market is highly price-sensitive in the consumer segment but exhibits strong growth in wholesale traffic and enterprise connectivity driven by expanding manufacturing and service industries requiring global BPO operations. Regulatory diversity and varying termination rates across countries like China, India, and Southeast Asia necessitate complex operational strategies for global carriers.

- North America (NA): North America is characterized by high ARPU and technological maturity. The market focus is primarily on advanced enterprise solutions, including UCaaS, CCaaS, and global SIP trunking, targeting Fortune 500 companies. While residential international calling has largely shifted to OTT, the region maintains high-value traffic through secure corporate communications and robust wholesale exchange volumes, serving as a critical global peering hub. Demand is driven by quality, reliability (SLAs), and seamless cloud integration.

- Europe: Europe is a highly fragmented market influenced by strict regulatory frameworks (like GDPR) and diverse local competitive landscapes. Key drivers include intra-European migration and strong economic ties to former colonies and trading partners. The market is mature, emphasizing service bundling (e.g., convergence of fixed, mobile, and international services) and strategic consolidation among major telecom groups to achieve economies of scale in cross-border operations. Regulatory arbitrage related to termination rates remains a significant factor in wholesale traffic management.

- Middle East and Africa (MEA): MEA displays strong growth fueled by high remittance traffic and expatriate populations (particularly in the GCC nations). The market structure is heavily influenced by government-owned telecom operators and strict regulations regarding VoIP usage. Growth opportunities exist in infrastructure development, leveraging new submarine cable routes (e.g., along the African coast), and providing specialized, regulated international services that circumvent potential bandwidth or application restrictions common in several MEA countries.

- Latin America (LATAM): The LATAM market exhibits variable maturity, with countries like Brazil and Mexico having advanced mobile penetration, while others lag in fixed-infrastructure deployment. International calling demand is strongly linked to migration to the US and Europe. Price sensitivity is high, making prepaid and discounted wholesale minutes popular. Investment focuses on improving connectivity and reducing latency across the continent to support growing digital economies and intra-regional business activity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the International Calling Market.- AT&T Inc.

- Vodafone Group Plc

- Orange S.A.

- Deutsche Telekom AG

- China Mobile Communications Group Co., Ltd.

- Verizon Communications Inc.

- British Telecom (BT) Group

- NTT Communications Corporation

- Lumen Technologies (formerly CenturyLink)

- Tata Communications

- Telefónica S.A.

- IDT Corporation

- BICS

- Telia Carrier

- Vonage (Ericsson)

- RingCentral

- Twilio Inc.

- GTT Communications

- Airtel (Bharti Airtel)

- Etisalat Group

Frequently Asked Questions

Analyze common user questions about the International Calling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the International Calling Market despite free alternatives?

Growth is sustained by enterprise demand for high-reliability, SLA-backed voice services, the necessity for secure regulatory communication channels (e.g., MFA), and the persistent requirement for connectivity to areas lacking reliable internet, which necessitates carrier-grade voice termination.

How does VoIP technology dominate international calling?

VoIP dominates by using internet infrastructure for cost-effective transmission, leveraging Session Initiation Protocol (SIP) to establish and manage calls, dramatically lowering operational costs and increasing call capacity compared to traditional circuit-switched networks.

What role does Artificial Intelligence (AI) play in market operations?

AI is crucial for dynamic Least-Cost Routing (LCR 2.0), real-time fraud detection (protecting carriers from financial loss), and predictive network maintenance to ensure superior Quality of Service (QoS) on complex international routes.

Which segment offers the highest revenue potential in the current market?

The Business User (Enterprise) segment offers the highest revenue potential due to its reliance on Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) platforms, demanding dedicated global SIP trunks and premium service contracts with guaranteed reliability.

How significant is regulatory compliance in international calling?

Regulatory compliance is highly significant, particularly regarding Call Detail Record (CDR) retention, anti-fraud regulations, and adherence to varying Mobile Termination Rates (MTRs) set by different national governments, which profoundly influence wholesale pricing and routing strategies globally.

What impact does 5G deployment have on the market?

5G deployment enhances the market by offering ultra-low latency and higher bandwidth, significantly improving the quality and reliability of international mobile VoIP, making carrier-grade mobile voice a more attractive proposition for high-quality enterprise and consumer needs.

Why is the Asia Pacific region leading market growth?

APAC leads market growth due to its extensive labor migration corridors, increasing globalization of businesses operating out of key hubs like India and China, and continuous investment in mobile network infrastructure that supports high volumes of international traffic.

What are the primary security concerns for international carriers?

Primary security concerns include sophisticated toll fraud, interconnect bypass fraud, traffic pumping, and robocalling, necessitating significant investment in real-time fraud management systems and secure signaling protocols to protect revenue and network integrity.

How do competitive forces influence pricing strategies?

Competitive forces, especially from free OTT applications in the consumer space, mandate a focus on low, flat-rate subscription models and highly competitive wholesale termination pricing, shifting the carrier focus from high per-minute profit to high-volume operational efficiency.

What is the difference between direct and indirect distribution channels?

Direct channels involve carriers selling services straight to end-users (residential or enterprise). Indirect channels utilize specialized resellers, MVNOs, and wholesale aggregators to package and distribute minutes, increasing local market reach without requiring extensive physical infrastructure.

What are the main restraints hindering faster market growth?

The main restraints are the overwhelming dominance of free Over-The-Top (OTT) messaging and video platforms for personal communication, alongside the structural complexities and unpredictability caused by disparate global regulatory policies on termination rates and licensing.

What is SIP trunking and why is it important for international business calling?

SIP trunking is a technology that allows businesses to connect their on-premise or cloud PBX system to the public switched telephone network (PSTN) via the Internet, enabling streamlined, scalable, and cost-effective international voice communication using high-quality carrier routes.

What is the current trend in the wholesale international calling segment?

The wholesale segment trend is towards high-volume, low-margin transactions, heavily reliant on highly accurate Least Cost Routing (LCR) and a continuous drive for optimized capacity utilization across global IP networks to maintain profitability amid fierce competition.

How are business users typically billed for international calls?

Business users are typically billed through post-paid subscription models, often based on seat licenses for UCaaS platforms or bundled usage packages for SIP trunks, prioritizing guaranteed service levels over the lowest possible per-minute rate.

Why is global economic integration a key market driver?

Global economic integration increases the necessity for multinational corporations to maintain constant, reliable communication across supply chains, operational centers, and client bases in various countries, directly driving up demand for high-quality, dedicated international voice infrastructure.

What are the implications of latency for international voice quality?

High latency significantly degrades the quality of international calls by introducing noticeable delays, making conversations unnatural. Carriers invest heavily in minimizing latency through optimized fiber routes and 5G deployment to ensure superior user experience, especially for HD voice services.

What distinguishes Tier 1 carriers in this market?

Tier 1 carriers distinguish themselves by owning vast international infrastructure, including submarine cables and global peering agreements, allowing them to route calls directly without paying transit fees, ensuring superior quality control and cost advantages for wholesale operations.

How does the consumer segment typically access paid international calling?

The consumer segment predominantly accesses paid services through prepaid calling cards, subscription add-ons from their mobile operator, or specialized retail VoIP applications that offer low-cost, high-volume minutes primarily targeting migrant communities.

What is the role of technology standardization in global calling?

Standardization, particularly around SIP and ENUM protocols, is vital as it ensures interoperability between thousands of different carrier networks globally, allowing seamless establishment and termination of calls regardless of the underlying core network technology.

How does the concept of regulatory arbitrage affect wholesale pricing?

Regulatory arbitrage occurs when wholesale carriers exploit differences in government-set termination rates between countries, routing traffic through intermediate jurisdictions with lower costs to maximize profit, leading to market volatility and complex routing algorithms.

What is the projected future direction of the International Calling Market?

The future direction points towards full convergence onto IP-based, cloud-native platforms, heavily augmented by AI for operational efficiency and security, with sustained growth focused almost exclusively on providing value-added, high-quality enterprise and secure government communication services.

Why are developing economies critical to market volume growth?

Developing economies in APAC and MEA are critical because they host major emigration populations whose families rely heavily on international calling, and they are experiencing rapid increases in mobile and internet penetration, fueling high demand for affordable international minutes.

What is the impact of anti-fraud measures on operational costs?

While anti-fraud measures require initial investment in systems like signaling firewalls and AI-driven monitoring, they significantly reduce long-term operational costs by preventing substantial financial losses due to toll fraud, interconnect bypass, and fraudulent revenue share schemes.

How does the market differentiate between personal and corporate applications?

Personal applications are generally price-sensitive and quality-tolerant, focusing on social communication. Corporate applications prioritize security, guaranteed quality (SLAs), dedicated support, and integration with professional communication systems like UC platforms.

What are the challenges associated with operating in the Latin American market?

Challenges in LATAM include varying levels of fixed-line infrastructure maturity, high levels of price sensitivity among consumers, and economic volatility which can affect capital expenditure for network upgrades and influence cross-border traffic flows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager