International Money Transfer Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434753 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

International Money Transfer Service Market Size

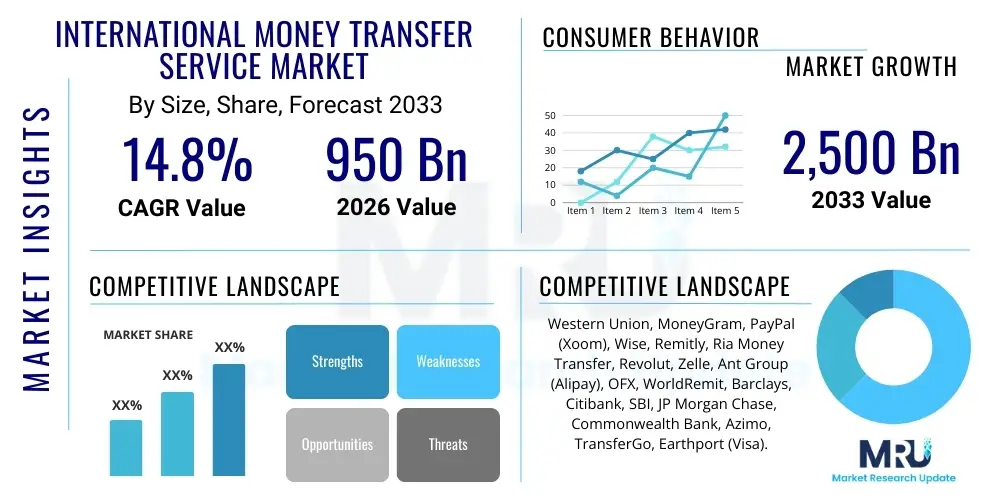

The International Money Transfer Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 950 Billion in 2026 and is projected to reach USD 2,500 Billion by the end of the forecast period in 2033.

International Money Transfer Service Market introduction

The International Money Transfer Service Market encompasses all mechanisms, platforms, and financial channels used to facilitate the movement of funds across national borders. This service is crucial for global trade, investment, and, most prominently, personal remittances sent by migrant workers to their home countries. The industry has undergone a radical transformation, moving from traditional agent-based cash transfers to highly efficient, digital-first platforms leveraging mobile applications, instant payment rails, and blockchain technology. Key applications include person-to-person (P2P) remittances, business-to-business (B2B) cross-border payments, and foreign exchange (FX) transactions conducted by small and medium-sized enterprises (SMEs).

The primary benefits of modern money transfer services center on speed, transparency, and reduced costs. Digital disruptors like Wise and Remitly have significantly lowered average transaction fees, enhancing financial inclusion for recipients in developing economies. Furthermore, the push towards real-time gross settlement (RTGS) systems and the adoption of API-driven platforms allow businesses to manage supply chain payments instantly, mitigating currency risk and improving working capital efficiency. These services are foundational to the interconnected global economy, supporting both humanitarian efforts and commercial expansion.

Driving factors for sustained market growth include mass migration patterns and increasing global labor mobility, which directly fuel the remittance market. Simultaneously, the accelerating digitization of financial services globally, particularly in emerging markets, reduces dependence on physical banking infrastructure. Regulatory support for digital finance and the establishment of harmonized payment standards across regions (such as the EU’s Payment Services Directive 2, PSD2) further catalyze competition and innovation. These factors collectively mandate continuous technological refinement to meet evolving consumer expectations for seamless and secure cross-border transactions.

- Market Introduction: Facilitation of cross-border financial transactions supporting remittances, trade, and investment.

- Product Description: Services range from traditional bank wires and agent networks to digital transfers, mobile wallets, and blockchain-enabled platforms.

- Major Applications: P2P remittances, B2B cross-border trade settlements, foreign direct investment capital movements, and travel expense management.

- Benefits: Enhanced transaction speed (often real-time), lower transfer fees, increased transparency in exchange rates, and improved financial inclusion.

- Driving Factors: Rising global migration, increasing penetration of smartphones and digital payments, strong regulatory support for FinTech innovation, and demand for faster B2B payment solutions.

International Money Transfer Service Market Executive Summary

The International Money Transfer Service Market is characterized by intense competition between legacy financial institutions, traditional money transfer operators (MTOs), and high-growth FinTech companies. Current business trends indicate a definitive shift toward digital channels, with mobile applications and online portals accounting for a rapidly increasing share of total transaction volume, particularly in the P2P segment. Consolidation among FinTech platforms and strategic acquisitions by major banks aiming to enhance their digital capabilities are defining the competitive landscape. Furthermore, compliance expenditure, particularly related to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, remains a significant operational challenge and a competitive differentiator for firms offering robust, automated compliance solutions.

Regionally, Asia Pacific (APAC) stands out as the largest and fastest-growing market, driven by high inbound remittance volumes, especially to countries like India, China, and the Philippines, fueled by large overseas diaspora populations in North America and the Middle East. North America and Europe, while mature markets, are leading in the adoption of advanced payment technologies such as instant payments and central bank digital currencies (CBDCs) research, influencing global standards for cross-border settlement. The Middle East and Africa (MEA) region remains crucial as a major source of outbound remittances, heavily relying on traditional agent networks but quickly integrating mobile money solutions.

Segmentation trends highlight the acceleration of the digital segment over traditional cash-based services. The business (B2B) segment is experiencing robust growth as SMEs seek alternatives to expensive and slow bank wires, adopting specialized FX and payment platforms. Within the technology segment, blockchain and distributed ledger technology (DLT) platforms are gaining traction, not yet for mass consumer adoption, but for institutional and interbank settlements, promising to revolutionize back-end liquidity management and cross-currency clearing processes, thereby challenging the dominance of correspondent banking networks.

AI Impact Analysis on International Money Transfer Service Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) primarily revolve around three critical areas: enhanced security and fraud prevention, optimization of customer service processes, and the efficiency gains in regulatory compliance (RegTech). Users frequently question how AI can detect complex, evolving financial crime patterns that evade traditional rules-based systems, specifically concerning cross-border transactions where jurisdiction and data sparsity present unique challenges. Furthermore, there is high expectation that AI will dramatically reduce operational costs associated with KYC verification and sanctions screening, improving the speed of onboarding and transaction throughput without compromising stringent regulatory standards. The integration of generative AI into multilingual customer support and personalized dynamic pricing models also represents a key theme of interest, driving competitive advantage.

- Fraud Detection and Prevention: AI analyzes billions of transaction data points in real-time, identifying complex, non-linear fraud patterns and suspicious anomalies far beyond human capability, significantly reducing financial loss during cross-border transfers.

- Enhanced Regulatory Compliance (RegTech): Machine Learning algorithms automate and accelerate Anti-Money Laundering (AML) and Know Your Customer (KYC) processes, screening high-risk entities and automatically generating regulatory reports, drastically lowering compliance operating costs.

- Optimized Routing and Pricing: AI algorithms determine the most cost-effective and fastest route for cross-border payments by analyzing liquidity pools, exchange rates, and correspondent banking fees dynamically, offering better pricing transparency to end-users.

- Customer Service Automation: Utilizing natural language processing (NLP), AI-powered chatbots and virtual assistants provide instantaneous, multilingual support for inquiries related to transfer tracking, status updates, and documentation requirements, improving customer satisfaction.

- Credit Scoring and Risk Assessment: In lending scenarios related to international trade or business payments, ML models provide sophisticated risk assessment for counterparties, enabling faster and safer extension of credit lines or trade finance guarantees.

DRO & Impact Forces Of International Money Transfer Service Market

The market dynamics are governed by a complex interplay of powerful growth drivers, persistent regulatory and operational restraints, and transformative technological opportunities, all mediated by critical impact forces. The primary driver is the sheer volume of global remittances, sustained by demographic shifts and labor market demands. Coupled with this is the rapid global adoption of digital financial services, which lowers the barrier to entry for digital-native MTOs. However, the regulatory environment presents a major restraint; the fragmented global compliance landscape, including differing AML, KYC, and data localization laws across hundreds of jurisdictions, imposes immense operational burdens and capital expenditure requirements on service providers, hindering seamless global expansion and interoperability.

Opportunities are predominantly rooted in technological innovation, specifically the commercialization of blockchain for institutional settlement and the proliferation of real-time payment infrastructures globally. This allows providers to circumvent inefficient legacy banking systems, offering near-instantaneous settlement. Moreover, addressing the underserved B2B cross-border payment market for SMEs represents a vast, untapped opportunity, demanding tailored, high-frequency, low-cost solutions. Impact forces, such as the increasing geopolitical instability leading to stringent sanctions enforcement and the rising threat of sophisticated cyberattacks, necessitate continuous, substantial investment in security and resilience, influencing consumer trust and operational viability across the sector.

The market’s future trajectory is heavily dependent on the willingness of national central banks and regulatory bodies to cooperate on harmonized payment standards and data sharing protocols. Should global standards like ISO 20022 become universally adopted for cross-border messages, friction will decrease dramatically, unlocking significant growth potential. Conversely, protectionist policies or excessively restrictive data sovereignty laws could segment the market further, increasing transaction costs and slowing down the penetration of digital services in key growth regions.

- Drivers (D): Rising global migrant population and associated remittance flow; increasing penetration of mobile and internet connectivity in emerging markets; demand for transparent and low-cost transaction fees.

- Restraints (R): Fragmented global regulatory landscape (AML, KYC, sanctions); persistent threat of cyberattacks and data breaches; dependence on correspondent banking relationships in certain corridors; volatility in foreign exchange rates.

- Opportunities (O): Expansion of B2B payment services for SMEs; adoption of blockchain and DLT for institutional settlement; integration with e-commerce platforms; development of cross-border CBDC frameworks.

- Impact Forces: Technological disruption (FinTech innovation); regulatory scrutiny and enforcement; consumer demand for instant payments; geopolitical risk and economic sanctions.

Segmentation Analysis

The International Money Transfer Service Market is meticulously segmented based on the type of service offered, the channels utilized for execution, and the primary end-user demographic. Segmentation provides granular insights into consumer behavior and operational requirements, allowing providers to tailor their product offerings. The market is increasingly polarized between legacy infrastructure (bank wires, agent networks) and modern digital solutions (online platforms, mobile wallets), with growth overwhelmingly concentrated in the latter due to superior user experience and operational efficiency. Understanding these segments is critical for developing targeted marketing strategies and allocating capital investment effectively across varying regional regulatory contexts and technological maturity levels.

- By Type:

- Bank Transfers (Wire Transfers)

- Money Orders and Cash Pickup Services

- Digital Wallets and Mobile Money

- FX Payments and Specialized Fintech Transfers

- By Channel:

- Online/Digital Platforms (Websites and Mobile Apps)

- Offline/Agent-based Networks (Retail Outlets, Physical Branches)

- By End-User:

- Personal (P2P Remittances)

- Business (B2B Payments and Trade Finance)

- Others (Government, NGOs)

- By Technology:

- Traditional Correspondent Banking Systems

- SWIFT Network

- Blockchain and Distributed Ledger Technology (DLT)

- Proprietary Payment Rails

Value Chain Analysis For International Money Transfer Service Market

The value chain for international money transfer services starts with the initiation stage (Upstream), involving customer onboarding, fund aggregation, and robust KYC/AML verification. Upstream activities require advanced identity verification technology and data infrastructure to ensure compliance across various jurisdictions. Modern FinTechs excel in this stage by utilizing API-driven data validation and biometrics, significantly reducing the traditional time and cost associated with manual client intake. Legacy institutions, conversely, rely heavily on their existing branch networks and established compliance teams, often leading to slower processing times but maintaining high regulatory integrity.

The core of the value chain involves the processing and settlement phase (Midstream). This includes foreign exchange conversion, liquidity management, and the actual transfer mechanism, whether through traditional SWIFT messages, proprietary real-time payment rails, or DLT solutions. Liquidity provision is a critical determinant of cost; platforms that can internally net transactions or utilize pre-funded accounts and local banking partnerships minimize reliance on high-cost interbank FX market spreads. Disruption here is focused on eliminating intermediaries to achieve real-time atomic settlement, drastically reducing counterparty risk and processing latency.

The Downstream segment focuses on the disbursement of funds to the beneficiary, encompassing diverse distribution channels such as direct account credit, cash pickup via agent networks, or loading onto digital wallets (e.g., M-Pesa, Alipay). The efficiency of the downstream relies heavily on local infrastructure, regulatory accessibility, and robust partnerships. Direct and indirect distribution channels coexist; direct channels, primarily digital platforms, offer higher margins and greater control over the customer experience, while indirect distribution relies on extensive, geographically dispersed agent networks (like Western Union or MoneyGram), which are crucial for reaching unbanked populations in remote areas.

International Money Transfer Service Market Potential Customers

The International Money Transfer Service Market serves a broad spectrum of end-users, broadly categorized into personal/retail users and corporate/business entities. Personal customers, primarily migrant workers, students studying abroad, and expatriates, constitute the largest volume segment, driving demand for P2P remittance services. Their key requirements are low transaction costs, high transfer speed, and accessibility via mobile devices, especially when sending money to nations with high mobile money penetration. The demographic diversity necessitates multilingual support and a user interface designed for individuals who may lack sophisticated financial literacy but require frequent, reliable transfers to support family members.

The B2B segment represents a high-value, high-growth area, encompassing multinational corporations, SMEs engaged in import/export activities, and e-commerce platforms requiring cross-border payment processing. These institutional buyers prioritize robust API integration for automated payments, precise FX hedging tools, transparent fees structures, and guaranteed regulatory compliance in complex trade corridors. Unlike P2P users, B2B clients often handle high-value, recurring payments, driving demand for tailored liquidity management and enterprise-grade security protocols. FinTech providers offering streamlined integration with ERP systems are particularly attractive to this segment.

Additionally, institutional clients, including non-governmental organizations (NGOs) and governmental bodies, form a specialized customer base. NGOs require reliable and auditable mechanisms for fund disbursement to conflict zones or areas lacking traditional banking infrastructure, often favoring mobile money and secure, traceable ledger systems. Governments utilize these services for cross-border pension payments, diplomatic transfers, and official aid distribution. These buyers demand stringent reporting capabilities and adherence to global anti-terrorism financing standards, emphasizing traceability and compliance over mere speed or cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 Billion |

| Market Forecast in 2033 | USD 2,500 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Western Union, MoneyGram, PayPal (Xoom), Wise, Remitly, Ria Money Transfer, Revolut, Zelle, Ant Group (Alipay), OFX, WorldRemit, Barclays, Citibank, SBI, JP Morgan Chase, Commonwealth Bank, Azimo, TransferGo, Earthport (Visa). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

International Money Transfer Service Market Key Technology Landscape

The technological evolution of the International Money Transfer Service Market is centered on enhancing speed, security, and cost-efficiency. Traditional technology relied heavily on the global SWIFT (Society for Worldwide Interbank Financial Telecommunication) network for messaging and instruction, backed by correspondent banking relationships for actual settlement. While robust, this system is inherently slow and opaque regarding fees, often requiring multiple intermediary banks. Modernization efforts focus on leveraging high-speed proprietary payment rails and open banking APIs, facilitating direct integration between sending and receiving systems, enabling instant processing and minimizing reliance on dated batch processing methods prevalent in legacy banking.

The most disruptive technology is Distributed Ledger Technology (DLT) and blockchain, utilized both by new entrants and major financial consortia. DLT bypasses the need for traditional nostro/vostro accounts and pre-funding in different currencies by enabling atomic settlement—the simultaneous exchange of funds and assets—through smart contracts. This technology reduces liquidity costs, counterparty risk, and settlement time from days to seconds. While adoption faces scalability and regulatory hurdles, institutional pilots, such as those leveraging RippleNet or specialized central bank initiatives, demonstrate significant potential for wholesale payment reform, particularly in low-volume, high-cost corridors.

Furthermore, cloud computing infrastructure and advanced data analytics are foundational to modern money transfer services. Cloud platforms provide the scalability required to handle massive, fluctuating transaction volumes across diverse geographies, while simultaneously offering robust disaster recovery and security protocols. Data analytics, often powered by AI/ML, are crucial not only for fraud detection and compliance but also for optimizing customer acquisition, personalizing user experiences, and providing dynamic, competitive FX rate quoting, ensuring the continuous optimization of the service delivery mechanism.

Regional Highlights

The global market exhibits significant regional variations in growth drivers, technological maturity, and regulatory complexities. These differences dictate competitive strategies, influencing pricing models and channel priority, such as the preference for mobile money in Africa versus direct bank integration in North America.

- Asia Pacific (APAC): Dominates the market both in terms of value and volume of remittances, driven by countries like India, China, and the Philippines, which receive substantial diaspora contributions. The region is characterized by high mobile wallet adoption (e.g., Alipay, WeChat Pay) and rapidly expanding digital infrastructure, making it the primary hub for digital remittance innovation and deployment.

- North America: A mature and significant outbound remittance source market. It leads in the adoption of consumer-centric FinTech platforms (Wise, Remitly) and is characterized by robust regulatory frameworks focused on consumer protection and financial crime prevention. Demand centers on instant, low-fee transfers to Latin America and APAC.

- Europe: A major source and destination for transfers, heavily influenced by EU regulations like PSD2, which mandates open banking and fosters competition. The push towards the SEPA Instant Credit Transfer scheme (SCT Inst) within the Eurozone influences global expectations for cross-border speed, though transfers outside SEPA remain complex.

- Middle East and Africa (MEA): Crucial as a high-volume source of outbound transfers (GCC nations) and a primary recipient region (Africa). Africa, particularly, relies heavily on agent networks and pioneering mobile money solutions (M-Pesa), driven by low banking penetration, creating unique technological opportunities for mobile-first operators.

- Latin America: Characterized by high currency volatility and a growing need for financial stability and inclusion. Digital remittances are rapidly replacing traditional channels, supported by increasing smartphone penetration and the launch of regional instant payment schemes, such as PIX in Brazil, influencing cross-border interoperability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the International Money Transfer Service Market.- Western Union

- MoneyGram

- PayPal (Xoom)

- Wise (formerly TransferWise)

- Remitly

- Ria Money Transfer (Euronet Worldwide)

- Revolut

- Zelle (via participating banks)

- Ant Group (Alipay)

- OFX

- WorldRemit

- Barclays

- Citibank

- State Bank of India (SBI)

- JP Morgan Chase

- FIS Global

- Ripple

- Mastercard (Cross-Border Services)

- Visa (Visa Direct)

- Nium

Frequently Asked Questions

Analyze common user questions about the International Money Transfer Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.How is the adoption of blockchain impacting the cost and speed of international money transfers?

Blockchain and Distributed Ledger Technology (DLT) primarily impact the wholesale settlement layer by eliminating intermediaries (correspondent banks). This reduces settlement time from days to near-instantaneous and lowers liquidity costs by reducing the need for pre-funded accounts, ultimately enabling providers to offer faster and cheaper services to the end consumer, especially for high-volume B2B payments.

What are the primary factors driving the shift from offline agent-based transfers to digital platforms?

The primary drivers include enhanced convenience and accessibility (24/7 service via mobile apps), significantly lower transaction fees offered by digital-native FinTechs, greater transparency in exchange rate pricing, and increasing smartphone penetration globally, particularly in key remittance receiving corridors in APAC and Africa.

What role does regulatory compliance play in the growth of cross-border payment providers?

Regulatory compliance, specifically Anti-Money Laundering (AML) and Know Your Customer (KYC) standards, is paramount. Robust compliance systems are essential for obtaining operational licenses and maintaining consumer trust. While compliance costs are high, providers using advanced AI/ML-driven RegTech solutions gain a competitive advantage by expediting onboarding and streamlining transaction monitoring without compromising security.

Which geographical region is currently experiencing the highest growth in outbound remittances?

While Asia Pacific receives the largest inflow, the Middle East, particularly the Gulf Cooperation Council (GCC) countries, continues to exhibit very high volumes of outbound remittances due to large populations of expatriate workers. North America and parts of Europe also remain significant source markets, benefiting from rapid digital platform adoption.

How are traditional banks adapting to competition from FinTech money transfer services?

Traditional banks are adapting through a dual strategy: strategic acquisitions of successful FinTechs to integrate advanced digital capabilities, and the development of their own proprietary digital platforms, focusing on real-time payment implementation (e.g., SWIFT gpi adoption) and leveraging their inherent advantages in trust and existing customer relationships for high-value B2B and corporate FX services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager