Internet Crowdfunding and Wealth Management Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436720 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Internet Crowdfunding and Wealth Management Market Size

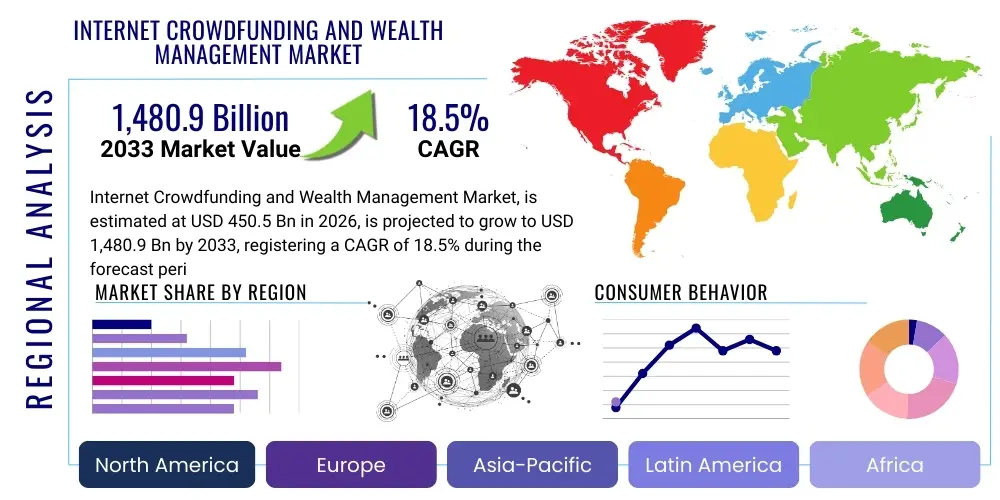

The Internet Crowdfunding and Wealth Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 1,480.9 Billion by the end of the forecast period in 2033.

Internet Crowdfunding and Wealth Management Market introduction

The Internet Crowdfunding and Wealth Management Market encompasses digital platforms that leverage technology to connect investors and fundraisers, simultaneously providing sophisticated, accessible financial planning and asset management tools. This market represents a confluence of FinTech innovation, democratizing access to capital for entrepreneurs through various crowdfunding models (equity, debt, rewards, donation) and offering retail investors robust, algorithm-driven wealth management services, commonly known as robo-advisory. The core product offering includes automated portfolio management, fractional ownership of assets, peer-to-peer lending platforms integrated with investment features, and specialized platforms for real estate or intellectual property financing.

Major applications of these platforms span business start-up funding, personal financial goal setting, retirement planning, and diversified investment allocation across alternative assets. For businesses, crowdfunding provides a vital non-traditional capital source, often bypassing stringent traditional banking requirements. For individual users, digital wealth management offers personalized investment strategies at significantly lower costs than traditional human advisors, enhanced by behavioral finance principles and real-time data analytics. This synergistic ecosystem fosters greater financial inclusion and enables seamless, transparent transaction execution.

The primary benefits driving market expansion include reduced transaction costs, 24/7 accessibility, high levels of personalization enabled by machine learning, and enhanced transparency through digital ledger technologies. Key driving factors accelerating market growth involve the increasing penetration of high-speed internet and mobile devices, the burgeoning millennial population seeking digital-first financial solutions, favorable regulatory shifts supporting FinTech innovation (such as sandbox environments), and the persistent need for diversified and alternative investment avenues amidst volatile traditional markets. Furthermore, the rapid adoption of digitized processes during and after global crises has cemented digital finance platforms as essential components of modern capital markets.

Internet Crowdfunding and Wealth Management Market Executive Summary

The Internet Crowdfunding and Wealth Management Market is characterized by vigorous innovation, strong regulatory evolution, and aggressive strategic integration across geographic boundaries. Business trends are dominated by the vertical integration of services, where crowdfunding platforms are expanding into wealth management offerings, and conversely, established wealth managers are incorporating alternative investment sourcing via digital means. A major trend is the shift toward hybrid models, where automated advisory services are augmented by human consultants for complex financial scenarios, offering a balanced proposition of efficiency and personalized trust. Furthermore, blockchain integration is profoundly impacting market infrastructure, primarily through tokenized assets and enhanced security protocols, leading to faster settlements and greater investor confidence in digital platforms. This convergence is creating highly resilient and scalable business models capable of handling massive volumes of retail and institutional capital.

Regionally, North America maintains market leadership, driven by a mature FinTech ecosystem, high consumer trust in digital financial services, and supportive capital market regulations, particularly concerning equity crowdfunding. However, the Asia Pacific (APAC) region is demonstrating the most explosive growth trajectory, fueled by a large, unbanked or underbanked population rapidly adopting mobile finance, massive digital infrastructure investment, and government initiatives promoting financial inclusion and technology adoption in countries like China and India. Europe exhibits robust growth, primarily focusing on cross-border investment harmonization and adherence to stringent data protection regulations (like GDPR), positioning itself as a hub for regulatory technology (RegTech) integration in wealth management.

Segmentation trends highlight the increasing dominance of the Retail Investor segment due to the low entry barriers provided by robo-advisors and fractional investing. By platform type, Peer-to-Peer (P2P) Lending remains highly significant, though Equity Crowdfunding is experiencing rapid percentage growth as sophisticated investors seek early-stage exposure to high-potential startups. The technological underpinning of the market is increasingly focused on sophisticated data analytics, leading to highly customized product segments tailored to specific demographic profiles, risk appetites, and ESG (Environmental, Social, and Governance) preferences. The market structure is evolving from disparate platforms to interconnected financial ecosystems, prioritizing user experience and holistic financial health management.

AI Impact Analysis on Internet Crowdfunding and Wealth Management Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Internet Crowdfunding and Wealth Management Market frequently center on themes of algorithmic transparency, job displacement among traditional advisors, the security of automated investment decisions, and the potential for enhanced personalization and risk assessment. Common questions include: "How does AI ensure fairness in capital allocation on crowdfunding platforms?" and "Will robo-advisors completely replace human financial planners?" Analysis indicates that users are concerned about inherent bias in AI algorithms potentially skewing investment opportunities or wealth advice, yet simultaneously anticipate significant benefits from AI-driven efficiency and predictive modeling. Key expectations revolve around AI's capacity to revolutionize compliance (AI-powered Know Your Customer/Anti-Money Laundering), vastly improve fraud detection in crowdfunding campaigns, and deliver hyper-personalized financial coaching that traditional models cannot sustain, ultimately driving down costs and enhancing investment performance for the end user.

- AI-driven Predictive Analytics: Utilizing machine learning algorithms to forecast market trends, assess startup viability in crowdfunding campaigns, and optimize asset allocation strategies for individual wealth management clients.

- Hyper-Personalization: Employing AI to analyze vast datasets of user behavior, financial goals, and risk tolerance to deliver customized investment portfolios and highly relevant financial advice instantaneously.

- Enhanced Regulatory Compliance (RegTech): Implementing AI tools for continuous monitoring of transactions, automated compliance checks against complex financial regulations, and proactive identification of suspicious activity, significantly reducing operational and legal risks.

- Automated Due Diligence: Using natural language processing (NLP) and machine learning to rapidly analyze pitch decks, business plans, and financial statements of crowdfunding ventures, automating initial screening and risk scoring.

- Optimized Customer Service: Deployment of sophisticated AI chatbots and virtual assistants to handle routine queries, onboarding processes, and technical support, freeing up human advisors for high-value client interactions.

- Fraud Detection and Security: Leveraging AI pattern recognition to detect anomalous behavior, potential scams on crowdfunding platforms, and unauthorized access attempts, bolstering platform security and investor trust.

- Behavioral Finance Integration: Utilizing AI to analyze investor psychological biases and herd behavior, allowing platforms to nudge users toward rational financial decisions and optimal savings habits.

DRO & Impact Forces Of Internet Crowdfunding and Wealth Management Market

The market dynamics are defined by a powerful interplay of Driving forces, Restraints, and Opportunities (DRO), all modulated by significant Impact Forces. Key Drivers include the widespread global proliferation of digital infrastructure and mobile connectivity, making digital financial services accessible to billions. The high costs and complexity associated with traditional financial institutions are pushing both retail and institutional investors toward transparent, low-fee digital platforms. Furthermore, supportive regulatory frameworks globally, designed to foster FinTech growth while maintaining investor protection, provide the necessary trust foundation for market expansion. These drivers collectively create a fertile environment for sustained double-digit growth, particularly in emerging economies where financial inclusion is paramount. However, these positive factors are constrained by critical Restraints, primarily stemming from persistent cybersecurity threats and the inherent risk of data breaches, which erode consumer confidence. Regulatory fragmentation across international jurisdictions poses compliance challenges for platforms aiming for global reach. Moreover, a lack of standardized valuation methodologies, particularly for early-stage companies funded through equity crowdfunding, can create uncertainty for secondary market liquidity.

Significant Opportunities exist in the application of decentralized finance (DeFi) principles to both crowdfunding and wealth management, offering novel methods for fractional ownership and portfolio diversification through tokenization of real-world assets like real estate and fine art. The integration of ESG criteria into automated investment mandates presents a massive opportunity to capture values-driven investment capital, appealing especially to younger demographics. Furthermore, expanding geographical reach into underserved markets in Africa and Latin America, combined with the development of highly specialized, niche wealth management products (e.g., concentrated venture capital portfolios), promises new avenues for revenue generation and market penetration. These strategic opportunities necessitate robust technological development and careful navigation of jurisdictional compliance requirements to maximize potential returns.

The Impact Forces, which dictate the speed and direction of market evolution, include the accelerating pace of technological innovation, particularly AI and blockchain, fundamentally reshaping operational efficiencies and product offerings. Socio-demographic changes, specifically the wealth transfer to tech-savvy generations, mandate digital-first solutions. Regulatory pressure, oscillating between protectionism and innovation encouragement, acts as a critical force multiplier; overly strict regulations can stifle growth, while permissive frameworks can accelerate rapid, yet potentially risky, market expansion. Finally, competitive intensity, driven by the emergence of powerful non-traditional financial entrants (Big Tech firms) and incumbent banks launching their own digital arms, forces continuous service improvement and pricing innovation. Understanding and managing these complex interactions of drivers, restraints, and impact forces is central to strategic success in the Internet Crowdfunding and Wealth Management Market.

Segmentation Analysis

The Internet Crowdfunding and Wealth Management Market is broadly segmented based on deployment model, platform type, offering, and end-user, reflecting the diverse applications and underlying technologies powering this ecosystem. The segmentation strategy is crucial for providers to accurately target specific needs, ranging from venture-seeking entrepreneurs requiring seed capital through equity platforms to passive retail investors seeking automated, diversified retirement savings plans via robo-advisory tools. Detailed analysis reveals a market structure characterized by rapid specialization, where niche platforms focusing on specific asset classes (e.g., real estate crowdfunding) or user demographics (e.g., high-net-worth individuals utilizing hybrid advisory models) capture significant value. Understanding these granular segments allows for the precise allocation of marketing resources and regulatory compliance efforts, maximizing Return on Investment (ROI) and minimizing operational friction in diverse regulatory landscapes.

- By Platform Type:

- Equity Crowdfunding

- Peer-to-Peer (P2P) Lending/Debt Crowdfunding

- Rewards-based Crowdfunding

- Donation-based Crowdfunding

- Robo-Advisors (Automated Wealth Management)

- Hybrid Advisory Models

- By Offering/Service:

- Automated Portfolio Management

- Financial Planning Software

- Micro-investing and Fractional Shares

- Tax Optimization and Harvesting

- Lending and Credit Facilitation

- Alternative Asset Investment (Real Estate, VC Funds)

- By End-User:

- Retail Investors (Mass Market)

- High-Net-Worth Individuals (HNWIs)

- Small and Medium-sized Enterprises (SMEs)

- Startups and Entrepreneurs

- Venture Capital (VC) Firms (Utilizing platforms for deal sourcing)

- By Deployment Model:

- Cloud-Based

- On-Premise

Value Chain Analysis For Internet Crowdfunding and Wealth Management Market

The value chain for the Internet Crowdfunding and Wealth Management Market begins with the Upstream activities centered on core technology development and capital aggregation. This involves the creation of proprietary AI algorithms for risk assessment, the establishment of secure blockchain infrastructure for asset tokenization, and the integration of data analytics tools to profile investors and ventures accurately. Key upstream providers include specialized FinTech software developers, cloud service providers (e.g., AWS, Azure), and data science firms that provide the intelligence backbone for automated decision-making. The efficiency and security of these upstream processes directly determine the scalability and competitiveness of the final platform offering.

Midstream activities revolve around platform operation and user engagement, which constitute the core differentiation factor. This includes rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, automated investment matching, seamless user interface design, and personalized content delivery. Distribution channels are predominantly direct-to-consumer (D2C) via web and mobile applications, emphasizing immediate accessibility and a friction-free onboarding experience. Indirect channels, although less prevalent, include partnerships with established financial institutions (B2B2C model) that utilize the platform’s technology stack under their own brand or referral networks established through independent financial advisors who leverage robo-advisory tools.

Downstream activities focus on post-transaction management and value realization. For wealth management, this involves continuous portfolio rebalancing, performance reporting, tax document generation, and ongoing financial education. In crowdfunding, this includes monitoring post-funding milestones, facilitating secondary market liquidity (where permitted), and providing investor relations management for funded companies. The primary goal downstream is retention and expansion of the client lifetime value through exceptional service and verifiable investment performance, ultimately cementing the platform’s reputation as a reliable and transparent financial partner.

Internet Crowdfunding and Wealth Management Market Potential Customers

The potential customer base for the Internet Crowdfunding and Wealth Management Market is highly diverse, spanning individual consumers seeking simplified investing tools and small businesses requiring flexible capital. The largest and fastest-growing segment consists of Retail Investors, typically millennials and Gen Z, who are digital natives expecting affordable, transparent, and mobile-first financial solutions for goals like retirement savings and general wealth accumulation. These individuals are attracted to micro-investing, fractional shares, and automated portfolios that align with ESG mandates. High-Net-Worth Individuals (HNWIs) represent another critical customer segment, utilizing hybrid advisory models to combine the efficiency of algorithms with the tailored strategic advice of human consultants, often seeking access to private equity and alternative assets sourced through specialized crowdfunding channels.

On the fundraising side, Small and Medium-sized Enterprises (SMEs) are crucial potential customers, utilizing debt or equity crowdfunding to bridge financing gaps often ignored by traditional banks. Startups and early-stage entrepreneurs rely heavily on these platforms for initial seed funding and market validation, often preferring the rapid deployment of capital provided by crowdfunding over lengthy venture capital fundraising rounds. Furthermore, established Venture Capital (VC) and Private Equity (PE) firms are increasingly becoming customers, utilizing crowdfunding platforms as efficient deal sourcing mechanisms, allowing them to track promising companies and potentially participate in later funding rounds, treating the platforms as innovative pipeline feeders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 1,480.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wealthfront, Betterment, Kickstarter, Indiegogo, LendingClub, Funding Circle, AngelList, SeedInvest, Robinhood, M1 Finance, Nutmeg, Sygnum, Republic, Kabbage (now KServicing), Personal Capital (Empower). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Internet Crowdfunding and Wealth Management Market Key Technology Landscape

The technological landscape of the Internet Crowdfunding and Wealth Management Market is dominated by three major pillars: Artificial Intelligence (AI) and Machine Learning (ML), Blockchain/Distributed Ledger Technology (DLT), and sophisticated Cloud Computing infrastructure. AI/ML algorithms are foundational, powering robo-advisory services by performing automatic portfolio rebalancing, sophisticated risk profiling, and tax-loss harvesting. In crowdfunding, AI aids in the rigorous screening and scoring of potential ventures, improving the due diligence process and reducing information asymmetry for investors. The continued evolution of deep learning models allows platforms to offer increasingly nuanced and individualized financial advice, moving beyond generic models to true hyper-personalization based on real-time market movements and user interactions.

Blockchain and DLT are transformative technologies specifically targeting transparency and efficiency. They are utilized to create immutable records of investment ownership and transactions, significantly reducing counterparty risk and processing times, particularly in cross-border transactions. Tokenization, enabled by blockchain, is a major innovation allowing for fractional ownership of high-value assets (like real estate or private equity stakes) which were previously illiquid or inaccessible to retail investors. Furthermore, the implementation of smart contracts automates the execution of investment terms, dividend payouts, and regulatory compliance checks, removing the need for costly intermediaries and streamlining the entire investment lifecycle from issuance to settlement.

Cloud Computing provides the essential scalable, resilient, and cost-effective infrastructure necessary for handling the massive transactional data volumes generated by millions of global users. Platforms rely on scalable cloud environments to manage sudden spikes in trading activity, secure storage of sensitive client data (complying with GDPR, CCPA, etc.), and facilitate rapid software updates and deployment of new algorithmic models. The shift toward cloud-native architecture ensures platforms can maintain high uptime and rapidly iterate on their offerings, which is critical in a competitive, fast-paced financial environment, enabling global accessibility regardless of the end-user's geographic location or device preference. Additionally, advanced APIs (Application Programming Interfaces) facilitate seamless integration with third-party financial tools and services, creating expansive financial ecosystems.

Regional Highlights

- North America: This region holds the largest market share, characterized by high adoption rates of automated wealth management services (robo-advisors) and a mature ecosystem for equity crowdfunding, driven by robust regulatory frameworks (e.g., Reg A+ in the U.S.) that facilitate capital raising. The U.S. and Canada benefit from a high concentration of FinTech innovation hubs, significant venture capital investment into platform development, and a strong culture of individual responsibility for retirement planning, favoring self-directed digital investment tools.

- Europe: The European market is defined by regulatory harmonization efforts, notably through PSD2 and MiFID II, which encourage open banking and cross-border digital financial services. The U.K. remains a dominant hub for P2P lending and digital wealth management. Growth is robust across key member states, with an emphasis on adherence to strict data protection (GDPR) and the increasing popularity of sustainable and ESG-focused automated investment portfolios, reflecting strong public demand for ethical finance.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by immense digital transformation and high mobile penetration, particularly in developing economies like India, Indonesia, and Southeast Asia. Governments actively promote FinTech to achieve financial inclusion goals. China historically dominated P2P lending, though regulatory crackdowns have shifted focus toward structured, government-backed wealth management platforms and institutional participation in digital finance. Japan and South Korea lead in technological deployment, exploring blockchain applications in securitization and asset management.

- Latin America (LATAM): This region presents substantial untapped potential, fueled by high rates of unbanked populations and a general distrust of traditional banking institutions, creating a strong market pull for transparent digital finance alternatives. Brazil and Mexico are emerging as regional leaders, witnessing rapid adoption of local crowdfunding and micro-investment platforms. Challenges include volatile macroeconomic conditions and the need for standardized regulatory clarity across disparate national markets.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the GCC (Gulf Cooperation Council) nations and South Africa. GCC countries are establishing FinTech hubs (e.g., Dubai, Abu Dhabi, Riyadh) with specific sandbox initiatives to attract digital financial innovation, often tailored to Sharia-compliant wealth management and investment products. Africa is primarily driven by mobile money penetration, with crowdfunding platforms serving as vital tools for development finance and small business funding, addressing acute capital access deficiencies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Internet Crowdfunding and Wealth Management Market.- Wealthfront

- Betterment

- AngelList

- SeedInvest

- Republic

- Kickstarter

- Indiegogo

- Funding Circle

- LendingClub

- Robinhood Markets, Inc.

- M1 Finance

- Acorns

- Personal Capital (Empower Retirement)

- Stash Invest

- Nutmeg (acquired by J.P. Morgan)

- SyndicateRoom

- OurCrowd

- Kabbage (now KServicing)

- FutureAdvisor (BlackRock)

- OpenInvest (acquired by JP Morgan)

Frequently Asked Questions

Analyze common user questions about the Internet Crowdfunding and Wealth Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes a robo-advisor from a traditional financial advisor?

Robo-advisors utilize advanced algorithms and machine learning to provide automated, low-cost portfolio management and financial planning with minimal human intervention. Traditional advisors offer personalized, high-touch strategic consulting, often at a higher cost, making robo-advisors significantly more accessible to retail investors and those seeking passive, diversified investment strategies based on predefined risk profiles and goals.

How does the integration of blockchain technology benefit crowdfunding platforms?

Blockchain benefits crowdfunding platforms by enhancing transactional transparency, reducing operational costs through automated smart contracts for capital distribution, and enabling asset tokenization. Tokenization allows for fractional ownership of crowdfunded assets, increasing liquidity and facilitating broader participation from small-scale investors in previously restricted asset classes like real estate or private equity.

What are the primary regulatory challenges facing global internet wealth management platforms?

The primary regulatory challenges include managing compliance across fragmented international jurisdictions, particularly regarding investor protection, KYC/AML procedures, and data privacy (like GDPR). Platforms must navigate the complexities of cross-border capital flow rules and often face delays in obtaining necessary operating licenses, necessitating the use of specialized RegTech solutions to maintain market access.

Is equity crowdfunding inherently riskier than traditional investment options like mutual funds?

Yes, equity crowdfunding is generally considered high risk, as investments are typically made in early-stage startups that have a high failure rate and limited liquidity. Unlike diversified mutual funds, crowdfunding investments often require long lock-up periods and rely heavily on the success of a single, unproven venture, making thorough due diligence and a deep understanding of market mechanics crucial for investors.

How is Artificial Intelligence enhancing personalization in wealth management services?

AI enhances personalization by continuously analyzing vast datasets related to individual investor behavior, market fluctuations, and external economic indicators. This enables automated systems to dynamically rebalance portfolios, suggest tax optimization strategies, and deliver highly specific financial recommendations tailored instantaneously to the user's evolving risk tolerance, life events, and specific financial objectives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager